Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Santaro Interactive Entertainment Co | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Santaro Interactive Entertainment Co | v336394_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Santaro Interactive Entertainment Co | v336394_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Santaro Interactive Entertainment Co | v336394_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2012 | |

| OR | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ______________ to ______________ |

Commission file number 333-165751

SANTARO INTERACTIVE ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

| Nevada | 27-1571493 |

| (State or other jurisdiction of | (IRS. Employer |

| incorporation or organization) | Identification No.) |

901C, 9th Floor, Building 4, Courtyard 1

Shangdi East Road, Haidian District, Beijing 100025, The People’s Republic of China

(Address of principal executive offices, including zip code)

(8610) 82167111

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

| Non-accelerated filer | ¨ | Smaller reporting company | x | ||

| (Do not check if a smaller reporting company) | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $24,061,425 based on the closing price of such shares on June 29, 2012.

As of March 15, 2013, there are 69,875,000 shares of common stock outstanding.

TABLE OF CONTENTS

| Page Number | |

| Special Note Regarding Forward Looking Statements | 1 |

| PART I | |

| Item 1. Business | 2 |

| Item 1A. Risk Factors | 19 |

| Item 1B. Unresolved Staff Comments | 19 |

| Item 2. Properties | 19 |

| Item 3. Legal Proceedings | 19 |

| Item 4. Mine Safety Disclosures | 19 |

| PART II | |

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 |

| Item 6. Selected Financial Data | 20 |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 |

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk | 27 |

| Item 8. Financial Statements and Supplementary Data | 28 |

| Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 29 |

| Item 9A. Controls and Procedures | 31 |

| Item 9B. Other Information. | 34 |

| PART III | |

| Item 10. Directors, Executive Officers and Corporate Governance | 34 |

| Item 11. Executive Compensation | 39 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 42 |

| Item 14. Principal Accounting Fees and Services | 43 |

| PART IV | |

| Item 15. Exhibits, Financial Statement Schedules | 44 |

| SIGNATURES |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve assumptions, and describe our future plans, strategies, and expectations. Such statements are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words of other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our products, our potential profitability, and cash flows (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans and (e) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under "Item 1. Business" and "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations," as well as in this Annual Report on Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors as described in this Annual Report on Form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report on Form 10-K will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to ensure that the required statements, in light of the circumstances under which they are made, are not misleading.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

All references in this Annual Report on Form 10-K to the terms “we”, “our”, “us”, “Santaro” and “the Company” refer to Santaro Interactive Entertainment Company.

| 1 |

ITEM 1. BUSINESS

ORGANIZATIONAL HISTORY

We were incorporated in the State of Nevada on December 30, 2009. We maintain our statutory registered agent's office at EastBiz.com, Inc., 5348 Vegas Drive, Las Vegas, NV 89108, and our business office is located at 901C, 9th Floor, Building 4, Courtyard 1, Shangdi East Road, Haidian District, Beijing, China. We have not been subject to any bankruptcy, receivership, or similar proceeding, or any material reclassification or consolidation.

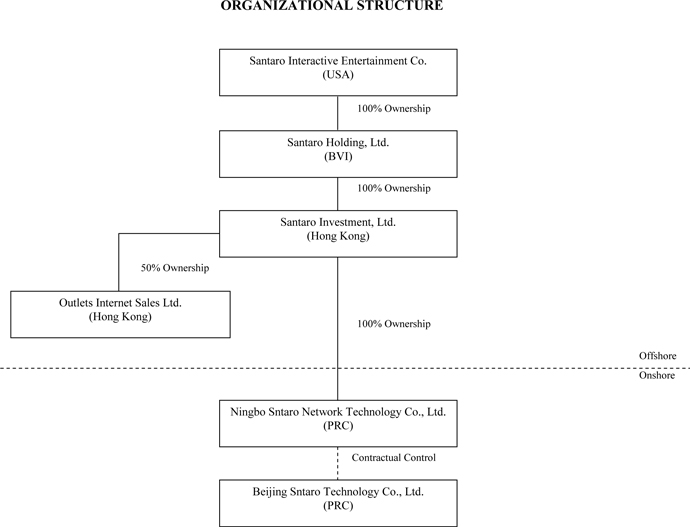

On October 12, 2010, Santaro Interactive Entertainment Company (OTCBB: STIE.OB) (“STIE”) completed the acquisition of 100% of the issued and outstanding capital stock of Santaro Holdings, Ltd. (“SHL”), a limited liability company organized under the laws of British Virgin Islands on December 2, 2009, in exchange for Fifty Five Million Six Hundred Seventy Thousand (55,670,000) shares of STIE. As a result of the acquisition, SHL became our wholly owned subsidiary. As shown in the chart below, SHL’s wholly-owned subsidiary, Santaro Investments, Ltd, a Hong Kong corporation, was incorporated on January 27, 2010. Santaro Investments, Ltd.’s wholly-owned subsidiary, Ningbo Sntaro Network Technology Co., Ltd., a wholly foreign owned enterprise (“WFOE”) organized under the laws of the People’s Republic of China (“PRC”), was incorporated on July 13, 2010. Ningbo Sntaro Network Technology Co., Ltd. exercises contractual control over Beijing Sntaro Technology Co., Ltd. (the “Beijing Sntaro”), an operating company organized under the laws of the PRC, which is principally engaged in the development and operation of online games. A detailed discussion regarding the contractual arrangement may be found below under the caption “VIE Structure”. Beijing Sntaro owned a 100% equity interest in Beijing Sntaro Freeland Network Co., Ltd, a company organized under the laws of the PRC, until December 31, 2012, when it transferred such interest to an unrelated third party. As a result of the transfer, FL Network ceased to be our subsidiary starting on December 31, 2012.

On July 18, 2011, Santaro Investments, Ltd established Outlets Internet Sale Limited jointly with New Select Group Limited, an unrelated company incorporated in BVI, each holding a 50% of the equity interest. The primary objective of the joint venture is to further extend and develop our online sales in the PRC.

| 2 |

ORGANIZATIONAL STRUCTURE

| 3 |

VIE Structure

PRC regulations prohibit direct foreign ownership of business entities providing internet content, or ICP, services in the PRC such as the businesses providing online games. In September 2010, a series of contractual arrangements were entered into between Ningbo Sntaro and Beijing Sntaro, its individual owners. These arrangements were renewed in December 5, 2011 due to the change in the paid-in capital of Beijing Sntaro. Pursuant to the agreements, Ningbo Sntaro provides exclusive technical consulting and management services to Beijing Sntaro. A summary of the major terms of the agreements are as follows:

| (1) | Ningbo Sntaro has a decisive right to determine the amount of the fees it will receive and it intends to transfer substantially all of the economic benefits of Beijing Sntaro to Ningbo Sntaro; |

| (2) | The equity owners of Beijing Sntaro irrevocably granted Ningbo Sntaro the right to make all operating and business decisions for Beijing Sntaro on behalf of the equity owners; |

| (3) | All equity owned by the three equity owners of Beijing Sntaro shall be pledged to Ningbo Sntaro as collateral for the service fee payable to Ningbo Sntaro; and |

| (4) | The equity owners of Beijing Sntaro may not dispose of or enter into any other agreements involving all and any of the equity interest of Beijing Sntaro without prior agreement by Ningbo Sntaro. |

Pursuant to the above arrangements, all of the equity owners' rights and obligations of Beijing Sntaro were assigned to Ningbo Sntaro, which resulted in the equity owners of Beijing Sntaro inability to make decisions that have a significant effect on Beijing Sntaro's operations, and enable Ningbo Sntaro to extract the profits from the operation of Beijing Sntaro and assume Beijing Sntaro's residual benefits. Because Ningbo Sntaro and its indirect parent are the sole interest holders of Beijing Sntaro, the Company consolidated Beijing Sntaro from its inception consistent with the provisions of FASB Accounting Standards Codification ("ASC") 810.

In addition, since all of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in the PRC, they will be interpreted in accordance with PRC law and any disputes will be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could further limit the Company’s ability to enforce these contractual arrangements. Furthermore, these contracts may not be enforceable in China if PRC government authorities or courts take a view that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event the Company is unable to enforce these contractual arrangements, it may not be able to exert effective control over Beijing Sntaro and its ability to conduct its business may be materially and adversely affected.

None of the assets of the variable interest entities (the “VIEs”) can be used to settle obligations of the consolidated VIE. Conversely, liabilities recognized as a result of consolidating the VIEs do not represent additional claims on the Company’s general assets.

Most of our operations are conducted through our affiliates that the Company controls through contractual agreements in the form of VIEs. Current regulations in China permit our PRC subsidiaries to pay dividends only out of accumulated distributable profits, if any, determined in accordance with their articles of association and PRC accounting standards and regulations. The ability of these Chinese affiliates to pay dividends may be restricted by factors that include changes in applicable foreign exchange and other laws and regulations.

| A. | Under PRC law, our subsidiary may only pay dividends after 10% of its after-tax profits have been set aside as reserve funds, unless such reserves have reached at least 50% of its registered capital. Such cash reserve may not be distributed as cash dividends. |

| B. | The PRC Income Tax Law also imposes a 10% withholding income tax on dividends generated on or after January 1, 2008 and distributed by a resident enterprise to its foreign investors, if such foreign investors are considered a non-resident enterprise without any establishment or place in China, or if the dividends have no connection with such foreign investors’ establishment or place in China, unless such foreign investors’ jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement. |

| 4 |

All of our current revenue is generated in PRC currency Renminbi (“RMB”). Any future restrictions on currency exchanges may limit our ability to use net revenues generated in Renminbi, to make dividends or other payments in U.S. dollars, or fund possible business activities outside China.

Foreign currency exchange regulation in China is primarily governed by the following rules:

| · | Foreign Exchange Administration Rules (1996), as amended in August 2008, or the Exchange Rules; |

| · | Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules. |

Under the Administration Rules, RMB is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service related foreign exchange transactions, but not for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, unless the prior approval of the SAFE is obtained and prior registration with the SAFE is made. Foreign-invested enterprises like ours that need foreign exchange for the distribution of profits to their shareholders may affect payment from their foreign exchange accounts or purchase and pay foreign exchange rates at the designated foreign exchange banks to their foreign shareholders by producing board resolutions for such profit distribution. Based on their needs, foreign-invested enterprises are permitted to open foreign exchange settlement accounts for current account receipts and payments of foreign exchange along with specialized accounts for capital account receipts and payments of foreign exchange at certain designated foreign exchange banks.

BUSINESS OVERVIEW

Santaro Interactive Entertainment Company is a development stage company that primarily designs, develops and operates web-based Massive Multiplayer Online Role-Playing Games (MMORPGs), mobile games, browser game platforms, as well as related products and services. We launched our first MMORPG, the 108 Warriors, and a browser game platform, www.1799.com, in August 2012 and November 2012, respectively. We are in the process of developing a number of web-based and mobile games, including League of Chibi Warriors and Rainblood Zero (temporary), which are excepted to be released in the third quarter of 2013.

MMORPGs

Santaro employs a development team with strong Research and Development (R&D) expertise and experience in the online gaming industry in China and Korea. Since our establishment, we have invested heavily in developing proprietary SOUL Game Engine and Coral Game Engine for new MMORPG development. In August 2012 Santaro launched its first MMORPG, the 108 Warriors.

The 108 Warriors

Our first MMORPG, the 108 Warriors, is a new Chinese martial arts online game based on traditional Chinese culture and inspired by ancient martial arts techniques. The game involves the twelve animals of the Chinese Zodiac, with masks from the Beijing Opera used to identify various characters. Players will be able to purchase different identities and the themes used are linked to the tribes of Chinese minority groups.

108 Warriors tells stories of a group of heroes who stand for different classes of people daring to struggle against the corrupt and unjust royal court and then rise up at the end of Northern Song Dynasty. It is a realistic martial-art game based on one of the Four Chinese Classical Masterpieces, Outlaws of the Marsh.

108 Warriors won the Golden Plume Award in 2012 for “Best Originality Online Game” after the release of the 3.1.6 version in August, 2012. The Golden Plume Awards is considered the most important award in the online gaming industry in China. The award is voted on by more than 50 million gamers across China is notorious for providing the best-representing of gamers in Chinese gaming industry.

| 5 |

As of December 31, 2012, there were 203,734 registered users since the development of the game, including 69,069 registered since the open beta release in August 2012.

We expect that a new server will be opened in April 2013. The total registered members of 108 Warriors in the fiscal year 2013 is expected to reach approximately 500,000.

Other MMORPGs

The following is an overview of other MMORPGs in development.

UU World. UU World is a competitive leisure racing game, and is the first game in Santaro’s UU World library, which will consist of a series of similar and separate role-playing games (RPGs). Players will be able to communicate, trade tools, and conduct various activities in the lobby of UU World. UU World is a platform for online game users to switch from one game to another. New games will be added to UU World in the future, such as UU Combat, UU Air Battle, UU Golf, UU Tennis and UU Fishing. Although these games are separate from each other, tools obtained in one game can be used in another.

UU World was suspended due to changes of market perspectives in the industry and we expect to further modify and optimize the contents and designs of the game in the future.

Browser Games Platform

In November 16, 2012, the Company established the web browser game platforms www.05yx.com, which later rebranded to www.1799.com. The website focus on providing a platform to Santaro’s self-developed browser games as well as higher quality third party games. The platform distributes games such as MMORPG, simulation games, board games, puzzle games and social games. The focus of the platform is to provide diversification and to make available a wide variety of games that appeal to a large and diverse spectrum of users. At the end of 2012, Santaro entered into distribution agreements with five third party game developers, pursuant to which we will distribute six new massive multiplayer online role-playing browser games developed by those developers.

The following are some brief descriptions of the games.

Heroes of Sango. Redesigned from Santaro’s development stage MMORPG, the Three Kingdoms Online, Heroes of Sango adopts the ancient history of China as the background to promoting Chinese martial arts and culture in a traditional way. This new game is based on the ‘Three Kingdoms’ (‘Three Kingdoms’ translated in Chinese is ‘SanGuo’), a well-known historical novel. The Three Kingdoms period, from 220 – 280 AD, is one of the bloodiest in Chinese history and is part of an era of disunity, the Six Dynasties, following the loss of power of the Han Dynasty emperors. Although relatively short, this historic period was full of power struggles, and the sophisticated military strategies have been greatly romanticized in Chinese, Japanese and Korean cultures. Celebrated and popularized over the centuries in operas, folk tales and novels in more recent times, the Three Kingdoms saga has now been produced in films, television series, and video games.

Contrary to other games based on the Three Kingdoms legend which are either formatted into western fantasy-style games or into more traditional Japanese-style games, Three Kingdoms Online reproduces the Three Kingdoms scenes very closely to reality with the help of strong historical content, thereby allowing players to have a better and more accurate feel for the game.

Three Kingdoms Online players need to choose a kingdom and start the game in their first role as a soldier. Players can enjoy reaching character levels and earning free points under the easy level-playing feature, and are enthralled by the large-scale lifelike combat and war systems. Players not only have to focus on the characters’ individual abilities, but must also attach importance to using additional equipment to get more power to defeat the enemies through a card system.

| 6 |

Cards offer instant magical power to attack the enemy, which is usually a decisive factor in battle. Players can recruit their own army once they have accumulated enough points, a feature which is separate from the various grades a player can obtain. Contestants will need to fight their way up the hierarchy to become the King of all Lands, who has all the power and privileges, commands the army in war and tries to unite all of the tribes.

The Three Kingdoms Online game is currently in post-development stage.

New Fantasy City. Developed by Funcity Inc., New Fantasy City was launched on November 16, 2012. The game is a cartoon-style turn-based MMORPG web browser game. It includes multiple battling systems such as group battles and Dungeons. The game has a total of 44 Bosses to compete with, making the game a unique style in the industry. Under the agreement with Funcity, Inc., Santaro is entitled to 65% of the monthly revenue derived from distributing the game if the monthly revenue is less than RMB300,000 (approximately US$48,000), and is entitled to 70% of the monthly revenue if the monthly revenue is at greater than or equal to RMB300,000 (approximately US$48,000).

Swooned Journey to the West. Developed by Guangzhou Jieyou Software Co., Ltd., Swooned Journey to the West was launched on November 23, 2012. The game’s storyline is based on one of the four masterpieces of Chinese ancient literature, Journey to the West. The game is integrated with multiple elements, including adventure, role-playing, etc. The featured graphic design and visual effects make it a fun playing game. Under the agreement with Jieyou Software Co., Ltd., Santaro is entitled to 60% of monthly revenue derived from distributing the game if the monthly revenue is less than RMB1,000,000 (approximately US$160,000), and is entitled to 65% of the monthly revenue if the monthly revenue is at greater than or equal to RMB1,000,000 (approximately US$160,000).

Battle of Thousand Heroes. Developed by Gamewave Group, Battle of Thousand Heroes was launched on November 30, 2012. The game is an action MMORPG based on the popular theme, the Three Kingdom. It has a faction battle system which makes it unique from other web browser games. The faction battle system was originally introduced from client-based MMORPGs and the system can often attract more users to join and play the game. Under the agreement with Gamewave Group, Santaro is entitled to 65% of monthly gross revenue derived from distributing the game.

Fallen Immortals. Developed by Guangzhou Mingchao Network Co., Ltd. Fallen Immortals was launched on December 20, 2012. The game is a cartoon-style action game which has a sophisticated item system and a dungeon system as well. The game’s storyline is based on fantasy fairytales, such as immortals fallen into the human land and conquer the devils and other enemies. Under the agreement with Mingchao Network Co., Ltd., Santaro is entitled to 60% of monthly revenue derived from distributing the game if the monthly revenue is less than RMB200,000 (approximately US$32,000), and is entitled to 65% of such monthly revenue if such revenue is at greater than or equal to RMB200,000 (approximately US$32,000).

Additionally, the Company has entered into distribution agreements with Shanghai UUZU Information Technology Co., Ltd., Guangzhou Xianhai Network Technology Co., Ltd., and Beijing Babeltime Technology Co., Ltd., pursuant to which the Company will distribute the games Knight Saga, a role playing MMORPG which won the 2012 Golden Plume Award for “User Most Enjoyed Top Ten Webgame”, the General, a simulation game (SLG) which won the 2012 Golden Plume Award for “User Most Anticipated Top Ten Webgame”, Warlord Flame, and Blood King Someday.

During the fiscal year 2012, we believe that we have enhanced our game portfolio through agreements with quality and award-winning developers for our expanding user base. We intend to broaden our strategic relationships in China as well as internationally in 2013.

Mobile Games

Mobile games are commonly referred to the games that are developed specifically for smart phones and other portable devices. According to Pyramid Research, the mobile gaming market is predicted to reach $18 billion by 2014 due to the growing number of wireless subscribers in emerging markets such as Brazil, China, India, Mexico, Nigeria, Poland, Russia and South Africa. Therefore the Company believes that, with the huge number of smart phone users increasing in China, the mobile game sector will be the Company’s next revenue generating point.

| 7 |

As of December 31, 2012, Santaro was in the process of developing two mobile games that are expected to be released in 2013.

League of Chibi Warriors

League of Chibi Warriors is a cartoon-style collectible card game (CCG). Users can access and control a variety of different legendary heroes from different times throughout the Chinese history. With all kinds of card-evolving and breeding systems, the users’ desire of collecting cards will be fulfilled in the most possible way by thousands of different kinds of cards.

The beta version of the game is expected to be released in May 2013, and we expect to launch the game in July 2013. Also we expect that the total revenue of the fiscal year of 2013 for this game will be approximately RMB 5.7 million (approximately USD 900,000).

Rainblood Zero (Temporary)

Rainblood Zero is an action game and it is one of a series of games originally developed in China. It tells a story about a virtual world filled with mystery and darkness, and people have to live in betrayal, lies and conspiracies. Our version is the mobile-transplanted version of the Rainblood Series Game

We expect to release the beta version of the game in early April 2013, and launch the full version in July 2013. The revenue of the fiscal year of 2013 is expected to be approximately RMB 4.6 million (approximately USD 730,000).

Other Services

E-Commerce Platform

On July 18, 2011, the Company established Outlets Internet Sale Limited jointly with New Select Group Limited, an unrelated company incorporated in BVI, each holding 50% of the equity interest. The primary objective for the joint venture is to further extend and develop our online sales in the PRC.

Jointly developed by Santaro and Outlet (China) Limited, the Outlets E-Commerce Platform Project is an e-commerce business and management platform, and an online virtual version of the Outlets China centers (www.outletcn.com/en/index.aspx), luxury-brand physical shopping centers currently under construction in the five largest metro regions of China. The Company expects the Outlets Online to be China’s first fully interactive virtual shopping environment, allowing the user to walk around the virtual outlets compound, enter the individual virtual shops, look through the product selection, input the user’s individual size and dimensions, try on the item and purchase it online.

Santaro’s proprietary platform offers numerous entertaining applications through its Application Programming Interface (API), providing a perfect high end shopping experience to online users.

Platform Features:

1. Fine System Structure. Through our proprietary system structure, users rapidly access the luxury Outlets shopping centers, and select products anytime from anywhere, through a platform that is stable, secure, accurate and expandable.

2. Characteristic 3D Shopping. Through 3D models and dressing up technology, products are displayed with fine effects. Online users can comprehensively experience a virtual shopping experience in a most realistic way, including trying on garments and accessories.

3. Flexible Business Management. Offers brand distributors many cooperation models for flexibility and ease of use.

| 8 |

4. Powerful Contents Management. Contents management including web, brands, products, commercials and events can be managed through self-management backstage system.

5. Complete Data Statistic. Customer preference analysis through tracking online behavior enables personalized shopping experiences catered to a customer’s individual needs and preferences.

6. Open Platform. Easily connects to a wide variety of applications through its open API function, building an integrated composite platform with features including shopping, lifestyle, entertainment, social network and so on.

In January, 2012, we developed a demo version of the virtual platform which contains most of the above features. However the development of the platform is fully depended on the development of the physical shopping centers since the look of the virtual malls will fully reflect the appearance of its physical models. We are currently waiting for the physical malls to be constructed and inhabited before we can further develop our virtual version of these malls. The constructions of the physical malls which was initiated and commenced by our partner was delayed. We expect to finalize the development of our virtual platform once we are informed of the completion of the physical malls by our partner.

TECHNOLOGY

SOUL Game Engine

Santaro has developed its own proprietary game engine technology for the development of MMORPGs, namely, the SOUL Game Engine. Three Kingdoms Online and UU World have both been developed using the SOUL Game Engine and, in the future, this engine will continue to be used for the development of both MMORPGs and web games.

Content might be king, but when it comes to Internet content, keeping up with technological innovation is just as crucial. Companies are continually developing new games with the latest technological tools to attract more users and boost revenues. Without its own game engine, a company cannot understand in any depth the key drivers needed for developing an online game. This is the reason why Santaro decided to develop its own proprietary advanced online engine product, which it calls the SOUL Game Engine. Santaro’s proprietary technology will support over 40,000 simultaneous players. This is a larger concurrent user capacity than most online game companies are currently able to operate in China. Below is a brief description of the six key components of the SOUL Game Engine. These include: World Map Editor, Physical Properties Tool, Physical Effects Tool, Visual Material Tool, Artificial Intelligence Tool, and User Interface Tool.

World Map Editor

With highly sophisticated computer graphic design techniques and editing, art designers can build colorful topography and geomorphology through a basic height picture that is dynamic and flexible. Different levels of blending materials can be used, including displacement mapping, normal mapping and all kinds of complicated textures. For example, a rough and winding gravel path can be designed through the hills and tracks covered with various types of plants and vegetation. The SOUL Game Engine’s map editor completely supports the conversion between indoor and outdoor environments and also enables dynamic features per pixel for light and shade effects. With the synthesizing of the world map editor, the game can show and simulate waves, realistic fire, smoke, etc. In addition, the combination of the dynamic sky box and cloud editor system can produce a lifelike sky effect. Santaro’s aim is to create beautifully designed virtual space and have its customers ‘feel’ they are playing in a stimulating and special game environment.

| 9 |

Physical Properties Tool

The ultimate role of the Physical Properties Tool editor is to enable games to appear more realistic. Most backgrounds and objects in earlier 3D games look very unreal. Through the dynamic simulation techniques, the SOUL physical properties tool can set a physical collision bounding box for each model and all the objects in one scene can have the physical information of mass, centre of gravity, linear and angular velocity, linear and angular momentum, etc. This tool provides players with an incredible sensation of the real physical world. The SOUL Game Engine physical properties tool enables players to experience the games as a film spectacle, with realistic effects, such as explosions, collisions between different kinds of objects, collapsed buildings, etc.

Physical Effects Tool

The Physical Effects Tool editor covers diverse effects, including a smart particle system that can be used for all objects under any type of scenario, such as fire, shining metal, and smoke on battlefields. For example, the effect of light and shade on weapons can be seen in the game when a warrior shoots an arrow, or a ray of light will appear when a phoenix is passing by. Users can imitate the particle effects from the real world, and experience a more realistic lifelike effect.

Visual Material Tool

The Visual Material Tool editor can create multi-layer blending through adjusting alpha and attenuation. This provides numerous colors and a display function that supports various functions of the games, such as battle, fight, and run. Based on all surface light effects of an object and the physical properties and geometric characteristics of the material, the refractive index and reflectivity of each point can be calculated precisely.

With this tool, a ray of light will travel more naturally and create vivid light and shade effects, e.g. the path of a bullet can be tracked more easily. The most representative usage of the visual material editor is to produce light reflection for the metallic sheen of weapons, such as swords. Providing gloss for precious stones or gold coins is another typical usage.

Artificial Intelligence Tool

The Artificial Intelligence (AI) Tool is used for editing the movements of non-player characters in the games. It mainly focuses on behavior selection and path-finding techniques. For example, the AI tool can make monsters walk along a path, keep them away from barriers, chase after a character, and attack players who are in their sphere of influence. All the monsters in Santaro’s online games will be given specific individual characteristics to make them seem true-to-life, so that online game players feel that the virtual games are close to reality.

User Interface Tool

The User Interface (UI) Tool is used for designing the game players’ interface. Designers establish a main interface, a skills interface, and set up conversation windows by editing all kinds of controls, such as user login interface, role specifications, and a series of other features to help players maximize their game experience.

Coral Game Engine

Santaro has developed another 3D game engine specifically for the development of its 108 Warrior MMORPG. It is integrated with below features:

3D Shadowing

The Coral game engine fully and equally supports OpenGL technology and Direct3D technology, both of which are the dominant technologies on 3D shadowing in the industry.

Compatibility

It is compatible for both 2D and 3D modes, and combines the advantages from both modes as well.

Shadowing Engine

The shadowing engine is highly optimized to reflect real lighting effects.

| 10 |

Hardware Acceleration

It also supports hardware acceleration which results high efficiency on model shadowing.

Scene Management System

Script System

It fully supports LUA script language.

Network Underlying Library

It contains a fast and secure network underlying library.

User Interface Tool

It contains an easy to use User Interface (UI) Tool which includes map tools, graphic tools and effects tool etc.

Technology Infrastructure

Santaro’s major Internet Data Centre (IDC) is located in Beijing. This centre is critical to Santaro’s overall operations, as it hosts key customer information such as account verification as well as the accounting and billing system. As the centre contains key data, it also has a sophisticated security system consisting of firewall, load balance devices, multi-processing and multi-core routers. In addition, when the number of concurrent users reaches 100,000, this core IDC will also play a key role for off-site disaster recovery, if needed. The facility is a major back-up center in case of force majeure events, such as earthquake and five, as well as a center managing users’ data and network traffic.

The Company has built a reliable and secure network infrastructure to fully support its operations. In order to maintain stable operation of its MMORPGs, Santaro maintains 300 servers located in Internet Data Centers (IDC) in 80 major cities in China. These major cities are Shanghai, Guangzhou, Shijiazhuang, Shenyang, Chengdu, and Xi’an and are the network backbone nodes. These nodes provide various regions with the capacity to accommodate up to 100,000 concurrent game players and a sufficient amount of connectivity bandwidth to maintain such a service. When the number of players is close to 100,000, new backbone nodes will be set up.

OPERATIONS

Customer Service

Santaro provides consistent high-quality customer service and is responsive to game players’ needs. Game players using Santaro products are able to access the customer service center via in-game chats, phone or e-mail 24 hours a day, seven days a week. In addition, a forum website was setup in August 2012 for game players to submit feedback. As of December 31, 2012, Santaro currently has over 17 dedicated customer service representatives called Game Masters (GMs), many of whom are MMORPG enthusiasts. In August 2012, Santaro has set up detailed guidelines on how GMs should handle requests, complaints, suggestions or bug reports they receive from customers by email, phone or chat lines, as well as how to send information back to the Product Development Department and/or the Operation and Maintenance Department, to ensure issues are addressed promptly and accurately.

Pricing

The online game industry in China requires free-to-play content if an item-based charging business model is offered. In fact, unlike most western online game operators that rely on a time-based charging business model to generate revenues, the majority of Chinese online game operators offer their games for free. The companies make profits when players purchase virtual online items in the course of their games.

| 11 |

Santaro currently uses an item-based revenue model for its games. Under the item-based revenue model, game players can activate the basic functions of the game free of charge for as long as they want. Santaro generates revenue through the sale of virtual items, such as performance-enhancing clothing, equipment, and accessories that enhance the game-playing experience.

Distribution

Santaro primarily distributes its games through third party prepaid cards distributors, online commercials on game media websites, and pre-installs game software in Internet café computers.

Distribution Through Internet Cafes

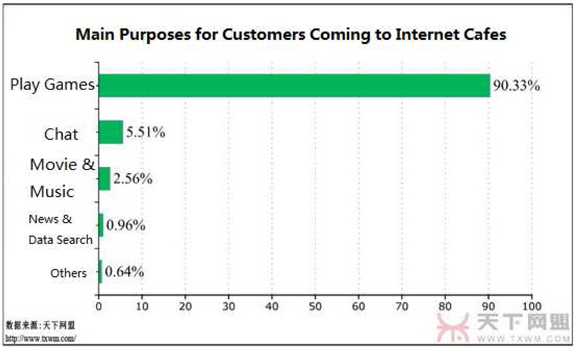

The Internet cafe industry is a derivative of the World Wide Web economy in China. It is considered to be the most convenient place for people to access the Internet in China. Internet cafes has become the third largest internet accessing place for internet users after home and office, according to the Revelation of the Current Status of Internet Cafe Business in China issued on www.netbarcn.com. According to the internet cafe market report issued by the Culture Department, the total number of internet cafes in China was 146,000 by the end of 2011, while the total number of internet café users has reached 126 million as of the end of 2012, according to CNNIC.

According to the 2012 China Internet Cafe Development Report issued by TXWM.com, 90.33% of customers go to internet cafes to play games as their main purposes, making a unique advantage for distributing online games through internet cafes.

Santaro is in the process of establishing an online promotion platform for internet cafes featuring the following advantages: direct access to end users shortening the distribution channel, lower promotion costs as compared to the traditional distribution channels, and real-time monitoring. Santaro’s internet cafe promotion platform is focusing on the diversification of the products and services. We believe that making all of our products available on the platform will provide internet cafes more options, giving them more room for their own promotion activities. Through our existing connections in the areas of Sichuan, Shandong, Hebei and other provinces, we expect to have at least 4,000 internet cafes joining the plan in 2013. We believe that with further development of the platform, the concept will become a key to the internet cafes business in China. We are confident to make our platform available to cover the majority of China’s Internet cafe business in the near future.

| 12 |

Distribution Through Prepaid Cards

Additionally, Santaro sells prepaid game cards in virtual and physical form to a range of regional third-party distributors, who in turn re-distribute them to numerous retail outlets across China. Online payment systems in China are not as widely available to, nor accepted by, consumers as they are in the United States. As a result, companies still need to rely on a physical distribution network, composed of third-party distributors covering a network of retail outlets across China for the sale of their products and services. As of December 31, 2012, Santaro’s nationwide distribution network consisted of two prepaid cards distributors, and reached over 15 retail outlets.

It is our intention once the MMORPGs have been fully operational for at least one to two years and regional distributors are more familiar with Santaro and its games, to establish direct distribution relationships with local dealers. Typically, Santaro will collect payment from its distributors upon delivery of its prepaid game cards and plans to offer sales discounts and rebates to its distributors. The distribution agreements will be non-exclusive, and will not prohibit distributors from working with other online game operators.

Promotion

Santaro’s promotion activities include online advertising, offline promotions and traditional media. The Company uses different methods to target different demographic groups of game players:

| · | For online advertising, the Company advertises on a variety of websites, including on Internet cafe homepages. Santaro also uses videos to promote its games online, as a dynamic video can show the lifelike scenes of a game and at the same time can give a sense of the exciting special effects. |

| · | Santaro also uses a variety of offline promotional events including, Internet cafe events, free trial plays, game players’ gatherings, and provides souvenirs, awards and prizes. |

| · | With respect to traditional media, promotions include print advertisements in magazines that target the Company’s game player base and outdoor multimedia. |

Network promotion strategy consists of voluntary individuals or groups with sales skills capabilities and who are keen to promote the product to other potential users. Santaro will seek to minimize distribution and advertising costs to attract customers, and will provide rewards such as high-recharge bonus and virtual item redemption to those individuals or groups of people bringing new players and clients to the Company.

Overseas Distribution Strategy

Identifying appropriate overseas markets, negotiating with potential third-party licensees and managing the relationships with those licensees require substantial management effort and skills.

Chinese online games can prove attractive to foreign markets and some Asian countries, such as Malaysia, Taiwan and Vietnam are fast-growing online games markets, but lack local product development. Because those countries have less competition than what is currently in China, they are attractive markets for Santaro. In order to distribute some of our online games to those selective overseas markets, we will establish cooperation agreements with one of the local game operators in a selected country. The basic structure of the cooperation agreement will enable the local online game operators acting as distribution agents for Santaro’s games in their local market. Overseas licensing revenues will consist of an initial license fee and ongoing revenue-based royalties.

We expect to initiate the discussion later in the year 2013 with some potential overseas distributors in some Asian markets especially in Chinese speaking markets such as Hong Kong, Taiwan and Malaysia.

Billing System

Santaro’s billing system can effectively capture the purchase and consumption of virtual items and record game players’ purchase patterns, so the Company can improve its product offerings by designing new virtual items. At the same time, it enables the Company to adjust prices according to consumers’ preferences.

The Company sells a substantial portion of virtual prepaid game cards and game points to its players through third-party online payment platforms. Starting from the launch of 108 Warriors on August 23, 2012 through the end of the fiscal year, we sold 1,739 virtual prepaid game cards through our online system as well as third party online payment platforms.

| 13 |

In addition, the Company plans to collect game operations revenue through the sale of prepaid game cards or online direct sales of game points straight from its own website.

Santaro’s online players are offered a number of different payment options for playing the Company’s online games. These payment options include the following:

Online Banking: Users may make payments online to Santaro through their online banking account. Santaro has established cooperation agreements with third-party payment platforms such as Alipay, TenPay, 99Bill, and Yeepay.

Physical Card: Users may purchase physical game point cards with printed card numbers and passwords in software stores, Internet cafes, kiosks and department stores. Santaro plans to sign distribution agreements with national general agents possessing strong distribution channels.

Virtual Card: Players may purchase Santaro’s virtual cards by using third-party electronic point card sales platforms. They are also given the option to e-recharge their virtual cards, if needed. Santaro cooperates with third-party electronic point card sales platforms such as CNcard (cncard.com) and Cobuy (cobuy.com.cn).

China Mobile, China Unicom, and China Telecom Top-up Card: China Mobile, China Unicom and China Telecom top-up cards are widely distributed in China and can be used to make online payments, as they are considered as a form of ‘hard currency’. Santaro offers this type of payment through a cooperation agreement with Yeepay.

SMS and Fixed Line: Users are able to buy game point cards via SMS or their fixed line through the cooperation agreement Santaro has set up with Yeepay.

Marketing Strategy

In order to produce a strong brand of online games, Santaro expects to differentiate the Company from its competition through the marketing strategies highlighted below:

Market Coverage Strategies

The Company is implementing targeted marketing strategies for each of its online game products and services to attract customers. There are generally three market coverage strategies to choose from:

Undifferentiated Marketing. This strategy consists of targeting a market as a homogeneous unit, instead of a heterogeneous group, in order to attract as many customers as possible with only one product, one price, and one promotion type. Undifferentiated marketing relies on mass distribution and mass advertising, aiming to give the product a superior image in the minds of the consumers. It is a very effective strategy when launching an innovative product in a market where competition is close to nil. Today, this market coverage strategy is not applicable to Santaro.

Differentiated Marketing. With this strategy, companies break the market into several sub-markets and design different products and sales tactics for each of these sub-markets. This helps to satisfy different consumer demands. Typically differentiated marketing creates more total sales than undifferentiated marketing, but it also increase the costs of doing business. Santaro will implement this marketing strategy at a later stage and plans to design different products that will satisfy different consumers’ requirements and needs. We will adopt different marketing strategies tailored to the various sub-markets that we sell our games in.

Concentrated Marketing. Concentrated marketing focuses on one small part of the marketplace and is affected by a concentrated marketing promotion that seeks to gain a large share of a small market. Concentrated marketing is particularly effective for small companies with limited resources because it enables the company to achieve a strong market position in the specific market segment it serves without mass production, mass distribution or mass advertisement. Companies adopting this kind of strategy generally have a good understanding of their target markets, and as this strategy works well for early-stage operators. Concentrated marketing is the strategy that Santaro currently has adopted.

| 14 |

Product Life Cycle

The Company is also looking constantly for new markets to establish additional distribution channels in order to maximize revenues from products that have already been developed. This is done by maximizing awareness of each online game in the market based on its life cycle. The operational life cycle of any developed retail product can be divided into four phases: warm-up period, commercial period, mature period and steady period.

Warm-up Period: This stage is the beta launch of a new product in the market. In order to attract attention and interest in our products, we will ensure attractive features, side-effects, fashionable trends, and popular themes are contained in each product we develop.

Commercial Period: After modifications are integrated into the product, the commercial operational phase will start and we will start receiving revenue from our customers. Promotion and advertising for this phase will be done via the Internet and by using billboards located in public places with high user density and a large number of viewers.

Mature Period: During this phase, to increase our brand image and awareness of our products in the market, we will increase advertising in the market to gain more online players, and boost revenue. Because in today’s markets there are more and more online players, the demand for games is now from a diversified group of consumers, giving us the opportunity to attract more users.

Steady Period: We will establish a network of cooperation with local communities throughout the country, as well as overseas agents, to further promote our products and increase our customer base.

For each product we develop, we constantly adjust our marketing strategy depending on the outcome of management’s assessment of the opportunity, and at what stage the product is in its current life cycle. In addition, we strive to ensure we have more than one product in the market in order to increase our product offering, strengthen our brand name and annual revenue.

GOVERNMENT REGULATIONS

Our online games, online services and related content on our websites are subject to various PRC laws and regulations relating to the telecommunications industry, Internet and online games. We are regulated by various government authorities, including:

| • | the Ministry of Industry and Information Technology and, before its formal establishment in 2008, its predecessor, the Ministry of Information Industry; |

| • | the General Administration of Press and Publications (the National Copyright Administration); |

| • | the State Administration for Industry and Commerce; |

| • | the Ministry of Culture; and |

| • | the Ministry of Public Security. |

The principal PRC regulations governing Internet content, as well as online game services in China include:

| • | Telecommunications Regulations (2000); |

| • | the Administrative Rules for Foreign Investments in Telecommunications Enterprises (2001, and as amended in 2008); |

| • | the Administrative Measures for Telecommunications Business Operating Licenses (2009); |

| • | the Internet Information Services Administrative Measures (2000); |

| • | the Interim Measures for the Administration of Online Games (2010); |

| 15 |

| • | the Tentative Measures for Administration of Internet Culture (2010); |

| • | the Tentative Measures for Administration of Internet Publication (2002); |

| • | the Notice of Implementing the State Council’s “Regulation ‘Sanding’” and Relevant Interpretation Issued by State Commission Office for Public Sector Reform (“SCOPSR”) and Further Strengthen the Administration and Approval of the Pre-approval and Import of Online Games (2009); |

| • | the Foreign Investment Industrial Guidance Catalog (2011); |

| • | the Administrative Measures on Electronic Publications (2008); |

| • | the Administrative Measures on Software Products (2009); |

| • | the Administrative Measures on Internet Electronic Bulletin Board Services (2000); |

| • | the Measures on Computer Software Copyright Registration (2002); |

| • | the Notice of the Ministry of Culture on Enhancing the Content Review Work of Online Game Products (2004); |

| • | Some Opinions of the Ministry of Culture and the MIIT on the Development and Administration of Online Games (2005); |

| • | the Notice on the Work of Purification of Online Games (2005); |

| • | the Circular on Strengthening the Administration of Foreign Investment in and Operation of Value-added Telecommunications Business (2006); |

| • | the Circular on Implementing Online Game Anti-fatigue System to Protect the Health of the Minors (2007); |

| • | the Administrative Measures on Internet Video/Audio Program Services (2007); |

| • | Notice on Initializing the verification of Real-name Registration for Anti-Fatigue System on Internet Games (or the Real-name Registration Notice) (2011); |

| • | the Tentative Catalog of Internet Video/Audio Program Services (2010); |

| • | the Notice on the Reinforcement of the Administration of Internet Cafés and Online Games (2007); |

| • | the Tentative Measures for Administration of Internet Commodity Transaction and Relevant Services (2010); |

| • | the Notice on Strengthening the Administration of Virtual Currency of Online Games (2009); and |

| • | the Tentative Measures for Administration of Internet Goods and Relevant Services Transactions (2010). |

As the online game industry is at an early stage of development in China, new laws and regulations may be adopted from time to time to require additional licenses and permits. As a result, substantial uncertainties exist regarding the interpretation and implementation of current and any future Chinese laws and regulations applicable to the online game industries.

Restrictions on Foreign Investment

Under the above regulations, a foreign investor is currently prohibited from owning more than 50% of the equity interest in a Chinese entity that provides value-added telecommunications services, including online games and other Internet content provision services. In addition, foreign and foreign invested enterprises are currently not able to apply for certain required licenses to provide these services.

| 16 |

The Circular on Strengthening the Administration of Foreign Investment in and Operation of Value-added Telecommunications Business issued by the MIIT in July 2006, reiterated the regulations on foreign investment in telecommunications business, which require foreign investors to set up foreign-invested enterprises and obtain an ICP license in order to conduct any value-added telecommunications business in China. Under this circular, a domestic company that holds an ICP license is prohibited from leasing, transferring or selling the license to foreign investors in any form, and from providing any assistance in forms of resources, sites or facilities to foreign investors that conduct value-added telecommunications business illegally in China. Furthermore, the relevant trademarks and domain names that are used in the value-added telecommunications business must be owned by the local ICP license holder or its shareholders. This circular further requires each ICP license holder to have the necessary facilities for its approved business operations and to maintain such facilities in the regions covered by its license. In addition, all value-added telecommunications service providers are required to maintain network and information security in accordance with the standards set forth under relevant PRC regulations. Due to the lack of further necessary interpretation from the regulators, it remains unclear what impact this circular will have on us or the other Chinese Internet companies that have adopted the same or similar corporate and contractual structures as ours.

On September 28, 2009, GAPP, the National Copyright Administration, and National Office of Combating Pornography and Illegal Publications jointly issued the GAPP Notice, which restates that foreign investors are not permitted to invest in online game-operating businesses in China via wholly owned, equity joint venture or cooperative joint venture investments. The GAPP Notice expressly prohibits foreign investors from gaining control over or participating in domestic online game operators through indirect ways such as establishing other joint venture companies, or contractual or technical arrangements. However, the GAPP Notice does not provide any interpretation of the term “foreign investors” or make a distinction between foreign online game companies and China based companies under a similar corporate structure like ours. Thus, it is unclear whether such regulations will be applicable to us or many other China based companies that rely on similar contractual arrangements with variable interest entities that operate online games in China. Since the promulgation of the GAPP Notice, we have applied for and obtained ISBNs from GAPP for Internet publications of several new games without encountering any problem. We are not aware that GAPP has taken any enforcement action under the GAPP Notice against any online game operators under a similar corporate structure like ours.

We conduct our online game and related businesses through contractual arrangements with Beijing Sntaro. Such arrangements are described in greater details under the caption “VIE Structure”.

Regulation of Licenses for Online Games

Online game operators are required to hold a variety of permits and licenses, which include:

ICP License

Under current Chinese laws and regulations, a commercial operator of Internet content provision services must obtain a value-added telecommunications business operating license for Internet content provision from the appropriate telecommunications authorities in order to carry on any commercial Internet content provision operations in China. Santaro has obtained the ICP licenses.

Internet Culture Operation License

Each ICP license holder that engages in the supply of Internet culture products and related services, including provision of online games services, must obtain an additional Internet culture operation license from the appropriate culture administrative authorities pursuant to the newly issued Tentative Measures for Administration of Internet Culture (2011), which superseded the Tentative Measures for Administration of Internet Culture (2003, and as amended in 2004).

Internet Publishing License

The GAPP and the MIIT jointly impose a license requirement for any company that intends to engage in Internet publishing, defined as any act by an Internet information service provider to select, edit and process content or programs and to make such content or programs publicly available on the Internet. According to the Tentative Measures for Administration of Internet Publication (2002), the provision of online games services is deemed an Internet publication activity. Therefore, online game operators need to obtain an Internet publishing license in order to directly make their online games services publicly available in China.

| 17 |

Online Bulletin Board Service Approval

The MIIT has promulgated rules requiring ICP license holders that provide online bulletin board services to register with, and obtain approval from, the relevant telecommunication authorities.

Regulation of Internet Content

The Chinese government has promulgated measures relating to Internet content through a number of ministries and agencies, including the MIIT, the Ministry of Culture and the GAPP. These measures specifically prohibit Internet activities, which includes the operation of online games, that result in the publication of any content which is found to, among other things, propagate obscenity, gambling or violence, instigate crimes, undermine public morality or the cultural traditions of the PRC, or compromise State security or secrets. When an Internet content provider or an Internet publisher finds that information falling within the above scope is transmitted on its website or is stored in its electronic bulletin service system, it shall terminate the transmission of such information or delete such information immediately and keep records and report to relevant authorities. If an ICP license holder violates these measures, the PRC government may revoke its ICP license and shut down its websites. In addition, in accordance with the Notice on Enhancing the Content Review Work of Online Game Products (2004) promulgated by the Ministry of Culture, imported and domestic online games should be filed with the Ministry of Culture before the operation of each game.

Regulation of Information Security

Internet content in China is also regulated and restricted from a State security standpoint. The National People’s Congress, China’s national legislative body, has enacted a law that may subject to criminal punishment in China any effort to: (1) gain improper entry into a computer or system of strategic importance; (2) disseminate politically disruptive information; (3) leak State secrets; (4) spread false commercial information; or (5) infringe intellectual property rights.

The Ministry of Public Security has promulgated measures that prohibit use of the Internet in ways which, among other things, result in a leak of State secrets or a spread of socially destabilizing content. The Ministry of Public Security has supervision and inspection rights in this regard, and we may be subject to the jurisdiction of the local public security bureaus. If an ICP license holder violates these measures, the PRC government may revoke its ICP license and shut down its websites.

Intellectual Property Rights

The State Council and the National Copyright Administration have promulgated various regulations and rules relating to protection of software in China. Under these regulations and rules, software owners, licensees and transferees may register their rights in software with the National Copyright Administration or its local branches and obtain software copyright registration certificates. Although such registration is not mandatory under PRC law, software owners, licensees and transferees are encouraged to go through the registration process and registered software rights may receive better protections.

The PRC Trademark Law, adopted in 1982 and revised in 2001, with its implementation rules adopted in 2002, protects registered trademarks. The Trademark Office of the SAIC handles trademark registrations and grants a protection term of ten years to registered trademarks.

Virtual Currency

On February 15, 2007, the Ministry of Commerce, the People’s Bank of China and other relevant government authorities jointly issued the Notice on the Reinforcement of the Administration of Internet Cafes and Online Games, or the Internet Cafés Notice. Under this notice, the People’s Bank of China is directed to strengthen the administration of virtual currency in online games to avoid any adverse impact on the economy and financial system. This notice provides that the total amount of virtual currency issued by online game operators and the amount purchased by individual game players should be strictly limited, with a strict and clear division between virtual transactions and real transactions carried out by way of electronic commerce. This notice also provides that virtual currency should only be used to purchase in-game items.

| 18 |

On June 4, 2009, Ministry of Commerce jointly issued Notice on the Reinforcement of the Administration of Virtual Currency in Online Games, which defines what is virtual currency and requires that entities shall obtain the approval from the Ministry of Commerce before issuing virtual currency and engaging in transactions using virtual currency in connection with online games. Entities are prohibited from using virtual currency to carry out gambling business.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved comments from the SEC.

ITEM 2. PROPERTIES

The Company’s office is located at Dazhongsi Zhongkun Plaza Building E, 903. 18A North 3rd Ring Road West, Haidian District Beijing 100098 PRC. We do not own any real property. The Company’s other property and equipment consists wholly of computer equipment, leasehold improvements, and furniture. The net value of the Company’s property was $556,884 as of December 31, 2012.

ITEM 3. LEGAL PROCEEDINGS

Currently we are not involved in any pending litigation or legal proceeding.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder in all likelihood will be unable to resell his securities in our Company. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops.

Our company's securities are traded on the Over-The-Counter Bulletin Board (“OTCBB”) operated by the Financial Industry Regulatory Authority (FINRA) under the symbol “STIE”.

| Fiscal Quarter | High Bid | Low Bid | ||||||

| 2012 | ||||||||

| Fourth Quarter | $ | 2.00 | $ | 0.30 | ||||

| Third Quarter | $ | 0.90 | $ | 0.16 | ||||

| Second Quarter | $ | 0.80 | $ | 0.10 | ||||

| First Quarter | $ | 2.39 | $ | 0.35 | ||||

| Fiscal Quarter | High Bid | Low Bid | ||||||

| 2011 | ||||||||

| Fourth Quarter | $ | 4.95 | $ | 1.12 | ||||

| Third Quarter | $ | 5.29 | $ | 3.00 | ||||

| Second Quarter | $ | 5.35 | $ | 4.00 | ||||

| First Quarter | $ | 5.35 | $ | 4.50 | ||||

| 19 |

Holders

As of March 15, 2013, we had 316 holders of record of our common stock, including shares held by brokerage clearing houses, depositories or otherwise in unregistered form.

Dividends

We have not declared any cash dividends. We do not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended, that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities Authorized for Issuance under Equity Compensation Plans

We have no equity compensation plans and accordingly we have no shares authorized for issuance under an equity compensation plan.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| 20 |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This Annual Report on Form 10-K and other reports filed by the Company from time to time with the Securities and Exchange Commission (collectively, the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the Filings, the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan”, or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to the Company’s industry, and the Company’s operations and results of operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this quarterly report, which attempt to advise interest parties of the risks and factors that may affect our business, financial condition, results of operations, and prospects.

Our financial statements are prepared in accordance with U.S. GAAP. These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which are relied are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. In many cases, the accounting treatment of a particular transaction is specifically dictated by U.S. GAAP and does not require management’s judgment in its application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result.

Accounting Policy of Revenue Recognition

The Company currently provides online game services in the PRC and recognizes revenue in accordance to the criteria of ASC subtopic 605 (“ASC 605”), Revenue Recognition when persuasive evidence of an arrangement exists, the service has been rendered, the sales price is fixed or determinable, and collectability is reasonably assured. Online game revenues include our MMOG operations and Co-operation Web-based game revenues.

MMOG operations

The Company operates Massively Multiplayer Online Role-Playing Games (“MMORPG”) under a free-to-play model. The online game revenue derives from the sale of in-game virtual items and revenue was recognized pursuant to the item-based revenue model.

Under the item-based model, players are able to play the basic features of the game for free. We generate revenues when players purchase virtual items that enhance their playing experience, such as weapons, clothing, accessories and pets. The item-based revenue model allows us to introduce new virtual items or change the features or properties of virtual items to enhance game player interaction and create a better game community.