Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PACKAGING CORP OF AMERICA | d611750d8k.htm |

| EX-99.1 - EX-99.1 - PACKAGING CORP OF AMERICA | d611750dex991.htm |

| EX-99.3 - EX-99.3 - PACKAGING CORP OF AMERICA | d611750dex993.htm |

| EX-23.1 - EX-23.1 - PACKAGING CORP OF AMERICA | d611750dex231.htm |

Exhibit 99.2

Report of Independent Registered Public Accounting Firm

The Board of Directors and Stockholders

Boise Inc.:

We have audited the accompanying consolidated balance sheets of Boise Inc. and subsidiaries (the Company) as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, stockholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2012. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Boise Inc. and subsidiaries as of December 31, 2012 and 2011, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2012, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Boise, Idaho

February 26, 2013

1

Report of Independent Registered Public Accounting Firm

The Board of Directors

Boise Inc.:

We have audited the accompanying consolidated balance sheets of BZ Intermediate Holdings LLC and subsidiaries (the Company) as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, capital, and cash flows for each of the years in the three-year period ended December 31, 2012. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of BZ Intermediate Holdings LLC and subsidiaries as of December 31, 2012 and 2011, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2012, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Boise, Idaho

February 26, 2013

2

Boise Inc.

Consolidated Statements of Income

(dollars and shares in thousands, except per-share data)

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Sales |

||||||||||||

| Trade |

$ | 2,495,092 | $ | 2,364,024 | $ | 2,058,132 | ||||||

| Related parties |

60,271 | 40,057 | 35,645 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2,555,363 | 2,404,081 | 2,093,777 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Costs and expenses |

||||||||||||

| Materials, labor, and other operating expenses (excluding depreciation) |

2,004,044 | 1,880,271 | 1,634,039 | |||||||||

| Fiber costs from related parties |

19,772 | 18,763 | 25,259 | |||||||||

| Depreciation, amortization, and depletion |

152,306 | 143,758 | 129,926 | |||||||||

| Selling and distribution expenses |

121,827 | 107,654 | 58,107 | |||||||||

| General and administrative expenses |

79,748 | 60,587 | 52,273 | |||||||||

| St. Helens charges |

27,559 | — | — | |||||||||

| Other (income) expense, net |

2,572 | 1,994 | 213 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2,407,828 | 2,213,027 | 1,899,817 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

147,535 | 191,054 | 193,960 | |||||||||

|

|

|

|

|

|

|

|||||||

| Foreign exchange gain |

179 | 135 | 890 | |||||||||

| Loss on extinguishment of debt |

— | (2,300 | ) | (22,225 | ) | |||||||

| Interest expense |

(61,740 | ) | (63,817 | ) | (64,825 | ) | ||||||

| Interest income |

160 | 269 | 306 | |||||||||

|

|

|

|

|

|

|

|||||||

| (61,401 | ) | (65,713 | ) | (85,854 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

86,134 | 125,341 | 108,106 | |||||||||

| Income tax provision |

(33,984 | ) | (50,131 | ) | (45,372 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 62,734 | ||||||

|

|

|

|

|

|

|

|||||||

| Weighted average common shares outstanding: |

||||||||||||

| Basic |

99,872 | 101,941 | 80,461 | |||||||||

| Diluted |

101,143 | 106,746 | 84,131 | |||||||||

| Net income per common share: |

||||||||||||

| Basic |

$ | 0.52 | $ | 0.74 | $ | 0.78 | ||||||

| Diluted |

$ | 0.52 | $ | 0.70 | $ | 0.75 | ||||||

See accompanying notes to consolidated financial statements.

1

Boise Inc.

Consolidated Statements of Comprehensive Income

(dollars in thousands)

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 62,734 | ||||||

| Other comprehensive income (loss), net of tax |

||||||||||||

| Foreign currency translation adjustment, net of tax of $76, $0, and $0, respectively |

50 | (352 | ) | — | ||||||||

| Cash flow hedges: |

||||||||||||

| Change in fair value, net of tax of $534, ($2,611), and $0, respectively |

850 | (4,165 | ) | — | ||||||||

| Loss included in net income, net of tax of $1,015, $291, and $131, respectively |

1,622 | 463 | 553 | |||||||||

| Actuarial gain (loss) and prior service cost (including related amortization) for defined benefit pension plans, net of tax of $11,303, ($24,540), and ($4,892), respectively |

18,033 | (39,149 | ) | (7,744 | ) | |||||||

| Other, net of tax of ($13), ($10), and ($53), respectively |

103 | 63 | (78 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| 20,658 | (43,140 | ) | (7,269 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Comprehensive income |

$ | 72,808 | $ | 32,070 | $ | 55,465 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

2

Boise Inc.

Consolidated Balance Sheets

(dollars in thousands)

| December 31 | ||||||||

| 2012 | 2011 | |||||||

| ASSETS |

||||||||

| Current |

||||||||

| Cash and cash equivalents |

$ | 49,707 | $ | 96,996 | ||||

| Receivables |

||||||||

| Trade, less allowances of $1,382 and $1,343 |

240,459 | 228,838 | ||||||

| Other |

8,267 | 7,622 | ||||||

| Inventories |

294,484 | 307,305 | ||||||

| Deferred income taxes |

17,955 | 20,379 | ||||||

| Prepaid and other |

8,828 | 6,944 | ||||||

|

|

|

|

|

|||||

| 619,700 | 668,084 | |||||||

|

|

|

|

|

|||||

| Property |

||||||||

| Property and equipment, net |

1,223,001 | 1,235,269 | ||||||

| Fiber farms |

24,311 | 21,193 | ||||||

|

|

|

|

|

|||||

| 1,247,312 | 1,256,462 | |||||||

|

|

|

|

|

|||||

| Deferred financing costs |

26,677 | 30,956 | ||||||

| Goodwill |

160,130 | 161,691 | ||||||

| Intangible assets, net |

147,564 | 159,120 | ||||||

| Other assets |

7,029 | 9,757 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,208,412 | $ | 2,286,070 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

3

Boise Inc.

Consolidated Balance Sheets (continued)

(dollars and shares in thousands, except per-share data)

| December 31 | ||||||||

| 2012 | 2011 | |||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current |

||||||||

| Current portion of long-term debt |

$ | 10,000 | $ | 10,000 | ||||

| Accounts payable |

185,078 | 202,584 | ||||||

| Accrued liabilities |

||||||||

| Compensation and benefits |

70,950 | 64,907 | ||||||

| Interest payable |

10,516 | 10,528 | ||||||

| Other |

20,528 | 22,540 | ||||||

|

|

|

|

|

|||||

| 297,072 | 310,559 | |||||||

|

|

|

|

|

|||||

| Debt |

||||||||

| Long-term debt, less current portion |

770,000 | 790,000 | ||||||

|

|

|

|

|

|||||

| Other |

||||||||

| Deferred income taxes |

198,370 | 161,260 | ||||||

| Compensation and benefits |

121,682 | 172,394 | ||||||

| Other long-term liabilities |

73,102 | 57,010 | ||||||

|

|

|

|

|

|||||

| 393,154 | 390,664 | |||||||

|

|

|

|

|

|||||

| Commitments and contingent liabilities |

||||||||

| Stockholders’ equity |

||||||||

| Preferred stock, $0.0001 par value per share: 1,000 shares authorized; none issued |

— | — | ||||||

| Common stock, $0.0001 par value per share: 250,000 shares authorized; 100,503 and 100,272 shares issued and outstanding |

12 | 12 | ||||||

| Treasury stock, 21,151 shares held |

(121,423 | ) | (121,421 | ) | ||||

| Additional paid-in capital |

868,840 | 866,901 | ||||||

| Accumulated other comprehensive income (loss) |

(101,304 | ) | (121,962 | ) | ||||

| Retained earnings |

102,061 | 171,317 | ||||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

748,186 | 794,847 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 2,208,412 | $ | 2,286,070 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

4

Boise Inc.

Consolidated Statements of Cash Flows

(dollars in thousands)

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Cash provided by (used for) operations |

||||||||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 62,734 | ||||||

| Items in net income not using (providing) cash |

||||||||||||

| Depreciation, depletion, and amortization of deferred financing costs and other |

157,040 | 149,715 | 137,495 | |||||||||

| Share-based compensation expense |

5,983 | 3,695 | 3,733 | |||||||||

| Pension expense |

11,279 | 10,916 | 9,241 | |||||||||

| Deferred income taxes |

33,684 | 44,301 | 38,884 | |||||||||

| St. Helens charges |

28,481 | — | — | |||||||||

| Other |

1,868 | 1,878 | 95 | |||||||||

| Loss on extinguishment of debt |

— | 2,300 | 22,225 | |||||||||

| Decrease (increase) in working capital, net of acquisitions |

||||||||||||

| Receivables |

(9,803 | ) | 1,624 | 57,255 | ||||||||

| Inventories |

8,136 | (22,237 | ) | (17,120 | ) | |||||||

| Prepaid expenses |

(814 | ) | (275 | ) | 4,690 | |||||||

| Accounts payable and accrued liabilities |

(16,505 | ) | 3,803 | (6,690 | ) | |||||||

| Current and deferred income taxes |

(1,938 | ) | 4,632 | 5,585 | ||||||||

| Pension payments |

(35,205 | ) | (25,414 | ) | (25,174 | ) | ||||||

| Other |

674 | 43 | (3,172 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by operations |

235,030 | 250,191 | 289,781 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by (used for) investment |

||||||||||||

| Acquisition of businesses and facilities, net of cash acquired |

— | (326,223 | ) | — | ||||||||

| Expenditures for property and equipment |

(137,642 | ) | (128,762 | ) | (111,619 | ) | ||||||

| Purchases of short-term investments |

— | (3,494 | ) | (25,336 | ) | |||||||

| Maturities of short-term investments |

— | 14,114 | 24,744 | |||||||||

| Other |

1,393 | 1,048 | 2,941 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash used for investment |

(136,249 | ) | (443,317 | ) | (109,270 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by (used for) financing |

||||||||||||

| Issuances of long-term debt |

5,000 | 275,000 | 300,000 | |||||||||

| Payments of long-term debt |

(25,000 | ) | (256,831 | ) | (334,096 | ) | ||||||

| Payments of financing costs |

(188 | ) | (8,613 | ) | (12,003 | ) | ||||||

| Repurchases of common stock |

(2 | ) | (121,421 | ) | — | |||||||

| Proceeds from exercise of warrants |

— | 284,785 | 638 | |||||||||

| Payments of special dividends |

(119,653 | ) | (47,916 | ) | (32,276 | ) | ||||||

| Tax withholdings on net settlements of share-based awards |

(5,833 | ) | (2,775 | ) | (1,629 | ) | ||||||

| Other |

(394 | ) | 1,060 | (3,705 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by (used for) financing |

(146,070 | ) | 123,289 | (83,071 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Increase (decrease) in cash and cash equivalents |

(47,289 | ) | (69,837 | ) | 97,440 | |||||||

| Balance at beginning of the period |

96,996 | 166,833 | 69,393 | |||||||||

|

|

|

|

|

|

|

|||||||

| Balance at end of the period |

$ | 49,707 | $ | 96,996 | $ | 166,833 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

5

Boise Inc.

Consolidated Statements of Stockholders’ Equity

(dollars and shares in thousands)

| Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||

| Preferred Stock |

Common Stock | Treasury Stock | Additional Paid-In |

Accumulated Other Comprehensive |

Retained | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Income (Loss) | Earnings | Total | |||||||||||||||||||||||||||||

| Balance at December 31, 2009 |

$ | — | 84,419 | $ | 8 | — | $ | — | $ | 578,669 | $ | (71,553 | ) | $ | 113,811 | $ | 620,935 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income |

62,734 | 62,734 | ||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax |

(7,269 | ) | (7,269 | ) | ||||||||||||||||||||||||||||||||

| Dividends declared |

(32,338 | ) | (32,338 | ) | ||||||||||||||||||||||||||||||||

| Warrants exercised |

85 | — | 638 | 638 | ||||||||||||||||||||||||||||||||

| Share-based compensation awards |

562 | — | 3,733 | 3,733 | ||||||||||||||||||||||||||||||||

| Restricted stock withheld for taxes |

(221 | ) | — | (1,629 | ) | (1,629 | ) | |||||||||||||||||||||||||||||

| Other |

31 | 31 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance at December 31, 2010 |

$ | — | 84,845 | $ | 8 | — | $ | — | $ | 581,442 | $ | (78,822 | ) | $ | 144,207 | $ | 646,835 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income |

75,210 | 75,210 | ||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax |

(43,140 | ) | (43,140 | ) | ||||||||||||||||||||||||||||||||

| Dividends declared |

(48,100 | ) | (48,100 | ) | ||||||||||||||||||||||||||||||||

| Warrants exercised |

38,407 | 4 | 284,781 | 284,785 | ||||||||||||||||||||||||||||||||

| Repurchases of common stock |

(21,151 | ) | — | 21,151 | (121,421 | ) | (121,421 | ) | ||||||||||||||||||||||||||||

| Share-based compensation awards |

(1,579 | ) | — | 3,695 | 3,695 | |||||||||||||||||||||||||||||||

| Restricted stock withheld for taxes |

(250 | ) | — | (2,775 | ) | (2,775 | ) | |||||||||||||||||||||||||||||

| Other |

(242 | ) | (242 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance at December 31, 2011 |

$ | — | 100,272 | $ | 12 | 21,151 | $ | (121,421 | ) | $ | 866,901 | $ | (121,962 | ) | $ | 171,317 | $ | 794,847 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income |

52,150 | 52,150 | ||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax |

20,658 | 20,658 | ||||||||||||||||||||||||||||||||||

| Dividends declared |

(121,406 | ) | (121,406 | ) | ||||||||||||||||||||||||||||||||

| Repurchases of common stock |

— | — | — | (2 | ) | (2 | ) | |||||||||||||||||||||||||||||

| Share-based compensation awards |

695 | — | 5,983 | 5,983 | ||||||||||||||||||||||||||||||||

| Restricted stock withheld for taxes |

(464 | ) | — | (5,833 | ) | (5,833 | ) | |||||||||||||||||||||||||||||

| Dividends accrued on share-based awards |

1,125 | 1,125 | ||||||||||||||||||||||||||||||||||

| Other |

664 | 664 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance at December 31, 2012 |

$ | — | 100,503 | $ | 12 | 21,151 | $ | (121,423 | ) | $ | 868,840 | $ | (101,304 | ) | $ | 102,061 | $ | 748,186 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

See accompanying notes to consolidated financial statements.

6

BZ Intermediate Holdings LLC

Consolidated Statements of Income

(dollars in thousands)

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Sales |

||||||||||||

| Trade |

$ | 2,495,092 | $ | 2,364,024 | $ | 2,058,132 | ||||||

| Related parties |

60,271 | 40,057 | 35,645 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2,555,363 | 2,404,081 | 2,093,777 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Costs and expenses |

||||||||||||

| Materials, labor, and other operating expenses (excluding depreciation) |

2,004,044 | 1,880,271 | 1,634,039 | |||||||||

| Fiber costs from related parties |

19,772 | 18,763 | 25,259 | |||||||||

| Depreciation, amortization, and depletion |

152,306 | 143,758 | 129,926 | |||||||||

| Selling and distribution expenses |

121,827 | 107,654 | 58,107 | |||||||||

| General and administrative expenses |

79,748 | 60,587 | 52,273 | |||||||||

| St. Helens charges |

27,559 | — | — | |||||||||

| Other (income) expense, net |

2,572 | 1,994 | 213 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2,407,828 | 2,213,027 | 1,899,817 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

147,535 | 191,054 | 193,960 | |||||||||

|

|

|

|

|

|

|

|||||||

| Foreign exchange gain |

179 | 135 | 890 | |||||||||

| Loss on extinguishment of debt |

— | (2,300 | ) | (22,225 | ) | |||||||

| Interest expense |

(61,740 | ) | (63,817 | ) | (64,825 | ) | ||||||

| Interest income |

160 | 269 | 306 | |||||||||

|

|

|

|

|

|

|

|||||||

| (61,401 | ) | (65,713 | ) | (85,854 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

86,134 | 125,341 | 108,106 | |||||||||

| Income tax provision |

(33,984 | ) | (50,131 | ) | (44,529 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 63,577 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

7

BZ Intermediate Holdings LLC

Consolidated Statements of Comprehensive Income

(dollars in thousands)

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 63,577 | ||||||

| Other comprehensive income (loss), net of tax |

||||||||||||

| Foreign currency translation adjustment, net of tax of $76, $0, and $0, respectively |

50 | (352 | ) | — | ||||||||

| Cash flow hedges: |

||||||||||||

| Change in fair value, net of tax of $534, ($2,611), and $0, respectively |

850 | (4,165 | ) | — | ||||||||

| Loss included in net income, net of tax of $1,015, $291, and $131, respectively |

1,622 | 463 | 553 | |||||||||

| Actuarial gain (loss) and prior service cost (including related amortization) for defined benefit pension plans, net of tax of $11,303, ($24,540), and ($4,892), respectively |

18,033 | (39,149 | ) | (7,744 | ) | |||||||

| Other, net of tax of ($13), ($10), and ($53), respectively |

103 | 63 | (78 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| 20,658 | (43,140 | ) | (7,269 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Comprehensive income |

$ | 72,808 | $ | 32,070 | $ | 56,308 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

8

BZ Intermediate Holdings LLC

Consolidated Balance Sheets

(dollars in thousands)

| December 31 | ||||||||

| 2012 | 2011 | |||||||

| ASSETS |

||||||||

| Current |

||||||||

| Cash and cash equivalents |

$ | 49,707 | $ | 96,996 | ||||

| Receivables |

||||||||

| Trade, less allowances of $1,382 and $1,343 |

240,459 | 228,838 | ||||||

| Other |

8,267 | 7,622 | ||||||

| Inventories |

294,484 | 307,305 | ||||||

| Deferred income taxes |

17,955 | 20,379 | ||||||

| Prepaid and other |

8,828 | 6,944 | ||||||

|

|

|

|

|

|||||

| 619,700 | 668,084 | |||||||

|

|

|

|

|

|||||

| Property |

||||||||

| Property and equipment, net |

1,223,001 | 1,235,269 | ||||||

| Fiber farms |

24,311 | 21,193 | ||||||

|

|

|

|

|

|||||

| 1,247,312 | 1,256,462 | |||||||

|

|

|

|

|

|||||

| Deferred financing costs |

26,677 | 30,956 | ||||||

| Goodwill |

160,130 | 161,691 | ||||||

| Intangible assets, net |

147,564 | 159,120 | ||||||

| Other assets |

7,029 | 9,757 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,208,412 | $ | 2,286,070 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

9

BZ Intermediate Holdings LLC

Consolidated Balance Sheets (continued)

(dollars in thousands)

| December 31 | ||||||||

| 2012 | 2011 | |||||||

| LIABILITIES AND CAPITAL |

||||||||

| Current |

||||||||

| Current portion of long-term debt |

$ | 10,000 | $ | 10,000 | ||||

| Accounts payable |

185,078 | 202,584 | ||||||

| Accrued liabilities |

||||||||

| Compensation and benefits |

70,950 | 64,907 | ||||||

| Interest payable |

10,516 | 10,528 | ||||||

| Other |

20,528 | 22,540 | ||||||

|

|

|

|

|

|||||

| 297,072 | 310,559 | |||||||

|

|

|

|

|

|||||

| Debt |

||||||||

| Long-term debt, less current portion |

770,000 | 790,000 | ||||||

|

|

|

|

|

|||||

| Other |

||||||||

| Deferred income taxes |

189,823 | 152,712 | ||||||

| Compensation and benefits |

121,682 | 172,394 | ||||||

| Other long-term liabilities |

73,152 | 57,061 | ||||||

|

|

|

|

|

|||||

| 384,657 | 382,167 | |||||||

|

|

|

|

|

|||||

| Commitments and contingent liabilities |

||||||||

| Capital |

||||||||

| Business unit equity |

857,987 | 925,306 | ||||||

| Accumulated other comprehensive income (loss) |

(101,304 | ) | (121,962 | ) | ||||

|

|

|

|

|

|||||

| 756,683 | 803,344 | |||||||

|

|

|

|

|

|||||

| Total liabilities and capital |

$ | 2,208,412 | $ | 2,286,070 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

10

BZ Intermediate Holdings LLC

Consolidated Statements of Cash Flows

(dollars in thousands)

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Cash provided by (used for) operations |

||||||||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 63,577 | ||||||

| Items in net income not using (providing) cash |

||||||||||||

| Depreciation, depletion, and amortization of deferred financing costs and other |

157,040 | 149,715 | 137,495 | |||||||||

| Share-based compensation expense |

5,983 | 3,695 | 3,733 | |||||||||

| Pension expense |

11,279 | 10,916 | 9,241 | |||||||||

| Deferred income taxes |

33,684 | 44,446 | 37,882 | |||||||||

| St. Helens charges |

28,481 | — | — | |||||||||

| Other |

1,868 | 1,878 | 95 | |||||||||

| Loss on extinguishment of debt |

— | 2,300 | 22,225 | |||||||||

| Decrease (increase) in working capital, net of acquisitions |

||||||||||||

| Receivables |

(9,803 | ) | 1,624 | 57,255 | ||||||||

| Inventories |

8,136 | (22,237 | ) | (17,120 | ) | |||||||

| Prepaid expenses |

(814 | ) | (275 | ) | 4,690 | |||||||

| Accounts payable and accrued liabilities |

(16,505 | ) | 3,803 | (6,690 | ) | |||||||

| Current and deferred income taxes |

(1,938 | ) | 4,487 | 5,744 | ||||||||

| Pension payments |

(35,205 | ) | (25,414 | ) | (25,174 | ) | ||||||

| Other |

674 | 43 | (3,172 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by operations |

235,030 | 250,191 | 289,781 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by (used for) investment |

||||||||||||

| Acquisition of businesses and facilities, net of cash acquired |

— | (326,223 | ) | — | ||||||||

| Expenditures for property and equipment |

(137,642 | ) | (128,762 | ) | (111,619 | ) | ||||||

| Purchases of short-term investments |

— | (3,494 | ) | (25,336 | ) | |||||||

| Maturities of short-term investments |

— | 14,114 | 24,744 | |||||||||

| Other |

1,393 | 1,048 | 2,941 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash used for investment |

(136,249 | ) | (443,317 | ) | (109,270 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by (used for) financing |

||||||||||||

| Issuances of long-term debt |

5,000 | 275,000 | 300,000 | |||||||||

| Payments of long-term debt |

(25,000 | ) | (256,831 | ) | (334,096 | ) | ||||||

| Payments of financing costs |

(188 | ) | (8,613 | ) | (12,003 | ) | ||||||

| Payments (to) from Boise Inc., net |

(124,824 | ) | 115,196 | (31,639 | ) | |||||||

| Other |

(1,058 | ) | (1,463 | ) | (5,333 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash provided by (used for) financing |

(146,070 | ) | 123,289 | (83,071 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Increase (decrease) in cash and cash equivalents |

(47,289 | ) | (69,837 | ) | 97,440 | |||||||

| Balance at beginning of the period |

96,996 | 166,833 | 69,393 | |||||||||

|

|

|

|

|

|

|

|||||||

| Balance at end of the period |

$ | 49,707 | $ | 96,996 | $ | 166,833 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

11

BZ Intermediate Holdings LLC

Consolidated Statements of Capital

(dollars in thousands)

| Capital | ||||||||||||

| Business Unit Equity |

Accumulated Other Comprehensive Income (Loss) |

Total | ||||||||||

| Balance at December 31, 2009 |

$ | 700,143 | $ | (71,553 | ) | $ | 628,590 | |||||

|

|

|

|

|

|

|

|||||||

| Net income |

63,577 | 63,577 | ||||||||||

| Other comprehensive loss, net of tax |

(7,269 | ) | (7,269 | ) | ||||||||

| Net equity transactions with Boise Inc. |

(29,566 | ) | (29,566 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Balance at December 31, 2010 |

$ | 734,154 | $ | (78,822 | ) | $ | 655,332 | |||||

|

|

|

|

|

|

|

|||||||

| Net income |

75,210 | 75,210 | ||||||||||

| Other comprehensive loss, net of tax |

(43,140 | ) | (43,140 | ) | ||||||||

| Net equity transactions with Boise Inc. |

115,942 | 115,942 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Balance at December 31, 2011 |

$ | 925,306 | $ | (121,962 | ) | $ | 803,344 | |||||

|

|

|

|

|

|

|

|||||||

| Net income |

52,150 | 52,150 | ||||||||||

| Other comprehensive income, net of tax |

20,658 | 20,658 | ||||||||||

| Net equity transactions with Boise Inc. |

(119,469 | ) | (119,469 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Balance at December 31, 2012 |

$ | 857,987 | $ | (101,304 | ) | $ | 756,683 | |||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

12

Notes to Consolidated Financial Statements

1. Nature of Operations and Basis of Presentation

Boise Inc. is a large, diverse manufacturer and seller of packaging and paper products. Our operations began on February 22, 2008, when we acquired the packaging and paper assets of Boise Cascade Holdings, L.L.C. (Boise Cascade). We are headquartered in Boise, Idaho, and we operate largely in the United States but also have operations in Europe, Mexico, and Canada. We manufacture and sell corrugated containers and sheets, protective packaging products and papers associated with packaging, such as label and release papers, and newsprint. Additionally, we manufacture linerboard, which when combined with corrugating medium is used in the manufacture of corrugated sheets and containers. The term containerboard is used to describe linerboard, corrugating medium, or a combination of the two.

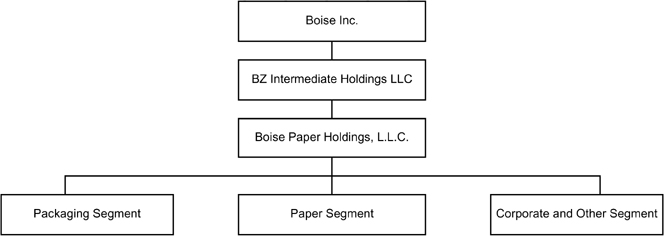

Our organizational structure is noted below:

See Note 17, Segment Information, for additional information about our three reportable segments, Packaging, Paper, and Corporate and Other (support services).

The consolidated financial statements included herein are those of the following:

| • | Boise Inc. and its wholly owned subsidiaries, including BZ Intermediate Holdings LLC (BZ Intermediate). |

| • | BZ Intermediate and its wholly owned subsidiaries, including Boise Paper Holdings, L.L.C. (Boise Paper Holdings). |

In these consolidated financial statements, unless the context indicates otherwise, the terms “the Company,” “we,” “us,” “our,” or “Boise” refer to Boise Inc. and its consolidated subsidiaries, including BZ Intermediate. There are no significant differences between the results of operations, financial condition, and cash flows of Boise Inc. and those of BZ Intermediate other than income taxes and common stock activity. Some amounts in prior periods’ consolidated financial statements have been reclassified to conform with the current period’s presentation, none of which were considered material.

2. Summary of Significant Accounting Policies

Consolidation and Use of Estimates

The consolidated financial statements include the accounts of Boise Inc. and its subsidiaries after elimination of intercompany balances and transactions. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions about future events. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities, and reported amounts of revenues and expenses. Such estimates include the valuation of accounts receivable, inventories, goodwill, intangible assets, and asset retirement obligations; assumptions used in retirement benefit obligations; the recognition, measurement, and valuation of income taxes; the determination and allocation of the fair values of assets acquired and liabilities assumed in acquisitions; and assessment of the recoverability of long-lived assets. These estimates and

13

assumptions are based on management’s best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, which management believes to be reasonable under the circumstances. We adjust such estimates and assumptions when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ significantly from these estimates. Changes in these estimates resulting from continuing changes in the economic environment will be reflected in the consolidated financial statements in future periods.

Revenue Recognition

We recognize revenue when the following criteria are met: persuasive evidence of an agreement exists, delivery has occurred or services have been rendered, our price to the buyer is fixed or determinable, and collectibility is reasonably assured. Delivery is not considered to have occurred until the customer takes title and assumes the risks and rewards of ownership. The timing of revenue recognition is dependent on shipping terms. Revenue is recorded at the time of shipment for terms designated freight on board (FOB) shipping point. For sales transactions designated FOB destination, revenue is recorded when the product is delivered to the customer’s delivery site. Fees for shipping and handling charged to customers for sales transactions are included in “Sales”. Costs related to shipping and handling are included in “Materials, labor, and other operating expenses (excluding depreciation)”. We present taxes collected from customers and remitted to governmental authorities on a net basis in our Consolidated Statements of Income.

Share-Based Compensation

We recognize compensation expense for awards granted under the Boise Inc. Incentive and Performance Plan (the Plan) based on the fair value on the grant date. We recognize the cost of the equity awards over the period the awards vest. See Note 11, Share-Based Compensation, for more information.

Advertising Costs

We expense advertising costs as incurred. These expenses are generally recorded in “Selling and distribution expenses” in our Consolidated Statements of Income. For the years ended December 31, 2012 and 2011, advertising costs were $3.8 million in both periods, compared with $3.0 million in 2010.

Foreign Currency

Local currencies are the functional currencies for our operations outside the United States. Assets and liabilities are remeasured into U.S. dollars using the exchange rates as of the Consolidated Balance Sheet date. Revenue and expense items are remeasured into U.S. dollars using an average exchange rate prevailing during the period. Any resulting translation adjustments are recorded in the Consolidated Statements of Comprehensive Income. The foreign exchange gain (loss) reported in the Consolidated Statements of Income resulted from remeasuring transactions into the functional currencies.

Cash and Cash Equivalents

We consider all highly liquid interest-earning investments, including time deposits and certificates of deposit, with a maturity of three months or less at the date of purchase to be cash equivalents. The fair value of these investments approximates their carrying value. Cash totaled $44.9 million and $21.9 million at December 31, 2012 and 2011, respectively. Included in the December 31, 2012 and 2011, amounts were $8.0 million and $4.3 million, respectively, of cash at our operations outside the United States. Cash equivalents totaled $4.8 million and $75.1 million, respectively, at December 31, 2012 and 2011.

Trade Accounts Receivable and Allowance for Doubtful Accounts

Trade accounts receivable are stated at the amount we expect to collect. Trade accounts receivable do not bear interest. The allowance for doubtful accounts is our best estimate of the losses we expect will result from the inability of our customers to make required payments. We determine the allowance based on a combination of actual historical loss experience and an analysis of specific customer accounts. We periodically review our allowance for doubtful accounts and adjustments to the valuation allowance are charged to income. Trade accounts receivable balances that remain outstanding after we have used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable. We may, at times, insure or arrange for guarantees on our receivables.

14

Financial Instruments

Our financial instruments include cash and cash equivalents, short-term investments, accounts receivable, accounts payable, long-term debt, and energy hedges. The recorded values of cash and cash equivalents, short-term investments, accounts receivable, and accounts payable approximate fair values based on their short-term nature. Our long-term debt is recorded at the face value of those obligations. Our energy hedges are recorded at fair value.

We are exposed to market risks, including changes in interest rates, energy prices, and foreign currency exchange rates. We employ a variety of practices to manage these risks, including operating and financing activities and, where deemed appropriate, the use of derivative instruments. Derivative instruments are used only for risk management purposes and not for speculation or trading. Derivatives are such that a specific debt instrument, contract, or anticipated purchase determines the amount, maturity, and other specifics of the hedge. If a derivative contract is entered into, we either determine that it is an economic hedge or we designate the derivative as a cash flow or fair value hedge. We formally document all relationships between hedging instruments and the hedged items, as well as our risk management objectives and strategies for undertaking various hedged transactions. For those derivatives that are not designated as economic hedges, such as cash flow or fair value hedges, we formally assess, both at the derivatives’ inception and on an ongoing basis, whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in the hedged items. Any ineffective portion of hedging transactions is recognized in income (loss).

We record all derivative instruments as assets or liabilities on our Consolidated Balance Sheets at fair value. The fair value of these instruments is determined by us using third-party valuations based on quoted prices for similar assets and liabilities. Changes in the fair value of derivatives are recorded in either “Net income (loss)” or “Other comprehensive income (loss)” as appropriate. The gain or loss on derivatives designated as cash flow hedges is included in “Other comprehensive income (loss)” in the period in which changes in fair value occur and is reclassified to income (loss) in the period in which the hedged item affects income (loss), and any ineffectiveness is recognized currently in “Net income (loss)”. The gain or loss on derivatives that have not been designated as hedging instruments is included in income (loss) in the period in which changes in fair value occur.

Fair Value Measurements

The Fair Value Measurements and Disclosures Topic of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) establishes a fair value hierarchy, which prioritizes the inputs of valuation techniques used to measure fair value into three levels. The fair value hierarchy gives the highest priority to quoted market prices (Level 1) and the lowest priority to unobservable inputs (Level 3). Where applicable, we use quoted prices in active markets for identical assets or liabilities to determine fair value (Level 1). If quoted prices in active markets for identical assets or liabilities are not available to determine fair value, we use quoted prices for similar assets and liabilities or inputs that are observable either directly or indirectly (Level 2). If quoted prices for identical or similar assets are not available or are unobservable, we may use internally developed valuation models, whose inputs include bid prices and third-party valuations utilizing underlying asset assumptions (Level 3). Outstanding financial derivative instruments expose us to credit loss in the event of nonperformance by the counterparties to the agreements. We monitor credit ratings of counterparties to the agreements, which are large financial institutions, to consider the impact, if any, on the determination of fair value. No significant adjustments were made in any periods presented.

Customer Rebates and Allowances

We provide rebates to our customers based on the volume of their purchases. We provide the rebates to increase the sell-through of our products. The rebates are recorded as a decrease in “Sales, Trade” in our Consolidated Statements of Income. At December 31, 2012 and 2011, we had $20.8 million and $14.5 million, respectively, of rebates payable recorded in “Accounts payable” on our Consolidated Balance Sheets.

15

Inventory Valuation

The majority of our inventories are valued at the lower of cost or market, where cost is based on the average cost method of inventory valuation. Manufactured inventories include costs for materials, labor, and factory overhead. Other inventories are valued at the lower of either standard cost, which approximates cost based on the actual first-in, first-out usage pattern, or market.

Inventories include the following (dollars in thousands):

| December 31 | ||||||||

| 2012 | 2011 | |||||||

| Finished goods |

$ | 150,496 | $ | 155,588 | ||||

| Work in process |

41,575 | 41,172 | ||||||

| Fiber |

35,840 | 38,469 | ||||||

| Other raw materials and supplies |

66,573 | 72,076 | ||||||

|

|

|

|

|

|||||

| $ | 294,484 | $ | 307,305 | |||||

|

|

|

|

|

|||||

Property and Equipment

Property and equipment are recorded at cost. Cost includes expenditures for major improvements and replacements and the amount of interest cost associated with significant capital additions. For the years ended December 31, 2012, 2011, and 2010, capitalized interest, if any, was immaterial. Repairs and maintenance costs are expensed as incurred. When property and equipment are retired, sold, or otherwise disposed of, the asset’s carrying amount and related accumulated depreciation are removed from the accounts and any gain or loss is included in “Net income (loss)”. In all periods presented, we used the straight-line method of depreciation. We periodically assess the estimated useful lives of our assets. Changes in circumstances, such as changes to our operational or capital strategy, changes in regulation, or technological advances, may result in the actual useful lives differing from our estimates. Revisions to the estimated useful lives of assets requires judgment and constitutes a change in accounting estimate, which is accounted for prospectively by adjusting or accelerating depreciation and amortization rates.

Property and equipment consisted of the following asset classes and the following general range of estimated useful lives (dollars in thousands):

| December 31 | General Range of Estimated Useful |

|||||||||||

| 2012 | 2011 | Lives in Years | ||||||||||

| Land |

$ | 28,899 | $ | 34,735 | ||||||||

| Buildings and improvements |

260,607 | 248,174 | 9 - 40 | |||||||||

| Machinery and equipment |

1,479,212 | 1,375,069 | 3 - 20 | |||||||||

| Construction in progress |

46,538 | 44,563 | ||||||||||

|

|

|

|

|

|||||||||

| 1,815,256 | 1,702,541 | |||||||||||

| Less accumulated depreciation |

(592,255 | ) | (467,272 | ) | ||||||||

|

|

|

|

|

|||||||||

| $ | 1,223,001 | $ | 1,235,269 | |||||||||

|

|

|

|

|

|||||||||

Weighted average useful lives are approximately 27 years for buildings and improvements and 13 years for machinery and equipment. Machinery and equipment consists of the following categories of assets and the following estimated useful lives:

| Computer hardware and software |

3 - 10 | |||

| Furniture and fixtures |

3 - 10 | |||

| Vehicles |

3 - 7 | |||

| Packaging and papermaking equipment |

9 - 20 |

16

Depreciation expense for the years ended December 31, 2012, 2011, and 2010, was $134.0 million, $129.8 million, and $120.5 million, respectively.

Leases

We assess lease classification as either capital or operating at lease inception or upon modification. We lease some of our locations, as well as other property and equipment, under operating leases. For purposes of determining straight-line rent expense, the lease term is calculated from the date of possession of the facility, including any periods of free rent and any renewal option periods that are reasonably assured of being exercised.

Fiber Farms

Costs for activities related to the establishment of a new crop of trees, including planting, thinning, fertilization, pest control, herbicide application, irrigation, and land lease costs, are capitalized. The capitalized costs are accumulated by specifically identifiable farm or irrigation blocks. We charge capitalized costs, excluding land, to “Depreciation, amortization, and depletion” in the accompanying Consolidated Statements of Income at the time of harvest based on actual accumulated costs associated with the fiber cut. Costs for administration, harvesting, insurance, and property taxes are recognized in “Materials, labor and other operating expenses (excluding depreciation)” in the accompanying Consolidated Statements of Income at the time the associated fiber is utilized.

Long-Lived Asset Impairment

An impairment of long-lived assets exists when the carrying value of an asset is not recoverable through future undiscounted cash flows from operations and when the carrying value of an asset exceeds its fair value. We review the carrying value of long-lived assets for impairment when events or changes in circumstances indicate that the carrying amount of assets may not be recoverable.

Goodwill and Intangible Assets

We maintain two reporting units for purposes of our goodwill and intangible asset impairment testing, Packaging and Paper, which are the same as our operating segments discussed in Note 17, Segment Information. We test goodwill, recorded in our Packaging segment, and indefinite-lived intangible assets, recorded in our Paper segment, for impairment annually in the fourth quarter or sooner if events or changes in circumstances indicate that the carrying value of the asset may exceed fair value. Additionally, we evaluate the remaining useful lives of our finite-lived purchased intangible assets to determine whether any adjustments to the useful lives are necessary. See Note 7, Goodwill and Intangible Assets, for additional information.

Deferred Software Costs

Internal-use software is software that is developed internally, developed or modified solely to meet our needs, and for which, during the software’s development or modification, a plan does not exist to market the software externally. We defer internal-use software costs that benefit future years. These costs are amortized using the straight-line method over the expected life of the software, typically three to five years. “Other assets” in the Consolidated Balance Sheets include $6.4 million of deferred software costs at both December 31, 2012 and 2011, respectively. We amortized $1.6 million, $0.9 million, and $0.8 million of deferred software costs for the years ended December 31, 2012, 2011, and 2010, respectively.

Pension Benefits

Several estimates and assumptions are required to record pension costs and liabilities, including discount rate, return on assets, and longevity and service lives of employees. We review and update these assumptions annually unless a plan curtailment or other event occurs, requiring we update the estimates on an interim basis. While we believe the assumptions used to measure our pension obligations are reasonable, differences in actual experience or changes in assumptions may materially affect our pension obligations and future expense.

New and Recently Adopted Accounting Standards

In February 2013, the FASB issued Accounting Standards Update (ASU) 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income. This ASU requires entities to disclose additional information about changes in and significant items reclassified out of accumulated other comprehensive income. The guidance is effective for annual and interim reporting periods beginning after January 1, 2013. We do not believe the adoption of this update will have a material effect on our financial position and results of operations.

17

In January 2013, the FASB issued ASU 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities. This ASU clarifies which instruments and transactions are subject to the offsetting disclosure requirements established by ASU 2011-11. This guidance is effective for annual and interim reporting periods beginning January 1, 2013. We do not believe the adoption of this update will have a material effect on our financial position and results of operations.

In July 2012, the FASB issued ASU 2012-02, Intangibles — Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment. This ASU gives entities testing indefinite-lived intangible assets for impairment the option first to assess qualitative factors to determine whether the existence of events and circumstances indicates that it is more likely than not that the indefinite-lived intangible asset is impaired. If, after assessing the totality of events and circumstances, an entity concludes that it is not more likely than not that the indefinite-lived intangible asset is impaired, the entity is not required to take further action. However, if an entity concludes otherwise, a quantitative impairment test is required. This guidance is effective for our annual and interim impairment tests beginning January 1, 2013, with early adoption permitted. We do not believe the adoption of this update will have a material effect on our financial position and results of operations.

In December 2011, the FASB issued ASU 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities. This ASU improves reporting and transparency of offsetting (netting) assets and liabilities and the related effects on the financial statements. This guidance is effective for annual and interim reporting periods beginning January 1, 2013. We do not believe the adoption of this update will have a material effect on our financial position and results of operations.

In September 2011, the FASB issued ASU 2011-08, Intangibles — Goodwill and Other (Topic 350): Testing Goodwill for Impairment. This ASU gives entities testing goodwill for impairment the option of performing a qualitative assessment before calculating the fair value of a reporting unit in step 1 of the goodwill impairment test. If entities determine, on the basis of qualitative factors, that the fair value of a reporting unit is more likely than not less than the carrying amount, the two-step impairment test would be required. Otherwise, further testing would not be needed. We adopted the provisions of this guidance on January 1, 2012, and it had no effect on our financial position and results of operations.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income. This ASU increases the prominence of other comprehensive income in financial statements. Under this ASU, we have the option to present the components of net income and comprehensive income in either one or two consecutive financial statements. The ASU eliminates the option to present the components of other comprehensive income as part of the statement of equity. We adopted the provisions of ASU 2011-05 on January 1, 2012. The adoption of this guidance resulted in adding the Consolidated Statements of Comprehensive Income to our Consolidated Financial Statements.

In May 2011, the FASB issued ASU 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (IFRS). This ASU was issued to provide largely identical guidance about fair value measurement and disclosure requirements for entities that disclose the fair value of an asset, a liability, or an instrument classified in shareholders’ equity in their consolidated financial statements as that provided in the International Accounting Standards Board’s new IFRS 13, Fair Value Measurement. This ASU does not extend the use of fair value but, rather, provides guidance about how fair value should be applied where it already is required or permitted under U.S. generally accepted accounting principles (GAAP). We adopted the provisions of ASU 2011-04 on January 1, 2012. The adoption of this guidance did not have a material effect on our financial statement disclosures.

There were no other accounting standards recently issued that had or are expected to have a material impact on our financial position or results of operations.

18

3. St. Helens Charges

In December 2012, we ceased paper production on our one remaining paper machine at our St. Helens, Oregon, paper mill. The cessation is a result of the machine’s inability to compete in the marketplace over the long-term, due primarily to high fiber costs and declining product demand. This reduces our annual uncoated freesheet capacity by almost 60,000 tons and results in the loss of approximately 100 jobs, primarily at the mill. The remaining machine, which is owned by Cascades Tissue Group (Cascades), continues to operate on the site, and we continue to lease Cascades supporting assets.

During the year ended December 31, 2012, we recorded $31.7 million of pretax costs in our Paper segment, related primarily to ceasing paper production at the mill. In our Consolidated Statements of Income, we recorded $27.6 million of shutdown costs in “St. Helens charges” and $4.1 million in “Materials, labor, and other operating expenses (excluding depreciation)” related to inventory write-downs and other one-time costs incurred. At December 31, 2012, $4.3 million of costs were recorded in “Accrued liabilities, Compensation and benefits”, $0.7 million in “Accrued liabilities, Other”, and $10.3 million in “Other long-term liabilities” on our Consolidated Balance Sheet.

An analysis of the St. Helens costs is as follows (in thousands):

| Noncash | Cash (a) | Total Costs | ||||||||||||

| Asset write-down |

$ | 11,144 | (b) | $ | — | $ | 11,144 | |||||||

| Inventory write-down |

1,982 | — | 1,982 | |||||||||||

| Employee-related costs |

— | 4,334 | 4,334 | |||||||||||

| Pension curtailment loss |

1,060 | — | 1,060 | |||||||||||

| Increase in asset retirement obligations (Note 15) |

— | 10,256 | 10,256 | |||||||||||

| Other |

— | 2,969 | 2,969 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| $ | 14,186 | $ | 17,559 | $ | 31,745 | |||||||||

|

|

|

|

|

|

|

|||||||||

| (a) | We expect to pay approximately $7.3 million of the $17.6 million of cash costs in early 2013 and the remaining cash costs over a longer term. |

| (b) | During third quarter 2012, we assessed the St. Helens long-lived assets for impairment. Our assessment was based upon, among other things, our estimates of the amount of future net cash flows to be generated by the long-lived assets and our estimates of the current fair value of the assets (Level 3 inputs). Considerable management judgment is necessary to evaluate estimated future cash flows. The assumptions used in our impairment evaluations are consistent with our operating plans. |

4. Acquisitions

On March 1, 2011, we acquired Tharco Packaging, Inc. and its subsidiaries (Tharco) for $201.3 million (Tharco Acquisition), and on December 1, 2011, we acquired Hexacomb Corporation and its affiliated companies and all of the honeycomb packaging-related assets of Pregis Mexico (Hexacomb) for $124.9 million (Hexacomb Acquisition). We acquired 100% of the outstanding stock and voting equity interests of both Tharco and Hexacomb. The financial results for Tharco and Hexacomb are included in our Packaging segment.

During the year ended December 31, 2012, we recorded approximately $1.8 million of purchase price adjustments that decreased goodwill. These adjustments related primarily to changes in deferred tax liabilities that resulted from further analysis of the tax basis of acquired assets and liabilities and other tax adjustments.

19

5. Net Income Per Common Share

Net income per common share is computed by dividing net income by the weighted average number of shares of common stock outstanding during the period. Net income per common share is not applicable to BZ Intermediate because it does not have common shares. Boise Inc.’s basic and diluted net income per share is calculated as follows (dollars and shares in thousands, except per-share data):

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Net income |

$ | 52,150 | $ | 75,210 | $ | 62,734 | ||||||

| Weighted average number of common shares for basic net income per common share (a) |

99,872 | 101,941 | 80,461 | |||||||||

| Incremental effect of dilutive common stock equivalents: |

||||||||||||

| Restricted stock and restricted stock units |

999 | 2,502 | 3,670 | |||||||||

| Performance units |

268 | 87 | — | |||||||||

| Common stock warrants (b) |

— | 2,214 | — | |||||||||

| Stock options (c) |

4 | 2 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Weighted average number of common shares for diluted net income per common share |

101,143 | 106,746 | 84,131 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income per common share: |

||||||||||||

| Basic |

$ | 0.52 | $ | 0.74 | $ | 0.78 | ||||||

|

|

|

|

|

|

|

|||||||

| Diluted |

$ | 0.52 | $ | 0.70 | $ | 0.75 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | During the year ended December 31, 2011, 40.3 million warrants were exercised, resulting in the issuance of 38.4 million additional common shares. For the year ended December 31, 2011, the exercise added 25.7 million to the number of weighted average shares included in basic net income per share. |

During the year ended December 31, 2011, 21.2 million common shares were repurchased, resulting in a 5.1 million decrease in the number of weighted average shares included in basic and diluted net income per share.

| (b) | For the year ended December 31, 2010, the warrants were not included in the computation of diluted net income per share because the exercise price exceeded the average market price of our common stock. The warrants were accounted for under the treasury stock method. |

| (c) | We excluded 0.8 million and 0.3 million of stock options from the computation of diluted net income per common share because they were antidilutive for the years ended December 31, 2012 and 2011, respectively. We had no stock options outstanding during 2010. |

20

6. Income Taxes

A reconciliation of the statutory U.S. federal tax provision and the reported tax provision is as follows (dollars in thousands):

| Boise Inc. | BZ Intermediate | |||||||||||||||||||||||

| Year Ended December 31 | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Income before income taxes |

$ | 86,134 | $ | 125,341 | $ | 108,106 | $ | 86,134 | $ | 125,341 | $ | 108,106 | ||||||||||||

| Statutory U.S. income tax rate |

35.0 | % | 35.0 | % | 35.0 | % | 35.0 | % | 35.0 | % | 35.0 | % | ||||||||||||

| Statutory tax provision |

$ | 30,147 | $ | 43,870 | $ | 37,837 | $ | 30,147 | $ | 43,870 | $ | 37,837 | ||||||||||||

| Foreign rate differential |

(165 | ) | 3 | — | (165 | ) | 3 | — | ||||||||||||||||

| State taxes |

3,340 | 4,839 | 4,120 | 3,340 | 4,839 | 4,120 | ||||||||||||||||||

| Valuation allowance |

225 | 146 | 307 | 225 | 146 | 307 | ||||||||||||||||||

| Nondeductible costs |

985 | 1,476 | 652 | 985 | 1,476 | 652 | ||||||||||||||||||

| Other |

(548 | ) | (203 | ) | 2,456 | (548 | ) | (203 | ) | 1,613 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income tax provision |

$ | 33,984 | $ | 50,131 | $ | 45,372 | $ | 33,984 | $ | 50,131 | $ | 44,529 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Effective income tax provision rate |

39.5 | % | 40.0 | % | 42.0 | % | 39.5 | % | 40.0 | % | 41.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The income tax provision shown in the Consolidated Statements of Income includes the following (dollars in thousands):

| Boise Inc. | BZ Intermediate | |||||||||||||||||||||||

| Year Ended December 31 | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Current income tax provision (benefit) |

||||||||||||||||||||||||

| Federal |

$ | (599 | ) | $ | 2,249 | $ | 4,253 | $ | (599 | ) | $ | 2,047 | $ | 4,454 | ||||||||||

| State |

832 | 3,472 | 2,236 | 832 | 3,529 | 2,194 | ||||||||||||||||||

| Foreign |

67 | 109 | (1 | ) | 67 | 109 | (1 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current |

$ | 300 | $ | 5,830 | $ | 6,488 | $ | 300 | $ | 5,685 | $ | 6,647 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Deferred income tax provision (benefit) |

||||||||||||||||||||||||

| Federal |

$ | 29,985 | $ | 40,778 | $ | 34,061 | $ | 29,985 | $ | 40,980 | $ | 33,151 | ||||||||||||

| State |

3,705 | 3,524 | 4,831 | 3,705 | 3,467 | 4,739 | ||||||||||||||||||

| Foreign |

(6 | ) | (1 | ) | (8 | ) | (6 | ) | (1 | ) | (8 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total deferred |

$ | 33,684 | $ | 44,301 | $ | 38,884 | $ | 33,684 | $ | 44,446 | $ | 37,882 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income tax provision (a) |

$ | 33,984 | $ | 50,131 | $ | 45,372 | $ | 33,984 | $ | 50,131 | $ | 44,529 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | In January 2013, the U.S. President signed into law the American Taxpayer Relief Act of 2012, which extended many tax provisions that would have otherwise expired in 2012. Our income tax provision at December 31, 2012, does not include the effect of this law; however, the effect, if any, would not be significant. We will record the effect, if any, of the extended tax provisions in first quarter 2013. |

During the year ended December 31, 2012, refunds received, net of cash paid for taxes, was $0.5 million. During the years ended December 31, 2011 and 2010, cash paid for taxes, net of refunds received, was $1.9 million and $0.7 million, respectively.

21

The following details the scheduled expiration dates of our tax effected net operating loss (NOL) and tax credit carryforwards at December 31, 2012 (dollars in thousands):

| Boise Inc. | BZ Intermediate | |||||||||||||||||||||||||||||||

| 2013 Through 2022 |

2023 Through 2032 |

Indefinite | Total | 2013 Through 2022 |

2023 Through 2032 |

Indefinite | Total | |||||||||||||||||||||||||

| U.S. federal and non-U.S. NOLs |

$ | 4,432 | $ | 35,820 | $ | — | $ | 40,252 | $ | 4,432 | $ | 35,920 | $ | — | $ | 40,352 | ||||||||||||||||

| State taxing jurisdiction NOLs |

351 | 3,380 | — | 3,731 | 351 | 3,380 | — | 3,731 | ||||||||||||||||||||||||

| U.S. federal, non-U.S., and state tax credit carryforwards |

196 | 589 | 4,053 | 4,838 | 196 | 589 | 4,053 | 4,838 | ||||||||||||||||||||||||

| U.S. federal capital loss carryforwards |

1,232 | — | — | 1,232 | 1,232 | — | — | 1,232 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

$ | 6,211 | $ | 39,789 | $ | 4,053 | $ | 50,053 | $ | 6,211 | $ | 39,889 | $ | 4,053 | $ | 50,153 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Internal Revenue Code Section 382 imposes limitations on our ability to use net operating losses if we experience “ownership changes.” In general terms, ownership change may result from transactions increasing the ownership of specified shareholders by greater than 50 percentage points over a three year period. We cannot give any assurance we will not undergo any ownership change at a time when these limitations would have a significant effect. To the extent we are not able to use net operating losses in any given year, the unused limitation amount may be carried over to later years. We believe it is more likely than not that our net operating losses will be fully realized before they expire.

22

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts for income tax purposes. The components of our net deferred tax assets and liabilities at December 31, 2012 and 2011, in the Consolidated Balance Sheets are as follows (dollars in thousands):

| Boise Inc. | BZ Intermediate | |||||||||||||||

| December 31 | ||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Deferred tax assets |

||||||||||||||||

| Employee benefits (a) |

$ | 68,375 | $ | 84,453 | $ | 68,375 | $ | 84,453 | ||||||||

| Deferred financing costs |

1,584 | 1,593 | 1,584 | 1,593 | ||||||||||||

| Intangible assets and other |

310 | 122 | 310 | 122 | ||||||||||||

| Net operating loss carryforwards (b) |

61,106 | 61,262 | 60,999 | 61,155 | ||||||||||||

| Alternative minimum tax |

4,053 | 4,877 | 4,053 | 4,877 | ||||||||||||

| Asset retirement obligations |

8,025 | 3,933 | 8,025 | 3,933 | ||||||||||||

| Inventories |

7,752 | 11,875 | 7,752 | 11,875 | ||||||||||||

| State income tax adjustments |

4,894 | 4,701 | 4,894 | 4,701 | ||||||||||||

| Other |

9,130 | 10,000 | 9,130 | 10,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross deferred tax assets |

165,229 | 182,816 | 165,122 | 182,709 | ||||||||||||

| Valuation allowance (c) |

(5,296 | ) | (5,340 | ) | (5,296 | ) | (5,340 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net deferred tax assets |

$ | 159,933 | $ | 177,476 | $ | 159,826 | $ | 177,369 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Deferred tax liabilities |

||||||||||||||||

| Property and equipment |

$ | 266,120 | $ | 244,230 | $ | 266,120 | $ | 244,230 | ||||||||

| Intangible assets and other |

60,195 | 61,416 | 60,195 | 61,416 | ||||||||||||

| Deferred income |

9,647 | 9,647 | 908 | 908 | ||||||||||||

| Other |

4,386 | 3,064 | 4,471 | 3,148 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Deferred tax liabilities |

$ | 340,348 | $ | 318,357 | $ | 331,694 | $ | 309,702 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| As reported on our Consolidated Balance Sheets |

||||||||||||||||

| Current deferred tax assets, net |

$ | 17,955 | $ | 20,379 | $ | 17,955 | $ | 20,379 | ||||||||

| Noncurrent deferred tax liabilities |

198,370 | 161,260 | 189,823 | 152,712 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total deferred tax liabilities, net (d) |

$ | 180,415 | $ | 140,881 | $ | 171,868 | $ | 132,333 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | The decrease relates to the tax effect of changes in recorded pension liabilities. See Note 10, Retirement and Benefit Plans, for more information. |

| (b) | At December 31, 2012 and 2011, net operating losses exclude $9.8 million and $4.4 million, respectively, of tax benefits that arose directly from tax deductions related to equity compensation in excess of compensation recognized for financial reporting. To the extent such net operating losses are utilized, stockholders’ equity will be increased. |

| (c) | Deferred tax assets are reduced by a valuation allowance when it is more likely than not that some portion of the deferred tax assets will not be realized. In 2012 and 2011, we recorded a $5.3 million valuation allowance. In 2012, $4.1 million of the valuation allowance relates to foreign net operating loss carryforwards, and the remaining $1.2 million relates to a valuation allowance recorded in full on deferred tax assets relating to capital losses. In 2011, $4.3 million of the valuation allowance relates to foreign net operating loss carryforwards and credits acquired as part of the Hexacomb acquisition. The remaining $1.0 million valuation allowance recorded during 2011 relates to a valuation allowance recorded in full on deferred tax assets relating to capital losses. We do not expect to generate capital gains before the losses expire. If or when recognized, the tax benefits relating to the reversal of any of or all of the valuation allowance will be recognized as a reduction of income tax expense. |

| (d) | As of December 31, 2012, we had not recognized U.S. deferred income taxes on our cumulative total of undistributed earnings for non-U.S. subsidiaries. Determining the unrecognized deferred tax liability related to investments in these non-U.S. subsidiaries that are indefinitely reinvested is not practicable. We currently intend to indefinitely reinvest those earnings in operations outside the United States. |

23

Pretax income from domestic and foreign sources is as follows (dollars in thousands):

| Boise Inc. | BZ Intermediate | |||||||||||||||||||||||

| Year Ended December 31 | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Domestic |

$ | 85,287 | $ | 125,072 | $ | 108,095 | $ | 85,287 | $ | 125,072 | $ | 108,095 | ||||||||||||

| Foreign |

847 | 269 | 11 | 847 | 269 | 11 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

$ | 86,134 | $ | 125,341 | $ | 108,106 | $ | 86,134 | $ | 125,341 | $ | 108,106 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Uncertain Income Tax Positions

A reconciliation of the unrecognized tax benefits is as follows (dollars in thousands):

| Boise Inc. | BZ Intermediate | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Beginning balance |