Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sleep Number Corp | form8k071713investorpresen.htm |

Driving long-term profitable growth July 2013 ®

Forward looking statements Statements used in this presentation relating to future plans, events, financial results or performance are forward- looking statements subject to certain risks and uncertainties including, among others, such factors as current general and industry economic trends; consumer confidence; the effectiveness of our marketing and sales programs, including advertising and promotional efforts; consumer acceptance of our products, product quality and brand image; our ability to continue to improve our product line and product quality; warranty obligations; availability of attractive and cost-effective consumer credit options; execution of our retail store distribution strategy; rising commodity costs and other inflationary pressures; our dependence on significant suppliers, including several sole- source suppliers and the vulnerability of suppliers to recessionary pressures; industry competition; risks of pending and potentially unforeseen litigation; increasing government regulations; the adequacy of our management information systems to meet the evolving needs of our business and evolving regulatory standards; our ability to attract and retain key employees; and uncertainties arising from global events, such as terrorist attacks or a pandemic outbreak, or the threat of such events. Additional information concerning these and other risks and uncertainties is contained in our filings with the SEC, including our Annual Report on Form 10-K, and other periodic reports filed with the SEC. The company has no obligation to publicly update or revise any of the forward-looking statements in this presentation. 2

Our Mission …to improve lives by Individualizing Sleep Experiences Our Vision …to become the world’s most beloved brand by delivering an Unparalleled Sleep Experience

Sleep Number® competitive advantages End-to-end customer experience Proprietary products • Adjustable air leadership • Benefit-driven and individualized • Difficult to replicate • Vertical – retailer and manufacturer • Customer feedback informs strategy • Lifetime customer relationships • Extraordinary in-store experience • Destination retailer • Control pricing Exclusive distribution Iconic brand – 6th most productive retailer* *Sales per square foot; source: retailsails.com 1 2 3 4 5 6 4 ®

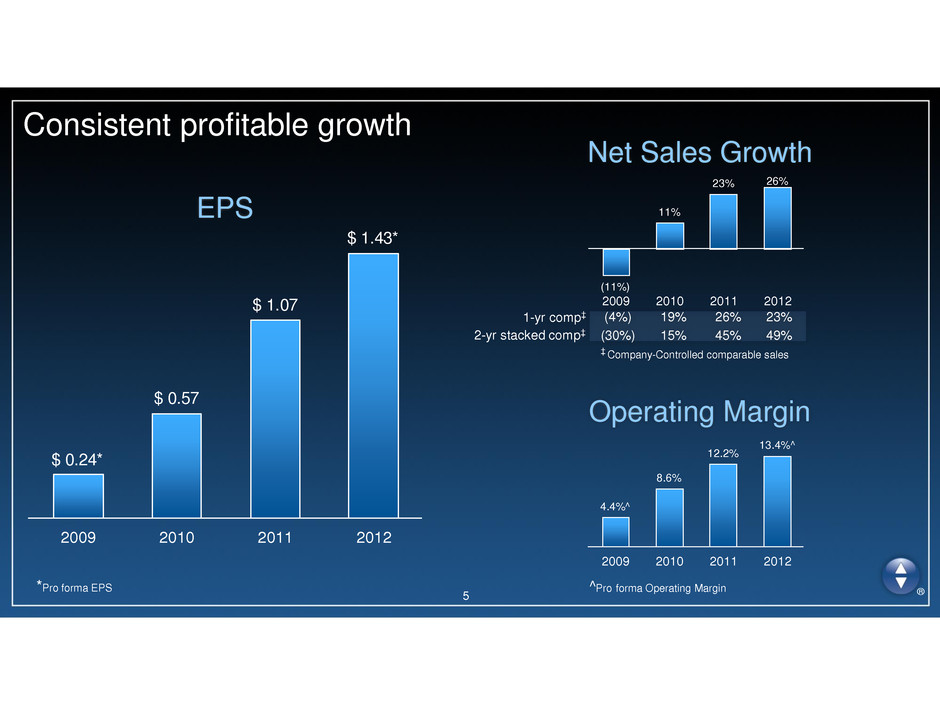

Consistent profitable growth EPS Net Sales Growth Operating Margin $ 0.24* $ 0.57 $ 1.07 $ 1.43* 2009 2010 2011 2012 (11%) 11% 23% 26% 2009 2010 2011 2012 (4%) 19% 26% 23% (30%) 15% 45% 49% 1-yr comp‡ 2-yr stacked comp‡ ‡ Company-Controlled comparable sales 4.4%^ 8.6% 12.2% 13.4%^ 2009 2010 2011 2012 *Pro forma EPS ^Pro forma Operating Margin 5 ®

$5.8 $6.5 $6.8 $6.9 $6.2 $5.7 $5.9 $6.3 $6.8 $7.2 $7.7 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013F 2014F Size of the opportunity US wholesale mattress sales $ in billions Industry sales $M Premium segment (>$1,000) percent of total Non-innerspring percent of total Source: Industry report (ISPA) & company estimates • “Sweet spot” of premium and non-innerspring • Good/better/best premium strategy • Sleep Number has 5% share of ~$14B industry at retail 6 19% 31% 53% 36% ®

$743M $400M+ $400M+ $1.5B 2011 Optimize existing stores Add new stores Target 7 Integrated growth formula Net sales growth Key drivers • Brand awareness • Local market development • Breakthrough product innovation ®

8 Brand awareness Broadened target customer Media investment & effectiveness Redefined target customer • Younger, more affluent & aspirational • Includes prime mattress buying years Advertising migration towards broader customer • Creative approach • Media execution • 30-54 yrs. old • $75K+ income • Values health • Will pay premium • Benefit driven • 45-65+ yrs. old • $50K+ income • Need state driven Increases target market 4x Before After 2009 2013E Primarily direct response (short-form infomercial & 1-800) Primarily broad reach (omni channel) 3x reach $61M ~$150M ®

54% 30% 21% 9 Brand awareness Awareness opportunity Awareness correlates to market share • Leading markets illustrate opportunity through local market development • Sleep Number unaided brand awareness below industry leaders – significant opportunity Leading Innerspring Sleep Number Leading Non-innerspring Sleep Number National Averages Sleep Number Leading Market Awareness Market share 21% 35% 5% 13% ®

$1.0M $1.3M $1.7M $2.2M $3.0M 2009 2010 2011 2012 Target 10 Local market development Optimize stores Location • format • design • Relocate mall to non-mall - Increased flexibility and billboard for brand - 2 times square footage with similar fixed costs • Mall remodels/expansions • New design: 50% 90%+ of stores by 2015 Average sales per store ®

11 Local market development Grow stores Fill-in national footprint • New store economics - Capital investment ~$350K - Inventory $30K - Payback 12-18 months - Average year 1 sales ~$2M 403 386 381 410 >500 2009 2010 2011 2012 2015E 2% 3% 8% 19% % Non-Mall Ending store count ® $3M Store $1.2+ $2.2M Store $0.8 - $0.9 • 2012 4-wall profit ($ in millions)

12 Local market development Initial 7 markets Aggressive growth strategy • Strategy - 13 underdeveloped markets – 1/3 of U.S. bedding sales - Objective: double market share in 3 years - Heavy-up local media and real estate optimization - Launched 4 in 2011 and 3 in 2012; 6 remain for 2013-2015 • Results to date - On track to double market share in three years - Profitability exceeding goals Awareness* +2pts +4pts 17% +1pts +2pts 4% +6pts +3pts +91% +127% Market share Local market Profit** Revenue Year 2 results (4 markets) Year 1 results (7 markets) At launch (7 markets) *Unaided Brand Awareness per Company study **Profit excluding national media and customer service ®

13 Breakthrough product innovation DualTemp™ Layer New m & i series • Temperature balancing layer can be used on all mattress brands • Proprietary active air technology evenly distributes each sleeper’s desired temperature • Queen DualTemp™ layer: $1,699 • Advanced DualAir™ technology achieves ideal comfort and support with a simple intuitive remote • Proprietary foam and layer combinations • Temperature balancing materials • Queen bed sets start at: $3,499 ®

4.4%^ 8.6% 12.2% 13.4%^ 15% 2009 2010 2011 2012 Target 14 Advantaged business model Operating margin Key drivers ^Pro forma Operating Margin • Gross margin rate improvement - Product innovation - Operational efficiency • Modest SG&A leverage as we invest in growth - New stores/occupancy - Marketing to build awareness - R&D investment - Infrastructure/depreciation ®

$52 $24 $7 $178 $146 $76 201220112010 Capital expenditures Cash & marketable securities 15 Advantaged business model Adjusted EBITDA Cash balance $ in millions, trailing-twelve months $ in millions • Operate with strong cash reserves • Self-funding growth ... #1 priority for cash • Maintain share count through stock repurchase program • No debt, strong balance sheet $54 $62 $65 $70 $82 $90 $100 $109 $124 $134 $149 $150 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412 ®

16 Sleep Well and Dream Big

17 Appendix Sleep Number® Bed Series Pricing (Queen Sets): c3 c4 p5 p6 c2 Classic Performance Memory Foam m7 m9 $1,399 $1,699 $2,099 $2,599 $999 $3,299 $4,699 Innovation i8 i10 $3,299 $4,699 ®

Andy Carlin SVP & Chief Sales Officer Sleep Number since 2008 Other experience: Gander Mountain, Kohl’s, Target 18 Kathy Roedel EVP & Chief Services & Fulfillment Officer Sleep Number since 2005 Other experience: GE Healthcare Shelly Ibach President & CEO Sleep Number since 2007 Other experience: Macy’s, Target Corporation Karen Richard SVP & Chief Human Capital Officer Sleep Number since 1996 Other experience: TCF Financial Corp Annie Bloomquist SVP & Chief Product Officer Sleep Number since 2008 Other experience: Macy’s, Target Corporation Melissa Barra VP Strategy & Consumer Insights Sleep Number since 2013 Other experience: Best Buy, Grupo Futuro, Citibank Hunter Saklad SVP & Chief Technology Officer Sleep Number since 2004 Other experience: Ford Motor Company, Visteon Mark Kimball SVP & Chief Legal & Risk Officer Sleep Number since 1999 Other experience: Oppenheimer, Wolff & Donnelly Wendy Schoppert EVP & Chief Financial Officer Sleep Number since 2005 Other experience: US Bank, America West, Northwest Sleep Number ® Setting Experienced management team Sleep Number ® Setting Sleep Number ® Setting Sleep Number ® Setting Sleep Number ® Setting Sleep Number ® Setting Sleep Number ® Setting Sleep Number ® Setting Sleep Number ® Setting ®

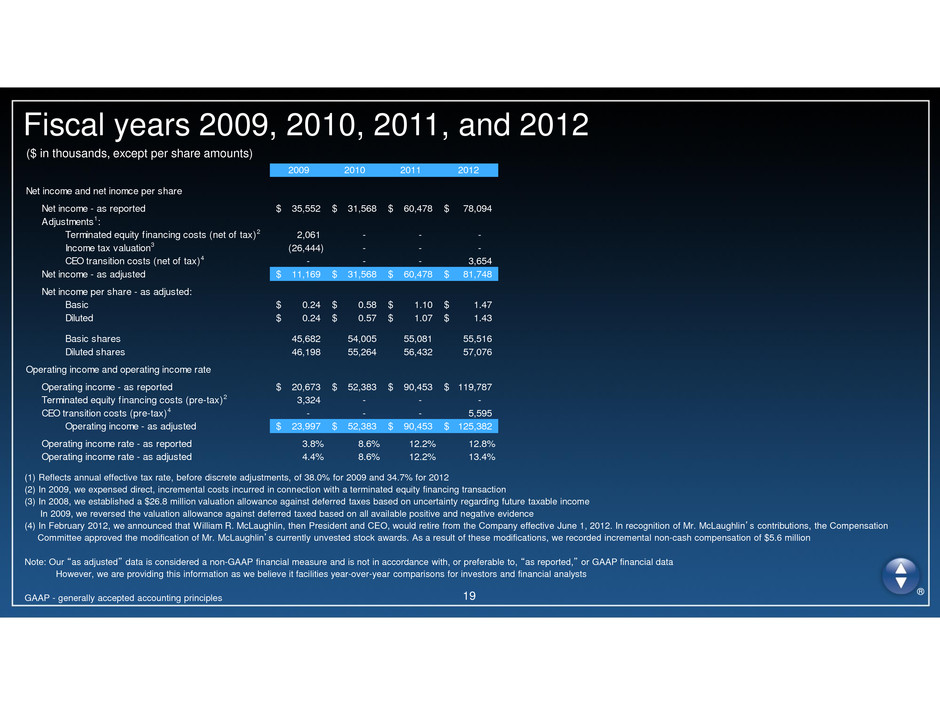

19 (1) Reflects annual effective tax rate, before discrete adjustments, of 38.0% for 2009 and 34.7% for 2012 (2) In 2009, we expensed direct, incremental costs incurred in connection with a terminated equity financing transaction (3) In 2008, we established a $26.8 million valuation allowance against deferred taxes based on uncertainty regarding future taxable income In 2009, we reversed the valuation allowance against deferred taxed based on all available positive and negative evidence (4) In February 2012, we announced that William R. McLaughlin, then President and CEO, would retire from the Company effective June 1, 2012. In recognition of Mr. McLaughlin’s contributions, the Compensation Committee approved the modification of Mr. McLaughlin’s currently unvested stock awards. As a result of these modifications, we recorded incremental non-cash compensation of $5.6 million Note: Our “as adjusted” data is considered a non-GAAP financial measure and is not in accordance with, or preferable to, “as reported,” or GAAP financial data However, we are providing this information as we believe it facilities year-over-year comparisons for investors and financial analysts GAAP - generally accepted accounting principles Fiscal years 2009, 2010, 2011, and 2012 ($ in thousands, except per share amounts) 2009 2010 2011 2012 Net income and net inomce per share Net income - as reported 35,552$ 31,568$ 60,478$ 78,094$ Adjustments1: Terminated equity f inancing costs (net of tax)2 2,061 - - - Income tax valuation3 (26,444) - - - CEO transition costs (net of tax)4 - - - 3,654 Net income - as adjusted 11,169$ 31,568$ 60,478$ 81,748$ Net income per share - as adjusted: Basic 0.24$ 0.58$ 1.10$ 1.47$ Diluted 0.24$ 0.57$ 1.07$ 1.43$ Basic shares 45,682 54,005 55,081 55,516 Diluted shares 46,198 55,264 56,432 57,076 Operating income and operating income rate Operating income - as reported 20,673$ 52,383$ 90,453$ 119,787$ Terminated equity f inancing costs (pre-tax)2 3,324 - - - CEO transition costs (pre-tax)4 - - - 5,595 Operating income - as adjusted 23,997$ 52,383$ 90,453$ 125,382$ Operating income rate - as reported 3.8% 8.6% 12.2% 12.8% Operating income rate - as adjusted 4.4% 8.6% 12.2% 13.4% ®

20 (trailing-twelve month basis) Adjusted EBITDA for 2009, 2010, 2011, and 2012 SELECT COMFORT CORPORATION AND SUBSIDIARIES Earnings before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) (in millions) We define earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) as net income plus income tax expense (benefit), interest expense, depreciation and amortization, stock-based compensation and asset impairments. Management believes Adjusted EBITDA is a useful indicator of our financial performance and our ability to generate cash flows from operations. Our definition of Adjusted EBITDA may not be comparable to similarly titled definitions used by other companies. The tables below reconcile Adjusted EBITDA (on a trailing-twelve month basis), which is a non-GAAP financial measure, to comparable GAAP financial measures: Columns may not foot due to rounding Note: Our Adjusted EBITDA calculation is considered a non-GAAP financial measure and is not in accordance with, or preferable to, “as reported,” or GAAP financial data However, we are providing this information as we believe it facilitates analysis of the Company’s financial performance by investors and financial analysts GAAP - generally accepted accounting principles (tr ili g-twelve mo t , $ in millions) Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Net income 35.6$ 46.0$ 56.2$ 59.8$ 31.6$ 40.4$ 45.5$ 52.2$ 60.5$ 66.3$ 72.0$ 81.0$ 78.1$ Income tax expense (benefit) (20.9) (17.3) (17.1) (14.2) 18.9 24.0 26.6 29.6 29.9 32.0 34.7 39.5 41.9 Interest expense 6.0 5.9 4.5 2.9 2.0 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 Depreciation and amortization 17.7 16.4 14.9 13.2 13.0 12.8 12.8 13.0 13.5 14.6 16.1 17.8 19.7 Stock-based compensation 3.2 3.0 2.9 3.5 4.0 4.3 4.7 4.9 5.0 10.8 11.1 10.9 10.3 Asset impairments 0.7 0.3 0.2 0.4 0.3 0.3 0.4 0.1 0.1 - - 0.1 0.1 Adjusted EBITDA 42.3$ 54.3$ 61.6$ 65.5$ 69.7$ 82.2$ 90.3$ 100.2$ 109.2$ 123.9$ 134.0$ 149.4$ 150.3$ ®