Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REX ENERGY CORP | d628004d8k.htm |

Rex Energy Corporation | 366 Walker Drive | State College, PA 16801

P: (814) 278-7267 | F: (814) 278-7286

E: InvestorRelations@RexEnergyCorp.com

www.rexenergy.com

Responsible Development of America’s Energy Resources

Rex Energy

SunTrust 5

th

Annual Utica Shale Mini-Conference

November 14, 2013

Exhibit 99.1 |

Except

for

historical

information,

statements

made

in

this

presentation,

including

those

relating

to

significant

potential

opportunities,

future

earnings,

resource

potential,

cash

flow,

capital

expenditures,

production

growth,

planned

number

of

wells

(as

well

as

the

timing

of

rig

operations,

natural

gas

processing

plant

commissioning

and

operations,

fracture

stimulation

activities

and

the

completion

of

wells

and

the

expected

dates

that

wells

are

producing

hydrocarbons

that

are

sold)

and

potential

ethane

sales

pipeline

projects

are

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

These

forward-looking

statements

are

indicated

by

words

such

as

“expected”,

“expects”,

“assumes”,

“anticipates”

and

similar

words.

These

statements

are

based

on

assumptions

and

estimates

that

management

believes

are

reasonable

based

on

currently

available

information;

however,

management's

assumptions

and

the

company's

future

performance

are

subject

to

a

wide

range

of

business

risks

and

uncertainties,

and

there

is

no

assurance

that

these

goals

and

projections

can

or

will

be

met.

Any

number

of

factors

could

cause

actual

results

to

differ

materially

from

those

in

the

forward-looking

statements,

including

(without

limitation)

the

following:

The

company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements.

Further

information

on

the

company’s

risks

and

uncertainties

is

available

in

the

company's

filings

with

the

Securities

and

Exchange

Commission.

The

company's

internal

estimates

of

reserves

may

be

subject

to

revision

and

may

be

different

from

estimates

by

the

company's

external

reservoir

engineers

at

year

end.

Although

the

company

believes

the

expectations

and

forecasts

reflected

in

these

and

other

forward-looking

statements

are

reasonable,

it

can

give

no

assurance

they

will

prove

to

have

been

correct.

They

can

be

affected

by

inaccurate

assumptions

or

by

known

or

unknown

risks

and

uncertainties.

2

Forward Looking Statements & Estimates

Hydrocarbon Volumes

The

SEC

permits

publicly-reporting

oil

and

gas

companies

to

disclose

“proved

reserves”

in

their

filings

with

the

SEC.

“Proved

reserves”

are

estimates

that

geological

and

engineering

data

demonstrate

with

reasonable

certainty

to

be

recoverable

in

future

years

from

known

reservoirs

under

existing

economic

and

operating

conditions.

SEC

rules

also

permit

the

disclosure

of

“probable”

and

possible”

reserves.

Rex

Energy

discloses

proved

reserves

but

does

not

disclose

probable

or

possible

reserves.

We

may

use

certain

broader

terms

such

as

“resource

potential,”

“EUR”

(estimated

ultimate

recovery

of

resources,

defined

below)

and

other

descriptions

of

volumes

of

potentially

recoverable

hydrocarbon

resources

throughout

this

presentation.

These

broader

classifications

do

not

constitute

“reserves”

as

defined

by

the

SEC

and

we

do

not

attempt

to

distinguish

these

classifications

from

probable

or

possible

reserves

as

defined

by

SEC guidelines.

The

company

defines

EUR

as

the

cumulative

oil

and

gas

production

expected

to

be

economically

recovered

from

a

reservoir

or

individual

well

from

initial

production

until

the

end

of

its

useful

life.

Our

estimates

of

EURs

and

resource

potential

have

been

prepared

internally

by

our

engineers

and

management

without

review

by

independent

engineers.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved,

probable

and

possible

reserves

and

accordingly

are

subject

to

substantially

greater

risk

of

being

actually

realized.

We

include

these

estimates

to

demonstrate

what

we

believe

to

be

the

potential

for

future

drilling

and

production

by

the

company.

Ultimate

recoveries

will

be

dependent

upon

numerous

factors

including

actual

encountered

geological

conditions,

the

impact

of

future

oil

and

gas

pricing,

exploration

and

development

costs,

and

our

future

drilling

decisions

and

budgets

based

upon

our

future

evaluation

of

risk,

returns

and

the

availability

of

capital

and,

in

many

areas, the

outcome

of

negotiation

of

drilling

arrangements

with

holders

of

adjacent

or

fractional

interest

leases.

Estimates

of

resource

potential

and

other

figures

may

change

significantly

as

development

of

ourresource

plays

provide

additional

data

and

therefore actual quantities that may ultimately be recovered will likely differ from these

estimates. Potential Drilling Locations

Our

estimates

of

potential

drilling

locations

are

prepared

internally

by

our

engineers

and

management

and

are

based

upon

a

number

of

assumptions

inherent

in

the

estimate

process.

Management,

with

the

assistance

of

engineers

and

other

professionals,

as

necessary,

conducts

a

topographical

analysis

of

our

unproved

prospective

acreage

to

identify

potential

well

pad

locations

using

operationally

approved

designs

and

considering

several

factors,

which

may

include

but

are

not

limited

to

access

roads,

terrain,

well

azimuths,

and

well

pad

sizes.

For

our

operations

in

Pennsylvania,

we

then

calculate

the

number

of

horizontal

well

bores

for

which

the

company

appears

to

control

sufficient

acreage

to

drill

the

lateral

wells

from

each

potential

well

pad

location

to

arrive

at

an

estimated

number

of

net

potential

drilling

locations.

For

our

operations

in

Ohio,

we

calculate

the

number

of

horizontal

well

bores

that

may

be

drilled

from

the

potential

well

pad

and

multiply

this

by

the

company’s

net

working

interest

percentage

of

the

proposed

unit

to

arrive

at

an

estimated

number

of

net

potential

drilling

locations.

In

both

cases,

we

then

divide

the

unproved

prospective

acreage

by

the

number

of

net

potential

drilling

locations

to

arrive

at

an

average

well

spacing.

Management

uses

these

estimates

to,

among

other

things,

evaluate

our

acreage

holdings

and

to

formulate

plans

for

drilling.

Any

number

of

factors

could

cause

the

number

of

wells

we

actually

drill

to

vary

significantly

from

these

estimates,

including:

the

availability

of

capital,

drilling

and

productioncosts,

commodity

prices,

availability

of

drilling

services

and

equipment,

lease

expirations,

regulatory

approvals

and

other

factors.

•

economic

conditions

in

the

United

States

and

globally;

the

difficult

and

adverse

conditions

in

the

domestic

and

global

capital

and

credit

markets;

domestic

and

global

demand

for

oil

and

natural

gas;

sustained

or

further

declines

in

the

prices

the

company

receives

for

oil

and

natural

gas;

the

effects

of

government

regulation,

permitting

and

other

legal

requirements;

the

geologic

quality

of

the

company’s

properties

with

regard

to,

among

other

things,

the

existence

of

hydrocarbons

in

economic

quantities;

uncertainties

about

the

estimates

of

the

company’s

oil

and

natural

gas

reserves;

the

company’s

ability

to

increase

production

and

oil

and

natural

gas

income

through

exploration

and

development;

the

company’s

ability

to

successfully

apply

horizontal

drilling

techniques

and

tertiary

recovery

methods;

the

number

of

well

locations

to

be

drilled,

the

cost

to

drill

and

the

time

frame

within

which

they

will

be

drilled;

the

effects

of

adverse

weather

on

operations;

drilling

and

operating

risks;

the

ability

of

contractors

to

timely

and

adequately

perform

their

drilling,

construction,

well

stimulation,

completion

and

production

services;

the

availability

of

equipment,

such

as

drilling

rigs

and

transportation

pipelines;

changes

in

the

company’s

drilling

plans

and

related

budgets;

the

adequacy

of

capital

resources

and

liquidity

including

(without

limitation)

access

to

additional

borrowing

capacity;

uncertainties

relating

to

the

potential

divestiture

of

the

Niobrara

assets,

including

the

ability

to

reach

an

agreement

with

a

potential

purchaser

on

terms

acceptable

to

the

company;

and

uncertainties

associated

with

our

legal

proceedings

and

the

outcome. |

Warrior

Prospects – Status Update

3

Area

Pad

Well

Lateral

Length

Status

Warrior North

Brace

Brace 1H

4,170 ft.

•

Placed into sales in September 2012

Warrior North

Graham

Graham 1H

3,973 ft.

•

Placed into sales in June 2013

Graham 2H

3,572 ft.

Warrior North

Brace West

Brace West 1H

4,178 ft.

•

Placed into sales in July 2013

Brace West 2H

4,658 ft.

Warrior North

Ocel

Ocel 1H

4,449 ft.

•

Expected to begin completion operations in 1Q14

Ocel 2H

4,350 ft.

Ocel 3H

4,340 ft.

Warrior North

Grunder

Grunder SW 1H

4,717 ft.

•

Completed drilling of first well on pad

•

One more well on Grunder pad expected to be drilled in 2013

•

Remaining three wells on pad will be drilled in 2014

Grunder SW 3H

4,585 ft.

Grunder SW 5H

5,012 ft.

Grunder SE 7H

5,013 ft.

Grunder SE 9H

4,914ft.

Warrior South

Guernsey/Noble

Guernsey 1H

3,587 ft.

•

Placed into sales in June 2013

Guernsey 2H

3,640 ft.

Noble 1H

3,378 ft.

Warrior South

J. Anderson

J. Anderson 1H

3,222 ft.

•

J. Anderson 1H & 2H placed into sales on November 11, 2013

•

Remaining

three

wells

will

be

placed

into

sales

on

December

1,

2013

J. Anderson 2H

4,133 ft.

J. Anderson 3H

3,874 ft.

J. Anderson 4H

4,339 ft.

J. Anderson 5H

5,162 ft. |

Ohio Utica

Midstream Providers 4

REXX Warrior

South Acreage

Blue Racer –

Hastings Plant

Blue Racer –

Natrium Plant

EPD ATEX Express

Pipeline

REXX Carroll

County Acreage

Mariner West

Pipeline

Blue Racer East

Ohio Pipeline

Currently in Service

Under Construction

Source: Publicly available press releases or presentations

MWE Seneca

Processing

Complex

MWE Cadiz

Processing

Complex

MarkWest Energy -

Cadiz Processing Complex

Interim Refrigeration

60 MMcf/d

In Service

Cadiz I

125 MMcf/d

In Service

Cadiz II

200 MMcf/d

3Q14

De-ethanization

40,000 Bbl/d

1Q14

MarkWest Energy -

Seneca Processing Complex

Interim Refrigeration

45 MMcf/d

In Service

Seneca I

200 MMcf/d

In Service

Seneca II

200 MMcf/d

In Service

Seneca III

200 MMcf/d

2Q14

De-ethanization

38,000 Bbl/d

4Q14

Blue Racer Facilities

Hastings

180 MMcf/d

In Service

Natrium

200 MMcf/d

In Service

Natrium Fractionation

36,000 Bbls/d

In Service

Pipeline to ATEX

27,000 Bbls/d

2Q14 |

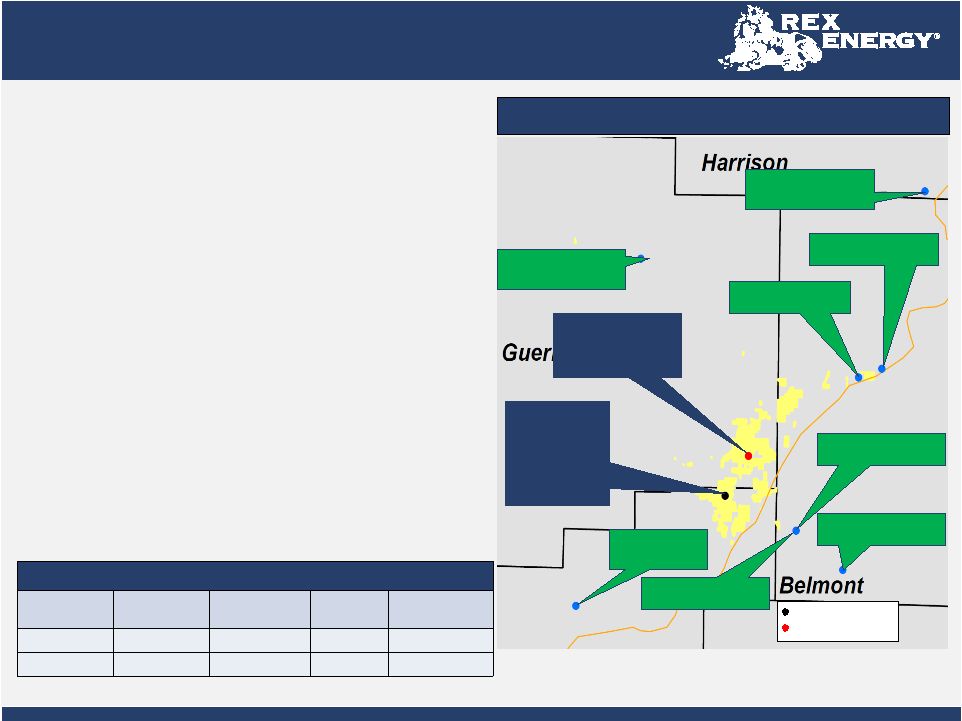

Ohio Utica

– Warrior North Prospect

5

1.

Assumes full ethane recovery

Warrior North Drilling Program

Year

Wells Drilled

Fracture

Stimulated

Placed in

Sales

Awaiting

Completion

YTD

6

4

4

3

2013E

8

4

4

3

Warrior North Prospect

5-Day Sales Rate (Average Per Well)¹

Natural

Gas

Condensate

NGLs

Total

%

Liquids

Total

(Ethane

Rejection)

G. Graham 1H

513

497

701

1,710

70%

1,417

Brace West 1H

459

296

709

1,464

69%

1,164

Brace West 2H

323

448

488

1,260

74%

1,045

•

~16,800 gross / ~16,500 net acres in Carroll County, OH

•

~115 potential gross drilling locations (pro forma for acreage trade)

•

Completed drilling three-well Ocel pad; expected to be completed

in 1Q14

•

Reduced two-pad drilling costs for 4,500’

lateral from $8.8 million at

end of last year to current $8.1 million

•

Plan to average 5-6 wells per pad with laterals averaging 5,000’

going forward

•

Average lateral length of ~ 4,400 feet

•

First wells drilled without intermediate casing to kick-off point;

expected to be next step in reducing drilling costs |

Ohio Utica

– Warrior South Prospect

•

~7,000 gross / ~4,300 net acres in Guernsey, Noble and

Belmont Counties, OH (63% WI)

•

~ 38 potential gross drilling locations

2

•

Completed 5-well J. Anderson pad

•

J. Anderson 1H & 2H placed into sales

•

Remaining three wells expected to be placed

into sales on December 1, 2013

•

Three-well Guernsey / Noble pad:

•

Average lateral length of 3,535 feet

•

Completed utilizing “Super Frac”

design

•

5-day avg. sales rate –

1.7 Mboe/d

1

•

1,237 BTU; 57% liquids

•

30-day avg. sales rate –

1.6 Mboe/d

1

•

1,237 BTU; 55% liquids

6

Warrior South Drilling Program³

Year

Wells Drilled

Fracture

Stimulated

Placed in

Sales

Awaiting

Completion

YTD

5

5

3

0

2013E

5

5

8

0

Warrior South Prospect

REXX –

Completed

Three-well

Guernsey/Noble

pad –

Avg. 24 Hour

Sales Rate:

3.1 Mboe/d¹

Antero Miley Pad:

Avg. 3.6 Mboe/d

GPOR –

Groh 1-12H:

5,414’

lateral 1.9 Mboe/d

GPOR –

Shugert 1-1H:

5,758’

lateral; 4.9 Mboe/d

Completed Pads

Potential Pad Location

1.

Assumes full ethane recovery

2.

See note on Potential Drilling Locations on page 3

3.

Well information in gross

GPOR –

Shugert 1-12H:

7.5 Mboe/d

GPOR –

Stutzman 1-14H:

8,634’

lateral; 4.1 Mboe/d

REXX –

Five-well J.

Anderson Pad; Avg.

Lateral Length of ~4,250’

GPOR –

McCourt 1-28H:

7,501’

lateral; 2.2 Mboe/d

GPOR –

Wagner 3-28H:

6,867’

lateral; 2.6 Mboe/d

GPOR –

McCourt 2-28H:

9,489’

lateral; 2.7 Mboe/d |

Warrior

South Industry Results Comparison 7

> 65% Liquids

Company

Well Name

Lateral

(feet)

BTU

Shrink %

Gas (Mcf/d)

Oil (Bbls/d)

NGL (Bbls/d)

Boe/d (Full Ethane

Recovery)

% Liquids

Boe/d assuming 3,500’

Lateral*

GPOR

Lyons 2-27H

7,100

1,320

23%

1,386

1,373

155

1,759

87%

867

GPOR

Lyons 1-27H

6,694

1,271

21%

1,975

1,087

137

1,553

79%

812

PDCE

Onega Commissioners 14-

25H

3,950

1,254

20%

~1,891

~841

~345

1,501

79%

1,330

GPOR

Boy Scout 5-33H

6,029

1,259

22%

2,262

902

383

1,662

77%

965

PDCE

Detweiler 42-3H

3,868

1,263

21%

~3,059

~999

~530

2,039

75%

1,845

GPOR

Boy Scout 1-33H

7,974

1,310

25%

5,325

1,560

1,008

3,456

74%

1,517

GPOR

Clay 1-14H

7,372

1,258

27%

4,307

747

761

2,226

68%

1,057

GPOR

BK Stephens 1-16H

5,276

1,207

11%

6,141

1,224

759

3,007

66%

1,994

Average

6,034

1,268

21%

3,293

1,092

510

2,150

76%

1,298

50% -

65% Liquids

REXX

Guernsey 2H

3,640

1,207

20%

8,082

564

1,200

3,111

57%

2,991

REXX

Guernsey 1H

3,587

1,216

20%

7,603

549

1,152

2,968

57%

2,896

REXX

Noble 1H

3,378

1,216

20%

8,004

392

1,212

2,938

55%

3,044

Average

3,535

1,213

20%

7,896

502

1,188

3,006

56%

2,977

< 50% Liquids

GPOR

Wagner 1-28H

8,143

1,214

18%

14,022

432

1,881

4,650

50%

1,999

GPOR

Stutzman 1-14H

8,634

1,078

11%

18,690

0

945

4,060

23%

1,646

Average

8,389

1,146

15%

16,356

216

1,413

4,355

37%

1,823

Source: Publicly available press releases announcing well test results

*Internal calculation based upon

lateral lengths shown in table

Other Recent Results

•

MHR Farley well –

6,500’

lateral; produced at a test rate of 3.0 MMcfe/d assuming full ethane rejection

•

PDCE Garvin 1H –

1,530 Boe/d; 54% liquids |