Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPARTON CORP | d598769d8k.htm |

INVESTOR INVESTOR

PRESENTATION

PRESENTATION

NYSE: SPA

September 2013

Exhibit 99.1 |

2

Safe Harbor Statement

Safe Harbor Statement

Certain

statements

herein

constitute

forward-looking

statements

within

the

meaning

of

the

Securities

Act

of

1933,

as

amended

and

the

Securities

Exchange

Act

of

1934,

as

amended.

When

used

herein,

words

such

as

“believe,”

“expect,”

“anticipate,”

“project,”

“plan,”

“estimate,”

“will”

or

“intend”

and

similar

words

or

expressions

as

they

relate

to

the

Company

or

its

management

constitute

forward-looking

statements.

These

forward-looking

statements

reflect

our

current

views

with

respect

to

future

events

and

are

based

on

currently

available

financial,

economic

and

competitive

data

and

our

current

business

plans.

The

Company

is

under

no

obligation

to,

and

expressly

disclaims

any

obligation

to,

update

or

alter

its

forward-looking

statements

whether

as

a

result

of

such

changes,

new

information,

subsequent

events

or

otherwise.

Actual

results

could

vary

materially

depending

on

risks

and

uncertainties

that

may

affect

our

operations,

markets,

prices

and

other

factors.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

forward-looking

statements

include

those

contained

under

the

heading

of

risk

factors

and

in

the

management’s

discussion

and

analysis

contained

from

time-to-time

in

the

Company’s

filings

with

the

Securities

and

Exchange

Commission.

Related

to

Onyx,

adjusted

gross

profit

and

adjusted

operating

income

exclude

the

gross

profit

effect

of

capitalized

profit

in

inventory

from

acquisition

and

unusual

write-downs

of

inventory

and

accounts

receivable

related

to

an

Onyx

customer

(“Augustine”)

which

was

excluded

from

the

acquisition.

Adjusted

EBITDA

related

to

Onyx

represents

operating

income

before

depreciation

and

amortization

as

adjusted

for

the

gross

profit

effect

of

capitalized

profit

in

inventory

from

acquisition

and

unusual

write-downs

of

inventory

and

accounts

receivable

related

to

an

Onyx

customer

(“Augustine”)

which

was

excluded

from

the

acquisition. |

3

Investment Considerations

Investment Considerations

Continued EPS

Growth

Established

Growing

Business

Expanded

Gross Margins

Solid

Balance Sheet

Repositioned the

Company for Growth

113 year old business with market leadership in defense and

medical sectors; 19% sales increase in fiscal 2013; 33% year-over-

year adjusted EBITDA increase in fiscal 2013

As of June 30, 2013, $6 million in cash, $10 million borrowed and

$55 million unused line of credit; Completing $3.0 million stock

buyback program that was initiated in FY13Q4

Fiscal 2013:

17.4%

Fiscal 2010:

15.3%

Fiscal 2012:

17.2%

Fiscal 2009:

7.2%

Fiscal 2011:

16.3%

Fiscal 2013:

$ 1.17

Fiscal 2010:

$ (0.40)

Fiscal 2012:

$ 0.91

Fiscal 2009:

$ (1.61)

Fiscal 2011:

$ 0.64

All adjusted and include dilution.

New Programs

New Customers

Potential Annualized Revenue

17.7

$

39.4

$

FY12

28

20

23.8

$

FY13

71

12

FY11

14

79 |

4

Mission

Mission

Sparton will continue to differentiate itself as a premier supplier

of sophisticated electromechanical devices, sub-assemblies

and related services for highly regulated environments in the

Medical, Military & Aerospace, and Industrial markets by

leveraging and expanding its capabilities and offerings within

the electromechanical value stream. |

5

•

Sparton

is

in

one

single

line

of

business

called

Electromechanical

Devices

•

Sparton

is

currently

segmented

into

three

financial

reporting

business

units

Defense & Security

Design

and

Manufacturing

(both

as

a

contractor

and

OEM)

Medical Device

Contract

Design,

Manufacturing,

and

Assembly

Complex Systems

Commonly

referred

to

within

legacy

Sparton

as

EMS,

but

currently

consists

of

circuit

card

assembly

and

box

build

(contract

manufacturing

and

assembly)

outside

of

the

medical

and

defense

markets.

In

the

future,

may

include

electro-mechanical

based

B2B

products

as

well

as

EMS

services.

•

Sparton

currently

serves

three

electronics

markets

Our Business

Our Business

–

Military

&

Aerospace

–

Medical

–

Industrial & Instrumentation |

6

Strategically Located

Strategically Located

•

Six domestic and one low-cost country

manufacturing facilities

–

De Leon Springs, FL

(Orlando)

–

Strongsville, OH

(Cleveland)

–

Frederick, CO

(Denver)

–

Brooksville, FL

(Tampa)

–

Watertown, SD

(Sioux Falls)

–

Birdsboro, PA

(Philadelphia)

–

Ho Chi Minh City, Viet Nam

–

Sparton owns 558,000 square feet of

production facility capacity across the U.S.

and Asia

•

1,442 employees worldwide

•

100+ engineers on staff |

7

Senior Management Team

Senior Management Team

Cary B. Wood, Chief Executive Officer

•

Appointed CEO November 2008

•

Formerly Chief Operating Officer of Citation Corporation, a private company with

foundry, machinery and assembly operations with 20+ years of experience at

GM, United Technologies & Elkay Manufacturing

•

Developed a track record with performance turn-around and growth strategies in

both private and public company settings

•

Appointed CFO in November 2012

•

Previously CFO at Paperworks Industries, Thetford Corporation, and Lake City

Industries as well as Corporate Controller for Littelfuse, Inc. and various

financial roles at Newell Company. •

30+ years experience improving manufacturing quality and productivity at companies

including Citation Corporation, Lear Corp. and United Technologies

Mike Osborne, Senior Vice President –

Corporate Development

•

Responsible for driving corporate and business unit strategic planning and

development, M&A activity, business development & customer

retention, and investor relations Steve Korwin, Senior Vice President

– Quality & Engineering

•

Extensive experience leading manufacturing operations and improving quality

processes to increase profitability and sales

Larry Brand, Vice President –

Corporate HR

•

Considerable experience providing strategic leadership and tactical direction for

the overall Human Resources function to senior management and company

leadership teams Mark

Schlei,

Chief

Financial

Officer

Gordon

Madlock,

Senior

Vice

President

–

Operations |

8

Market Dynamics

Market Dynamics

Medical

Industrial &

Instrumentation

Military &

Aerospace

Computer

Automotive

Consumer

Communication

Electronics Market ($1.3 trillion)

Total 2010 EMS/ODM Outsourced Market:

$276 billion

2010 –

2013 Compounded Annual Growth Rate:

7.6%

Defense & Security

Navigation & Exploration

Medical

= business segment market focus

Highest growth

sector

No current

customers

Volume &

commodity pricing

resulting in low

margins

OEMs are experts

at outsourcing

High growth

High volume

production drives

lower margins

Outsourcing

mostly in low cost

country regions

Complexity is

general low

Moderate growth

High volume

production drives

lower margins

Outsourcing

mostly in low cost

country regions

OEMs are experts

at outsourcing

Moderate growth

High volume

production drives

lower margins

Outsourcing

mostly in low cost

country regions

OEMs are experts

at outsourcing

Source:

Technology Forecasters Inc, Dec. 2010

Market:

$15B

Growth:

9.3%

Market:

$6B

Growth:

6.2%

Market:

$20B

Growth:

6.6%

Market:

$10B

Growth:

12.9%

Market:

$44B

Growth:

7.8%

Market:

$84B

Growth:

6.8%

Market:

$98B

Growth:

3.1%

X

X

X

X |

9

Vision

Vision

Sparton will become a $500 million revenue entity by

fiscal 2015 by attaining key market positions in our

primary lines of business and through complementary

and compatible acquisitions; and will consistently

rank in the top half of our peer group in return on

shareholder equity and return on net assets. |

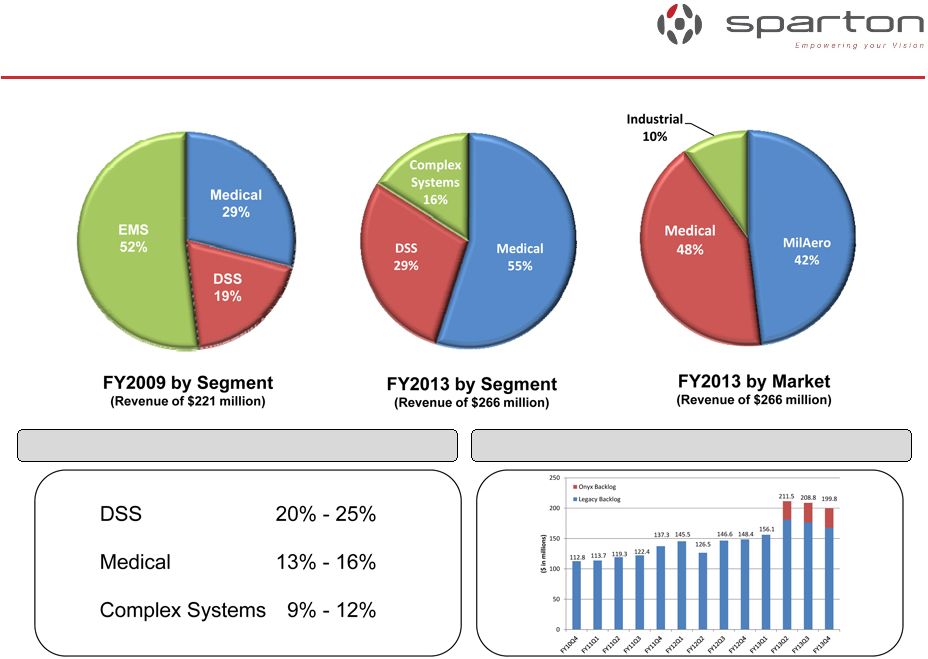

10

Backlog

Shifting Revenue Mix To

Shifting Revenue Mix To

Higher Margin Businesses

Higher Margin Businesses

FY2014 Target Gross Margin by Segment |

11

•

Develop, design, and manufacture security

products, primarily anti-submarine warfare

detection devices for the U.S. and other free-

world governments, and commercially

develop spin-off technology for existing and

alternate markets (Navigation & Exploration)

•

One of the two largest sonobuoy producers

–

Consumable device lasting approximately 8

hours used to detect submerged submarines

•

FY2013 Sales: $77 million, consistently

profitable business

•

Visible Business: $86 million in government

funded backlog as of June 30, 2013

•

Key Customers:

Defense & Security Systems

Defense & Security Systems

Sonobuoys

Navigation Sensors |

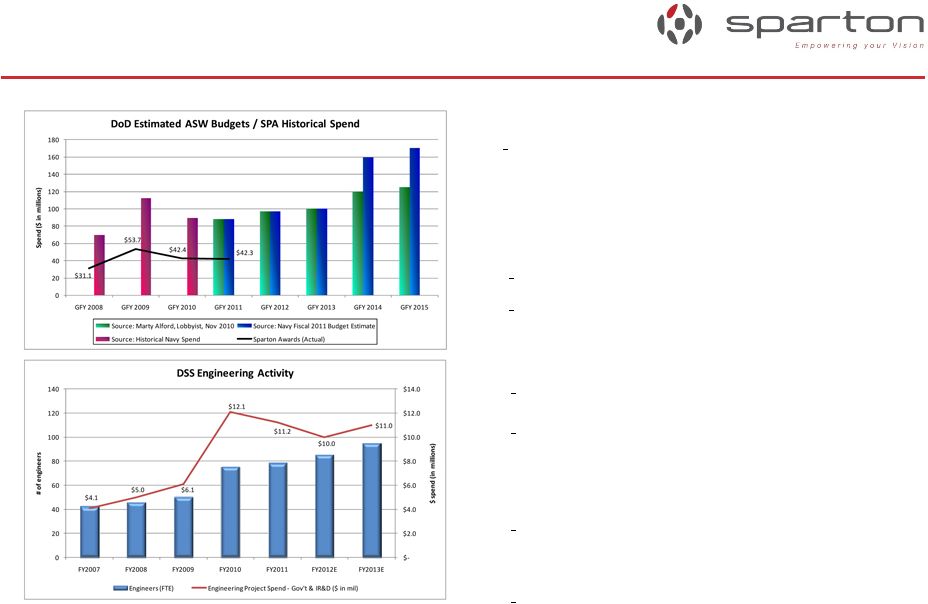

12

Defense & Security Systems

Defense & Security Systems

Market Outlook

Market Outlook

•

Government FY2009 production peak was realized primarily

in Sparton’s FY2011

•

Limited risk of a negative impact of sonobuoy sales to the

U.S. Navy if sequestration occurs

•

Foreign sales are still somewhat unpredictable although a

sharp increase was seen in the 2

nd

quarter of FY2010 & 1

st

nine months of FY2012

•

The Boeing P-8 Poseidon aircraft to become the new

launch vehicle for sonobuoys

Reduced U.S. Navy sonobuoy production volume in Sparton’s

FY2012 will be partially offset by the pursuit of new

developmental engineering funds from the DoD for Antisubmarine

Warfare related applications ($37 million over 5 years of

engineering funds already announced)

Anti-Submarine Warfare budget line item is less than $250

million

Budget is a small fraction of the cost of a single ship

Continued military actions taken by North Korea and China

should have an impact in the use of sonobuoys in that region

The leak of government sensitive information may also put

foreign nations on guard and require more monitoring of their

territorial waterways

U.S. Navy plans to buy 117 P-8A anti-submarine warfare, anti-

surface warfare, intelligence, surveillance and reconnaissance

aircraft to replace its existing P-3 fleet. Initial operational

capability is scheduled for 2013.

The Indian navy signed a contract for eight P-8I aircraft in

January 2009. Boeing will deliver the first P-8I within 48 months

of contract signing and the remaining seven by 2015.

|

13

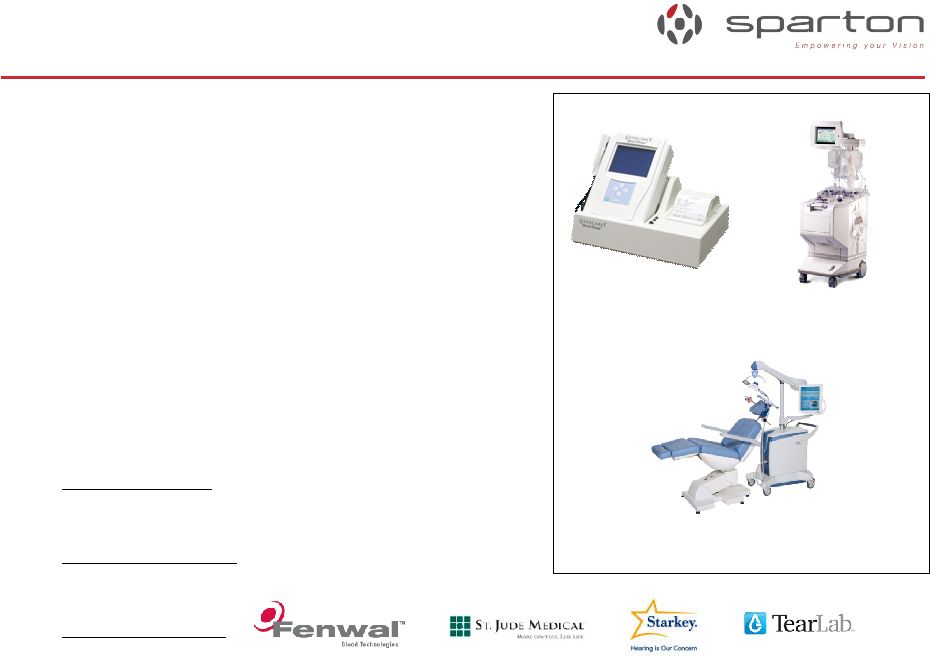

Medical

Medical

•

Design and manufacture medical devices

and instruments for the In Vitro Diagnostics

and Therapeutics Device markets

•

Work with OEMs and biomedical companies to

interface their core technology into a complex medical

laboratory instrument or point of care device

•

Manufacturer of The NeuroStar®

TMS Therapy

System, the first and only Transcranial Magnetic

Stimulation (TMS) device cleared by the FDA for the

treatment of depression

•

Recurring revenue due to highly regulated

medical industry

•

FY2013 Sales: $147 million of consistently

profitable business

•

Visible Business: $75 million of backlog as of

June 30, 2013

•

Key Customers:

Analyzers

Neurology

Blood Separation |

14

Complex Systems

Complex Systems

•

Manufacturer of circuit card assemblies and

electronic based box build products primarily

for the military and commercial aerospace

markets

•

New prototyping capabilities to shorten

development and introduction lead times for

customers

•

Consolidated business from old and

inefficient sites to state-of-the-art and

technologically advanced facilities in Florida

and Viet Nam for improved efficiencies and

capacity utilization

•

FY2013 External Sales: $42 million

•

Visible Business: $40 million of backlog as of

June 30, 2013

•

Key Customers:

Circuit Board

Assembly

Sub Assembly

Complete System

Box Build |

15

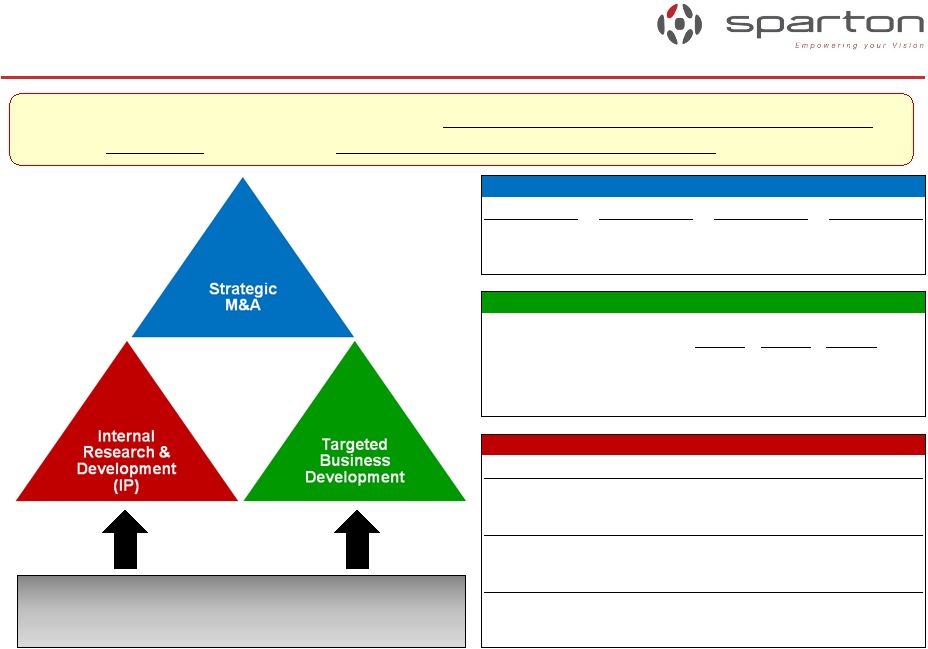

Strategic Direction

Strategic Direction

Growth Planning by Segment

Growth Planning by Segment

Vision:

Sparton will become a $500 million revenue entity with 10% EBITDA margins by fiscal

2015 by attaining key market positions in our primary lines of business and

through complementary and compatible acquisitions; and will strive to be

consistently ranked at the top of our peer group in return on shareholder

equity and return on net assets. Navigation & Exploration

Medical

Defense & Security

Complex Systems

Develop new Navigation System and

Acoustic Detection & Communication

products

for existing and new markets

such

as Defense, Port Security, Oil & Gas, and

Advanced Security Systems.

Continue to lead in Anti-Submarine Warfare

(ASW) device production and related

advanced developmental engineering

projects for the U.S. government.

Continue to make business enhancements to

improve its return on sales by engaging new

and existing customers on contract design

and manufacturing.

Improve market share within the In Vitro

Diagnostics and Therapeutic Device markets

through geographic expansion and new &

increased vertical offerings.

Pursue complementary and

compatible acquisitions

including B2B products and

other services.

Pursue complementary and

compatible acquisitions

including B2B products and

other services that do not

directly compete with our

customers. |

16

Growth Investments

Growth Investments

Summary

Summary

Focus:

Use

growth

investments

to

achieve

sustainable

year-over-year

revenue

and

profit

increases

and

to

further

place

protective

barriers

around

Sparton.

Supported by market research & go-to-

market programs

New Programs

New Customers

Potential Annualized Revenue

17.7

$

Internal Research & Development

Fiscal 2011

Gyro-enhanced digital compass

Hydrophone

Fiscal 2012

AHRS-8

Temperature compensated attitude heading reference system

Fiscal 2014

IMU-10

Harsh environment inertial sensing system

39.4

$

FY12

28

20

23.8

$

Acquisitions

New Business Awards

FY13

71

12

FY11

14

79

Fiscal 2014

Aydin Displays

Fiscal 2013

Onyx EMS

Creonix

Fiscal 2012

None

Fiscal 2011

Delphi Medical

Byers Peak

GEDC-6

PHOD-1 |

17

•

Creonix

–

Closed transaction on June 6, 2013

–

Manufactures complex electromechanical devices and engineers and

manufactures

cables and wire harnesses for the Industrial and Military & Aerospace

markets –

$12 million of revenue

–

Purchase inventory and equipment for $2.1 million

–

Consolidating into the Brooksville location by the end of December

•

Aydin Displays

–

Closed transaction on August 30, 2013

–

Develops enhanced flat panel display and touch-screen solutions with

application- critical performance criteria for the Military &

Aerospace and Civil Marine. –

$18 million of revenue

–

$15 million purchase price plus a potential $6.6 million earnout

within 12 months

–

Financials reported within DSS segment

Acquisition Updates

Acquisition Updates |

18

Financial Highlights

Financial Highlights |

19

•

Awarded a total of 71 new business programs in our contract services

business with potential annualized sales of $39 million.

•

Completed the acquisition of certain assets of Creonix, LLC and Onyx

EMS, LLC. Onyx had net sales of $31.2 million, adjusted operating

income of $0.1 million and adjusted EBITDA of $3.3 million.

•

Quarter end sales backlog of approximately $200 million, including

approximately $32 million from the Company’s newly acquired business.

•

Added to the Russell 2000 Index.

•

Entered into a new five year banking agreement with BMO Harris Bank

providing $65 million of committed credit facilities.

•

Recognized a $2.1 million income tax benefit with respect to the

Company’s investments in and advances to its 100% owned Canadian

subsidiary.

Fiscal 2013 Highlights

Fiscal 2013 Highlights |

20

Consolidated Financial Results

Consolidated Financial Results

Fiscal 2013

Fiscal 2013

(Adjusted)

(Adjusted)

(Adjusted)

2013

2012

2013

2012

Net Sales

$ 266,015

$ 223,577

$ 266,015

$ 223,577

$ 42,438

$ 31,189

$ 11,249

Gross Profit

45,602

38,502

46,168

38,396

7,772

4,381

3,391

17.1%

17.2%

17.4%

17.2%

14.0%

Selling and Administrative Expense

26,451

22,232

26,451

22,232

(4,219)

2,495

(1,724)

9.9%

9.9%

9.9%

9.9%

Internal R&D Expense

1,300

1,293

1,300

1,293

(7)

-

(7)

Amortization of intangible assets

1,575

435

1,575

435

(1,140)

1,198

58

Restructuring/impairment charges

55

(68)

-

-

-

-

-

Other operating expense, net

13

65

13

65

52

-

52

Operating Income

16,270

14,545

16,829

14,371

2,458

688

1,770

6.1%

6.5%

6.3%

6.4%

2.2%

Income Before Provision For Income Tax

16,401

14,586

16,960

14,285

2,675

688

1,987

Provision For Income Taxes

2,963

5,078

5,015

4,973

(42)

227

(269)

Net Income

$ 13,638

$ 9,508

$ 11,945

$ 9,312

$ 2,633

$ 461

$ 2,172

5.1%

4.3%

4.5%

4.2%

Income per Share (Basic)

$ 1.34

$ 0.93

$ 1.17

$ 0.92

$ 0.25

$ 0.25

Income per Share (Diluted)

$ 1.33

$ 0.93

$ 1.17

$ 0.91

$ 0.26

$ 0.26

($ in 000’s, except per share)

(adjusted removes certain gains and charges, including imputing taxes at 32%

effective rates for FY2013 and FY2012, respectively) Onyx

Legacy YoY

Variance

(Reported)

(Adjusted)

Fiscal ended June 30,

Fiscal ended June 30,

Total YoY

Variance |

21

Consolidated Financial Results

Consolidated Financial Results

Adjusted EBITDA

Adjusted EBITDA

2013

2012

Net Income

$ 13,638

$ 9,508

$ 4,130

Interest expense

518

696

(178)

Interest income

(102)

(94)

(8)

Provision for income taxes

2,763

5,078

(2,315)

Depreciation and amortization

4,761

1,814

2,947

Restructuring/impairment charges

55

(68)

123

Gain on acquisition

(62)

- (62)

Gross profit effect of acquisition¹

566

- 566

Gross profit effect of acquisition²

- (106)

106

Gain on sale of investment

- (127)

127

Adjusted EBITDA

$ 22,137

$ 16,701

$ 5,436

8.3%

7.5%

Onyx adjusted EBITDA

$ 3,291

$ -

$ 3,291

Adjusted EBITDA without Onyx

$ 18,846

$ 16,701

$ 2,145

8.0%

7.5%

1 - Gross profit effect of capitalized profit in inventory from acquisition

2 - Gross profit effect of acquisition contingency settlement

Fiscal ended June 30,

YoY

Variance |

22

Quarterly Adjusted EPS

Quarterly Adjusted EPS

Diluted

Diluted |

23

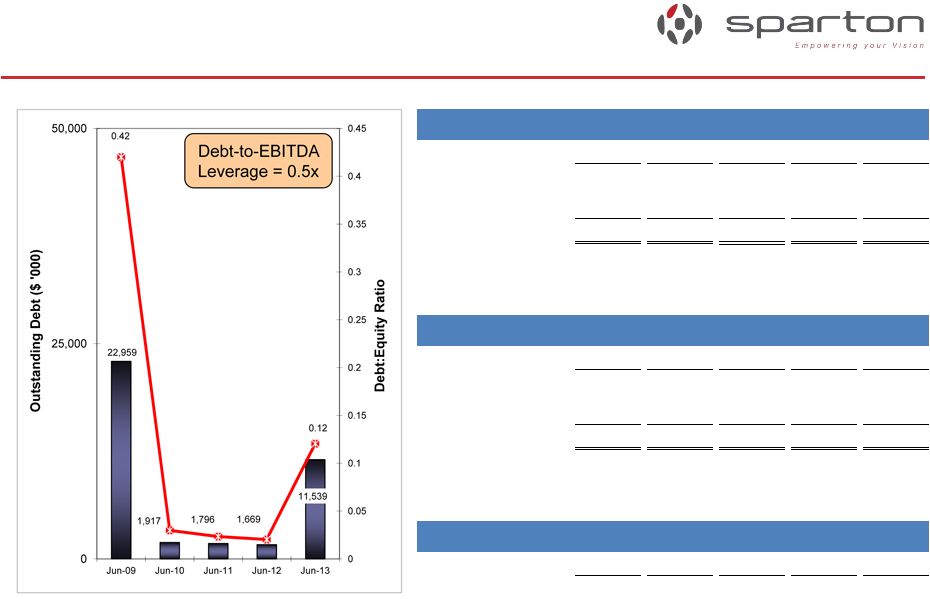

Liquidity & Capital Resources

Liquidity & Capital Resources

($ in '000)

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

Cash and equivalents

46,950

43,096

6,066

4,358

6,085

LOC Availability

16,277

16,012

51,000

52,000

55,000

Total

63,227

59,108

57,066

56,358

61,085

($ in '000)

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

Credit Revolver

-

-

14,000

13,000

10,000

IRB (Ohio)

1,669

1,637

1,604

1,572

1,539

Total

1,669

1,637

15,604

14,572

11,539

($ in '000)

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

Net Inventory

35,102

38,467

45,367

46,928

46,334

Cash Availability

Debt

Inventory |

24

•

Implementation of the strategic growth plan

–

Continue to grow organically

–

Maintain our level of investment in internal research & development to

commercially extend our product lines

–

Continue to enable our engineering workforce to develop new and innovative

proprietary solutions for our end markets

–

Continue to seek out complementary and compatible acquisitions

–

Further leverage Viet Nam as a low cost country alternative and in-region

provider •

Focus on sustained profitability

–

Continue margin improvements across the entire company

–

Increase capacity utilization

–

Continue additional improvements in operating performance through lean and quality

efforts

•

Complete the integration of Creonix and Aydin Displays

Fiscal 2014 Outlook

Fiscal 2014 Outlook |

25

Sparton Corporation

NYSE: SPA

Cary Wood, President & CEO

425 N. Martingale Road

Suite 2050

Schaumburg, IL 60173 |