Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Fidelity & Guaranty Life | d658993d8k.htm |

| EX-99.1 - EX-99.1 - Fidelity & Guaranty Life | d658993dex991.htm |

Exhibit 99.2

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

ITEM 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s discussion and analysis reviews our audited consolidated financial position at September 30, 2013, and the audited consolidated results of operations for fiscal year ended September 30, 2013, and where appropriate, factors that may affect future financial performance. This analysis should be read in conjunction with our audited Consolidated Financial Statements and notes thereto appearing elsewhere in this Form 10-K.

Dollar amounts in the accompanying discussion are presented in millions, unless otherwise noted.

Presentation of Financial Information

Certain financial data relating to FGL Insurance and our other insurance subsidiaries have been derived from their statutory financial statements, which are based on SAP permitted or prescribed by the insurance regulator in their state of domicile. Statutory accounting varies in certain respects from U.S. GAAP. See Note 16 to our audited consolidated financial statements for a discussion of these differences. In particular, our statutory financial statements continue to apply a December 31 calendar year end, as they did before the FGLH Acquisition, and such financial statements were not subject to the acquisition method adjustments, which only affected our U.S.GAAP financial statements.

Due to these changes, as well as significant changes in our business strategy since the FGLH Acquisition, we do not believe it would be useful to compare our results of operations in pre- and post-acquisition periods. Therefore, our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” addresses the following periods:

| • | Fiscal Year Ended September 30, 2013 compared to Fiscal Year Ended September 30, 2012. We refer to these periods as Fiscal 2013 and Fiscal 2012, respectively. The audited consolidated financial statements for Fiscal 2013 and Fiscal 2012, respectively, are included in the accompany financial statements. |

| • | Period from April 6, 2011 to September 30, 2011. We have provided a discussion of this period without comparison to prior or subsequent periods, as it represents a stub period subsequent to the FGLH Acquisition. As such, we do not believe it would be useful to compare our results of operations in pre and post-acquisition periods. |

Overview

We provide our principal life and annuity products through our insurance subsidiaries-FGL Insurance and FGL NY Insurance. Our customers range across a variety of age groups and are concentrated in the middle-income market. Our fixed indexed annuities provide for pre-retirement wealth accumulation and post-retirement income management. Our life insurance provides wealth protection and transfer opportunities through indexed universal life products. Life and annuity products are primarily distributed through IMOs and independent insurance agents.

Our principal products are sold through a network of approximately 200 independent marketing organizations (“IMOs”) representing approximately 20,000 independent agents and managing general agents. As of September 30, 2013, we had over 700,000 policyholders nationwide and we distribute our products throughout the United States.

We identify our most important 34 IMOs as “Power Partners.” Our Power Partners are currently comprised of 20 annuity IMOs and 14 life insurance IMOs. For the fiscal year ended September 30, 2013, these Power Partners accounted for approximately 78% of our sales volume. We believe that our relationships with these IMOs are strong. The average tenure of the top ten Power Partners is approximately 12 years.

Fixed annuities represent an important type of insurance policy or retirement and savings plan, and we believe these products deliver investment returns and predictable income streams to customers. In addition, we believe life insurance products present customers with a complementary alternative to annuities which allow the policyholder to earn returns on their premiums and provide a payment to the designated beneficiary upon the policyholder’s death. A significant portion of our business involves indexed products, such as FIAs and IULs. In calendar year 2013, FIAs generated approximately 94% of our total sales. These fixed indexed products tie contractual returns to specified market indices, such as the S&P 500 Index. The benefit of FIAs to our customers is to provide a portion of the gains of an underlying market index without the risk of losing the original principal. Our annuity contracts generally

1

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

include “surrender charges” that discourage early redemptions. In addition, the majority of these contracts contain provisions that permit us to annually reset the parameters of the formula by which index credits are provided in response to changing market conditions

For the Fiscal Year 2013, we have written approximately $40.9 million in premiums for indexed universal life insurance policies.

Since the FGLH Acquisition, we have made several significant changes to our business. We have ceded the majority of our life insurance business, with the exception of traditional life products that contain return of premium riders, to Wilton Re to transfer the risk of the lifetime guarantee on a large portion of the universal life insurance line of business; we reduced the number of product offerings to concentrate on capital efficient products and to this end have launched several new FIA products; we began managing a significant portion of our investment portfolio internally; and we re-positioned our investment portfolio by shortening the overall duration, all of which are described in more detail below. These changes have positively impacted our recent net income and profitability.

Trends and Uncertainties

The following factors represent some of the key trends and uncertainties that have influenced the development of our business and our historical financial performance and that we believe will continue to influence our business and financial performance in the future.

Market Conditions

Market volatility has affected and may continue to affect our business and financial performance in varying ways. Volatility can pressure sales and reduce demand as consumers hesitate to make financial decisions. In the long-term, however, we believe that the 2008 through 2010 financial crisis and resultant lingering financial uncertainty will motivate individuals to seek solutions combining elements of capital preservation, income and growth. We believe current market conditions may ultimately enhance the attractiveness of our product portfolio. We continue to monitor the behavior of our customers, as evidenced by mortality rates, morbidity rates, annuitization rates and lapse rates, which adjust in response to changes in market conditions in order to ensure that our products and services remain attractive and profitable.

Interest Rate Environment

The current low interest rate environment has affected and is likely to continue to affect the demand for our products and our financial performance. Our investment portfolio, which had a fair value of approximately $16.2 billion as of September 30, 2013, consists predominantly of fixed income investments. As investments that were made in a relatively higher interest rate environment mature, we earn a lower yield as we reinvest the proceeds. Over the next 5 years, we’re expecting $6,097 million in maturities, calls, and pay-downs with an average statutory book yield of 4.65%. Assets remaining after five years have an average statutory book yield of 5.20%. This projection excludes the impact of $800 million of cash and $600 million of T-bills held temporarily at September 30, 2013. The excess cash and proceeds of T-bill sales occurring in October 2013 will be reinvested during the first quarter of the 2014 Fiscal Year, which will marginally but not materially increase maturities, calls, and pay-downs over the next five years, and will not increase the reinvestment risk from asset cash flows. There is no reinvestment risk resulting from these asset cash flows, because asset-liability modeling indicates no net reinvestment cash flow risk during the next five years. The current average yield on our fixed income investment portfolio is approximately 5.0%, and we currently anticipate that proceeds that are reinvested in fixed income investments in the second half of 2013 will earn an average yield in the range of 5.0% to 5.5%. If prevailing interest rates were to rise, we believe the yield on our new investment purchases would also rise and positively impact earnings. Rising interest rates also influence the prices of fixed income investments that we sell on the secondary market rather than holding until maturity or repayment, with rising interest rates generally leading to lower prices in the secondary market, and falling interest rates generally leading to higher prices.

2

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Certain of our products include guaranteed minimum crediting rates, most notably our fixed rate annuities. As of September 30, 2013, the GAAP reserves and average crediting rate on our fixed rate annuities were $2.5 billion and 3.5%, respectively. We are required to pay these guaranteed minimum crediting rates even if earnings on our investment portfolio decline, which would negatively impact earnings. In addition, we expect more policyholders to hold policies with comparatively high guaranteed rates for a longer period in a low interest rate environment. Conversely, a rise in average yield on our investment portfolio would positively impact earnings if the average interest rate we pay on our products does not rise correspondingly. Similarly, we expect that policyholders would be less likely to hold policies with existing guarantees as interest rates rise and the relative value of other new business offerings are increased, which would negatively impact our earnings and cash flows.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations- Quantitative and Qualitative Disclosures about Market Risk” for a more detailed discussion of interest rate risk.

Aging of the U.S. Population

We believe that the aging of the U.S. population will affect the demand for our products. As the “baby boomer” generation prepares for retirement, we believe that demand for retirement savings, growth and income products will grow. The impact of this growth may be offset to some extent by asset outflows as an increasing percentage of the population begins withdrawing assets to convert their savings into income.

Industry Factors and Trends Affecting Our Results of Operations

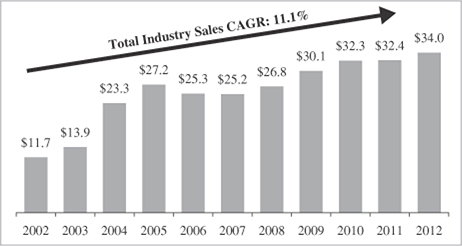

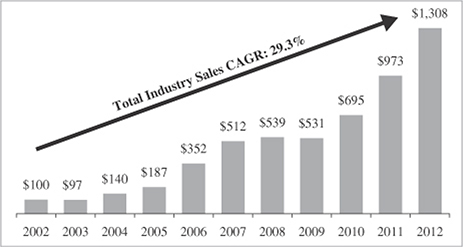

Demographics and macroeconomic factors are increasing the demand for our FIA and IUL products, for which demand is large and growing: over 10,000 people will turn 65 each day in the United States over the next 15 years. The proportion of the U.S. population over the age of 65 is expected to grow from 13% in 2010 to 18% in 2030. Due to a turbulent period for the stock market in 2007 and 2008, many middle-income Americans have grown to appreciate the security these indexed products afford. As a result, the IUL market expanded from $100 million of annual premiums in 2002 to over $1.3 billion of annual premiums in 2012. Similarly, the FIA market grew from nearly $12 billion of sales in 2002 to $34 billion of sales in 2012.

3

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

The following charts demonstrate relevant market trends:

FIA Industry Sales

(dollars in billions)

IUL Industry Sales

(dollars in millions)

Source: Wink, Inc. (formerly AnnuitySpecs)

4

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Competition

Our insurance subsidiaries operate in highly competitive markets. We face a variety of large and small industry participants. These companies compete for the growing pool of retirement assets driven by a number of exogenous factors, such as the continued aging of the U.S. population and the reduction in financial safety nets provided by governments and corporations. In many segments, product differentiation is difficult as product development and life cycles have shortened.

The top three sellers of FIAs accounted for 37% of total FIA sales for the nine months ended September 30, 2013, the top ten carriers accounted for 72% and no single carrier represented more than 14%. During this same time period, we had a market share of approximately 3% and 1% for FIAs and IULs, respectively. The composition of the IUL segment resembles that of the FIA segment. The top three carriers accounted for 30% of total IUL sales, the top ten carriers accounted for 65% and no single carrier represented more than 14%. Our own sales of FIAs and IULs by quarter in recent years were as follows:

| FIA Sales | IUL Sales | |||||||||||||||||||||||||||||||

| (in millions) |

Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | Fiscal 2013 | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | Fiscal 2013 | ||||||||||||||||||||||||

| Q1 |

$ | 177.9 | $ | 200.6 | $ | 344.5 | $ | 243.1 | $ | 3.3 | $ | 4.5 | $ | 4.2 | $ | 5.5 | ||||||||||||||||

| Q2 |

161.4 | 126.6 | 539.8 | 238.6 | 3.2 | 3.4 | 4.5 | 4.3 | ||||||||||||||||||||||||

| Q3 |

194.8 | 142.1 | 461.4 | 263.8 | 4.3 | 4.1 | 3.4 | 4.3 | ||||||||||||||||||||||||

| Q4 |

218.3 | 167.8 | 259.8 | 237.3 | 3.4 | 4.3 | 4.0 | 4.7 | ||||||||||||||||||||||||

| Total |

$ | 752.4 | $ | 637.1 | $ | 1,605.5 | $ | 982.8 | $ | 14.2 | $ | 16.3 | $ | 16.1 | $ | 18.8 | ||||||||||||||||

We had a different business model prior to the FGLH Acquisition and, since 2010, have changed our business model and reinsured substantially all of our life business as of the FGLH Acquisition Date. Thus, we do not have comparable sales data for the period from 2002 to 2010. As illustrated in “-Industry Factors and Trends Affecting Our Results of Operations” above, the FIA market grew 132% between years 2002 to 2005 before leveling off until 2009, when the market reached the first of four record years through modest growth. We believe we were a key contributor to the FIA market’s early growth, ranking in the top five in terms of market share from 2003 through 2007. Our compounded annual growth rate (“CAGR”) for the period from fiscal 2010 to September 30, 2013 is 9.3% for FGL Insurance’s FIAs and 9.8% for FGL Insurance’s IULs. Our favorable FIA results were due to the successful introduction of Prosperity Elite in September 2011, our first new product launch since the FGLH Acquisition. The new product re-engaged our distribution outlets, which increased our market share back into the top ten. Even though FGL Insurance’s IULs showed significant sales growth, the industry showed a higher growth rate, which we believe was largely due to FGL Insurance’s lower financial strength ratings relative to our main competitors.

We believe that our strong presence in the FIA market and the longevity of our relationships with our leading IMOs position us to effectively serve consumers’ increasing demand for retirement savings, income and protection solutions. We maintain strong relationships with the IMOs through product innovation, attention, and compensation. Frequent new product introductions give our IMOs something new to sell while we maintain shelf relevance. A distinct benefit to selling our products is the potential for IMOs to design products in partnership with us and have the exclusive right to sell such products for a specified time period. Our IMOs receive a high level of service from operations and direct access to senior management. Lastly, our strong compensation plan, including overrides, production bonuses and potential to participate in the Power Partner Incentive program, is designed to keep loyalty strong.

Fiscal Year 2012 shows the impact of the release of Prosperity Elite, a product developed with one of our leading IMOs. The product includes competitive features and commissions meeting our profitability targets. The IMO remained loyal with us even as we adjusted our sales volume to maintain profitability.

5

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Key Components of Our Historical Results of Operations

Under U.S. GAAP, premium collections for fixed indexed and fixed rate annuities and immediate annuities without life contingency are reported as deposit liabilities (i.e., contract holder funds) instead of as revenues. Similarly, cash payments to customers are reported as decreases in the liability for contractholder funds and not as expenses. Sources of revenues for products accounted for as deposit liabilities are net investment income, surrender and other charges deducted from contractholder funds, and net realized gains (losses) on investments. Components of expenses for products accounted for as deposit liabilities are interest-sensitive and index product benefits (primarily interest credited to account balances or the cost of providing index credits to the policyholder), amortization of DAC and VOBA, other operating costs and expenses, and income taxes.

Earnings from products accounted for as deposit liabilities are primarily generated from the excess of net investment income earned over the interest credited or the cost of providing index credits to the policyholder, known as the net investment spread. With respect to FIAs, the cost of providing index credits includes the expenses incurred to fund the annual index credits, and where applicable, minimum guaranteed interest credited. Proceeds received upon expiration or early termination of call options purchased to fund annual index credits are recorded as part of the change in fair value of derivatives, and are largely offset by an expense for index credits earned on annuity contractholder fund balances.

Our profitability depends in large part upon the amount of assets under management (“AUM”), the net investment spreads earned on our AAUM, our ability to manage our operating expenses and the costs of acquiring new business (principally commissions to agents and bonuses credited to policyholders). As we grow AUM, earnings generally increase. AUM increases when cash inflows, which include sales, exceed cash outflows. Managing net investment spreads involves the ability to manage our investment portfolios to maximize returns and minimize risks on our AUM such as interest rate changes and defaults or impairment of investments, and our ability to manage interest rates credited to policyholders and costs of the options and futures purchased to fund the annual index credits on the FIAs or IULs. We analyze returns on AAUM pre- and post-DAC and VOBA as well as pre- and post-tax to measure our profitability in terms of growth and improved earnings.

Pretax Adjusted Operating Income

Pretax Adjusted Operating Income (“Pretax AOI”) is an economic measure we use to evaluate financial performance each period for the periods subsequent to the FGLH Acquisition.

Pretax AOI is calculated by adjusting income before income taxes to adjust for interest expense and certain gains realized from the FGLH Acquisition, to eliminate the impact of net investment gains, excluding gains and losses on derivatives and including net OTTI losses recognized in operations, the effect of changes in the rates used to discount the FIA embedded derivative liability, the effects of acquisition-related reinsurance transactions, net of the corresponding DAC and VOBA impact related to these adjustments. These items fluctuate period-to-period in a manner inconsistent with our core operations. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of our operations. Together with income before income taxes, we believe Pretax AOI and Return on AAUM provide meaningful financial metrics that help investors understand our underlying results and profitability.

Pretax AOI should not be used as a substitute for income before income taxes. However, we believe the adjustments made to operating income in order to derive Pretax AOI are significant to gaining an understanding of our overall results of operations. For example, we could have strong operating results in a given period, yet report income before income taxes that is materially less, if during such period the fair value of our derivative assets hedging the FIA index credit obligations decreased due to general equity market conditions but the embedded derivative liability related to the index credit obligation did not decrease in the same proportion as the derivative assets because of non-equity market factors such as interest rate movements. Similarly, we could also have poor operating results in a given period yet show operating income that is materially greater, if during such period the fair value of the derivative assets increases but the embedded derivative liability did not increase in the same proportion as the derivative assets. We hedge our FIA index credits with a combination of static and dynamic strategies, which can result in earnings volatility, the effects of which are generally likely to reverse over time. Our management and

6

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

board of directors review Pretax AOI, and Return on AAUM and income before income taxes as part of their examination of our overall financial results. However, these examples illustrate the significant impact derivative and embedded derivative movements can have on our income before income taxes. Accordingly, our management and board of directors perform an independent review and analysis of these items, as part of their review of our hedging results each period.

The adjustments to income before income taxes are net of DAC and VOBA amortization. Amounts attributable to the fair value accounting for derivatives hedging the FIA index credits and the related embedded derivative liability fluctuate from period to period based upon changes in the fair values of call options purchased to fund the annual index credits for FIAs, changes in the interest rates used to discount the embedded derivative liability, and the fair value assumptions reflected in the embedded derivative liability. The accounting standards for fair value measurement require the discount rates used in the calculation of the embedded derivative liability to be based on risk-free interest rates. The impact of the change in risk-free interest rates has been removed from operating income. Additionally, in evaluating our operating results, the effects of transaction-related reinsurance have been removed from reported operating income. For Fiscal 2012, these effects reflect one-time settlement adjustments related to the cession of significantly all of FGL Insurance’s remaining life insurance business that it had retained upon acquisition. For Fiscal 2013, these adjustments reflect the increase in fair value of the reinsurance related embedded derivative which is based on the change in fair value of the underlying assets held in the Front Street funds withheld portfolio.

In addition, we regularly monitor and report the production volume metric titled “Sales”. Sales are not derived from any specific GAAP income statement accounts or line items and should not be view as a substitute for any financial measure determined in accordance with GAAP. Management believes that presentation of sales as measured for management purposes enhances the understanding of our business and helps depict longer term trends that may not be apparent in the results of operations due to the timing of sales and revenue recognition.

7

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Results of Operations

Fiscal Year Ended September 30, 2013, 2012 and period from April 6, 2011 to September 30, 2011.

The following tables set forth the consolidated results of operations for Fiscal 2013, 2012 and the period April 6, 2011 to September 30, 2011:

| Fiscal Year | ||||||||||||

| 2013 | 2012 | April 6, 2011 to September 30, 2011 |

||||||||||

| Revenues: |

||||||||||||

| Premiums |

$ | 58.4 | $ | 55.3 | $ | 39.0 | ||||||

| Net investment income |

672.9 | 716.2 | 369.8 | |||||||||

| Net investment gains (losses) |

544.6 | 410.0 | (166.9 | ) | ||||||||

| Insurance and investment product fees and other |

57.7 | 40.3 | 48.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

$ | 1,333.6 | $ | 1,221.8 | $ | 290.8 | ||||||

|

|

|

|

|

|

|

|||||||

| Benefits and expenses: |

||||||||||||

| Benefits and other changes in policy reserves |

496.7 | 777.4 | 247.6 | |||||||||

| Acquisition and operating expenses, net of deferrals |

98.5 | 119.9 | 72.4 | |||||||||

| Amortization of intangible assets |

225.0 | 160.7 | (11.1 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total benefits and expenses |

$ | 820.2 | $ | 1,058.0 | $ | 308.9 | ||||||

|

|

|

|

|

|

|

|||||||

| Operating Income (loss) |

513.4 | 163.8 | (18.1 | ) | ||||||||

| Interest expense |

(20.4 | ) | (23.5 | ) | (15.4 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

493.0 | 140.3 | (33.5 | ) | ||||||||

| Income tax (expense) benefit |

(156.1 | ) | 145.7 | (41.7 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 336.9 | $ | 286.0 | $ | 8.2 | ||||||

|

|

|

|

|

|

|

|||||||

8

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Net income for Fiscal 2013 was $336.9 million, an increase of $50.9 million, from $286.0 million for the Fiscal 2012. Income before taxes in Fiscal 2013 was $493.0 million, an increase of $352.7 million, from $140.3 million for Fiscal 2012. The increase in pre-tax income was primarily due to trading gains on our available-for-sale (“AFS”) portfolio, the revaluation of assets and liabilities to reflect increased interest rates, the impact of the implementation of the annual assumption review recommendations on the FIA embedded derivative reserve and DAC amortization and unlocking calculations and mortality gains. Realized investment gains on AFS securities increased $59.8 million year over year, net of related DAC and VOBA amortization, due to portfolio re-positioning trades and implementation of a tax strategy. The increase in the interest rates during the fiscal period decreased our embedded derivative liability and increased the fair value of the reinsurance related embedded derivative resulting in an increase in operating income of $63.8 million and $75.3 million, respectively, net of related DAC and VOBA amortization. As part of the assumption review process that takes place in the September quarter each year, changes were made to the surrender rates, earned rates and future index credits to bring the assumptions in line with current and expected future experience. These assumptions are used in the FIA embedded derivative reserve and DAC and VOBA calculations and resulted in a reserve decrease of $78.8 million during the fourth quarter of Fiscal 2013, net of related DAC and VOBA amortization and unlocking impact. We also experienced immediate annuity mortality gains of $35.6 million during Fiscal 2013 due to higher large case deaths. Partially offsetting these increases to operating income was a $301.8 million increase in income tax (expense) benefit year over year. During Fiscal 2012, we recognized an income tax benefit of $145.7 largely due to a partial release of the valuation allowance held against certain deferred tax assets of $204.7 million and our change in judgment regarding the realization of certain deferred tax assets in future years due to our continued profitability since the FGLH Acquisition. Comparatively, we had income tax expense of $156.1 during Fiscal 2013 primarily due to pre-tax earnings of $493.0 million.

Net income was $8.2 million for the period from April 6, 2011 to September 30, 2011. Income for the period included adjustments related to equity market volatility and lower interest rates which impacted the value of our asset and liabilities and to transaction related activities in connection with the April 6, 2011 acquisition of FGLH. The embedded derivative liability increased $42.6 million, net of VOBA and DAC effect, primarily related to the decrease in risk free rates used to discount the liability. Additionally, settlement adjustments through September 30, 2011 of ceding the block to Wilton Re resulted in a $10.4 million charge for the period. The period also included a $13.8 million charge for letter of credit (“LOC”) facility fees due to the early termination of the facility. The facility which collateralized statutory redundant reserves ceded to a wholly owned affiliate on April 7, 2011 was replaced by recapturing the block and ceding it to Wilton Re as of October 17, 2011. Substantially offsetting these items was a $41.7 million tax benefit primarily resulting from the recognition of deferred tax assets which previously had a reserve set up against them.

Annuity sales during the Fiscal 2013, Fiscal 2012 and the period from April 6, 2011 to September 30, 2011 were $1.0 billion, $1.7 billion and $380.0 million, respectively, including $982.8 million, $1.6 billion and $310.0 million, respectively, of FIA sales. Sales of our core product, Prosperity EliteSM, which was introduced during the year ended September 30, 2011, was the primary driver of the strong sales during Fiscal 2012. The period over period declines in annuity sales was primarily due to the launch of our Prosperity EliteSM product which created positive sales momentum in fiscal 2012. Product sales declined in subsequent quarters as a result of the targeted production levels we established for the product. FIAs have become the dominant product within the fixed annuity market and industry growth is expected to continue as individuals nearing retirement increasingly seek the safety and guaranteed income benefits of fixed index annuities.

9

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Pretax AOI

The table below shows the adjustments made to reconcile income before income taxes to our Pretax AOI:

| April 6, 2011 through |

||||||||||||

| Fiscal Year | September 30, | |||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Reconciliation to income before income taxes: |

||||||||||||

| Income before taxes |

$ | 493.0 | $ | 140.3 | $ | (33.5 | ) | |||||

| Interest expense |

20.4 | 23.5 | 15.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) |

513.4 | 163.8 | (18.1 | ) | ||||||||

| Effect of realized investment (gains) losses, net of offsets |

(192.2 | ) | (132.4 | ) | (0.6 | ) | ||||||

| Effect of change in FIA embedded derivative discount rate, net of offsets |

(45.2 | ) | 18.6 | 42.6 | ||||||||

| Effects of transaction-related reinsurance |

(75.3 | ) | 11.8 | 24.2 | ||||||||

|

|

|

|

|

|

|

|||||||

| Pretax AOI |

$ | 200.7 | $ | 61.8 | 48.1 | |||||||

|

|

|

|

|

|

|

|||||||

| AAUM |

15,701.9 | 16,111.9 | 16,272.3 | |||||||||

| Return on AAUM, Pretax AOI |

1.3 | % | 0.4 | % | 0.3 | % | ||||||

For Fiscal 2013, pretax AOI increased $138.9 million to $200.7 million from $61.8 million for Fiscal 2012. The increase is primarily due to annual assumption changes were made to the surrender rates, earned rates and future index credits used in the FIA embedded derivative reserve calculation which resulted in a reserve decrease of $78.8 million during the fourth quarter of Fiscal 2013, net of related DAC and VOBA amortization and unlocking impact. Also contributing to the increase were immediate annuity mortality gains of $35.6 million during Fiscal 2013 caused by large case deaths, as discussed below in benefits and other changes in policy reserves, as well as the absence of an $11.0 million charge for unclaimed death benefits recorded in Fiscal 2012 resulting from a search of the social security administration database that produced a listing of deceased policyholders that died while their policy was in force. See Note 13 in our audited consolidated financial statements for additional information regarding this charge.

For the period from April 6, 2011 to September 30, 2011, pretax AOI was $48.1 million. The accounting standards for fair value measurement require the discount rates used in the calculation of the embedded derivative liability to be based on the risk-free interest rates adjusted for our non-performance. A decline in the equity market during the period caused the fair value of our derivative assets and embedded derivative liability to decrease. However, a decrease in discount rates resulted in a partially offsetting increase in the embedded derivative liability, which we have removed from adjusted operating income. Also included in adjustments to operating income was LOC facility fees amortization due to the early termination of the facility. The facility, which collateralized redundant reserves ceded to an affiliate on April 7, 2011 was replaced by recapturing the block and ceding it to Wilton Re as of October 17, 2011. Settlement adjustments through September 30, 2011 for the life insurance business ceded to Wilton Re also resulted in a charge for the period which we have removed from operating income. In evaluating our operating results, these adjustments have been removed from operating income as acquisition-related reinsurance transactions.

10

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Revenues

Premiums. Premiums primarily reflect insurance premiums for traditional life insurance products which are recognized as revenue when due from the policyholder. We have ceded the majority of our traditional life business to unaffiliated third party reinsurers. The remaining traditional life business is primarily related to traditional life contracts that contain return of premium riders, which have not been reinsured to third party reinsurers.

For Fiscal 2013, premiums increased $3.1 million, or 5.6%, to $58.4 million from $55.3 million for Fiscal 2012, primarily due to the partial rescission of a coinsurance agreement which resulted in the return of $4.5 million of premiums previously ceded.

Net investment income. For Fiscal 2013 we had net investment income of $672.9 million compared to $716.2 million for Fiscal 2012. Investment income has been impacted by our decision in Fiscal Year 2012 to be defensive with our investment portfolio, given the interest rate environment, by continuing to reduce the credit and interest rate risk exposures in the portfolio, and to shorten the duration of the portfolio relative to our liabilities. In addition, we sold certain investments that utilized pre-acquisition tax benefits (carryforwards) which resulted in tax free capital gains. These strategies resulted in significant sales of investments during Fiscal 2012 through the first half of Fiscal 2013. The proceeds from the investment sales, including the tax free gains, were primarily held in cash, cash equivalents and treasury notes, which temporarily lowered investment income until the proceeds were reinvested. We began reinvesting the sales proceeds during the second quarter of Fiscal 2013 and saw a substantial increase in our earned yield during the second half of Fiscal 2013. However the average yield earned remained below the average yield earned for Fiscal 2012. Also contributing to the year over year decrease was the funds withheld reinsurance agreement with Front Street Re, effective December 31, 2012, which resulted in the ceding of $38.6 million of net investment income to Front Street Re.

The Company’s cash and short-term investments position is summarized as follows:

| April 6, 2011 | ||||||||||||

| to September 30, | ||||||||||||

| (in $ millions) | Fiscal 2013 | Fiscal 2012 | 2011 | |||||||||

| Q1 |

2,643.6 | 1,990.4 | N/A | |||||||||

| Q2 |

1,516.3 | 2,107.3 | N/A | |||||||||

| Q3 |

1,138.3 | 1,696.8 | 1,208.1 | |||||||||

| Q4 |

1,995.3 | 1,979.7 | 999.3 | |||||||||

AAUM (on an amortized cost basis) were $15.7 billion, $16.1 billion and $16.3 billion and the average yield earned on AAUM was 4.37%, 4.52% and 4.78% for Fiscal 2013, Fiscal 2012 and the period from April 6, 2011 to September 30, 2011, respectively, compared to interest credited and option costs of 3.14%, 3.24% and 3.46% for each period, respectively.

11

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Our net investment spread for the period is summarized as follows:

| April 6, 2011 to |

||||||||||||

| Fiscal Year | September 30, | |||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Average yield on AAUM |

4.37 | % | 4.52 | % | 4.78 | % | ||||||

| Less: Interest credited and option cost |

3.14 | % | 3.24 | % | 3.46 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Net investment spread |

1.23 | % | 1.28 | % | 1.32 | % | ||||||

The net investment spread is virtually unchanged from Fiscal 2012 as the decrease in average yield earned from the investment strategy was offset by lower interest credited/option costs that resulted from lower crediting rates on a large block of fixed rate annuities renewing at a lower rate and a reduction in the cost of call options hedging the FIA index credits. The higher net investment spread for the period from April 6, 2011 to September 30, 2011was primarily due to higher yielding assets in our investment portfolio during the period.

Net investment gains (losses). For Fiscal 2013, we had net investment gains of $544.6 million compared to net investment gains of $410.0 million for Fiscal 2012. The period-over-period increase of $134.6 million is primarily due to a $118.0 million increase in fair value of the reinsurance related embedded derivative which is based on the change in fair value of the underlying assets held in the Front Street Re funds withheld portfolio (see Note 5 of the Notes to Consolidated Financial Statements, herein, for more details). The decrease in the fair value of the underlying assets was primarily due to the rise in Treasury rates during the fourth quarter of Fiscal 2013. This gain is largely offset in the balance sheet through AOCI. Additionally, net investment gains on fixed maturity and equity available-for-sale securities increased $12.4 million increase period over period is primarily due to our investment strategy described above. Included in Fiscal 2012 was $30.5 million of gains associated with the asset transfer on October 1, 2011 for the closing of the final transaction-related reinsurance transaction with Wilton Re. The $30.5 million of gains were paid to Wilton Re as part of the initial asset transfer.

For the period from April 6, 2011 to September 30, 2011, we had net investment losses of $166.9 million primarily due to net realized and unrealized losses on our derivative instruments of $171.0 million. These losses resulted primarily from the performance of the S&P 500 index, upon which a substantial portion of our call options and futures contracts are based, which decreased 15.3% during the period.

The components of the realized and unrealized gains on derivative instruments used to hedge our FIA products are as follows:

| April 6, 2011 to | ||||||||||||

| Fiscal Year | September 30, | |||||||||||

| 2013 | 2011 | 2011 | ||||||||||

| Call options: |

||||||||||||

| Gain (loss) on option expiration |

$ | 118.3 | $ | (53.0 | ) | $ | (23.2 | ) | ||||

| Change in unrealized gain/loss |

13.1 | 153.0 | (119.7 | ) | ||||||||

| Futures contracts: |

||||||||||||

| Gain (loss) on futures contracts expiration |

17.4 | 42.7 | (21.4 | ) | ||||||||

| Change in unrealized gain/loss |

0.1 | 3.4 | (6.7 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 148.9 | $ | 146.1 | $ | (171.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

12

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

The average index credits to policyholders during the following periods are as follows:

| April 6, 2011 through |

||||||||||||

| Fiscal Year | September 30, | |||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| S&P 500 Index: |

||||||||||||

| Point-to-point strategy |

5.25 | % | 2.68 | % | 4.63 | % | ||||||

| Monthly average strategy |

4.95 | % | 1.84 | % | 4.03 | % | ||||||

| Monthly point-to-point strategy |

4.58 | % | 0.45 | % | 2.69 | % | ||||||

| 3 Year high water mark |

23.28 | % | 17.51 | % | 0.04 | % | ||||||

A point-to-point strategy is an indexing method that calculates the percentage change in the value of the S&P 500 Index on two specified dates. In a monthly point-to-point strategy, the point-to-point changes in the S&P 500 Index for each month are added together, subject to a maximum monthly cap. A monthly average strategy calculates the average of the percentage change in the S&P 500 Index for each month over the course of a year.

For Fiscal 2013 the average credit to contractholders from index credits during the period was 5.07% compared to 1.81% for Fiscal 2012. The credits for Fiscal 2012 were based on comparing the S&P 500 on each issue date in Fiscal 2012 to the same issue date in Fiscal 2011. The volatility at different points in these periods created lower overall credits in Fiscal 2012 compared to the consistent double-digit S&P growth for those issue dates in Fiscal 2013. For the period from April 6, 2011 to September 30, 2011 the average credit to contractholders from index credits during the period was 3.61%.

Actual amounts credited to contractholder fund balances may be less than the index appreciation in the S&P 500 Index due to contractual features in the FIA contracts (caps, spreads, participation rates and asset fees) which allows us to manage the cost of the options purchased to fund the annual index credits.

Insurance and investment product fees and other. For Fiscal 2013 and 2012, insurance and investment product fees and other consists primarily of cost of insurance charges, policy fees collected from the contractholder and surrender charges assessed against policy withdrawals in excess of the policyholder’s allowable penalty-free amounts (up to 10% of the prior year’s value, subject to certain limitations). These revenues increased $17.4 million, or 43.2%, to $57.7 million for Fiscal 2013 compared to $40.3 million for Fiscal 2012. These increases are primarily due to cost of insurance revenue on new universal life policies issued during the last twelve months and policy rider fees on the Prosperity Elite product line which was introduced during the fourth quarter of Fiscal Year 2011.

Insurance and investment product fees were $48.9 million for the period from April 6, 2011 to September 30, 2011and included the cost of insurance and surrender fees associated with the IUL line of business, the majority of which we ceded to Wilton Re during the first quarter of Fiscal 2012. Thus reducing the total amount retained by the Company after 2011. Withdrawals from annuity and universal life policies subject to surrender charges were $571.9 million for the period and the average surrender charge collected on withdrawals was 3.49% for the period.

Benefits and expenses

Benefits and other changes in policy reserves. For Fiscal 2013 benefits and other changes in policy reserves decreased $280.7 million, or 36.1%, to $496.7 million from $777.4 million for Fiscal 2012, principally due to the present value of future credits and guarantee liability which decreased $202.1 million during Fiscal 2013 compared to a $7.0 million increase during Fiscal 2012. The period over period decrease of $209.1 million was primarily driven by the increase in the risk free rates which reduced reserves by $88.5 million during Fiscal 2013 compared to the decrease in rates which increased reserves $39.9 during the Fiscal 2012, a year over year decrease of $128.4 million. Additionally, annual assumption changes were made to the surrender rates, earned rates and future index credits used in the FIA embedded derivative reserve calculation which resulted in a reserve decrease of $76.2 million during the fourth quarter of Fiscal 2013.

13

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Lastly, immediate annuity policy reserves were lower in Fiscal 2013 by $35.6 million. The decrease in reserves was due to a favorable mortality experience on our immediate annuities. Upon a death, we release the reserve established for the expected remaining benefits which are based on assumptions for mortality among other things. To the extent the actual deaths in the period are higher than expected, additional reserves will be released.

For the period from April 6, 2011 to September 30, 2011 we had benefits and other changes in policy reserves of $247.6 million which includes the change in the FIA embedded derivative liability which includes the market value option liability change and the present value of future credits and guarantee liability change. The market value option liability decreased $263.6 million for the period from April 6, 2011 to September 30, 2011 primarily due to the decrease in the equity markets during the period. The present value of future credits and guarantee liability increased $121.1 million for the period primarily as a result of the decrease in the risk-free rates. Fair value accounting for derivative instruments and the embedded derivatives in the FIA contracts creates differences in the recognition of revenues and expenses from derivative instruments, including the embedded derivative liability in FIA contracts. The change in fair value of the embedded derivatives will not correspond to the change in fair value of the derivatives (purchased call options and futures contracts) because the purchased derivatives cover the next annual index period while the embedded derivative liabilities cover estimated credits over the expected life of the FIA contracts. Additionally, there were index credits, interest credits and bonuses of $292.0 million and policy benefits and other reserve movements of $98.1 million during the period. Changes in index credits are attributable to changes in the underlying indices and the amount of funds allocated by policyholders to the respective index options. Benefits also include claims incurred during the period in excess of contractholder fund balances, traditional life insurance benefits and the change in reserves for traditional life insurance products.

Below is a summary of the major components included in benefits and other changes in policy reserves for Fiscal Year 2013, 2012 and the period April 6, 2011 to September 30, 2011:

| April 6, 2011 to |

||||||||||||

| Fiscal Year | September 30, | |||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| FIA market value option liability change |

$ | 6.1 | $ | 177.9 | $ | (263.6 | ) | |||||

| FIA present value future credits & guarantee liability change |

(202.1 | ) | 7.0 | 121.1 | ||||||||

| Index credits, interest credited & bonuses |

536.3 | 382.4 | 292.0 | |||||||||

| Annuity payments |

209.1 | 241.7 | 126.3 | |||||||||

| Other policy benefits and reserve movements |

(52.7 | ) | (31.6 | ) | (28.2 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total benefits and other changes in policy reserves |

$ | 496.7 | $ | 777.4 | $ | 247.6 | ||||||

|

|

|

|

|

|

|

|||||||

Acquisition, operating and general expenses, net of deferrals. Acquisition and operating expenses, net of deferrals, decreased $21.4 million, or 17.8%, to $98.5 million for Fiscal 2013, from $119.9 million for Fiscal 2012 principally due to a $31.1 million ceding commission paid to Wilton Re. This ceding commission primarily related to $30.5 million of investment gains realized on the securities transferred to Wilton Re on October 17, 2011, the effective date of the second acquisition-related reinsurance amendment, in connection with closing the final acquisition-related reinsurance transaction with Wilton Re.

Partially offsetting this year over year decrease was a one-time expense of $10.3 million in relation to the settlement of trail commissions. In September 2013, FGL Insurance agreed to accelerate the payment of trail commissions to Creative Marketing (“Creative”), a long-standing IMO of the Company, to facilitate the purchase of Creative by its management from Aviva USA Corporation (“Aviva”).

For the period from April 6, 2011 to September 30, 2011 we had acquisition and operating expenses, net of deferrals and included a $13.8 million charge for letter of credit facility fees due to the early termination of the facility, $6.3 million in expense allowances paid to reinsurers, general operating expenses of $41.5 million, and $11.1 million of commission and bonus expenses, net of deferrals. Included in total net commission expense was $9.1 million of commission related to pre-acquisition life business which was not deferred as there was no VOBA established for it as of the Acquisition Date.

14

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Amortization of intangibles. For Fiscal 2013, amortization of intangibles increased $64.3 million, or 40.0%, to $225.0 million from $160.7 million for Fiscal 2012. The increase is primarily due to $42.7 million of amortization related to the increase in fair value of the reinsurance related embedded derivative discussed above. Amortization of intangibles is based on historical, current and future expected gross margins (pre-tax operating income before amortization). The increase in the current gross margins driven by the lower embedded derivative liability discussed above increased amortization however it was partially offset by the increase in future expected gross margins from the change in assumptions also discussed above which decreased amortization. The change in the embedded derivative liability moves with the changes in the market value of the option liability as well as with changes in interest rates. If the current embedded derivative liability increases then future margins increase, as the higher liability amortizes into income over time and vice versa. When future expected margins increase amortization generally slows down and vice versa when the future expected margins decrease. The change in assumptions during the year resulted in an increase in future expected margins and corresponding “unlocking” adjustment, reducing the net amortization in Fiscal 2013. See the “DAC and VOBA” discussion under critical accounting policies herein for additional details.

For the period from April 6, 2011 to September 30, 2011, amortization of intangibles of $(11.1) million includes capitalized accrued interest of $14.0 million, which increases the and VOBA intangible asset, less $2.0 million of net VOBA amortization based on gross margins, resulting in net negative VOBA amortization of $12.0 million, which was partially offset by $0.9 million of DAC amortization during the period from April 6, 2011 to September 30, 2011.

Other items affecting net income

Interest expense. Interest expense for Fiscal 2013 was $20.4 million, compared to interest expense of $23.5 million during Fiscal 2012. The intercompany term loan and revolving of credit facility between FGLH and HFG resulted in interest expense of $9.0 million and $23.5 million during Fiscal 2013 and Fiscal 2012, respectively. On February 28, 2013, HFG and FGLH entered into a termination and release agreement whereby HFG notified FGLH of its election to convert the loans to equity resulting in the decrease in interest expense year over year. Partially offsetting this decrease was interest expense of $9.8 million related to interest incurred on the $300.0 million of outstanding Senior Notes issued in March 2013. The outstanding notes pay interest semi-annually at a coupon rate of 6.375%.

Interest expense $15.4 million for the period April 6, 2011 to September 30, 2013 was primarily related to the intercompany term loan and revolving of credit facility between FGLH and HFG.

15

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Income tax expense (benefit). Income tax expense for Fiscal 2013 was $156.1 million net of a valuation allowance release of $18.8 million, compared to an income tax benefit of $145.7 for Fiscal 2012 which consisted of $52.1 million of tax expense and other tax related charges offset by a release in valuation of $197.8 million. The increase in income tax expense of $301.8 million for Fiscal 2013 is due to a combination of pre-tax income increasing $352.7 million year over year and a much smaller valuation allowance release in Fiscal 2013 relative to Fiscal 2012.

In assessing the recoverability of our deferred tax assets, we regularly consider the guidance outlined within ASC 740 (“Income Taxes”). The guidance requires an assessment of both positive and negative evidence in determining the realizability of deferred tax assets. A valuation allowance is required to reduce our deferred tax asset to an amount that is more likely than not to be realized. In determining the net deferred tax asset and valuation allowance, we are required to make judgments and estimates related to projections of future profitability. These judgments include the following: the timing and extent of the utilization of net operating loss carry-forwards, the reversals of temporary differences, and tax planning strategies. We have recorded a partial valuation allowance of $158.7 million against our gross deferred tax assets of $620.4 million as of September 30, 2013.

We maintain a valuation allowance against certain §382 limited capital loss carry-forwards and the deferred tax assets of our non-life insurance company subsidiaries. A valuation allowance has been placed against §382 limited capital loss carry-forwards to reduce these deferred tax assets to an amount that is more likely than not to be realized before the attributes expire. Our non-life insurance company subsidiaries have a history of losses and insufficient sources of future income in order to recognize any portion of their deferred tax assets.

The valuation allowance is reviewed quarterly and will be maintained until there is sufficient positive evidence to support a release. At each reporting date, we consider new evidence, both positive and negative, that could impact the future realization of deferred tax assets. We will consider a release of the valuation allowance once there is sufficient positive evidence that it is more likely than not that the deferred tax assets will be realized. Any release of the valuation allowance will be recorded as a tax benefit increasing net income or other comprehensive income. The valuation allowance was decreased by $18.8 million for Fiscal 2013. The adjustment is due to previously unrealizable capital loss carryforwards that were utilized during Fiscal 2013, which was partially offset by full valuation allowance placed against the current period income tax benefit of our non-life insurance company subsidiaries. For Fiscal 2012 the valuation allowance was reduced by $197.8 million when management determined that sufficient positive evidence existed, based on a change in circumstance related to the Company’s cumulative loss position, to conclude that it was more likely than not that additional deferred tax assets were realizable.

Income tax benefit for the period from April 6, 2011 to September 30, 2011 was $41.7 million. Our effective tax rate of (30.9%) was positively impacted by the release of valuation allowance attributable to our determination that certain of its deferred tax assets became more likely than not realizable during the current reporting period. We have recorded a partial valuation allowance of $375.3 million against its gross deferred tax assets of $979.9 million as of September 30, 2011.

For the period from April 6, 2011 to September 30, 2011, we recorded a release of valuation allowance of $30.0 million, related in large part to the recognition of certain acquisition-date built-in gains. The recognition of built-in gains had the effect of increasing our annual §382 limit, which in turn allowed for the release of valuation allowance against capital loss carryforwards and net operating losses previously reserved for as components within the valuation allowance.

16

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Investment Portfolio

The types of assets in which we may invest are influenced by various state laws, which prescribe qualified investment assets applicable to insurance companies. Within the parameters of these laws, we invest in assets giving consideration to three primary investment objectives: (i) maintain robust absolute returns; (ii) provide reliable yield and investment income; and (iii) preserve capital.

Our investment portfolio is designed to contribute stable earnings and balance risk across diverse asset classes and is primarily invested in high quality fixed income securities.

As of September 30, 2013 and September 30, 2012, our investment portfolio was approximately $16.2 billion and $16.6 billion, respectively, and was divided among the following asset classes:

| (dollars in millions) |

September 30, 2013 | September 30, 2012 | ||||||||||||||

| Asset Class |

Fair Value | Percent | Fair Value | Percent | ||||||||||||

| Corporates |

$ | 9,418.3 | 58.1 | % | $ | 11,009.0 | 66.5 | % | ||||||||

| ABS |

1,764.6 | 10.9 | % | 1,027.9 | 6.2 | % | ||||||||||

| Non-agency RMBS |

1,368.0 | 8.4 | % | 660.6 | 4.0 | % | ||||||||||

| Municipals |

1,007.0 | 6.2 | % | 1,224.0 | 7.4 | % | ||||||||||

| U.S. Government |

1,001.8 | 6.2 | % | 930.4 | 5.6 | % | ||||||||||

| CMBS |

454.3 | 2.8 | % | 553.8 | 3.3 | % | ||||||||||

| Hybrids |

428.8 | 2.6 | % | 528.2 | 3.2 | % | ||||||||||

| Other (primarily policy loans and derivatives) |

410.0 | 2.5 | % | 219.5 | 1.3 | % | ||||||||||

| Equities |

271.1 | 1.7 | % | 248.1 | 1.5 | % | ||||||||||

| Agency RMBS |

98.6 | 0.6 | % | 155.0 | 0.9 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total investments |

$ | 16,222.5 | 100.0 | % | $ | 16,556.5 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Insurance statutes regulate the type of investments that our life subsidiaries are permitted to make and limit the amount of funds that may be used for any one type of investment. In light of these statutes and regulations and our business and investment strategy, we generally seek to invest in United States government and government-sponsored agency securities and corporate securities rated investment grade by established nationally recognized statistical rating organizations (each, an “NRSRO”) or in securities of comparable investment quality, if not rated.

17

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

As of September 30, 2013 and September 30, 2012, our fixed maturity AFS portfolio was approximately $15.5 billion and $16.1 billion, respectively. The increase in B and below investments from September 30, 2012 to September 30, 2013 is primarily due to the acquisition of certain non-agency RMBS securities, which carry a NAIC 1 designation. The following table summarizes the credit quality, by NRSRO rating, of our fixed income portfolio:

| (dollars in millions) |

September 30, 2013 | September 30, 2012 | ||||||||||||||

| Rating |

Fair Value (c) | Percent | Fair Value | Percent | ||||||||||||

| AAA |

$ | 1,924.3 | 12.4 | % | $ | 1,842.3 | 11.5 | % | ||||||||

| AA |

2,423.1 | 15.6 | % | 2,042.9 | 12.7 | % | ||||||||||

| A |

3,791.3 | 24.4 | % | 4,280.4 | 26.6 | % | ||||||||||

| BBB |

5,508.6 | 35.4 | % | 7,084.0 | 44.0 | % | ||||||||||

| BB (a) |

468.2 | 3.0 | % | 459.0 | 2.9 | % | ||||||||||

| B and below (b) |

1,426.0 | 9.2 | % | 380.3 | 2.3 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 15,541.5 | 100.0 | % | $ | 16,088.9 | 100 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes $31.4 million and $61.7 million at September 30, 2013 and September 30, 2012, respectively, of non-agency RMBS that carry a carry a NAIC 1 designation |

| (b) | Includes $1,096.3 million and $334.9 million at September 30, 2013 and September 30, 2012, respectively, of non-agency RMBS that carry a NAIC 1 designation |

The NAIC’s Securities Valuation Office (“SVO”) is responsible for the day-to-day credit quality assessment and valuation of securities owned by state regulated insurance companies. Insurance companies report ownership of securities to the SVO when such securities are eligible for regulatory filings. The SVO conducts credit analysis on these securities for the purpose of assigning an NAIC designation and/or unit price. Typically, if a security has been rated by an NRSRO, the SVO utilizes that rating and assigns an NAIC designation based upon the following system:

| NAIC Designation |

NRSRO Equivalent Rating | |

| 1 |

AAA/AA/A | |

| 2 |

BBB | |

| 3 |

BB | |

| 4 |

B | |

| 5 |

CCC and lower | |

| 6 |

In or near default |

The NAIC adopted revised designation methodologies for non-agency RMBS, including RMBS backed by subprime mortgage loans and for CMBS. The NAIC’s objective with the revised designation methodologies for these structured securities was to increase the accuracy in assessing expected losses and to use the improved assessment to determine a more appropriate capital requirement for such structured securities. The NAIC designations for structured securities, including subprime and Alternative A-paper, or Alt-A, RMBS, are based upon a comparison of the bond’s amortized cost to the NAIC’s loss expectation for each security. Securities where modeling results in no expected loss in all scenarios are considered to have the highest designation of NAIC 1. A large percentage of our RMBS securities carry a NAIC 1 designation while the NRSRO rating indicates below investment grade. This is primarily due to the credit and intent impairments recorded by us which reduced the amortized cost on these securities to a level resulting in no expected loss in all scenarios, which corresponds to a NAIC 1 designation. The revised methodologies reduce regulatory reliance on rating agencies and allow for greater regulatory input into the assumptions used to estimate expected losses from such structured securities. In the tables below, we present the rating of structured securities based on ratings from the revised NAIC rating methodologies described above (which may not correspond to rating agency designations). All NAIC designations (e.g., NAIC 1-6) are based on the revised NAIC methodologies.

18

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

The tables below present our fixed maturity securities by NAIC designation as of September 30, 2013 and September 30, 2012:

| (dollars in millions) |

September 30, 2013 | |||||||||||

| NAIC Designation |

Amortized Cost (a) | Fair Value (b) | Percent of Total Carrying Amount | |||||||||

| 1 |

$ | 9,342.0 | $ | 9,554.0 | 61.5 | % | ||||||

| 2 |

5,362.2 | 5,379.3 | 34.6 | % | ||||||||

| 3 |

405.0 | 415.4 | 2.7 | % | ||||||||

| 4 |

132.7 | 133.0 | 0.9 | % | ||||||||

| 5 |

53.9 | 53.8 | 0.3 | % | ||||||||

| 6 |

5.9 | 6.0 | — | % | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 15,301.7 | $ | 15,541.5 | 100.0 | % | |||||||

|

|

|

|

|

|

|

|||||||

| September 30, 2012 | ||||||||||||

| NAIC Designation |

Amortized Cost | Fair Value | Percent of Total Carrying Amount | |||||||||

| 1 |

$ | 8,070.1 | $ | 8,634.0 | 53.7 | % | ||||||

| 2 |

6,569.1 | 7,047.4 | 43.8 | % | ||||||||

| 3 |

381.3 | 386.4 | 2.4 | % | ||||||||

| 4 |

8.5 | 8.8 | 0.1 | % | ||||||||

| 5 |

8.2 | 8.2 | — | % | ||||||||

| 6 |

3.8 | 4.1 | — | % | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 15,041.0 | $ | 16,088.9 | 100.0 | % | |||||||

|

|

|

|

|

|

|

|||||||

19

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

The amortized cost and fair value of fixed maturity AFS securities by contractual maturities as of September 30, 2013 and September 30, 2012, as applicable, are shown below. Actual maturities may differ from contractual maturities because issuers may have the right to call or prepay obligations.

| September 30, 2013 | September 30, 2012 | |||||||||||||||

| (in millions) |

Amortized Cost |

Fair Value | Amortized Cost |

Fair Value | ||||||||||||

| Corporate, Non Structured Hybrids, Municipal and U.S. Government securities: |

||||||||||||||||

| Due in one year or less |

$ | 978.5 | $ | 982.4 | $ | 700.5 | $ | 703.9 | ||||||||

| Due after one year through five years |

2,739.1 | 2,805.8 | 3,230.6 | 3,324.5 | ||||||||||||

| Due after five years through ten years |

2,972.4 | 3,000.9 | 3,692.3 | 3,995.8 | ||||||||||||

| Due after ten years |

5,007.5 | 5,037.5 | 4,972.2 | 5,532.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

11,697.5 | 11,826.6 | 12,595.6 | 13,556.6 | ||||||||||||

| Other securities which provide for periodic payments: |

||||||||||||||||

| Asset-backed securities |

$ | 1,745.2 | $ | 1,764.6 | $ | 1,010.9 | $ | 1,027.9 | ||||||||

| Commercial-mortgage-backed securities |

431.3 | 454.3 | 520.0 | 553.8 | ||||||||||||

| Structured hybrids |

27.1 | 29.4 | 135.8 | 135.1 | ||||||||||||

| Agency residential mortgage-backed securities |

96.5 | 98.6 | 149.5 | 154.9 | ||||||||||||

| Non-agency residential mortgage-backed securities |

1,304.0 | 1,368.0 | 629.1 | 660.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total fixed maturity available-for-sale securities |

$ | 15,301.6 | $ | 15,541.5 | $ | 15,040.9 | $ | 16,089.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Subprime and Alt-A Mortgage Exposure

Between 2009 and 2011, we actively reduced our exposure to non-agency RMBS holdings where we saw fundamental concerns and prospective impairments. Consistent with this strategy and as part of the Stock Purchase Agreement with HGI, our insurance subsidiaries sold approximately $1.6 billion of structured assets.

In late 2011 and 2012, following stabilization in the housing market, and a review of the loss severity methodology utilized by the NAIC, which took into account home price appreciation vectors, rather than NRSRO ratings criteria, we began to increase exposure to non-agency RMBS securities across the spectrum, including prime, Alt-A, subprime, and option-adjustable rate mortgage securities, where the purchase price was sufficiently low enough to ensure a cushion to an NAIC 1 rating. These investment decisions were driven by rigorous analysis of the underlying collateral, as well as considerations of structural characteristics associated with these positions.

In all cases, we have been buyers of non-agency RMBS securities in the secondary market. We do not originate non-agency whole loans, regardless of underlying collateral.

Our investment in non-agency RMBS securities is predicated by the conservative and adequate cushion between purchase price and NAIC 1 rating, favorable capital characteristics, general lack of sensitivity to interest rates, positive convexity to prepayment rates, and correlation between the price of the securities and the unfolding recovery of the housing market. We believe the incremental purchases of non-agency RMBS securities brings our asset allocation back more in line with typical life insurance company’s structured exposure.

20

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

The fair value of our investments in subprime and Alt-A RMBS securities, respectively, was $360.1 million and $394.9 million as of September 30, 2013, respectively, and $233.3 million and $121.6 million as of September 30, 2012, respectively. We continue to focus on NAIC 1 and 2 rated investments and have reduced our exposure to NAIC 4 or lower rated investments. The following tables summarize our exposure to subprime and Alt-A RMBS by credit quality using NAIC designations, NRSRO ratings and vintage year as of September 30, 2013 and September 30, 2012:

| NAIC Designation | NRSRO | Vintage | ||||||||||||||||||||

| September 30, 2013 |

1 | 92.5 | % | AAA | 4.8 | % | 2007 | 21.8 | % | |||||||||||||

| 2 | 6 | % | AA | 2.3 | % | 2006 | 23.9 | % | ||||||||||||||

| 3 | 0.7 | % | A | 8.7 | % | 2005 and prior | 54.3 | % | ||||||||||||||

| 4 | 0.5 | % | BBB | 3.9 | % | |||||||||||||||||

| 5 | 0.3 | % | BB and below |

80.3 | % | |||||||||||||||||

| 6 | — | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| September 30, 2012 |

1 | 92.5 | % | AAA | 11.0 | % | 2007 | 14.3 | % | |||||||||||||

| 2 | 5.0 | % | AA | 20.3 | % | 2006 | 15.5 | % | ||||||||||||||

| 3 | 1.6 | % | A | 9.9 | % | 2005 and prior | 70.2 | % | ||||||||||||||

| 4 | 0.8 | % | BBB | 0.6 | % | |||||||||||||||||

| 5 | — | % | BB and below |

58.2 | % | |||||||||||||||||

| 6 | 0.1 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

ABS Exposure

As of September 30, 2013, the ABS exposure was largely composed of NAIC 1 rated tranches of collateralized loan obligations (“CLO”), which comprised 88.8% of all ABS holdings. These exposures, typically rated NAIC 1, are senior tranches of CLOs, which have leveraged loans as their underlying collateral. The remainder of the ABS exposure was largely diversified by underlying collateral and issuer type, including credit card and automobile receivables and home equity-backed securities.

21

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

The following tables summarize our exposure to ABS holdings. The non-CLO exposure represents 11.1% of total ABS assets, or 1.2% of total invested assets. As of September 30, 2013, the CLO and non-CLO positions were trading at a net unrealized gain (loss) position of $20.4 million and $(1.0) million, respectively.

The non-CLO exposure at September 30, 2012 represents 5.9% of total ABS assets, or 0.4%, of total invested assets. As of September 30, 2012, the CLO and non-CLO positions were trading at a net unrealized gain position of $16.8 million and $0.2 million respectively.

| (dollars in millions) |

September 30, 2013 | September 30, 2012 | ||||||||||||||

| Asset Class |

Fair Value | Percent | Fair Value | Percent | ||||||||||||

| ABS CLO |

1,569.4 | 88.8 | % | 967.0 | 94.1 | % | ||||||||||

| ABS Car Loan |

11.7 | 0.7 | % | 4.6 | 0.5 | % | ||||||||||

| ABS Credit Card |

— | — | % | 10.5 | 1.0 | % | ||||||||||

| ABS Home Equity |

68.1 | 3.9 | % | — | — | % | ||||||||||

| ABS Other |

107.3 | 6.1 | % | 35.7 | 3.5 | % | ||||||||||

| ABS Utility |

8.0 | 0.5 | % | 10.0 | 0.9 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total ABS |

1,764.5 | 100.0 | % | 1,027.8 | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

22

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

Unrealized Losses

The amortized cost and fair value of fixed maturity securities and equity securities that were in an unrealized loss position as of September 30, 2013 and September 30, 2012 were as follows:

| September 30, 2013 | ||||||||||||||||

| (in millions) | Number of Securities |

Amortized Cost | Unrealized Losses | Fair Value | ||||||||||||

| Fixed maturity securities, available for sale: |

||||||||||||||||

| United States Government full faith and credit |

18 | $ | 758.8 | $ | (3.9 | ) | $ | 754.9 | ||||||||

| United States Government sponsored entities |

17 | 10.1 | (0.2 | ) | 9.9 | |||||||||||

| United States municipalities, states and territories |

71 | 518.5 | (40.8 | ) | 477.7 | |||||||||||

| Corporate securities: |

||||||||||||||||

| Finance, insurance and real estate |

170 | 1,867.8 | (84.2 | ) | 1,783.6 | |||||||||||

| Manufacturing, construction and mining |

48 | 537.1 | (36.0 | ) | 501.1 | |||||||||||

| Utilities and related sectors |

73 | 546.8 | (19.2 | ) | 527.6 | |||||||||||

| Wholesale/retail trade |

45 | 362.9 | (13.6 | ) | 349.3 | |||||||||||

| Services, media and other |

50 | 513.7 | (32.1 | ) | 481.6 | |||||||||||

| Hybrid securities |

6 | 55.3 | (3.3 | ) | 52.0 | |||||||||||

| Non-agency Residential mortgage backed securities |

85 | 408.5 | (13.4 | ) | 395.1 | |||||||||||

| Commercial mortgage backed securities |

10 | 33.0 | (1.6 | ) | 31.4 | |||||||||||

| Asset backed securities |

56 | 416.0 | (5.2 | ) | 410.8 | |||||||||||

| Equity Securities |

17 | 161.1 | (10.3 | ) | 150.8 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 666 | $ | 6,189.6 | $ | (263.8 | ) | $ | 5,925.8 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| September 30, 2012 | ||||||||||||||||

| (in millions) |

Number of securities |

Amortized Cost | Unrealized Losses | Fair Value | ||||||||||||

| Fixed maturity securities, available for sale: |

||||||||||||||||

| United States Government full faith and credit |

6 | $ | 0.9 | $ | (0.2 | ) | $ | 0.7 | ||||||||

| United States Government sponsored agencies |

10 | 7.3 | (0.1 | ) | 7.2 | |||||||||||

| United States municipalities, states and territories |

18 | 72.3 | (1.1 | ) | 71.2 | |||||||||||

| Corporate securities: |

||||||||||||||||

| Finance, insurance and real estate |

31 | 241.7 | (4.9 | ) | 236.8 | |||||||||||

| Manufacturing, construction and mining |

10 | 95.6 | (3.0 | ) | 92.6 | |||||||||||

| Utilities and related sectors |

7 | 48.5 | (0.4 | ) | 48.1 | |||||||||||

| Wholesale/retail trade |

7 | 59.1 | (1.3 | ) | 57.8 | |||||||||||

| Services, media and other |

4 | 21.9 | (0.4 | ) | 21.5 | |||||||||||

| Hybrid securities |

8 | 130.7 | (9.6 | ) | 121.1 | |||||||||||

| Non-agency residential mortgage-backed securities |

26 | 118.9 | (4.3 | ) | 114.6 | |||||||||||

| Commercial mortgage-backed securities |

9 | 13.9 | (2.4 | ) | 11.5 | |||||||||||

| Asset-backed securities |

17 | 178.9 | (1.6 | ) | 177.3 | |||||||||||

| Equity securities |

3 | 45.7 | (1.2 | ) | 44.5 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 156 | $ | 1,035.4 | $ | (30.5 | ) | $ | 1,004.9 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The gross unrealized loss position on the portfolio as of September 30, 2013, was $263.8 million, and an increase of 233.3 million from $30.5 million as of September 30, 2012. The following is a description of the factors causing the unrealized losses as of September 30, 2013. Through September 30, 2013, Treasury yields climbed as concerns about the cessation of Federal Reserve stimulus affected market participants. Bond mutual fund flows turned

23

FIDELITY & GUARANTY LIFE HOLDINGS, INC.

sharply negative in the last months of the quarter, and fixed income security prices declined accordingly. Longer dated assets, such as municipal bonds, were particularly affected and account for $40.8 million of the unrealized loss position; to date, this sector has not seen material price movements and we view the recent price action in municipal bonds as largely interest-rate related.

Our municipal bond exposure is a combination of general obligation bonds (fair value of $323.7 million and an amortized cost of $322.9 million) and special revenue bonds (fair value of $757.1 million and amortized cost of $748.2 million). Across all municipal bonds, the largest issuer represented 8.3% of the category, and the largest single municipal bond issuer represents less than 0.60% of the entire portfolio and is rated NAIC 1. Our focus within municipal bonds is on NAIC 1 rated instruments, and 97.2% of the municipal bond exposure is rated NAIC 1. We have no exposure to troubled municipalities, including the City of Detroit.