Attached files

| file | filename |

|---|---|

| EX-32.2 - TURV HARDING EXHIBIT 32 - TWO RIVERS WATER & FARMING Co | exh32harding2013q3.htm |

| EX-31.2 - TURV HARDING EXHIBIT 32 - TWO RIVERS WATER & FARMING Co | exh31harding2013q3.htm |

| EX-31.1 - TURV MCKOWEN EXHIBIT 31 - TWO RIVERS WATER & FARMING Co | exh31mckowen2013q3.htm |

| EX-32.1 - TURV MCKOWEN EXHIBIT 32 - TWO RIVERS WATER & FARMING Co | exh32mckowen2013q3.htm |

| EXCEL - IDEA: XBRL DOCUMENT - TWO RIVERS WATER & FARMING Co | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X]

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2013

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-51139

TWO RIVERS WATER & FARMING COMPANY

(Exact name of registrant as specified in its charter)

|

Colorado

|

13-4228144

|

|

|

State or other jurisdiction of incorporation or organization

|

I.R.S. Employer Identification No.

|

|

|

2000 South Colorado Boulevard, Tower 1, Suite 3100, Denver, CO 80222

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

Registrant’s telephone number, including area code:

(303) 222-1000

|

||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No |_|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |X| No |_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One).

|

Large accelerated filer

|

[___]

|

Accelerated filer

|

[___]

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

[___]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes |_| No |X|

As of November 8, 2013 there were 24,889,548 shares outstanding of the registrant's Common Stock.

|

Page

|

||

|

Item 1

|

Financial Statements (Unaudited)

|

|

|

Condensed Consolidated Balance Sheets

September 30, 2013 and December 31, 2012

|

1

|

|

|

Condensed Consolidated Statements of Operations – Three months ended September 30, 2013 and 2012 and nine months ended September 30, 2013 and 2012

|

2

|

|

|

Condensed Consolidated Statements of Cash Flows – Nine months ended September 30, 2013 and 2012

|

3

|

|

|

4

|

||

|

Item 2

|

19

|

|

|

Item 3

|

23

|

|

|

Item 4

|

24

|

|

|

|

||

|

Item 2

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

27

|

|

Item 5

|

Other Information

|

28

|

|

Item 6

|

Exhibits

|

28

|

|

SIGNATURES

|

28

|

|

TWO RIVERS WATER & FARMING COMPANY AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (In Thousands)

|

September 30, 2013

|

December 31, 2012

|

|||||||

|

(Unaudited)

|

(Derived from Audit)

|

|||||||

|

ASSETS:

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 1,010 | $ | 1,340 | ||||

|

Advances and accounts receivable, net

|

394 | 184 | ||||||

|

Farm product

|

433 | 49 | ||||||

|

Deposits and other current assets

|

186 | 74 | ||||||

|

Total Current Assets

|

2,023 | 1,647 | ||||||

|

Long Term Assets:

|

||||||||

|

Property, equipment and software, net

|

1,831 | 2,397 | ||||||

|

Land

|

5,013 | 3,919 | ||||||

|

Water assets

|

31,536 | 35,388 | ||||||

|

Intangible assets, net

|

1,007 | 1,037 | ||||||

|

Other long term assets

|

112 | 64 | ||||||

|

Total Long Term Assets

|

39,499 | 42,805 | ||||||

|

TOTAL ASSETS

|

$ | 41,522 | $ | 44,452 | ||||

|

LIABILITIES & STOCKHOLDERS' EQUITY:

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$ | 250 | $ | 298 | ||||

|

Current portion of notes payable

|

1,509 | 10,978 | ||||||

|

Accrued liabilities

|

305 | 830 | ||||||

|

Total Current Liabilities

|

2,064 | 12,106 | ||||||

|

Notes Payable - long term, net of current portion

|

11,829 | 4,368 | ||||||

|

Total Liabilities

|

13,893 | 16,474 | ||||||

|

Commitments & Contingencies (Note 3)

|

||||||||

|

Stockholders' Equity:

|

||||||||

|

Convertible preferred shares, $0.001 par value, 4,000,000 shares authorized, 3,794,000 shares and outstanding at Sep 30, 2013 and Dec 31, 2012, respectively (liquidation value of $4,022,000 and $3,794,000, respectively), net

|

2,851 | 2,851 | ||||||

|

Common stock, $0.001 par value, 100,000,000 shares authorized, 24,689,548 and 24,028,202 shares issued and outstanding at Sep 30, 2013 and Dec 31, 2012, respectively

|

25 | 24 | ||||||

|

Additional paid-in capital

|

62,484 | 56,703 | ||||||

|

Accumulated (deficit)

|

(47,686 | ) | (41,440 | ) | ||||

|

Total Two Rivers Water Company Shareholders' Equity

|

17,674 | 18,138 | ||||||

|

Noncontrolling interest in subsidiary

|

9,955 | 9,840 | ||||||

|

Total Stockholders' Equity

|

27,629 | 27,978 | ||||||

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

|

$ | 41,522 | $ | 44,452 | ||||

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

TWO RIVERS WATER & FARMING COMANY AND SUBSIDIARIES

Condensed Consolidated Statements of Operations (In Thousands)

|

Three Months Ended Sep 30,

|

Nine Months Ended Sep 30,

|

|||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

|||||||||||||

|

Revenue

|

||||||||||||||||

|

Farm

|

$ | 946 | $ | 381 | $ | 994 | $ | 381 | ||||||||

|

Water

|

40 | 34 | 40 | 34 | ||||||||||||

|

Member assessments

|

- | - | 11 | 36 | ||||||||||||

|

Other

|

9 | (6 | ) | 9 | 5 | |||||||||||

|

Total Revenue

|

995 | 409 | 1,054 | 456 | ||||||||||||

|

Direct cost of revenue

|

598 | 280 | 639 | 280 | ||||||||||||

|

Gross Margin

|

397 | 129 | 415 | 176 | ||||||||||||

|

Operating Expenses:

|

||||||||||||||||

|

General and administrative

|

1,377 | 2,018 | 4,723 | 6,649 | ||||||||||||

|

Depreciation

|

123 | 107 | 362 | 235 | ||||||||||||

|

Total operating expenses

|

1,500 | 2,125 | 5,085 | 6,884 | ||||||||||||

|

(Loss) from operations

|

(1,103 | ) | (1,996 | ) | (4,670 | ) | (6,708 | ) | ||||||||

|

Other income (expense)

|

||||||||||||||||

|

Interest expense

|

(299 | ) | (1,028 | ) | (670 | ) | (2,589 | ) | ||||||||

|

Warrant expense

|

(27 | ) | (18 | ) | (55 | ) | (315 | ) | ||||||||

|

Other income (expense)

|

9 | (45 | ) | 108 | (81 | ) | ||||||||||

|

Total other income (expense)

|

(317 | ) | (1,091 | ) | (617 | ) | (2,985 | ) | ||||||||

|

Net (Loss) from continuing operations before taxes

|

(1,420 | ) | (3,087 | ) | (5,287 | ) | (9,693 | ) | ||||||||

|

Income tax (provision) benefit

|

- | - | - | - | ||||||||||||

|

Net (Loss)

|

(1,420 | ) | (3,087 | ) | (5,287 | ) | (9,693 | ) | ||||||||

|

Net loss (income) attributable to the noncontrolling interest

|

(14 | ) | 8 | (6 | ) | 4 | ||||||||||

|

Net (Loss) attributable to Two Rivers Water & Farming Company

|

$ | (1,434 | ) | $ | (3,079 | ) | $ | (5,293 | ) | $ | (9,689 | ) | ||||

|

(Loss) Per Share - Basic and Dilutive:

|

$ | (0.06 | ) | $ | (0.13 | ) | $ | (0.21 | ) | $ | (0.41 | ) | ||||

|

Weighted Average Shares Outstanding:

|

||||||||||||||||

|

Basic and Dilutive

|

24,940 | 23,910 | 24,824 | 23,564 | ||||||||||||

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

TWO RIVERS WATER & FARMING COMPANY AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (In Thousands)

|

For the nine months ended Sep 30,

|

||||||||

|

2013

|

2012

|

|||||||

|

Cash Flows from Operating Activities:

|

||||||||

|

Net (Loss)

|

$ | (5,287 | ) | $ | (9,689 | ) | ||

|

Adjustments to reconcile net income or (loss) to net cash (used in) operating activities:

|

||||||||

|

Depreciation

|

362 | 235 | ||||||

|

Amortization of intangibles and debt issuance costs

|

153 | 1,402 | ||||||

|

Assumption of assessments due to purchase of HCIC shares

|

80 | - | ||||||

|

Loss on disposal of assets

|

156 | - | ||||||

|

Stock based compensation and warrant expense

|

2,158 | 3,051 | ||||||

|

Stock for services

|

939 | 742 | ||||||

|

Net change in operating assets and liabilities:

|

||||||||

|

Decrease (increase) in advances & accounts receivable

|

(211 | ) | (265 | ) | ||||

|

(Increase) in farm product

|

(384 | ) | (421 | ) | ||||

|

(Increase) decrease in deposits, prepaid expenses and other assets

|

34 | (91 | ) | |||||

|

(Decrease) Increase in accounts payable

|

(48 | ) | (220 | ) | ||||

|

Increase (decrease) in accrued liabilities and other

|

(525 | ) | 1,081 | |||||

|

Net Cash (Used in) Operating Activities

|

(2,573 | ) | (4,175 | ) | ||||

|

Cash Flows from Investing Activities:

|

||||||||

|

Purchase of property and equipment

|

(34 | ) | (722 | ) | ||||

|

Purchase of land, water shares, infrastructure

|

(1,335 | ) | (748 | ) | ||||

|

Proceeds from sale of assets

|

58 | 68 | ||||||

|

Net Cash (Used in) Investing Activities

|

(1,311 | ) | (1,402 | ) | ||||

|

Cash Flows from Financing Activities:

|

||||||||

|

Proceeds from issuance of bridge loan

|

- | 3,994 | ||||||

|

Payment of offering costs

|

(223 | ) | (45 | ) | ||||

|

Payment on notes payable

|

(422 | ) | (38 | ) | ||||

|

Proceeds from sale of convertible preferred shares in DFP

|

1,600 | - | ||||||

|

Proceeds from long-term debt

|

2,599 | 1,117 | ||||||

|

Net Cash Provided by Financing Activities

|

3,554 | 5,028 | ||||||

|

Net (Decrease) in Cash & Cash Equivalents

|

(330 | ) | (549 | ) | ||||

|

Beginning Cash & Cash Equivalents

|

1,340 | 777 | ||||||

|

Ending Cash & Cash Equivalents

|

$ | 1,010 | $ | 228 | ||||

|

Supplemental Disclosure of Cash Flow Information

|

||||||||

|

Cash paid for interest

|

$ | 469 | $ | 689 | ||||

|

Stock & warrants for debt issuance costs

|

$ | 580 | $ | 315 | ||||

|

Equipment purchases financed

|

$ | - | $ | 97 | ||||

The accompanying notes to condensed consolidated financial statements are an integral part of these statements

TWO RIVERS WATER & FARMING COMPANY AND SUBSIDIARIES

For the Nine Months Ended September 30, 2013 and September 30, 2012

(Unaudited)

Unless the context requires otherwise, references in this document to “Two Rivers Water & Farming Company,” “Two Rivers,” “We,” “Our,” “Us” or the “Company” is to Two Rivers Water & Farming Company and its subsidiaries.

Note about Forward-Looking Statements

This Form 10-Q contains forward-looking statements, such as statements relating to our financial condition, results of operations, plans, objectives, future performance and business operations. These statements relate to expectations concerning matters that are not historical facts. These forward-looking statements reflect our current views and expectations based largely upon the information currently available to us and are subject to inherent risks and uncertainties. Although we believe our expectations are based on reasonable assumptions, they are not guarantees of future performance and there are a number of important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained in this Quarterly Report is not a complete description of our business or the risks associated with an investment in our common stock or other securities. Factors that could cause or contribute to the differences are discussed in “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2012, as well as in “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-Q, and in our other SEC filings. By making these forward-looking statements, we do not undertake to update them in any manner except as may be required by our disclosure obligations in filings we make with the SEC under the federal securities laws. Our actual results may differ materially from our forward-looking statements.

NOTE 1 – ORGANIZATION AND BUSINESS

Our Business

Two Rivers has developed and operates a new farming and water business model suitable for arid regions in the Southwestern United States whereby the Company synergistically integrates high value fruit and vegetable farming and wholesale water distribution into one company, utilizing a practice of rotational farm fallowing. Rotational farm fallowing, as it applies to water, is a best methods farm practice whereby portions of farm acreage are temporarily fallowed in cyclic rotation to give soil an opportunity to reconstitute itself. As a result of fallowing, an increment of irrigation water can be made available for municipal use without permanently drying up irrigated farmland. Collaborative rotational farm fallowing agreements between farmers and municipalities make a portion of irrigation water available for urban use. The Company’s initial area of focus is in the Arkansas River basin and its tributaries on the southern Front Range of Colorado.

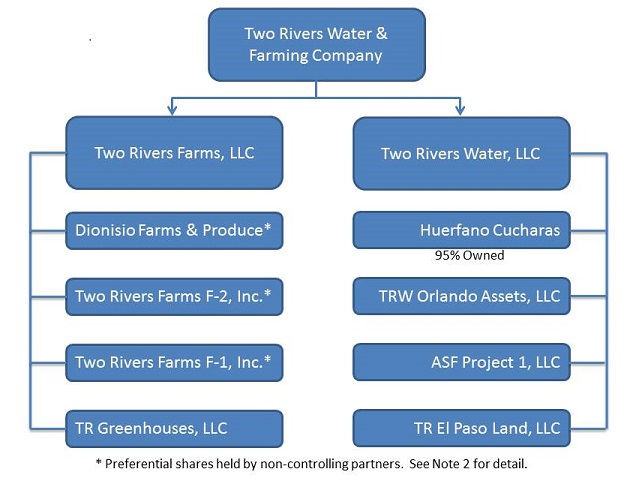

Our Corporate Structure

Two Rivers Water & Farming Company

We conduct our farming and water operations in wholly owned subsidiaries, except for the Huerfano Cucharas Irrigation Company (“HCIC”), of which we own 95%. The Company’s organizational structure is illustrated below:

Our Farming Operations

The Company currently owns approximately 7,467 gross acres. In 2013, we farmed a total of 1,337 acres, of which 820 acres were planted and 517 acres received federal crop insurance due to drought conditions. For the nine months ended September 30, 2013, Two Rivers generated $946,000 in farm revenues, a 148% increase over 2012.

Two Rivers’ current crop production consists of cabbage, pumpkins and squash. Two Rivers expects to increase the variety of crops we produce as we expand our farming operations. As a rotation crop to reconstitute the soils and diminish disease and pest pressure, the Company grows animal feed crops, including corn, oats, sorghum and alfalfa.

Two Rivers plans to acquire and develop up to 30,000 acres of high-yield fruit and vegetable production on irrigated farmland along the Arkansas River in Colorado over the next ten years.

Dionisio Farms & Produce, Inc. (“DFP”)

Two Rivers acquired the properties in DFP in 2012 and conducted its first full year of farm operations in 2013. In 2013, 230 acres were farmed by DFP, of which 105.5 acres were owned and 124.5 were leased. DFP’s revenues accounted for 90% of the Company’s overall farm revenues, in 2013.

DFP’s farmland is located in Pueblo County, Colorado with surface water provided by the Bessemer Irrigating Ditch Company (“Bessemer Ditch”) which has senior water rights on the main stem of the Arkansas River and whose water is stored in the Pueblo Reservoir. DFP obtains additional water from wells that draw water from the Arkansas River alluvium. We believe that the farmland served by the Bessemer Ditch has the soils, climate and water resources that in combination make this farmland some of the most prolific farm areas in the United States.

Farmland served by the Bessemer Ditch is underutilized since approximately 90% of the farmland produces fodder crops. Changing the crop production to fruit and vegetables generates 8 to 10 times more revenue per acre and a similar increase in gross profit margins. One of Two Rivers’ main goals for the next three to five years is to acquire additional irrigated farmland and work collaboratively with other Bessemer farmers to increase the production and marketing of fruits and vegetables.

Butte Valley Farm

In 2012, as part of Two Rivers Farms F-2, Inc. (“F-2”), we purchased the Butte Valley Farm and put 150 fallowed acres in Huerfano County, Colorado back into crop production. In 2013, the Butte Valley Farm produced corn, sorghum, oats and triticale feed crops. In 2014, the Company expects to begin fruit and vegetable crop production.

HCIC Farms

In 2010 and 2011, Two Rivers purchased land served by the HCIC ditch system. In 2010, Two Rivers tested growing feed corn and found the land to be extremely fertile with the soil composition comparable to farmland served by the Bessemer Ditch. Based on the average annual diversion of surface stream flow, in 2011, as part of Two Rivers Farms F-1, Inc. (“F-1”), the Company redeveloped approximately 500 acres of HCIC farmland that had lain fallow for over a half century. From 2011 to 2013, only dry land crops were planted due to the exceptional drought in the area. In 2014, we intend to continue irrigated crop production, moving toward fruit and vegetable production in 2016.

Future Farming Operations

Two Rivers expects to develop additional irrigated farmland along the Arkansas River and its tributaries. Prior to redeveloping farmland, the Company assembles water resources that include:

|

·

|

purchasing a suite of water rights, including both surface flow, augmentation and storage rights;

|

|

·

|

refurbishing historic ditch systems and reservoirs to restore and upgrade their efficiency;

|

|

·

|

negotiating with appropriate water authorities the necessary agreements to sustain production, and

|

|

·

|

providing for rotational farm fallowing.

|

When redeveloping farmland, we deploy state-of-the-art methods and equipment with the aim of optimizing product yield, water efficiencies and labor inputs. This includes:

|

·

|

deep-plowing fields to loosen soil beds;

|

|

·

|

laser-leveling planting areas to optimize water and nutrient absorption and minimize runoff;

|

|

·

|

installing state of the art irrigation facilities to increase water efficiencies, and

|

|

·

|

applying organic and non-organic fertilizers and soil conditioners to enhance plant growth.

|

Redevelopment generally takes two to three years to transform fallow farmland into fruit and vegetable crop production.

Our Water Operations

Two Rivers acquires its portfolio of water rights through the acquisition of its farming assets. In evaluating its farm acquisitions, the most determinant factor in evaluating the farmland acquisition is the water right.

Water Rights

The right to water in Colorado is a right that can be developed, managed, purchased or sold much like real property subject to appropriate regulation. Water rights are judicially decreed and, under Colorado’s application of the Prior Appropriation Doctrine (“first in time, first in right”), senior water right holders are entitled to the beneficial use of water prior to junior holders. Consequently senior water rights are more consistent, reliable and valuable than junior rights, which may be interrupted, or “called out” in the parlance of Colorado water administration. Two Rivers will continue to evaluate acquisitions of farmland in light of their associated water rights.

Rotational Farm Fallowing

Water is a scarce and extremely valuable natural resource in Colorado and other portions of the southwestern United States. In Colorado, approximately 86% of all water rights are held by agricultural users as a result of the original water court adjudications occurring during the end of the 19th century when most water use was for growing fodder crops1. Today, the majority of Colorado’s population (85%), lives in urban or suburban areas2.

As municipal populations have grown and rural populations shrunk in Colorado, a well-documented water supply shortage for municipal users has developed. To help solve the water supply shortage for municipal water users, irrigation water from fodder crop production is being transferred to municipal use. However, the people of Colorado have politically and prudently determined that it is bad long term social policy to “buy and dry” the best irrigated farmlands that can grow local higher value fruit and vegetable crops so that municipal users can sprinkle lawns or fill swimming pools. The people of Colorado have also recognized that fodder crop production is not the best use of a valuable water right3.

A better policy has evolved over time that forestalls drying up the best farmland and enables the transfer of water from fodder crop irrigation use to municipal use through rotational farm fallowing. Colorado, through the Governor’s office, the Colorado Legislature and the Colorado Water Conservation Board, are aggressively developing rules and procedures supporting rotational farm fallowing.

Two Rivers has acquired its farms and associated water rights with a view towards unlocking the true value of water by converting fodder crop production into vegetable crop production. Two Rivers intends to provide up to 25% of surface water available for municipal and industrial use through rotational farm fallowing. The Company expects to accomplish this without diminishing the amount or revenue from farming by replacing the surface flow transferred to municipal and industrial users with water Two Rivers pumps from river alluvium.

The Bessemer Ditch System

The Bessemer Ditch is a mutual ditch company that operates an irrigation canal which has its headgate in the Pueblo Dam and delivers irrigation water for growing crops from the Pueblo Reservoir to eastern Pueblo County. Its water rights date back to 1861. DFP currently owns 183 shares of the Bessemer Ditch.

The Southern Delivery System

In 2010, Colorado Springs Utilities (“CSU”) began construction of the Southern Delivery System (“SDS”) which is to be completed in 2016. The pipeline is expected to cost in excess of $1,000,000,000 and will pump water from the Pueblo Reservoir and deliver the water to CSU’s municipal water system.

When the SDS is completed, it will enable CSU and other water users in the southern half of the Front Range of Colorado to receive physical water from the Arkansas River that is stored in the Pueblo Reservoir.

Orlando Water Rights

The Orlando water rights were purchased through TRW Orlando Water Assets, LLC in 2011 and include the #1 and the #9 water rights which are used to irrigate the Butte Valley Farm. The assets purchased also included the Orlando Reservoir which has a storage capacity of 3,100 acre-feet on the Huerfano branch of the Huerfano River. The seniority of the Butte Valley water rights allowed the production of crops during the most recent drought.

Huerfano Cucharas Irrigation Company

In 2009, Two Rivers began purchasing the shares of HCIC in anticipation of restoring 20,000 acres of previously highly productive fruit and vegetable irrigated farmland. The farmland became fallow in the middle of the 20th century when coal mines in Huerfano County, Colorado were shut down. The coal mines when in production continuously pumped water from the Vermejo/Trinidad Formation, which contained a renewable underground aquifer that is fed by Sangre de Cristo Mountains snowmelt. The Vermejo/Trinidad Formation contains an estimated 30 million acre-feet of relatively untapped, clean and renewable water4.

Two Rivers, through HCIC Holdings, LLC, eventually acquired 95% of the ownership of HCIC in 2012. HCIC owns the Cucharas and Huerfano Valley Reservoirs and two ditch systems located in Pueblo County, Colorado. The HCIC ditch systems have the right to distribute water over approximately 40,000 acres in Pueblo County, Colorado.

Augmentation

Tributary ground water is any underground water that is hydraulically connected to a stream system that influences the rate and/or direction of flow on that stream system. Any new ground water diversions that are tributary to an over appropriated stream system require augmentation to off-set out-of-priority depletions.5 In 2013, as a result of the drought, many well water users on the Arkansas River and its tributaries were unable to use their wells due to a lack of augmentation water. As a result, Two Rivers was asked by one of the augmentation providers to help build a more efficient and plentiful augmentation supply. Two Rivers has begun the development of additional augmentation sources in conjunction with that augmentation provider and expects to provide additional supplemental augmentation in 2014.

Management plans for funding future operations

As of September 30, 2013 our current assets of $2,023,000 consisting of $1,010,000 in cash, $394,000 in accounts receivable, $433,000 in farm product and $186,000 other current assets. The current portion of long-term debt is $1,509,000. The Company plans to raise up to $10,000,000 in additional funds through scheduled and anticipated financings and the sale and lease back of some of its assets to one or more independent investors. There can be no assurance that the Company will succeed in raising additional capital.

To assess our ability to fund ongoing operating requirements, we have made assumptions regarding operating cash flow. Critical sources of funding, and key assumptions and areas of uncertainty include:

|

·

|

as of November 4, 2013 we had $805,000 in cash and accounts receivable of $957,000;

|

|

·

|

additional cash flow from crops stored, but not yet sold, estimated to be in excess of $100,000;

|

|

·

|

near term monetization of development projects sold to third parties;

|

|

·

|

scheduled sale and lease back, debt and equity financings;

|

|

·

|

farm management fees;

|

|

·

|

hunting and grazing leases;

|

|

·

|

continued support of, and extensions of credit by, our suppliers and lenders, and

|

|

·

|

the level of spending necessary to support our planned initiatives, which we estimate for our operations to be less than $1,500,000 of cash expenses until our farm income begins again in 2014.

|

Based on these assumptions, we believe our existing cash and cash equivalents, along with the cash generated by our anticipated results from operations, will be sufficient to meet our needs through 2014. We intend to seek additional capital to provide a cash reserve against contingencies, address the seasonal nature of our working capital needs, and to enable us to invest further in trying to increase the scale of our business. We may seek additional funding through debt and/or equity offerings, or through sale and leaseback transactions. However, there can be no assurance we will be able to raise this additional capital, that we will be able to increase the scale of our business, or that our existing resources will be sufficient to meet all of our cash requirements. In such an event we would reduce the scale of our operations and take such actions as are available to us to reduce our cash requirements. However, there can be no assurance that such actions would be successful.

The Company maintains a website at www.2riverswater.com, which is not incorporated in, and is not a part of, this report.

1 Colorado Foundation for Water Education, 2009, Citizens Guide to Colorado Water Law, Denver, Colorado

4 USGS, Thad G. McLaughlin, 1966, Ground Water in Huerfano County, Colorado, Washington DC, United States Printing Office

5 Colorado Division of Water Resources, Agumentation Plans, http://water.state.co.us/groundwater/GWAdmin/Pages/AugPlans.aspx

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements do not include all of the disclosures required by accounting principles generally accepted in the U.S. (“GAAP”), pursuant to the rules and regulations of the SEC. The unaudited Consolidated Financial Statements reflect all adjustments, which, in the opinion of management, are necessary to present fairly the consolidated financial position of the Company as of September 30, 2013, and the consolidated results of operations and cash flows of the Company for the three and nine months ended September 30, 2013 and 2012. Operating results for the three and nine months ended September 30, 2013, are not necessarily indicative of the results that may be expected for the year ending December 31, 2013.

These unaudited Consolidated Financial Statements should be read in conjunction with the Company’s audited Consolidated Financial Statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Two Rivers and its subsidiaries contained in our Farming and Water Operations. All significant inter-company balances and transactions have been eliminated in consolidation.

Non-controlling Interest

Non-controlling interest is recorded for the ownership of HCIC not owned by the Company and for preferred shares not owned by the Company in the Company’s subsidiaries. Below is the detail of non-controlling interest shown on the balance sheet:

|

Entity

|

September 30, 2013

|

December 31, 2012

|

||||||

|

HCIC

|

$ | 1,347,000 | $ | 2,205,000 | ||||

|

HCIC farmland

|

1,494,000 | 1,494,000 | ||||||

|

Butte Valley

|

3,933,000 | 3,933,000 | ||||||

|

DFP

|

3,181,000 | 2,208,000 | ||||||

|

Totals

|

$ | 9,955,000 | $ | 9,840,000 | ||||

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ materially from those estimates.

Fair Value of Measurements and Disclosures

Fair Value of Assets and Liabilities Acquired

Fair value is the price that would be received from the sale of an asset or paid to transfer a liability (i.e., an exit price) in the principal or most advantageous market in an orderly transaction between market participants. In determining fair value, the accounting standards established a three-level hierarchy that distinguishes between (i) market data obtained or developed from independent sources (i.e., observable data inputs) and (ii) a reporting entity’s own data and assumptions that market participants would use in pricing an asset or liability (i.e., unobservable data inputs). Financial assets and financial liabilities measured and reported at fair value are classified in one of the following categories, in order of priority of observability and objectivity of pricing inputs:

|

|

• Level 1 – Fair value based on quoted prices in active markets for identical assets or liabilities.

|

|

|

• Level 2 – Fair value based on significant directly observable data (other than Level 1 quoted prices) or significant indirectly observable data through corroboration with observable market data. Inputs would normally be (i) quoted prices in active markets for similar assets or liabilities, (ii) quoted prices in inactive markets for identical or similar assets or liabilities or (iii) information derived from or corroborated by observable market data.

|

|

|

• Level 3 – Fair value based on prices or valuation techniques that require significant unobservable data inputs. Inputs would normally be a reporting entity’s own data and judgments about assumptions that market participants would use in pricing the asset or liability.

|

The fair value measurement level for an asset or liability is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques should maximize the use of observable inputs and minimize the use of unobservable inputs.

Recurring Fair Value Measurements

The carrying value of cash held as demand deposits, money market and certificates of deposit, accounts receivable, short-term borrowings, accounts payable and accrued liabilities approximated their fair value. The fair value of the Company’s long-term debt, including the current portion approximated its carrying value.

Farm product

The Company capitalizes all expenditures directly associated with producing crops for sale. This includes wages of farmers, preparing the soil, soil maintenance, crop insurance, cost of operating and maintaining equipment, seed, fertilizer, water and other direct farming expenses. Upon sale of the farm product, the respective farm product cost is recognized as direct cost of farm product sold.

At least once per calendar quarter, management discusses with farming management their opinion on the cost of the farm product versus the expected farm product revenue. The cost of the farm product includes the investment in the farm product to date plus the anticipated expenses to bring the farm product to market. If the anticipated cost of the farm product is greater than the anticipated revenue, then an impairment is recorded.

Land

Land acquired for farming is recorded at cost. Some of the land acquired has not been farmed for many years, if not decades. Therefore, additional expenditures are required to make the land ready for efficient farming. Expenditures for leveling the land are added to the cost of the land. Irrigation is not capitalized in the cost of land (see Property and Equipment below). No amortization or depreciation is taken on Land. However, the land is reviewed by management at least once per year to ascertain if a further analysis is necessary for any potential impairment.

Water Rights and Infrastructure

The Company has acquired both direct flow water rights and water storage rights. We have obtained water rights through the purchase of shares in a mutual ditch company, which we did with our purchase of shares in HCIC, or through the purchase of an entity holding water rights, which we did with our purchase of the Orlando. The Company may also acquire water rights through outright purchase. In all cases, such rights are recognized under decrees of the Colorado water court and administered under the jurisdiction of the Office of the State Engineer.

Upon purchasing water rights, the value is recorded at our purchase price. If a majority interest is acquired in a company holding water assets (potentially with other assets including water delivery infrastructure, right of ways, and land), the Company determines the fair value of the assets. To assist with the valuation, the Company may consider reports from a third-party valuation firm. If the value of the water rights is greater than what the Company paid then a bargain purchase gain is recognized. If the value of the water assets are less than what the Company paid then goodwill is recognized.

Subsequent to purchase, management periodically evaluates the carrying value of its assets, and if the carrying value is in excess of fair market value, the Company will establish an impairment allowance. Currently, there are no impairments on the Company’s land and water shares. No amortization or depreciation is taken on the water rights.

Intangibles

Two Rivers recognizes the estimated fair value of water rights acquired by the Company’s purchase of stock in HCIC and Orlando. These intangible assets will not be amortized because they have an indefinite remaining useful life based on many factors and considerations, including, the historical upward valuation of water rights within Colorado.

Revenue Recognition

Farm Revenues

Revenues from farming operations are recognized when sold into the market. All direct expenses related to farming operations are capitalized as farm product and recognized as a direct cost of sale upon the sale of the crops. As of September 30, 2013, we reserved 3% of our outstanding accounts receivable balance.

Water Revenues

Previous water revenues are from the lease of water own by HCIC to farmers in the HCIC service area and through re-leasing of our water from the Pueblo Board of Water lease. Water revenues are recognized when the water is consumed.

Member Assessments

Once per year the HCIC board estimates HCIC’s expenses, less anticipated water revenues, and establishes an annual assessment per ownership share. One-half of the member assessment is recorded in the first quarter of the calendar year and the other one-half of the member assessment is recorded in the third quarter of the calendar year. Assessments paid by Two Rivers Water Company to HCIC are eliminated in consolidation of the financial statements.

HCIC does not reserve against any unpaid assessments. Assessments due, but unpaid, are secured by the member’s ownership of HCIC. The value of this ownership is significantly greater than the annual assessments.

Net Income (Loss) per Share

The Company computes net income (loss) per share of common stock in accordance with Accounting Standards Codification (“ASC”) 260. ASC 260 requires companies with complex capital structures to present basic and diluted Earnings per Share (“EPS”). Basic EPS is measured as the income or loss available to common stockholders divided by the weighted average shares of common stock outstanding for the period. Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common stock (e.g., convertible securities, options, and warrants) as if they had been converted at the beginning of the periods presented. Potential shares of common stock that have an anti-dilutive effect (i.e., those that increase income per share or decrease loss per share) are excluded from the calculation of diluted EPS. All potentially dilutive securities outstanding have been excluded for the periods presented since their effect would be antidilutive.

The dilutive effect of the outstanding 6,134,282 RSUs, 1,668,200 options and 9,890,209 warrants at September 30, 2013, have not been included in the determination of diluted earnings per share since, under ASC 260 they would anti-dilutive.

New Accounting Pronouncements and Effect on the Company

In July 2013, the FASB issued ASU 2013-11, “Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists,” which among other things, require an unrecognized tax benefit, or a portion of an unrecognized tax benefit, to be presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward, except as denoted within the ASU. The amendments in this ASU are effective for fiscal years, and interim periods within those years, beginning after December 15, 2013. This new guidance will not have a material impact on our financial statements.

NOTE 3 – NOTES PAYABLE

Below is a discussion of our long term debt that has changed since December 31, 2012. Refer to the Company’s December 31, 2012 Form 10K for a detailed discussion on notes payable.

HCIC Seller Carry Back

In June 2013, the Company negotiated an extension on holders representing $6,164,000 of the seller carry back notes. Previously these amounts were due either August or September, 2013. The holders of the notes agreed to extend the due date to June 30, 2016. In exchange for this extension, the Company increased the principal balance by 20% from $6,164,000 to $7,397,000, paid 5.43% against the principal and agreed to begin paying monthly interest and principal at a 20-year amortization rate.

Holders representing $2,911,000 of the notes held conversion rights into the Company’s common shares at $1.00 to $1.25. These conversions were cancelled and replaced by 5-year warrants at $3.00 per share. A total of 1,367,000 warrants were issued. The warrants issued had a fair value of $580,000 using the Black Scholes method of fair value determination.

Pursuant to ASC 470-50-40-10, testing was performed by management on whether the new note structure constituted a debt extinguishment and issuance of new debt. Management determined that this note modification qualified as a debt extinguishment. Therefore ASC 820 was used to determine the fair value of the new debt issued. The fair value, using a 10% discount factor for the present value analysis of the new cash flow stream and fair value of the warrants issued determined the fair value of the new debt to be $6,071,000. Compared to the prior debt value of $6,164,000, the fair value produced a one-time $93,000 gain, recorded in the second quarter of 2013.

Additionally, a discount on the HCIC debt was recorded in the quarter ended June 30, 2013 for $1,906,000, which will be amortized using an effective interest rate of 10% over the three year term.

As of September 30, 2013 the discount was $1,783,000.

Seller Carry Back – SW Farms

On December 31, 2012, the Company purchased property from Southwest Farms, Inc. and Southwest Ready-Mix of Pueblo, Inc. (“SW Farms”). The Company paid $4,300,000 for the acquisition with the seller taking back a $4,200,000 note. The terms of the SW Farms seller carry back note is 2% per annum and due in full by April 30, 2013 with an extension, at the Company’s option, to May 31, 2013 with no additional funds required. However, in the three months ended March 31, 2013, the Company paid an additional $100,000 to extend the note to a due date of August 31, 2013. The $100,000 payment was applied to the principal.

On August 22, 2013, the Company cancelled its acquisition of the SW Farms and thereby forfeited the $196,000 paid and gave up the rights to all of the SW Farms assets. This transaction resulted in a non-operating loss of $154,000.

ASF Note

In May 2013, ASF began offering, only to accredited investors, 8.0% senior secured notes due 2023. The Notes are offered to help with funding the further research, engineering, hydrology and permitting for the constructing of gravel pit storage reservoirs just east of the confluence of the Arkansas River and Fountain Creek in Pueblo County, Colorado. The intention is to collaborate with Colorado Front Range municipal water districts.

ASF is offering up to $3,000,000 in Notes plus prepaid interest through May 31, 2014 was offered. Through September 30, 2013, $2,036,000 (including $150,000 prepaid interest) of the Notes was sold.

The ASF Notes carry a mandatory redemption if a related metropolitan district issues municipal bond obligations. There is also an optional redemption that can be exercised by ASF or the Company. If there is an early redemption, there is a make-whole provision whereby ASF or the Company pays the par value of the Notes plus accrued and unpaid interest thereon to the date of redemption plus an amount equal to the present value of all remaining interest payments on the Notes, calculated using a discount rate of 8%.

ASF and the Company guarantee the Notes fully and unconditionally.

Below is a summary of the Company’s consolidated long-term debt:

|

Note

|

Sep 30, 2013

Principal balance

|

Sep 30, 2013 accrued interest

|

Interest rate

|

Security

|

|||||||||

|

HCIC seller carry back

|

$ | 8,105,000 | $ | - | 6 | % |

Shares in the Mutual Ditch Company

|

||||||

|

Orlando seller carry back

|

187,000 | 27,000 | 7 | % |

188 acres of land

|

||||||||

|

Series A convertible debt

|

110,000 | 5,000 | 5-6 | % |

F-1 assets

|

||||||||

|

Series B convertible debt

|

405,000 | 18,000 | 6 | % |

F-2 assets

|

||||||||

|

CWCB

|

1,151,000 | 22,000 | 2.5 | % |

Certain Orlando and Farmland assets

|

||||||||

|

FNB - Dionisio Farm

|

851,000 | 38,000 | (1 | ) |

Dionisio farmland and 146.4 shares of Bessemer Irrigating Ditch Company Stock, well permits

|

||||||||

|

Seller Carry Back - Dionisio

|

590,000 | - | 6.0 | % |

Unsecured

|

||||||||

|

FNB - Mater

|

169,000 | 9,000 | (1 | ) |

Secured by Mater assets purchased

|

||||||||

|

Seller Carry Back - Mater

|

25,000 | - | 6.0 | % |

Land from Mater purchase

|

||||||||

|

McFinney Agri-Finance

|

647,000 | - | 6.8 | % |

2,579 acres of pasture land in Ellicott Colorado

|

||||||||

|

Ellicott second mortgage

|

400,000 | - | 12.0 | % |

Second lien on above Ellicott land

|

||||||||

|

ASF Note holders

|

2,036,000 | - | 8.0 | % |

ASF assets

|

||||||||

|

Equipment loans

|

445,000 | 6,000 | 5 - 8 | % |

Specific equipment

|

||||||||

|

Total

|

15,121,000 | $ | 125,000 | ||||||||||

|

Less: HCIC Discount

|

(1,783,000 | ) | |||||||||||

|

Less: Current portion

|

(1,509,000 | ) | |||||||||||

|

Long Term portion

|

$ | 11,829,000 | |||||||||||

|

Notes:

|

|

(1) Prime rate + 1%, but not less than 6%.

|

NOTE 4 – INFORMATION ON BUSINESS SEGMENTS

We organize our business segments based on the nature of the products and services offered. We focus on the Water and Farming Business with Two Rivers Water & Farming Company as the parent company. Therefore, we report our segments by these lines of businesses: Farms and Water. The Farms segment contains all of our Farming Business. The Water segment contains our Water Business. Our “Parent” category is not a separate reportable operating segment. Segment allocations may differ from those on the face of the income statement.

In the following tables of financial data, the total of the operating results of these business segments is reconciled, as appropriate, to the corresponding consolidated amount. There are some corporate expenses that were not allocated to the business segments, and these expenses are contained in the “Total Operating Expenses” under Parent.

Operating results for each of the segments of the Company are as follows (in thousands):

|

For the nine months ended Sep 30, 2013

|

For the nine months ended Sep 30, 2012

|

|||||||||||||||||||||||||||||||

|

Parent

|

Farms

|

Water

|

Total

|

Parent

|

Farms

|

Water

|

Total

|

|||||||||||||||||||||||||

|

Revenue

|

||||||||||||||||||||||||||||||||

|

Assessments

|

$ | - | - | 11 | $ | 11 | $ | - | - | - | $ | - | ||||||||||||||||||||

|

Farm revenue

|

- | 994 | - | 994 | - | 381 | - | 381 | ||||||||||||||||||||||||

|

Water revenue

|

- | 40 | 40 | - | - | 75 | 75 | |||||||||||||||||||||||||

|

Other & misc.

|

- | 8 | 1 | 9 | - | - | - | - | ||||||||||||||||||||||||

| - | 1,002 | 52 | 1,054 | - | 381 | 75 | 456 | |||||||||||||||||||||||||

|

Less: direct cost of revenue

|

- | 567 | 73 | 639 | - | 280 | - | 280 | ||||||||||||||||||||||||

|

Gross Margin

|

- | 435 | (21 | ) | 415 | - | 101 | 75 | 176 | |||||||||||||||||||||||

|

Total Operating Expenses

|

3,965 | 539 | 580 | 5,085 | 5,494 | 676 | 714 | 6,884 | ||||||||||||||||||||||||

|

Total Other Income/(Expense)

|

(102 | ) | 135 | 584 | 617 | (1,645 | ) | (1,009 | ) | (331 | ) | (2,985 | ) | |||||||||||||||||||

|

Net (Loss) Income from continuing operations before income taxes

|

(3,864 | ) | (238 | ) | (1,185 | ) | (5,287 | ) | (7,139 | ) | (1,584 | ) | (970 | ) | (9,693 | ) | ||||||||||||||||

|

Income Taxes (Expense)/Credit

|

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

|

Net Income (Loss) from continuing operations

|

(3,864 | ) | (238 | ) | (1,185 | ) | (5,287 | ) | (7,139 | ) | (1,584 | ) | (970 | ) | (9,693 | ) | ||||||||||||||||

|

Non-controlling interest

|

- | - | (6 | ) | (6 | ) | - | - | 4 | 4 | ||||||||||||||||||||||

|

Net (Loss) Income

|

$ | (3,864 | ) | (238 | ) | (1,191 | ) | $ | (5,293 | ) | $ | (7,139 | ) | (1,584 | ) | (966 | ) | $ | (9,689 | ) | ||||||||||||

|

Segment assets

|

$ | 216 | 13,306 | 28,000 | $ | 41,522 | $ | 711 | 9,791 | 27,201 | $ | 37,703 | ||||||||||||||||||||

NOTE 5 – EQUITY TRANSACTIONS

Common Stock

During the nine months ended September 30, 2012, the Company had the following equity transactions:

|

·

|

In January 2012, we issued 50,000 shares of our common stock to the independent members of the Board in exchange for Board of Director services rendered in 2011.

|

|

·

|

In January 2012, we issued 125,000 shares of our common stock upon vesting of outstanding Restricted Stock Units (“RSUs”) to a non-executive employee under the Two Rivers Water Company 2011 Long-Term Stock Incentive Plan (the “2011 Plan”); the underlying RSUs were previously issued in exchange for the employee’s surrender of 250,000 options (strike price of $2.00/share) under the 2005 Navidec Financial Services, Inc. (“Navidec”) 2005 Stock Option Plan. Navidec was a predecessor company.

|

|

·

|

In January 2012, we issued 100,000 shares of common stock to our Chief Financial Officer (“CFO”) upon vesting of a portion of 700,000 RSUs that were previously granted to the CFO pursuant to his employment agreement and the 2011 Plan.

|

|

·

|

In January 2012, 200,000 shares of common stock, as part of an overall grant of 400,000 shares, were issued to a former member of the Board of Directors.

|

|

·

|

In February 2012, we issued 83,330 shares of common stock to our investor relations consultants as partial payment for their services.

|

|

·

|

In March 2012, we issued 400,000 shares of common stock to participating lenders in consideration of the Bridge Loan.

|

|

·

|

In April 2012, the Company issued 25,000 shares of common stock upon vesting of outstanding RSUs to the estate of a previous employee under our 2011 Plan.

|

|

·

|

In June 2012, the Company issued 166,666 shares of common stock to our CFO upon vesting of a portion of 700,000 RSUs that were previously granted to the CFO pursuant to his employment agreement and the 2011 Plan.

|

|

·

|

In June 2012, the Company issued 200,000 shares of common stock to complete a grant of 400,000 shares to a former member of the Board of Directors.

|

|

·

|

In June 2012, we issued 50,000 shares of common stock to a key vendor, as partial payment for services performed.

|

|

·

|

In June 2012, we issued 166,666 shares of common stock upon vesting of RSUs that were previously granted to a board member for consulting services performed from April 1, 2012 through June 30, 2012.

|

|

·

|

In June 2012, we issued 100,000 shares of common stock through the exercise of warrants.

|

|

·

|

In September 2012, the Company issued 50,000 shares to a key vendor, as partial payment for services performed.

|

During the nine months ended September 30, 2013, the Company had the following common stock transactions:

|

·

|

In February 2013, we issued 179,348 shares of common stock to a consultant for work performed in 2012.

|

|

·

|

In February 2013, we issued 85,000 shares of common stock to the independent members of the Board of Directors in exchange for Board services rendered in 2012.

|

|

·

|

In March 2013, we issued 200,000 shares of common stock to a consultant for investor relations work performed in first quarter, 2013.

|

|

·

|

In March 2013, we issued 100,000 shares of common stock to an independent member of the DFP Board of Directors in exchange for Board services rendered in 2012.

|

|

·

|

In April 2013, we issued 200,000 shares of our common stock to an investor relations firm for services.

|

|

·

|

In June 2013, we returned 3,002 shares of our common stock from a profit sharing plan that was no longer in effect to our authorized but unissued common stock.

|

|

·

|

In July 2013, we retired 100,000 shares of our common stock that we received from a settlement of a legal action.

|

During the nine months ended September 30, 2013 and September 30, 2012, the Company recognized non-cash expense of granting of options, warrants and restrictive stock units of $2,161,000 and $3,051,000, respectively.

None.

Note about Forward-Looking Statements

This From 10-Q contains forward-looking statements, such as statements relating to our financial condition, results of operations, plans, objectives, future performance and business operations. These statements relate to expectations concerning matters that are not historical facts. These forward-looking statements reflect our current views and expectations based largely upon the information currently available to us and are subject to inherent risks and uncertainties. Although we believe our expectations are based on reasonable assumptions, they are not guarantees of future performance and there are a number of important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to the differences are discussed in “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2012, as well as in this “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in our other SEC filings. By making these forward-looking statements, we do not undertake to update them in any manner except as may be required by our disclosure obligations in filings we make with the Securities and Exchange Commission under the Federal securities laws. Our actual results may differ materially from our forward-looking statements.

Overview

Two Rivers has developed and operates a new farming and water business model suitable for arid regions in the Southwestern United States whereby the Company synergistically integrates high value fruit and vegetable farming and wholesale water distribution into one company, utilizing a practice of rotational farm fallowing. Rotational farm fallowing, as it applies to water, is a best methods farm practice whereby portions of farm acreage are temporarily fallowed in cyclic rotation to give soil an opportunity to reconstitute itself. As a result of fallowing, an increment of irrigation water can be made available for municipal use without permanently drying up irrigated farmland. Collaborative rotational farm fallowing agreements between farmers and municipalities make a portion of irrigation water available for urban use. The Company’s initial area of focus is in the Arkansas River basin and its tributaries on the southern Front Range of Colorado.

Results of Operations

Our Consolidated Operations

For the three Months Ended September 30, 2013 Compared to the three Months Ended September 30, 2012

During the three months ended September 30, 2013 and 2012 we recognized revenues of $995,000 compared to $409,000, in the three-month period ended September 30, 2012. Our primary revenue source is from the sale of agriculture products grown by us. The sale of these products is highly seasonal and occurs primarily in the third and fourth quarter of the year. The increase of $586,000 is primarily due to expanding our farm operations and the occurrence of a less severe drought in 2013 compared to 2012.

Our direct cost of revenue was $598,000 compared to $280,000 for the three months ended September 30, 2013 and 2012, respectively. This produced a gross margin $397,000 compared to $129,000 for the three months ended September 30, 2013 and 2012, respectively.

Operating expenses during the three months ended September 30, 2013 and 2012 were $1,500,000 and $2,125,000, respectively. The decrease of $625,000 is primarily due to a reduction of stock-based compensation of $483,000, a reduction in consulting fees and management’s focus on reducing expenses. Therefore, for operations, during the three months ended September 30, 2013 and 2012, we recognized a net loss of $1,103,000 and $1,996,000, respectively. Management expects the expenses will increase in future periods as we expand our business focus in irrigated farming and water infrastructure development.

Our non-operating expenses decreased from $1,091,000 to $317,000 for the three months ended September 30, 2012 and 2013, respectively. The decrease of $774,000 is primarily due to a $729,000 decrease of interest expense (including amortization of debt discounts). The decrease of interest expense is due to the conversion of debt to preferred shares.

For the Nine Months Ended September 30, 2013 Compared to the Nine Months Ended September 30, 2012

During the nine months ended September 30, 2013, we recognized revenues from continuing operations of $1,054,000, as compared to $456,000 in revenues during the nine months ended September 30, 2012. Our primary revenue source is from the sale of agriculture products grown by us. The sale of these products is highly seasonal and occurs primarily in the third and fourth quarter of the year. The increase of $598,000 is primarily due to expanding our farm operations and the occurrence of a less severe drought in 2013 compared to 2012.

Our direct cost of revenue was $639,000 compared to $280,000 for the nine months ended September 30, 2013 and 2012, respectively. This produced a gross margin $415,000 compared to $176,000 for the nine months ended September 30, 2013 and 2012, respectively.

Operating expenses from operations during the nine months ended September 30, 2013 and 2012 were $5,085,000 and $6,884,000, respectively. The decrease of $1,799,000 is primarily due to: (i) a $893,000 decrease in the non-cash expense of granting of options, warrants and restrictive stock units, from $3,051,000 for the nine months ended September 30, 2012 to $2,161,000 for the nine months ended September 30, 2013; (ii) a $565,000 decrease in professional fees, and (iii) overall cost reduction efforts. Management expects the expenses will increase in future periods as we expand our business focus in irrigated farming and water. Therefore, for operations, during the nine months ended September 30, 2013 and 2012, we recognized a net loss of $4,670,000 and $6,708,000, respectively.

For the nine months ended September 30, 2013 and 2012, we recognized a net loss of $5,293,000 and $9,689,000, respectively. The decreased loss of $4,396,000 is due to the factors mentioned above and a decrease of interest expense of $1,919,000.

LIQUIDITY

From the Company’s inception through September 30, 2013, we have funded our operations primarily from the following sources:

|

-

|

Equity proceeds through private placements of Two Rivers Water & Farming Company and subsidiaries’ securities;

|

|

-

|

Revenue generated from operations;

|

|

-

|

Loans and lines of credit;

|

|

-

|

Sales of residential properties acquired through deed-in-lieu of foreclosure actions;

|

|

-

|

Sales of equity investments, and

|

|

-

|

Proceeds from the exercise of legacy Navidec options.

|

At the present time the Company has no available line or letters of credit.

Cash flow from operations has not historically been sufficient to sustain our operations without the above additional sources of capital. As of September 30, 2013, the Company had cash and cash equivalents of $1,010,000. Cash flow consumed by our operating activities totaled $2,573,000 for the nine months ended September 30, 2013, as compared to $4,175,000 for the nine months ended September 30, 2012. The decrease in the cash consumed by our operating activities is due to an expansion of our farm revenue, an overall decrease in operating expenses and a reduction of cash paid for interest expense.

As of September 30, 2013, the Company had $2,023,000 in current assets and $2,064,000 in current liabilities. The Company intends to continue with its strategy of offering debt and equity securities to expand their Farming Business and Water Business and retire portions of its current debt.

Cash used in investing activities was $1,311,000 for the nine months ended September 30, 2013 compared to use of cash of $1,402,000 for the nine months ended September 30, 2012. During the nine months ended September 30, 2013, we purchased $1,335,000 of land, water shares and infrastructure, added $34,000 of equipment and sold equipment for $58,000. During the nine months ended September 30, 2012, we purchased $1,470,000 in land, water shares and infrastructure and sold equipment of $68,000.

Cash flows provided by our financing activities for the nine months ended September 30, 2013 were $3,554,000 compared to $5,028,000 for the nine months ended September 30, 2012. The decrease is primarily due to reduced borrowings, which decreased from $5,111,000 as of September 30, 2012 to $4,199,000 as of September 30, 2013.

Two Rivers has entered into a water lease arrangement with Pueblo Board of Water Works (PBWW). The lease is effective April 1, 2012, has a term of five years, and calls for annual payments of $100,000 beginning in April 2012. The annual payments can be escalated based upon the percentage increase, if any, over the previous year of the PBWW water rates for its general customers for treated water. The lease is for up to 500 acre feet of water per year. There are no further obligations under this lease.

The purpose of the lease is two-fold; a) to establish an appropriation of a water right for exchange from the Arkansas River main stream water to various Two Rivers’ reservoirs, and b) to provide supplemental irrigation water for our farming operations through releases from those reservoirs.

To assess our ability to fund ongoing operating requirements, we have made assumptions regarding operating cash flow. Critical sources of funding, and key assumptions and areas of uncertainty include:

|

·

|

as of November 4, 2013 we had $805,000 in cash and accounts receivable of $957,000;

|

|

·

|

additional cash flow from crops stored, but not yet sold, estimated to be in excess of $100,000;

|

|

·

|

near term monetization of development projects sold to third parties;

|

|

·

|

scheduled sale and lease back, debt and equity financings;

|

|

·

|

farm management fees;

|

|

·

|

hunting and grazing leases;

|

|

·

|

continued support of, and extensions of credit by, our suppliers and lenders, and

|

|

·

|

the level of spending necessary to support our planned initiatives, which we estimate for our operations to be less than $1,500,000 of cash expenses until our farm income begins again in 2014.

|

Based on these assumptions, we believe our existing cash and cash equivalents, along with the cash generated by our anticipated results from operations, will be sufficient to meet our needs through 2014. We intend to seek additional capital to provide a cash reserve against contingencies, address the seasonal nature of our working capital needs, and to enable us to invest further in trying to increase the scale of our business. We may seek additional funding through debt and/or equity offerings, or through sale and leaseback transactions. However, there can be no assurance we will be able to raise this additional capital, that we will be able to increase the scale of our business, or that our existing resources will be sufficient to meet all of our cash requirements. In such an event we would reduce the scale of our operations and take such actions as are available to us to reduce our cash requirements. However, there can be no assurance that such actions would be successful.

CRITICAL ACCOUNTING POLICIES

Two Rivers Water & Farming Company has identified the policies below as critical to the Company’s business operations and the understanding of the Company’s results from operations. The impact and any associated risks related to these policies on the Company’s business operations is discussed throughout Management’s Discussion and Analysis of Financial Conditions and Results of Operations where such policies affect the Company’s reported and expected financial results. For a detailed discussion on the application of these and other accounting policies, see Note 2 in the Notes to the Consolidated Financial Statements. Note that the Company’s preparation of this document requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of The Company’s financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actual results will not differ from those estimates.

REVENUE RECOGNITION

The Company follows specific and detailed guidelines in measuring revenue; however, certain judgments may affect the application of the Company’s revenue policy. Revenue results are difficult to predict, and any shortfall in revenue or delay in recognizing revenue could cause the Company’s operating results to vary significantly from quarter to quarter and could result in future operating losses.

GOODWILL AND INTANGIBLE ASSETS

The Company has acquired water shares in HCIC, which is considered an intangible asset and shown on our balance sheet as part of “Water rights and infrastructure.” Currently, these shares are recorded at purchase price less the Company’s prorata share of the negative net worth in HCIC. Management evaluates the carrying value, and if necessary, will establish an impairment of value to reflect current fair market value. Currently, there are no impairments on the water shares.

In 2012, the Company acquired a produce business, which is considered an intangible asset and shown on our balance sheet as “Intangible assets, net.” Management evaluated the purchase price of $1,037,000 and allocated this price to customer list, trade name and goodwill.

SEASONALITY OF FARMING BUSINESS

Our Farming Operations are subject to seasonality. We begin planting early in the calendar year for harvesting that begins in early July and continues through November. Management believes that the Company has enough capital and outside capital resources to fund the farming inputs until revenue is generated.

MATERIAL CONTRACTUAL OBLIGATIONS

During the three months ended March 31, 2013, the Company purchased approximately an additional 4% of the shares of HCIC. For the purchase the Company assumed the sellers’ past due assessment to HCIC of $80,000, which was eliminated on consolidation. This transaction was recorded as a reclassification from HCIC non-controlling interest to additional paid in capital. Further, the Company committed to provide the sellers a 100-year water lease equal to 4% of the total water available through the HCIC system at no additional charge to the sellers.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company is exposed to the impact of interest rate changes and change in the market values of the Company’s investments. Based on the Company’s market risk sensitive instruments outstanding as of September 30, 2013, as described below, management has determined that there was no material market risk exposure to the Company’s consolidated financial position, results of operations, or cash flows as of such date. The Company does not enter into derivatives or other financial instruments for trading or speculative purposes.

INTEREST RATE RISK

At September 30, 2013, the Company’s exposure to market rate risk for changes in interest rates relates primarily to its borrowings and opportunities for retiring or rolling over its debt. The Company has not used derivative financial instruments in its credit facilities. A hypothetical 10% increase in the Prime Rate would not be significant to the Company's financial position, results of operations, or cash flows.

IMPAIRMENT POLICY

At least once every year, management examines all of the Company’s assets for proper valuation and to determine if an allowance for impairment is necessary. In terms of real estate owned, this impairment examination also includes the accumulated depreciation. Management examines market valuations and if an additional impairment is necessary for lower of cost or market, then an impairment charge is recorded.

INVESTMENT RISK

From time to time the Company has made investments in equity instruments in companies for business and strategic purposes. These investments, when held, are included in other long-term assets and are accounted for under the cost method since ownership is less than 20% and the Company does not assert significant influence.

INFLATION

The Company does not believe that inflation will have a material negative impact on its future operations.

We are exposed to the impact of interest rate changes and change in the market values of our real estate properties and water assets. Because the Company has no market risk sensitive instruments outstanding as of September 30, 2013, it was determined that there was no material market risk exposure to our consolidated financial position, results of operations, or cash flows as of such date. We do not enter into derivatives or other financial instruments for trading or speculative purposes.

Disclosures Controls and Procedures

We have adopted and maintain disclosure controls and procedures (as such term is defined in Rules 13a-15I and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act")) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the ’EC's rules and forms and that the information is gathered and communicated to our management, including our Chief Executive Officer (Principal Executive Officer) and Chief Financial Officer (Principal Financial Officer), as appropriate, to allow for timely decisions regarding required disclosure.

Pursuant to Rule 13a-15(b) under the Exchange Act, the Company carried out an evaluation, with the participation of the Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO” who is also the Company’s principal financial and accounting officer), of the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based on that evaluation, and taking the matters described below into account, the Company’s CEO and CFO have concluded that our disclosure controls and procedures over financial reporting were not effective during reporting periods ended December 31, 2012 and September 30, 2013.

Eide Bailly LLP, our registered independent public accounting firm, was not required to and has not issued a report concerning the effectiveness of our internal control over financial reporting as of December 31, 2012.

Management's Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company in accordance with as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

(i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets;

(ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made in accordance with authorizations of our management and directors; and

(iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

A material weakness is a control deficiency, or combination of control deficiencies, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management’s assessment of the effectiveness of the small business issuer’s internal control over financial reporting as of the year ended December 31, 2012 and nine months ended September 30, 2013, the Company did not maintain effective internal control over financial reporting because of the following control deficiencies that constitute material weakness:

|

·

|