Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - Li3 Energy, Inc. | v345845_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - Li3 Energy, Inc. | v345845_ex99-2.htm |

| 8-K - FORM 8-K - Li3 Energy, Inc. | v345845_8k.htm |

Exhibit 99.1

“ Advancing the Development of Li thium & other Strategic Minerals” May 2013 1 Corporate Presentation Li3 / Blue Wolf Transaction

Disclaimer: 2 Any statements contained herein which are not statements of historical fact may be deemed to be forward - looking statements, including, without limitation, statements identified by or containing words like “believes,” “expects,” “anticipates,” “intends,” “estimates,” “projects,” “potential,” “target,” “goal,” “plans,” “objective,” “should”, or similar expressions . All statements by us regarding our possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives and similar matters are forward - looking statements . Li 3 and Blue Wolf give no assurances that the assumptions upon which such forward - looking statements are based will prove correct . Forward - looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions (many of which are beyond our control), and are based on information currently available to us . Actual results may differ materially from those expressed herein due to many factors, including, without limitation : the risk that more than 1 , 467 , 970 of Blue Wolf’s ordinary shares will be validly tendered and not properly withdrawn prior to the expiration of Blue Wolf’s tender offer which would then cause us to ( i ) be unable to satisfy the Maximum Tender Condition and the Merger Condition (as each is described in Blue Wolf’s Offer to Purchase), (ii) be unable to consummate the merger and (iii) withdraw Blue Wolf’s tender offer ; the risk that Blue Wolf’s Registration Statement on Form F - 4 is not declared effective prior to July 22 , 2013 , or even if effective, Li 3 may not have sufficient time subsequent to effectiveness to seek stockholder approval of the merger under Nevada law, or even if so, that Li 3 stockholders do not approve the merger ; the risk that governmental and regulatory review of the tender offer documents may delay the merger or result in the inability of the merger to be consummated by July 22 , 2013 and the length of time necessary to consummate the proposed merger ; the risk that a condition to consummation of the merger may not be satisfied or waived ; the risk that the anticipated benefits of the merger may not be fully realized or may take longer to realize than expected ; the risk that any projections, including earnings, revenues, expenses, margins, mineral reserve estimates or any other financial items are not realized ; changing legislation and regulatory environments including those in foreign jurisdictions in which Li 3 intends to operate ; the ability to list and comply with NASDAQ’s continuing listing standards, including having the requisite number of round lot holders or stockholders and meeting the independent director requirements for the board of directors and its committees ; Li 3 ’s mineral operations are subject to Chilean law and government regulation ; validation of the POSCO technology ; obtaining and the issuance of necessary government consents ; confirmation of initial exploration results ; our ability to raise additional capital for exploration ; development and commercialization of our projects ; future findings and economic assessment reports ; our ability to identify appropriate corporate acquisition or joint venture opportunities in the lithium mining sector and to establish appropriate technical and managerial infrastructure ; political stability in countries in which we operate ; and lithium prices . These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the Schedule TO (and any amendments thereto) to be filed by Blue Wolf in connection with the transaction and the tender offer . For further information about risks faced by Li 3 , and its Maricunga Project, see the “Risk Factors” section of the Company’s Form S - 1 , filed with the SEC on January 17 th, 2013 . Blue Wolf and Li 3 undertake no obligation to update any forward - looking statement contained herein to reflect events or circumstances which arise after the date of this presentation .

3 Transaction Overview May 17 , 2013 , Blue Wolf Mongolia Holdings Corp . (NASDAQ : MNGL)(“BW”) and Li 3 Energy Inc . (OTC BB : LIEG)(“Li 3 ”) entered into an Agreement and Plan of Merger At closing, a wholly owned subsidiary of BW will merge with and into Li 3 (the “Merger”), with Li 3 surviving the Merger On the closing date, BW intends to change its name to Li 3 Energy Corp . and continue to have its securities listed on the NASDAQ Stock Market Prior to closing, BW to effect redemptions of its ordinary shares through a tender offer BW needs to retain an aggregate of approximately $ 7 . 8 MM to fund transaction related expenses and satisfy a condition of the Merger that BW retain at least $ 5 . 0 MM of cash thereafter BW’s sponsor will forfeit 80 % of its founder shares and 80 % of its sponsor warrants in support of the transaction Prior to closing, Li 3 will hold a shareholder meeting to approve the Merger Based on its discussions with POSCO and other large shareholders, Li 3 ’s management expects Li 3 to meet the following closing conditions in support of the Merger : 1 ) Li 3 shareholders holding at least 51 % of Li 3 ’s shares, including POSCO and Li 3 ’s officers and directors, will execute support & lockup agreements, and 2 ) POSCO will execute a new investor rights agreement with Li 3 and BW At closing, Li 3 shareholders will receive 1 BW share of BW for every 250 Li 3 shares of common stock held by them BW shareholders who DO NOT tender for cash will be shareholders of the Li 3 Energy Corp . Li 3 Energy Corp . will retain a minimum of $ 5 . 0 MM and a maximum of $ 19 . 4 MM of proceeds, net of BW shareholder redemptions and transaction related expenses It is anticipated that proceeds will be used to repay Li 3 short - term debt and for Li 3 acquisition payments, working capital and the development of its lithium projects in Chile The transaction received unanimous approval by the boards of directors of both Li 3 and BW The Board of Li 3 Energy Corp . will consist of 7 directors, 4 nominated by Li 3 and 3 by BW

Li3 Energy Overview Largest owner of lithium concessions in the Salar de Maricunga, the second largest lithium - bearing salt brine deposit in Chile Maricunga Lithium Brine Project In May 2011 , paid $ 64 MM in cash and stock for a 60 % controlling interest In 2012 , completed $ 8 million exploration and development program In April 2012 , published NI 43 - 101 Compliant Measured Resource ( 20 - year life at 15 , 000 tonnes per year Lithium Carbonate) In March 2013 , received DIA (environmental permit) that allows Li 3 to move towards Feasibility study In May 2013 , signumBOX ranked Li 3 ’s Maricunga the 4 th Top Undeveloped Lithium Projects in the World SLM Cocina mining concessions Paid $ 7 . 3 MM cash, including $ 2 . 0 MM at signing of acquisition in April 2013 Concessions are adjacent to the Maricunga Project Grandfathered rights – an exploitation license is not required to produce and sell lithium from these concessions POSCO is strategic partner and largest individual shareholder ( 25 . 4 % ) Invested $ 18 MM in equity in two equity tranches in 2011 and 2012 Developer and owner of proprietary technology for extracting lithium from brine Completed testing of a pilot plant in Chile in March 2013 ; Processed Maricunga brine and demonstrated faster and higher recoveries than conventional evaporation processing methods 4

Rock Drilling / Boart Longyear Camp Core Samples Office Storage Dormitories Kitchen & Dining Trucks Lab Showers Restrooms Lithium Brine Assets 1 , 888 Hectares in the Salar de Maricunga Maricunga Project SLM Litio 1 - 6 : 1 , 438 hectares (blue) NI 43 - 101 Measured Report shows 630 , 432 t lithium carbonate and 1 , 628 , 409 KCl as resources 60 % owned via Chilean subsidiary Minera Li Energy SPA SLM Cocina : 450 hectares (green ) Adjacent to Maricunga Project Acquired for $ 7 . 3 MM cash ; $ 2 . 0 MM paid at signing on April 16 , 2013 , $ 2 . 0 MM due on July 16 , 2013 , $ 1 . 8 M due on October 16 , 2013 , and $ 100 k annually for 15 years beginning April 16 , 2014 Acquisition makes Li 3 the largest holder of lithium exploration properties in the Salar de Maricunga Grandfathered right to exploit lithium ; Lithium is not exploitable under current Chilean regulations, however, the SLM Cocina property is not subject to that limitation Li 3 ’s technical team has developed a circa $ 7 MM NI 43 - 101 compliant work program targeted to produce a Feasibility S tudy by 4 Q 14 5

Partnership with POSCO 6 A blue chip multinational company based in South Korea One of the world’s largest steel producers, with operations in 12 countries Publicly - listed on the NYSE with an equity market cap of $ 22 Bn and investment grade credit ratings Developer and owner of proprietary technology for extracting lithium and other chemicals from salt brine without the reliance on solar evaporation ponds Strategic partner and largest individual shareholder of Li 3 Signed strategic partnership with Li 3 in 2012 Invested $ 18 MM in two equity tranche : $ 10 MM in 2011 and $ 8 MM in 2012 Represented by SungWon Lee, Phd on Li 3 ’s board of directors Owns 25 . 4 % of Li 3 ’s outstanding shares and 65 % of its warrants and options Built and tested a pilot plant in Chile Located near the the Salar de Maricunga ; Constructed and operated at POSCO’s sole expense In March 2013 , POSCO announced pilot plant test results on processing of Maricunga brine* Demonstrated lithium recoveries of approximately 80 % versus typical recoveries of 40 - 50 % for conventional solar evaporation* Achieved lithium carbonate end product in 8 hours versus industry average of 12 months typical of conventional solar evaporation* Non dependent on climate conditions, self contained and eliminates the use of evaporation ponds* * Source: BN Americas, March 12, 2013

Alternative Lithium Extraction Methods For extracting lithium from salt brines, the conventional approach uses natural solar evaporation Typical processing time of 12 - 18 months for extraction of lithium with typical recoveries of 40 - 50% Requires a large land footprint Solar evaporation ponds represent one of the largest capital expenditures for the project Evaporation and production rates are sensitive to elevation and climate conditions POSCO’s proprietary technology offers several potential advantages for extracting lithium from salt brine* Eliminates the use of evaporation ponds, thereby reducing capital requirements, time to market, required land footprint, and variability of production rates and quality Lowers processing times (typically 8 hours), thereby reducing working capital requirements and time to market Higher lithium recoveries (typically 70 - 80%), thereby enabling faster and greater recovery of lithium from the same brine resource 7 * Source: Li3 management, BN Americas article dated March 12, 2013

8 Transaction Rationale Li 3 seeks to recapitalize the company, strengthen its balance sheet in order to advance the development of its projects and become a low cost lithium producer It is anticipated that transaction proceeds will be used to repay Li 3 short - term debt and for Li 3 acquisition payments, working capital, and development of its lithium projects in Chile Implement a NI 43 - 101 work program for the SLM Cocina asset Demonstrate POSCO Technology in Chile Test Facility Advance both assets (Maricunga & Cocina) to Feasibility Study stage and commercial scale Pursue possible joint venture opportunities in Maricunga Following the Merger, Li 3 Energy Corp . will apply for a listing on the TSX Venture Exchange, which if successful, could broaden institutional investor base and research coverage The transaction will position Li 3 Energy Corp . as an emerging producer and a consolidator in the lithium industry Li 3 believes that many of the current junior lithium projects currently being developed will fail due to lack of funding Consolidation in the industry has begun, with two mergers completed in the last 12 months (Galaxy acquisition of Lithium One and Chengdu Tianqi Industry acquisition of Talison)

9 9 9 9 9 9 9 9 Projected 18 Month Capital Need 9 Li 3 ’s capital requirements are anticipated to be as follows :

10 10 10 10 10 10 10 10 Transaction Proceeds 10 At closing, Li 3 Energy Corp . will retain a minimum of $ 5 . 0 MM and a maximum of $ 19 . 4 MM proceeds, net of BW shareholder redemptions and transaction related expenses

11 Pro Forma Capitalization At closing, BW will issue a total of approximately 1 . 58 MM shares valued at an aggregate of approximately $ 15 . 8 MM for 100 % of the issued and outstanding shares of Li 3

Management Luis Saenz – Chief Executive Officer – Director Named head of Standard’s Bank PLC . mining and metals team, Americas ( 2007 ) . Joined Standard Bank Plc’s investment banking unit in New York ( 1997 ) and relocated to Peru ( 1998 ) to establish Standard’s local Rep office to lead its mining and metals organization in Latin America . – Standard Bank (JSE:SBK ) is South Africa’s largest bank, conducting operations worldwide with a focus on emerging markets. Previously worked for Pechiney World Trade in base metals trading before joining Merrill Lynch as VP Commodities (Latin America) . Over 18 years of experience in mining finance and metals trading . Luis Santillana – Chief Financial Officer Over 13 years mining industry experience in finance and fund raising, debt facilities, deal negotiation and execution, strategic and financial planning, valuations to support decision making, treasury management, and improvement of management reporting . Former Strategic Planning Manager for ENRC PLC, a $ 7 B revenue diversified mining company listed on the LSE (FTSE 100 ) . Former member of the core management team at Hochschild Mining plc, a Peruvian gold and silver producer, that led Hochschild’s successful IPO and listing on the LSE (FTSE 250 ) . Financial Manager for the Peruvian subsidiaries . MBA from IESE Business School (Spain) and a Bachelor’s Degree in Industrial Engineering from Universidad de Lima (Peru) . Marc S . Lubow – Executive Vice President 25 + years of experience in business development, investment banking, finance, operations, operational preparedness and readiness initiatives, transaction negotiation and execution and strategic and financial planning . Successful track record as consultant for both public and private sector companies for successfully implementing strategies, strategic partnerships and alliances, business development, corporate communications and investor relations 12

Board of Directors 13 Patrick Cussen – Chairman of the Board 35 + years minerals and mining experience ; President of Celta, a mining consulting company based in Chile ; Former Managing Director of Chile Copper Ltd . , subsidiary of Codelco, in London ; Chairman of the Board of Cesco, the Chilean think - tank on mining . Patricio Campos – Director 40 years minerals and mining experience in project exploration, evaluation, technical and economic preparation ; Consultant to Anglo American and SQM (Salar de Atacama project), Falcon Mines, MAGSA, ACF Minera S . A . , Former Professor of Mining Economy and due diligence at the Mining Department, Universidad de Chile and Instituto de Ingenieros de Minas de Chile . Harvey McKenzie – Director Chartered Accountant, CFO and Corporate Secretary to Anconia Resources Corp . (TSXV : ARA . V) and Eurotin Inc . , (TSXV : TIN . V) ; CFO and Director to Manor Global Inc . , ; Former CFO to several Canadian publicly listed exploration, development and producing mining companies ; SungWon Lee, PhD . – Director Metallurgist with vast knowledge in aluminum forming and superplasticity ; Joined POSCO in 2000 currently serving as Director of Lithium Project Department ; Team Leader of New Business Development Department ; Led the development of the Magnesium Coil Project and the Fe - Mn Alloy Joint Venture . Luis Saenz – CEO & Director 18 + years of experience in mining finance and metals trading ; CEO of Li 3 Energy since its founding in 2009 ; Former Managing Director and Head of Americas Mining & Metals investment banking for Standard Bank ; Former base metals trader for Pechiney World Trade and Vice President of Commodities (Latin America) for Merrill Lynch Myron Manternach – Director 19 years of experience in investment banking and institutional investment management ; Financial advisor to investment funds, companies and projects in the natural resources and transportation industries as a Managing Director of Composite Capital, LLC and ACA Associates, Inc .; Director of Prophecy Platinum Corp . (TSXV : NKL . V), a Canadian junior mining company, and Bosques Amazonicos, a Peruvian forestry company Jonathan Lee – Director President of JGL Partners a consultant to investment funds and capital markets firms specializing in the natural resources and metals industries . Previously an equity research analyst with Byron Capital Markets specializing in the specialty metals industry, including lithium, vanadium, and graphite markets . Advised a number of shareholders on lithium investment holdings . Previously an engineer with Camp, Dresser & McKee Inc .

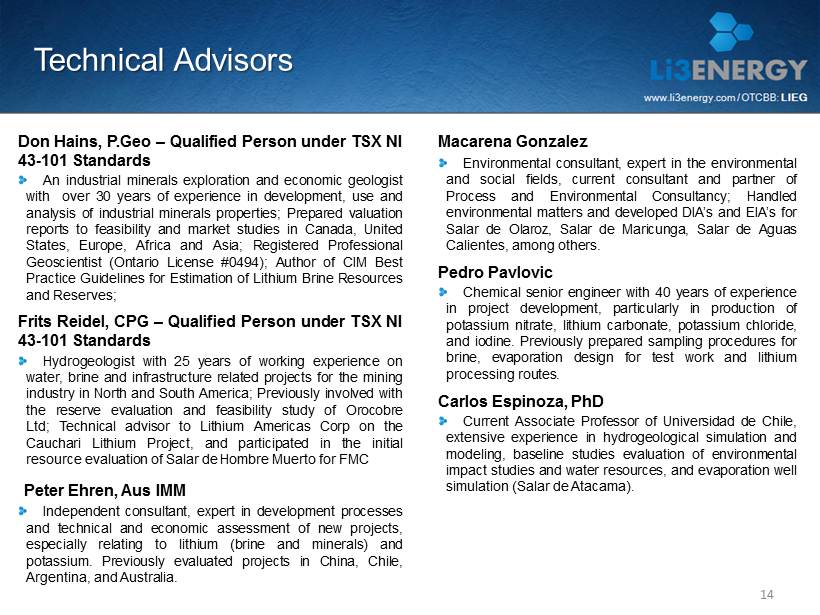

Technical Advisors 14 Don Hains, P . Geo – Qualified Person under TSX NI 43 - 101 Standards An industrial minerals exploration and economic geologist with over 30 years of experience in development, use and analysis of industrial minerals properties ; Prepared valuation reports to feasibility and market studies in Canada, United States, Europe, Africa and Asia ; Registered Professional Geoscientist (Ontario License # 0494 ) ; Author of CIM Best Practice Guidelines for Estimation of Lithium Brine Resources and Reserves ; Frits Reidel, CPG – Qualified Person under TSX NI 43 - 101 Standards Hydrogeologist with 25 years of working experience on water, brine and infrastructure related projects for the mining industry in North and South America ; Previously involved with the reserve evaluation and feasibility study of Orocobre Ltd ; Technical advisor to Lithium Americas Corp on the Cauchari Lithium Project, and participated in the initial resource evaluation of Salar de Hombre Muerto for FMC Peter Ehren, Aus IMM Independent consultant, expert in development processes and technical and economic assessment of new projects, especially relating to lithium (brine and minerals) and potassium . Previously evaluated projects in China, Chile, Argentina, and Australia . Macarena Gonzalez Environmental consultant, expert in the environmental and social fields, current consultant and partner of Process and Environmental Consultancy ; Handled environmental matters and developed DIA’s and EIA’s for Salar de Olaroz, Salar de Maricunga, Salar de Aguas Calientes, among others . Pedro Pavlovic Chemical senior engineer with 40 years of experience in project development, particularly in production of potassium nitrate, lithium carbonate, potassium chloride, and iodine . Previously prepared sampling procedures for brine, evaporation design for test work and lithium processing routes . Carlos Espinoza, PhD Current Associate Professor of Universidad de Chile, extensive experience in hydrogeological simulation and modeling, baseline studies evaluation of environmental impact studies and water resources, and evaporation well simulation (Salar de Atacama) .

15 Important Information About The Tender Offer: The tender offer for the outstanding ordinary shares of Blue Wolf Mongolia Holdings Corp . (“Blue Wolf”) referred to herein recently commenced . This presentation is neither an offer to purchase nor a solicitation of an offer to sell any securities . The solicitation and the offer to buy Blue Wolf’s securities has been made pursuant to an offer to purchase and related materials that Blue Wolf has filed with the SEC . At the time the offer commenced, Blue Wolf filed a tender offer statement on Schedule TO with the SEC . The tender offer statement (including an offer to purchase, a letter of transmittal and other offer documents) contains important information that should be read carefully and considered before any decision is made with respect to the tender offer . These materials are being sent free of charge to all shareholders of Blue Wolf when available . In addition, all of these materials (and other materials filed by Blue Wolf with the SEC) are available at no charge from the SEC through its website at www . sec . gov . Shareholders may also obtain free copies of the documents filed with the SEC by Blue Wolf by directing a request to : Blue Wolf Mongolia Holdings Corp . , Suite 409 , Central Tower, 2 Sukhbaatar Square, Sukhbaatar District 8 , Ulaanbaatar 14200 , Mongolia . Blue Wolf’s shareholders are urged to read the tender offer documents and the other relevant materials before making any investment decision with respect to the tender offer because they contain important information about the tender offer, the business combination transaction and the parties to the Agreement and Plan of Merger .

Maricunga Project Highlights & Lithium Market Statistics Appendix: 16

Lithium Market Growth 17 Lithium consumption is estimated to exceed 400,000 tonnes by 2025, driven by lithium battery demand SQM 26% Rockwoo d 12% FMC 7% China - own 18% Others 1% Talison 35% Lithium Market Share 2012 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Lithium c onsumption - Forecast 2012 - 2025 Tonnes LCE Others Polymers Aluminum Medical Continuos Casting Powders Air conditioning Lubricating greases Glass Frits Batteries Source: signumBOX estimates March 2013.

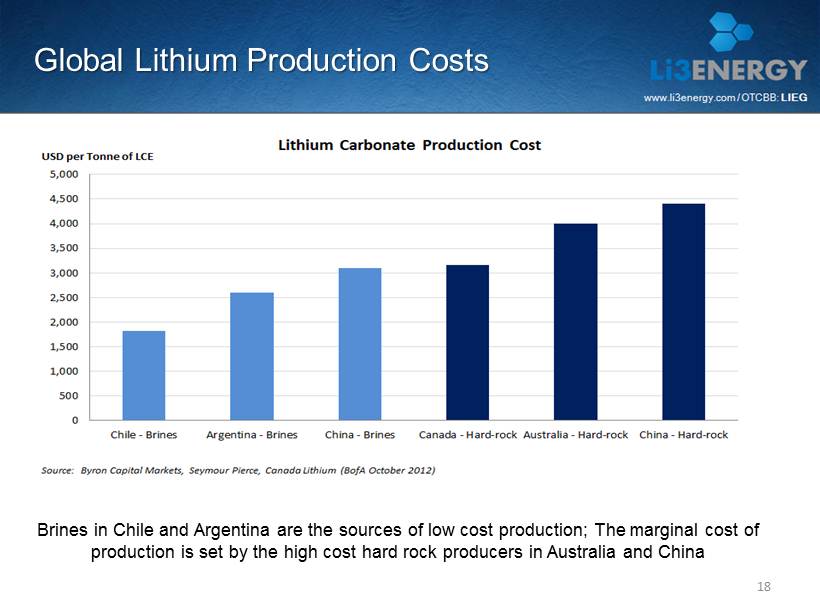

Global Lithium Production Costs 18 Brines in Chile and Argentina are the sources of low cost production; The marginal cost of production is set by the high cost hard rock producers in Australia and China

19 Capacity Utilization According to current forecasts for demand and capacity expansions, capacity begins to become constrained in 2023 66% 60% 53% 51% 52% 53% 56% 59% 63% 63% 68% 73% 79% 86% 92% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 100,000 200,000 300,000 400,000 500,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Demand – Production C apacity Balance Tonnes LCE Demand Production Capacity Utilization rate (%) Source: signumBOX estimates March 2013. New projects will be necessary to satisfy lithium demand

20 With demand growing, leading global companies are partnering in order to secure a stable, steady and secure secondary source of lithium Strategic Interest Note: Information compiled from public sources; April 2013 Numerous countries deem lithium as a strategic metal

Maricunga Project Highlights 21 Purchased 60 % of Maricunga from Sociedades de Minerales LITIO 1 a 6 de la Sierra Hoyada de Maricunga, a group of private companies : Comprised of six mining concessions, covering a total area of 1438 hectares ; Close to strategic mining epicenters (Copiapo and El Salvador) ; Infrastructure (road, port and Power) in place to support development ; Operative throughout the year . Located in the northeast section of the Salar de Maricunga in Region III of Atacama in northern Chile : Situated at an elevation of 3 , 760 m . a . s . l . Salar is listed as the 7 th largest lithium brine resource at 200 , 000 tonnes lithium, according to industry sources ; Previous studies (CORFO) indicate Maricunga would have a production cost lower than Salar de Hombre Muerto and slightly higher than Salar de Atacama due to net evaporation . In May 2013 , signumBOX, a leading, independent resource sector market analysis and research firm, ranked Li 3 ’s Maricunga : As 4 th top lithium project in the world out of 47 other brine salars ; Ranked behind 3 Argentina projects ; Highest ranked undeveloped lithium project in Chile ; Maricunga has 2 nd highest quality deposit of Li in Chile (After Atacama) ; Contains sodium chloride and other potassium salts as by - products ; Argentinean brines have lower Li and K concentrations ;

Maricunga Project Resource 22 In December 2011 , Li 3 completed a $ 8 MM Phase One Exploration and Development Program A total of 431 samples were taken during the drilling and were submitted to the University of Antofagasta in Antofagasta, Chile for analysis Excellent brine chemistry High concentration of Li ( 1 . 25 g/L) and a Mg/Li ratio ( 6 . 63 ) permitting lithium recovery Significant potential co - products , including boron Based on the results from Li 3 ’s Phase One Exploration and Development Program, the brine chemistry of the Salar de Maricunga compares favorable to that of other salars in Chile and Argentina

The April 2012 NI 43 - 101 Compliant Measured Resource Report includes the following conclusions and recommendations : “Results of airlift testing during the RC exploration drilling program and pumping tests on test trenches indicate that future brine production can be achieved through a combination of production wells and open trenches” “The analyses of brine chemistry indicate that the brine is amenable to lithium and potash recovery through conventional technology” “It is believed that through the application of proprietary technology developed by Li 3 ’s strategic partners, lithium recovery from the Maricunga brine can be significantly enhanced and may range from 45 percent to more than 70 percent” “It is the recommendation of the authors that a full feasibility study be completed for the Project” Maricunga Project Resource (cont’d) In April 2012 , Hains Technology & Associates completed a NI 43 - 101 Compliant Measured Resource Report with the following lithium and potassium resources (as compounds) estimated at : 23

Maricunga Development Plans 24 In March 2013 , Li 3 received a DIA (environmental permit) that allows it to move towards a Feasibility study Management plans further exploration work and expenditures to complete a Feasibility Study for the Maricunga and SLM Cocina properties As part of the feasibility study work plan, Li 3 plans to continue working with POSCO in order to evaluate the use of its proprietary processing technology as an alternative to solar evaporation methods

Maricunga Exploration: Site Map and Camp 25 Legend : : 2007 Campaign Drill Holes : Seismic Lines : Sonic Core Boreholes : Production Wells Camp was located 4km northeast from the Project. Camp Location Rock Drilling / Boart Longyear Camp Core Samples Office Storage Dormitories Kitchen & Dining Trucks Lab Showers Restrooms

Maricunga Exploration: Sonic Drilling (C - 1 to C - 6) and Core Samples 26 Sonic Drilling Truck at C - 3 Sonic Drill Hole Sonic Drilling Truck at C - 3 C - 3 Core Samples Core Sample Lab Samples C - 3 Core Samples

Maricunga Exploration: P - 1 and P - 2 Production Wells 27 Monitoring Well (Total of 4 per Production Well) Well Drilling Truck P - 2 Samples Production Well Pump, Located at P - 1 and P - 2 P - 2 and Monitoring Well Trench Brine Pumping Well Pump

Maricunga Operating Synergies & Economics Maricunga Lithium Process Potassium Chloride Lithium Carbonate Potential Nitrate Process Credit Potassium Nitrate Iodine The Maricunga Project expects to produce a potassium chloride (potash) co - product The potash to be shipped to a potential Nitrate Project, where it will be upgraded to a potassium nitrate fertilizer The value added process will upgrade the lithium carbonate potash to 120,000 tonne per year of potassium nitrate which is priced at approximately US$989 per tonne* Potential Nitrate Project could produce 700 tonnes per year of iodine which is priced at approximately US$41,000 per metric tonne* 28 Sodium Nitrate = + * Note: Pricing for Potasium and Iodine were compiled from public sources in January 2013 and are subject to change

Chilean Mining Law and Government Permit Updates 29 In Chile, lithium is considered “strategic” and therefore under current law is not exploitable under existing current mining concessions Li 3 formed a Consortium for the purpose of participating in the Chilean CEOL Auction consisting of POSCO, Mitsui, Daewoo International and Li 3 September 14 , 2012 : As required by the rules of the CEOL Auction, Li 3 submitted its sealed bid September 24 , 2012 : The Chilean Government notified Li 3 that the bid was won by SQM SQM Submitted a $ 40 M+ bid Li 3 Consortium submitted a $ 17 M+ bid Errazuris (Samsung as Backer) submitted a $ 6 MM+ bid September 27 , 2012 : Li 3 submitted a writ seeking to disqualify the SQM bid due to outstanding litigation (CEOL Rules clearly stated that no bidder would have any outstanding litigation with the State of Chile) October 1 , 2012 : Chilean Government, rescinded the SQM bid and declared the entire CEOL process invalid October 5 , 2012 : Li 3 filed formal request based upon the Rules established by the Ministry of Mining which stated it could disqualify any bidder due to not meeting the requirements, but it did not state the Government could declare the entire process invalid, thereby the CEOL should be awarded to the second highest bidder January 6 , 2013 : Li 3 submitted a letter to the Chilean Comptroller requesting to review the CEOL process . This is deemed the last administrative recourse before pursuing judicial remedies . Li 3 continues to evaluate strategies that could allow it to exploit lithium at the Maricunga Project

30 Comparable Company Statistics Note: As of May 17, 2013; Source: Management estimates, SEDAR and other public sources; For comparison purposes only; Not a form of expressed or implied outcome Project Maricunga - Brine Cauchari - Brine Oloroz - Brine Mkt Cap $13.72 MM $38.65MM $166.02MM Location Chile Argentina Argentina Economics Pre-Tax NPV (8%): $670MM Pre-Tax NPV (8%): $738MM Pre-Tax NPV (7.5%) $449MM Li Grade (mg/L Li) 1,250 585 690 Total LCE (tonnes) 663,264 11,752,000 1,500,000 Potassium Grade (mg/L K) 8,970 4,851 5,730 Total Potash (tonnes) 1,628,409 35,279,000 10,100,000 Mg/Li Ratio 6.6:1 2.34:1 2.4:1 Stage of Development NI 43-101 M&I Report Definitive Feasibility Study, Environmental Definitive Feasibility Study DIA for further work approved; Impact Study, Local Government Approval Project is fully permitted DFS Expected Q1-2014 Project is fully permitted Pre-construction Li 3 has a relatively low valuation based on the relative public market valuations and relative lithium resources

Li3 Equity Ownership 31

Contact: 32 Luis Saenz, Chief Executive Officer Marchant Pereira 150 Oficina 803 Providencia, Santiago - Chile luis.saenz@li3energy.com T: +56 2 2 896 - 9100