Attached files

| file | filename |

|---|---|

| EX-31.2 - TURV HARDING EXHIBIT 31 - TWO RIVERS WATER & FARMING Co | exh31harding2012q1.htm |

| EX-32.2 - TURV HARDING EXHIBIT 31 - TWO RIVERS WATER & FARMING Co | exh32harding2012q1.htm |

| EX-32.1 - TURV MCKOWEN EXHIBIT 32 - TWO RIVERS WATER & FARMING Co | exh32mckowen2012q1.htm |

| EX-31.1 - TURV MCKOWEN EXHIBIT 31 - TWO RIVERS WATER & FARMING Co | exh31mckowen2012q1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - TWO RIVERS WATER & FARMING Co | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X]

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2012

Or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-51139

TWO RIVERS WATER COMPANY

(Exact name of registrant as specified in its charter)

|

Colorado

|

13-4228144

|

|

|

State or other jurisdiction of incorporation or organization

|

I.R.S. Employer Identification No.

|

|

|

2000 South Colorado Boulevard, Annex Ste 420, Denver, CO 80222

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

Registrant’s telephone number, including area code:

(303) 222-1000

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class registered

|

Name of each exchange on which registered

|

|

|

Not Applicable

|

Not Applicable

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

Common Stock

(Title of class)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No |_|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |_| No |_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One).

|

Large accelerated filer

|

[___]

|

Accelerated filer

|

[___]

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

[___]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes |_| No |X|

As of May 1, 2012 there were 23,176,350 shares outstanding of the registrant's Common Stock.

|

Page

|

||

|

Item 1

|

Financial Statements (Unaudited)

|

|

|

March 31, 2012 and December 31, 2011

|

1

|

|

|

Condensed Consolidated Statements of Operations – Three months ended March 31, 2012 and 2011

|

2

|

|

|

Condensed Consolidated Statements of Cash Flows – Three months ended March 31, 2012 and 2011

|

3

|

|

|

4

|

||

|

Item 2

|

20

|

|

|

Item 3

|

23

|

|

|

Item 4

|

23

|

|

|

|

||

|

Item 1

|

Legal Proceedings

|

25

|

|

Item 2

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

25

|

|

Item 3

|

Defaults Upon Senior Securities – Not Applicable

|

26

|

|

Item 4

|

Mine Safety Disclosures – Not Applicable

|

|

|

Item 5

|

Other Information – Not Applicable

|

26

|

|

Item 6

|

Exhibits

|

26

|

|

27

|

||

TWO RIVERS WATER COMPANY AND SUBSIDIARIES

|

March 31, 2012 (Unaudited)

|

December 31, 2011 (Derived from Audit)

|

|||||||

|

ASSETS:

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 3,557 | $ | 777 | ||||

|

Marketable securities, available for sale

|

93 | 137 | ||||||

|

Advances and accounts receivable

|

53 | 87 | ||||||

|

Farm product

|

44 | 43 | ||||||

|

Deposits and other current assets

|

51 | 20 | ||||||

|

Total Current Assets

|

3,798 | 1,064 | ||||||

|

Property, equipment and software, net

|

1,079 | 1,129 | ||||||

|

Other Assets

|

||||||||

|

Debt issuance costs

|

597 | 663 | ||||||

| Land | 2,968 | 2,968 | ||||||

|

Water rights and infrastructure

|

28,786 | 28,786 | ||||||

|

Dam and water infrastructure construction in progress

|

1,291 | 848 | ||||||

|

Total Other Assets

|

33,642 | 33,265 | ||||||

|

TOTAL ASSETS

|

$ | 38,519 | $ | 35,458 | ||||

|

LIABILITIES & STOCKHOLDERS' EQUITY:

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$ | 632 | $ | 631 | ||||

|

Current portion of notes payable

|

10,863 | 32 | ||||||

|

Accrued liabilities

|

390 | 495 | ||||||

|

Total Current Liabilities

|

11,885 | 1,158 | ||||||

|

Notes Payable - Long Term

|

6,830 | 13,508 | ||||||

|

Total Liabilities

|

18,715 | 14,666 | ||||||

|

Commitments & Contingencies (Notes 2, 3, 5, 6)

|

||||||||

|

Stockholders' Equity:

|

||||||||

|

Common stock, $0.001 par value, 100,000,000 shares authorized, 23,176,350 and 23,258,494 shares issued and outstanding at March 31, 2012 and December 31, 2011, respectively

|

23 | 23 | ||||||

|

Additional paid-in capital

|

40,195 | 38,357 | ||||||

|

Accumulated Comprehensive (Loss)

|

(96 | ) | (51 | ) | ||||

|

Accumulated (deficit)

|

(22,472 | ) | (19,699 | ) | ||||

|

Total Two Rivers Water Company Shareholders' Equity

|

17,650 | 18,630 | ||||||

|

Noncontrolling interest in subsidiary

|

2,154 | 2,162 | ||||||

|

Total Stockholders' Equity

|

19,804 | 20,792 | ||||||

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

|

$ | 38,519 | $ | 35,458 | ||||

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

TWO RIVERS WATER COMANY AND SUBSIDIARIES

|

Three months ended March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Revenue

|

||||||||

|

Farm revenue

|

$ | - | $ | - | ||||

|

Water revenue

|

- | - | ||||||

|

Member assessments

|

- | - | ||||||

|

Other income

|

1 | - | ||||||

|

Total Revenue

|

1 | - | ||||||

|

Direct cost of revenue

|

- | - | ||||||

|

Gross Margin (Loss)

|

1 | - | ||||||

|

Operating Expenses:

|

||||||||

|

General and administrative

|

2,094 | 1,063 | ||||||

|

Depreciation

|

53 | 14 | ||||||

|

Total operating expenses

|

2,147 | 1,077 | ||||||

|

(Loss) from operations

|

(2,146 | ) | (1,077 | ) | ||||

|

Other income (expense)

|

||||||||

|

Interest expense

|

(580 | ) | (169 | ) | ||||

|

Warrant expense

|

(55 | ) | (188 | ) | ||||

|

Other income (expense)

|

- | 8 | ||||||

|

Total other income (expense)

|

(635 | ) | (349 | ) | ||||

|

Net (Loss) from continuing operations before taxes

|

(2,781 | ) | (1,426 | ) | ||||

|

Income tax (provision) benefit

|

- | - | ||||||

|

Net (Loss) from continuing operations

|

(2,781 | ) | (1,426 | ) | ||||

|

Discontinued Operations (Note 1)

|

||||||||

|

Loss from operations of discontinued real estate and mortgage business

|

- | (22 | ) | |||||

|

Income tax (provision) benefit from discontinued operations

|

- | - | ||||||

|

(Loss) on discontinued operations

|

- | (22 | ) | |||||

|

Net (Loss)

|

(2,781 | ) | (1,448 | ) | ||||

|

Net loss (income) attributable to the noncontrolling interest (Note 2)

|

8 | - | ||||||

|

Net (Loss) attributable to Two Rivers Water Company

|

$ | (2,773 | ) | $ | (1,448 | ) | ||

|

(Loss) Per Share - Basic and Dilutive:

|

||||||||

|

(Loss) from continuing operations

|

$ | (0.12 | ) | $ | (0.07 | ) | ||

|

(Loss) from discontinued operations

|

- | - | ||||||

|

Total

|

$ | (0.12 | ) | $ | (0.07 | ) | ||

|

Weighted Average Shares Outstanding:

|

||||||||

|

Basic and Dilutive

|

23,217 | 20,783 | ||||||

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

TWO RIVERS WATER COMPANY AND SUBSIDIARIES

|

For the three months ended March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Cash Flows from Operating Activities:

|

||||||||

|

Net (Loss)

|

$ | (2,781 | ) | $ | (1,448 | ) | ||

|

Adjustments to reconcile net income or (loss) to net cash (used in) operating activities:

|

||||||||

|

Depreciation (including discontinued operations)

|

53 | 14 | ||||||

|

Amortization of debt issuance costs and pre-paids

|

270 | 25 | ||||||

|

(Gain) Loss on extinguishment of notes payables

|

- | 188 | ||||||

|

(Gain) Loss on sale of investments and assets held

|

- | (20 | ) | |||||

|

Stock based compensation and warrant expense

|

1,000 | 498 | ||||||

|

Stock for services

|

- | 107 | ||||||

|

Options for Services

|

- | - | ||||||

|

Net change in operating assets and liabilities:

|

||||||||

|

Decrease (increase) in advances & accounts receivable

|

3 | 14 | ||||||

|

(Increase) in farm product

|

(1 | ) | (12 | ) | ||||

|

(Increase) decrease in deposits, prepaid expenses and other assets

|

- | (159 | ) | |||||

|

Decrease in long term mortgage

|

- | 135 | ||||||

|

(Decrease) Increase in accounts payable

|

1 | 62 | ||||||

|

Increase (decrease) in accrued liabilities and other

|

131 | 4 | ||||||

|

Net Cash (Used in) Operating Activities

|

(1,324 | ) | (592 | ) | ||||

|

Cash Flows from Investing Activities:

|

||||||||

|

Purchase of property, equipment and software

|

(3 | ) | (371 | ) | ||||

|

Purchase of land, water shares, infrastructure

|

- | (292 | ) | |||||

|

Construction in Progress

|

(443 | ) | - | |||||

|

Net Cash (Used in) Investing Activities

|

(446 | ) | (663 | ) | ||||

|

Cash Flows from Financing Activities:

|

||||||||

|

Proceeds from issuance of convertible notes

|

- | 1,975 | ||||||

|

Proceeds from issuance of bridge loans

|

3,994 | - | ||||||

|

Payment of offering costs

|

(45 | ) | (219 | ) | ||||

|

Payment on notes payable

|

(5 | ) | (38 | ) | ||||

|

Payment for settlement of note payable

|

- | (105 | ) | |||||

|

Proceeds from long-term debt

|

606 | - | ||||||

|

Warrants exercised

|

- | 50 | ||||||

|

Net Cash Provided by Financing Activities

|

4,550 | 1,663 | ||||||

|

Net Increase in Cash & Cash Equivalents

|

2,780 | 408 | ||||||

|

Beginning Cash & Cash Equivalents

|

777 | 645 | ||||||

|

Ending Cash & Cash Equivalents

|

$ | 3,557 | $ | 1,053 | ||||

|

Supplemental Disclosure of Cash Flow Information

|

||||||||

|

Cash paid for interest

|

$ | 474 | $ | 526 | ||||

|

Cash received from income tax refunds

|

$ | - | $ | 501 | ||||

|

Conversion of note receivable for loan on land

|

$ | - | $ | 295 | ||||

|

Common stock issued for land and water share purchase

|

$ | - | $ | 500 | ||||

|

Stock issued for non-controlling interest in HCIC

|

$ | - | $ | 11,379 | ||||

|

Stock & warrants for debt issuance costs

|

$ | 115 | $ | - | ||||

The accompanying notes to condensed consolidated financial statements are an integral part of these statements

TWO RIVERS WATER COMPANY AND SUBSIDIARIES

For the Three Months Ended March 31, 2012 and March 31, 2011

(Unaudited)

NOTE 1 – ORGANIZATION AND BUSINESS

GENERAL

The following is a summary of some of the information contained in this document. Unless the context requires otherwise, references in this document to “Two Rivers Water Company,” or the “Company” is to Two Rivers Water Company and its subsidiaries.

Two Rivers Water Company acquires and develops high yield irrigated farmland and the associated water rights in the Arkansas River watershed, particularly along the Huerfano and Cucharas Rivers, in Southeastern Colorado.

The Company owns a 91% interest in the Huerfano Cucharas Irrigation Company, a mutual irrigation company, which interest was purchased in 2010. The Company also purchased the Orlando Reservoir and Butte Valley water rights in February 2011. The Company currently has the right to store 15,000 acre-feet of water1 within the Huerfano and Cucharas Rivers watershed. When the Company’s reservoirs are fully restored, they will have the ability to store in excess of 70,000 acre-feet of water. The Company also has the right to divert from the natural flows of the two rivers in excess of 50 cubic feet per second which historically yields 15,000 acre-feet of water annually, subject to river conditions and competing uses.

The Company currently owns approximately 4,700 gross acres of irrigable farmland within the watershed of the Huerfano and Cucharas Rivers, upstream of the Huerfano’s confluence with the Arkansas River. Based on progress in preparing this land for long-term farming, the Company expects that approximately 800 acres of its land will be in production during the 2012 growing season and an additional 1,000 acres of land will be developed for 2012 fall planting. Each acre of irrigated farmland is capable of producing the equivalent of 200+ bushels of corn or 6 tons of alfalfa during an annual growing season. The Company expects to acquire and develop in excess of 25,000 acres of such farmland within the Huerfano/Cucharas two river watershed within the next five years, subject to capital availability and operational constraints.

The Company expects to acquire and develop the right to divert and store an additional 55,000 acre-feet of water in the two rivers watershed within the next five years.

Two Rivers Water Company plans to operate two core businesses, organic crop production from high yield irrigated farmland and water supply to municipal markets in Huerfano County and the Front Range of Colorado. The Company’s initial crop production will consist of organic premium to supreme alfalfa hay and exchange traded grains. The Company also expects to initiate production of organic vegetable and fruit crops following further development of its water asset portfolio. Based on rotational farm fallowing and other advanced agronomy, the Company expects to be able to support long-term crop production and to supply water on a highly reliable basis for municipal water users within Southeast Colorado.

1 An acre-foot of water is the amount of water required to cover one acre to a depth of one foot. An acre-foot of water contains 325,851 gallons, generally considered enough water to supply two average households for a year. Annual irrigation of alfalfa in Southeastern Colorado consumes approximately three acre-feet of water per acre of crop.

The Company has expanded operations through various funding mechanisms, which include debt, convertible debt and equity capital. Since inception, the Company has raised and invested over $30 million in assembling and improving assets necessary to support its two integrated businesses. The Company hopes to raise an additional $100 million to support expansion over the next five years in order to fully develop the high yield irrigated farmland and water assets within the Huerfano Cucharas two river basin. We cannot make any assurances that we will be able to raise such funds or whether we would be able to raise such funds on terms that are acceptable to us.

The Company believes it is unique in developing a business model whereby it acquires and develops agricultural assets (both land and associated water rights and facilities) to create a profitable, synergistic relationship between crop production and other water uses in the arid western regions of the United States.

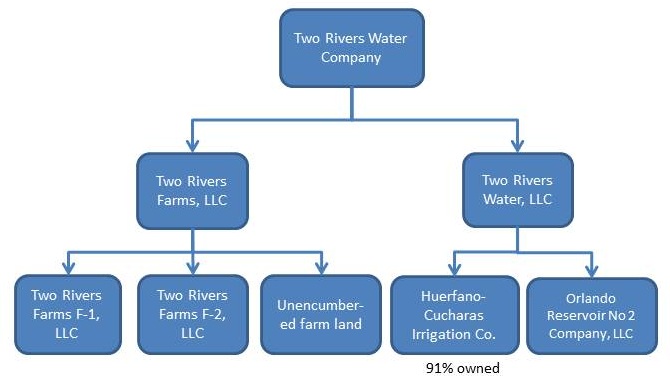

Two Rivers Water Company Corporate Organization

The Company’s organizational structure is illustrated in the above chart. Two Rivers Water Company is the parent company and owns 100% of Two Rivers Farms, LLC and Two Rivers Water, LLC. Two Rivers Farms owns 100% of Two Rivers Farms F-1, LLC and Two Rivers Farms F-2, LLC. Two Rivers Farms also owns unencumbered farmland that will eventually be redeveloped and brought into production. Two Rivers Water, LLC owns 91% of the Huerfano-Cucharas Irrigation Company (sometimes referred to elsewhere in this quarterly report as the Mutual Ditch Company) and 100% of the Orlando Reservoir No. 2 Company LLC (the “Orlando”).

Two Rivers Farms, LLC (“Farms”) – Our Farming Business

In order to put its water rights and facilities to productive use, the Company formed Farms to manage farms in proximity to our water distribution facilities and has undertaken a program of redeveloping the land, introducing modern agricultural and water management practices including deep plowing, laser leveling and installing efficient irrigation facilities.

During the 2010 growing season, approximately 400 acres of the Company’s land were farmed, primarily for wheat and feed corn, to determine the fertility of the soil and the most efficient and cost effective means of irrigation.

During 2011, the Company developed additional ways to add irrigable acreage. As a result, the Company developed 533 acres in 2011. These additions increased the Company’s farmable acreage to 713. However, because of the extensive drought in the area and because redevelopment of the Orlando and Phase I reconstruction of the Cucharas Reservoirs had not been completed; Farms did not produce a 2011 crop.

Two Rivers Farms F-1, LLC (“F-1”) and Two Rivers Farms F-2, LLC (“F-2”)

On January 21, 2011 the Company formed F-1 to hold certain farming assets and as an entity to raise debt financing for the Company’s expansion of the Farming Business. In February 2011, F-1 sold $2,000,000 in 5% per annum, 3-year convertible promissory notes that also participates in 1/3 of the crop profit from the related land. Proceeds from these notes were used to improve irrigation systems, pay for the farmland and retire seller carry-back debt from the purchase of the Mutual Ditch Company. This allowed water available through the Mutual Ditch Company to be used to irrigate the F-1 farms without encumbrances.

On April 5, 2011 the Company formed F-2 to hold certain farming and water assets and as an entity to raise additional debt for the Company’s expansion of the Farming Business. Proceeds from the notes that were sold in Summer 2011, were used to acquire the Orlando and additional farmland and to install irrigation systems.

Both F-1 and F-2 lease their farmland and farming assets to Farms as the operator of the Company’s farming activities.

Two Rivers Water Company, LLC (“TR Water”) – our Water Business

During 2011, the Company formed TR Water to secure additional water rights, rehabilitate water diversion, conveyance and storage facilities and to develop one or more special water districts.

The Huerfano-Cucharas Irrigation Company (the “Mutual Ditch Company”)

In order to supply its farms with irrigation water, the Company began to acquire shares in the Mutual Ditch Company in order to develop and put to use their water rights on the two rivers. At the time the Mutual Ditch Company was formed in 1944, the water in the two rivers was continuously augmented by groundwater pumped from coal mines that operated in the watershed. The augmented and natural flow of the rivers, along with the water rights and facilities of the Mutual Ditch Company were sufficient to provide reliable irrigation water for the Mutual Ditch Company shareholders and their expanding farm enterprises. However, in the years following World War II, the mines began to cease production and, therefore, stopped pumping groundwater out of the mine shafts and into the river channels. As a result of the reduction in downstream flow in the rivers, the extent of farming in the watershed could no longer be reliably irrigated. In some years, crops failed for lack of late summer irrigation water and, over time, once thriving farms withered. Because of such failures and the reduced flow in the rivers, the shareholders of the Mutual Ditch Company were unable or unwilling to adequately maintain the water diversion, conveyance and storage facilities. Therefore, at the time the Company decided to invest in the Huerfano/Cucharas watershed, the shares in the Mutual Ditch Company had become less valuable and the residual farming in the area had reverted primarily to pasture and dry grazing.

Beginning in 2009, the Company systematically acquired shares in the Mutual Ditch Company and, as of December 31, 2010, had acquired 91% of the shares, which it continues to own. The shares were acquired from willing sellers in a series of negotiated transactions for cash and the Company’s common shares. As the controlling shareholder, the Company currently operates the Mutual Ditch Company and has undertaken a long-term program to refurbish and restore the water management facilities.

Orlando Reservoir No. 2 Company, LLC (the “Orlando”)

The Orlando is a Colorado limited liability company originally formed to divert water from the Huerfano River for storage in the Orlando Reservoir to be re-timed and used for irrigation of farmland in Huerfano and Pueblo Counties. At the time the Company began investing in the Huerfano/Cucharas watershed, the Orlando owned an historic diversion structure, a conveyance system and a reservoir and also owned a small amount of irrigable farmland. However, the water facilities were in deteriorated condition. Beginning in January, 2011, through a series of transactions, the latest of which closed on September 7, 2011, the Company acquired 100% ownership of the Orlando (through its wholly-owned subsidiary, TR Water) for a combination of cash, stock and seller-financing. Promptly following the acquisition, the Company began the program for refurbishing the facilities to restore their operating efficiency.

The Orlando assets include not only the reservoir, but also the senior-most direct flow water right on the Huerfano River (the #1 priority), along with the #9 priority and miscellaneous junior water rights. These water rights are now integrated with the Company’s other water rights on the Huerfano and Cucharas River to optimize the natural water supply. In addition, the water storage rights, and the physical storage reservoirs, are critical to water supply reliability in the watershed, because the storage system allows the natural spring runoff from snowmelt to be captured and re-timed for delivery to irrigate crops throughout the growing season. Coupled with the Company’s distribution facilities and farmland, these water diversion and storage rights are expected to provide consistent supplies to irrigate and grow our crops.

Discontinued Operations

In early 2009, the Company (then named Navidec Financial Services, Inc.) discontinued its short-term real estate lending and development in an effort to reduce its exposure to credit risk. The wind down of discontinued operations was completed by December 31, 2011.

Management plans for funding future operations

During the quarter ended March 31, 2012, the Company placed a $3,994,000 bridge loan (the “Bridge Loan”) with a group of private lenders, including the Company’s CEO. The Bridge Loan is unsecured, pays monthly interest at 12% per annum, and is due October 31, 2012. The holders of the Bridge Loan also received one share of the Company’s stock for each $10 of debt. The Company anticipates retiring any portion of the Bridge Loan not converted to common equity from the proceeds of a take-out equity financing currently under development.

As of March 31, 2012, the Company had $3,557,000 in demand deposits and $93,000 in highly liquid gold ETFs. These funds, along with the anticipated take-out equity financing will provide enough capital to implement the Company’s strategy through 2013.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Two Rivers Water Company and its subsidiaries, Farms, F-1, F-2, TR Water, the Mutual Ditch Company, the Orlando, and discontinued operations. All significant inter-company balances and transactions have been eliminated in consolidation. The Company has completed the termination of the discontinued operations.

Non-controlling Interest

The Company owns 91% of the Mutual Ditch Company, so the results for the Mutual Ditch Company are consolidated in the Company’s financial statements. As of March 31, 2012, the non-controlling members’ equity in the Mutual Ditch Company (the remaining 9% ownership interests) was $2,154,000.

Below is the breakdown of the non-controlling interests’ share of (loss) and gains.

|

For the quarter ended

March 31, 2012

|

Year ended

December 31, 2011

|

|||||||

|

Mutual Ditch Company

|

$ | (8,000 | ) | $ | 51,000 | |||

The non-controlling interests’ shares are assessed their pro-rata share of expected expenses to operate the Mutual Ditch Company.

Reclassification

Certain amounts previously reported have been reclassified to conform to current presentation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ materially from those estimates.

Fair Value of Measurements and Disclosures

Fair Value of Assets and Liabilities Acquired

Fair value is the price that would be received from the sale of an asset or paid to transfer a liability (i.e., an exit price) in the principal or most advantageous market in an orderly transaction between market participants. In determining fair value, the accounting standards establish a three-level hierarchy that distinguishes between (i) market data obtained or developed from independent sources (i.e., observable data inputs) and (ii) a reporting entity’s own data and assumptions that market participants would use in pricing an asset or liability (i.e., unobservable data inputs). Financial assets and financial liabilities measured and reported at fair value are classified in one of the following categories, in order of priority of observability and objectivity of pricing inputs:

|

|

• Level 1 – Fair value based on quoted prices in active markets for identical assets or liabilities.

|

|

|

• Level 2 – Fair value based on significant directly observable data (other than Level 1 quoted prices) or significant indirectly observable data through corroboration with observable market data. Inputs would normally be (i) quoted prices in active markets for similar assets or liabilities, (ii) quoted prices in inactive markets for identical or similar assets or liabilities or (iii) information derived from or corroborated by observable market data.

|

|

|

• Level 3 – Fair value based on prices or valuation techniques that require significant unobservable data inputs. Inputs would normally be a reporting entity’s own data and judgments about assumptions that market participants would use in pricing the asset or liability.

|

The fair value measurement level for an asset or liability is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques should maximize the use of observable inputs and minimize the use of unobservable inputs.

Recurring Fair Value Measurements:

The carrying value of the Company’s financial assets and financial liabilities is their cost, which may differ from fair value. The carrying value of cash held as demand deposits, money market and certificates of deposit, accounts receivable, short-term borrowings, accounts payable and accrued liabilities approximated their fair value. Marketable securities are valued at Level 1 due to readily available market quotes. The fair value of the Company’s long-term debt, including the current portion approximate its carrying value.

Investments

Investments in publicly traded equity securities over which the Company does not exercise significant influence are recorded at market value in accordance with ASC 320 "Investments - Debt and Equity Securities," which requires that all applicable investments be classified as trading securities, available for sale securities or held-to-maturity securities. Comprehensive income includes unrealized net gain or loss and changes in equity from the market price variations in stock and warrants held by the Company.

Marketable securities available for sale

In 2011, the Company established a securities trading account for the purposes of hedging against increasing farm development costs. The account is limited to offsetting equal long call and put option positions on the GLD ETF. As of December 31, 2011 there was $4,000 in cash and $137,000 in GLD ETF. As of March 31, 2012, there was $4,000 in cash and $93,000 in GLD ETF. The Company holds the securities as “available for sale.” Therefore, unrealized gains and losses are recorded as adjustment to other comprehensive income/loss in the Statement of Changes in Stockholders’ Equity and the value of the securities held is adjusted to market value. There was no securities trading account during 2010.

Land

Land acquired for farming is recorded at cost. Some of the land acquired has not been farmed for many years. Therefore, additional expenditures are required to make the land ready for efficient farming. Expenditures for leveling the land are added to the cost of the land. Irrigation equipment is not capitalized in the cost of land (see Property and Equipment below). Land is not depreciated. However, at least once per year, and more often if certain triggering events occur, Management assesses the value of land held by the Company; if, based on this assessment, the land has become impaired, the Company will establish an allowance against the land. To date, no such land impairment allowances have been established by the Company.

Intangibles

The Company recognizes the estimated fair value of water rights acquired by the Company, through, for instance, its acquisition of stock in the Mutual Ditch Company and of the Orlando. These intangible assets are not depreciated, because they have an indefinite but long-term remaining useful life. Management at least annually, and more often if certain triggering events occur, assesses the value of the water rights held by the Company; if, based on this assessment, the rights have become impaired, the Company will establish an allowance against the water rights. To date, no such water rights impairment allowances have been established by the Company.

Revenue Recognition

Farm Revenues

Revenues from farming operations are recognized when resulting crops are sold into the market. All direct expenses related to farming operations are capitalized as farm product and recognized as a direct cost of sale upon the sale of the crops.

Water Revenues

Current water revenues are from the sale of water arising under water rights owned by the Mutual Ditch Company to farmers in the Mutual Ditch Company service area who are not affiliated with the Company. Water revenues are recognized when the water is invoiced at the established rate per acre foot of water consumed.

Member Assessments

Once per year the Mutual Ditch Company board estimates the Mutual Ditch Company’s expenses, less anticipated water revenues, and establishes an annual assessment per ownership share. One-half of the member assessment is recorded in the second quarter of the calendar year and the other one-half of the member assessment is recorded in the fourth quarter of the calendar year. Assessments paid by Two Rivers Water Company to the Mutual Ditch Company are eliminated in consolidation of the financial statements.

The Mutual Ditch Company does not reserve against any unpaid assessments. Assessments due, but unpaid, are secured by the member’s ownership of the Mutual Ditch Company. The value of this ownership is significantly greater than the annual assessments. If assessments are not paid, after proper notifications to the delinquent party and a set time, the shares are offered at the amount of assessments due including interest and fees.

Net Income (Loss) per Share

Basic net income per share is computed by dividing net income (loss) attributed to the Company available to common shareholders for the period by the weighted average number of common shares outstanding for the period. Diluted net income (loss) per share is computed by dividing the net income for the period by the weighted average number of common and potential common shares outstanding during the period.

The dilutive effect of 4,115,474 RSUs, 1,727,562 options and 2,653,424 warrants at December 31, 2011, and the dilutive effect of 6,560,000 RSUs, 1,541,199 options, 2,953,424 warrants and 6,926,800 conversion rights at March 31, 2012 has not been included in the determination of diluted earnings per share because, under ASC 260 they would be anti-dilutive.

Comprehensive Income (Loss)

Comprehensive income (loss) excludes net income or loss and changes in equity from the market price variations in securities held by the Company. Since these securities are classified as “available for sale” any unrecognized gain or loss is shown in Other Comprehensive Income (Loss) section in the Statement of Changes in Stockholders’ Equity. At December 31, 2011 and March 31, 2012 the Company had $51,000 and $96,000, respectively, in unrecognized loss.

At December 31, 2011 and March 31, 2012, the Company held $137,000 and $93,000, respectively, in highly liquid gold-based ETFs. For financial statement presentation, this amount is included in marketable securities available for sale.

Recently issued Accounting Pronouncements

Goodwill Impairment Testing

In September 2011, the FASB issued guidance to amend and simplify the rules related to testing goodwill for impairment. The revised guidance allows an entity to make an initial qualitative evaluation, based on the entity’s events and circumstances, to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. The results of this qualitative assessment determine whether it is necessary to perform the currently required two-step impairment test. The new guidance is effective now and has been adopted by the Company. The adoption of this guidance is not expected to have a material impact on the Company’s consolidated financial statements, because the Company currently does not have any goodwill assets on its balance sheet.

Presentation of Comprehensive Income

In June 2011, the FASB issued ASU No. 2011-05, Presentation of Comprehensive Income. The issuance of ASU 2011-5 was intended to improve the comparability, consistency and transparency of financial reporting and to increase the prominence of items reported in other comprehensive income. This guidance is effective now. The Company’s adoption of this guidance is not expected to have a material impact on the Company’s consolidated financial statements.

Disclosures about Offsetting Assets and Liabilities

In December 2011, FASB issued ASU No. 2011-11, Disclosures about Offsetting Assets and Liabilities which requires an entity to disclose information about offsetting and related arrangements to enable financial statement user to understand the effect of those arrangements on its financial position. This ASU is effective for periods beginning on or after January 1, 2013. At the present, the adoption of this guidance is not expected to have a material impact on the Company’s consolidated financial statements.

There were various other accounting standards and interpretations issued in 2012 and 2011, none of which is expected to have a material impact on the Company’s financial position, operations or cash flows.

NOTE 3 – NOTES PAYABLE

Beginning on September 17, 2009, the Company began acquiring shares in the Mutual Ditch Company and related land from Mutual Ditch Company shareholders. As part of these transactions, many of the sellers financed the acquisitions by accepting notes payable from the Company and HCIC. As of December 31, 2011 and March 31, 2012, these loans totaled $7,403,000. The notes carry interest at 6% per annum, interest payable monthly, the principal amounts due at various dates from September 1, 2012 through March 31, 2013, and are collateralized by the Mutual Ditch Company shares and land. As of March 31, 2012, due to a maturity on the seller financed notes being within 12 months, the entire $7,403,000 is classified as a current portion of long-term debt.

As of March 31, 2012, of the $7,403,000 in seller carry back notes, $2,114,000 provides the holders the right to convert some or all of debt into the Company’s common stock at $1/share to $1.25/share. Each of the holders of such conversion rights can convert anytime until the related note is paid.

During the year ended December 31, 2011, the Company exchanged $1,575,000 in Mutual Ditch Company debt into 722,222 shares of the Company’s common stock, a cash payment of $37,500, and $37,500 in an unsecured note. The fair market value of the consideration paid by the Company to induce the exchange exceeded the face amount of the debt by $272,000. An expense due to loss on extinguishment of note payable of $272,000 was recognized due to the difference between the stock price conversion and the fair market value of the Company’s common stock.

During the year ended December 31, 2011, the Company offered holders of HCIC notes the option of an early payoff in exchange for a discount on the face amount of the note. A total of $189,000 of notes was retired early and a gain on forgiveness of the HCIC notes of $84,000 was recognized and is netted against the loss on extinguishment of note payables mentioned above in the statement of operations.

On January 28, 2011, the Company purchased water storage rights and direct flow water diversion rights from the Orlando Reservoir No. 2 Company, LLC (the “Orlando”) for $3,100,000, which consisted of a cash payment of $100,000 and a Company note payable to the seller in the amount of $3,000,000.

However, in July 2011, the Company substantially restructured the transaction resulting in the Company acquiring the Orlando for (i) 650,000 shares of the Company’s common stock, (ii) a $1,412,500 cash payment, and (iii) a seller carryback note of $187,500 at 7% per annum with principal and interest due on January 28, 2014.. For purposes of the transaction, the Company shares were valued at $1,557,000. Upon the completion of the Orlando purchase, the Company engaged a water research firm to perform a valuation of the Orlando. The valuation report (which took into account the rehabilitation project then nearing completion) was issued on January 16, 2012 with an approximate value of $5,195,000.

In February 2011 the Company closed a $2,000,000 Series A convertible debt offering to finance the land, water rights, improvements, and farm equipment for F-1. The debt pays interest at 6% per annum to maturity on March 31, 2014 plus one-third of the F-1 crop profit. The crop profit participation will be recognized as an interest expense upon the sale of the F-1 crop. Holders of the debt have the right to convert its principal into Company common stock at $2.50/share. Because conversion at $2.50/share would be accretive to the Company, no additional beneficial interest has been recorded in favor of the debt.

In August 2011, the Company closed a $5,332,000 Series B convertible debt offering to finance the land, water rights, and improvements for F-2. The debt pays interest at 6% per annum to maturity on June 30, 2014 plus10% of the net crop revenue from land owned by F-2. The crop profit participation will be recognized as an interest expense upon the sale of the F-2 crop. Holders of the debt have the right to convert its principal into Company common stock at $2.50/share. Because conversion at $2.50/share would be accretive to the Company, no additional beneficial interest has been recorded in favor of the debt.

The conversion option on the Series A and Series B Notes cannot be separated from their respective notes. However, in conjunction with the Series B Notes, the Company issued 2,132,800 warrants to purchase the Company common stock at $2.50/share through December 31, 2012. Further, in connection with the placement of the Series A and Series B Notes, the Company also issued 171,000 warrants to purchase the Company’s common stock at $2.50/share to three broker-dealers; those warrants have an expiration of September 30, 2014. The fair value of the warrants issued was computed at $1,675,000 for the debt holder warrants. This amount was recorded as a discount on the note and is amortized over the life of the note to interest expense utilizing the effective-interest method. There is an additional $149,000 for the broker dealer warrants, which warrants were issued as partial compensation for the successful completion of the Series B placement. These warrants are amortized over the life of the warrants and recognized as interest expense.

During the quarter ended March 31, 2012, the Company closed a short-term bridge financing (the “Bridge Loan”) in the total amount of $3,994,000. The Company’s CEO participated as a lender in the Bridge Loan. The Bridge Loan pays monthly interest at 12% per annum and is due on October 31, 2012. The Bridge Loan holders also received one share of the Company’s stock for each $10 of Bridge Loan participation. Participants in the Bridge Loan have the option of converting the principal into the Company’s common stock at the price offered in a take-out equity financing which the Company plans to complete during the quarter ending September 30, 2012. The total cost of the Bridge Loan is $655,000, which is recorded as a debt discount being amortized on a straight-line basis over its term.

Below is a summary of the Company’s debt:

|

Note

|

Mar 31, 2012 principal balance

|

Mar 31, 2012 accrued interest

|

Interest rate

|

Security

|

|||||||||

|

Mutual Ditch seller carry back

|

$ | 7,403,000 | $ | - | 6 | % |

Shares in the Mutual Ditch Company

|

||||||

|

Orlando purchase

|

187,000 | 3,500 | 7 | % |

188 acres of land

|

||||||||

|

Convertible debt Series A

|

2,000,000 | 85,500 | 6 | % |

F-1 assets

|

||||||||

|

Convertible debt Series B

|

5,332,000 | 160,000 | 6 | % |

F-2 assets

|

||||||||

|

Bridge Loan

|

3,994,000 | - | 12 | % |

unsecured

|

||||||||

|

CWCB

|

606,000 | - | 2.50 | % |

Various water and land assets

|

||||||||

|

Equipment loans

|

128,000 | - | 5 – 8 | % |

Specific equipment

|

||||||||

|

Total

|

$ | 19,650,000 | $ | 249,000 | |||||||||

|

Less: Current portion

|

(10,863,000 | ) | |||||||||||

|

Less: Unamortized cost of Bridge Loan

|

(564,000 | ) | |||||||||||

|

Less: Unamortized placement cost of Series A,B

|

(1,393,000 | ) | |||||||||||

|

Long-term portion

|

$ | 6,830,000 | |||||||||||

NOTE 4 – INFORMATION ON BUSINESS SEGMENTS

We organize our business segments based on the nature of the products and services offered. We focus on the Water and Farming Business with Two Rivers Water Company as the parent company. Therefore, we report our segments by these lines of businesses: Parent, Farms and Water. Farms contain all of our Farming Business (Farms, F-1, F-2). Water contains our Water Business (Mutual Ditch Company and Orlando).

In the following tables of financial data, the total of the operating results of these business segments is reconciled, as appropriate, to the corresponding consolidated amount. There are some corporate expenses that were not allocated to the business segments, and these expenses are contained in the “Total Operating Expenses” under Two Rivers Water Company.

Operating results for each of the segments of the Company are as follows (in thousands):

|

For the three months ended March 31, 2012

|

For the three months ended March 31, 2011

|

|||||||||||||||||||||||||||||||||||||||

|

Parent

|

Farms

|

Water

|

Discontinued Operations

|

Total

|

Parent

|

Farms

|

Water

|

Discontinued Operations

|

Total

|

|||||||||||||||||||||||||||||||

|

Revenue

|

||||||||||||||||||||||||||||||||||||||||

|

Assessments

|

$ | - | - | - | - | $ | - | - | - | - | - | |||||||||||||||||||||||||||||

|

Farm revenue

|

- | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

|

Water revenue

|

- | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

|

Other & misc.

|

- | - | 1 | - | 1 | - | - | - | - | - | ||||||||||||||||||||||||||||||

| - | - | 1 | - | 1 | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

Less: direct cost of revenue

|

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

Gross Margin

|

- | - | 1 | - | 1 | - | - | - | - | - | ||||||||||||||||||||||||||||||

|

Total Operating Expenses

|

1,614 | 199 | 334 | - | 2,147 | (905 | ) | (115 | ) | (57 | ) | - | (1,077 | ) | ||||||||||||||||||||||||||

|

Total Other Income/(Expense)

|

293 | 231 | 111 | - | 635 | 7 | (36 | ) | (320 | ) | - | (349 | ) | |||||||||||||||||||||||||||

|

Net (Loss) Income from continuing operations before income taxes

|

(1,907 | ) | (430 | ) | (444 | ) | - | (2,781 | ) | (898 | ) | (151 | ) | (377 | ) | - | (1,426 | ) | ||||||||||||||||||||||

|

Income Taxes (Expense)/Credit

|

- | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

|

Net Income (Loss) from continuing operations

|

(1,907 | ) | (430 | ) | (444 | ) | - | (2,781 | ) | (898 | ) | (151 | ) | (377 | ) | - | (1,426 | ) | ||||||||||||||||||||||

|

Discontinued operations:

|

||||||||||||||||||||||||||||||||||||||||

|

(Loss) from operations of discontinued real estate and mortgage business

|

- | - | - | - | - | - | - | (22 | ) | (22 | ) | |||||||||||||||||||||||||||||

|

Income tax benefit

|

- | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

|

Loss on discontinued operations

|

- | - | - | - | - | - | - | - | (22 | ) | (22 | ) | ||||||||||||||||||||||||||||

|

Non-controlling interest

|

- | - | 8 | - | 8 | - | - | - | - | - | ||||||||||||||||||||||||||||||

|

Net (Loss) Income

|

$ | (1,907 | ) | (430 | ) | (436 | ) | - | (2,773 | ) | $ | (898 | ) | (151 | ) | (377 | ) | (22 | ) | (1,448 | ) | |||||||||||||||||||

|

Segment assets

|

$ | 4,302 | 7,090 | 27,127 | - | 38,519 | $ | 1,495 | 606 | 29,348 | 42 | 31,491 | ||||||||||||||||||||||||||||

NOTE 5 – EQUITY TRANSACTIONS

Common Stock

During the three months ended March 31, 2011 the Company had the following common stock transactions:

|

·

|

In January, 2011 we issued 15,000 shares of our common stock to the independent members of the Board in exchange for Board of Director services.

|

|

·

|

On February 18, 2011 70,000 shares of our common stock were issued in exchange for consulting services.

|

|

·

|

In March, 2011 we issued a total of 722,000 shares to a creditor of the Company, as payment in full for the debt in the amount of $1,575,000. At the time of the transaction, the fair value of the Company’s common stock exceeded the amount of debt retired, which resulted in a loss from debt retirement of $272,000.

|

During the three months ended March 31, 2012 the Company had the following common stock transactions:

|

·

|

In January, 2012 we issued 50,000 shares of our common stock to the independent members of the Board in exchange for Board of Director services rendered in 2011.

|

|

·

|

In January, 2012 we issued 125,000 shares to cover 125,000 Restricted Stock Units (“RSUs”) issued to an non-executive employee under the 2011 Plan in exchange for his surrender of 250,000 options (strike price of $2.00/share) under the 2005 Plan.

|

|

·

|

In January, 2012 100,000 shares, as part of an overall grant of 700,000 shares, were issued to the Company’s CFO pursuant to the 2011 Plan.

|

|

·

|

In January, 2012 200,000 shares, as part of an overall grant of 400,000 shares, were issued to a former member of the Board of Directors.

|

|

·

|

In February, 2012 we issued 83,330 shares to our investor relations consultants as partial payment for their services.

|

|

·

|

In March, 2012 we issued 400,000 shares to participating lenders in consideration of the Bridge Loan.

|

Stock Incentive Plans

The Company previously had a 2005 Stock Option Plan (“2005 Plan”) that was superseded by the Two Rivers 2011 Long-Term Stock Incentive Plan (“2011 Plan”). Upon the Company’s shareholder adoption of the 2011 Plan, the 2005 Plan stopped issuance of any further grants, except for grants previously committed by agreement.

Under the 2005 Plan, we have the following options issued:

|

Optionee

|

Company Relationship

|

Shares

|

Date of Grant

|

Vesting Date

|

Performance Requirement

|

Expiration Date

|

Exercise Price

|

Exercised to Date

|

|||||||||||||||

|

Howard Farkas

|

Former Director

|

1,023,200 |

Jul 2006

|

Jul 2006

|

Satisfied

|

Jul 2016

|

$ | 1.25 | - | ||||||||||||||

|

Employees

|

Employee

|

40,000 |

Apr 2011

|

(1) | (2) |

Apr 2021

|

$ | 3.00 | - | ||||||||||||||

|

Wallick Associates

|

Consultant

|

477,999 |

Apr 2011

|

Apr 2011

|

(3) |

Apr 2021

|

$ | 1.25 | - | ||||||||||||||

| 1,541,199 | |||||||||||||||||||||||

|

Exercisable March 31, 2012

|

1,501,199 | ||||||||||||||||||||||

|

Notes:

|

|||

|

(1) Vests 1/3 at the end of each 12 months from Date of Grant

|

|||

|

(2) Satisfactory employee performance during vesting period

|

|||

|

(3) Satisfactory consultant performance pursuant to services contract

|

|||

If all of the options were exercised, $1,996,000 would be collected by the Company and yield an average share price of $1.30.

During the three months ended March 31, 2012, the Company issued 83,333 options under the 2005 Plan and pursuant to a prior written agreement with a financial consultant. The options have a strike of $1.25/share. Because the options were issued in conjunction with a successful debt placement, the fair value is being amortized over the three-year life of the associated debt, or $3,000 per quarter which is recognized as interest expense.

Option Valuation Process

The fair value of each option award is estimated on the date of grant. To calculate the fair value of options, the Company uses the Black-Scholes model employing the following variables:

|

Expected stock price volatility

|

78%

|

|

Risk-free interest rate

|

2.64%

|

|

Expected option life (years)

|

2.2 to 5.2

|

|

Expected annual dividend yield

|

0%

|

The Company arrived at the foregoing estimate of volatility of the Company’s common stock based on observation of pricing volatility of the publicly-traded stocks of other entities in a similar line of business for a period commensurate with the contractual term of the underlying options and used weekly intervals for price observations. The Company will continue to consider the volatilities of those other stocks unless circumstances change such that the identified entities are no longer similar to the Company or until there is sufficient information available to substitute the Company’s own stock price volatility. The risk-free rate for periods within the expected term of the options is based on the U.S. Treasury yield curve in effect at the time of grant. The Company believes these estimates and assumptions are reasonable. However, these estimates and assumptions may change in the future based on actual experience as well as market conditions.

Under the 2011 Plan, we have issued the following Restricted Stock Units (RSUs):

|

Grantee

|

Company Relationship

|

RSUs

|

Date of Grant

|

Vesting Date

|

Performance Requirement

|

Issued to Date

|

|

John McKowen

|

Chairman/CEO

|

2,480,948

|

Oct 2010

|

(1)

|

(2)

|

-

|

|

1,400,000

|

Jan 2012

|

(1)

|

(3)

|

-

|

||

|

Gary Barber

|

President/COO

|

1,000,000

|

Oct 2010

|

(1)

|

(2)

|

-

|

|

1,400,000

|

Jan 2012

|

(1)

|

(3)

|

-

|

||

|

Wayne Harding

|

CFO

|

700,000

|

Oct 2010

|

(1)

|

(2)

|

200,000

|

|

500,000

|

Jan 2012

|

(1)

|

(3)

|

-

|

||

|

John Stroh

|

Director

|

53,570

|

Oct 2010

|

Jan 2011

|

n/a

|

53,570

|

|

Jolee Henry

|

Prior Director

|

400,000

|

Oct 2010

|

Jan 2011

|

n/a

|

200,000

|

|

Employees (5)

|

888,570

|

Various

|

(1)

|

(4)

|

125,000

|

|

|

8,823,088

|

578,570

|

|

Notes:

|

|

(1) Vests 1/3 at the end of each 12 months from Date of Grant

|

|

(2) Subject to employer deferral and employment agreement, if applicable

|

|

(3) Vests 1/3 when the Company's common stock is listed on a National Exchange and attains closing bid of $3 per share, a second 1/3 when the share price attains $6 per share, and the final 1/3 when the share price attains $9 per share, respectively

|

|

(4) Satisfactory employee performance during vesting period

|

|

(5) A total of nine employees are in this group

|

The 2011 Plan has a total of 10,000,000 shares available for grants. With 8,823,088 RSUs granted, a balance of 1,176,912 shares is available for grants under the 2011 Plan.

It is estimated that $6,903,000 in stock-based compensation expense will be fully amortized by December 31, 2015.

The stock-based compensation expenses recognized for the years ended December 31, 2011 and 2010 were $4,841,000 and $2,678,000, respectively.

Warrants

On January 27, 2012, our Board of Directors authorized an extension of the expiration date of 100,000 warrants to purchase the Company’s common stock at $1.00/share held by the Elevation Fund. The former expiration date was December 31, 2011, and the expiration date was extended to June 30, 2012. The extension was granted in consideration of the Elevation Fund’s assistance with the Company’s capital financing. Due to the extension of the warrant expiration date, a new fair value calculation was performed using the Black-Scholes method. Based on this calculation, an expense of $55,000 was recognized for the three months ended March 31, 2012.

As of March 31, 2012, the Company has outstanding the following warrants to purchase common stock:

|

Grantee

|

Company Relationship

|

Shares

|

Date of Grant

|

Vesting Date

|

Expiration Date

|

Exercise Price

|

||||||||||

|

Elevation Fund

|

Investors

|

100,000 |

Apr 2005

|

Apr 2005

|

Jun 2012

|

$ | 1.00 | |||||||||

|

Holders of Series B Debt

|

Investors

|

2,132,800 |

Aug 2012

|

Aug 2012

|

Dec 2013

|

$ | 2.50 | |||||||||

|

Broker Dealer Series B Debt

|

Placement Agent

|

170,624 |

Aug 2012

|

Aug 2012

|

Sep 2014

|

$ | 2.50 | |||||||||

|

Boenning Scattergood

|

Financial Advisor

|

250,000 |

May 2011

|

May 2011

|

May 2016

|

$ | 2.00 | |||||||||

|

Investor Group

|

Investors

|

300,000 |

Feb 2012

|

Feb 2012

|

(1) | (1) | ||||||||||

|

(1) These warrants are priced at the same price per share as the expected equity offering and expire one year after the completion of the expected equity offering.

|

||||||||||||||||

Conversion Rights:

As of March 31, 2012, through the Company’s various capital raising activities, we have issued the following rights to convert debt into the Company’s common stock as follows:

|

Grantee

|

Company Relationship

|

Shares

|

Date of Grant

|

Vesting Date

|

Expiration Date

|

Exercise Price

|

||||||||||

|

Holders of Series A Debt

|

Investors

|

800,000 |

Feb 2011

|

Feb 2011

|

Mar 2014

|

$ | 2.50 | |||||||||

|

Holders of Series B Debt

|

Investors

|

2,132,800 |

Aug 2011

|

Aug 2011

|

Jun 2014

|

$ | 2.50 | |||||||||

|

Holders of Bridge Loan

|

Investors

|

3,994,000 |

Feb 2012

|

Feb 2012

|

(1) | (1) | ||||||||||

|

(1) These conversion rights are priced at the same price per share as the expected equity offering and expire one year after the completion of the expected equity offering.

|

||||||||||||||||

This section includes all material subsequent events through the date the financial statements were available to be issued:

|

·

|

In April 2012, the Company entered into a purchase agreement to purchase the Dionisio farms and produce business in Pueblo County Colorado. As part of the agreement, the Company loaned the current owners $400,000 which is secured by a first lien on Dionisio’s crop production. The Company has until June 30, 2012 to complete its diligence and close on the Dionisio purchase.

|

|

·

|

In April 2012, the Company completed Phase I of a two phase rehabilitation program designed to restore the Cucharas Reservoir into service. Based on the Phase I completion, the dam is now capable of storing up to 10,000 AF of water.

|

Note about Forward-Looking Statements

This From 10-Q contains forward-looking statements, such as statements relating to our financial condition, results of operations, plans, objectives, future performance and business operations. These statements relate to expectations concerning matters that are not historical facts. These forward-looking statements reflect our current views and expectations based largely upon the information currently available to us and are subject to inherent risks and uncertainties. Although we believe our expectations are based on reasonable assumptions, they are not guarantees of future performance and there are a number of important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. By making these forward-looking statements, we do not undertake to update them in any manner except as may be required by our disclosure obligations in filings we make with the Securities and Exchange Commission under the Federal securities laws. Our actual results may differ materially from our forward-looking statements.

Overview

During 2009, Two Rivers Water Company focused its business development activities on acquiring, rehabilitating and operating irrigated farmland, water rights and associated infrastructure.

The Farming Business is seasonal. Further, we are buying farmland that has not been productive for many years. We expend capital leveling the land, acquiring water rights, building efficient irrigation systems in order for the land to grow crops. Further, farm inputs (expenses relating to planting and growing the crops) are expended during planting until harvest. These expenses are capitalized as Farm Product and then expensed when the harvest and sale of crops occur. Each calendar quarter, the Company’s management assesses the need for any impairment of the crop based on the anticipated sales price and yield of the crops planted.

During 2012, the Company is planning to have 800 acres in production and another 1,000 acres prepared for 2012 fall planting. We are targeting land in Huerfano and Pueblo Counties, Colorado to grow organic alfalfa and other crops.

We have completed the Phase I repair of the Cucharas Reservoir and the repair of the Orlando Reservoir. The Cucharas Reservoir is now capable of storing up to 10,000 acre feet in time for the expected spring snow melt and run-off.

Results of Operations

For the Three Months Ended March 31, 2012 Compared to the Three Months Ended March 31, 2011

During the three months ended March 31, 2012, we recognized revenues from continuing operations of $1,000, compared to $-0- in revenues from continuing operations during the three months ended March 31, 2011.

Operating expenses from continuing operations during the three months ended March 31, 2012 and 2011 were $2,147,000 and $1,077,000, respectively. The increase of $1,070,000 is primarily due to the increase of non-cash expense of granting of restrictive stock units ($1,000,000 for the three months ended March 31, 2012 compared to $498,000 for the three months ended March 31, 2011) and to increased expansion in the Farming Business. Management expects the expenses will continue to increase as we expand our Farming and Water Business.

For continuing operations, during the three months ended March 31, 2012 and 2011, we recognized a net loss of $2,781,000 and $1,426,000, respectively. The increased loss of $1,355,000 is due primarily to an increase of stock based compensation expense and our rapid expansion of the Farming Business and Water Business.

LIQUIDITY

From the Company’s inception through March 31, 2012, we have funded our operations primarily from the following sources:

|

-

|

Equity proceeds through private placements of Two Rivers Water Company securities and convertible debt;

|

|

-

|

Limited revenue generated from operations;

|

|

-

|

Loans and lines of credit (none currently available);

|

|

-

|

Sales of equity investments, and

|

|

-

|

Proceeds from the exercise of legacy Navidec, Inc. Options

|

There can be no assurance that additional funds will be available to us, from the sources listed above, to allow us to cover the Company’s expenses, until such a time that we are recognizing revenues from our ongoing operations.

Cash flow from operations has not historically been sufficient to sustain our operations without the above additional sources of capital. As of March 31, 2012, the Company had cash and cash equivalents of $3,557,000. Cash flow consumed by our operating activities totaled $1,324,000 for the three months ended March 31, 2012 compared to operating activities consuming $592,000 for the three months ended March 31, 2011. The increase in the cash consumed by our operating activities is due to the expansion of our Farming Business.

As of March 31, 2012, the Company had $3,798,000 in current assets and $11,885,000 in current liabilities. The Company intends to continue with its strategy of offering debt and equity securities to expand their Farming Business and Water Business and retire portions of its current debt.

Cash used in investing activities was $446,000 for the three months ended March 31, 2012 compared to use of cash of $663,000 for the three months ended March 31, 2011. During the three months ended March 31, 2012 we began Phase I of the Cucharas Dam rehabilitation and completed the replacement of the Orlando Reservoir infrastructure.

Cash flows used by our financing activities for the three months ended March 31, 2012 were $4,550,000 compared to $1,663,000 for the three months ended March 31, 2011. The increase is primarily due to the completion of our short-term Bridge Loan of $3,994,000 and drawing $606,000 against a construction loan provided by the Colorado Water Conservation Board.

During the three months ended March 31, 2011 we completed our convertible debt offering of $1,975,000, retired selected debt and had $50,000 in warrant exercises.

CRITICAL ACCOUNTING POLICIES

Two Rivers Water Company has identified the policies below as critical to the Company’s business operations and the understanding of the Company’s results from operations. The impact and any associated risks related to these policies on the Company’s business operations is discussed throughout Management’s Discussion and Analysis of Financial Conditions and Results of Operations where such policies affect the Company’s reported and expected financial results. For a detailed discussion on the application of these and other accounting policies, see Note 2 in the Notes to the Consolidated Financial Statements beginning on page [INSERT PAGE NUMBER] of this document. Note that the Company’s preparation of this document requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of The Company’s financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actual results will not differ from those estimates.

REVENUE RECOGNITION

The Company follows specific and detailed guidelines in measuring revenue; however, certain judgments may affect the application of the Company’s revenue policy. Revenue results are difficult to predict, and any shortfall in revenue or delay in recognizing revenue could cause the Company’s operating results to vary significantly from quarter to quarter and could result in future operating losses.

GOODWILL AND INTANGIBLE ASSETS

The Company has acquired water shares in the Mutual Ditch Company, which is considered an intangible asset. Currently, these shares are recorded at purchase price less the Company’s prorata share of the negative net worth in the Mutual Ditch Company. Management evaluates the carrying value, and if necessary, will establish an impairment of value to reflect current fair market value. Currently, there are no impairments on the water shares.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company is exposed to the impact of interest rate changes and change in the market values of the Company’s investments. Based on the Company’s market risk sensitive instruments outstanding as of March 31, 2012, as described below, management has determined that there was no material market risk exposure to the Company’s consolidated financial position, results of operations, or cash flows as of such date. The Company does not enter into derivatives or other financial instruments for trading or speculative purposes.

INTEREST RATE RISK

At March 31, 2012, the Company’s exposure to market rate risk for changes in interest rates relates primarily to its borrowings and opportunities for retiring or rolling over its debt. The Company has not used derivative financial instruments in its credit facilities. A hypothetical 10% increase in the Prime Rate would not be significant to the Company's financial position, results of operations, or cash flows.

IMPAIRMENT POLICY

At least once every year, management examines all of the Company’s assets for proper valuation and to determine if an allowance for impairment is necessary. In terms of real estate owned, this impairment examination also includes the accumulated depreciation. Management examines market valuations and if an additional impairment is necessary for lower of cost or market, then an impairment charge is recorded.

INVESTMENT RISK

From time to time the Company has made investments in equity instruments in companies for business and strategic purposes. These investments, when held, are included in other long-term assets and are accounted for under the cost method since ownership is less than 20% and the Company does not assert significant influence.

INFLATION

The Company does not believe that inflation will have a material negative impact on its future operations.

We are exposed to the impact of interest rate changes and change in the market values of our real estate properties and water assets. Because the Company has no market risk sensitive instruments outstanding as of March 31, 2012, it was determined that there was no material market risk exposure to our consolidated financial position, results of operations, or cash flows as of such date. We do not enter into derivatives or other financial instruments for trading or speculative purposes.

Disclosures Controls and Procedures

We have adopted and maintain disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended [the "Exchange Act"]) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the SEC's rules and forms and that the information is gathered and communicated to our management, including our Chief Executive Officer (Principal Executive Officer) and Chief Financial Officer (Principal Financial Officer), as appropriate, to allow for timely decisions regarding required disclosure.

As required by SEC Rule 15d-15(b), Mr. John McKowen, our Chief Executive Officer, and Mr. Wayne Harding, our Chief Financial Officer, carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Exchange Act Rule 15d-14 as of the end of the period covered by this report.

The Company, under the supervision and with the participation of the Company's management and staff, documented and then performed an evaluation of the effectiveness of the design and operation of the Company's disclosure controls and procedures as of March 31, 2012. Based on that evaluation, the Chief Executive Officer and the Chief Financial Officer concluded that, the Company's disclosure controls and procedures were effective as of March 31, 2012.

There was no change in our internal control over financial reporting that occurred during the quarter ended March 31, 2012, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 1. LEGAL PROCEEDINGS

There has been no significant change from the filing of our December 31, 2011 Annual Report on Form 10K.

Not applicable to Smaller Reporting Issuers.

During the period of January 1, 2012 through March 31, 2012 the Company had the following common stock transactions:

|

·

|

In January, 2012 we issued 50,000 shares of our common stock in exchange for Board of Director services to the independent members of the Board for their service in 2011.

|

|

·

|

In January, 2012 we issued 125,000 shares represented by the conversion of 250,000 options under the 2005 Plan to 125,000 RSU shares under the 2011 Plan.

|

|

·

|

In January, 2012 100,000 shares of the total grant of 700,000 shares were issued pursuant to the CFO’s employment agreement and to the 2011 Plan.

|

|

·

|

In January, 2012, pursuant to the 2011 Plan, 200,000 shares of the total grant of 400,000 shares, were issued to a former member of the Board of Directors.

|

|

·

|

In February, 2012 we issued 83,330 shares to a key vendor, as partial payment for services performed.

|

|

·

|

As required by the terms of the Bridge Loan, in March, 2012 we issued 400,000 shares to our Bridge Loan lenders.

|

|

·

|

In February 2012, the Company issued 300,000 warrants to acquire our common shares to an investor group. These warrants are exercisable at the same price per share as the expected equity offering to provide capital to take out the Bridge Loan, fund contemplated land and water rights acquisitions, repay a portion of the Company’s debt and fund Company operations. These warrants expire one year from the closing of the planned equity offering.

|

Exemption From Registration Claimed