Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VERIFONE SYSTEMS, INC. | d601637d8k.htm |

| EX-10.1 - EX-10.1 - VERIFONE SYSTEMS, INC. | d601637dex101.htm |

| EX-99.1 - EX-99.1 - VERIFONE SYSTEMS, INC. | d601637dex991.htm |

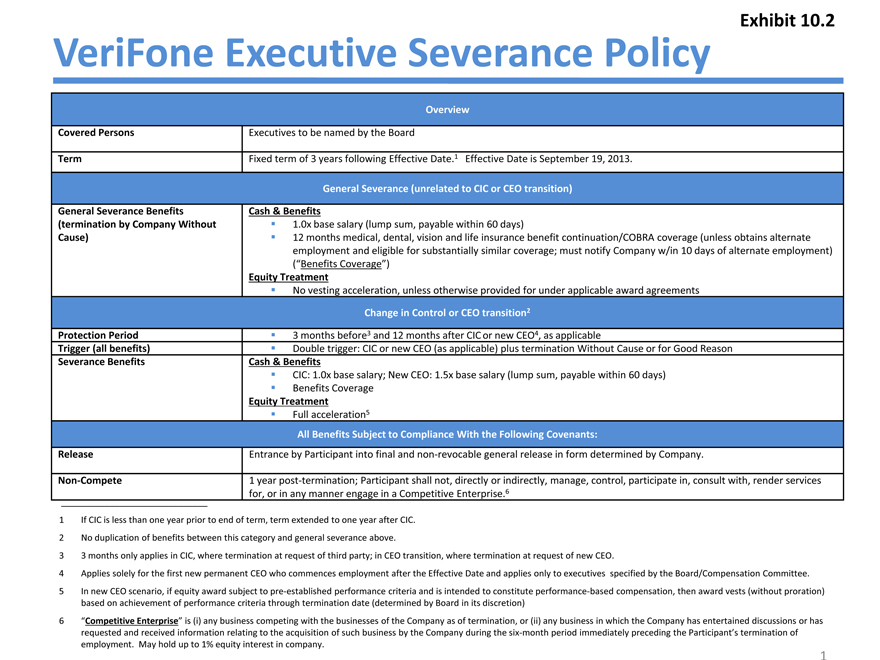

VeriFone Executive Severance Policy

Overview

Covered Persons Executives to be named by the Board

Term Fixed term of 3 years following Effective Date. 1 Effective Date is September 19, 2013.

General Severance (unrelated to CIC or CEO transition)

General Severance Benefits

(termination by Company Without

Cause)

Cash & Benefits

1.0x base salary (lump sum, payable within 60 days)

12 months medical, dental, vision and life insurance benefit continuation/COBRA coverage (unless obtains alternate

employment and eligible for substantially similar coverage; must notify Company w/in 10 days of alternate employment)

(“Benefits Coverage”)

Equity Treatment

No vesting acceleration, unless otherwise provided for under applicable award agreements

Change in Control or CEO transition2

Protection Period 3 months before3 and 12 months after CIC or new CEO4, as applicable

Trigger (all benefits) Double trigger: CIC or new CEO (as applicable) plus termination Without Cause or for Good Reason

Severance Benefits Cash & Benefits

CIC: 1.0x base salary; New CEO: 1.5x base salary (lump sum, payable within 60 days)

Benefits Coverage

Equity Treatment

Full acceleration5

All Benefits Subject to Compliance With the Following Covenants:

Release Entrance by Participant into final and non revocable general release in form determined by Company.

Non Compete 1 year post termination; Participant shall not, directly or indirectly, manage, control, participate in, consult with, render services

for, or in any manner engage in a Competitive Enterprise.6

1 If CIC is less than one year prior to end of term, term extended to one year after CIC.

2 No duplication of benefits between this category and general severance above.

3 3 months only applies in CIC, where termination at request of third party; in CEO transition, where termination at request of new CEO.

4 Applies solely for the first new permanent CEO who commences employment after the Effective Date and applies only to executives specified by the Board/Compensation Committee.

5 In new CEO scenario, if equity award subject to pre established performance criteria and is intended to constitute performance based compensation, then award vests (without proration) based on achievement of performance criteria through termination date (determined by Board in its discretion)

6 “Competitive Enterprise” is (i) any business competing with the businesses of the Company as of termination, or (ii) any business in which the Company has entertained discussions or has requested and received information relating to the acquisition of such business by the Company during the six month period immediately preceding the Participant’s termination of employment. May hold up to 1% equity interest in company.

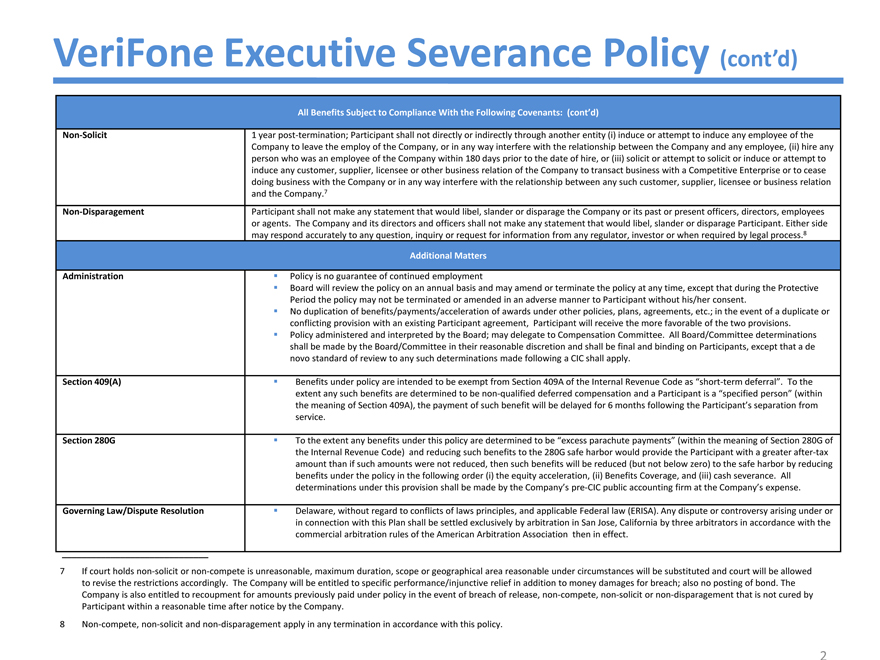

VeriFone Executive Severance Policy (cont’d)

All Benefits Subject to Compliance With the Following Covenants: (cont’d)

Non Solicit 1 year post termination; Participant shall not directly or indirectly through another entity (i) induce or attempt to induce any employee of the Company to leave the employ of the Company, or in any way interfere with the relationship between the Company and any employee, (ii) hire any person who was an employee of the Company within 180 days prior to the date of hire, or (iii) solicit or attempt to solicit or induce or attempt to induce any customer, supplier, licensee or other business relation of the Company to transact business with a Competitive Enterprise or to cease doing business with the Company or in any way interfere with the relationship between any such customer, supplier, licensee or business relation and the Company.7

Non Disparagement Participant shall not make any statement that would libel, slander or disparage the Company or its past or present officers, directors, employees or agents. The Company and its directors and officers shall not make any statement that would libel, slander or disparage Participant. Either side may respond accurately to any question, inquiry or request for information from any regulator, investor or when required by legal process.8

Additional Matters

Administration Policy is no guarantee of continued employment

Board will review the policy on an annual basis and may amend or terminate the policy at any time, except that during the Protective Period the policy may not be terminated or amended in an adverse manner to Participant without his/her consent.

No duplication of benefits/payments/acceleration of awards under other policies, plans, agreements, etc.; in the event of a duplicate or conflicting provision with an existing Participant agreement, Participant will receive the more favorable of the two provisions.

Policy administered and interpreted by the Board; may delegate to Compensation Committee. All Board/Committee determinations shall be made by the Board/Committee in their reasonable discretion and shall be final and binding on Participants, except that a de novo standard of review to any such determinations made following a CIC shall apply.

Section 409(A) Benefits under policy are intended to be exempt from Section 409A of the Internal Revenue Code as “short term deferral”. To the extent any such benefits are determined to be non qualified deferred compensation and a Participant is a “specified person” (within the meaning of Section 409A), the payment of such benefit will be delayed for 6 months following the Participant’s separation from service.

Section 280G To the extent any benefits under this policy are determined to be “excess parachute payments” (within the meaning of Section 280G of the Internal Revenue Code) and reducing such benefits to the 280G safe harbor would provide the Participant with a greater after tax amount than if such amounts were not reduced, then such benefits will be reduced (but not below zero) to the safe harbor by reducing benefits under the policy in the following order (i) the equity acceleration, (ii) Benefits Coverage, and (iii) cash severance. All determinations under this provision shall be made by the Company’s pre CIC public accounting firm at the Company’s expense.

Governing Law/Dispute Resolution Delaware, without regard to conflicts of laws principles, and applicable Federal law (ERISA). Any dispute or controversy arising under or in connection with this Plan shall be settled exclusively by arbitration in San Jose, California by three arbitrators in accordance with the commercial arbitration rules of the American Arbitration Association then in effect.

7 If court holds non solicit or non compete is unreasonable, maximum duration, scope or geographical area reasonable under circumstances will be substituted and court will be allowed to revise the restrictions accordingly. The Company will be entitled to specific performance/injunctive relief in addition to money damages for breach; also no posting of bond. The Company is also entitled to recoupment for amounts previously paid under policy in the event of breach of release, non compete, non solicit or non disparagement that is not cured by Participant within a reasonable time after notice by the Company.

8 Non compete, non solicit and non disparagement apply in any termination in accordance with this policy.

| 2 |

|

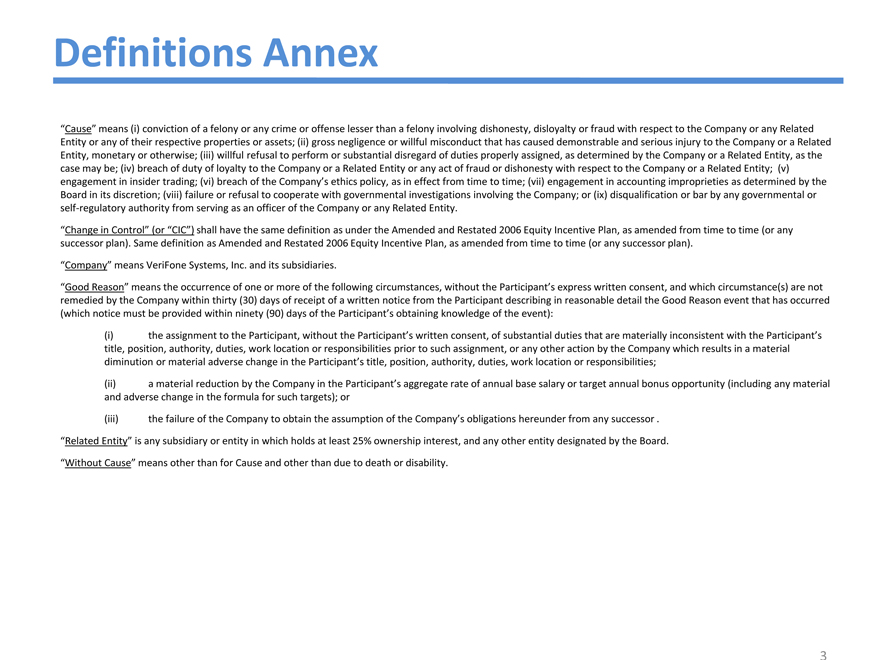

Definitions Annex

“Cause” means (i) conviction of a felony or any crime or offense lesser than a felony involving dishonesty, disloyalty or fraud with respect to the Company or any Related Entity or any of their respective properties or assets; (ii) gross negligence or willful misconduct that has caused demonstrable and serious injury to the Company or a Related Entity, monetary or otherwise; (iii) willful refusal to perform or substantial disregard of duties properly assigned, as determined by the Company or a Related Entity, as the case may be; (iv) breach of duty of loyalty to the Company or a Related Entity or any act of fraud or dishonesty with respect to the Company or a Related Entity; (v) engagement in insider trading; (vi) breach of the Company’s ethics policy, as in effect from time to time; (vii) engagement in accounting improprieties as determined by the Board in its discretion; (viii) failure or refusal to cooperate with governmental investigations involving the Company; or (ix) disqualification or bar by any governmental or self regulatory authority from serving as an officer of the Company or any Related Entity.

“Change in Control” (or “CIC”) shall have the same definition as under the Amended and Restated 2006 Equity Incentive Plan, as amended from time to time (or any successor plan). Same definition as Amended and Restated 2006 Equity Incentive Plan, as amended from time to time (or any successor plan).

“Company” means VeriFone Systems, Inc. and its subsidiaries.

“Good Reason” means the occurrence of one or more of the following circumstances, without the Participant’s express written consent, and which circumstance(s) are not remedied by the Company within thirty (30) days of receipt of a written notice from the Participant describing in reasonable detail the Good Reason event that has occurred (which notice must be provided within ninety (90) days of the Participant’s obtaining knowledge of the event):

(i) the assignment to the Participant, without the Participant’s written consent, of substantial duties that are materially inconsistent with the Participant’s title, position, authority, duties, work location or responsibilities prior to such assignment, or any other action by the Company which results in a material diminution or material adverse change in the Participant’s title, position, authority, duties, work location or responsibilities;

(ii) a material reduction by the Company in the Participant’s aggregate rate of annual base salary or target annual bonus opportunity (including any material and adverse change in the formula for such targets); or

(iii) the failure of the Company to obtain the assumption of the Company’s obligations hereunder from any successor .

“Related Entity” is any subsidiary or entity in which holds at least 25% ownership interest, and any other entity designated by the Board.

“Without Cause” means other than for Cause and other than due to death or disability.

| 3 |

|