Attached files

| file | filename |

|---|---|

| EX-23.3 - EX-23.3 - STONEGATE MORTGAGE CORP | d594685dex233.htm |

| EX-23.2 - EX-23.2 - STONEGATE MORTGAGE CORP | d594685dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 10, 2014

Registration No. 333-192715

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Stonegate Mortgage Corporation

(Exact name of Registrant as specified in its charter)

| Ohio | 6162 | 34-1194858 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

9190 Priority Way West Drive, Suite 300

Indianapolis, IN 46240

Phone: (317) 663-5100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Barbara A. Cutillo, CPA

Chief Administrative Officer

9190 Priority Way West Drive, Suite 300

Indianapolis, IN 46240

Phone: (317) 663-5100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| Robert W. Downes Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 (212) 558-4000 (212) 558-3588 (Facsimile) |

Curt W. Hidde, Esq. Barnes & Thornburg LLP 11 South Meridian Street Indianapolis, IN 46204-3535 (317) 231-7707 (317) 231-7433 (Facsimile) |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling shareholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated January 10, 2014

PROSPECTUS

(Subject to completion)

6,388,889 Shares

Stonegate Mortgage Corporation

Common Stock

This prospectus relates solely to the resale of up to an aggregate of 6,388,889 shares of our common stock by the selling shareholders identified in this prospectus (which term as used in this prospectus includes pledgees, donees, transferees or other successors-in-interest). We are registering the offer and sale of the shares, which were acquired by the selling shareholders in our private offering in May 2013.

The selling shareholders may offer the shares from time to time as they may determine through public transactions or through other means described in the section entitled “Plan of Distribution” at prevailing market prices, at prices different than prevailing market prices or at privately negotiated prices. The prices at which the selling shareholders may sell the shares may be determined by the prevailing market price for the shares at the time of sale, may be different than such prevailing market prices or may be determined through negotiated transactions with third parties.

We will not receive any of the proceeds from the sale of these shares by the selling shareholders. We have agreed to pay all expenses relating to registering the shares. The selling shareholders will pay any brokerage commissions and/or similar charges incurred for the sale of these shares.

Because all of the shares offered under this prospectus are being offered by the selling shareholders, we cannot currently determine the price or prices at which our shares may be sold under this prospectus.

Our common stock is listed on the NYSE under the symbol “SGM”. On January 8, 2014, the last reported sale price of our common stock was $16.93.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and therefore have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 19 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January , 2014.

Table of Contents

| Page | ||||

| 1 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 45 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

51 | |||

| 102 | ||||

| 107 | ||||

| 114 | ||||

| 134 | ||||

| 141 | ||||

| 158 | ||||

| 163 | ||||

| 165 | ||||

| 171 | ||||

| CERTAIN PROVISIONS OF OHIO LAW AND STONEGATE’S ARTICLES AND REGULATIONS |

173 | |||

| MATERIAL UNITED STATES TAX CONSEQUENCES TO NON-U.S. HOLDERS OF COMMON STOCK |

182 | |||

| 186 | ||||

| 188 | ||||

| 190 | ||||

| 192 | ||||

| 193 | ||||

| CHANGE IN THE COMPANY’S INDEPENDENT REGISTERED ACCOUNTING FIRM |

194 | |||

| 195 | ||||

| F-1 | ||||

-i-

Table of Contents

Unless the context requires otherwise, references in this prospectus to “Stonegate,” the “Company,” “we,” “us” and “our” refer to Stonegate Mortgage Corporation and its consolidated subsidiaries.

In this prospectus, we refer to Long Ridge Equity Partners, LLC as “Long Ridge Equity Partners” and Stonegate Investors Holdings LLC, our largest shareholder, as “Stonegate Investors Holdings.”

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor the selling shareholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or of any sale of our common stock.

For investors outside the United States: Neither we nor any of the selling shareholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

Market data used in this prospectus has been obtained from independent industry sources and publications as well as from research reports prepared for other purposes. We have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

-ii-

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should read the entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes. Unless the context otherwise requires, the information in this prospectus reflects our stock dividend of 12.861519 additional shares of our common stock for each share of our common stock that was outstanding on May 14, 2013.

Our Company

We are a leading, non-bank, integrated mortgage company focused on efficiently and effectively originating, acquiring, selling, financing and servicing U.S. residential mortgage loans. We are also one of the fastest growing non-bank mortgage originators, having grown origination volume by 209% during the nine months ended September 30, 2013 as compared to the nine months ended September 30, 2012. Our origination volume increased 12%, to $2.3 billion, during the three months ended September 30, 2013 from $2.1 billion in originations in the three months ended June 30, 2013 and grew 123% from origination volume of $1.1 billion in the three months ended September 30, 2012. Our loan originations are primarily sourced through our network of retail branches and through our relationships with approximately 1,000 third party originators (“TPOs”) as of September 30, 2013. For the nine months ended September 30, 2013, we originated $6.3 billion in loans ($2.3 billion of which were originated in the three months ended September 30, 2013) and, as of September 30, 2013, we serviced a portfolio with an unpaid principal balance of $9.7 billion, an increase of 28% from the June 30, 2013 ending unpaid principal balance of $7.6 billion, and an increase of 229% over the unpaid principal balance at September 30, 2012 of $2.9 billion.

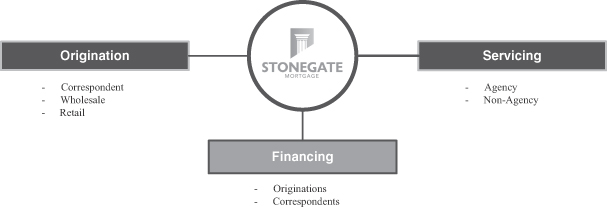

We attribute our growth to our vertically integrated and scalable mortgage banking platform, which we believe enables us to efficiently and effectively originate, acquire, sell, finance and service residential mortgage loans, and to our on-going geographic and product expansion. Since January 1, 2012, we have expanded our business into 18 additional states and Washington, D.C., added approximately 960 correspondent and wholesale customers, opened or acquired 19 retail branch offices and as a result increased our origination volume substantially. We also recently launched additional mortgage products, including our mortgage financing business, through a wholly-owned operating subsidiary, NattyMac, LLC (“NattyMac”), which will complement our growth. We focus on originating mortgage loans associated with the purchase of residential real estate, representing 53% of our originations for the twelve months ended September 30, 2013, as opposed to the refinancing of existing mortgage loans.

Since June 2013, the U.S. residential mortgage industry has experienced an increase in interest rates. Industry-wide mortgage loan originations have declined as the recent increase in interest rates has made the refinancing of mortgage loans less attractive for borrowers. Increasing interest rates can have a direct impact on the operating results of companies in the mortgage industry, including on our operating results. Our revenues decreased 27%, to $32.3 million, in the three months ended September 30, 2012 from $44.3 million in the three months ended June 30, 2013. We believe our third quarter results reflect solid business execution during a period of rising interest rates and underscore the strength of our differentiated, vertically integrated and scalable mortgage banking platform. Our three lines of business—mortgage originations, mortgage servicing and mortgage financing—complement each other and create a natural hedge against interest rate volatility and business cyclicality, an important factor in our performance.

We were founded in 2005 by members of our executive team who held various senior level executive positions at large mortgage companies and financial institutions. The loans we originate, finance and service conform to the requirements of Government-Sponsored Enterprises (“GSEs”), such as the Federal National

-1-

Table of Contents

Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”), as well as government agencies, such as the Government National Mortgage Association (“Ginnie Mae”), the Federal Housing Administration (“FHA”), the Department of Veterans Affairs (“VA”), and private investors. We utilize proprietary technology to automate many of our core processes, which allows us to perform a high level of risk-based due diligence on each loan. We have also automated various aspects of quality control and regulatory compliance risk processes, which allows us to ensure adherence to credit, compliance and collateral standards of the GSEs and other investors. We believe that our expertise and the strength of our mortgage platform is best demonstrated by our exceptional track record as a mortgage originator and servicer, coupled with our ability to scale operations without compromising the quality of originated and serviced loans. As a result of our strong operating, technology and underwriting procedures that we apply consistently to each loan, we have not incurred any material losses related to repurchase or indemnification demands from the GSEs or other investors in our loans. We believe our lack of legacy issues and our focus on purchase versus refinance mortgages has positioned us as one of the leading non-bank integrated mortgage origination and servicing providers capable of taking advantage of growth opportunities in the mortgage sector.

Recent Events

Acquisition of Crossline Capital, Inc. On December 20, 2013, we acquired Crossline Capital, Inc., or Crossline, a California-based mortgage lender that originates and services residential mortgages. The acquisition of Crossline allows us to increase our retail origination volume through “tuck-in” acquisition. Crossline is licensed to originate mortgages in 20 states including Arizona, California, Colorado, Connecticut, Florida, Georgia, Idaho, Maryland, Massachusetts, New Hampshire, New Mexico, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Utah, Virginia and Washington, and is an approved FNMA Seller Servicer. In addition, Crossline operates two national mortgage origination call centers in Lake Forest, California and Scottsdale, Arizona and also operates retail mortgage origination branches in seven other locations in Southern California. The purchase price for Crossline, which, along with working capital for the business, is being funded out of our existing cash resources and line of credit facilities with our warehouse lenders, was approximately $9.4 million.

Acquisition of Wholesale Channel and Retail Assets from Nationstar Mortgage Holdings, Inc. On November 29, 2013, we acquire the wholesale lending channel and certain distributed retail assets of Nationstar Mortgage Holdings Inc., or Nationstar. The acquisition of Nationstar’s wholesale lending channel and retail assets complement our existing wholesale and retail channels and accelerates our geographic retail channel expansion. In the acquisition, we agreed to purchase the assets and offer employment to certain employees associated with these businesses. The purchase price for the assets acquired from Nationstar was approximately $0.5 million, which, along with working capital for the business, is being funded out of our existing cash resources and line of credit facilities with our warehouse lenders.

Initial Public Offering. On October 16, 2013, we sold our common stock in our initial public offering (the “IPO”). We realized net proceeds of approximately $123.9 million from the IPO, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from the IPO to make investments relating to our business and for general corporate purposes.

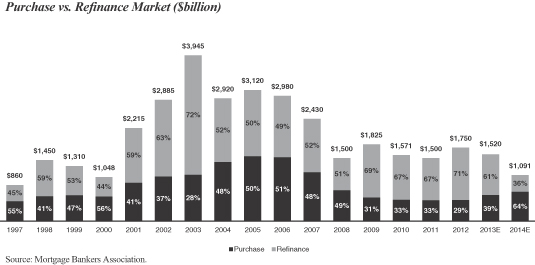

Market Overview

The U.S. residential mortgage industry is the largest segment of the consumer finance industry with over $10.0 trillion of outstanding debt at December 31, 2012 and originations of $1.8 trillion, including $1.2 trillion of refinancing volume, for the year ending December 31, 2012. Of the 2012 total volume, over 87% of originations conformed to the requirements of the GSEs or government agencies, compared to approximately 38% and 36% in 2005 and 2006, respectively. We expect that with the proposed GSE reform, lower qualifying loan limits and higher GSE guarantee fees, origination volumes conforming to the requirements of the GSEs or government agencies

-2-

Table of Contents

(collectively referred to as “Agency mortgage loans”) will gradually decline while non-Agency mortgage loans will increase and comprise a larger portion of the mortgage loan market. The non-Agency mortgage loan market has also been stressed due to the limited ability of mortgage originators to securitize mortgage loans or sell loans to investors. According to Inside Mortgage Finance, non-Agency mortgage-backed securities (“MBS”) issuance, which accounted for 56% of all MBS in 2006, declined to less than 1% in 2012, though volumes are expected to increase with higher quality originations and increasing confidence in a housing recovery.

Participants in the mortgage industry consist of large depository institutions and non-bank originators that sell directly to the GSEs as well as other originators, referred to as TPOs, that originate loans from retail customers and sell them to a depository institution or non-bank originator (referred to as an “Aggregator”), such as ourselves. Loans are sourced through a variety of channels including retail branches, the internet and call centers, as well as acquired from TPOs such as banks, mortgage bankers and brokers. The mortgage industry is extremely fragmented and is principally comprised of a large number of regional participants. Of the over 15,000 mortgage companies that are currently licensed to originate mortgage loans in the U.S., 81% have a presence in only one state and 75% have five or fewer mortgage loan officers. These mortgage originators either sell directly to the GSEs or to Aggregators, though there is significant concentration amongst the loans sold to the GSEs. Of the $710 billion of loans sold to the GSEs during the six months ended June 30, 2013, as reported to Inside Mortgage Finance, the top 25 sellers accounted for 70%, or $495 billion, of loan originations with the remaining approximately 2,000 sellers accounting for the remaining 30% or $215 billion of loan originations.

The financial crisis led many of the largest depository institutions to reduce their participation in the mortgage market, including discontinuing the acquisition of mortgages from TPOs, and the industry remains in a period of significant transformation. Additionally, GSEs and other regulators have imposed substantial compliance requirements, increased capital requirements and proposed enhanced fees based on volume for smaller originators, thus potentially limiting participants in the sector and driving consolidation across the sector. We expect that these changes will drive more and more originators to become TPOs and sell originations to Aggregators such as ourselves, rather than the current practice of selling directly to the GSEs. During the six months ended June 30, 2013, over 1,700 sellers sold $50 million or less in loans to the GSEs, representing $21 billion or 3% of total volume. Further, we also believe that evolving market conditions, including the higher requirements to be able to sell directly to the GSEs, will also drive consolidation amongst industry participants with smaller originators lacking scale being acquired by larger participants in the sector. We believe that the fragmented mortgage industry, increasing regulation and stricter policies provide an attractive opportunity to an Aggregator such as ourselves.

As a result of regulatory and market driven changes instituted in the mortgage market, including higher capital requirements for commercial banks on mortgage servicing rights (“MSR”) and increased quality control and compliance standards for mortgage underwriting, we believe that mortgage origination activity is gradually shifting from banks to non-banks. We believe that this trend is expected to continue at an accelerated rate in the future. Additionally, because the residential mortgage industry is characterized by high barriers to entry, including the necessity for approvals required to sell loans to, and service loans for, the GSEs or government organizations, state licensing requirements, and operating and technology platform requirements, we believe that we are well positioned to lead the rapidly evolving mortgage loan origination and servicing sector.

Our Business

We are an integrated mortgage company that derives revenue from three principal sources: mortgage origination, mortgage financing and mortgage servicing. Our mortgage origination business generates income primarily through origination fees and gains upon the sale of mortgage loans sourced through our correspondent, wholesale and retail channels. We also provide financing to our correspondent customers and others while they are accumulating loans prior to selling them to Aggregators, including ourselves, through our mortgage financing business and we earn interest and fee income for these services. We also have the ability to retain the MSRs on the loans we sell and to create a recurring servicing income stream in our mortgage servicing business. We

-3-

Table of Contents

believe our three business lines are complementary and provide us with the ability to effectively and efficiently source, finance, sell and service mortgage loans.

Mortgage Originations

Our mortgage origination business primarily originates and sells residential mortgage loans, which conform to the underwriting guidelines of the GSEs and government agencies. We also originate and sell jumbo loans, i.e., loans that conform to the underwriting guidelines of the GSEs, except that they exceed the maximum loan size allowed for single unit properties. We expect that as the non-Agency market continues to recover and GSE reform is approved and implemented, a larger proportion of the industry volume will be comprised of non-Agency mortgage loans. We believe we are well positioned to benefit from this shift in the market given our business model and management expertise in originating and securitizing non-Agency mortgage loans.

We are currently licensed in 39 states and Washington, D.C., including six states (California, Montana, Oregon, Rhode Island, Virginia and Washington) where we have become licensed since June 30, 2013. We intend to become licensed in all 48 of the contiguous United States in the first half of 2014. The nine states in which we are not licensed, including six states where we have a pending license application, represented approximately 15% of the overall residential mortgage origination market in 2012 and the five states where we have become licensed since June 30, 2013, represented approximately 30% of the overall residential mortgage origination market in 2012. As we become licensed in these additional states and as we increase our origination activity in the states where we have only recently become licensed, we believe our origination volume will increase substantially. Economic and housing and mortgage market conditions can vary significantly from one geographic region to another; therefore, the geographic distribution of our mortgage originations can have a direct impact on the overall performance of our servicing portfolio. As of September 30, 2013, approximately 14%, 10% and 9% of the aggregate outstanding loan balances in our servicing portfolio were concentrated in Texas, Indiana and Ohio, respectively. Although we anticipate that our origination and servicing portfolios will become less geographically concentrated over time as we expand our operations into the additional nine states where we are not currently licensed and the states where we have only recently become licensed, the geographic distribution of the mortgage loans we originate and service in the near term will likely be similar to that of our current servicing portfolio. To the extent the states where we have a higher concentration of loans experience weaker economic conditions, greater rates of decline in single family residential real estate values or reduced demand within the residential mortgage sector relative to the United States generally, the risks inherent in our business would be magnified as compared to our competitors that have a broader and less concentrated geographic footprint.

Additionally, since inception, we have focused on originating mortgage loans associated with purchase transactions as opposed to refinancings to a greater degree than many industry participants. During 2012,

-4-

Table of Contents

approximately 45% of our loan originations were purchase loans and approximately 55% were refinance transactions, compared to 29% and 71%, respectively, for the industry as a whole. We believe purchase transactions are more sustainable than refinance transactions, and typically have slower prepayment speeds in early years, making the MSRs more valuable and less volatile. Additionally, we believe that the mortgage market will increasingly shift to purchase mortgages as the housing market continues to recover, first time home buyers re-enter the housing market and interest rates increase. Further, as the non-Agency market continues to recover, we believe that our platform and management expertise in originating and securitizing these mortgages will position us well to benefit from this transformation.

We originate residential mortgage loans through three channels: correspondent, wholesale and retail. Although the majority of our originations are currently through our correspondent channel, our presence in the wholesale and retail channels makes our platform both diversified and scalable. While the channels are diverse, we constantly focus on quality control and maintaining high underwriting standards. We perform diligence on and underwrite loans through our proprietary technology platform, Online Loan Information Exchange (“OLIE”), an integrated, automated risk-based due diligence engine that automates the review process by applying business rules specific to the loan and the seller. We analyze credit, collateral and compliance risk on every loan on a pre-funding or a pre-purchase basis in order to ensure that each loan meets our investors’ standards and any applicable regulatory rules. We also capture loan data and documents associated with the loan from application through sale/securitization and servicing, giving us the ability to run additional business rules that provide indication of loan performance. We believe that the ability to offer greater transparency and data to institutional investors that purchase our loans or securities backed by our loans will provide us with a substantial advantage over our competitors in our sales executions as the mortgage market continues to evolve and we begin to securitize our own non-Agency mortgage loans.

Our three mortgage loan originations channels are discussed in more detail below.

Correspondent Channel

We acquire newly originated loans conforming to the underwriting standards of the GSEs or government agencies as well as non-Agency mortgage loans conforming to the standards of our investors from our network of correspondents across 39 states plus Washington, D.C. We identify our correspondent customers through a team of relationship managers who are responsible for signing-up customers and ensuring that we receive an adequate share of their origination volume. In addition to competitive pricing, we offer our correspondents access to a state-of-the-art technology platform, funding through our financing platform (NattyMac), including access to innovative financing programs such as early purchase facilities, as well as a timely and transparent process of acquiring their loans. In return, our correspondents provide us with high quality products that meet our underwriting standards. We track the performance of our correspondents on a score-card and terminate relationships where quality and other requirements are not met. We believe that our programs offer correspondents an attractive value proposition, including greater access to capital and liquidity, as they seek to maintain and grow their businesses. As a testament to our relationship management and product offering, our correspondent origination volume has increased from $1.2 billion in the nine months ended September 30, 2012 to $4.6 billion in the nine months ended September 30, 2013, or by 283%, including a 19% increase from $1,488.6 million in the second quarter of 2013 to $1,766.3 in the third quarter of 2013.

Our growth has been driven by adding new correspondents as well as deepening relationships with existing correspondents. Our correspondent channel represented 73% of our mortgage originations for the nine months ended September 30, 2013. We conduct financial, operational and risk reviews of each correspondent prior to initially approving them as a customer and on an annual basis to ensure compliance with our guidelines and those of the various regulators who govern our business. In addition we conduct background and financial reviews of the principals and their mortgage loan officers, and in some cases require personal guarantees. We believe that as we receive licenses in additional states and continue to increase our coverage of correspondents, we will continue to increase our market share.

-5-

Table of Contents

Wholesale Channel

Through our wholesale channel, we originate loans through a network of approximately 460 non-exclusive relationships with various approved mortgage companies and mortgage brokers. Mortgage brokers identify applicants, help them complete a loan application, gather required information and documents, and act as our liaison with the borrower during the lending process. We review and underwrite an application submitted by a broker, accept or reject the application, determine the range of interest rates and other loan terms, and fund the loan upon acceptance by the borrower and satisfaction of all conditions to the loan in much the same manner as our retail channel. By relying on brokers to market our products and assist the borrower throughout the loan application process, we can increase loan volume through our wholesale channel with proportionately lower increases in overhead costs compared with the costs of increasing loan volume through loan originations in our retail channels.

We provide a variety of Agency, government insured and non-Agency mortgage loan products to our brokers to allow them to better service their borrowers. Before approving a mortgage broker for business, we focus on several attributes including origination volume, quality of originations and tangible net worth. We also conduct financial and background checks on the principals and their mortgage loan officers through various third-party sources and in some cases we require personal guarantees. Once we begin acquiring loans from our mortgage brokers, we track the performance of the loans on an on-going basis and terminate business relationships if the loans consistently do not perform or if there is evidence of misrepresentation. During the twelve months ended September 30, 2013, we did not terminate any significant relationships due to our continued focus on underwriting loans and ensuring compliance with policies.

Retail Channel

Our retail channel primarily operates through 40 retail offices across 14 states. In this channel, company representatives originate loans through their relationships with local real estate agents, builders, telemarketing and other local contacts. This channel accounted for 15% of our 2012 originations. We expect to continue to grow our retail channel by adding new branches for at least the next 24 months. In addition, we expect that with the continued transformation of the mortgage sector there will be opportunities to acquire small retail mortgage operators as several independent mortgage originators will lack the scale to profitably originate and sell mortgages. We believe that we could provide a solution to such operators by acquiring and integrating them into our branch network. We are currently actively evaluating opportunities to acquire several of these retail originators and believe that the continued development and growth of our retail channel is central to our business strategy.

Financing

We acquired our financing platform, known as NattyMac, in August 2012, and fully integrated the platform into our mortgage banking operations in December of 2012. Founded in 1994, NattyMac earlier operated as an independent mortgage warehouse lender focused on financing prime mortgage collateral, such as Agency-eligible, government insured and government guaranteed loans that were committed for purchase by GSEs. Following our acquisition, in June 2013, we consolidated our NattyMac financing platform into a wholly-owned subsidiary which will focus on providing warehouse financing to us, our correspondent customers and others. We expect that NattyMac will be able to leverage our proprietary technology (OLIE) and our existing due diligence and underwriting processes to efficiently underwrite the warehouse lines of credit it provides for our correspondents who are its customers and others. We intend for this to create an additional source of funding for our correspondents to originate mortgage loans that meet our underwriting requirements and are eligible for us to purchase.

Our financing platform features a centralized custodian and disbursement agent allowing us to enter into participation arrangements with financial institutions, such as regional banks for an interest in our newly

-6-

Table of Contents

originated loans during the time these loans would otherwise be funded by a warehouse line or traditional repurchase facility. Additionally, by offering regional banks an opportunity to invest in a liquid high-quality asset, we are able to earn fee and net interest income. We believe that regional banks continue to have significant appetite for such investment opportunities and we believe our financing platform allows us to compete with bank-owned mortgage lenders who have access to cheaper deposit funding. We believe this is a competitive advantage over other non-bank mortgage originators and servicers who are reliant on other forms of wholesale financing to fund their operations.

Mortgage Servicing

Our mortgage servicing business is organized to maintain a high quality servicing portfolio and keep delinquency rates far below the industry average. We perform loan administration, collection and default activities, including the collection and remittance of loan payments, responding to customer inquiries, accounting for principal and interest, holding custodial (impound) funds for the payment of property taxes and insurance premiums, counseling delinquent mortgagors, modifying loans and supervising foreclosures and our property dispositions.

Our servicing model is also very focused on “recapture,” which involves actively working with existing borrowers to refinance their mortgage loans. When a loan is paid off or refinanced with a different lender, we lose the servicing fees on the loan, so our ability to recapture loans successfully is important to the longevity of our servicing cash flows. Because the refinanced loans typically have lower interest rates or lower monthly payments, and, in general, subsequently refinance more slowly and default less frequently, these refinancings also typically improve the overall quality of our servicing portfolio. For the twelve months ended September 30, 2013, we recaptured 33% of our payoffs (based on the dollar amount of refinanced mortgage loans).

Our servicing business produces strong recurring, contractual fee-based revenue with minimal credit risk. Servicing fees are primarily based on the aggregate unpaid principal balance (“UPB”) of the loans serviced and the payment structure varies by loan source and type. These include differences in rate of servicing fees as a percentage of UPB and in the structure of advances. We believe our origination business gives us a distinct advantage in building a high-quality portfolio of MSRs over those who rely heavily on purchasing MSRs from others to build their portfolios as originated portfolios generally perform better given the extensive diligence and underwriting procedures that we apply to each loan.

We service loans using a model designed to improve loan performance and reduce loan defaults and foreclosures. Our servicing portfolio consists of MSRs we retain from loans that we originate and MSRs we acquire from third party originators, including in transactions facilitated by GSEs, such as Fannie Mae and Freddie Mac. The loans we service are typically securitized by us, i.e., the loans have been pooled together with multiple other loans and interests have been sold to third party investors that are secured by loans in the securitization pool. As of September 30, 2013, our servicing portfolio contained $9.7 billion of residential first mortgages, with a weighted average coupon of 3.71% and a weighted average age of nine months. At September 30, 2013, the 90+ day delinquency rate in our servicing portfolio was 0.34%, the weighted average FICO score of our servicing portfolio was 740, and the adjusted constant prepayment rate (“CPR”) of our servicing portfolio as of September 30, 2013 was 5.80%.

Our Strengths

Leading, Non-Bank, Integrated Mortgage Company

We are a leading, non-bank, integrated mortgage company focused on efficiently and effectively originating, acquiring, selling, financing and servicing residential mortgage loans. We originate mortgages loans through our correspondent, wholesale and retail channels which provide diversity, increase scale and reduce

-7-

Table of Contents

dependency on any particular channel. During the nine months ended September 30, 2013, the correspondent, wholesale and retail channels accounted for 73%, 19% and 8%, respectively, of our origination volume. Our origination and financing businesses enable us to offer a comprehensive product suite to our customers and build an attractive mortgage servicing portfolio.

Profitable, Sustainable Business with Significant Growth Potential

We have been profitable every year since 2008 and, for the nine months ended September 30, 2013, our net income grew by 54% over the same period last year. Net income for the three months ended September 30, 2013, which was impacted by rising interest rates, was $1.7 million, compared to $9.1 million in the three months ended June 30, 2013 and $9.5 million in the three months ended September 30, 2012. The growth in net income has been driven by a significant increase in origination volume which increased by 209% during the nine months ended September 30, 2013 over the same period last year. We were able to achieve this growth as we expanded geographically into additional states, deepened correspondent relationships and expanded product offerings. We believe that we have significant growth potential as we are currently licensed in only 39 states plus Washington, D.C., representing approximately 85% of the nation’s total origination volume in 2012. These 39 states include six states (California, Montana, Oregon, Rhode Island, Virginia and Washington) where we have become licensed since June 30, 2013 and have not yet commenced any material operations. As we launch our services nationally and expand in the remaining nine contiguous United States, which accounted for approximately $287 billion, or approximately 15%, of the nation’s origination volume in 2012 and the six states where we have become licensed since June 30, 2013, which accounted for approximately $590 billion, or approximately 30%, of the nation’s origination volume in 2012, we believe that we will be able to continue to see meaningful growth in our origination volume. We will also see meaningful growth as we expect to benefit from consolidation in the mortgage market with the potential acquisition of retail originators, such as our acquisitions of Crossline and the retail assets of Nationstar.

Additionally, we are focused on purchase money volume which accounted for 53% of our origination volume for the twelve months ended September 30, 2013 compared to the industry average of 28% for the twelve months ended September 30, 2013. We believe that as refinancing volumes potentially decline with an increase in interest rates, we will be better positioned than the rest of the industry as our origination volumes will be more sustainable. Further, we also benefit from our growing mortgage servicing business which produces recurring fee income and from our financing business which provides fee and interest income.

We have made significant strategic investments in our business as we strive for growth. These investments include the opening of 19 retail branches in six states during 2012 and first half of 2013. In addition, in June 2013 we launched our non-Agency jumbo mortgage loan program and mortgage financing business to offer our customers a full suite of products. In order to achieve our growth targets, we have made significant investments and incurred significant operating expenses, which we believe will generate attractive returns over time.

Stable, Diversified and Complementary Funding Platform

Our NattyMac platform allows us to integrate a “syndicated” financing facility into our mortgage banking platform that consists of repurchase and participation agreements with major financial institutions, as well as regional and community banks. The financing facility provides a stable, low-cost diversified source of funding for our business and allows us to offer this as a service to our correspondent and other customers. We view this as a competitive advantage over other non-bank mortgage originators and servicers and a means of competing with banks that historically use deposit funding sources to finance their businesses. The platform also provides an ancillary source of fee and net interest income as we sell participations to depository institutions seeking an interest in liquid assets.

-8-

Table of Contents

We view our NattyMac platform as being complementary to our origination business as correspondents are incentivized to sell the loans warehoused on our platform to us as it provides them with greater liquidity and minimizes the capital they require in their business. We believe our “pre-funding” due diligence process also reduces credit, compliance, collateral, interest rate and market risk by allowing us to assess the salability to potential funding sources and/or other loan investors prior to funding.

Consistent Ability to Produce High Quality Loans

We are focused on originating and servicing a portfolio of high quality residential mortgage loans. The table below contains information on the quality of our loans and delinquency rates for the dates indicated.

| As of or for the |

||||||||||||

| Nine Months |

Year Ended December 31, |

|||||||||||

| 2013 |

2012 |

2011 |

||||||||||

| Average FICO score of loans originated |

729 | 747 | 741 | |||||||||

| LTV of loans originated |

85 | % | 83 | % | 84 | % | ||||||

| Servicing portfolio weighted average FICO score |

740 | 744 | 735 | |||||||||

| Servicing portfolio 90+ day delinquency rate |

0.34 | % | 0.44 | % | 0.37 | % | ||||||

We believe that our asset performance is superior to the industry due to our technologically advanced platform, consistent and conservative underwriting processes and focus on conducting a pre-funding review of each loan to ensure it meets the standards set by the GSEs or our loan investors. These practices differ from many of our competitors that apply different underwriting standards and review policies depending on the channel from which the loan is originated from. For example, some of our competitors conduct a pre-funding analysis on a sampling basis for loans acquired in the correspondent and wholesale channels but a full review on loans originated through the retail channel. We believe that our relentless focus on quality and consistency in applying underwriting policies and procedures has enabled us to have no significant repurchase demands, thus minimizing our risk profile and differentiating us from much of our competition.

Our Complementary Origination, Servicing and Financing Businesses Create a Natural Hedge Against Interest Rate Volatility and Business Cyclicality

Our principal sources of revenue, mortgage servicing, mortgage origination and mortgage financing, contribute to our stable business profile by creating a natural hedge against changes in the interest rate environment. As interest rates rise and the likelihood of refinancing decreases, MSRs generally increase in value which helps to offset any decline in origination volumes. Additionally, as long-term interest rates increase we will earn greater fee and interest income as yields on mortgage loans will increase while the funding costs will remain proportionately lower. As interest rates decline and the likelihood of refinancing increases, origination volumes tend to increase which helps to offset the decline in the value of MSRs caused by the higher probability of loan prepayment. In addition, our origination platform helps us to recapture servicing rights on loan payoffs and thus replenish our MSRs during periods of high prepayments. For the twelve months ended September 30, 2013, our recapture rate was 33% of payoffs (based on the dollar amount of refinanced mortgage loans). We expect that our recapture rate will increase further as our retail call center operations continues to expand their focus on retention of our servicing portfolio.

Robust, Proprietary Operating Platform

We believe that the current processes and systems generally used by brokers and correspondents to originate loans are fragmented and result in inconsistent data, lack of controls, and limited transparency for

-9-

Table of Contents

market participants. In response to this weakness, we have built a proprietary diligence and underwriting decision platform, OLIE, that incorporates what we believe to be the best balance of data integrity, efficiency, ease of use, speed of decision, loan quality, consistency and control. We believe this service is valued by our brokers and correspondents and offers us a distinct advantage over our competitors.

OLIE provides a transparent view of all documents and loan level data throughout the entire life of a loan, from origination through securitization and final disposition, enabling us to measure and manage the performance of our loans, giving us the ability to proactively identify trends that may negatively impact our operational or financial performance. After we originate a loan, we also capture loan data and documents associated with the loan from application through sale/securitization and servicing, giving us the ability to run additional business rules that test the effectiveness of our system and provide indication of loan performance. We believe that our current platform and our robust diligence procedures are the central reason we have not had any significant loan losses from indemnification or repurchase demands compared to other competitors who have realized significant losses. Additionally, we are able to offer greater transparency to the institutional investors that purchase our loans which is reflected in our sales execution.

Subsequent to June 30, 2013, we implemented version 1.0 and 2.0 of our “C3” automated risk-based diligence engine, which is integrated with OLIE. C3 allows us to perform an electronic quantitative risk assessment on each loan, enabling us to target our due diligence procedures on higher risk loans and thereby gain efficiencies in performing the diligence process. Our servicing of these loans gives us the ability to analyze the effectiveness of our C3 automated risk-based diligence engine and, we believe, as an integrated platform with OLIE, has provided our institutional investors with even more robust diligence procedures targeted at the loans where they seek that additional level of due diligence.

Seasoned Management Team

Our senior management team is comprised of experienced mortgage industry executives with a track record of managing all aspects of the residential mortgage business through a variety of credit cycles and market conditions. Our founder and Chief Executive Officer, Jim Cutillo, has successfully led and managed the company through the recent transformation of the mortgage industry. Additionally, our president and other members of our senior management team have an average of 20 years of experience in the mortgage banking industry. We believe our executive management team has a clear vision and common set of core values and will be able to successfully execute our rapid growth strategy.

Our Growth Drivers

We expect to drive future growth in the following ways:

Grow Origination Volume Across Channels

We intend to grow our origination volume across our channels by expanding nationally. We are currently licensed in 39 states plus Washington, D.C., which account for approximately 85% of U.S. residential mortgage originations. We intend to become licensed in all 48 contiguous United States in the first half of 2014. As we launch our services nationally and expand in the remaining nine contiguous United States, which accounted for approximately $287 billion, or approximately 15%, of the nation’s origination volume in 2012, and the six states where we have become licensed since June 30, 2013, which accounted for approximately $590 billion, or approximately 30%, of the nation’s origination market in 2012 we believe that we will be able to continue to see meaningful growth in our origination volume. This will also enable us to substantially grow our correspondent, wholesale and retail footprint and deepen existing correspondent and wholesale relationships.

-10-

Table of Contents

Expand into Non-Agency Mortgage Loans

Our extensive expertise in prime non-Agency jumbo securitization provides us the opportunity to substantially grow our non-Agency loan origination volume. We intend to focus on increasing production of loans that meet Agency criteria in nearly all respects other than loan size. These loans are generally referred to as “jumbo” loans and are originated through our existing channels. Over the last few years, this market has been hindered by the lack of an efficient capital market in which to sell such loans. We believe, as the market normalizes and non-Agency private securitization returns, we will be one of the few non-bank originators with this capability, giving us the ability to be an Aggregator for others and establishing ourselves as a market leader. The non-Agency MBS market was 56% of the total MBS market or $1.14 trillion in 2006 compared to 0.78% or $13.2 billion in 2012. In anticipation of the non-Agency market recovering and GSE reform, we intend to create a securitization shelf in 2014 and offer investors an opportunity to invest in securities backed by these loans. We may also retain the junior subordinated notes from the securitizations and create a recurring interest income stream for ourselves.

We believe that our integrated origination and servicing platform coupled with our expertise provides us with what we believe is a significant competitive advantage. We expect this investment strategy to create an attractive risk-adjusted return for our shareholders and to position us as one of the leading non-bank integrated mortgage origination and service providers.

Grow our Servicing Business

We anticipate being able to continue to retain the MSRs associated with loans we originate at attractive multiples through our integrated mortgage banking platform, whereas many of our competitors rely on purchasing MSRs. We feel our strategy is not only a more efficient utilization of capital but has less credit, collateral and compliance risk, since all loans are carefully reviewed by us prior to purchase.

We believe we can also leverage our correspondent channel to purchase MSRs from correspondent clients on a “co-issue” basis, meaning our clients originate and securitize Agency loans and concurrently transfer the servicing rights to us. This “co-issue” strategy will allow us to acquire the MSRs on an originated MSR (“OMSR”) basis versus a purchased MSR (“PMSR”) basis, since the servicing is treated as a whole loan origination. The “co-issue” strategy provides a competitive advantage over other purchasers of MSRs via bulk acquisitions as we have an existing relationship with the originator and understand their origination capabilities and techniques which drives the credit quality and performance of these loans. MSRs purchased in this way are expected to have substantially similar attributes to our originated loans with respect to note rate, credit quality and loan type. We completed our first transaction in the fourth quarter of 2013, acquiring an MSR portfolio with a UPB of approximately $142 million for a total cash purchase price of approximately $1.5 million, and continue to grow this area of our business to augment the acquisition of servicing rights. We plan to perform the same level of pre-funding due diligence on these loans prior to purchasing the servicing rights from the seller. This strategy is similar in nature to our origination strategy of offering mandatory delivery and is another delivery type that is not dependent on our origination business, making it highly scalable and efficient from an operational and financial perspective.

Grow our Mortgage Financing Business

In the current market, many correspondents lack capital to grow their businesses and, therefore, are constrained by their balance sheets from a warehouse lending perspective. A typical warehouse lender will provide financing subject to a tangible net worth covenant and require that the correspondent contribute a percentage of the principal balance to fund the warehoused loans. Often, this creates a capital constraint for the correspondent if the “take-out” or permanent investor takes too long to review or purchase the loan. We have created an early purchase facility that allows approved correspondents to sell us loans on an accelerated basis, moving them off their balance sheets and freeing up their warehouse lines so they can fund more loans. We earn fee and net interest income on

-11-

Table of Contents

these loans, which are held on average 15 days prior to sale. This also complements our mortgage origination business as we will generally acquire these loans from the correspondents, add the MSR to our portfolio and service the loans for borrowers going forward. We launched our financing business in June 2013 by hiring two dedicated experienced account executives and we expect to make additional hires as we roll out this business nationwide.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. Some of these risks are:

| • | our ability to compete successfully in the highly competitive mortgage loan servicing and mortgage loan origination industries; |

| • | experiencing financial difficulties like some originators and mortgage servicers have experienced; |

| • | adverse changes in the residential mortgage market; |

| • | our ability to obtain sufficient capital to meet our financing requirements; |

| • | our ability to grow our loan origination volume; |

| • | the geographic concentration of our servicing portfolio may result in a higher rate of delinquencies and/or defaults; |

| • | our mortgage financing business is subject to risks, including the risk of default and competitive risks; |

| • | our estimates may prove to be imprecise and result in significant changes in financial performance, including valuation; |

| • | the impact on our business of federal, state and local laws and regulations concerning loan servicing, loan origination, loan modification or the licensing of individuals and entities that engage in these activities; |

| • | substantial compliance costs arising from state licensing and operational requirements or loss of our licenses; |

| • | our ability to originate and/or acquire MSRs; |

| • | our ability to recover our significant investments in personnel and our technology platform; |

| • | the implementation of our proprietary loan due diligence, scoring and decision platform on schedule, which is still in the process of being refined and implemented; |

| • | the accuracy and completeness of information we receive about borrowers and counterparties; |

| • | a significant change in delinquencies and/or defaults for the mortgage loans we service; |

| • | our ability to recapture mortgage loans from borrowers who refinance; |

| • | changes in prevailing interest rates, such as the recent increase in rates experienced since June 2013, and any corresponding effects on origination volumes or the value of our assets; |

-12-

Table of Contents

| • | our rapid growth may be difficult to sustain and manage and may place significant demands on our administrative, operational and financial resources; |

| • | our ability to identify and complete acquisitions of retail mortgage originators and other businesses; |

| • | our ability to realize all of the anticipated benefits of our acquisitions; |

| • | the change of control rules under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), may limit our ability to use net operating loss carryforwards to reduce future taxable income; |

| • | failure to establish and maintain effective systems of internal controls; |

| • | errors in our financial models or changes in assumptions; |

| • | our ability to adapt to and implement technological changes; |

| • | the impact of the ongoing implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) on our business activities and practices, costs of operations and overall results of operations; |

| • | losses due to fraudulent and negligent acts on the part of loan applicants, brokers, other vendors, existing customers, our employees and other third parties; |

| • | the loss of the services of one or more of the members of our executive management team; and |

| • | an active trading market for our common stock may not be sustained. |

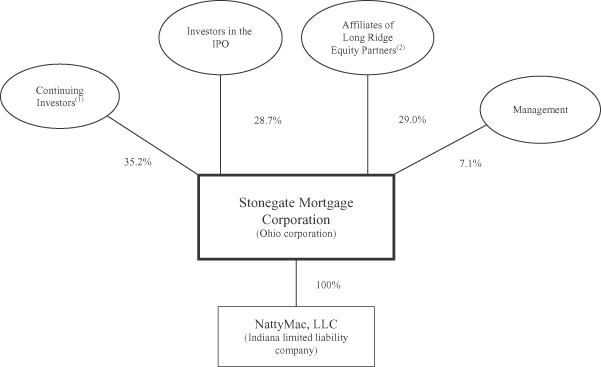

Our Ownership Structure

We are an Ohio corporation that was incorporated in 1976. Prior to March 2012, our shareholders were members of our executive management team and other investors. In March 2012, Long Ridge Equity Partners, a private investment firm focused on the financial services industry, invested in us through its affiliate. We completed a private offering in May 2013, which we refer to as our May 2013 private offering, in which we issued and sold 6,388,889 shares of our common stock to various institutional investors, accredited investors and offshore investors at an offering price of $18.00 per share, and we received approximately $115 million of proceeds, before expenses. Long Ridge Equity Partners remains our largest shareholder and has entered into various agreements with us and certain other parties which are described further in “Certain Relationships and Related Party Transactions—Arrangements with Long Ridge Equity Partners and its Affiliates.”

-13-

Table of Contents

The following chart illustrates our organizational structure, after giving effect to the IPO. We have one wholly-owned subsidiary, NattyMac, LLC, an Indiana limited liability company.

| 1 | Includes investors from our May 2013 private offering and our directors and other non-executive management shareholders (other than Stonegate Investors Holdings and its affiliates). |

| 2 | Includes the shares of common stock owned by Stonegate Investors Holdings, Long Ridge Equity Partners I, LP and Long Ridge Offshore Subsidiary Holdings, LLC, each of which is an affiliate of Long Ridge Equity Partners, LLC. Stonegate Investors Holdings and its affiliate also own warrants to purchase 242,621 shares of our common stock with an exercise price of $18.00 per share. Excludes shares issuable upon any exercise of the warrants. |

Recent Developments

Recent Industry Trends

Since June 2013, the U.S. residential mortgage industry has experienced an increase in interest rates. Industry-wide mortgage loan originations have declined as the recent increase in interest rates has made the refinancing of mortgage loans less attractive for borrowers. Increasing interest rates can have a direct impact on the operating results of companies in the mortgage industry, including on our operating results. An increase in interest rates generally could lead to the following, which may in the aggregate have an adverse effect on our results:

| • | a reduction in origination and loan lock volumes; |

| • | a shift from loan refinancing volume to purchase loan volume; |

| • | short-term contraction of the gain on sale margin of mortgage loans including negative fair market value adjustments on locked loans and loans held for sale; |

-14-

Table of Contents

| • | an increase in net interest income from financing (assuming a steeper forward yield curve); and |

| • | an increase in the value of mortgage servicing rights due to a decline in prepayment expectations. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” These exemptions provide that, so long as a company qualifies as an “emerging growth company,” it will, among other things:

| • | be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act, and certain disclosure requirements of the Dodd-Frank Act relating to compensation of its named executive officers; |

| • | be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and instead provide a reduced level of disclosure concerning executive compensation; and |

| • | be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements. |

Although we are still evaluating the JOBS Act, we may take advantage of some or all of the reduced regulatory and reporting requirements that will be available to us as long as we qualify as an “emerging growth company,” except that we have irrevocably elected not to take advantage of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act.

We will, in general, qualify as an “emerging growth company” until the earliest of:

| • | the last day of our fiscal year following the fifth anniversary of the date of the IPO; |

| • | the last day of our fiscal year in which we have annual gross revenue of $1.0 billion or more; |

| • | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; and |

| • | the date on which we are deemed to be a “large accelerated filer,” which will occur at such time as we (1) have an aggregate worldwide market value of common equity securities held by non-affiliates of $700 million or more as of the last business day of our most recently completed second fiscal quarter, (2) have been required to file annual and quarterly reports under the Exchange Act for a period of at least 12 months and (3) have filed at least one annual report pursuant to the Exchange Act. |

-15-

Table of Contents

Registration Rights and Lock-Up Agreements

Pursuant to a Registration Rights Agreement between us and the initial purchaser/placement agent for our May 2013 private offering, which we refer to as the Registration Rights Agreement, we are required, among other things, to:

| • | file or confidentially submit with the Securities and Exchange Commission, or the SEC, a resale shelf registration statement registering all of the shares of our common stock sold in our May 2013 private offering that are not sold by selling shareholders in the IPO no later than September 12, 2013 (which is 120 days after the closing date of our May 2013 private offering); and |

| • | use our commercially reasonable efforts to cause the resale shelf registration statement to become effective under the Securities Act of 1933, as amended (the “Securities Act”), as soon as reasonably practicable after the filing, and in any event, no later than February 15, 2014, and to maintain the resale shelf registration statement continuously effective under the Securities Act for a specified period. |

We confidentially submitted with the SEC on September 9, 2013 a registration statement on Form S-1 for the resale of the shares of our common stock sold in our May 2013 private offering and when the registration statement is declared effective by the Securities and Exchange Commission, we will have satisfied our obligations under the Registration Rights Agreement.

We, and each of our officers, directors and Stonegate Investors Holdings have entered into a lock-up agreement with the lead managing underwriter, of the IPO with respect to shares of our common stock, restricting the direct or indirect sale of such securities, subject to certain exceptions, for 180 days after the date of the IPO prospectus without the prior written consent of the representatives of the underwriters in the IPO. Additionally, our other shareholders who purchased common stock in our May 2013 private offering have agreed with us, subject to certain exceptions, not to directly or indirectly sell, offer to sell, grant any option or otherwise transfer or dispose of our common stock for 60 days after the date of the IPO prospectus, which was October 9, 2013.

Our Offices

Our principal executive offices are located at 9190 Priority Way West Drive, Suite 300, Indianapolis, Indiana, 46240. Our main telephone number is (317) 663-5100. Our Internet website is www.stonegatemtg.com.

-16-

Table of Contents

The following summary describes certain terms of the offering by the selling shareholders pursuant to this prospectus and certain terms of our common stock. The “Description of Capital Stock” section of this prospectus contains a more detailed description of our common stock.

| Common stock offered by selling shareholders in this offering |

6,388,889 shares |

| Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling shareholders pursuant to this prospectus. |

| Dividend policy |

We do not expect to pay dividends on our common stock for the foreseeable future. Instead, we anticipate that all of our earnings in the foreseeable future will be used for the operation and growth of our business. |

| Any future determination to pay dividends on our common stock will be at the discretion of our Board of Directors and will depend upon many factors, including our financial position, results of operations, liquidity, legal requirements, restrictions that may be imposed by the terms in current and future financing instruments and other factors deemed relevant by our Board of Directors. |

| Listing |

Our common stock is listed on the NYSE under the symbol “SGM”. |

| Risk factors |

Investing in our common stock involves a high degree of risk. For a discussion of factors you should consider in making an investment, see “Risk Factors” beginning on page 19. |

-17-

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA

The following tables present our summary historical financial data for the periods as of the dates indicated. The statement of operations data for the years ended December 31, 2012 and 2011 and the balance sheet data at December 31, 2012 and December 31, 2011 have been derived from our audited financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of results we expect in future periods. The statement of operations data for the nine months ended September 30, 2013 and 2012, and the balance sheet data as of September 30, 2013 have been derived from unaudited financial statements of Stonegate Mortgage Corporation included elsewhere in this prospectus. The unaudited financial statements of Stonegate Mortgage Corporation have been prepared on substantially the same basis as the audited financial statements and include all adjustments that we consider necessary for a fair presentation of our financial position and results of operations for all periods presented. Amounts presented for basic and diluted earnings per share reflect the impact of our stock dividend of 12.861519 additional shares of our common stock for each share of our common stock that was outstanding on May 14, 2013.

The data presented below should be read in conjunction with, and is qualified in its entirety by reference to, “Selected Historical Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes thereto included elsewhere in this prospectus.

| Nine Months Ended September 30, |

Year Ended December 31, |

|||||||||||||||

| (in thousands, except per share data) | 2013 |

2012 |

2012 |

2011 |

||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Statement of Operations Data |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Gains on mortgage loans held for sale |

$ | 63,791 | $ | 47,709 | $ | 73,337 | $ | 16,735 | ||||||||

| Fee income |

29,962 | 9,994 | 15,779 | 6,916 | ||||||||||||

| Changes in MSR valuation |

11,649 | — | — | — | ||||||||||||

| Other income |

11,106 | 4,330 | 6,429 | 2,371 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

116,508 | 62,033 | 95,545 | 26,022 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses: |

||||||||||||||||

| Salaries, commissions and benefits |

48,604 | 21,202 | 32,737 | 13,085 | ||||||||||||

| General and administrative |

15,026 | 4,429 | 7,705 | 3,163 | ||||||||||||

| Interest expense |

10,972 | 3,734 | 6,239 | 2,728 | ||||||||||||

| Amortization of MSRs |

— | 2,584 | 3,680 | 960 | ||||||||||||

| Impairment of MSRs |

— | 5,522 | 11,698 | 2 | ||||||||||||

| Other expenses |

8,886 | 3,008 | 5,677 | 2,050 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

83,488 | 40,479 | 67,736 | 21,988 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

33,020 | 21,554 | 27,809 | 4,034 | ||||||||||||

| Income taxes |

12,487 | 8,210 | 10,724 | 1,699 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 20,533 | $ | 13,344 | $ | 17,085 | $ | 2,335 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic earnings per share |

$ | 1.97 | $ | 4.13 | $ | 5.31 | $ | 0.70 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted earnings per share |

$ | 1.42 | $ | 1.95 | $ | 2.26 | $ | 0.59 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| September 30, |

December 31, |

|||||||||||

| (in thousands) | 2013 |

2012 |

2011 |

|||||||||

| (unaudited) | ||||||||||||

| Balance Sheet Data |

||||||||||||

| Cash and cash equivalents |

24,564 | $ | 15,056 | $ | 403 | |||||||

| Mortgage loans held for sale, at fair value |

518,858 | 218,624 | 61,729 | |||||||||

| MSRs, at fair value |

132,907 | — | — | |||||||||

| MSRs, at lower of amortized cost or fair value |

— | 42,202 | 17,679 | |||||||||

| Total assets |

748,929 | 309,606 | 89,108 | |||||||||

| Secured borrowings |

272,610 | 102,675 | 57,894 | |||||||||

| Warehouse lines of credit |

194,709 | 100,301 | — | |||||||||

| Total liabilities |

564,991 | 254,357 | 78,692 | |||||||||

| Total stockholders’ equity |

183,938 | 55,249 | 10,415 | |||||||||

-18-

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as other information contained in this prospectus, before deciding to invest in our common stock. The occurrence of any of the following risks could materially and adversely affect our business, prospects, financial condition, results of operations and cash flow, in which case, the trading price of our common stock could decline and you could lose all or part of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Concerning Forward-Looking Statements.”

Risks Related to Our Business and Industry

The industry in which we operate is highly competitive and our inability to compete successfully could adversely affect our business, financial condition and results of operations.

We operate in a highly competitive industry that could become even more competitive as a result of economic, technological and regulatory changes. Our mortgage loan origination business faces competition in mortgage loan offerings, rates, fees and levels of customer service. Competition to originate mortgage loans comes primarily from large commercial banks and savings institutions, but we also compete with a growing number of national and regional mortgage companies. Financial institutions generally have significantly greater resources and access to capital than we do, which gives them the benefit of a lower cost of funds and the ability to originate more mortgage loans. Our servicing business faces competition in areas such as fees and service. Competition to service mortgage loans comes from large commercial banks, large savings institutions and large independent servicers. Additionally, our servicing competitors may decide to modify their servicing model to compete more directly with our servicing model, or our servicing model may generate lower margins as a result of competition or as overall economic conditions improve.

In addition, technological advances and heightened e-commerce activities have increased consumers’ accessibility to products and services. This has intensified competition among banks and non-banks in offering mortgage loans and servicing them. We may be unable to compete successfully in our origination and servicing businesses, and this could materially and adversely affect our business, financial condition and results of operations.

We may experience financial difficulties like some originators and mortgage servicers have experienced, which could adversely affect our business, financial condition and results of operations.