Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT - INDEPENDENT BANK CORP | exhibit311.htm |

| EX-32.1 - EXHIBIT - INDEPENDENT BANK CORP | exhibit321-indb10xka.htm |

| EX-23.1 - EXHIBIT - INDEPENDENT BANK CORP | exhibit231-indb10xka.htm |

| EX-31.2 - EXHIBIT - INDEPENDENT BANK CORP | exhibit312-indb10xka.htm |

| EX-31.3 - EXHIBIT - INDEPENDENT BANK CORP | exhibit313-indb10xka.htm |

| EX-32.2 - EXHIBIT - INDEPENDENT BANK CORP | exhibit322-indb10xka.htm |

United States Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-9047

Independent Bank Corp.

(Exact name of registrant as specified in its charter)

Massachusetts | 04-2870273 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Office Address: 2036 Washington Street, Hanover Massachusetts Mailing Address: 288 Union Street, Rockland, Massachusetts (Address of principal executive offices) | 02339 02370 (Zip Code) |

Registrant’s telephone number, including area code:

(781) 878-6100

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, $.0l par value per share | NASDAQ Global Select Market |

Preferred Stock Purchase Rights | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,: “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

Large Accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant, computed by reference to the closing price of such stock on June 30, 2012, was approximately $585,587,884.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. February 28, 2013 22,776,461

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Portions of the Registrant’s definitive proxy statement for its 2013 Annual Meeting of Stockholders are incorporated into Part III, Items 10-13 of this Form 10-K.

______________________________________________________________________________________________________

EXPLANATORY NOTE

We are filing this Amendment No. 1 (this “Amendment”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2012 (the “Form 10-K”) to correct omissions from Items 7 and 9A in the initial Form 10-K filing and to correct a typographical error on the certification included as Exhibit 31.1 to the initial Form 10-K filing, as described below.

In Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) of the Form 10-K, the text indicating that the numbers of certain tables and charts appearing in the Executive Level Overview portion of the MD&A are reflected in thousands of dollars was inadvertently omitted from the table/chart header. This text is included where applicable in the version of Item 7 filed with this Amendment.

This Amendment also includes the conformed signature of Ernst & Young LLP on the Report of Independent Registered Public Accounting Firm (the “Report”) in Item 9A. Controls and Procedures. The Report had been physically signed by Ernst & Young LLP prior to the initial Form 10-K filing, but the conformed signature was unintentionally omitted from the initial Form 10-K when filed.

This Amendment also includes an amended form of the certification filed as Exhibit 31.1 to the initial 10-K filing that corrects a typographical error with respect to the date of the certificate. The amended Exhibit 31.1 included with this Amendment properly reflects the date the certificate was executed, which was the date of the filing March 12, 2013, while the version of this certification included with the initial 10-K filing stated the date of the certification as March 13, 2013.

Other than the above mentioned changes, we have made no other changes to Items 7 or 9A or to Exhibit 31.1 as they appeared in the initial Form 10-K filing. This Amendment does not amend any other information set forth in the initial Form 10-K, and we have not updated disclosures contained therein to reflect any events that may have occurred at a date subsequent to the date the initial Form 10-K was filed.

______________________________________________________________________________________________________

ITEM 7. MANAGEMENT'S DISCUSSION AND ANAYLISIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The Company is a state chartered, federally registered bank holding company, incorporated in 1985. The Company is the sole stockholder of Rockland Trust, a Massachusetts trust company chartered in 1907. For a full list of corporate entities see Item 1 “Business — General” hereto.

All material intercompany balances and transactions have been eliminated in consolidation. When necessary, certain amounts in prior year financial statements have been reclassified to conform to the current year’s presentation. The following should be read in conjunction with the Consolidated Financial Statements and related notes thereto.

Executive Level Overview

2012 Results

The Company reported net income of $42.6 million in 2012 as compared to $45.4 million in 2011. 2012 was negatively impacted by merger and acquisition expenses, goodwill impairment and a higher provision for loan losses associated with strong growth in the loan portfolio as well as increased loan losses, primarily due to a commercial loan fraud.

Management considers certain of these items to be non-core in nature and presents the following discussion of operating earnings as a non-GAAP measure, intended to provide the reader with a sense of the performance of its core banking business.

Net income on an operating basis improved to $47.1 million in 2012, as compared to $45.5 million in 2011, an increase of 3.6%. These results were due to a combination of:

• | Strong organic loan growth (+8.3%) and organic deposit growth (+8.1%) |

• | Declining net interest margin, reflecting the challenging interest rate environment |

• | Solid growth in noninterest income (+16.4%) |

• | Good expense control |

• | Increased provision for loan losses |

The following table illustrates key performance measures for the periods indicated:

Years Ended December 31 | |||||||

2012 | 2011 | ||||||

(Dollars in thousands, except per share data) | |||||||

Net income | $ | 42,627 | $ | 45,436 | |||

Net income on an operating basis | $ | 47,097 | $ | 45,456 | |||

Diluted earnings per share | $ | 1.95 | $ | 2.12 | |||

Diluted earnings per share on an operating basis | $ | 2.16 | $ | 2.12 | |||

Return on average assets | 0.83 | % | 0.96 | % | |||

Return on average common equity | 8.66 | % | 9.93 | % | |||

Net interest margin | 3.75 | % | 3.90 | % | |||

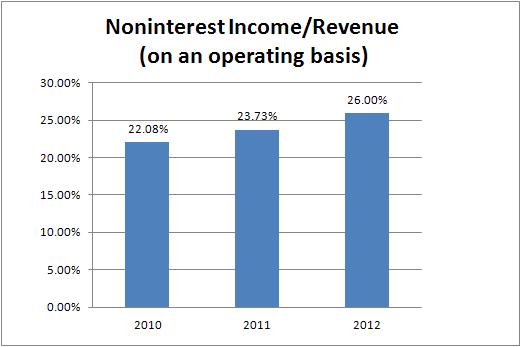

Recognizing the importance of noninterest income, management continued to focus on growing this category. 2012 represented strong growth in noninterest income in the absolute (+16.4%) and as a percentage of total revenue (increased to 26.0%).

The increases in noninterest income for the year ended 2012 were driven by the following items:

• | Interchange and ATM fees increased to by 26.5% to $9.8 million in 2012, from $7.7 million in 2011. The increase was partially due to increased debit card usage by the Bank's customers following increased promotion and sales activities. |

• | Mortgage banking income is up $2.3 million, reflective of strong mortgage originations and refinancing activity due to the low rate environment. |

• | Investment management income also increased by $1.2 million as assets under management has steadily climbed to $2.2 billion at December 31, 2012 |

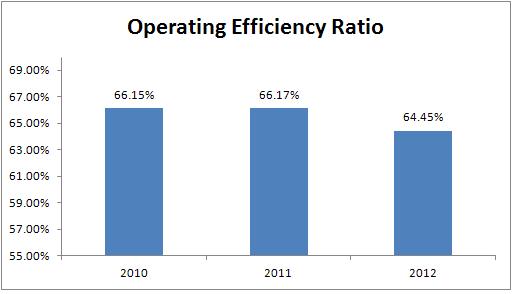

Noninterest expense increased over the prior year by 9.4% to $159.5 million. The increase in noninterest expense is largely related to the Bank's merger and acquisition expenses of $6.7 million and a $2.2 million goodwill impairment charge. Exclusive of these and other non-core charges, noninterest expense was well contained, increasing by 3.8% from the prior year. The Company's efficiency ratio, on an operating basis, has seen improvement during 2012, decreasing to 64.5%. The following chart shows the improving trends in the Company's efficiency ratio, on an operating basis, over the past three years:

(1) The operating efficiency ratio is calculated by dividing noninterest expense by the sum of net interest income and noninterest income.

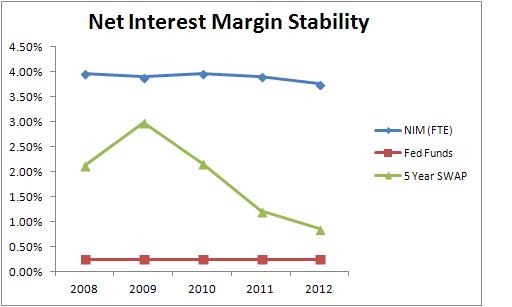

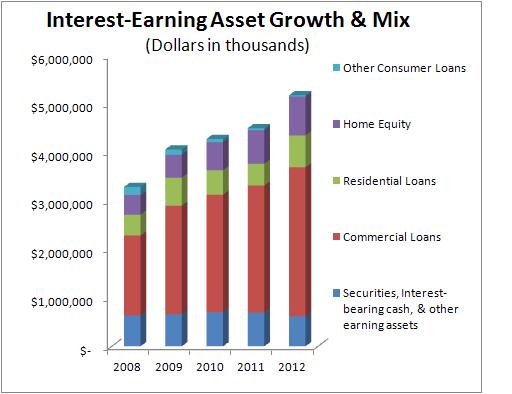

The net interest margin for the year decreased to 3.75%, down 15 basis points from the prior year, due to the prolonged low rate environment. However, the Company has been able to counter this pressure with the robust loan growth, especially within its commercial and home equity portfolios, both of which experienced double digit organic growth for the year, with commercial increasing by 11.7% and home equity increasing by 14.1%. The Company continues to focus on its ability to generate commercial loan originations as part of its strategic growth plan and was successful in doing so, originating $896.9 million in commercial loans during 2012. The following table shows the stability in the net interest margin as compared to the federal funds rate and the 5 year swap rate over the past five years:

Management's approach to balance sheet strategy and the net interest margin continues to emphasize:

• | Growth in commercial and home equity lending |

• | Funding by core deposits |

• | Structure asset generation with a keen view toward interest-rate sensitivity. |

• | Disciplined asset quality |

• | Avoid security purchases in this low rate environment |

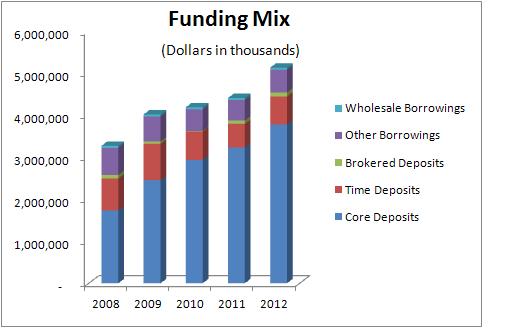

The following tables reflect this continued strategy:

In terms of asset quality, the Company's trends were stable in 2012 and remain strong with nonperforming assets representing only 0.74% of total assets at December 31, 2012, a decrease from 0.75% at December 31, 2011. Delinquency levels also remained low at 0.82% of total loans at December 31, 2012. Management continues to apply a disciplined approach to underwriting and maintains high credit standards.

The provision for loan losses was $18.1 million and $11.5 million for the years ended December 31, 2012 and 2011, respectively. The increase in provisioning levels is the result of shifts in the composition of loan portfolio mix, as certain portfolios require different levels of allowance allocations based upon the risks associated with each portfolio, as well as portfolio growth of outstanding balances, offset by improvements in certain asset quality measures. Net-charge-offs increased during 2012 to $14.5 million, from $9.5 million in the prior year, the increase in charge-offs in 2012 was largely impacted by a customer fraud situation, resulting in a charge-off of $4.8 million. The allowance for loan losses as a percent of loans was 1.15% at December 31, 2012, as compared to 1.27% at December 31, 2012. This decrease is largely attributable to the acquired loans which are accounted for at fair value, with no carryover of the related allowance.

Central Bancorp., Inc. Acquisition

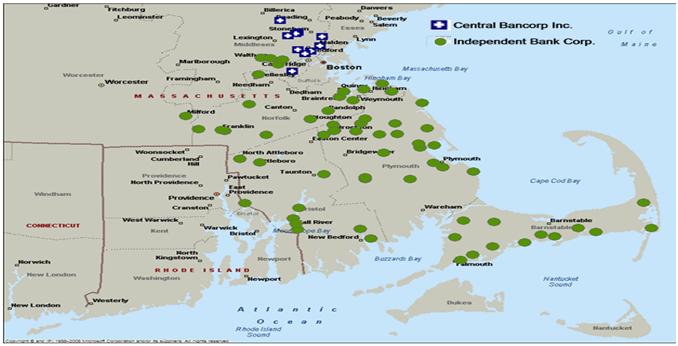

The Company announced and closed the acquisition of Central Bancorp., Inc. in 2012, adding 9 full service branches in the contiguous and demographically attractive Middlesex County market area, enhancing the Company's already strong presence in Eastern Massachusetts. The total transaction was valued at $52.0 million and was comprised of 60% stock and 40% cash consideration. The following map shows the acquired Central branches to the existing Rockland Trust branches:

Source: Microsoft MapPoint

The acquisition added loans of $450.7 million and acquired deposits of $357.4 million, at fair value. The following table shows the breakout of the acquired loans and deposits by type:

Loans Acquired (1) | Deposits Acquired | |||||||

(Dollars in thousands) | (Dollars in thousands) | |||||||

Commercial and industrial | $ | 536 | Demand deposits | $ | 75,438 | |||

Commercial real estate | 139,148 | Savings and interest checking | 65,110 | |||||

Residential real estate | 259,637 | Money market | 72,849 | |||||

Home equity and other consumer | 9,107 | Time certificates of deposits | 144,037 | |||||

Total | $ | 408,428 | Total | $ | 357,434 | |||

(1) Subsequent to the acquisition, on November 9, 2012 the Company sold approximately $42.2 million of performing jumbo residential mortgages

acquired in the transaction.

2013 Outlook

Despite the industry challenges of a modestly improving economy, increased competition, continued pressure on the net interest margin and increased regulatory and compliance requirements, management anticipates that the continuation of its strategy to grow solid core banking relationships with existing customers, while continually adding new relationships in the attractive markets of Eastern Massachusetts and Rhode Island, will allow for an increase in diluted earnings per share for 2013 to a range of $2.28 to $2.38, on an operating basis, as compared to the diluted earnings per share of $2.16 for 2012, on an operating basis.

Non-GAAP Measures

When management assesses the Company’s financial performance for purposes of making day-to-day and strategic decisions, it does so based upon the performance of its core banking business, which is primarily derived from the combination of net interest income and noninterest or fee income, reduced by operating expenses, the provision for loan losses, and the impact of income taxes. The Company’s financial performance is determined in accordance with Generally Accepted Accounting Principles (“GAAP”) which sometimes includes gains or losses due to items that management believes are unrelated to its core banking business and will not have a material financial impact on operating results in future periods, such as gains or losses on the sales of securities, merger and acquisition expenses, and other items. Management, therefore, also computes the Company’s non-GAAP operating earnings, which excludes these items, to measure the strength

of the Company’s core banking business and to identify trends that may to some extent be obscured by such gains or losses.

Management’s computation of the Company’s non-GAAP operating earnings information is set forth because management believes it may be useful for investors to have access to the same analytical tool used by management to evaluate the Company’s core operational performance so that investors may assess the Company’s overall financial health and identify business and performance trends that may be more difficult to identify and evaluate when noncore items are included. Management also believes that the computation of non-GAAP operating earnings may facilitate the comparison of the Company to other companies in the financial services industry.

Non-GAAP operating earnings should not be considered a substitute for GAAP results. An item which management deems to be noncore and excludes when computing non-GAAP operating earnings can be of substantial importance to the Company’s results for any particular quarter or year. The Company’s non-GAAP operating earning information set forth is not necessarily comparable to non-GAAP information which may be presented by other companies.

The following tables summarizes the impact of noncore items recorded for the time periods indicated below and reconciles them in accordance with GAAP:

Years Ended December 31 | |||||||||||||||||||||||

Net Income | Diluted Earnings Per Share | ||||||||||||||||||||||

2012 | 2011 | 2010 | 2012 | 2011 | 2010 | ||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||

As reported (GAAP) | |||||||||||||||||||||||

Net income | $ | 42,627 | $ | 45,436 | $ | 40,240 | $ | 1.95 | $ | 2.12 | $ | 1.90 | |||||||||||

Non-GAAP measures | |||||||||||||||||||||||

Noninterest income components | |||||||||||||||||||||||

Net gain on sale of securities, net of tax | (3 | ) | (428 | ) | (271 | ) | — | (0.02 | ) | (0.01 | ) | ||||||||||||

Proceeds from life insurance policies, tax exempt | (1,307 | ) | — | — | (0.06 | ) | — | — | |||||||||||||||

Noninterest expense components | |||||||||||||||||||||||

Prepayment fees on borrowings, net of tax | 4 | 448 | — | — | 0.02 | — | |||||||||||||||||

Merger and acquisition expenses, net of tax | 4,459 | — | — | 0.21 | — | — | |||||||||||||||||

Fair value mark on a terminated hedging relationship | — | — | 328 | — | — | 0.01 | |||||||||||||||||

Goodwill impairment, net of tax | 1,317 | — | — | 0.06 | — | — | |||||||||||||||||

Total impact of noncore items | 4,470 | 20 | 57 | 0.21 | — | — | |||||||||||||||||

As adjusted (non-GAAP) | $ | 47,097 | $ | 45,456 | $ | 40,297 | $ | 2.16 | $ | 2.12 | $ | 1.90 | |||||||||||

The following table summarizes the impact of noncore items on the calculation of the Company's efficiency ratio for the periods indicated:

Years Ended December 31 | ||||||||||||

2012 | 2011 | 2010 | ||||||||||

(Dollars in thousands) | ||||||||||||

Noninterest expense (GAAP) | $ | 159,459 | $ | 145,713 | $ | 139,745 | (a) | |||||

Merger & acquisition | (6,741 | ) | — | — | ||||||||

Goodwill impairment | (2,227 | ) | — | — | ||||||||

Prepayment fees on borrowings | (7 | ) | (757 | ) | — | |||||||

Fair value mark on a terminated hedging relationship | — | — | (554 | ) | ||||||||

Noninterest expense on an operating basis | $ | 150,484 | $ | 144,956 | $ | 139,191 | (b) | |||||

Noninterest income (GAAP) | $ | 62,016 | $ | 52,700 | $ | 46,906 | (c) | |||||

Net gain on sale of securities | (5 | ) | (723 | ) | (458 | ) | ||||||

Proceeds from life insurance policies | (1,307 | ) | — | — | ||||||||

Noninterest income on an operating basis | $ | 60,704 | $ | 51,977 | $ | 46,448 | (d) | |||||

Net interest income | $ | 172,799 | $ | 167,079 | $ | 163,961 | (e) | |||||

Total revenue (GAAP) | $ | 234,815 | $ | 219,779 | $ | 210,867 | (c+e) | |||||

Total operating revenue | $ | 233,503 | $ | 219,056 | $ | 210,409 | (d+e) | |||||

Ratio | ||||||||||||

Efficiency ratio (GAAP) | 67.91 | % | 66.30 | % | 66.27 | % | (a/(c+e)) | |||||

Operating efficiency ratio | 64.45 | % | 66.17 | % | 66.15 | % | (b/(d+e)) | |||||

Financial Position

Securities Portfolio The Company’s securities portfolio may consist of trading securities, securities available for sale, and securities which management intends to hold until maturity. Securities decreased by $10.9 million, or 2.1%, at December 31, 2012 as compared to December 31, 2011. The ratio of securities to total assets as of December 31, 2012 was 8.8%, compared to 10.4% at December 31, 2011.

The Company continually reviews investment securities for the presence of other-than-temporary impairment (“OTTI”). Further analysis of the Company’s OTTI can be found in Note 3 “Securities” within Notes to Consolidated Financial Statements included in Item 8 hereof.

During 2012, the Company transferred equity securities classified previously as trading to available for sale. As of December 31, 2011, the Company had $8.2 million of securities classified as trading.

The following table sets forth the fair value of available for sale securities and the amortized cost of held to maturity securities along with the percentage distribution:

Table 1 — Fair Value of Securities Available for Sale and Amortized Cost of Securities Held to Maturity

December 31 | ||||||||||||||||||||

2012 | 2011 | 2010 | ||||||||||||||||||

Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

Fair value of securities available for sale | ||||||||||||||||||||

U.S. treasury securities | $ | — | — | $ | — | — | % | $ | 717 | 0.2 | % | |||||||||

U.S. government agency securities | 20,822 | 6.3 | % | |||||||||||||||||

Agency mortgage-backed securities | 221,425 | 67.2 | % | 238,391 | 78.1 | % | 313,302 | 83.1 | % | |||||||||||

Agency collateralized mortgage obligations | 68,376 | 20.8 | % | 53,801 | 17.6 | % | 46,135 | 12.2 | % | |||||||||||

Private mortgage-backed securities | 3,532 | 1.1 | % | 6,110 | 2.0 | % | 10,254 | 2.7 | % | |||||||||||

Single issuer trust preferred securities issued by banks | 2,240 | 0.7 | % | 4,210 | 1.4 | % | 4,221 | 1.1 | % | |||||||||||

Pooled trust preferred securities issued by banks and insurers | 2,981 | 0.9 | % | 2,820 | 0.9 | % | 2,828 | 0.7 | % | |||||||||||

Marketable securities | 9,910 | 3.0 | % | — | — | % | — | — | % | |||||||||||

Total fair value of securities available for sale | $ | 329,286 | 100.0 | % | $ | 305,332 | 100.0 | % | $ | 377,457 | 100.0 | % | ||||||||

Amortized cost of securities held to maturity | ||||||||||||||||||||

U.S. treasury securities | $ | 1,013 | 0.6 | % | $ | 1,014 | 0.5 | % | $ | — | — | |||||||||

Agency mortgage-backed securities | 72,360 | 40.6 | % | 109,553 | 53.5 | % | 95,697 | 47.2 | % | |||||||||||

Agency collateralized mortgage obligations | 97,507 | 54.6 | % | 77,804 | 38.0 | % | 89,823 | 44.3 | % | |||||||||||

State, county and municipal securities | 915 | 0.5 | % | 3,576 | 1.7 | % | 10,562 | 5.2 | % | |||||||||||

Single issuer trust preferred securities issued by banks | 1,516 | 0.9 | % | 8,000 | 3.9 | % | 6,650 | 3.3 | % | |||||||||||

Corporate debt securities | 5,007 | 2.8 | % | 5,009 | 2.4 | % | — | — | % | |||||||||||

Total amortized cost of securities held to maturity | $ | 178,318 | 100.0 | % | $ | 204,956 | 100.0 | % | $ | 202,732 | 100.0 | % | ||||||||

Total | $ | 507,604 | $ | 510,288 | $ | 580,189 | ||||||||||||||

The Company’s available for sale securities are carried at fair value and are categorized within the fair value hierarchy based on the observability of model inputs. Securities which require inputs that are both significant to the fair value measurement and unobservable are classified as Level 3. As of December 31, 2012 and 2011, the Company had $6.5 million and $13.1 million of securities categorized as Level 3.

The following tables set forth contractual maturities of the Bank’s securities portfolio at December 31, 2012. Actual maturities will differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

Table 2 — Fair Value of Securities Available for Sale and Amortized Cost of Securities Held to Maturity, Amounts Maturing

Within One Year | One year to Five Years | Five Years to Ten Years | Over Ten Years | Total | ||||||||||||||||||||||||||||||

Amount | Weighted Average Yield | Amount | Weighted Average Yield | Amount | Weighted Average Yield | Amount | Weighted Average Yield | Amount | Weighted Average Yield | |||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

Fair value of securities available for sale | ||||||||||||||||||||||||||||||||||

U.S. government agency securities | $ | — | — | $ | — | — | $ | 20,822 | 2.1 | % | $ | — | — | $ | 20,822 | 2.1 | % | |||||||||||||||||

Agency mortgage-backed securities | 235 | 4.0 | % | 1,179 | 5.6 | % | 52,699 | 3.9 | % | 167,312 | 3.9 | % | 221,425 | 3.9 | % | |||||||||||||||||||

Agency collateralized mortgage obligations | — | — | 1,722 | 4.1 | % | 3,554 | 4.0 | % | 63,100 | 1.8 | % | 68,376 | 2.0 | % | ||||||||||||||||||||

Private mortgage-backed securities | — | — | — | — | 2,436 | 6.0 | % | 1,096 | 6.0 | % | 3,532 | 6.0 | % | |||||||||||||||||||||

Single issuer trust preferred securities issued by banks | — | — | — | — | — | — | 2,240 | 5.1 | % | 2,240 | 5.1 | % | ||||||||||||||||||||||

Pooled trust preferred securities issued by banks and insurers | — | — | — | — | — | — | 2,981 | 1.0 | % | 2,981 | 1.0 | % | ||||||||||||||||||||||

Marketable securities(1) | — | — | — | — | — | — | 9,910 | — | 9,910 | — | ||||||||||||||||||||||||

Total fair value of securities available for sale | $ | 235 | 4.0 | % | $ | 2,901 | 4.7 | % | $ | 79,511 | 3.5 | % | $ | 246,639 | 3.3 | % | $ | 329,286 | 3.4 | % | ||||||||||||||

Amortized cost of securities held to maturity | ||||||||||||||||||||||||||||||||||

U.S. Treasury securities | $ | — | — | $ | — | — | $ | 1,013 | 3.0 | % | $ | — | — | $ | 1,013 | 3.0 | % | |||||||||||||||||

Agency mortgage-backed securities | — | — | 786 | 5.5 | % | — | — | 71,574 | 3.5 | % | 72,360 | 3.5 | % | |||||||||||||||||||||

Agency collateralized mortgage obligations | — | — | — | — | — | — | 97,507 | 2.5 | % | 97,507 | 2.5 | % | ||||||||||||||||||||||

State, county and municipal securities | 239 | 4.7 | % | 676 | 4.8 | % | — | — | — | — | 915 | 4.8 | % | |||||||||||||||||||||

Single issuer trust preferred securities issued by banks | — | — | — | — | — | — | 1,516 | 7.4 | % | 1,516 | 7.4 | % | ||||||||||||||||||||||

Corporate debt securities | — | — | 5,007 | 3.4 | % | — | — | — | — | 5,007 | 3.4 | % | ||||||||||||||||||||||

Total amortized cost of securities held to maturity | $ | 239 | 4.7 | % | $ | 6,469 | 3.8 | % | $ | 1,013 | 3.0 | % | $ | 170,597 | 2.9 | % | $ | 178,318 | 3.0 | % | ||||||||||||||

Total | $ | 474 | 4.4 | % | $ | 9,370 | 4.1 | % | $ | 80,524 | 3.5 | % | $ | 417,236 | 3.2 | % | $ | 507,604 | 3.2 | % | ||||||||||||||

(1) Marketable securities have no contractual maturity and are excluded from the weighted average yield and amounts maturing.

As of December 31, 2012, the weighted average life of the securities portfolio was 4.6 years and the modified duration was 4.0 years.

Residential Mortgage Loan Sales The Company’s primary loan sale activity arises from the sale of government sponsored enterprise eligible residential mortgage loans to other financial institutions. During 2012 and 2011, the Bank originated residential loans with the intention of selling them in the secondary market. Loans are sold with servicing rights released and with servicing rights retained. The table below reflects the origination of these loans during the periods indicated:

Table 3 — Residential Mortgage Loan Sales

December 31 | |||||||

2012 | 2011 | ||||||

(Dollars in thousands) | |||||||

Loans originated and sold with servicing rights released | $ | 313,329 | $ | 270,357 | |||

Loans originated and sold with servicing rights retained | $ | 33,393 | $ | 8,627 | |||

The Company originates and sells loans to third parties and recognizes a mortgage servicing rights asset when it sells a loan with servicing rights retained. When a loan is sold, the Company enters into agreements that contain representations and warranties about the

characteristics of the loans sold and their origination. The Company may be required to either repurchase mortgage loans or to indemnify the purchaser from losses if representations and warranties are breached. During the year ended December 31, 2012 and 2011 the Company incurred losses of $304,000 and $222,000 on loans that were agreed to be repurchased. The Company has not at this time established a reserve for loan repurchases because it believes the amount of probable losses is not reasonably estimable and material losses are not probable.

Forward sale contracts of mortgage loans, considered derivative instruments for accounting purposes, are utilized by the Company in its efforts to manage risk of loss associated with its mortgage loan commitments and mortgage loans held for sale. Prior to closing and funding certain one-to-four residential mortgage loans, an interest rate lock commitment is generally extended to the borrower. During the period from commitment date to closing date, the Company is subject to the risk that market rates of interest may change. If market rates rise, investors generally will pay less to purchase such loans resulting in a reduction in the gain on sale of the loans or, possibly, a loss. In an effort to mitigate such risk, forward delivery sales commitments are executed, under which the Company agrees to deliver whole mortgage loans to various investors. See Note 11, “Derivative and Hedging Activities” within Notes to Consolidated Financial Statements included in Item 8 hereof for more information on mortgage loan commitments and forward sales agreements.

Loan Portfolio Management continues to focus on growth in the commercial and home equity lending categories, while placing less emphasis on the other lending categories. Although deemphasizing certain lending categories has led to a slower growth rate than what otherwise might have been realized, management believes the change to be prudent, given the prevailing interest rate and economic environment, as well as strategic priorities. The following table sets forth information concerning the composition of the Bank’s loan portfolio by loan type at the dates indicated:

Table 4 — Loan Portfolio Composition

December 31 | ||||||||||||||||||||||||||||||||||

2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

Amount | Percent | Amount | Percent | Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||||||||

Commercial and industrial | $ | 687,511 | 15.2 | % | $ | 575,716 | 15.2 | % | $ | 502,952 | 14.1 | % | $ | 373,531 | 11.0 | % | $ | 270,832 | 10.2 | % | ||||||||||||||

Commercial real estate | 2,122,153 | 46.9 | % | 1,847,654 | 48.6 | % | 1,717,118 | 48.4 | % | 1,614,474 | 47.5 | % | 1,126,295 | 42.4 | % | |||||||||||||||||||

Commercial construction | 188,768 | 4.2 | % | 128,904 | 3.4 | % | 129,421 | 3.6 | % | 175,312 | 5.2 | % | 171,955 | 6.5 | % | |||||||||||||||||||

Small business | 78,594 | 1.7 | % | 78,509 | 2.1 | % | 80,026 | 2.3 | % | 82,569 | 2.4 | % | 86,670 | 3.3 | % | |||||||||||||||||||

Residential real estate | 604,668 | 13.4 | % | 416,570 | 11.0 | % | 473,936 | 13.3 | % | 555,306 | 16.4 | % | 413,024 | 15.6 | % | |||||||||||||||||||

Residential construction | 8,213 | 0.2 | % | 9,631 | 0.3 | % | 4,175 | 0.1 | % | 10,736 | 0.3 | % | 10,950 | 0.4 | % | |||||||||||||||||||

Home equity | 802,149 | 17.8 | % | 696,063 | 18.3 | % | 579,278 | 16.3 | % | 471,862 | 13.9 | % | 406,240 | 15.3 | % | |||||||||||||||||||

Consumer — other | 26,955 | 0.6 | % | 41,343 | 1.1 | % | 68,773 | 1.9 | % | 111,725 | 3.3 | % | 166,570 | 6.3 | % | |||||||||||||||||||

Gross loans | 4,519,011 | 100.0 | % | 3,794,390 | 100.0 | % | 3,555,679 | 100.0 | % | 3,395,515 | 100.0 | % | 2,652,536 | 100.0 | % | |||||||||||||||||||

Allowance for loan losses | 51,834 | 48,260 | 46,255 | 42,361 | 37,049 | |||||||||||||||||||||||||||||

Net loans | $ | 4,467,177 | $ | 3,746,130 | $ | 3,509,424 | $ | 3,353,154 | $ | 2,615,487 | ||||||||||||||||||||||||

The following table summarizes loan growth during the year ending December 31, 2012:

Table 5 - Components of Loan Growth/(Decline)

Organic Growth/(Decline) % | |||||||||||||||||||

December 31 | Central Acquisition | Organic Growth/(Decline) | |||||||||||||||||

2012 | 2011 | ||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

Commercial and industrial | $ | 687,511 | $ | 575,716 | $ | 536 | $ | 111,259 | 19.3 | % | |||||||||

Commercial real estate | 2,122,153 | 1,847,654 | 139,148 | 135,351 | 7.3 | % | |||||||||||||

Commercial construction | 188,768 | 128,904 | — | 59,864 | 46.4 | % | |||||||||||||

Small business | 78,594 | 78,509 | — | 85 | 0.1 | % | |||||||||||||

Residential real estate | 604,668 | 416,570 | 259,637 | (1) | (71,539 | ) | (17.2 | )% | |||||||||||

Residential construction | 8,213 | 9,631 | — | (1,418 | ) | (14.7 | )% | ||||||||||||

Home equity | 802,149 | 696,063 | 8,281 | 97,805 | 14.1 | % | |||||||||||||

Consumer - other | 26,955 | 41,343 | 826 | (15,214 | ) | (36.8 | )% | ||||||||||||

Total loans | $ | 4,519,011 | $ | 3,794,390 | $ | 408,428 | $ | 316,193 | 8.3 | % | |||||||||

(1) Excludes $42.2 million of acquired loans which were sold subsequent to the closing of the acquisition.

The following table sets forth the scheduled contractual amortization of the Bank’s loan portfolio at December 31, 2012. Loans having no schedule of repayments or no stated maturity are reported as due in one year or less. The following table also sets forth the rate structure of loans scheduled to mature after one year:

Table 6 — Scheduled Contractual Loan Amortization

December 31, 2012 | ||||||||||||||||||||||||||||||||||||

Commercial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Residential Construction | Home Equity | Consumer Other | Total | ||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||||

Amounts due in: | ||||||||||||||||||||||||||||||||||||

One year or less | $ | 247,905 | $ | 240,210 | $ | 49,068 | $ | 15,240 | $ | 27,694 | $ | 8,213 | $ | 21,919 | $ | 15,429 | $ | 625,678 | ||||||||||||||||||

After one year through five years | 267,512 | 1,119,046 | 63,511 | 33,179 | 91,202 | — | 90,673 | 8,860 | 1,673,983 | |||||||||||||||||||||||||||

Beyond five years | 172,094 | 762,897 | 76,189 | 30,175 | 485,772 | — | 689,557 | 2,666 | 2,219,350 | |||||||||||||||||||||||||||

Total | $ | 687,511 | $ | 2,122,153 | $ | 188,768 | (1) | $ | 78,594 | $ | 604,668 | $ | 8,213 | $ | 802,149 | $ | 26,955 | $ | 4,519,011 | |||||||||||||||||

Interest rate terms on amounts due after one year: | ||||||||||||||||||||||||||||||||||||

Fixed rate | $ | 177,186 | $ | 711,376 | $ | 38,359 | $ | 32,596 | $ | 420,142 | $ | — | $ | 343,880 | $ | 11,526 | 1,735,065 | |||||||||||||||||||

Adjustable rate | 262,420 | 1,170,567 | 101,341 | 30,758 | 156,832 | — | 436,350 | — | 2,158,268 | |||||||||||||||||||||||||||

(1) | Includes certain construction loans that will convert to commercial mortgages and will be reclassified to commercial real estate upon the completion of the construction phase. |

As of December 31, 2012, $5.1 million of loans scheduled to mature within one year were nonperforming.

Generally, the actual maturity of loans is substantially shorter than their contractual maturity due to prepayments and, in the case of real estate loans, due-on-sale clauses, which generally gives the Bank the right to declare a loan immediately due and payable in the event that, among other things, the borrower sells the property subject to the mortgage and the loan is not repaid. The average life of real estate loans tends to increase when current real estate loan rates are higher than rates on mortgages in the portfolio and, conversely, tends to decrease when rates on mortgages in the portfolio are higher than current real estate loan rates. Under the latter scenario, the weighted average yield on the portfolio tends to decrease as higher yielding loans are repaid or refinanced at lower rates. Due to the fact that the Bank may, consistent with industry practice, renew a significant portion of commercial and commercial real estate loans at or immediately prior to their maturity by renewing the loans on substantially similar or revised terms, the principal repayments actually received by the Bank are anticipated to be significantly less than the amounts contractually due in any particular period. In other circumstances, a loan, or a portion of a loan, may not be repaid due to the borrower’s inability to satisfy the contractual obligations of the loan.

Asset Quality The Company continually monitors the asset quality of the loan portfolio using all available information. Based on this information, loans demonstrating certain payment issues or other weaknesses may be categorized as delinquent, impaired, nonperforming and/or put on nonaccrual status. Additionally, in the course of resolving such loans, the Company may choose to restructure the contractual terms of certain loans to match the borrower’s ability to repay the loan based on their current financial condition. If a restructured loan meets certain criteria, it may be categorized as a troubled debt restructuring (TDR).

Delinquency The Bank’s philosophy toward managing its loan portfolios is predicated upon careful monitoring, which stresses early detection and response to delinquent and default situations. The Bank considers a loan to have defaulted when it reaches 90 days past due. The Bank seeks to make arrangements to resolve any delinquent or default situation over the shortest possible time frame. Generally, the Bank requires that a delinquency notice be mailed to a borrower upon expiration of a grace period (typically no longer than 15 days beyond the due date). Reminder notices may be sent and telephone calls may be made prior to the expiration of the grace period. If the delinquent status is not resolved within a reasonable time frame following the mailing of a delinquency notice, the Bank’s personnel charged with managing its loan portfolios contact the borrower to ascertain the reasons for delinquency and the prospects for payment. Any subsequent actions taken to resolve the delinquency will depend upon the nature of the loan and the length of time that the loan has been delinquent. The borrower’s needs are considered as much as reasonably possible without jeopardizing the Bank’s position. A late charge is usually assessed on loans upon expiration of the grace period.

Nonaccrual Loans As a general rule, within commercial real estate or home equity categories, loans more than 90 days past due with respect to principal or interest are classified as nonaccrual loans. As permitted by banking regulations, certain consumer loans past due 90 days or more continue to accrue interest. In addition, certain commercial and real estate loans that are more than 90 days past due may be kept on an accruing status if the loans are well secured and in the process of collection. Income accruals are suspended on all nonaccrual loans and all previously accrued and uncollected interest is reversed against current income. A loan remains on nonaccrual status until it becomes current with respect to principal and interest (and in certain instances remains current for up to six months), when the loan is liquidated, or when the loan is determined to be uncollectible and is charged-off against the allowance for loan losses.

Troubled Debt Restructurings In the course of resolving problem loans, the Bank may choose to restructure the contractual terms of certain loans. The Bank attempts to work-out an alternative payment schedule with the borrower in order to avoid or cure a default. Any loans that are modified are reviewed by the Bank to identify if a TDR has occurred, which is when, for economic or legal reasons related to a borrower’s financial difficulties, the Bank grants a concession to the borrower that it would not otherwise consider. Terms may be modified to fit the ability of the borrower to repay in line with its current financial status and the restructuring of the loan may include adjustments to interest rates, extensions of maturity, consumer loans where the borrower's obligations have been effectively discharged through Chapter 7 Bankruptcy and the borrower has not reaffirmed the debt to the Bank, and other actions intended to minimize economic loss and avoid foreclosure or repossession of collateral. If such efforts by the Bank do not result in satisfactory performance, the loan is referred to legal counsel, at which time foreclosure proceedings are initiated. At any time prior to a sale of the property at foreclosure, the Bank may terminate foreclosure proceedings if the borrower is able to work-out a satisfactory payment plan.

It is the Bank’s policy to have any restructured loans which are on nonaccrual status prior to being modified remain on nonaccrual status for six months, subsequent to being modified, before management considers its return to accrual status. If the restructured loan is on accrual status prior to being modified, it is reviewed to determine if the modified loan should remain on accrual status. Loans that are considered TDRs are classified as performing, unless they are on nonaccrual status or greater than 90 days delinquent. Loans classified as TDRs remain classified as such, for the life of the loan, except in limited circumstances, when it is determined that the borrower is performing under modified terms and the restructuring agreement specified an interest rate greater than or equal to an acceptable market rate for a comparable new loan at the time of the restructuring.

Purchased Credit Impaired Loans Purchased Credit Impaired (“PCI”) loans are acquired loans which had evidence of deterioration in credit quality since origination and for which it is probable that all contractually required payments will not be collected. The PCI loans are recorded at fair value without any carryover of the allowance for loan losses. The excess cash flows expected to be collected over the carrying amount of the loans, referred to as the "accretable yield", is accreted into interest income over the life of the loans using the effective yield method. Accordingly, PCI loans are not subject to classification as nonaccrual in the same manner as originated loans, rather they are considered to be accruing loans because their interest income recognized relates to the accretable yield and not to contractual interest payments. The carrying amount of these purchased credit impaired loans was $32.1 million as of December 31, 2012. See Note 4, "Loans, Allowance for Loan Losses and Credit Quality" within Notes to Consolidated Financial Statements included in Item 8 hereof for more information.

Nonperforming Assets Nonperforming assets are comprised of nonperforming loans, nonperforming securities, Other Real Estate Owned (“OREO”), and other assets in possession. Nonperforming loans consist of nonaccrual loans and loans that are more than 90 days past due but still accruing interest.

Nonperforming securities consist of securities that are on nonaccrual status. The Company holds six collateralized debt obligation securities (“CDOs”) comprised of pools of trust preferred securities issued by banks and insurance companies, which are currently deferring interest payments on certain tranches within the bonds’ structures including the tranches held by the Company. The bonds are anticipated to continue to defer interest until cash flows are sufficient to satisfy certain collateralization levels designed to protect more senior tranches. As

a result the Company has placed the six securities on nonaccrual status and has reversed any previously accrued income related to these securities.

OREO consists of real estate properties, which have served as collateral to secure loans, that are controlled or owned by the Bank. These properties are recorded at fair value less estimated costs to sell at the date control is established, resulting in a new cost basis. The amount by which the recorded investment in the loan exceeds the fair value (net of estimated costs to sell) of the foreclosed asset is charged to the allowance for loan losses. Subsequent declines in the fair value of the foreclosed asset below the new cost basis are recorded through the use of a valuation allowance. Subsequent increases in the fair value are recorded as reductions in the allowance, but not below zero. All costs incurred thereafter in maintaining the property are charged to noninterest expense. In the event the real estate is utilized as a rental property, rental income and expenses are recorded as incurred and included in noninterest income and noninterest expense, respectively.

Other assets in possession primarily consist of foreclosed non-real estate assets deemed to be in control of the Company.

The following table sets forth information regarding nonperforming assets held by the Bank at the dates indicated:

Table 7 — Nonperforming Assets

December 31 | |||||||||||||||||||

2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

Loans accounted for on a nonaccrual basis(1) | |||||||||||||||||||

Commercial and industrial | $ | 2,666 | $ | 1,883 | $ | 3,123 | $ | 4,205 | $ | 1,942 | |||||||||

Commercial real estate | 6,574 | 13,109 | 9,836 | 18,525 | 12,370 | ||||||||||||||

Small business | 570 | 542 | 887 | 793 | 1,111 | ||||||||||||||

Residential real estate | 11,472 | 9,867 | 6,728 | 10,829 | 9,394 | ||||||||||||||

Home equity | 7,311 | 3,130 | 1,752 | 1,166 | 1,090 | ||||||||||||||

Consumer — other | 121 | 381 | 505 | 373 | 751 | ||||||||||||||

Total | $ | 28,714 | $ | 28,912 | $ | 22,831 | $ | 35,891 | $ | 26,658 | |||||||||

Loans past due 90 days or more but still accruing | |||||||||||||||||||

Home equity | $ | — | $ | — | $ | 4 | $ | — | $ | — | |||||||||

Consumer — other | 52 | 41 | 273 | 292 | 275 | ||||||||||||||

Total | $ | 52 | $ | 41 | $ | 277 | $ | 292 | $ | 275 | |||||||||

Total nonperforming loans | $ | 28,766 | $ | 28,953 | $ | 23,108 | $ | 36,183 | $ | 26,933 | |||||||||

Nonaccrual securities(2) | 1,511 | 1,272 | 1,051 | 920 | 910 | ||||||||||||||

Other assets in possession | 176 | 266 | 61 | 148 | 231 | ||||||||||||||

Other real estate owned | 11,974 | 6,658 | 7,273 | 3,994 | 1,809 | ||||||||||||||

Total nonperforming assets | $ | 42,427 | $ | 37,149 | $ | 31,493 | $ | 41,245 | $ | 29,883 | |||||||||

Nonperforming loans as a percent of gross loans | 0.64 | % | 0.76 | % | 0.65 | % | 1.07 | % | 1.02 | % | |||||||||

Nonperforming assets as a percent of total assets | 0.74 | % | 0.75 | % | 0.67 | % | 0.92 | % | 0.82 | % | |||||||||

(1) | Included in these amounts were $6.6 million, $9.2 million, $4.0 million, $3.4 million, and $74,000 of TDRs on nonaccrual at December 31, 2012, 2011, 2010, 2009 and 2008, respectively. |

(2) | Amounts represent the fair value of nonaccrual securities. The Company had six nonaccrual securities in 2012, 2011, 2010 and 2009, and five nonaccrual securities in 2008. |

The following table summarizes the changes in nonperforming assets for the periods indicated:

Table 8 - Activity in Nonperforming Assets

Years Ended December 31 | |||||||||||||

2012 | 2011 | ||||||||||||

(Dollars in thousands) | |||||||||||||

Nonperforming assets beginning balance | $ | 37,149 | $ | 31,493 | |||||||||

New to nonperforming | 42,606 | 40,290 | |||||||||||

Loans charged-off | (16,591 | ) | (11,341 | ) | |||||||||

Loans paid-off | (10,381 | ) | (10,593 | ) | |||||||||

Loans restored to accrual status | (9,091 | ) | (5,465 | ) | |||||||||

Loans transferred to other real estate owned/other assets | (7,061 | ) | (6,285 | ) | |||||||||

Change to other real estate owned: | |||||||||||||

New to other real estate owned | 7,061 | 6,285 | |||||||||||

Acquired other real estate owned | 2,633 | ||||||||||||

Valuation write down | (776 | ) | (1,569 | ) | |||||||||

Sale of other real estate owned | (5,871 | ) | (6,479 | ) | |||||||||

Development of other real estate owned | 2,269 | 938 | |||||||||||

Other | — | 210 | |||||||||||

Total change to other real estate owned | 5,316 | (615 | ) | ||||||||||

Change in fair value on nonaccrual securities | 239 | 221 | |||||||||||

Other | 241 | (556 | ) | ||||||||||

Nonperforming assets ending balance | $ | 42,427 | $ | 37,149 | |||||||||

The following table sets forth information regarding troubled debt restructured loans as of the dates indicated:

Table 9 — Troubled Debt Restructurings

December 31 | |||||||||||||||||||

2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

Performing troubled debt restructurings | $ | 46,764 | $ | 37,151 | $ | 26,091 | $ | 10,484 | $ | 1,063 | |||||||||

Nonaccrual troubled debt restructurings | 6,554 | 9,230 | 3,982 | 3,498 | 74 | ||||||||||||||

Total | $ | 53,318 | $ | 46,381 | $ | 30,073 | $ | 13,982 | $ | 1,137 | |||||||||

Performing troubled debt restructurings as a % of total loans | 1.03 | % | 0.98 | % | 0.73 | % | 0.31 | % | 0.04 | % | |||||||||

Nonaccrual troubled debt restructurings as a % of total loans | 0.15 | % | 0.24 | % | 0.11 | % | 0.10 | % | — | % | |||||||||

Total troubled debt restructurings as a % of total loans | 1.18 | % | 1.22 | % | 0.84 | % | 0.41 | % | 0.04 | % | |||||||||

The following table summarizes changes in TDRs for the periods indicated:

Table 10 - Activity in Troubled Debt Restructurings

December 31 | |||||||

2012 | 2011 | ||||||

(Dollars in thousands) | |||||||

TDRs beginning balance | $ | 46,381 | $ | 30,073 | |||

New to TDR status | 8,350 | 22,485 | |||||

Court ordered concessions (1) | 5,143 | — | |||||

Paydowns | (6,080 | ) | (5,646 | ) | |||

Charge-offs | (476 | ) | (531 | ) | |||

Loans removed from TDR status | — | — | |||||

TDRs ending balance | $ | 53,318 | $ | 46,381 | |||

(1) Represents consumer loans where the borrower's obligation has been effectively discharged through Chapter 7 Bankruptcy and the borrower has not reaffirmed the debt for all applicable prior periods.

Income accruals are suspended on all nonaccrual loans and all previously accrued and uncollected interest is reversed against current income. The table below shows interest income that was recognized or collected on all nonaccrual loans and performing TDRs as of the dates indicated:

Table 11 — Interest Income Recognized/Collected on Nonaccrual Loans and Troubled Debt Restructured Loans

Years Ended December 31 | |||||||||||

2012 | 2011 | 2010 | |||||||||

(Dollars in thousands) | |||||||||||

Interest income that would have been recognized if nonaccruing loans had been performing | $ | 2,623 | $ | 1,739 | $ | 2,749 | |||||

Interest income recognized on TDRs still accruing | 2,609 | 2,140 | 1,425 | ||||||||

Interest collected on nonaccrual loans and TDRs and included in interest income | $ | 3,642 | $ | 2,708 | $ | 1,874 | |||||

A loan is considered impaired when, based on current information and events, it is probable that the Bank will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record, and the amount of the shortfall in relation to the principal and interest owed.

Impairment is measured on a loan by loan basis for commercial and industrial, commercial real estate, commercial construction, and small business categories and for all loans identified as a troubled debt restructuring by comparing the loan’s value to either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price, or the fair value of the collateral if the loan is collateral dependent. For impaired loans deemed collateral dependent, where impairment is measured using the fair value of the collateral, the Bank will either order a new appraisal or use another available source of collateral assessment such as a broker’s opinion of value to determine a reasonable estimate of the fair value of the collateral.

At December 31, 2012, impaired loans included all commercial and industrial loans, commercial real estate loans, commercial construction, and small business loans that are on nonaccrual status, TDRs, and other loans that have been categorized as impaired. Total impaired loans at December 31, 2012 and 2011 were $66.7 million and $61.7 million, respectively. For additional information regarding the Bank’s asset quality, including delinquent loans, nonaccruals, TDRs, and impaired loans, see Note 4, “Loans, Allowance for Loan Losses, and Credit Quality” within Notes to Consolidated Financial Statements included in Item 8 hereof.

Potential problem loans are any loans which are not included in nonaccrual or nonperforming loans, where known information about possible credit problems of the borrowers causes management to have concerns as to the ability of such borrowers to comply with present loan repayment terms. The table below shows the potential problem commercial loans at the time periods indicated:

Table 12 — Potential Problem Commercial Loans

December 31 | |||||||

2012 | 2011 | ||||||

(Dollars in thousands) | |||||||

Number of loan relationships | 70 | 64 | |||||

Aggregate outstanding balance | $ | 110,624 | $ | 113,641 | |||

At December 31, 2012, these potential problem loans continued to perform with respect to payments. Management actively monitors these loans and strives to minimize any possible adverse impact to the Bank.

Allowance for Loan Losses The allowance for loan losses is maintained at a level that management considers adequate to provide for probable loan losses based upon evaluation of known and inherent risks in the loan portfolio. The allowance is increased by providing for loan losses through a charge to provision for loan losses and by recoveries of loans previously charged-off and is reduced by loans charged-off.

While management uses available information to recognize losses on loans, future additions to the allowance may be necessary based on increases in nonperforming loans, changes in economic conditions, or for other reasons. Additionally, various regulatory agencies, as an integral part of the Bank’s examination process, periodically assess the adequacy of the allowance for loan losses and may require it to increase its provision for loan losses or recognize further loan charge-offs.

As of December 31, 2012, the allowance for loan losses totaled $51.8 million, or 1.15% of total loans as compared to $48.3 million, or 1.27% of total loans, at December 31, 2011. The increase in the amount of allowance is driven by shifts in the composition of the loan portfolio mix and loan growth, offset by improvements in certain asset quality measures. The decrease in the amount of the allowance as a percentage of loans is largely attributable to the acquired loans which are accounted for at fair value, with no carryover of the related allowance.

The following table summarizes changes in the allowance for loan losses and other selected statistics for the periods presented:

Table 13 — Summary of Changes in the Allowance for Loan Losses

December 31 | |||||||||||||||||||

2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

Average total loans | $ | 4,022,349 | $ | 3,681,418 | $ | 3,434,769 | $ | 3,177,949 | $ | 2,489,028 | |||||||||

Allowance for loan losses, beginning of year | $ | 48,260 | $ | 46,255 | $ | 42,361 | $ | 37,049 | $ | 26,831 | |||||||||

Charged-off loans: | |||||||||||||||||||

Commercial and industrial | 6,191 | 2,888 | 5,170 | 1,663 | 595 | ||||||||||||||

Commercial real estate | 4,348 | 2,631 | 3,448 | 834 | — | ||||||||||||||

Commercial construction | — | 769 | 1,716 | 2,679 | — | ||||||||||||||

Small business | 616 | 1,190 | 2,279 | 2,047 | 1,350 | ||||||||||||||

Residential real estate | 1,094 | 559 | 557 | 829 | 362 | ||||||||||||||

Home equity | 3,178 | 1,626 | 939 | 1,799 | 1,200 | ||||||||||||||

Consumer — other | 1,165 | 1,678 | 2,078 | 3,404 | 3,631 | ||||||||||||||

Total charged-off loans | 16,592 | 11,341 | 16,187 | 13,255 | 7,138 | ||||||||||||||

Recoveries on loans previously charged-off | |||||||||||||||||||

Commercial and industrial | 963 | 420 | 361 | 27 | 168 | ||||||||||||||

Commercial real estate | 188 | 97 | 1 | — | — | ||||||||||||||

Commercial construction | — | 500 | — | — | — | ||||||||||||||

Small business | 134 | 160 | 217 | 204 | 159 | ||||||||||||||

Residential real estate | 151 | — | 59 | 105 | — | ||||||||||||||

Home equity | 93 | 52 | 131 | 41 | 5 | ||||||||||||||

Consumer — other | 581 | 635 | 657 | 855 | 612 | ||||||||||||||

Total recoveries | 2,110 | 1,864 | 1,426 | 1,232 | 944 | ||||||||||||||

Net loans charged-off | |||||||||||||||||||

Commercial and industrial | 5,228 | 2,468 | 4,809 | 1,636 | 427 | ||||||||||||||

Commercial real estate | 4,160 | 2,534 | 3,447 | 834 | — | ||||||||||||||

Commercial construction | — | 269 | 1,716 | 2,679 | — | ||||||||||||||

Small business | 482 | 1,030 | 2,062 | 1,843 | 1,191 | ||||||||||||||

Residential real estate | 943 | 559 | 498 | 724 | 362 | ||||||||||||||

Home equity | 3,085 | 1,574 | 808 | 1,758 | 1,195 | ||||||||||||||

Consumer — other | 584 | 1,043 | 1,421 | 2,549 | 3,019 | ||||||||||||||

Total net loans charged-off | 14,482 | 9,477 | 14,761 | 12,023 | 6,194 | ||||||||||||||

Allowance related to business combinations | — | — | — | — | 5,524 | ||||||||||||||

Provision for loan losses | 18,056 | 11,482 | 18,655 | 17,335 | 10,888 | ||||||||||||||

Total allowances for loan losses, end of year | $ | 51,834 | $ | 48,260 | $ | 46,255 | $ | 42,361 | $ | 37,049 | |||||||||

Net loans charged-off as a percent of average total loans | 0.36 | % | 0.26 | % | 0.43 | % | 0.38 | % | 0.25 | % | |||||||||

Allowance for loan losses as a percent of total loans | 1.15 | % | 1.27 | % | 1.30 | % | 1.25 | % | 1.40 | % | |||||||||

Allowance for loan losses as a percent of nonperforming loans | 180.19 | % | 166.68 | % | 200.17 | % | 117.07 | % | 137.56 | % | |||||||||

Net loans charged-off as a percent of allowance for loan losses | 27.94 | % | 19.64 | % | 31.91 | % | 28.38 | % | 16.72 | % | |||||||||

Recoveries as a percent of charge-offs | 12.72 | % | 16.44 | % | 8.81 | % | 9.29 | % | 13.22 | % | |||||||||

For purposes of the allowance for loan losses, management segregates the loan portfolio into the portfolio segments detailed in the table below. The allocation of the allowance for loan losses is made to each loan category using the analytical techniques and estimation methods described herein. While these amounts represent management’s best estimate of the distribution of probable losses at the evaluation dates, they are not necessarily indicative of either the categories in which actual losses may occur or the extent of such actual losses that may be recognized within each category. Each of these loan categories possess unique risk characteristics that are considered when determining the appropriate level of allowance for each segment. The total allowance is available to absorb losses from any segment of the loan portfolio.

The following table sets forth the allocation of the allowance for loan losses by loan category at the dates indicated:

Table 14 — Summary of Allocation of Allowance for Loan Losses

December 31 | ||||||||||||||||||||||||||||||||||

2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||

Allowance Amount | Percent of Loans In Category To Total Loans | Allowance Amount | Percent of Loans In Category To Total Loans | Allowance Amount | Percent of Loans In Category To Total Loans | Allowance Amount | Percent of Loans In Category To Total Loans | Allowance Amount | Percent of Loans In Category To Total Loans | |||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

Allocated Allowance | ||||||||||||||||||||||||||||||||||

Commercial and industrial | $ | 13,461 | 15.2 | % | $ | 11,682 | 15.2 | % | $ | 10,423 | 14.1 | % | $ | 7,545 | 11.0 | % | $ | 5,532 | 10.2 | % | ||||||||||||||

Commercial real estate | 22,598 | 46.9 | % | 23,514 | 48.6 | % | 21,939 | 48.4 | % | 19,451 | 47.5 | % | 15,942 | 42.4 | % | |||||||||||||||||||

Commercial construction | 2,811 | 4.2 | % | 2,076 | 3.4 | % | 2,145 | 3.6 | % | 2,457 | 5.5 | % | 4,203 | 6.9 | % | |||||||||||||||||||

Small business | 1,524 | 1.7 | % | 1,896 | 2.1 | % | 3,740 | 2.3 | % | 3,372 | 2.4 | % | 2,170 | 3.3 | % | |||||||||||||||||||

Residential real estate | 2,930 | 13.6 | % | 3,113 | 11.3 | % | 2,915 | 13.4 | % | 2,840 | 16.4 | % | 2,447 | 15.6 | % | |||||||||||||||||||

Home equity | 7,703 | 17.8 | % | 4,597 | 18.3 | % | 3,369 | 16.3 | % | 3,945 | 13.9 | % | 3,091 | 15.3 | % | |||||||||||||||||||

Consumer — other | 807 | 0.6 | % | 1,382 | 1.1 | % | 1,724 | 1.9 | % | 2,751 | 3.3 | % | 3,664 | 6.3 | % | |||||||||||||||||||

Total | $ | 51,834 | 100.0 | % | $ | 48,260 | 100.0 | % | $ | 46,255 | 100.0 | % | $ | 42,361 | 100.0 | % | $ | 37,049 | 100.0 | % | ||||||||||||||

To determine if a loan should be charged-off, all possible sources of repayment are analyzed. Possible sources of repayment include the potential for future cash flows, the value of the Bank’s collateral, and the strength of co-makers or guarantors. When available information confirms that specific loans or portions thereof are uncollectible, these amounts are promptly charged-off against the allowance for loan losses and any recoveries of such previously charged-off amounts are credited to the allowance.

Regardless of whether a loan is unsecured or collateralized, the Company charges off the amount of any confirmed loan loss in the period when the loans, or portions of loans, are deemed uncollectible. For troubled, collateral-dependent loans, loss-confirming events may include an appraisal or other valuation that reflects a shortfall between the value of the collateral and the book value of the loan or receivable, or a deficiency balance following the sale of the collateral. During 2012 allowance amounts increased by approximately $3.6 million to $51.8 million at December 31, 2012.

For additional information regarding the Bank’s allowance for loan losses, see Note 1, “Summary of Significant Accounting Policies” and Note 4, “Loans, Allowance for Loan Losses, and Credit Quality” within Notes to Consolidated Financial Statements included in Item 8 hereof.

Federal Home Loan Bank Stock The Bank held an investment in Federal Home Loan Bank (“FHLB”) of Boston's stock, which amounted to $41.8 million at December 31, 2012 and $35.9 million at December 31, 2011, respectively. The increase during 2012 in the Company's investment in FHLB stock is primarily due to the Central acquisition. The FHLB is a cooperative that provides services to its member banking institutions. The primary reason for the FHLB of Boston membership is to gain access to a reliable source of wholesale funding, particularly term funding, as a tool to manage interest rate risk. The purchase of stock in the FHLB is a requirement for a member to gain access to funding. The Company purchases FHLB stock proportional to the volume of funding received and views the purchases as a necessary long-term investment for the purposes of balance sheet liquidity and not for investment return.

Goodwill and Identifiable Intangible Assets Goodwill and Identifiable Intangible Assets were $162.1 million and $140.7 million at December 31, 2012 and December 31, 2011, respectively. For additional information regarding the goodwill and identifiable intangible assets, see Note 6, “Goodwill and Identifiable Intangible Assets” within Notes to Consolidated Financial Statements included in Item 8 hereof.

The Company performed its annual goodwill impairment testing during the third quarter of 2012, and concluded that $2.2 million of goodwill was impaired. This amount represents the total amount of goodwill relating to Compass Exchange Advisors, LLC ("Compass") which was acquired in January of 2007. Compass’ business model success is closely correlated to the volume of U.S. commercial real estate

transactions and the interest rate spread that can be obtained on short-term funds among other factors. A sharp reduction in real estate transactions and the projected continuation of low interest rates resulted in the impairment being recognized. Goodwill is evaluated for impairment at least annually, or more often if warranted, using a combined qualitative and quantitative impairment approach. The initial qualitative approach assesses whether the existence of events or circumstances led to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If, after assessing the totality of events and circumstances, the Company determines it is more likely than not that the fair value is less than carrying value the two step quantitative impairment test is performed. Step one of the quantitative impairment testing compares book value to the fair value of the reporting unit. If test one is failed, a more detailed analysis is performed, which involves measuring the excess of the fair value of the reporting unit, as determined in step one, over the aggregate fair value of the individual assets, liabilities, and identifiable intangibles as if the reporting unit was being acquired in a business combination. Step 1 of the impairment testing was passed for all reporting units during 2012, with the exception of Compass.

Cash Surrender Value of Life Insurance Policies The Bank holds life insurance policies for the purpose of offsetting the Bank’s future obligations to its employees under its retirement and benefits plans. The cash surrender value of life insurance policies was $97.3 million and $86.1 million at December 31, 2012 and December 31, 2011, respectively. The Bank recorded tax exempt income from the life insurance policies of $3.1 million in 2012, $3.2 million in 2011, and in 2010. Also during 2012, the Company recognized a gain on life insurance policies in the amount of $1.3 million, relating to proceeds from death benefits. The death benefit proceeds are also tax-exempt income to the Company.

Deposits As of December 31, 2012, deposits of $4.5 billion were $669.8 million, or 17.3%, higher than the prior year-end. Core deposits, which the Company defines as nontime and nonbrokered deposits, increased by $546.9 million, or 16.9%, during 2012 and now comprise 83.2% of total deposits. The Company experienced growth in all categories of deposits, fueled by increases in business deposits from commercial loan customers, inflows of municipal deposits and higher consumer deposits resulting from an increased advertising presence. The growth was also significantly impacted by the Central acquisition.

The following table summarizes the organic deposit growth during the periods indicated:

Table 15 - Components of Deposit Growth

Organic | ||||||||||||||||||

December 31 | Central | Organic | Growth/(Decline) | |||||||||||||||

2012 | 2011 | Acquisition | Growth/(Decline) | % | ||||||||||||||

(Dollars in thousands) | ||||||||||||||||||

Demand deposits | $ | 1,248,394 | $ | 992,418 | $ | 75,438 | $ | 180,538 | 18.2 | % | ||||||||

Savings and interest checking accounts | 1,691,187 | 1,473,812 | 65,110 | 152,265 | 10.3 | % | ||||||||||||

Money market | 853,971 | 780,437 | 72,849 | 685 | 0.1 | % | ||||||||||||

Time certificates of deposit | 753,125 | 630,162 | 144,037 | (21,074 | ) | (3.3 | )% | |||||||||||

Total deposits | $ | 4,546,677 | $ | 3,876,829 | $ | 357,434 | $ | 312,414 | 8.1 | % | ||||||||

The following table sets forth the average balances of the Bank’s deposits for the periods indicated:

Table 16 — Average Balances of Deposits

December 31 | ||||||||||||||||||||

2012 | 2011 | 2010 | ||||||||||||||||||

Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

Demand deposits | $ | 1,070,577 | 26.7 | % | $ | 910,701 | 24.9 | % | $ | 773,718 | 22.0 | % | ||||||||

Savings and interest checking | 1,484,758 | 37.1 | % | 1,355,478 | 37.2 | % | 1,183,247 | 33.7 | % | |||||||||||

Money market | 803,656 | 20.1 | % | 728,380 | 19.9 | % | 739,264 | 21.1 | % | |||||||||||

Time certificates of deposits | 646,873 | 16.1 | % | 656,486 | 18.0 | % | 814,462 | 23.2 | % | |||||||||||

Total | $ | 4,005,864 | 100.0 | % | $ | 3,651,045 | 100.0 | % | $ | 3,510,691 | 100.0 | % | ||||||||

The following table sets forth the maturities of the Bank’s time certificates of deposits in the amount of $100,000 or more as of December 31, 2012:

Table 17 — Maturities of Time Certificates of Deposits $100,000 and Over

Balance | Percentage | |||||

(Dollars in thousands) | ||||||

1 to 3 months | $ | 100,209 | 31.6 | % | ||

4 to 6 months | 48,620 | 15.3 | % | |||

7 to 12 months | 72,740 | 22.9 | % | |||

Over 12 months | 95,869 | 30.2 | % | |||

Total | $ | 317,438 | 100.0 | % | ||

The Bank also participates in the Certificate of Deposit Registry Service (“CDARS”) program, allowing the Bank to provide easy access to multi-million dollar FDIC deposit insurance protection on certificate of deposits investments for consumers, businesses and public entities. The economic downturn and subsequent flight to safety makes CDARS an attractive product for customers. In addition, the Bank may occasionally raise funds through brokered certificates of deposit. This channel allows the Bank to seek additional funding in potentially large quantities by attracting deposits from outside the Bank’s core market. The following table sets forth the Bank’s brokered deposits as of the dates indicated:

Table 18 — Brokered Deposits

December 31 | |||||||

2012 | 2011 | ||||||

(Dollars in thousands) | |||||||

CDARS | $ | 72,218 | $ | 55,150 | |||

Brokered certificates of deposit | 13,815 | 13,815 | |||||

Brokered money market | 10,000 | 10,000 | |||||

Total brokered deposits | $ | 96,033 | $ | 78,965 | |||

Borrowings The following table shows the balance of borrowings at the periods indicated:

Table 19 — Borrowings by Category

December 31 | ||||||||||

2012 | 2011 | % Change | ||||||||

(Dollars in thousands) | ||||||||||

Federal Home Loan Bank and other borrowings | $ | 283,569 | $ | 229,701 | 23.5 | % | ||||

Wholesale repurchase agreements | 50,000 | 50,000 | — | % | ||||||

Customer repurchase agreements | 153,359 | 166,128 | (7.7 | )% | ||||||

Junior subordinated debentures | 74,127 | 61,857 | 19.8 | % | ||||||

Subordinated debentures | 30,000 | 30,000 | — | % | ||||||

Total | $ | 591,055 | $ | 537,686 | 9.9 | % | ||||

The increase in the borrowings for 2012 are primarily related to the acquired Central borrowings. See Note 8, "Borrowings" within Notes to Consolidated Financial Statements included in Item 8 hereof for more information regarding borrowings.

Capital Resources The Federal Reserve, the FDIC, and other regulatory agencies have established capital guidelines for banks and bank holding companies. Risk-based capital guidelines issued by the federal regulatory agencies require banks to meet a minimum Tier 1 risk-based capital ratio of 4.0% and a total risk-based capital ratio of 8.0%. A minimum requirement of 4.0% Tier 1 leverage capital is also mandated. At December 31, 2012, the Company and the Bank exceeded the minimum requirements for all regulatory capital ratios. See Note 17, “Regulatory Capital Requirements” within Notes to Consolidated Financial Statements included in Item 8 hereof for more information regarding capital requirements.

Mortgage Banking The Bank originates residential loans for both its portfolio and with the intention of selling them in the secondary market. The Bank’s mortgage banking income consists primarily of revenue from premiums received on loans sold with servicing released, origination fees, and gains and losses on sold mortgages less related commission expense. The following table shows the total residential loans that were closed and the amounts which were held in the portfolio or sold/held for sale in the secondary market during the periods indicated:

Table 20 — Closed Residential Real Estate Loans

Years Ended December 31 | |||||||||||

2012 | 2011 | 2010 | |||||||||

(Dollars in thousands) | |||||||||||

Held in portfolio | $ | 47,205 | $ | 63,824 | $ | 63,273 | |||||

Sold/held for sale in the secondary market | 373,063 | 270,427 | 357,527 | ||||||||

Total closed loans | $ | 420,268 | $ | 334,251 | $ | 420,800 | |||||

Included in the mortgage banking income results is the impact of the Bank’s mortgage servicing assets. Servicing assets are recognized as separate assets when rights are acquired through sale of loans with servicing rights retained. The principal balance of loans serviced by the Bank on behalf of investors amounted to $198.8 million at December 31, 2012 and $229.1 million at December 31, 2011. Upon sale, the mortgage servicing asset is established, which represents the then current estimated fair value based on market prices for comparable mortgage servicing contracts, when available, or alternatively is based on a valuation model that calculates the present value of estimated future net servicing income. The valuation model incorporates assumptions that market participants would use in estimating future net servicing income, such as the cost to service, the discount rate, an inflation rate, ancillary income, prepayment speeds and default rates and losses. Impairment is determined by stratifying the rights based on predominant characteristics, such as interest rate, loan type and investor type. Impairment is recognized through a valuation allowance, to the extent that fair value is less than the capitalized amount. If the Company later determines that all or a portion of the impairment no longer exists, a reduction of the allowance may be recorded as an increase to income. Servicing rights are recorded in other assets in the consolidated balance sheets, are amortized in proportion to and over the period of estimated net servicing income, and are assessed for impairment based on fair value at each reporting date.

The following table shows fair value of the servicing rights associated with these loans and the changes for the periods indicated:

Table 21 — Mortgage Servicing Asset

2012 | 2011 | ||||||

(Dollars in thousands) | |||||||

Balance as of January 1 | $ | 1,098 | $ | 1,619 | |||

Additions | 272 | 75 | |||||

Amortization | (522 | ) | (547 | ) | |||

Change in valuation allowance (1) | 51 | (49 | ) | ||||

Balance as of December 31 | $ | 899 | $ | 1,098 | |||

(1) The Company's valuation allowance related to mortgage servicing rights was $525,000 and $576,000 at December 31, 2012 and 2011, respectively, and are reflected in the balances shown above.

Results of Operations

Table 22 — Summary of Results of Operations

Years Ended December 31 | |||||||

2012 | 2011 | ||||||

(Dollars in thousands) | |||||||

Net income | $ | 42,627 | $ | 45,436 | |||

Diluted earnings per share | $ | 1.95 | $ | 2.12 | |||

Return on average assets | 0.83 | % | 0.96 | % | |||

Return on average equity | 8.66 | % | 9.93 | % | |||

Stockholders' equity as % of assets | 9.19 | % | 9.44 | % | |||

Net Interest Income The amount of net interest income is affected by changes in interest rates and by the volume, mix, and interest rate sensitivity of interest-earning assets and interest-bearing liabilities.

On a fully tax-equivalent basis, net interest income was $173.9 million in 2012, a 3.3% increase from 2011 net interest income of $168.4 million.