Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Oritani Financial Corp | d490310d8k.htm |

Keefe,

Bruyette & Woods Keefe, Bruyette & Woods

Boston Bank Conference

Boston Bank Conference

February 28, 2013

February 28, 2013

Exhibit 99.1 |

Forward-Looking Statements

•

This

presentation

contains

forward-looking

statements,

which

can

be

identified

by

the

use

of

words

such

as

“estimate,”

“project,”

“believe,”

“intend,”

“anticipate,”

“plan,”

“seek,”

“expect”

and words of similar meaning. These forward-looking statements include, but are not

limited to: statements of our goals, intentions and expectations;

statements regarding our business plans, prospects, growth and operating strategies;

statements regarding the asset quality of our loan and investment portfolios; and

estimates of our risks and future costs and benefits.

•

These

forward-looking

statements

are

based

on

current

beliefs

and

expectations

of

our

management

and

are

inherently

subject

to

significant

business,

economic and competitive uncertainties and contingencies, many of which are beyond our

control. In addition, these forward-looking statements are subject to assumptions

with respect to future business strategies and decisions that are subject to change.

•

The following factors, among others, could cause actual results to differ materially from

the anticipated results or other expectations expressed in the forward-looking

statements: changes

in

laws

or

government

regulations

or

policies

affecting

financial

institutions,

including

changes

in

regulatory fees

and

capital

requirements;

general economic conditions, either nationally or in our market areas, that are worse than

expected; estimates of our risks and future costs and benefits.

competition among depository and other financial institutions;

inflation and changes in the interest rate environment that reduce our margins or reduce

the fair value of financial instruments; adverse changes in the securities markets;

our ability to enter new markets successfully and capitalize on growth opportunities;

our ability to successfully integrate acquired entities, if any;

changes in consumer spending, borrowing and savings habits;

changes in our organization, compensation and benefit plans;

our ability to continue to increase and manage our commercial and residential real estate,

multi-family, and commercial and industrial loans; possible impairments of securities held by us, including those issued by government

entities and government sponsored enterprises; the level of future deposit premium assessments;

the

impact

of

the

current

recession

on

our

loan

portfolio

(including

cash

flow

and

collateral

values),

investment

portfolio,

customers

and

capital market

activities;

changes in the financial performance and/or condition of our borrowers; and

the effect of changes in accounting policies and practices, as may be adopted by the

regulatory agencies, as well as the Securities and Exchange Commission, the Public

Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters.

•

Because of these and other uncertainties, our actual future results may be materially

different from the results indicated by these forward-looking statements. |

Oritani Today

3

Oritani Bank is a New Jersey-chartered savings bank

headquartered in the Township of Washington, New

Jersey, with a longstanding history of community

banking since 1911

Focuses on organic growth of loan portfolio through

commercial real estate and multifamily loan originations

Gross loans have increased from $1.5 billion on

June 30, 2010 to $2.2 billion as of December 31,

2012

Operates 25 branches in demographically attractive

Northern New Jersey

Converted

to

MHC

structure

on

January 24 ,

2007,

raising $122 million of gross proceeds

Completed second-step conversion transaction on

June 24 , 2010 raising $414 million of gross proceeds;

experienced strong organic growth thereafter

Source: SNL Financial. Deposit information as of June 30, 2012.

New Jersey Franchise demographic information weighted by deposits by county.

th

rd

3

th

County

Rank

Branches

Company

Deposits

in Market

($000)

Deposit

Market

Share

(%)

Projected

Population

Change

2011-2016

(%)

Median

HH

Income

2011

($)

Projected

HH Income

Change

2011-2016

(%)

Bergen

9

17

1,176,354

2.96

0.70

79,903

14.56

Hudson

18

5

139,856

0.52

1.88

46,525

17.37

Passaic

16

2

70,442

0.67

0.34

58,123

20.53

Essex

30

1

23,618

0.09

(0.02)

52,839

18.16

Total

25

1,410,270

New Jersey Franchise

0.79

75,052

15.20

State of New Jersey

1.50

67,128

18.98

National

3.42

50,227

14.55

One of the largest community banking institutions in

Northern New Jersey

Oritani ranks

in

deposit

market

share

in

Bergen

County

with

17

branches;

ranks

among

New

Jersey based institutions

th

9 |

Experienced Management Team

4

Experienced, shareholder-focused board and management

Kevin J. Lynch –

Chairman, President and Chief Executive Officer

President and Chief Executive Officer of Oritani Bank since 1993, President and

Chief Executive Officer of Oritani Financial Corp. since its creation in

1998 Serves as a director of the FHLB-NY, serving on its Executive,

Compensation and Housing Committees John M. Fields, Jr. –

Executive Vice President and Chief Financial Officer

Employed with Oritani since 1999; prior experience as chief accounting officer at a

publicly-traded financial institution CPA designation

Michael A. DeBernardi -

Director, Executive Vice President and Chief Operating Officer

Served

as

Lead

Director

until

appointed

Executive

Vice

President

and

Chief

Operating

Officer

in

April

2008

Oritani’s Chief Risk Officer

Thomas G. Guinan –

Executive Vice President and Chief Lending Officer

Employed

with

Oritani

since

2003;

oversees

all

aspects

of

retail

and

commercial

lending

operations

Previously

served

as

senior

vice

president

of

commercial

lending

at

a

local

financial

institution

Philip M. Wyks –

Senior Vice President and Corporate Secretary

Employed with Oritani since 1976

Director of Thrift Institutions Community Investment Corporation, a subsidiary of

the New Jersey League of Community Bankers |

Highlights of

Business Strategy 5

Continue to focus on organic multifamily and commercial real estate originations.

Aggressively remedy delinquent loans.

Maintain and increase core deposits.

Expand market share within primary market area.

Continue to emphasize operating efficiencies and cost control.

Other Strategic Decisions pertinent to shareholders

Robust history of stock repurchases. Currently an open repurchase

authorization for 1.8 million shares.

Strong recurring dividend.

Special Dividend of $0.40 per share in November, 2012.

Executive management and the Board of Directors are materially invested in the

stock of Oritani Financial Corp. |

Dollars in Thousands

except per share amounts

Q2 2013

Q2 2012

YoY

Change

Assets

$2,809,686

$2,603,143

7.9%

Gross Loans

$2,214,071

$1,851,983

19.6%

Non-time Deposits

$841,292

$722,225

16.5%

Basic Earnings Per Share

$0.21

$0.18

15.8%

TBV Per Share

$11.15

$11.14

0.1%

Common Shares Outstanding

45,381,531

45,477,534

(0.2%)

Dividends Per Share*

$0.15

$0.125

20.0%

Non-Performing Assets

$32,218

$23,195

38.9%

Second Quarter Financial Highlights

6

Stable asset growth

Driven by prudent loan

underwriting

Strong core deposit growth

CRE and multi-family loan

growth initiative translating to

bottom line

Shareholder oriented capital

management

Repurchase program

Increased dividends

$0.40 special dividend in

Q2 2013

Proactive approach to non-

performers

*Q2 2013 is presented excluding a special dividend of $0.40 per share.

|

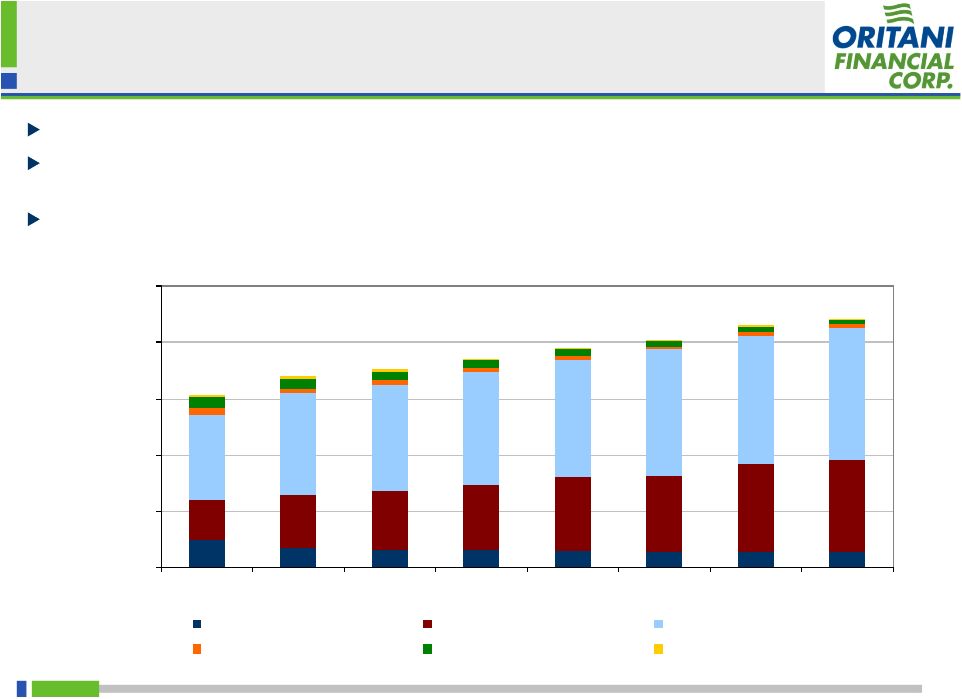

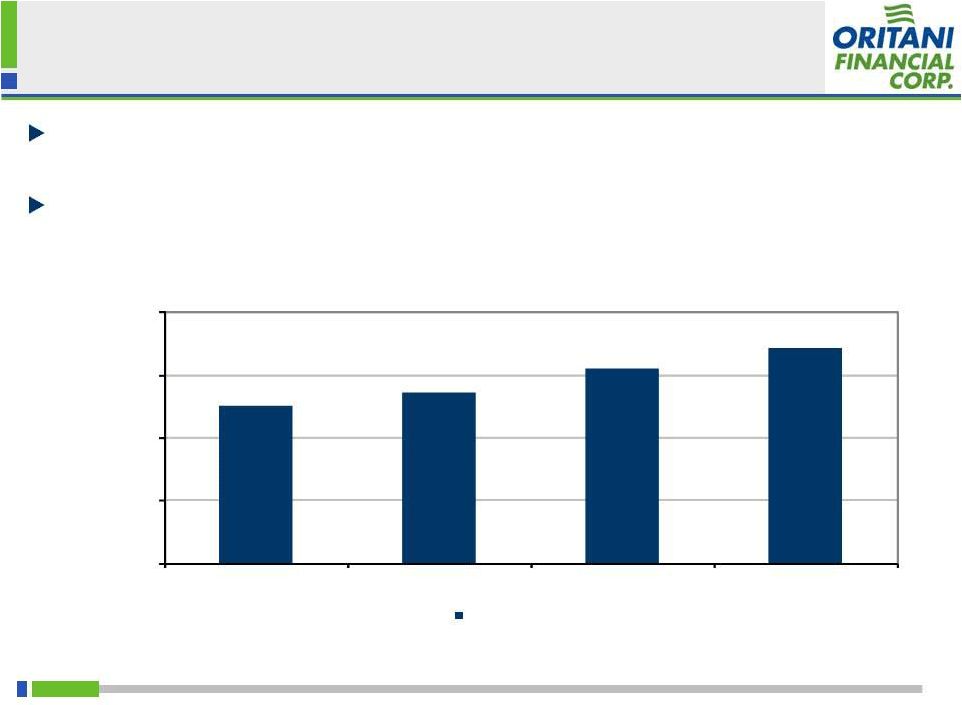

Strong

Asset Growth Trajectory 7

Oritani continues to experience strong balance sheet growth fueled by CRE and

multifamily originations

Dollars in thousands |

$1.53 B

$1.70 B

$1.76 B

$1.85 B

$1.94 B

$2.02 B

$2.15 B

$2.21 B

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

2010

2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Residential

Multi-family

Commercial Real Estate

Second Mortgage and Equity

Construction and Land

Other + Deferred Fees

Stable, Disciplined Loan Growth

8

Oritani’s

focus

on

commercial

real

estate

and

multifamily

loans

has

been

a

source

of

strength

Commercial

real

estate

loans

increased

from

$760

million

at

June

30,

2010

to

$1.2

billion

as

of

December 31, 2012

Multifamily loans increased from $360 million at June 30, 2010 to $828 million as of

December 31, 2012

Dollars in thousands

TOTAL LOANS |

Market Area Loan Portfolio

9

New Jersey (57%)

New York (28%)

Pennsylvania (12%)

Connecticut (2%)

Other (1%)

Oritani’s

market

area

for

multifamily

and

commercial

real

estate

lending

is

generally

about

150

miles

from

our

headquarters

in

Bergen

County,

New

Jersey.

It

includes

the

entire

state

of

NJ,

the

broader

New

York

metropolitan

area,

southern

New

York,

eastern

Pennsylvania,

and

southern

Connecticut.

Our

multifamily

and

commercial

real

estate

portfolio

at

December

31,

2012

consists

almost

entirely

of

organic

originations

within

our

lending

market

area. |

Continued Focus on Core Deposit Growth

10

Oritani’s core deposit gathering efforts have resulted in improved funding

costs for the Company

Dollars in thousands |

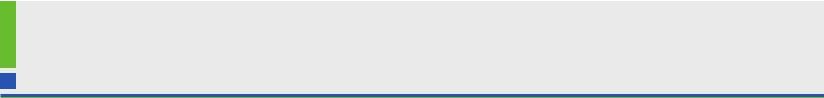

Disciplined Underwriting Culture

11

Oritani’s asset quality profile has remained strong in a difficult operating

environment Maintain disciplined underwriting standards and proactive

approach to problem assets Granular detail of the larger components of

nonaccrual loans is provided in the 10Q. Management believes that

several of the larger non-performing assets may be on the cusp of

favorable resolution. Dollars in thousands |

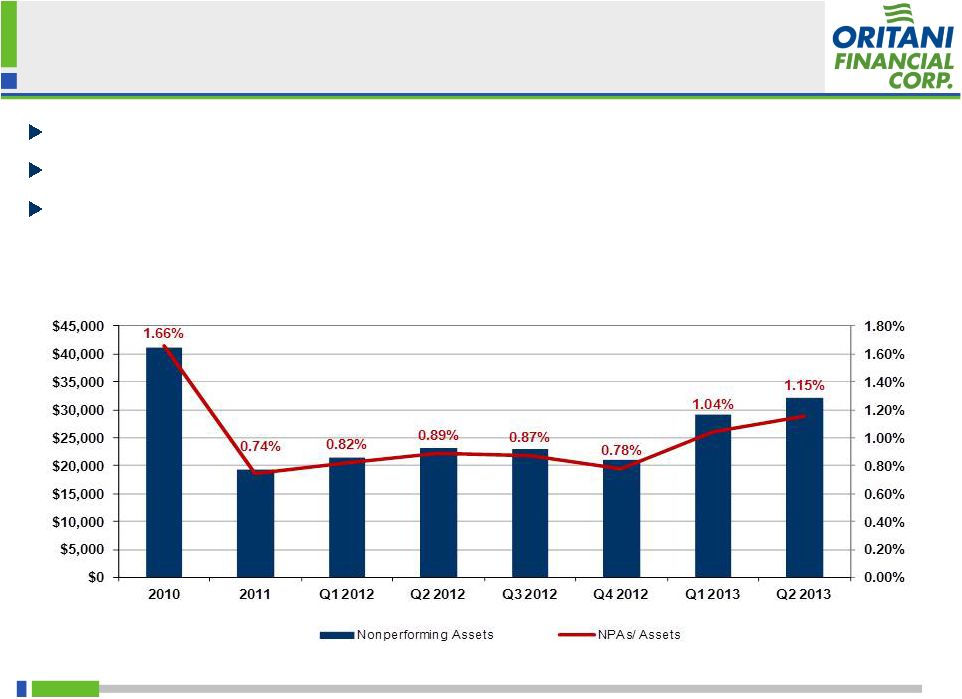

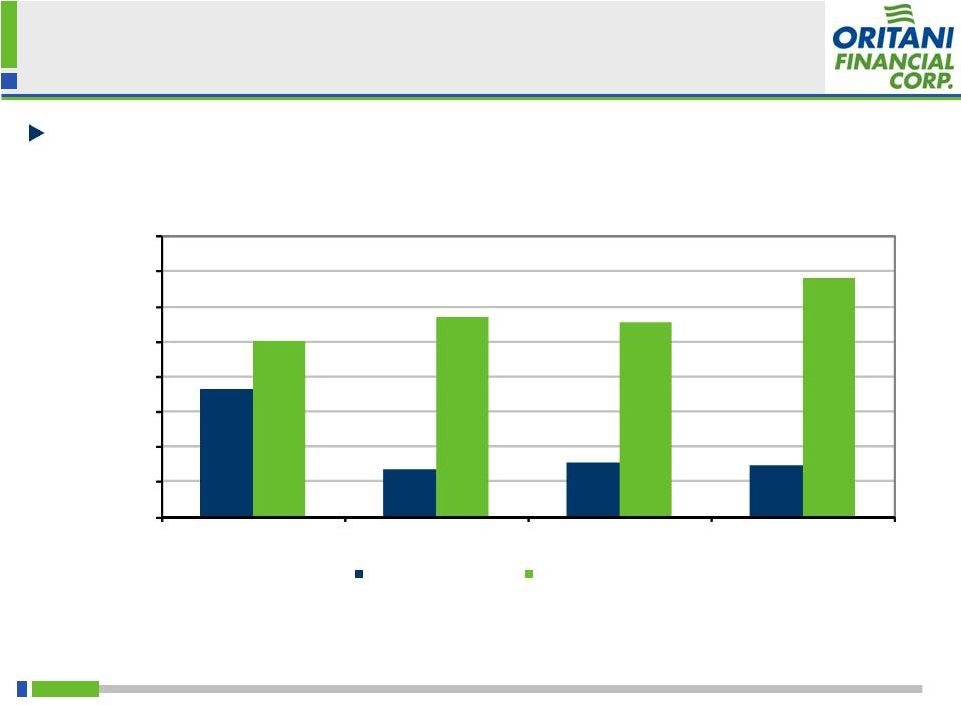

Steady Improving Profitability In Volatile

Environment

12

Oritani’s shareholder capital management has helped drive improved EPS and

ROAA

Net

Income

Trends

Since

2

Step

Conversion

(Dollars

in

thousands

except

per

share

amounts)

Note: YTD Q2 2013 figures shown on an annualized basis.

ORIT peers comprised of BRKL, DCOM, FFIC, FLIC, HVB, ISBC,

KRNY, LBAI, NBTB, NFBK, OCFC, PBNY, STL and SUBK.

1.50%

1.25%

1.00%

0.75%

0.50%

0.25%

0.73%

0.41%

2010

2011

2012

YTD Q2 2013

ORIT ROAA

Median Peer ROAA

1.13%

0.80%

1.21%

0.74%

1.32%

0.79%

$40,000

$30,000

$20,000

$10,000

$0

Net Income

Basic Earnings Per Share

$8,364

$0.15

$28,507

$0.54

$31,650

$0.71

$35,914

$0.86

$1.00

$0.80

$0.60

$0.40

$0.20

$0.00

nd

2010

2011

2012

YTD Q2 2013 |

Strong Net Interest Margin

Oritani’s spread and margin increased steadily over the 2012 fiscal year

and this

trend has extended into the current year to date

On a quarterly basis, spread and margin contracted slightly as of December 31,

2012. Factors impacting Oritani’s spread and margin are discussed

in detail in the 12/31/2012 10Q.

3.25%

3.36%

3.55%

3.71%

2.00%

2.50%

3.00%

3.50%

4.00%

2010

2011

2012

YTD Q2 2013

Net Interest Margin

13 |

Continued Focus on Cost Control

14

Oritani has been keenly focused on controlling costs while growing top line

revenues throughout a volatile environment

ORIT

peers

comprised

of

BRKL,

DCOM,

FFIC,

FLIC,

HVB,

ISBC,

KRNY,

LBAI,

NBTB,

NFBK,

OCFC,

PBNY,

STL

and

SUBK.

*Excludes non-recurring expense associated with the accelerated vesting of stock

awards and options triggered by the second step transaction and income from problem loan dispositions.

Including these items, the actual efficiency ratio was 62.5%

ORIT Efficiency Ratio

Median Peer Efficiency Ratio

70.0%

65.0%

60.0%

55.0%

50.0%

45.0%

40.0%

35.0%

30.0%

2010

2011

2012

YTD Q2 2013

48.2%*

55.0%

36.7%

58.5%

37.7%

57.7%

37.2%

63.9% |

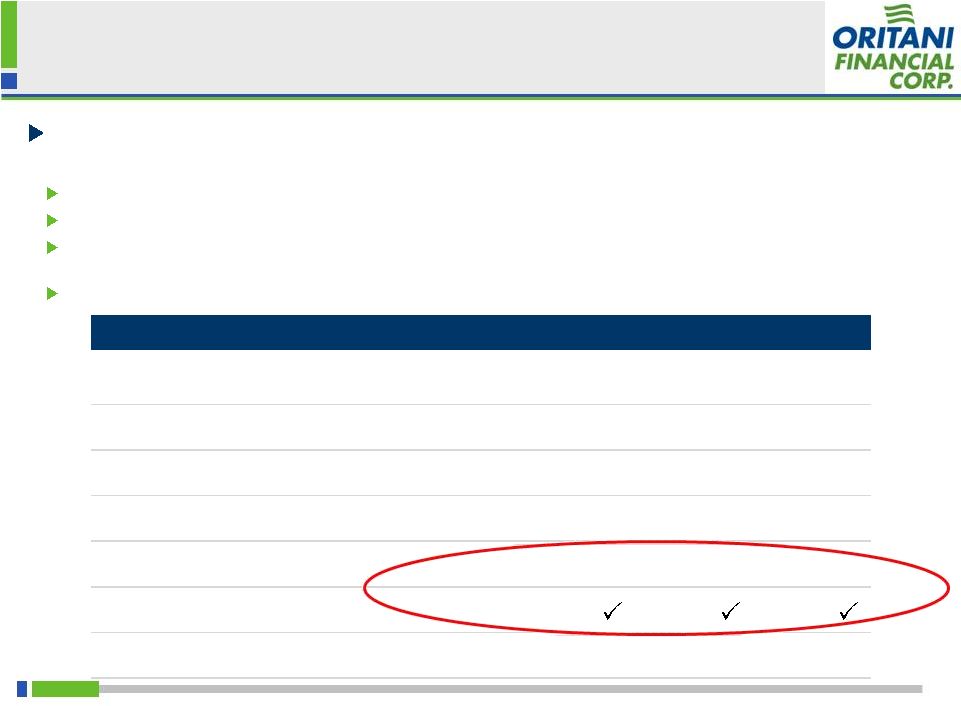

Shareholder Friendly Capital Management

15

Oritani strives to balance its strategy of deploying excess capital in a

shareholder friendly manner while also maintaining healthy capital levels

June 22, 2011: Announced share repurchase program for 10% of outstanding

shares September 14, 2011: Announced second share repurchase for another 10%

of outstanding shares November 14, 2011: Announced third share repurchase

program for 5% of outstanding shares, with 1,801,381 shares yet to be

repurchased as of December 31, 2012 November 20, 2012: Declared special

dividend of $0.40 per share *YTD through Q2 2013.

**YTD dividend presented annualized, excluding a special dividend of $0.40 per share

declared on 11/20/2012. 2010

2011

2012

YTD*

Tier 1 Ratio

38.4%

34.2%

23.2%

21.2%

Total RBC Ratio

39.6%

35.5%

24.5%

22.4%

Tier 1 To Average Assets

31.6%

25.1%

19.0%

18.2%

TCE Ratio

26.0%

24.9%

18.9%

18.0%

Dividends Per Share**

$0.18

$0.38

$0.50

$0.60

Share Repurchase Plan

n/a

Common Shares Outstanding

56,202,485

55,513,265

45,198,765

45,381,531 |

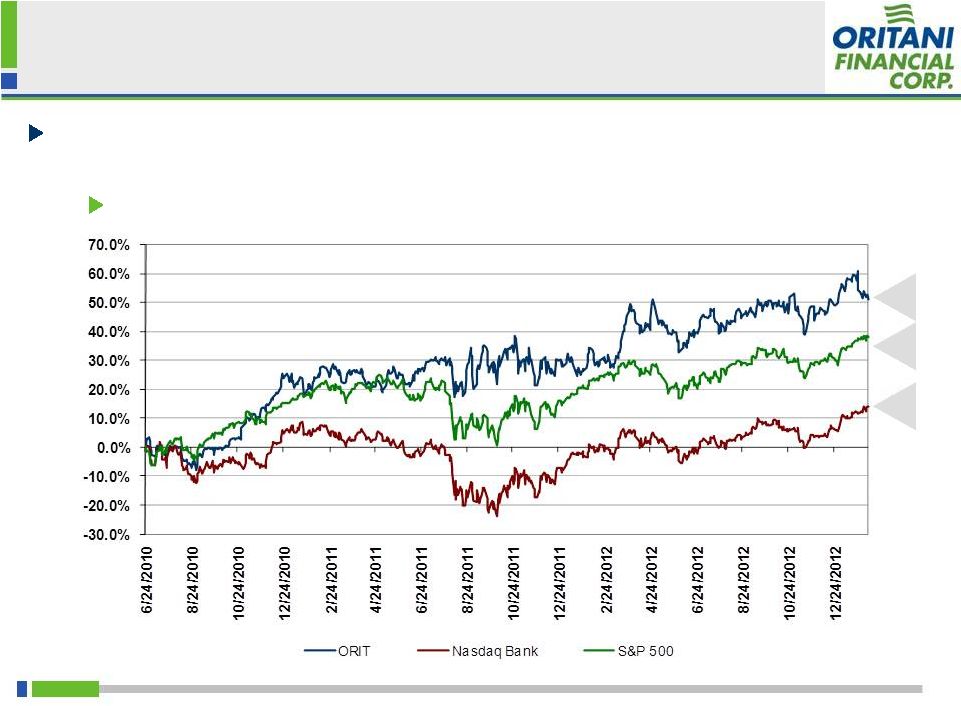

Price Performance Since 2

16

Since Oritani’s 2 step conversion, the Company has

significantly outperformed both the Nasdaq Bank Index and the S&P

500 Oritani’s business model has provided stability in difficult

markets Source: SNL Financial

Data as of February 7, 2013

51%

38%

14%

nd

nd

Step Conversion |

QUESTIONS

&

ANSWERS |