Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Nuverra Environmental Solutions, Inc. | d630950d8k.htm |

Investor Presentation November 2013

Exhibit 99.1 |

| Legal

Disclaimer 2

ABOUT FORWARD-LOOKING STATEMENTS:

This presentation may contain "forward-looking statements" within the meaning of

the safe harbor provisions of the United States Private Securities Litigation Reform Act of

1995. Words such as "expect," "estimate," "project," "budget,"

"forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential,"

"continue," and similar expressions are intended to identify such forward-looking

statements. Forward-looking statements in the presentation include, without limitation,

forecasts of growth, revenues, business activity, adjusted EBITDA and pipeline expansion, and

future benefits from UMO cost reductions, statements regarding possible divestitures,

timing of such divestitures, acquisitions, financings and other matters that involve known and unknown risks, uncertainties and other factors that may cause results,

levels of activity, performance or achievements to differ materially from results expressed or

implied by this presentation. Such risk factors include, among others: difficulties

encountered in acquiring and integrating businesses; uncertainties in evaluating goodwill and

long-lived assets for potential impairment; potential financial impact of litigation;

whether certain markets grow as anticipated; pricing pressures; risks associated with our

indebtedness; low oil and or natural gas prices; changes in customer drilling activities

and capital expenditure plans; shifts in production into shale areas in which we currently do

not have operations; control of costs and expenses; and the competitive and regulatory

environment. Additional risks and uncertainties are set forth in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2012, as well as

the Company's other reports filed with the United States Securities and Exchange Commission,

which are available at http://www.sec.gov/ as well as the Company's web site at

http://nuverra.com/. As a result of the foregoing considerations and the other limitations of

non-GAAP measures described elsewhere herein, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this

cautionary statement. The Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events

or otherwise. ABOUT NON-GAAP FINANCIAL MEASURES:

This presentation contains non-GAAP financial measures as defined by the rules and

regulations of the United States Securities and Exchange Commission. A non-GAAP financial

measure is a numerical measure of a company’s historical or future financial performance,

financial position or cash flows that excludes amounts, or is subject to adjustments

that have the effect of excluding amounts, that are included in the most directly comparable

measure calculated and presented in accordance with GAAP in the statements of

operations or balance sheets of the Company; or includes amounts, or is subject to adjustments

that have the effect of including amounts, that are excluded from the most directly

comparable measure so calculated and presented. Reconciliations of these non-GAAP financial measures to their comparable GAAP financial measures are included in

the attached financial tables.

These non-GAAP financial measures are provided because management of the Company uses

these financial measures in maintaining and evaluating the Company’s ongoing

financial results and trends. Management uses this non-GAAP information as an indicator of

business performance, and evaluates overall management with respect to such indicators.

Management believes that excluding items such as acquisition expenses, amortization of intangible assets, stock-based compensation, asset impairments,

restructuring charges and other non-recurring charges, among other items that are

inconsistent in amount and frequency (as with acquisition expenses), or determined pursuant

to complex formulas that incorporate factors, such as market volatility, that are beyond our

control (as with stock-based compensation), for purposes of calculating these non-

GAAP financial measures facilitates a more meaningful evaluation of the Company’s current

operating performance and comparisons to the past and future operating performance. The

Company believes that providing non-GAAP financial measures such as EBITDA, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per

share, and operating working capital, in addition to related GAAP financial measures, provides

investors with greater transparency to the information used by the Company’s

management in its financial and operational decision-making. These non-GAAP measures

should be considered in addition to, but not as a substitute for, measures of financial

performance prepared in accordance with GAAP. |

3

We put our energy behind sustainability.™

Innovative Environmental Solutions

•

Reduce environmental footprint

•

Recycle natural resources

•

Develop beneficial use of waste streams

•

Provide responsible disposal |

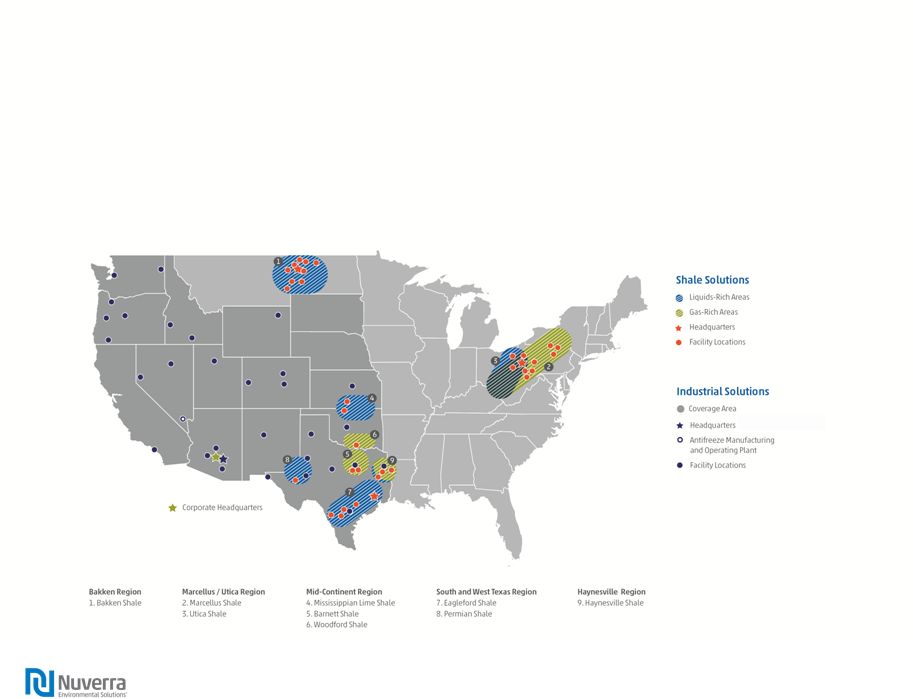

National

Operating Platform 4

Shale Solutions – provides environmental

solutions for the shale oil and natural

gas end market.

Industrial Solutions - provides environmental solutions for the retail,

automotive and manufacturing end market. |

Our Strategy: Full

Cycle Environmental Solutions •

Approximately 1,300 trucks

•

Approximately 5,600 tanks

•

Approximately 170 rail cars

•

50 miles of freshwater delivery pipeline

•

50 miles of produced water collection pipeline

•

AWS plant –

a wastewater treatment

recycling facility specifically designed to

treat and recycle water involved in the

hydraulic fracturing process in the

Marcellus Shale area

•

34 TFI treatment facilities –

process UMO

into RFO

•

56 liquid waste

disposal wells

•

Solid waste

landfill

•

Liquid and solid

waste

Disposal

Recycling

Treatment

Collection

Delivery

5

•

Fresh water to

drilling sites for

hydraulic fracturing

•

Drilling mud

•

Water procurement

•

E&P liquid waste

from fracking

•

E&P liquid waste

from ongoing

production

•

E&P solid waste

•

Used oil filters

•

Anti-freeze

•

Used motor oil into

Reprocessed Fuel Oil

•

Oily waste water

•

Used oil filters

•

Anti-freeze

•

E&P flowback water |

Nuverra

Today 6

Long-term secular tailwinds

–

Domestic energy renaissance

–

Increasing focus on health, safety and environment

–

Stricter regulatory environment

–

Need for national service provider

Focus on Shale Solutions

–

Planned Divestiture of TFI

Transition to full cycle environmental solutions

–

Landfill

–

Water recycling

–

Solid waste treatment

Financial Discipline

–

Divesting non-core assets

–

New divisional structure reduces financial and operational risk and complexity

–

Capital discipline

–

Focus on return on capital |

Key Near-Term

Priorities 7

Sale of TFI

–

Engaged investment banking firm

–

Expected to close in late Q1/ early Q2

–

Increases company’s financial flexibility

Flexible Capital Structure

–

Evaluating various credit facilities/senior debt structures to maximize flexibility and

optionality Operational Improvements in Certain Basins

Focus on Disposal, Treatment and Recycling Solutions

–

ND landfill volumes increasing as more customers receiving internal approvals

–

Expect to conduct our first H2O Forward frac during the first quarter of 2014

–

Exploring solid waste treatment options |

2014 Industry

Outlook 8

Increased Year-on-Year Activity

–

Increasing 2014 E&P capital budgets

–

Third-party forecasts projecting increased activity

–

Recent equity/debt capital raises -

$11.5B in capital raised in 2H:2013 by 22 E&P companies

Continued shift to “manufacturing”

of oil and gas assets

–

More pad drilling

–

More frac stages and longer laterals

–

Fewer days to production

Increased focus on environmental issues

–

Water sourcing and disposal

–

Solid waste disposal

Natural gas plays continue to remain challenged

–

Pockets of activity due to lower cost structure |

Expanding Our

Service Offerings Disposal

Recycling

Treatment

Collection

Delivery

9

Bakken Landfill Acquisition

•

Key component of Nuverra strategy to provide closed-loop

environmental

solutions

–

liquids

and

solids

•

Operations started in August and volumes have ramped up as

operators have received requisite internal approval

Disposal

Treatment & Recycling

Halliburton

H20

Forward

Service

•

Allows E&P operators to treat and re-use flowback and produced

water

•

Nuverra will provide surface environmental solutions, including

logistics and treatment

•

Permits approved by state, anticipate first frac in Q1:2014

SM |

Delivering

Environmental Solutions with Science & Engineering

10

•

•

•

•

•

Partnered with premier technology provider to oil

and gas companies to provide a recycled water

solution

•

Halliburton H20

Forward allows E&P operators

to treat and re-use flowback and produced water in

fracking operations, reducing the overall use of

fresh water

Formed a JV with EERC to identify alternatives

for managing solid waste cuttings

Third-party scientific support

Vast experience in the oil and gas industry

JV will bolster Company’s efforts to develop

solids treatment solutions and identify potential

beneficial uses of solid waste byproducts

SM |

Summary Pro Forma

Combined Financial Data 11

Note: Figures above are pro forma for TFI and Power Fuels transactions.

(1) Adjusted

EBITDA

Less

Capex.

Despite industry challenges in 2013, NES generated free cash flow

and paid down debt -

$32.5mm YTD revolver paydown

Year to-date 2013, the Company has generated $76.4mm of operating cash flow

Revenue

Adjusted EBITDA

Cash Capital Expenditures

Unlevered

Free

Cash

Flow

$153

$248

$548

$730

$654

$100

$200

$300

$400

$500

$600

$700

$800

2009

2010

2011

2012

LTM Sept '13

$37

$76

$173

$209

$122

$0

$50

$100

$150

$200

$250

2009

2010

2011

2012

LTM Sept '13

$35

$55

$240

$129

$48

$0

$50

$100

$150

$200

$250

$300

2009

2010

2011

2012

LTM Sept '13

$2

$21

-$67

$80

$74

-$80

-$60

-$40

-$20

$0

$20

$40

$60

$80

$100

2009

2010

2011

2012

LTM Sept '13

1

$0 |

Appendix |

Pro Forma

Combined Adjusted EBITDA Reconciliation (Unaudited)

13

Twelve Months Ended,

December 31, 2009

December 31, 2010

December 31, 2011

December 31, 2012 September 30, 2013

($Millions)

Net income (loss) from continuing operations

(3.7)

$

31.2

$

92.1

$

100.0

$

(210.1)

$

Depreciation

12.5

19.7

49.2

82.3

88.2

Amortization

5.1

6.0

8.9

16.6

28.7

Interest expense (income)

7.3

9.1

18.1

34.7

51.8

Income tax (benefit)

(0.4)

(3.1)

1.6

(57.7)

(104.1)

EBITDA from continuing operations

20.8

$

62.9

$

169.9

$

175.9

$

(145.4)

$

Transaction & integration

0.3

$

2.1

$

2.6

$

9.2

$

5.7

$

A/R reserve

accrual -

-

-

4.4

-

Environmental accrual

-

-

-

1.7

2.8

Loss on disposal of assets/asset impairment

-

-

-

8.6

212.6

Stock-based compensation

2.1

0.9

2.1

3.6

4.5

Legal Fees and Settlement

-

-

-

-

21.1

Other

13.4

10.4

(1.2)

6.0

20.8

Adjusted EBITDA from continuing operations

36.6

$

76.4

$

173.4

$

209.4

$

122.1

$

|