Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Wendy's Co | d655522d8k.htm |

ICR

XChange Conference January 13, 2014

Exhibit 99.1 |

Forward-Looking Statements

This presentation, and certain information that management may discuss in connection with

this presentation, contains

certain

statements

that

are

not

historical

facts,

including

information

concerning

possible

or

assumed

future

results

of

our

operations.

Those

statements

constitute

“forward-looking

statements”

within

the

meaning

of the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For

all forward-looking statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Reform Act. Many

important

factors

could

affect

our

future

results

and

could

cause

those

results

to

differ

materially

from

those expressed in or implied by our forward-looking statements. Such factors, all of

which are difficult or impossible to predict accurately, and many of which are

beyond our control, include but are not limited to those

identified

under

the

caption

“Forward-Looking

Statements”

in

our

news

release

issued

on

January

13,

2014

and

in

the

“Special

Note

Regarding

Forward-Looking

Statements

and

Projections”

and

“Risk

Factors”

sections of our most recent Form 10-K / Form 10-Qs.

The Company is currently in the process of finalizing its financial results for the three

months and full year ended

December

29,

2013.

All

financial

results

for

those

periods

included

in

this

presentation,

or

discussed

by

management in connection with this presentation, are unaudited preliminary estimates and

represent the most current information available to management. Therefore, it is

possible that actual results may differ materially from these estimates due to the

completion of financial closing procedures, final adjustments and other

developments that may arise between now and the time the financial results for the three

months and full year ended

December

29,

2013

are

finalized.

Accordingly,

readers

should

not

place

undue

reliance

on

these

estimates. |

Non-GAAP Financial Measures

In addition, this presentation and certain information management may discuss in

connection with this presentation reference non-GAAP financial measures, such

as adjusted earnings before interest, taxes, depreciation and amortization, or

adjusted EBITDA, and adjusted earnings per share. Adjusted EBITDA and adjusted

earnings per share exclude certain expenses, net of certain benefits. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measures are provided

in the Appendix to this presentation, and are included in our news release issued

on January 13, 2014 and posted on www.aboutwendys.com.

|

President & CEO

EMIL BROLICK |

2013

2013

Very Rewarding Year

* Open/Under Construction

Revitalizing

brand

proposition

to

“A

Cut

Above”

through

our

“Recipe

to

Win”

Regaining product innovation leadership with the successful launch of Pretzel

Bacon Cheeseburger, Pretzel Pub Chicken and Bacon Portabella Melt on Brioche

Provided 89% total shareholder return, including returning $141 million cash to

shareholders

System Optimization successfully launched, 384 of 415 restaurants sold/in

contract

or

LOI;

reduction

of

$30

million

in

G&A

on

track

for

2H

2014

Achieved Image Activation (IA) growth targets …100 Company, 99 Franchise*

Delivered Adjusted EBITDA growth of 10.1% and Adjusted EPS growth of 71% to

76% |

Wendy’s “A Cut Above”

Investment

•

“A Cut Above”

Brand Positioning Is Unique, It’s Working, Has Legs

•

IA Repositioning Restaurant Experience To “New QSR”

Standard

•

Product/Price Segmentation Differentiating Brand And Growing SRS

•

System Optimization Impact, EBITDA Neutral, Lifting Margins,

Increasing Earnings Quality

•

New Leadership Team, Building 5-Star Organization Talent

•

Returning Significant Cash To Shareholders While Reinvesting

•

Excellent TSR Potential With Growth & Income |

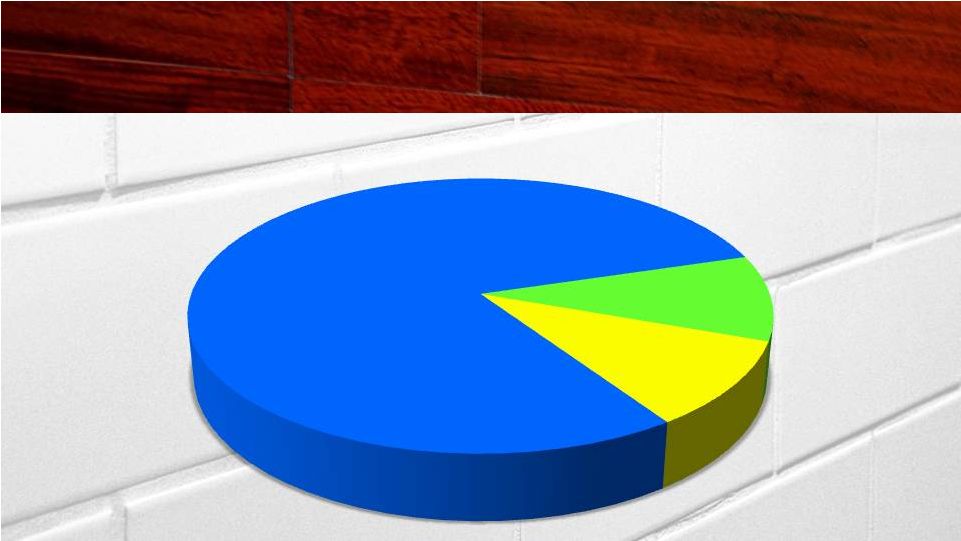

GROWTH…The Imperative

QSR

79%

Casual

Dining

10%

$435

Billion

Mid

Scale

10%

61+ Billion Visits

Source: NPD Crest

2013 Restaurant Industry Sales |

QSR BEST

DELIVERS ON CONVENIENCE & VALUE NEEDS

11.1

11.2

76.3

10.3

9.8

78.5

+2.2

2008

2013

(1.4)

(0.8)

QSR

Mid Scale

Casual Dining

Traffic Share Y/E November

Source: NPD Crest |

KEY BRAND

GROWTH DRIVERS BRAND

RELEVANCE

ECONOMIC MODEL

RELEVANCE |

EXPERIENCE

HIGH

HIGH

LOW

LOW

FUNCTIONAL

FUNCTIONAL

EMOTIONAL

EMOTIONAL

BRAND VISION

A

B

C

New

QSR

Traditional

QSR |

RECIPE

TO WIN PEOPLE

5-Star Talent

PRICE

New QSR Quality

PRODUCT

Playing a Different Game

PROMOTION

Tactically Brilliant

PLACE

Brand Transformation

PERFORMANCE

Keeping Brand Promise |

2010

$1.418M

2011

$1.456M

2012

$1.484M

2013

$1.514M

Economic Model Improving…

N.A. COMPANY AUV |

N.A.

COMPANY RESTAURANT MARGINS IMPROVING

2011

14.0%

2012

14.0%

2013

15.4% |

2013A IMAGE ACTIVATION

IMAGE ACTIVATION

Company

200

* Open or Under Construction, pre-System Optimization ownership

2014E

126

110

215

Reimages

Including

New Builds

*

Company

100

Franchise

99

*

Reimages

150-200

195-245

Franchise |

MESSAGE

MESSAGE

MEDIA

MEDIA

CREATIVE

CREATIVE

PLAYING A DIFFERENT GAME |

EXECUTE

EFFECTIVE HIGH-LOW STRATEGY PREMIUM

PRICE / VALUE |

Source: Millward Brown as of August 2013

BRAND COMMUNICATIONS WORKING

BRAND COMMUNICATIONS WORKING

HIGHEST AWARENESS SINCE 2005

HIGHEST AWARENESS SINCE 2005

Total Communication Awareness

+8pts

vs 2011

40

48

2009

2010

2011

2012

YTD 2013 |

HOW WE

GROW BRAND RELEVANCE + ECONOMIC RELEVANCE = GROWTH

Shareholder

Value-Enhancing

Initiatives

Core Organic

Growth

Strategies

Restaurant Ownership

Optimization

Financial Management

Global Growth

Restaurant Utilization &

Brand Access

New Restaurant Growth

Image / Experience Activation

North America Same-Restaurant Sales Growth |

WHAT WE

CONTROL |

Strategic

Reasons to Believe •

Strong Brand Heritage

•

Unique Brand Position

•

IA Contemporizing Brand Image

•

Strong Leadership Team, Growing 5-Star Talent

•

Economic Model Improving

•

Exceptional Franchisee Base and Commitment |

Chief

Financial Officer TODD PENEGOR |

FINANCIAL

UPDATE •

2013 Results

•

Image Activation Update

•

System Optimization Status

•

2014 & Long-Term Outlook

•

Plans to Build Shareholder Value |

Q4

FINANCIAL HIGHLIGHTS N.A. Company SRS

3.1%

(0.2)%

2013

2012

Adjusted EBITDA*

$89.0M

$95.9M

(7.2)%

Adjusted EPS*

$0.10-0.11

$0.09

+11-22%

N.A. Company Rest. Margin

16.3%

15.9%

+40bps

* See reconciliation of Adjusted EBITDA and Adjusted EPS in the appendix

B/(W)

2-YEAR

2.9% |

FULL YEAR

FINANCIAL HIGHLIGHTS N.A. Company SRS

1.9%

1.6%

2013

Adjusted EBITDA*

$367.1M

$333.3M

+10.1%

Adjusted EPS*

$0.29-0.30

$0.17

+71-76%

N.A. Company Rest. Margin

15.4%

14.0%

+140bps

* See reconciliation of Adjusted EBITDA and Adjusted EPS in the appendix

2012

B/(W)

2-YEAR

3.5% |

Company

200

100

+100

Franchise*

150-200

99

+51-101

Total

350-400

199

+151-201

2013

2014

vs. 2013

REIMAGES

NEW BUILDS

Company

15

26

(11)

Franchise*

45

11

+34

Total

60

37

+23

* Open or Under Construction; excludes 24 Franchise Non-IA New Builds in

2013 Total IA Restaurants

410-460

236

+174-224

2013 IMAGE ACTIVATION TARGETS MET

2014 ACCELERATES

2014E |

Image

Activation Aim for the SWEET SPOT

ECONOMICS

ECONOMICS

OPERATIONS

OPERATIONS

CONSUMERS

CONSUMERS

Solution: Ultra Modern Design with Customizable Upgrades

|

|

ONE SIZE

DOES NOT FIT ALL ~40%

~60%

25-40 YEARS OLD

< 25 YEARS OLD

Solutions for 85-90% of System

Solutions for 85-90% of System |

IA

Target Investment and Return Designing for Optimal Financial Returns

Investment

$450-650K

$1.5-1.9M

Reimages*

Scrape &

Rebuilds*

Sustainable Sales Lift

10-20%

25-35%

Profit Flow Through

40%

40%

Percent Of IA

80%

20%

* Estimates based on Company’s current outlook; Excludes Maintenance;

Median Cost for U.S. System Construction Closure

5 weeks

13 weeks |

System

Optimization Supports Growth Strategic Growth Initiative to Sell 415

Company-Owned Restaurants •

Concentrates Company Ownership to about 15%

•

Generates Higher Restaurant Operating Margin

•

Improves Quality and Predictability of Earnings

•

Executing in an EBITDA Neutral Fashion

•

Selling to 5-Star Franchisees who Support Wendy’s

Growth Initiatives

Sales Agreements will Include Commitments to Image Activate

180 Restaurants and Develop 100 New Restaurants over 5 Years

|

System

Optimization Progress SOLD IN 2013

243

$138M

SOLD IN 2013

243

$138M

BUYERS IDENTIFIED

31

**

BUYERS IDENTIFIED

31

**

TOTAL

415

$235M

TOTAL

415

$235M

UNDER CONTRACT*

141

**

UNDER CONTRACT*

141

**

* Executed Asset Purchase Agreement or LOI

**

**

RESTAURANTS

PROCEEDS

** Estimated Cash Proceeds Including Technical Assistance Fees

|

Continued

Momentum in 2014 1.6%

1.9%

2.5-3.5%

2012

2013

2014

SRS GROWTH

+60-160 bps

+30 bps

A

A

E

14.0%

15.4%

16.8-17.0%

2012

2013

2014

RESTAURANT MARGINS

+140 bps

+140-160 bps

A

A

E

N.A. Company Operated Restaurants |

Continued

Momentum in 2014 $333M

$367M

$390-400M

2012

2013

2014

ADJUSTED EBITDA

+10%

+6-9%

A

A

E

17¢

29-30¢

34-36¢

2012

2013

2014

ADJUSTED EPS

+71-76%

Mid-teens +

A

A

E

See reconciliation of Adjusted EBITDA and Adjusted EPS in appendix

|

2013

Adjusted EBITDA

$367M

Core

Restaurant

$30 -

$40M

Franchise Rev

& G&A Savings

$70 -

$80M

IA Impact

$0 -

$(5)M

2014E Adjusted

EBITDA

$390 -

$400M

Sold

Restaurants

$(75) -

$(80)M

2014 Improved Quality of Earnings

Expecting 6-9% Adjusted EBITDA Growth with 415 Fewer Restaurants

See reconciliation of Adjusted EBITDA and Adjusted EPS in appendix

|

Long-Term Outlook

SAME RESTAURANT

SALES

3% +

ADJUSTED

EBITDA

Growth Rate in the High-Single

to Low-Double Digit Range

ADJUSTED

EPS

Growth Rate in Mid-Teens |

Image

Activation System Adoption Accelerating Company Providing Leadership, Franchisees

Quickly Surpassing 2011A

2012A

2013A

2014E

2015E

2016E

2017E

COMPANY

10

57

126

215

FRANCHISE

0

2

110

195

to

245

2011A

2012A

2013A

2014E

2015E

2016E

2017E

85% COMPANY ADOPTION YE 2017

35% SYSTEM ADOPTION YE 2017

Includes Reimages & New Builds, pre-System Optimization ownership

|

$280-290M

$275-300M

$250-275M

$175-200M

$100-125M

2014E

2015E

2016E

2017E

2018E

Investment Expected to Peak in 2014/2015 to Drive Image Activation

Capital Spending

Long-Term Perspective |

Image Activation Investment Drives Accelerated Adjusted EBITDA Growth

2014E

2015E

2016E

2017E

2018E

Low-Double

High-Single

Adjusted EBITDA Growth

Long-Term Perspective |

CASH

PRIORITIES Building Shareholder Value

Invest in our Business

Invest in our Business

Image Activation Reimages, including Increasing Scrape &

Rebuilds

Dividend Growth

Dividend Growth

Generally in line with EPS growth (subject to Board approval)

Share Repurchase

Share Repurchase

Offset ongoing options dilution beyond 2014

Ended 2013

with $580M

of Cash |

Returning

Cash to Shareholders $275M

Completed $69M of Share Repurchases in 2013

Board Authorized

a Share Repurchase Program

for 2014

Expect Dutch Tender to Commence Tomorrow (Jan. 14)

Price Range of $8.50-$9.25

Leverages “Excess”

Cash

Proceeds from System Optimization of $235M

Arby’s Distribution of $40M

* See “Important Information Regarding the Anticipated Tender Offer”

in the appendix |

Building

A Stronger Wendy’s •

Results Exceeded Adjusted EBITDA/EPS Guidance

•

Restaurant Economic Model Improving

•

2013 Image Activation Targets Met; Accelerates for 2014

•

System Optimization Enhancing Quality of Earnings

•

Finished 2013 with Significant Cash

•

2014 Positioned for Another Solid Year

•

Long-Term Guidance on Track |

ICR

Xchange Conference January 13, 2014 |

Important

Information Regarding the Anticipated Tender Offer This presentation

is for informational purposes only and is not an offer to buy or the solicitation of

an offer to sell any shares of the Company’s common stock. The

anticipated tender offer described in this presentation

has not yet commenced, and there can be no assurances that the

Company will commence the tender offer on the terms described in

this presentation or at all. If

the Company commences the offer, the offer will be made solely by an Offer to Purchase

and the related Letter of Transmittal, as they may be amended or

supplemented. Stockholders and investors are urged to read the

Company’s commencement tender offer statement on Schedule TO anticipated to

be filed with the SEC in connection with the offer, which will include as

exhibits the Offer to Purchase, the related Letter of Transmittal and other

offer materials, as well as any amendments or supplements to the Schedule TO

when they become available, because they will contain important

information. If the Company commences the offer, each of these documents

will be filed with the SEC, and, when available, investors may obtain them for free

from the SEC at its website (www.sec.gov) or from the Company’s information

agent in connection with the offer. |

Low

End High End

2013

2013

2012

Adjusted EBITDA from continuing operations

89,011

$

89,011

$

95,883

$

(Less) plus:

Pension withdrawal expense in cost of sales

(13,500)

(13,500)

-

Depreciation and amortization

(47,518)

(47,518)

(36,840)

Facilities action (income) charges, net

16,040

16,040

(13,470)

Impairment of long-lived assets

(10,552)

(10,552)

(13,316)

Impairment of goodwill

(9,397)

(9,397)

-

Costs associated with closed restaurants in other operating

expense (income), net

-

-

-

Operating profit

24,084

24,084

32,257

Interest expense

(13,464)

(13,464)

(20,801)

Loss on early extinguishment of debt

(7,544)

(7,544)

-

Investment income, net

21,202

21,202

6,786

Other income (expense), net

233

233

551

Income (loss) from continuing operations before income taxes

and noncontrolling interests

24,511

24,511

18,793

Benefit from (provision for) income taxes

527

4,027

6,616

Income from continuing operations

25,038

28,538

25,409

Discontinued operations:

(Loss) income from discontinued operations, net of income taxes

(266)

(266)

1,167

Loss on disposal of discontinued operations, net of income taxes

-

-

(188)

Net (loss) income from discontinued operations

(266)

(266)

979

Net income

24,772

28,272

26,388

Net loss (income) attributable to noncontrolling

interests 410

410

-

Net income attributable to The Wendy's Company

25,182

$

28,682

$

26,388

$

Explanatory

Note:

The

Company

has

not

yet

completed

its

tax

closing

procedures

for

2013.

As

a

result,

the

Company

is

reporting

2013

Adjusted Earnings Per Share, and earnings per share as ranges. The above table

shows the low and high ends of the estimated range. Three Months

Estimated Range

Reconciliation of Adjusted EBITDA from Continuing Operations

to Net Income Attributable to The Wendy's Company

(In Thousands)

(Unaudited) |

Low

End High End

2013

2013

2012

Adjusted EBITDA from continuing operations

367,133

$

367,133

$

333,328

$

(Less) plus:

Pension withdrawal expense in cost of sales

(13,500)

(13,500)

-

Depreciation and amortization

(182,359)

(182,359)

(146,976)

Facilities action (income) charges, net

(15,650)

(15,650)

(41,031)

Impairment of long-lived assets

(15,879)

(15,879)

(21,097)

Impairment of goodwill

(9,397)

(9,397)

-

Costs associated with closed restaurants in other operating

expense (income), net

-

-

(1,477)

Operating profit

130,348

130,348

122,747

Interest expense

(69,012)

(69,012)

(98,604)

Loss on early extinguishment of debt

(28,563)

(28,563)

(75,076)

Investment income, net

23,565

23,565

36,243

Other income (expense), net

(2,080)

(2,080)

1,565

Income (loss) from continuing operations before income taxes

and noncontrolling interests

54,258

54,258

(13,125)

Benefit from (provision for) income taxes

(17,247)

(13,747)

21,083

Income from continuing operations

37,011

40,511

7,958

Discontinued operations:

(Loss) income from discontinued operations, net of income taxes

(266)

(266)

1,951

Loss on disposal of discontinued operations, net of income taxes

-

-

(442)

Net (loss) income from discontinued operations

(266)

(266)

1,509

Net income

36,745

40,245

9,467

Net loss (income) attributable to noncontrolling

interests 855

855

(2,384)

Net income attributable to The Wendy's Company

37,600

$

41,100

$

7,083

$

Explanatory

Note:

The

Company

has

not

yet

completed

its

tax

closing

procedures

for

2013.

As

a

result,

the

Company

is

reporting

2013

Adjusted Earnings Per Share, and earnings per share as ranges. The above table

shows the low and high ends of the estimated range. Reconciliation of Adjusted

EBITDA from Continuing Operations to Net Income Attributable to The Wendy's

Company (In Thousands)

(Unaudited)

Twelve Months

Estimated Range |

Per

share Per share

Per share

Adjusted income and adjusted earnings per share from continuing

operations 40,976

$

0.10

$

44,476

$

0.11

$

33,629

$

0.09

$

(Less) plus:

Impairment of goodwill

(9,207)

(0.02)

(9,207)

(0.02)

-

-

Depreciation of assets that will be replaced as part of the Image Activation

initiative (8,510)

(0.02)

(8,510)

(0.02)

-

-

Pension withdrawal expense in cost of sales

(8,286)

(0.02)

(8,286)

(0.02)

-

-

Impairment of long-lived assets

(6,567)

(0.02)

(6,567)

(0.02)

(8,216)

(0.02)

Loss on early extinguishment of debt

(4,692)

(0.01)

(4,692)

(0.01)

-

-

Facilities action (income) charges, net

6,774

0.02

6,774

0.02

(8,311)

(0.02)

Dividends from Arby's

14,550

0.03

14,550

0.03

2,868

0.01

Benefits of prior years' tax matters

-

-

-

-

5,439

0.01

Total adjustments

(15,938)

(0.04)

(15,938)

(0.04)

(8,220)

(0.02)

Income from continuing operations

25,038

0.06

28,538

0.07

25,409

0.07

Net (loss) income from discontinued operations

(266)

(0.00)

(266)

(0.00)

979

0.00

Net income

24,772

0.06

28,272

0.07

26,388

0.07

Net loss attributable to noncontrolling interests

410

0.00

410

0.00

-

-

Net income and earnings per share attributable to The Wendy's

Company 25,182

$

0.06

$

28,682

$

0.07

$

26,388

$

0.07

$

Per share

Per share

Per share

Adjusted income and adjusted earnings per share from continuing

operations 116,108

$

0.29

$

119,608

$

0.30

$

65,316

$

0.17

$

(Less) plus:

Facilities action (income) charges, net

(24,101)

(0.06)

(24,101)

(0.06)

(25,349)

(0.07)

Depreciation of assets that will be replaced as part of the Image Activation

initiative (23,822)

(0.06)

(23,822)

(0.06)

-

-

Loss on early extinguishment of debt

(17,829)

(0.05)

(17,829)

(0.05)

(46,547)

(0.12)

Impairment of long-lived assets

(9,899)

(0.02)

(9,899)

(0.02)

(13,017)

(0.04)

Impairment of goodwill

(9,207)

(0.02)

(9,207)

(0.02)

-

-

Pension withdrawal expense in cost of sales

(8,286)

(0.02)

(8,286)

(0.02)

-

-

(Loss) gain on sale of investment, net

(503)

(0.00)

(503)

(0.00)

17,978

0.05

Dividends from Arby's

14,550

0.03

14,550

0.03

2,868

0.01

Benefits of prior years' tax

matters -

-

-

-

7,620

0.02

Costs associated with closed restaurants in other operating expense (income),

net -

-

-

-

(911)

(0.00)

Total adjustments

(79,097)

(0.20)

(79,097)

(0.20)

(57,358)

(0.15)

Income from continuing operations

37,011

0.09

40,511

0.10

7,958

0.02

Net (loss) income from discontinued

operations (266)

(0.00)

(266)

(0.00)

1,509

0.00

Net income

36,745

0.09

40,245

0.10

9,467

0.02

Net loss (income) attributable to noncontrolling

interests 855

0.00

855

0.00

(2,384)

(0.00)

Net income and earnings per share attributable to The Wendy's

Company 37,600

$

0.09

$

41,100

$

0.10

$

7,083

$

0.02

$

Three Months

2013

Low End

High End

Estimated Range

Twelve Months

2013

2012

2013

2012

Estimated Range

Low End

High End

2013

Reconciliation of Adjusted Income and Adjusted Earnings Per Share from Continuing

Operations to Net Income and Earnings Per Share Attributable to The Wendy's

Company (In Thousands Except Per Share Amounts)

(Unaudited)

Explanatory Note: The Company has not yet completed its tax closing procedures for 2013. As a

result, the Company is reporting 2013 net Adjusted Earnings Per Share, and earnings per

share as ranges. The above table shows the low and high ends of the estimated range. |