Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERON THERAPEUTICS, INC. /DE/ | d626911d8k.htm |

| EX-99.1 - EX-99.1 - HERON THERAPEUTICS, INC. /DE/ | d626911dex991.htm |

| EX-99.2 - EX-99.2 - HERON THERAPEUTICS, INC. /DE/ | d626911dex992.htm |

Company Overview

OTCBB: APPA

November 2013

Exhibit 99.3 |

Legal

Disclaimer This presentation contains "forward-looking statements"

as defined by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve risks and uncertainties,

including uncertainties associated with timely development, approval, launch

and acceptance of new products, satisfactory completion of clinical studies,

establishment of new corporate alliances, progress in research and

development programs and other risks and uncertainties identified in the

Company's filings with the Securities and Exchange Commission. Actual

results may differ materially from the results expected in our forward looking

statements. We caution investors that forward-looking statements

reflect our analysis only on their stated date. We do not intend to

update them except as required by law.

2

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Company:

A.P. Pharma, Inc.

Ticker:

OTCBB: APPA.OB

Stock Price:

$0.46 (11/8/2013)

Market Capitalization:

$237

million

1

Cash:

$23

million

2

Debt:

$5

million

2

Stock Summary

1

Based on 516 million fully diluted, as-converted common shares assuming the

full conversion of convertible debt outstanding and 80 million warrants

using treasury stock method; not including options

2

As of September 30, 2013

3

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Barry

D. Quart, PharmD Chief Executive Officer

Ardea Biosciences

Agouron Pharmaceuticals

Pfizer

Robert Rosen

President &

Chief Commercial Officer

Bayer Healthcare

Sanofi-Synthèlabo

Imclone

Stephen Davis

Chief Operating Officer

Ardea Biosciences

Neurogen

Mark Gelder, M.D.

Senior Vice President &

Chief Medical Officer

GE Healthcare

Bayer Healthcare

Wyeth

Paul Marshall

Senior Vice President

Technical Operations

Amylin

Amgen

Baxter International

Brian Drazba

Vice President, Finance &

Chief Financial Officer

ISTA Pharmaceuticals

Insight Health Corp

Arthur Andersen & Co

Senior Management

4

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Highlights

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

5

Lead product candidate, SUSTOL™

(formerly known as APF530), is long-

acting, injectable product for chemotherapy-induced nausea and vomiting

(CINV)

Incorporates

widely

used

5-HT3

antagonist

-

granisetron

(Kytril

®

)

5-day delivery profile

Reduces both acute-

and delayed-onset CINV with single injection

Patent coverage into 2024; however, effective exclusivity actually longer due to

polymer SUSTOL

shown

to

be

non-inferior

to

market

leader

Aloxi

®

1,341-patient, randomized, controlled, Phase 3 study

SUSTOL targets a large market opportunity, with approximately 7 million

doses of chemotherapy annually in US alone*

Recent competitive setbacks could enhance commercial uptake

Could be second, long-acting, injectable product on market

Plans to leverage our Biochronomer™

drug delivery technology,

development capacity and commercial expertise for other opportunities:

Long-acting anesthetic for post-surgical pain

Triple-combination for CINV is under evaluation

Potential for several others

*TDR August 2006 internal report |

Strategic Product Development

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

6

Framework

Large, established markets with high unmet need

Rapid

development

&

approval

pathway

based

on

reformulations

and

505(b)(2)

strategy

Premium pricing through innovation and product differentiation

Clearly defined value proposition

Opportunities to optimize ROI through life cycle management (franchise

extension) Low cost of entry

Pipeline

Chemotherapy-induced nausea and vomiting

SUSTOL

Potential for triple-drug combination

Post-operative pain management

Long-acting local anesthetic

Potential for several others |

SUSTOL Clinical Summary

7

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

APF530

Pivotal Phase 3 Study Overview Randomized, controlled, multi-center

study 1,341 patients in primary efficacy population

Two doses of APF530 (5 mg and 10 mg granisetron) compared

to the approved dose of Aloxi (results from 10 mg dose group

presented)

Patients stratified by type of chemotherapy regimen (moderately

or highly emetogenic)

Primary end point compared complete response between

groups in both the acute (day 1) and delayed (days 2-5) phase

Complete response defined as no emesis and no rescue medications

A ±15% margin was used to establish non-inferiority

8

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

5-Day Profile: APF530 Pharmacokinetics

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

9

Granisetron is released rapidly following injection of APF530 and continues to be

released over a 5-day period, providing long-acting coverage for

CINV Minimum

therapeutic

concentration of

granisetron*

*Data from patent application 20120258164 for transdermal granisetron

0

5

10

15

20

0

24

48

72

96

120

144

168

Time after Dosing (h)

All subjects (n= 18)

mean ±

SEM |

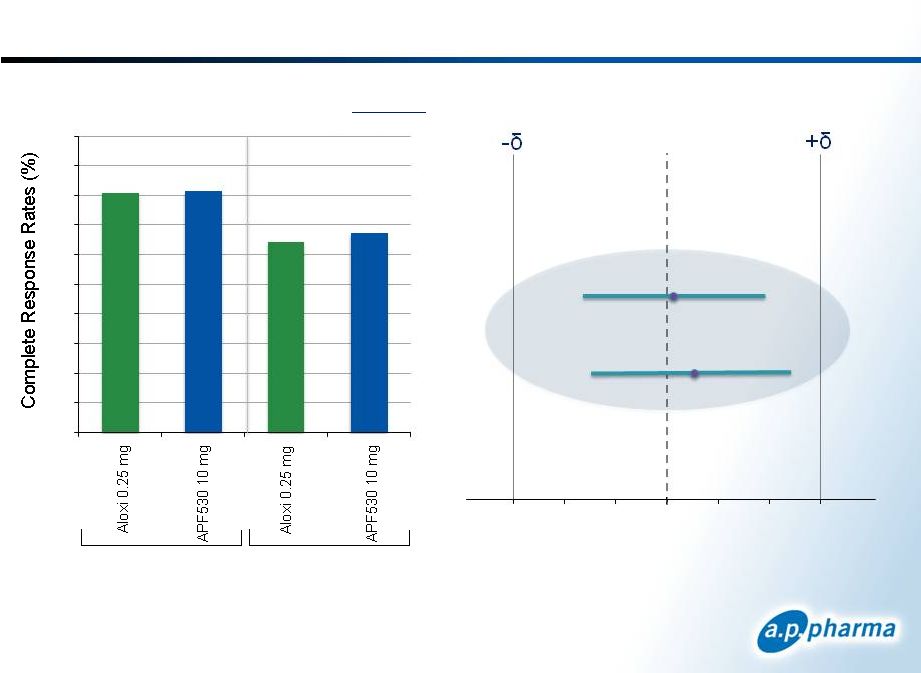

Primary Efficacy Results: Complete Response

Patients Receiving Moderately

Emetogenic Chemotherapy

Acute

Delayed

APF530 10mg

Acute

Delayed

Difference in Complete Response

APF530-Aloxi (97.5% CI)

-15

-10

-5

0

5

10

15

10

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

75.0

76.9

57.2

58.5

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

80.0

90.0

100.0 |

Primary Efficacy Results: Complete Response

Difference in Complete Response

APF530-Aloxi (98.33% CI)

-15

-10

-5

0

5

10

15

Patients Receiving Highly

Emetogenic Chemotherapy

Acute

Delayed

11

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

0

10

20

30

40

50

60

70

80

90

100

Acute

Delayed

APF530 10mg

80.7

81.3

64.3

67.1 |

Safety Summary

1

Safety results with the 5 mg dose of APF530 studied in separate arm of the phase 3

study are not included 2

>90% of injection site reactions were reported as mild; one patient

discontinued due to injection site reaction Reported in Cycle 1

12

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

APF530 10 mg

1

Aloxi 0.25 mg

N

%

N

%

Drug Related Serious Adverse Events

0

0

0

0

Discontinued Due to Adverse Event

1

0.2

0

0

Frequent Adverse Events

Gastrointestinal Disorders

Constipation

Diarrhea

Abdominal pain

72

44

13

15.4

9.4

2.8

62

39

28

13.4

8.4

6.0

Nervous System

Headache

47

10.0

45

9.7

Injection Site

Placebo (NaCl)

Bruising

Erythema (redness)

Nodule (lump)

Pain

93

51

50

33

19.9

10.9

10.7

7.1

41

14

3

5

8.9

3.0

0.6

1.1

2 |

FDA

Requested ASCO 2011 Reanalysis Improves Difference Between SUSTOL and

Aloxi Protocol Specified HEC Population

Acute

Delayed

13

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

Acute

Delayed

ASCO 2011 Guideline HEC Population

81

81

64

67

0

10

20

30

40

50

60

70

80

90

100

67

75

51

56

0

10

20

30

40

50

60

70

80

90

100 |

Largest Differences Between Arms is Seen With

Most Difficult Chemo Regimens

1

CR Rates by Treatment

Chemotherapeutic Regimen

APF530 10 mg

Aloxi 0.25 mg

Moderately

Emetogenic

Acute

Cyclophosphamide/Doxorubicin

70.7%

65.7%

All other regimens

84.4%

85.0%

Delayed

Cyclophosphamide/Doxorubicin

47.4%

46.3%

All other regimens

72.9%

70.0%

Highly

Emetogenic

Acute

Cisplatin regimens

81.1%

75.5%

Carboplatin/Paclitaxel

85.4%

89.8%

All other regimens

75.4%

67.6%

Delayed

Cisplatin regimens

66.0%

60.4%

Carboplatin/Paclitaxel

70.8%

71.4%

All other regimens

65.2%

57.4%

1

Data from post-hoc analysis. Not statistically significant.

Highlighted HEC regimens were considered HEC in both protocol specified Hesketh and

2011 ASCO Guidelines

14

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Summary of Clinical Results

Bio-erodible polymer technology releases granisetron to prevent CINV

over at least 5 days

Large, randomized, Phase 3 study conducted: APF530 10 mg showed

non-inferiority to Aloxi

For both acute-

and delayed-onset CINV

With both moderately and highly emetogenic chemotherapy

APF530 was well-tolerated

Incidence of adverse events comparable to Aloxi

Injection site reactions where predominately mild

Good response rates were observed in difficult chemotherapy

regimens

Efficacy was maintained with reanalysis using ASCO 2011 guidelines

and through multiple cycles of chemotherapy

TQT study showed APF530 has no clinically significant effect on QT;

differentiated from Zofran(ondansetron) and Anzemet(dolasetron)

15

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

SUSTOL Regulatory Status

16

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

SUSTOL NDA Status

Submitted NDA in May 2009 under 505(b)(2) filing pathway

Received Complete Response Letter in March 2010

FDA raised major issues in multiple areas

Resubmitted NDA in September 2012

Received Complete Response Letter March 2013 raising three

main issues:

17

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

CMC: correction of PAI issues and revision of one in-vitro release

method Requirement for Human Factors Validation Study with commercial

product Re-analysis of the existing Phase 3 study using the ASCO 2011

guidelines for categorization of MEC and HEC |

New

Management Team Is Addressing the CRL Chemistry, Manufacturing, and

Controls Sites with PAI issues are being eliminated from the supply chain,

with work transferred to well established site with no PAI issues

Transition is almost complete

Secondary benefit of consolidating manufacturing and release efforts is that

there has been a substantial improvement in the COGS

New in-vitro release method has been developed and being validated

Plan to produce three validation batches of finished product in advance of

re-filing to supply Human Factors Study

Human Factors Validation Study

Will be conducted as soon as commercial material available

Re-analysis of Phase 3 using new ASCO 2011 Guidelines

Re-analysis complete

Complete dataset and programs supplied to FDA and found acceptable

Re-submission is now planned for late 1Q2014

18

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

SUSTOL Life-Cycle Management

Plans to Obtain Post-Approval Indication for

“Delayed HEC”

19

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Palonosetron lacks an indication in delayed HEC because

it was unable to demonstrate superiority vs. ondansetron

©

2013. A.P. Pharma, Inc. All rights reserved.

20

Goal for New HEC Study is a

Differentiated Target Product Profile*

“Well, it appears to be certainly longer-acting, and the real

differentiator appears to be in the delayed setting”

–Oncologist, Suburban, Large Private Practice

“We’d probably try a few patients on it and as long as

we’re getting the sense that it is doing what it’s claimed to

do, then we may make the full switchover...

–

Oncologist, Urban, Group Practice

Physician Feedback

Source: August 2013 qualitative market research with n=30 oncologists

Nov 2013

*Text in blue is based on the successful outcome to the

planned HEC trial

“[The

delayed

HEC

study]

solidifies

my

impression

of

[APF530]

&

gives

even

more

confidence

in

its

clinical

profile.

–Oncologist,

Urban,

Mid-sized,

Multi-specialty

Practice

SUSTOL

Indication

MEC –

acute

and

delayed

CINV

HEC –

acute

and

delayed

CINV

Dosing

SC

injection

once

per

cycle

Duration

of action

Bioerodible

polymer technology maintains

super

therapeutic levels of granisetron

over 5 to 7 days

-

Study

SUSTOL vs. palonosetron

SUSTOL + fosaprepitant

ondansetron

fosaprepitant

•

•

vs.

+

Efficacy

Results

•

Non

inferior to palonosetron

•

Effective

in prevention of acute & delayed CINV in

MEC and acute CINV in HEC

•

SUSTOL superior to ondansetron

•

Effective

in prevention of delayed CINV in HEC

-

Safety

esults

•

Headache, constipation, injection site bruising and

pain. Majority of AEs were mild

•

Clean QT profile

R |

Planned Phase 3 “Delayed”

HEC Study Schematic

1000 patients

scheduled to receive

HEC* randomized

1:1

Ondansetron 0.15 mg/kg

IV (up to 16 mg IV) d1 +

Fosaprepitant 150 mg IV

d1 + Placebo SC d1

SUSTOL SC d1 +

Fosaprepitant 150 mg IV

d1 + Placebo IV d1

Cycle 1

1)

All subjects will receive dexamethasone 12 mg IV on day 1 and 8 mg PO on days 2-

4

2)

All subjects will be allowed to receive “rescue”

medications as needed at the discretion of their

treating physician

©

2013. A.P. Pharma, Inc. All rights reserved.

21

* HEC agents as defined in the 2011 ASCO CINV Guidelines

•

Study design has been accepted by FDA for obtaining expanded

indication

•

Study is powered to show superiority (10% difference) to three drug

“standard of care”

for HEC

•

Study planned to complete late 2014

Nov 2013 |

45

65

67

0

10

20

30

40

50

60

70

80

90

100

New SUSTOL Study in Delayed HEC Has a High

Likelihood of Success Based on Previous Results

^^Average

Complete

Response

rate

improvement

when

adding

an

NK-1

RA

to

a

5-HT3

RA

and

Dex

is

~15

-

20%

in

the

delayed

phase

* Poll-Bigelli; Cancer, 97:12, 3090, 2003

Projected

Response

with addition

of NK1

^^

Study

powered

to show 10%

difference:

65% vs 75%

APF530 + Dex

+ Fosaprepitant**

APF530+Dex

Ondansetron + Dex

+ Fosaprepitant*

Ondansetron + Dex*

87%

Standard of Care

Phase 3 Study

HEC Study

67%

65%

45%

Study powered for a 10% difference between arms

20% difference is expected with the addition of fosaprepitant,

©

2013. A.P. Pharma, Inc. All rights reserved.

22 |

SUSTOL Commercial Opportunity

23

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Continuing Unmet Need in CINV

Need for long-acting antiemetic

therapies

Delayed CINV (days 2-5) remains

particularly challenging to manage

Significant portion of patients fail to respond

to palonosetron

Need for antiemetic therapies with

sustained efficacy

CINV risk increases over multiple

chemotherapy cycles

1

Available at:

http://www.cancer.gov/cancertopics/pdq/supportivecare/nausea/HealthProfessional/page6#Section_183

“Despite the use of both first-generation

and

second-generation

5-HT

3

receptor

antagonists, the control of acute CINV, and

especially delayed nausea and vomiting, is

suboptimal,

and

there

is

considerable

opportunity for improvement

with either

the addition or substitution of new agents in

current regimens.”

NCI Statement On The Existing

Unmet

Need

in

CINV

1

24

©

2013. A.P. Pharma, Inc. All rights reserved.

Nov 2013 |

Addressing Debilitating Effects of CINV

©

2013. A.P. Pharma, Inc. All rights reserved.

25

More than 7 million cycles of

chemotherapy administered each

year*

~27% are highly emetogenic

~46% are moderately emetogenic

Most chemotherapy patients will

undergo 4-15 cycles of

chemotherapy

5-HT3 antagonists are standard-

of-

care for CINV

Recommended in ASCO, NCCN

and MASCC guidelines

NK-1 antagonists are only indicated

in combination with 5-HT3

antagonists

An Injectable 5-HT3 antagonist is

co-administered with more than

>80% of MEC and HEC regimens

If initial regimen is non-effective,

drugs are added or changed to

address CINV in subsequent cycles

*TDR August 2006

Nov 2013 |

U.S.

CINV Market Dynamics 26

©

2013. A.P. Pharma, Inc. All rights reserved.

Source: WK 07/2013

Nov 2013

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

Q2'06

Q4'06

Q2'07

Q4'07

Q2'08

Q4'08

Q2'09

Q4'09

Q2'10

Q4'10

Q2'11

Q4'11

Q2'12

Q4'12

Injectable Drugs for the Prevention of CINV

Number of Package Units Sold by Quarter

ALOXI

ANZEMET

KYTRIL

KYTRIL Generic (GRANISETRON)

ZOFRAN

ZOFRAN Generic (ONDANSETRON)

EMEND

* US Oncology

data added starting 1/2009. |

Physicians View SUSTOL As Highly Competitive

vs. Palonosetron

©

2013. A.P. Pharma, Inc. All rights reserved.

27

Physicians responded favorably to HTH

study

design

vs.

palonosetron

–

good

sample size, clinically meaningful

endpoints, & strong comparator

PK profile and efficacy results were

viewed

as

clinically

meaningful

–

SUSTOL viewed as a long-acting agent

with sustained efficacy over multiple

days

SUSTOL is perceived as a clinically

equivalent alternative to palonosetron for

most physicians

SUSTOL safety profile is similar to

palonosetron and very manageable

“Well designed, well done clinical trial, the kind of trial you

want to see. I think that’s very favorable.”

–

Oncologist, Mid-sized Community Practice

“I think it’s an incrementally better product than palonosetron.

The whole idea is probably the longer [PK profile].”

–

Oncologist, Large Community Practice

“I think [APF530] is great…we need something which has a

much longer [duration of action]…I would certainly use it.”

–

Oncologist, Urban, Community Practice

“It has [few] side effects…very comparable to medications

we are currently using.”

–

Oncologist, Suburban, Large Practice

Source: August 2013 qualitative market research with n=30 oncologists

Nov 2013 |

Despite lack of commercial presence, a significant

portion of physicians view SUSTOL as differentiated

©

2013. A.P. Pharma, Inc. All rights reserved.

28

Question: “Based on the design and results of these studies, how do you

perceive SUSTOL vs. palonosetron?”

““The [first] study is compared with

palonosetron and it seems like they

are equivalent. I’m OK with that.”

–Oncologist, Large Community

Practice

“Well, this product in comparison to

palonosetron seems to be better. So,

I would have no problems using a

better agent …The bottom line is that

your data show that this therapy was

better than palonosetron.”

–

Oncologist, Community Practice

Source: August 2013 qualitative market research with n=30 oncologists

“Also…

even

if

there

were

no

delayed

data

in

HEC,

I

would

still

use

it

because

then it would be very comparable to the current medication that I'm

using." –Oncologist, Mid-sized Community Practice

Nov 2013

Clinically

Equivalent

67%

Clinically

Differentiated

33% |

HEC

regimens represent a significant market opportunity for SUSTOL

©

2013. A.P. Pharma, Inc. All rights reserved.

29

1

IntrinsiQ data from July 2012 –

June 2013

HEC regimens account for ~20% (500K)

of palonosetron administrations

Of all HEC administrations, ~20% are given

without concomitant IV 5-HT3 –

inconsistent with clinical guidelines

Nov 2013

497,256

1,463,558

451,490

111,696

HEC

MEC

LEC

Minimal

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

497,256

317,915

188,988

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

Annual HEC

administrations

Untreated with

IV 5HT3

Treated with

generic IV

5HT3

Treated with

Aloxi |

SUSTOL

has the potential to be the next generation 5-HT3 receptor antagonist

(RA) 30

©

2013. A.P. Pharma, Inc. All rights reserved.

5-HT3

RAs

1

st

generation

2

nd

generation

3

rd

generation

Products

ondansetron

granisetron

palonosetron

SUSTOL

Duration of

action

Short acting

~ 8 hr half-life

Longer acting

~40 hr half-life

Long acting

PK profile 5-7 days

Indications

Prevention of CINV in

emetogenic chemo including

high-dose cisplatin

MEC –

acute & delayed CINV

HEC –

acute CINV

MEC

–

acute

&

delayed

CINV

HEC

–

acute

&

delayed

CINV*

*Obtaining delayed HEC will be based on completion of new clinical trial

Nov 2013 |

WKH Data Oct. 2012 –

Clinic Analysis

Palonosetron Clinical Use Is Highly

Concentrated

Cumulative Number of Accounts

32

1% accts

87

4% accts

161

7% accts

252

11% accts

500

22% accts

674

29% accts

904

39% accts

1246

54% accts

2305

100% accts

362

15% accts

80% of all units (2.2M) comes from community clinics

80% of clinic units (1.7M) comes from 39% of accounts (904)

50% of clinic units (1.1M) comes from 15% of accounts (362)

31

©

2013. A.P. Pharma, Inc. All rights reserved.

Nov 2013

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200 |

Summary

©

2013. A.P. Pharma, Inc. All rights reserved.

32

CINV market is a large, concentrated commercial opportunity

Over

2.7MM

annual

units

of

palonosetron

1

>80%

of

use

is

in

the

community

practice

setting

–

highly

concentrated

among

large

practices

1

Physicians view a non-inferior SUSTOL profile as highly competitive

5-7 day PK profile

Non-inferior to market leader palonosetron based on large,

head-to-head trial Good response in difficult chemotherapy regimens

including AC and cisplatin Sustained efficacy over multiple cycles of

chemotherapy Efficacy in palonosetron failures

Favorable safety profile with clean QT results

Differentiated profile would position SUSTOL as the next generation IV

5-HT3 Delayed

CINV,

especially

in

HEC

regimens,

is

the

biggest

area

of

unmet

need

No 5-HT3 drugs approved specifically for delayed CINV in HEC

Palonosetron failed to show superiority to ondansetron in delayed HEC

High likelihood of clinical success versus ondansetron

Supports differentiated value proposition vs. palonosetron

HEC regimens represent a significant market opportunity

20%

of

palonosetron

administrations

are

given

with

HEC

regimens

2

20%

of

patients

receiving

HEC

regimens

do

not

receive

concomitant

treatment

with

an

IV

5-HT3

2

1. Wolters Kluwer 2012, 2. Intrinsiq 2013

Nov 2013 |

New

Product Initiative 33

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

SUSTOL

Product Lifecycle Considerations 34

SUSTOL covered by multiple patents

2 patents covering combination of polymer, excipients and drug expire in

2021 3 patents covering APF530 expire in 2024

Polymer-based injectable products are difficult to copy independent of

IP

ANDA FDA requirements for injectable products

Must

have

same

inactive

ingredients

in

the

same

concentration

as

the

reference listed drug

Polymers are complex mixtures of varying-length molecules, making

characterization for “sameness”

very challenging

Obtaining the delayed HEC indication will further differentiate SUSTOL

from all other 5-HT3 products

Creating additional product opportunities with SUSTOL will further

leverage our investment in the HEC program

One opportunity under evaluation is a three-drug combination

containing SUSTOL, an NK1 antagonist and dexamethasone

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Biochronomer Triple-Drug Combination for CINV

in Dogs

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

35

Profile of each component of triple-drug combo is similar to individual

agents Single shot with all three of the drugs recommended for HEC

Registration could be based primarily on bioequivalence

0

10

20

30

40

50

60

70

80

90

0

100

200

300

400

500

600

700

800

900

0

24

48

72

96

120

144

168

Hours

NK1 Antagonist

Granisetron

Dexamethasone |

Biochronomer™

Bupivacaine/Ropivacaine:

Post-Surgical Pain Control

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

36

Opportunity to use our polymer for post-surgical pain control utilizing

the 505(b)(2) process

Once we have an FDA approved polymer, manufacturing site and syringe filler, the

next products using the polymer will be much easier and cheaper to develop

We believe the leading product in this market, EXPAREL, can be

substantially improved by:

Prolonging the period of anesthetic release, so peak concentration are seen at

48- 72 hours rather than 12-24 hours as seen with EXPAREL

Potentially using a better anesthetic agent, ropivacaine

|

Greatest Benefit for

EXPAREL Is First 12 Hours Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

37

Adapted from EXPAREL Product Monograph

*US Package Insert

Package insert states that there was minimal

to no difference between Exparel and placebo

treatments 24-72 hours post-dose* |

Mean

Plasma Bupivacaine Concentrations After EXPAREL From FDA Clinical Pharmacology

Review Data from FDA Clinical Pharmacology Review; NDA 22-496 EXPAREL; *

US Package Insert Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

38

Low concentrations of bupivacaine after 24 hr

may explain why there was minimal to no

difference between Exparel and placebo

treatments 24-72 hours post-dose* |

Biochronomer™

Bupivacaine Has Superior PK Profile

in Dogs

*Projected from 7.5 mg/kg dose; EXPAREL data from Richard, et. al. 2012

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

39 |

Biochronomer™

Ropivacaine Has Superior PK Profile

in Dogs

*Dose adjusted to match bupivacaine; EXPAREL data from Richard, et. al. 2012

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

40 |

Post-Operative Pain Management

Commercial Considerations

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

41 |

Post-operative pain

market represents an attractive opportunity for product development

©

2013. A.P. Pharma, Inc. All rights reserved.

42

•

Patients are typically treated with a combination of NSAIDs, opioids, local

anesthetics and/or simple analgesics

•

Strong opioids currently hold approximately half of the market sales

Treatment

Paradigm

•

As of 2012, approximately 24.8 million procedures associated with post-operative

pain were conducted in the US. Expected to grow to 32.3 million by 2022

•

US

post-operative

pain

market

sales*

are

expected

to

grow

1.6%

annually

from

~$3.1 billion in 2012 to ~$3.6 billion by 2022

•

Market growth is primarily driven by the increasing number of procedures and by

new reformulations

Market Size

•

Longer-acting local anesthetics (>3 days) with improved safety profiles

•

Potent opioid-sparing analgesics with improved tolerability and less severe side

effects compared to opioids

Unmet Needs

•

Pain is a major driver of inpatient admissions and increased length of stay

•

Reimbursement will increasingly be tied to measures of quality and ratings of

patient experience –

both of which are significantly impacted by pain

•

Costs of opioid addiction & opioid-related adverse events are significant concerns

High Cost of

Post-Operative

Pain

Source:

Decision

Resources,

Acute

Pain

Pharmacor,

December

2012;

Decision

Resources,

Post-operative

Pain

Pharmacor,

May

2006

Nov 2013 |

Innovation in a large, growing disease area with high

unmet need will drive significant dollar market growth

43

Source: Decision Resources, Post-Operative Pain Pharmacor, May 2006; Decision

Resources, Acute Pain, December 2012 2012 Post-Op Pain Market (US

only) 2012 Total: $3.1B

By 2020, 10% penetration into the 30M procedures requiring post-op pain

management equates to $850M+ opportunity at a price of $285/unit

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

25.3

25.9

26.5

27.1

27.8

28.5

29.2

29.9

30.6

32.5

0

5

10

15

20

25

30

35

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Procedures Requiring Post-Operative Pain

Management |

As a

potential development candidate, ropivacaine has advantages over

bupivacaine 44

Bupivacaine

Ropivacaine

Notes

1

KOL Feedback

Efficacy

•

Both molecules have similar

efficacy, onset of action, and

analgesic potency

“Both of these products work well for

blocking pain…

the issue is that they

are short acting.”

–

Orthopedic

Surgeon

Safety

•

Lower CV and CNS toxicity

•

Overall better side-effect profile

“Safety is where ropivacaine has a

clear advantage. It is widely known in

our institution that bupivacaine has

more cardiovascular toxicity.”

–

Anesthesiologist

MOA

•

Ropivacaine has been shown to

have shorter depth and duration

of motor block compared to

bupivacaine

“The goal is to achieve sensory

blockade without significant motor

blockade. In this way, ropivacaine

seems to perform better.”

–

Orthopedic Surgeon

Clinical

Flexibility

•

Considered more clinically

versatile by physicians

•

Approved for use in children

“For all these reasons, a long-acting

bupivacaine is a ‘hit’…

but a long-

acting ropivacaine would be a ‘home

run’.”

–

Orthopedic Surgeon

1

Sources:

1

Scott,

et

al.

Anesth

Analg

1989;

24:

514-518;

2

Knudsen

K,

et

al.

Br

J

Anesth

1997

78;

507-514;

3

Bertini,

et

al.

Reg

Anesth

Pain

Med

1999;

4

Chelly

JE,

et

al.

J

Orthop

Trauma

2003;

5

Turner

G,

et al.

Br

J

Anesth

1996;

76:606-610;

5

Writer

WDR,

et

al.

Br

J

Anaesth

1998;

81:

713-717.

6

McGlade,

et

al.

Anaesth

Intensive

Care

1998;26:515-520;

7

Arikan

OK,

et

al.

J

Otaryngol

Head

Neck

Surg

2008;

37(6):

836-43;

8

Ivani

G,

et

al.

Can

J

Anaesth

1999;

46(5):

467-469;

9

Pitimana-aree

S,

et

al.

Reg

Anesth

Pain

Med

2005;

30(5):

446-51;

http://www.naropin-us.com/about_benefits.php

2

Source:

KOL

interviews

October

2013

©

2013. A.P. Pharma, Inc. All rights reserved.

Nov 2013

2 |

Summary –

Pipeline offers significant opportunity for

commercial value creation

Large, concentrated commercial opportunity

Physicians view a non-inferior SUSTOL

profile as highly competitive with

palonosetron

5-7 day PK profile

Non-inferior to market leader palonosetron based on

large, head-to-head trial

Sustained efficacy over multiple cycles of chemotherapy &

efficacy in palonosetron failures

Favorable safety profile with clean QT results

With successful outcome in planned HEC

trial, a differentiated profile with delayed-

HEC indication would position SUSTOL as

the next generation IV 5-HT3

HEC regimens represent a significant

market opportunity

45

Large, growing market

High unmet need

3-5 day local anesthetic depot would offer

clinical differentiation

Clear value proposition given the costs of

post-operative pain

Rapid development and approval

pathway

Potential opportunity for pain franchise

through line extensions

©

2013. A.P. Pharma, Inc. All rights reserved.

1. Wolters Kluwer 2012, 2. Intrinsiq 2013

Chemotherapy-induced nausea

and vomiting

Post-Operative Pain

Nov 2013 |

Financial Summary

Nov 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

46

Summary Statement of Operations

(In thousands, except per share data)

Nine Months Ended

September 30, 2013

Revenue

$

– Operating expenses

40,626

Other income (expenses)

(614)

Net loss

$ (41,240)

Net loss per share

$ (0.13)

Condensed Balance Sheet Data

(In thousands)

September 30, 2013

Cash and cash equivalents

$ 22,597

Total assets

$ 26,370

Total stockholders’

equity

$ 20,872

1

Based on 306.1 million weighted average common shares outstanding for the period ended

September 30, 2013.

1 |