Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BENCHMARK ELECTRONICS INC | Form_8K.htm |

| EX-99.1 - EXHIBIT 99.1 - BENCHMARK ELECTRONICS INC | Ex_99.1.htm |

Third Quarter Fiscal 2013 October 24, 2013 Financial Results

design develop deliver advanced technology 2 Forward - Looking Statements This document contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . In addition, from time to time, Benchmark Electronics, Inc . (“the Company”) or its representatives have made or may make forward - looking statements, orally or in writing . Such forward - looking statements may be included in, but are not limited to, various filings made by the Company with the Securities and Exchange Commission, press releases or oral statements made with the approval of an authorized executive officer of the Company . Actual results could differ materially from those projected or suggested in any forward - looking statements as a result of many factors, some of which have been described in the section of the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2012 , entitled “Risk Factors,” and in other documents the Company’s files from time to time, with the Securities and Exchange Commission, including annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K . This document includes financial measures for earnings and earnings per share that exclude certain items and therefore are not in accordance with generally accepted accounting principles (GAAP) . A detailed reconciliation between GAAP results and results excluding special items (non - GAAP) is included in our press release and in the Appendix of this presentation .

design develop deliver advanced technology 3 Third Quarter 2013 Results (In millions, except EPS) Sept. 30, 2013 June 30, 2013 Sept. 30, 2012 Net Sales $599.7 $607.5 $610.8 Net Income $23.7 $8.5 $19.3 Net Income – non - GAAP $16.9 $16.8 $17.5 Diluted EPS $0.43 $0.16 $0.34 Diluted EPS – non - GAAP $0.31 $0.31 $0.31 Operating Margin 4.9% 2.1% 4.1% Operating Margin – non - GAAP 3.5% 3.5% 3.7% For the Three Months Ended Results within Guidance Provided for the September 30, 2013 Quarter: ▪ Revenue $590 – $620 ▪ Diluted EPS -- non - GAAP $0.28 – $0.32

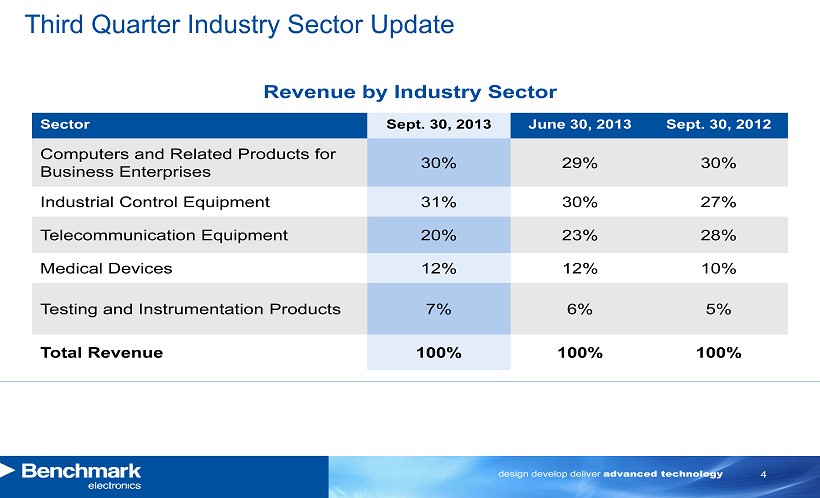

design develop deliver advanced technology 4 Third Quarter Industry Sector Update Sector Sept. 30, 2013 June 30, 2013 Sept. 30, 2012 Computers and Related Products for Business Enterprises 30% 29% 30% Industrial Control Equipment 31% 30% 27% Telecommunication Equipment 20% 23% 28% Medical Devices 12% 12% 10% Testing and Instrumentation Products 7% 6% 5% Total Revenue 100% 100% 100% Revenue by Industry Sector

design develop deliver advanced technology 5 ▪ Non - Recurring Items ▪ CTS Acquisition ▪ Thailand Flood Update Discussion Items Third Quarter Financial Statement Commentary

design develop deliver advanced technology 6 Financial Statement Highlights Income Statement Sept. 30, 2013 June 30, 2013 Sept. 30, 2012 Net Sales $599.7 $607.5 $610.8 Operating Margin – non - GAAP 3.5% 3.5% 3.7% Net Income – GAAP $23.7 $8.5 $19.3 Net Income – non - GAAP $16.9 $16.8 $17.5 Diluted EPS – non - GAAP $0.31 $0.31 $0.31 Effective Tax Rate – non - GAAP 21.3% 17.3% 21.6% For the Three Months Ended

design develop deliver advanced technology 7 Financial Statement Highlights Balance Sheet and Cash Flows Sept. 30, 2013 Dec. 31, 2012 Sept. 30, 2012 Cash and Long - term Investments $437.2* $394.9 $339.8 Cash Flow from Operating Activities $38.7 $80.9 $52.7 Capital Expenditures $6.8 $13.5 $14.6 Depreciation & Amortization $10.1 $9.3 $9.0 Accounts Receivable $423.6 $459.1 $455.3 Days Sales Outstanding 64x 65x 67x Inventory $395.0 $324.0 $375.5 Inventory Turns 5.6x 7.3x 6.0x Total Cost of Shares Repurchased $9.4 $15.7 $8.1 * Approximately $107 million of cash is in the U.S.

design develop deliver advanced technology 8 Third Quarter 2013 New Business Wins Q3 2013 Number of New Business Wins by Segment ▪ Q3 2013: 29 new business bookings including 7 engineering projects ▪ E stimated annual revenue run rate between $145 million and $170 million Quarterly Estimated Annual Revenue Run Rate for New Business Wins

design develop deliver advanced technology 9 Fourth Quarter 2013 Guidance Guidance Net Sales (in millions) $685 – $715 Diluted EPS – non - GAAP $0.34 – $0.38

design develop deliver advanced technology 10 Overall Market Updates ▪ Computing Growth ▪ Industrial Stable Demand ▪ Telecommunications Growth ▪ Medical Improving Demand ▪ Test & Instrumentation Modest Improvements Reporting Sector Outlook

design develop deliver advanced technology 11 ▪ Solid Q3 Results ▪ Focus on Growth ▪ New Program Execution o Acquisition Integration o Productivity Management o New Bookings and Program Ramps Summary Third Quarter 2013

design develop deliver advanced technology 12 Appendix

design develop deliver advanced technology 13 Reconciliation of GAAP to non - GAAP Financial Results (Amounts in Thousands, Except Per Share Data) – (UNAUDITED) 2013 2012 2013 2012 Income from operations (GAAP) $ 29,473 $ 24,882 $ 56,249 $ 50,975 1,214 523 7,323 773 - - 2,606 - (9,748) (3,078) (9,748) 11,798 $ 20,939 $ 22,327 $ 56,430 $ 63,546 $ 23,726 $ 19,314 $ 43,670 $ 38,492 1,002 422 6,947 583 - - 2,849 - (7,817) (2,195) (7,817) 11,180 $ 16,911 $ 17,541 $ 45,649 $ 50,255 Earnings per share: (GAAP) Basic $ 0.44 $ 0.35 $ 0.80 $ 0.68 Diluted $ 0.43 $ 0.34 $ 0.80 $ 0.67 Earnings per share: (Non-GAAP) Basic $ 0.31 $ 0.31 $ 0.84 $ 0.89 Diluted $ 0.31 $ 0.31 $ 0.83 $ 0.88 Thailand flood related items Thailand flood related items, net of tax Non-GAAP net income Net income (GAAP) Restructuring charges and integration and acquisition-related costs Non-GAAP income from operations Restructuring charges and integration and acquisition-related costs, net of tax Asset impairment charge and other Asset impairment charge and other, net of tax Nine Months EndedThree Months Ended September 30, September 30,