Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Intrepid Potash, Inc. | a13-20417_18k.htm |

Exhibit 99.1

|

|

September 2013 |

|

|

Cautionary Statements Regarding Forward Looking Information 2 Certain statements in this presentation, and other written or oral statements made by or on behalf of us, are “forward-looking statements” within the meaning of the federal securities laws. Statements regarding future events and developments and our future performance, as well as management’s expectations, beliefs, plans, estimates or projections relating to the future, including statements regarding our financial outlook, are forward-looking statements within the meaning of these laws. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that the expectations will be realized. These forward-looking statements are subject to a number of known and unknown risks and uncertainties, many of which are beyond our control, that could cause actual results to differ materially and adversely from such statements. These risks and uncertainties are detailed in our periodic filings with the U.S. Securities and Exchange Commission. Please refer to those filings for more information on these risk factors and uncertainties. All forward-looking statements are qualified in their entirety by such risk factors and uncertainties. Statements regarding our financial outlook speak only as of the date of our second quarter 2013 earnings release, July 31, 2013, and all other forward-looking statements speak only as of the initial release date of this presentation, September 11, 2013. Subsequent events and developments may cause our forward-looking statements to change, and we will not undertake efforts to update or revise publicly any forward-looking statements to reflect new information or future events or circumstances after this date. Unless the context otherwise requires, when we use ‘‘Intrepid,’’ ‘‘our,’’ ‘‘we’’ or ‘‘us’’ during this presentation, we are referring to Intrepid Potash, Inc. and its consolidated subsidiaries. |

|

|

Company Overview The largest U.S. producer of potash Only western-world producer created and dedicated solely to potassium- related products Supplies ~ 1.6% of global demand and ~ 9.3% of U.S. demand One of only two global producers of the specialty product, sulfate of potash magnesia or langbeinite, which we market as Trio® Five active production facilities – growing to six with the construction of the HB Solar Solution mine 3 |

|

|

4 Intrepid’s Unique Position Participating in a market with favorable demand trends Over the long term, earning the highest average net realized sales price and cash margin per ton by utilizing our geographic advantage and marketing strategy and by serving diverse customers and markets Increasing our margin advantage opportunity by lowering cash costs per ton including placing incremental, lower cash cost tons in marketplace from HB Solar Solution mine Benefitting from a strong capital structure Concluding major, multi-year capital investment program that will lower our unit costs, drive growth, increase production flexibility, and create margin expansion opportunities Free cash flow expected in 2014 |

|

|

Farmer economics are supportive of a positive demand environment Annual U.S. potash consumption has been fairly constant for decades Farmers likely to replenish the nutrients drawn down during growing season Balanced fertilization is necessary to achieve maximum yields We serve approximately 9% of the U.S. demand annually, and are advantaged by running our facilities at near capacity Our industrial and feed markets are stable Demand for our granular sized Trio® product is robust 5 Current Potash Market – Demand Fundamentals Remain Solid |

|

|

Geographically Advantaged, Serving Diversified Markets and Customer Base with Flexible Product Mix Production facilities located in the heart of the markets we serve Trio® markets further diversify crops and customers Industrial market primarily consists of oil and gas drillers Potash used as a nutritional supplement in animal feed Investments will result in ability to granulate more than 90% of our production 6 End Market Product Size 2012 YTD June 30, 2013 Agricultural Granular 81% 76% Industrial Standard 12% 17% Animal Feed Standard 7% 7% Potash Sales Mix Industrial Agricultural Animal Feed |

|

|

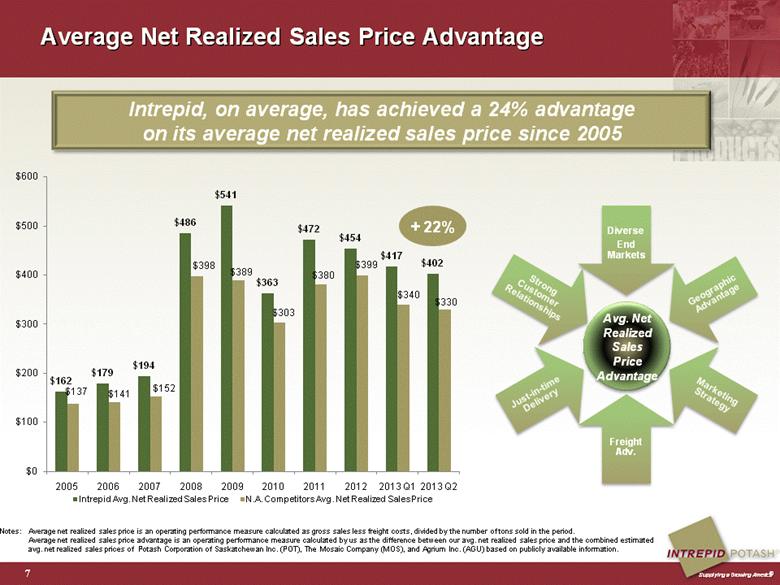

Average Net Realized Sales Price Advantage 7 Notes: Average net realized sales price is an operating performance measure calculated as gross sales less freight costs, divided by the number of tons sold in the period. Average net realized sales price advantage is an operating performance measure calculated by us as the difference between our avg. net realized sales price and the combined estimated avg. net realized sales prices of Potash Corporation of Saskatchewan Inc. (POT), The Mosaic Company (MOS), and Agrium Inc. (AGU) based on publicly available information. Intrepid, on average, has achieved a 24% advantage on its average net realized sales price since 2005 + 22% Avg. Net Realized Sales Price Advantage |

|

|

Average Cash Margin Advantage 8 (1) Cash Margin Advantage Note: Average cash margin advantage is calculated as average per ton net realized sales price advantage less warehousing and handling, royalties, and Cash COGS (calculated using the combined estimated average net realized sales prices and average estimated cash COGS of Potash Corporation of Saskatchewan Inc. (POT), The Mosaic Company (MOS), and Agrium Inc. (AGU) based on publicly available quarterly information). Cash COGS, net of by-product credits, is an operating performance measure defined as total cost of goods sold excluding royalties, warehousing and handling and depreciation, depletion and amortization divided by the number of tons sold in the period. Average Cash Margin Advantage Intrepid earns a higher average cash margin per ton for potash |

|

|

Improving Cash Margin Opportunity Through HB Cash operating costs set to improve as HB Solar Solution mine production ramps up HB cash operating costs projected to be less than $80 a ton on 150,000 to 200,000 annual tons in 2015 Benefit of incremental, lower-cost HB tons will begin with expected production of 100,000 tons in 2014 9 HB drives ability to expand potash cash margin advantage Note: Calculation assumes midrange of 2013 guidance as of July 31, 2013, which equals a $192.50 per ton cash operating cost for 800,000 tons, and an $80 cash operating cost per ton for 200,000 tons from HB. Cash operating costs ,net of by-product credits, is an operating performance measure defined as total cost of goods sold excluding royalties, warehousing and handling, and excluding depreciation, depletion and amortization divided by the number of tons sold in the period. Expected potash cash operating costs per ton pro forma for HB 11% to ~$170 Full year outlook for potash cash operating costs per ton ~$192 Expected HB cash operating costs per potash ton ~$80 |

|

|

HB Drives Cash Contribution Opportunity 10 Expected cash margin per ton from HB approximately double compared to current state Potential to grow cash margin faster than production growth Trio® adds nearly $161 of cash margin per ton Note: Calculation assumes midrange of 2013 guidance as of July 31, 2013, which equals a $192.50 per ton cash operating cost for 800,000 tons, and an estimated $80 cash operating cost per ton for 175,000 tons from HB. Cash operating costs, net of by-product credits, is an operating performance measure defined as total cost of goods sold excluding royalties, warehousing and handling, and excluding depreciation, depletion and amortization divided by the number of tons sold in the period. Average net realized sales price is 85% of Green Markets average Sep. 9, 2013 FOB cornbelt price. Trio® assumes Q2 2013 average net realized sales price and mid-ranges of 2013 guidance as of July 31, 2013, for production and cash operating costs. Indicative Projection of the Positive HB Impact $'s per ton, except cash contribution Potash Current State Expected HB Solar Contribution Potash Pro Forma Trio® Avg. net realized sales price: Green Markets FOB Cornbelt Sep. 9, 2013 $385 - $400 $385 - $400 $385 - $400 n/a Intrepid's historical average ~85% ~85% ~85% n/a Assumed avg. net realized sales price 334 $ 334 $ 334 $ 359 $ Cash operating costs 192 80 170 165 Royalties, warehousing and handling 32 32 32 33 Cash margin per ton 110 $ 222 $ 132 $ 161 $ Number of tons 800,000 175,000 975,000 172,500 Cash contribution 87,700,000 $ 38,784,375 $ 128,334,375 $ 27,772,500 $ |

|

|

Strong Capital Structure Cash and investment totaling $129 million at June 30 Cash on hand to fund completion of major capital projects Full availability under recently extended unsecured $250 million credit facility $150 million in unsecured long-term debt with average interest rate of less than 4% Capital investments in 2014 will be less than operating cash flows as major, multi-year projects are mostly concluded and placed into service in 2013 Expect to generate positive free cash flow in 2014 11 |

|

|

Capital Projects Are Focused on Growth, Flexibility & Margin 12 Reduced Per Ton Cash Costs Growth HB Solar Solution Mine Langbeinite Recovery Improvement Project Expansion and creation of new Moab horizontal potash caverns Langbeinite dense media separation plant Modernization of plants Increase West plant recoveries Focus on cash cost component of production North compaction Wendover compaction Langbeinite granulation Moab compaction Flexibility Margin & Recovery |

|

|

Project is nearly complete, ponds are full and mill construction underway Capital investment of $225-$245 million Cash production cost per ton estimated to be below $80 per ton at full production, making HB one of the lowest cost potash mines in North America Anticipated production timeline: First production to begin in late 2013 Ramp up of production expected during late 2014 Production levels increasing into 2015 and 2016 Opportunity for further expansion of solution mining activities with existing acreage at HB and recently acquired leaseholds 13 HB Solar Solution Mine – Driving Production Growth at Significantly Lower Cash Costs HB Solar Solution Mine Key Facts |

|

|

Expand Moab Solar Solution Mining – Incremental Production at Low Cost Expand solution mining footprint Cavern 1 began producing in 2002 and was expanded in 2012 Cavern 2 was constructed in 2012 and began producing in 2013 Cavern 3 is being drilled in 2013 with the benefit expected in late 2014 Excellent team of geologists and drilling experts successfully using latest technologies Creating horizontal intersecting mining caverns Incremental low cost solar solution tons 14 Expand Successful Operations |

|

|

Increases capacity and improves quality Flexibility to place the highest margin product into market Capacity to handle all of the new production from HB Solar Solution mine and increased production from our West mine Total capital investment is expected to be approximately $90 to $95 million, with $84 million invested through June 30, 2013 Commissioning underway with first line expected to be in service by end of the current quarter 15 Additional Granulation Capacity Is Key to Marketing and Production Flexibility Focus on Increasing Granulation Capacity at all Facilities Facility Product Anticipated Granulation Capacity Estimated In-Service Date Moab, Utah Potash 100% of annual production In service Wendover, Utah Potash 100% of annual production In service Carlsbad, New Mexico North Facility Potash 100% of annual production from West Mine and anticipated HB Solar Solution Mine production Commenced construction in Q2 2012; estimated in service date for 1st compactor line is Sep. 2013 Carlsbad, New Mexico East Facility Trio® Majority of annual standard Trio® production Began selling pellet production in 2013 Upgrade North Compaction Project |

|

|

16 Summary Only Western-World potash pure-play Highest average net realized sales price and cash margin per ton in North American Geographically advantaged assets serving diversified markets and customer base Focused on growth, flexibility, and margin expansion through the application of technology Capital investment program targeting incremental low cost tons from our reserve base and solar solution mining Strong capital structure Generating positive free cash flow in 2014 |

|

|

Appendix ® Supplying a Growing America® |

|

|

Financial Overview 18 Adjusted EBITDA* (in millions) Balance Sheet as of June 30, 2013 * These are financial measurements not calculated based on U.S. Generally Accepted Accounting Principles (Non-GAAP). Non-GAAP reconciliations available in the appendix to this presentation. Adjusted Net Income* (in millions) Earnings Per Share (Diluted) Cash and Investments $ 129 million Current Assets $ 214 million Total Assets $1,176 million Debt Outstanding(1) $ 150 million Total Liabilities $ 240 million Stockholders’ Equity $ 935 million Availability Under Unsecured Credit Facility $ 250 million (1) In April 2013, Intrepid issued $150 million aggregate principal amount of unsecured senior notes for proceeds of $149.3 million, net of offering costs. |

|

|

Non-GAAP Reconciliation Calculation of Adjusted EBITDA (in thousands) 19 Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is a non-GAAP financial measure that is calculated as net income adjusted for the add back of interest expense (including derivatives), income tax expense, depreciation, depletion, and amortization, and asset retirement obligation accretion. Management believes that the presentation of adjusted EBITDA assists investors and analysts in comparing Intrepid's performance across reporting periods on a consistent basis by excluding items that management does not believe are indicative of the Company's core operating performance. Intrepid uses adjusted EBITDA as one of the tools to evaluate the effectiveness of its business strategies. In addition, adjusted EBITDA is widely used by professional research analysts and others in the valuation, comparison, and investment recommendations of companies in the potash mining industry, and many investors use the published research of industry research analysts in making investment decisions. Adjusted EBITDA should not be considered in isolation or as a substitute for performance or liquidity measures calculated in accordance with U.S. GAAP. Because adjusted EBITDA excludes some but not all items that affect net income and net cash provided by operating activities and may vary among companies, the adjusted EBITDA amounts presented may not be comparable to similarly titled measures of other companies. The following is a reconciliation of adjusted EBITDA to net income, which is the most directly comparable U.S. GAAP measure: Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net Income $28,279 $30,708 $25,507 $24,917 $20,626 $19,013 $33,267 $14,537 $14,919 $11,317 Add: Interest Expense, including realized and 113 389 175 192 253 215 221 216 213 219 unrealized derivative gains and/losses Add: Income tax expense 18,851 20,068 16,547 10,384 12,613 12,312 10,685 13,874 8,698 7,171 Add: Depreciation, depletion, amortization and accretion 8,533 8,691 8,819 9,744 11,256 11,376 12,095 12,872 14,141 14,338 Total adjustments 27,497 29,148 25,541 20,320 24,122 23,903 23,001 26,962 23,052 21,728 Adjusted Earnings Before Income Taxes, Interest Depreciation, Depletion and Amortization $55,776 $59,856 $51,048 $45,237 $44,748 $42,916 $56,268 $41,499 $37,971 $33,045 2011 2012 2013 |

|

|

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net Income $28,279 $30,708 $25,507 $24,917 $20,626 $19,013 $33,267 $14,537 $14,919 $11,317 Adjustments Insurance settlements from property and business losses (12,500) - - - - - - - - - Income associated with New Mexico refundable employment-related credit* - (4,692) (3,230) - - - - - - - Unrealized derivative gain (321) (224) (368) (376) (224) (273) (272) (280) - - Loss on settlement of pension obligation termination 1,871 Compensating tax refund (1,705) Other - 5 188 3 330 (3) 181 60 8 4 Calculated tax effect** 5,128 1,955 1,350 148 (40) 107 30 78 (3) (64) Change in blended state tax rate to value deferred tax asset - - - (3,699) - - (4,290) 5,271 - 1,260 Total adjustments (7,693) (2,956) (2,060) (3,924) 66 (169) (4,351) 5,129 5 1,366 Adjusted Net Income $20,586 $27,752 $23,447 $20,993 $20,692 $18,844 $28,916 $19,666 $14,924 $12,683 2012 2011 2013 Non-GAAP Reconciliation Calculation of Adjusted Net Income (in thousands) 20 Adjusted net income is a non-GAAP financial measures that is calculated as net income adjusted for certain items that impact comparability of results from period to period including, among other items, insurance settlements from property and business losses, a portion of the income associated with the refundable employment-related credits from the State of New Mexico, non-cash unrealized gains or losses associated with derivative adjustments, and the effect of changes to Intrepid's state income tax rates on the value of its net deferred tax asset. Management believes that the presentation of adjusted net income provides useful additional information to investors for analysis of Intrepid's fundamental business on a recurring basis. In addition, management believes that the concept of adjusted net income is widely used by professional research analysts and others in the valuation, comparison, and investment recommendations of companies in the potash mining industry, and many investors use the published research of industry research analysts in making investment decisions. Adjusted net income should not be considered in isolation or as a substitute for net income, income from operations, cash provided by operating activities or other income, profitability, cash flow, or liquidity measures prepared under U.S. GAAP. Because adjusted net income excludes some but not all items that affect net income and may vary among companies, the adjusted net income amounts presented may not be comparable to similarly titled measures of other companies. The following are reconciliations of adjusted net income to net income which is the most directly comparable U.S. GAAP measure: * Included in “other operating (income) loss” line item ** Estimated effective tax rate of 37.7% for 2013 and 38.6% for 2012. |

|

|

Investing to Increase Production and Significantly Lower Costs 21 Intrepid has invested $750 million since inception underscoring our commitment to growth Major Capital Project Milestones Facility Year Completed / Estimated Completion HB Solar Solution Mine Carlsbad, NM – HB 2013E North Compaction Project Carlsbad, NM – North 2013E Horizontal Potash Cavern System Two Moab, UT 2012 Langbeinite Recovery Improvement Project / Granulation Plant Carlsbad, NM - East 2011/2012 Wendover Compaction Circuit / Warehouse Wendover, UT 2011/2012 New Warehouses Carlsbad, NM - East 2011 New Brine Heater Moab, UT 2010 New Compaction Circuit Moab, UT 2010 Underground Stacker / Reclaim Carlsbad, NM - West 2010 Coarse Tails Recovery Circuit Carlsbad, NM - West 2009 Wash Thickener Upgrade Carlsbad, NM - East 2009 Langbeinite Plant (Original Plant) Carlsbad, NM - East 2005 Horizontal Potash Cavern System One Moab, UT 2001 Major 2013 Capital Project In Progress Project Budget HB Solar Solution Mine $225-$245 North Compaction $90-$95 Moab Cavern System $20-$30 Total $335-$370 |

|

|

Historical Quarterly Production and Sales Summary 22 Jun. 30, Sep. 30, Dec. 31, Mar. 31, Jun. 30, Sep. 30, Dec. 31, Mar. 31, Jun. 30, Sep. 30, Dec. 31, Mar. 31, Jun. 30, Potash 165 166 224 234 209 173 197 218 170 189 218 222 182 Trio® 39 32 31 31 44 35 31 30 33 35 34 46 50 Potash 129 221 216 196 225 190 183 203 184 249 203 185 184 Trio® 63 45 27 52 39 39 28 28 26 27 43 39 35 2013 2010 Production Volume (In thousands of short tons) Sales Volume (In thousands of short tons) 2012 2011 |

|

|

United States Potash Consumption Remains Steady and Robust 23 Sources : Fertecon, United States Department of Agriculture (USDA), NOAA National Climatic Data Center. Potash consumption is shown in fertilizer years (July – June). Grains stocks include barley, corn, oats, sorghum and wheat. Potash fertilizer consumption has remained relatively constant with an annual volatility of approximately 9.8 percent over the past 32 years Corn acres planted in the U.S. in the years 2007 through 2012 were 93.5, 86.0, 86.4, 88.2, 91.9 and 97.2 million acres. 2013 planted acreage is forecast at 97.4 million acres. 1982: Recession leads to lower consumption; payment-in-kind program reduces planted acres 1991-1997: Low grain stocks lead to increased consumption 2001- mid 2008: Global economic expansion leads to increased demand (2006 delayed Chinese negotiations) 2010: Strong recovery in US agricultural markets Major droughts/floods in Corn Belt Droughts Floods 1987 1988 2000 2012 1993 2007 2008 2011 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% - 2,000 4,000 6,000 8,000 10,000 12,000 Grains Stocks - to - Use Ratio KCL Tons ('000) FERTECON U.S. Potash Consumption and Grains Stocks - to - Use Ratio KCL Tons Average KCl Consumption Stocks-to-Use Ratio |

|

|

Depleted Conventional Mines Mines Currently With Less than 15 Years Reserve Life Theodore, Amelie, Marie Louis mines- France Pasquasi and San Cataldo mines - Italy Salzdetfurth, Friedrichshall, Bergmannssegen-Hugo, Siegfried-Giesen, and Niedersachen-Riedel - Germany Trona, California Horizon-Amax, Wills-Weaver, Saunders – Carlsbad, New Mexico Hersey, United States - Mosaic Boulby, England – ICL Soligorsk I, Belarussia - Belaruskali Taquari, Brazil – Vale 24 sources: Fertecon, Intrepid Potash®, and public filings Global Industry Susceptible to Production Interruptions & Supply “Shocks” Mine Closures Due to Water Inflows PCA (Patience Lake) (0.8MM tons KCl / yr) Potacan mine (0.8MM tons KCl / yr) Mines with Water Inflows K2 Mine Esterhazy Produced 4.4 million tons KCl in 2012 Most recent 10-K indicated $250 million cost to mitigate in 2012 alone PCS New Brunswick Mine Produced 0.8 million tons KCl in 2012 Belaruskali Mine #2 Capacity to produce 2.5 million tons KCl per year St. Paul mine (Congo) (0.8MM tons KCl / yr) 1980 1984 1988 1996 2000 2013 2004 1992 1976 Berezniki I (1.3MM tons KCl / yr) Berezniki 3 mine (1.8MM tons KCl / yr) Mine Closures Due to Depletion Due to geology, in the 70 plus years of potash mining in the Carlsbad area, there has never been a mine lost to flooding or a water incursion |

|

|

Fundamentals of Increasing Population Continue to Drive Grain and Ultimately Potash Demand Over the Long Term 25 Note: Grains include corn, wheat, barley, oats and sorghum. Stocks-to-use ratio is ending inventory / consumption for that crop year; data updated monthly. Sources: United Nations Food and Agriculture Organization (FAO), World Bank, US Census Bureau, USDA, Potash & Phosphate Institute (PPI,) International Fertilizer Industry Association (IFA), Fertecon (1) Futures prices based on closing price of Chicago Board of Trade futures contracts as of 8/29/13; futures prices for November/December delivery in forecast years. Hectares of Arable Land per Person Hectares per person Crop Prices Over Time(1) World Grain Production and Stocks-to-Use Ratios Grain Production Stocks-to-Use Ratio 5 Year Average Fall 2013 Futures Soybeans: $11.64 $13.68 Wheat: $6.50 $6.54 Corn: $5.39 $4.97 Grain Production (Millions of Tons) Stocks-to-Use Ratio Trend line Population Growth vs. Potash Demand 2013F 0.32 0.27 0.24 0.23 0.20 0.18 0.17 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 1970 1980 1990 2000 2010 2020E 2030E 10% 20% 30% 40% 50% 600 800 1,000 1,200 1,400 1,600 1,800 2,000 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 |

|

|

Intrepid Potash, Inc. 707 17th Street, Suite 4200 Denver, CO 80202 Visit our website at: www.intrepidpotash.com Investor relations contact: Gary Kohn Phone: 303.996.3024 Email: gary.kohn@intrepidpotash.com |