Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a50558861.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a50558861ex99-1.htm |

Exhibit 99.2

|

THOMSON REUTERS STREETEVENTS

|

|

EDITED TRANSCRIPT

|

|

MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

|

EVENT DATE/TIME: FEBRUARY 07, 2013 / 02:00PM GMT

|

|

OVERVIEW:

|

|

MMS reported 1Q13 revenues of $286.3m and income from continuing operations (net of taxes) of $21.8m or $0.62 per diluted share. Expects FY13 revenues to be $1.25-1.30b and adjusted diluted EPS from continuing operations to be $3.00-3.15.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

1

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles MAXIMUS Inc - SVP of IR

David Walker MAXIMUS Inc - CFO

Rich Montoni MAXIMUS Inc - CEO

Bruce Caswell MAXIMUS Inc - President & GM, Health Services

CONFERENCE CALL PARTICIPANTS

Charles Strauzer CJS Securities - Analyst

Scott Green BofA Merrill Lynch - Analyst

Frank Sparacino First Analysis Securities - Analyst

James Naklicki Citigroup - Analyst

Brian Kinstlinger Sidoti & Company - Analyst

PRESENTATION

Greetings, and welcome to the Maximus Fiscal 2013 First Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation.

(Operator Instructions)

As a reminder, this conference is being recorded. It is now my pleasure to introduce your host Lisa Miles, Senior Vice President of Investor Relations for Maximus. Thank you Miss Miles. You may begin.

Lisa Miles - MAXIMUS Inc - SVP of IR

Good morning. Thank you for joining us on today's conference call. I would like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions, and actual events or results may differ materially as a result of risks we face including those discussed in Exhibit 99.1 out of our SEC filings. We encourage you to review the summary of these risks and our most recent 10K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

And with that, I'll turn the call over to Dave.

David Walker - MAXIMUS Inc - CFO

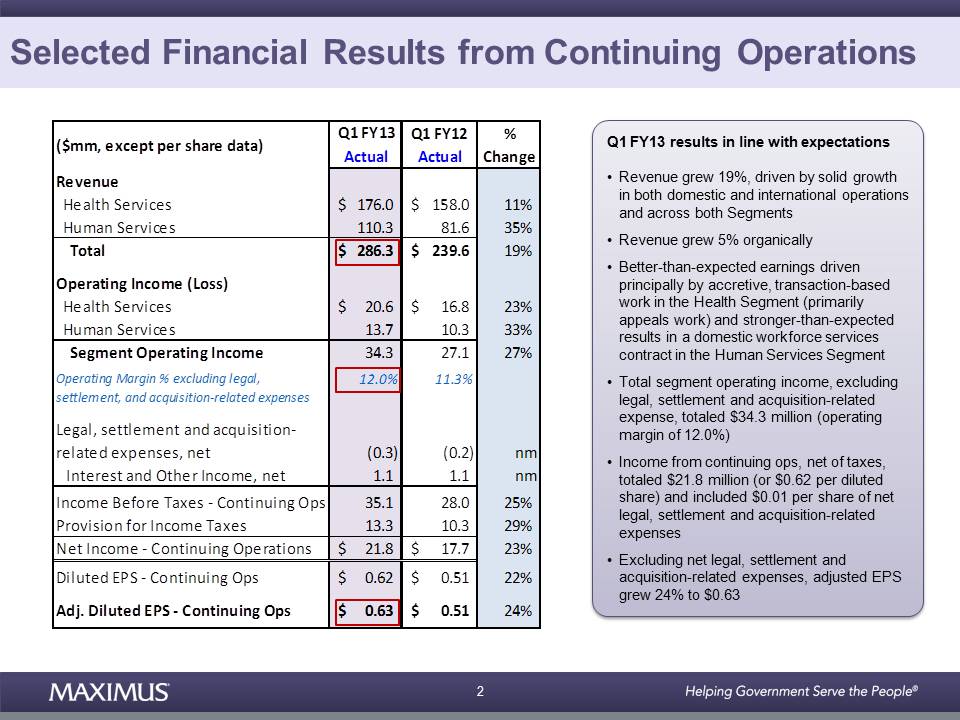

Thanks Lisa. This morning, Maximus reported first-quarter revenue that was in line with our expectations. Revenue in the quarter grew 19% to $286.3 million, compared to the same period last year with organic growth of 5%. Top line increases for the quarter came from solid growth in both our domestic and international operations, and across both segments. On the bottom line, earnings in the quarter were better than our expectations driven principally by accretive transaction-based work in the Health Services segment, primarily in our appeals business. We also experienced stronger than expected results in our Human Services segment from a domestic work force services contract.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

2

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

Total segment operating income excluding legal, settlement, and acquisition expense, totaled $34.3 million in the first fiscal quarter, and operating margins were 12%. For the first quarter, income from continuing operations, net of taxes, totaled $21.8 million or $0.62 per diluted share. This includes approximately $0.01 per share of net legal settlement and acquisition related expenses. Excluding these expenses, adjusted earnings per diluted share were $0.63 in the first quarter.

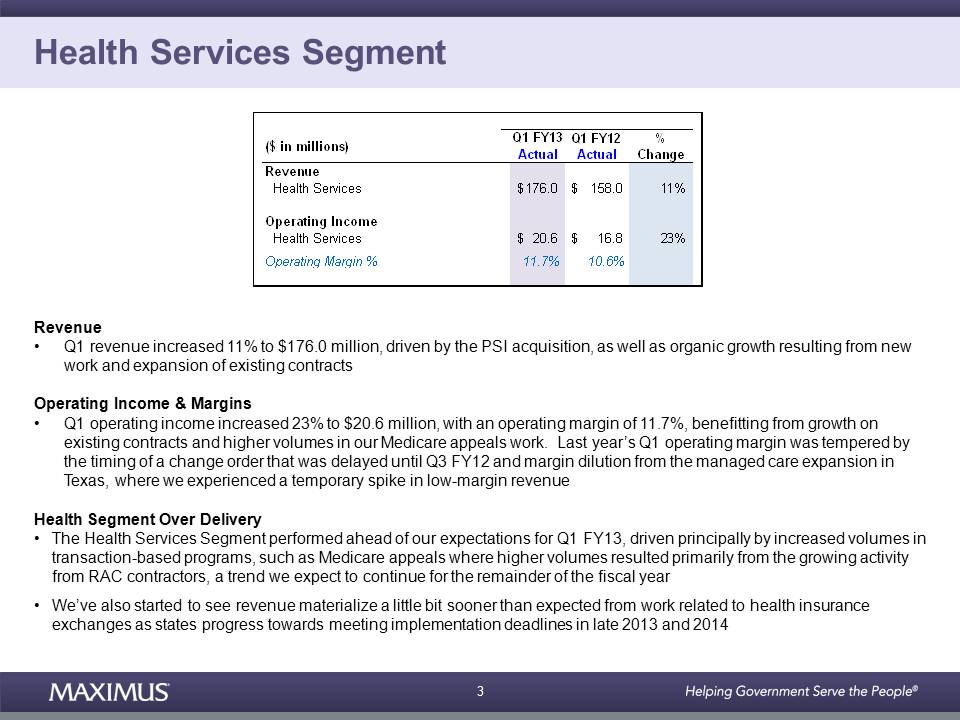

Let's jump into results by segment starting with Health Services. For the first quarter, Health Services revenue increased 11% to $176 million, compared to the same period last year. The growth was fueled by the PSI acquisition, as well as organic growth resulting from new work and expansion of existing contracts. On the bottom line, operating income for the Health Services segment was $20.6 million, and operating margin was 11.7% in the first quarter. The segment benefited from growth on existing contracts, and higher volumes in our Federal Medicare appeals work. Compared to the same period last year, operating income increased 23%, and operating margin expanded the 110 basis points. As a reminder, last year's first quarter operating margin was lowered by the timing of a change order that was delayed to the third quarter, and margin dilution from the Managed Care expansion in Texas where we experienced a temporary spike in low margin revenue.

The Health Services segment performed ahead of our expectations for the first quarter. The favorable revenue and margin results were driven principally by increased volumes in transaction-based programs such as our Federal Medicare appeals business, where higher volumes have resulted principally from the growing activity from RAC contractors. We expect this trend to continue for the remainder of the fiscal year. In addition, we've also started to see revenue materialize a little bit sooner than expected from work-related to health insurance exchanges as states progress towards meeting the implementation deadlines in late 2013 and 2014.

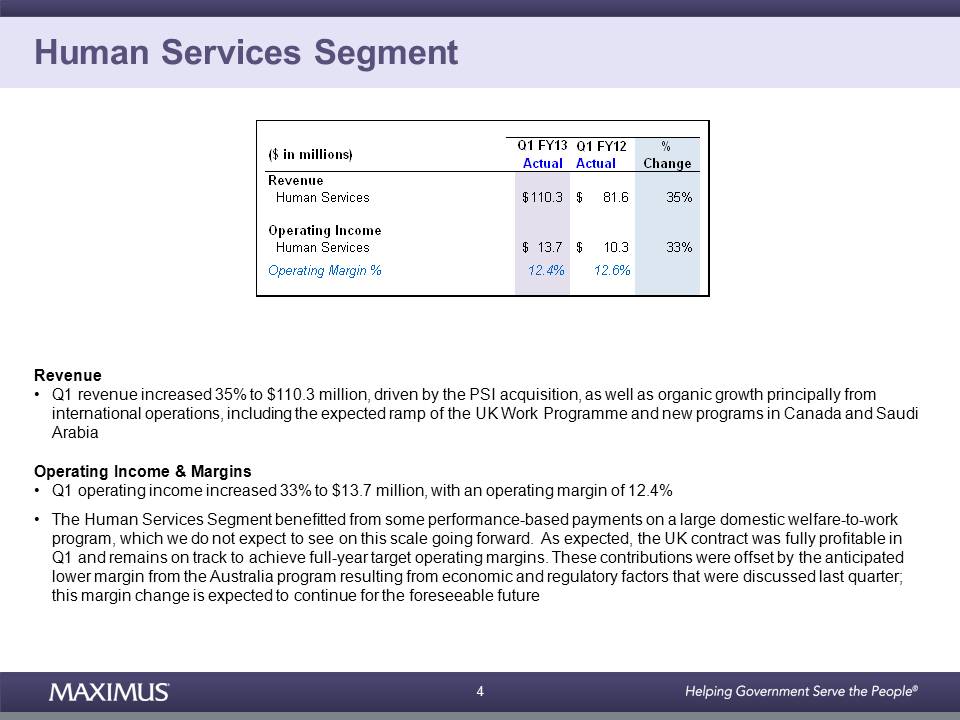

Let's now turn our attention to financial results for Human Services. For the first fiscal quarter, revenue for the Human Services segment increased 35% to $110.3 million, compared to last year. This growth was driven by the PSI acquisition, as well as organic growth principally from our international operations. This includes the expected ramp-up in the United Kingdom, as well as new programs in Canada and Saudi Arabia. First quarter operating income for the Human Services segment totaled $13.7 million, delivering a stronger than anticipated operating margin of 12.4%. The segment benefited from some performance-based payments on a large domestic welfare to work program, which we do not expect to see on this scale going forward.

I'm also pleased to note that the UK program was fully profitable in the first quarter, and remains on track to achieve our full year target operating margins. These contributions offset the anticipated lower margin from the Australia program, resulting from economic and regulatory factors that we discussed last quarter. This margin change is expected to continue for the foreseeable future.

Moving on to cash flow and balance sheet items. Cash flow in the fiscal first quarter was consistent with our seasonal expectations. As expected, cash flow was dampened as a result of normal government payment slowdowns during the holidays, which resulted in DSO's of 67 days in the quarter. However, we do expect DSO's to continue at a similar level next quarter, as a result of a couple of large programs that both have administrative processing challenges unrelated to funding. As a result, cash provided by operating activities from continuing operations totaled $10.1 million for the first quarter. Free cash flow was negative at approximately $0.5 million. This reflects an expected increase in CapEx related to the high level of startups, as well as the cash flow impact from the change in DSO's.

During the quarter, we continue to purchase shares of Maximus common stock under our Board authorized program. In Q1, we used cash of $14.6 million to purchase 249,549 shares. At December 31, 2012 we had approximately $114.6 million available for share repurchases under this program. As we've said in the past, our buyback program is opportunistic in nature, and we will continue to execute our repurchases in this manner.

At December 31, we had $167.1 million in cash and cash equivalents, of which approximately 75% is held overseas. The strength of our balance sheet continues to provide us with a lot of flexibility in deploying capital. We are committed to sensible cash deployment, where dividends and buybacks are part of our overall strategy. The team's recent focus has been heavily weighted towards M&A opportunities in current geographies, including international markets where we are seeing increased demand for our core services. This aligns with the investments we're making on business development to also drive organic growth across all our markets over the next three to five years.

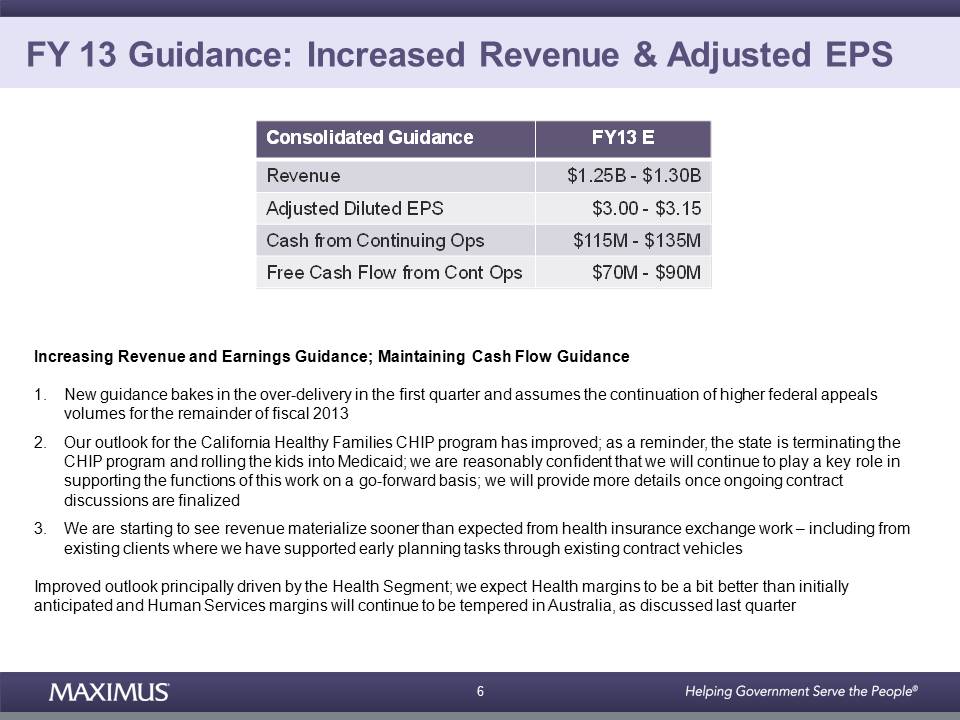

And lastly, guidance. As noted in this morning's press release, we are increasing our fiscal 2013 revenue and earnings guidance driven principally by three things. First, our new guidance bakes in the over delivery in the first quarter, and we have assume that we will continue to experience higher volumes in our Federal Health appeals business for the remainder of the year.

Second, our outlook related to our work for the California Healthy Families Chip Program has improved. As a reminder, the state is terminating this program and enrolling the kids into Medicaid. While we are still in contract negotiations with the client, we are reasonably confident that we will be able to serve a key role in supporting the functions of this work on a go forward basis. We will provide more details once we finalize the ongoing contract discussions.

And third, we are starting to see revenue materialize sooner than expected from health insurance exchange work, including from current clients where we have supported early planning tasks through our existing contract vehicles. Rich will provide some additional color during his prepared remarks.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

3

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

So when we add it all up, we now expect fiscal 2013 revenue to range between $1.25 billion and $1.30 billion. And on the bottom line, we now expect adjusted diluted EPS from continuing operations to range between $3 and $3.15. In addition, since our improved outlook is principally driven by the health segment, we expect that health margins could be bit better than initially anticipated, and Human Services margins will continue to be tempered in Australia as we discussed last quarter. We are also maintaining our cash flow guidance for fiscal 2013. We continue to expect cash provided by operating activities derived from continuing operations to be in the range of $115 million to $135 million, and we expect free cash flow from continuing operations to be in the range of $70 million to $90 million.

Thanks for joining us this morning, and now I'll turn the call over to Rich.

Rich Montoni - MAXIMUS Inc - CEO

Thanks David, and good morning everyone. We've kicked off fiscal 2013 with strong performances from both segments. I think it's fair to say that we're starting to benefit from the secular trends that are driving increasing demand for our services. And as we mentioned last quarter, we have an unprecedented number of start up programs underway, and I'm pleased to report that so far, these are going largely as planned. All in all, these tail winds position us for exceptional top and bottom line growth in fiscal 2013, and give us the confidence to be raising our revenue and earnings estimates so early in the year.

Let's start with an update on our domestic operations. Health care reform continues to serve as our primary growth driver in the US. We continue to make steady progress towards securing our fair share of this work. As a reminder, management continues to believe that a reasonable target for market share in the early years of health insurance exchanges is approximately 20% to 25% of the $500 million in total addressable market that we've laid out. On our November call, we shared that we expected to see procurement movement for the Federally Facilitated Exchange, or as it's referred to the FFE, in the first half of calendar year 2013. Three federal RFPs that have been issued could be of interest to Maximus.

The first, and potentially the largest, is the bid for the eligibility support functions of the FFE. The scope of work principally covers the paper-based support task for verifying and processing applications for enrollment into qualified health plans or insurance affordability programs, as well as shop applications, and requests for exemptions. The second RFP is for the call center operations of the Federal Exchange. These operations have been folded into the 1-800 Medicare re-bid. And the third RFP is for eligibility appeals work. However, a vendor cannot win both the eligibility support bid and the eligibility appeals work.

It's fair to say that Maximus has core competencies in all of these bids. But for competitive reasons, we have not provided further granularity on the expected size or our intent to bid on any of these. We also continue to see activity pick up in the state level for ACA related work. We are actively monitoring all of these opportunities, and identifying where Maximus can best add value.

In addition to our ongoing work in Minnesota, as David mentioned, revenue has started to materialize from our other health care reform activities and healthcare insurance exchanges. One example is New York, where the state is leveraging and transforming the existing centralized enrollment center operated by Maximus for its health insurance exchange. You may recall that when we first announced the New York health options contract, also known as the Enrollment Center in fiscal 2011, we explained that it was expected to serve as the blueprint for health insurance exchanges.

The Enrollment Center was part of the state's effort to offer a single entry point for assistance and information on all its public health insurance programs. The state has indicated in its HIX Planning Documents to the Department of Health and Human Services that the Enrollment Center will serve as the foundation for building the customer service in backroom operations of its Health Insurance Exchange, and that Maximus will be its vendor partner. I am very pleased to report that the state has modified our existing Enrollment Center contract to include planning and early implementation work for its Health Insurance Exchange.

As part of the customer service center operations, we are expanding our current call center scope to respond to increase from consumers, small businesses, and other exchange stakeholders. We will handle consumer inquiries about premium tax credits, as well as questions from employers and employees about the Small Business Exchange or shop. We look forward to helping the state realize its goals of providing more people with access to health insurance coverage, and establishing a place where they can shop knowledgeably for insurance.

We are also very excited about a couple of additional states where Maximus is in the process of negotiating work for their state-based health insurance exchanges. We were recently selected for the HIX Service Center operations for two small states. We are currently in negotiations with both of these states, so we're not in a position to disclose additional information at this time, but we hope to share more details in the coming months. We are excited to add these three important and strategic pieces of work to our growing HIX portfolio.

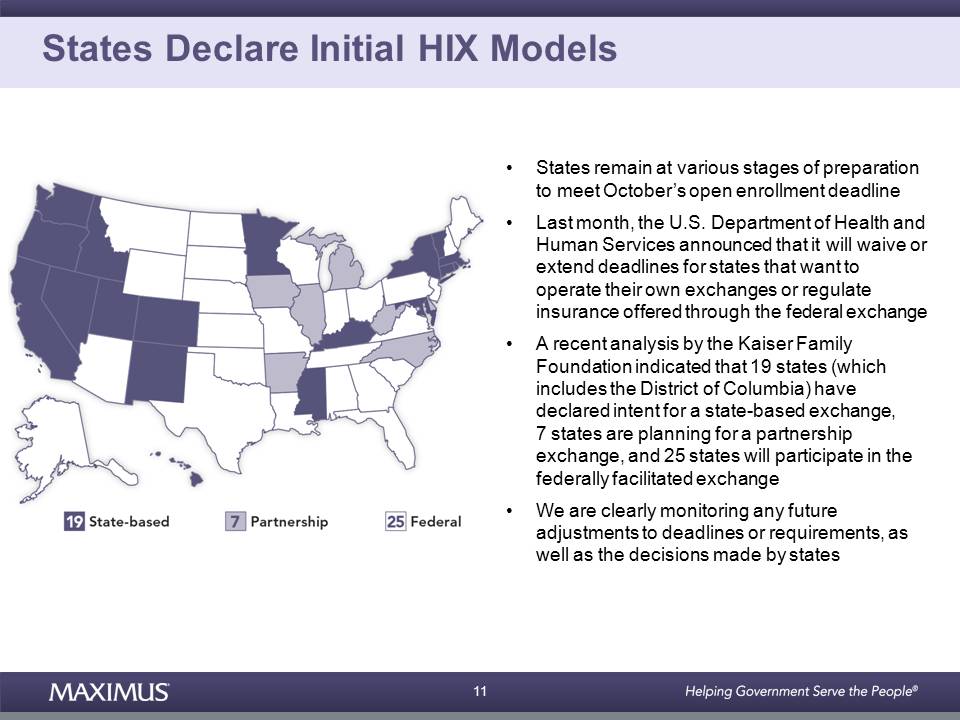

While states like New York are moving down a path to set up their own exchange, other states remain at various stages of preparation to meet October's open enrollment deadline. Last month, the US Department of Health and Human Services announced that it will waive or extend deadlines for states that want to operate their own exchanges or regulate insurance offered through the Federal Exchange. A recent analysis by the Kaiser Family Foundation indicated that 18 states and the District of Columbia have declared intent for a state-based exchange. Seven states are planning for a partnership exchange, and 25 states will participate in the Federally Facilitated Exchange. We are clearly monitoring any future adjustments to deadlines or requirements, as well as the decisions made by states.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

4

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

As expected, we have seen some new entrants in the state-based exchange market, such as commercial call center companies. In addition, we are seeing an increasing presence in certain states from unions representing government employees. For example, California has announced that it is likely to use a combination of county and state-based workers for the majority of its HIX service center operations. While this is a disappointment for vendors like Maximus, we think that over the long term, the market may follow a similar path as both the Medicaid and CHIP markets. Over time, some states shifted administrative functions for both programs to private vendors as a way to alleviate the work burden on state staff, and achieve efficiencies by managing labor resources more effectively.

Looking beyond the initial HIX deadlines, we see future waves of procurement opportunities. One opportunity is to provide BPO support to states that will transition off the Federally Facilitated Exchange to their own state-based exchanges in 2015 and beyond. As a result, we see a steady glide path for HIX opportunities. And as governments make progress for ensuring citizens have improved access to health insurance, they still must address issues like quality and cost. So, we still see health reform as a multi-year, long-term growth driver.

Now let's turn our attention to our international operations. Our pilot program in Saudi Arabia is fully operational and meeting our expectations. And our work program contract in the UK remains on track, as we continue to optimize our operations and meet case load demands.

During the quarter, the UK Department of Work and Pensions published initial performance statistics for the work program. Although the report only represented a snapshot in time and did not include all job outcomes secured to date, Maximus performed very well compared to other vendors. In fact, our team in the Thames Valley region achieved the highest ranking for percentage outcomes achieved. Our longer-term international growth strategy focuses on tracking reform efforts, where we see emerging opportunities for Maximus. We think the next 12 to 24 months may be the right time to expand our core health offerings to markets where our past focus has traditionally been on the welfare to work business.

For example, we see future opportunities in the BPO market that dovetail nicely with our core capabilities, as governments continue to look for solutions to control costs and improve their benefit programs. And policy level discussions that are taking place today, could lead to RFP activities as soon as the end of this calendar year or early calendar year 2014. Considering this, we believe it's an opportune time to take a good look at bringing our health capabilities to new markets, either through a partnership or an acquisition.

Moving on to re-bids. And as we mentioned last quarter, we have 14 contracts up for re-bid in fiscal 2013, for a total value of approximately $475 million. This includes our Texas Medicaid Enrollment and Mass Health contracts, which have a combined value of approximately $320 million. On January 7th, the Texas Health and Human Service Commission announced a tentative contract award to Maximus, contingent upon the successful negotiation and execution of a contract. We will provide additional details once the contract is signed. And for Mass Health, our current contract runs through June, so we hope to have something to share with you in the next 30 to 60 days.

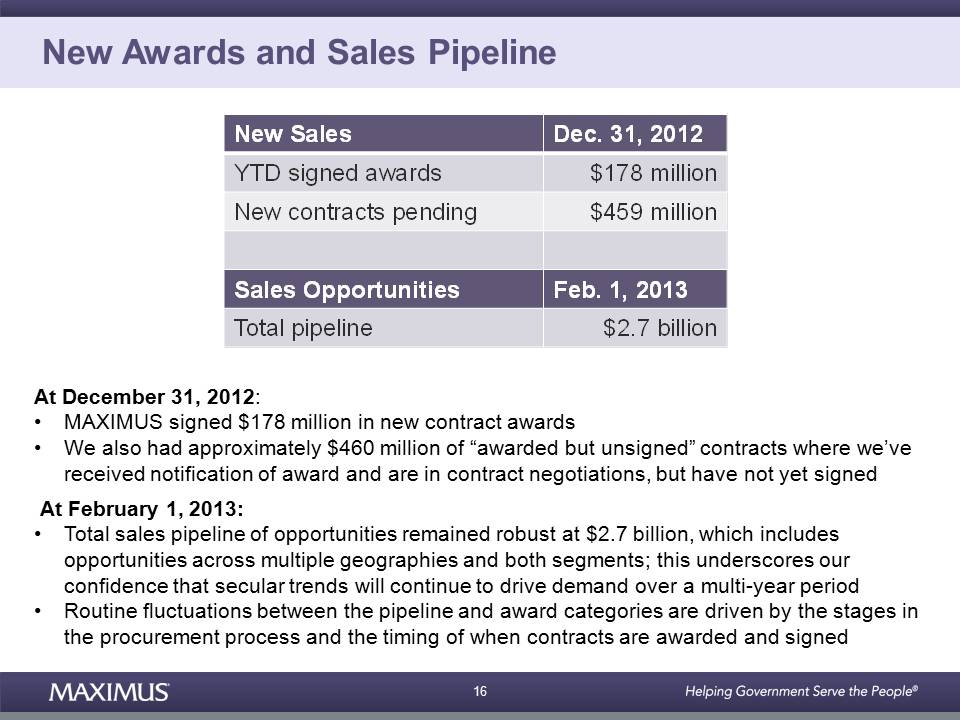

Turning now to new awards and sales pipeline. At December 31, we had $178 million of new signed awards. In addition, we also had awarded but unsigned contracts totaling approximately $460 million. These are contracts where we've received notification of award and are in contract negotiations, but have not yet been signed. At February 1, 2013 our total sales pipeline of opportunities remained robust at $2.7 billion, and includes opportunities across multiple geographies and across both segments. This underscores our confidence that secular trends will continue to increase demand for our services over a multi-year period. As a reminder, investors should expect routine fluctuations between the pipeline in the award categories, and these shifts are driven by different stages in the procurement process, as well as the timing of when contracts are awarded and ultimately signed.

In summary, governments are dealing with growing case volumes, aging populations, and increasingly complex benefit programs. Companies like Maximus can provide much-needed support as governments strive to address these issues. Most notably, we are gaining additional traction in the health segment as governments look for more efficient ways to run programs, while also tackling the implementation requirements under the Affordable Care Act. We look forward to continuing to make progress on our long-term goals for expanding our global operations, securing our fair share of health care reform work in the US, and growing our federal operations.

And with that, let's open it up for questions. Operator?

QUESTION AND ANSWER

Operator

Thank you. We will now be conducting a question-and-answer session.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

5

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

(Operator Instructions)

Charlie Strauzer of CJS Securities.

Charlie Strauzer - CJS Securities - Analyst

Rich, if you could expand a little more on the ACA opportunities. When you look at some of the posturing by some of the Republican governors out there about how they were pushing back against it, are you seeing any of that changing in terms of sentiment and in terms of them of adopting some of the ACA proposals that are out there?

Rich Montoni - MAXIMUS Inc - CEO

Good morning Charlie, thanks for your question.

I'm going to give you a tops down commentary on the ACA opportunities, and then ask Bruce Caswell, who has agreed to join us today as well. Bruce, I think you know, runs -- he's the President and GM of our health business. So day in and day out, he has the opportunity to deal with these state-by-state opportunities. Clearly, it's a very dynamic environment. You've got a bifurcation of the universe, and the states have decided to build their own exchanges, others have defaulted or chosen to go on to the Federal Exchange.

We have some early leaders who have solidified their plans, and gotten over their political deliberations and moving forward with health insurance exchanges. I think fewer have gotten over the hump as it relates to Medicaid expansion, which is also important, but it's equally political out there. So we do see a lot of political elements into this equation, and I think we're going to continue to see it. Not only during fiscal '13 and the build and launch phases of these health insurance exchanges, but as they're operationalized in fiscal '14, '15 and '16 and perfected. So I think they'll continue to be in the political fish bowl, and they will get a lot of attention.

Bruce, any commentary on this?

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

And I think that's exactly right. I know, Charlie, you've seen probably in recent days some Republican governors now come forward showing some support for Medicaid expansion, where previously that might not have been the case. And I think that's reflective of the legislative season that we're in, and the decisions that those governors are facing and has yet to play out fully. CMS has made it clear that states have no deadline for declaring their Medicaid expansion intent, so that could continue, as Rich has said, into 2015. And then similarly, states still have until February 15 to indicate and provide their blueprints for whether they're going do a state partnership exchange versus a fully Federally Facilitated Exchange. So those deliberations are going on presently, and we'll know more in the next week.

Charlie Strauzer - CJS Securities - Analyst

Great. Thank you very much.

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

You bet.

Rich Montoni - MAXIMUS Inc - CEO

Next question please.

Operator

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

6

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

Scott Green of Bank of America.

Scott Green - BofA Merrill Lynch - Analyst

Hello. Thanks. I had a couple questions.

First, is on the revenue guidance raise. It looks like revenue essentially in line in the quarter, and I recall the original guidance had a bigger than average allocation around 10% unsigned business was included. So at this point, what line of sight do you have into the 10% unsigned business? And how did you balance potential risks around exchange delays?

Rich Montoni - MAXIMUS Inc - CEO

Good morning, Scott.

You're right. At the beginning of the year, as we typically do, in that first quarter we lay out our forecasted guidance for top line and bottom line; and we did say 90% of our forecasted -- I think the midpoint of our forecasted range in revenue was in the form of backlog. First, you need to understand our definition of backlog, because a good portion of our contracts include transaction-based contracts. We will assume a certain level of revenue for those performance-based contracts. Hence, for those that are driven by volumes, we're assuming a certain volume level in that initial guidance.

And as we reconcile that prior position to the current position, there's three things that come to mind that I think give us the comfort to raise the revenue. One is, as we've talked about in the call and I think we mentioned in the press release, we have seen a meaningful increase in the volumes in our federal business relative to appeals in the Medicare program. We believe that, that is likely to continue, at least in the short term. And so we factored that into our new guidance.

Secondly, we have received more work in California on that California Healthy Families Program than we originally felt was the case. And hence, that's been an uplift to our guidance. And lastly, the New York Health Insurance Exchange work -- that work has come sooner than we had originally forecasted. Those would be the big three, Scott.

Scott Green - BofA Merrill Lynch - Analyst

Okay. That's really helpful.

And a follow-up -- can you tell us how much exchange revenue you've won versus your targeted fair share of 20% to 25% out of $500 million? Is that something you think that will give us a running updated total over the next couple quarters?

Rich Montoni - MAXIMUS Inc - CEO

At this point in time, we're not disclosing. We're not quantifying that. We are on track, we think, on a path to get, as we referred to, our fair share of that $500 million. But at this point, we don't have a quantification of where we stand. It's such a dynamic environment. I think it's best just to give you the directional commentary in terms of where we stand.

Scott Green - BofA Merrill Lynch - Analyst

Okay. And one last one -- I was just curious if you had any thoughts on the idea of immigration reform, and if there could potentially be any opportunity of some of those people ultimately look for other work or have to participate in some sign-up enrollment program, if there would be any business opportunity for Maximus?

Rich Montoni - MAXIMUS Inc - CEO

I think the answer is yes. And I think we need to let the leadership of the country get through their phase, which is the political aspect and any legislative reform or changes they'd like to make. But certainly we will keep our eye to it as it relates to opportunity for Maximus. And there's a couple aspects to it. It is actually being a participant in whatever new process is necessary to implement any new law. And then also, there's an overflow aspect if there's additional immigrants allowed into the country, many of our state clients will have increased populations that they will need to manage in their state-based Medicaid programs and/or HIX programs themselves.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

7

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

And by the way, we do actually have a meaningful role in Australia. We won some work down there that relates to actually helping the government manage the immigrants who are trying to move into Australia. And that's quite an exciting program. And we hope that one will grow as well.

Scott Green - BofA Merrill Lynch - Analyst

Okay. Thank you.

Rich Montoni - MAXIMUS Inc - CEO

Thank you, Scott. Next question please.

Operator

Frank Sparacino of First Analysis.

Frank Sparacino - First Analysis Securities - Analyst

First -- Dave, on the capitalized software side of things, that number is higher than it has been historically, and you had a nice contributor to earnings, particularly year-over-year even on a sequential basis. So I'm just curious as what's driving that? And then also, what level should we use going forward for that figure?

David Walker - MAXIMUS Inc - CFO

Yes, hello Frank.

When we give guidance for the full year for the free cash flow and the cash from continuing ops, the difference is CapEx. And for us, CapEx is [pretty plant] and equipment as well as capitalized software. So, actually, our spending is right in line with the guidance we give. And the increase is driven by the number of start-ups. You have put a lot of software in on these exchanges, and associated with these health programs on the front end as part of the BPO, and that's what it is.

Frank Sparacino - First Analysis Securities - Analyst

Great, thank you.

And then on the appeal side of things, I'm just curious, what's new? The Medicare RAC business, right, has been in existence for years and has been growing at pretty nice clips if you look at data from AHA, for example. So I'm trying to figure out what's new in that business that's changed for you guys. And then, if you could also just remind me as to how you get paid in that business.

Rich Montoni - MAXIMUS Inc - CEO

Frank, this is Rich.

First off, we get paid on a per transaction basis. So it's a fixed price per appeal processed. Secondly, as it relates to -- the RAC program has been in place for a number of years, but I think it has been only in the last couple of years where there's really been an increased focus on the RAC program. So there's a lot more RAC activity out there. I also think there's perhaps a bit of a tightening of the rules in terms of what's allowable and what's not allowable, of late. And I think that is what's behind the increased -- that's the biggest driver behind the increase in the volume of appeals.

Frank Sparacino - First Analysis Securities - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

8

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

Great. Thank you guys.

Rich Montoni - MAXIMUS Inc - CEO

You bet, Frank. Thank you.

Operator

James Naklicki of Citi.

James Naklicki - Citigroup - Analyst

Yes, good morning guys. Thanks for taking my question.

So yesterday, CBO revised down its estimate for the exchange membership to $7 million; that's down from $9 million prior. Does that have any impact on the $500 million opportunity for you guys, or the 20% to 25% reasonable penetration rate early on that you talked about?

Rich Montoni - MAXIMUS Inc - CEO

James, this is Rich.

I'm going to hand this off to Bruce as well. But from a summary level perspective -- and for those of you on the call who are not familiar with this, James is right. CBO did issue yesterday some revised guidance where they run the numbers in terms of how many participants they think there will be in health insurance exchanges by year, and also how many folks will participate in Medicaid expansion. And that's a very important driver. That's what was really behind our estimate of the $500 million total addressable market.

In summary, we've looked at that and we do not believe that it adjusts our $500 million total adjustable market nor the 20% to 25%. But there's a couple of footnotes that I think Bruce Caswell might want to comment upon as it relates to changes in the CBO estimates. Bruce?

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

Sure. And Rich you're absolutely right in that it doesn't really change our view of the total addressable market. The dynamics are several here. First of all the CBO numbers point to fewer people on Medicaid -- obviously related to the Medicaid expansion option that states have. So that's down to -- the original estimate was 17 million in 2022, and it's down to 12 million. But the countervailing pressure against that is, more individuals on exchanges.

So, the exchange volumes peak at about 27 million versus 23 million in the original estimate from CBO in 2012. And by the year 2022 we're about 26 million versus 22 million in the original estimate. The shift that you spoke of is really about a 1 million individual shift in the exchange population in 2014, pushing out to 2015. So if anything, you're seeing a slightly more gradual ramp in the exchange population. But in the end, no real material change in the total addressable market.

Rich Montoni - MAXIMUS Inc - CEO

Is that helpful, James?

James Naklicki - Citigroup - Analyst

Yes, very helpful.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

9

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

Just one other question I had was -- if I look at the Company's growth rate historically over the last 3 years, it's been in the high teens, mid to high teens. Do you think you can maintain that over the next three years given all of the opportunities from the exchanges?

Rich Montoni - MAXIMUS Inc - CEO

That is a great question, James.

And the answer is, I think we can maintain a high growth rate. And when I think about growth over the next three years -- and as you know, we don't provide specific guidance but for the current year. But on a directional basis, I think it's helpful to share what we see as the drivers that are in place that really provide us with the confidence that we have multi-year growth ahead of us. Obviously, a solid start to fiscal 2013, and a high degree of confidence in the rest of fiscal '13 is a good underpinning.

Our pipeline remains strong, and it's a multi-year pipeline. Our business model today really is, we sell this year what will be next year's growth. The recent startups are on track. That's comforting. And what's also very important about the recent startups is that they will provide a year-over-year pop in fiscal '14, as we have a full year in '14 versus a partial year in '13. We think that the new wins -- again, partial years in '13. I had also mentioned that when you look at the opportunities in health care reform, they really are shaping up to be multi-year type initiatives. And I think as we move forward, initially they may be launched as, I'll call it a health insurance exchange light.

I do think as we see and monitor the participation, the likelihood is that we'll receive additional assignments and our scope will grow. And I'd also add to it that internationally, I continue to strongly believe that the underpinnings for increasing demand exist. Our capabilities internationally, whether or not it's enrollment or case management, any of our core competencies -- I think they are also in demand internationally. And not only in our existing countries where we do business internationally -- Canada, Australia, and the UK. I do think that we've got health opportunities there. And if we're fortunate, we'll discover and have opportunities in additional countries. That's the basis for why we think we have several years of growth ahead of us.

Is that it?

James Naklicki - Citigroup - Analyst

Yes. Thanks guys.

Rich Montoni - MAXIMUS Inc - CEO

Next question please.

Operator

(Operator Instructions)

Brian Kinstlinger of Sidoti & Company.

Brian Kinstlinger - Sidoti & Company - Analyst

Hello. Good morning guys.

Rich Montoni - MAXIMUS Inc - CEO

Good morning Brian.

Brian Kinstlinger - Sidoti & Company - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

10

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

The first question is a follow-up from one of the callers. Volume in the past in the Medicaid enrollment brokers has only been one small piece of those contracts. So I guess basically I'm interested in how much the ramp will impact these contracts, and at what point they will hit peak revenue in that multi-year enrollment window?

Rich Montoni - MAXIMUS Inc - CEO

I think it's a great question.

And I of course have to bifurcate a little bit, because the work that we're doing now relates to the Medicare program, not the Medicaid program. The handling of the appeals in the Medicaid program is a different assignment. Primarily, most of our work is Medicare appeals, which has been in place for some time. I always felt that the majority of the work was driven by volumes, as opposed to cost-plus. And that would be, is and would be, continue to be the model.

Bruce, do you have any comment on this?

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

I think that's absolutely correct on the Medicare appeals. And if I can pivot for a second to the Medicaid enrollment broker piece as well, there are really two underlying dynamics there. One, as we've spoken about many times is the continued efforts of states to shift populations into managed care. And some of the most recent data in 2011 would suggest that only 74.2% of the population in Medicaid is presently in managed care nationally. The penetration rate being much higher in some states than others. So we do think that there's an opportunity, and we're seeing it. For states to continue to shift additional acute care, as well as long-term care populations into Medicaid, and that'll feed our growth there.

The second dynamic, of course is still very much in play with these state legislative seasons as it relates to Medicaid expansion. And now with several Republican governors, including Kasich in Ohio and Brewer in Arizona, and others -- Governor Snyder just yesterday in Michigan coming forward supporting Medicaid expansion. We think that we feel comfortable with the range in terms of total addressable market that we put out last summer, which was $130 million to $200 million for that opportunity for us. So the ramp could be a little bit back-end loaded in terms of 2015, 2016. Wouldn't be surprised by that, because CMS has been very clear that there's no deadline for them to declare their intention. However, the 100% money runs out in 2016 and starts to decline. So states have an incentive to try and move forward on it as quickly as they can.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay. Follow-up on that.

Just tell us about the ramp and how volume affects the exchange contracts like the one you won in New York. And then my final question is, on California, where they're using unionized workers, how many other of the 19 states, without naming them, because that would be sensitive, do you expect to go that route?

Rich Montoni - MAXIMUS Inc - CEO

So could you, first of all just repeat the first part of your question? Because I'm not sure which -- (multiple speakers)

Brian Kinstlinger - Sidoti & Company - Analyst

Yes, the first question, yes -- what I meant on my original question, and maybe I didn't word it appropriately -- is, on the Medicaid enrollment broker contracts, typically volume is one piece. Now the exchange is a similar project for you guys. How much is volume on those? Like the New York contract you won -- is it 90% of the contract that will ramp, or is it right away a fixed price and you generate that revenue?

Rich Montoni - MAXIMUS Inc - CEO

Got it.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

11

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

So I think the typical pricing structure would not be different from what we see in our enrollment broker and CHIP programs, where you have a combination of fixed and variable pricing. Often the volume bands are tiered to obviously accommodate higher volumes as they come on. And I think we've consistently said that we expect the exchange volumes to reach their peak in the 2016 timeframe or so, because there are a lot of things in play here. The uptake is a function of the outreach efforts of the state, how rapidly -- and the national outreach efforts that the Obama administration is just now starting to put traction to. So I think we need to wait and see in terms of how effective those are in terms of bringing people into the exchanges. And similarly, bringing in the Medicaid population that's currently eligible but un-enrolled. So that would be the first point.

The second question related to how significant is this indication in states like California related to using state unionized workers for these jobs. And I would just say that we've seen, without naming specific states, three instances in total, including California, where that's likely to be the case. So I would say it's not necessarily the dominant model, but it's one that adds a new dimension to the marketplace.

Rich Montoni - MAXIMUS Inc - CEO

And I would add this, Brian -- this has been a balance, and I think that equilibrium in the past has -- the Maximus' of the world are an alternative to a totally state-based unionized worker situation. And in many states we work hand in glove with those existing infrastructures. And so I think it's almost on a case-by-case situation to what extent we play, and I think that the union interest in this area is nothing really new, and there will be an equilibrium that we see state-by-state.

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

And just a reminder, the federal portion of all this -- we've been talking state -- we know is going to be cost-reimbursable. So that has a different characteristic. Lower risk, lower margin.

Rich Montoni - MAXIMUS Inc - CEO

Yes. Right. Good point.

Brian Kinstlinger - Sidoti & Company - Analyst

Thank you.

Rich Montoni - MAXIMUS Inc - CEO

You bet. Next question please.

Operator

It appears we have no further -- sorry, our next question is a follow-up from James Naklicki of Citi.

James Naklicki - Citigroup - Analyst

Yes, hello, guys, again.

Rich Montoni - MAXIMUS Inc - CEO

Hello, James.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

12

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

James Naklicki - Citigroup - Analyst

Just after -- you've reviewed the scope of work for the FFE contracts, you talked about the appeals and the eligibility support contracts. Do you feel you have the capabilities to bid as the prime vendor on those contracts if you were to bid?

Rich Montoni - MAXIMUS Inc - CEO

This is Rich. I'm going to ask Bruce to comment upon that. He and his team are quarterbacking all of the federal initiatives.

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

Yes. I would just say, James, as you're probably well aware, the federal marketplace is quite different from the state marketplace. And it's all about the teams that you put together to address the competencies and requirements and experiences that the client is looking for. So I would just say that our experience has been quite strong at the federal level, and we feel very comfortable being a member of -- or a prime on a major team like that. But you have to look at it as one that brings together the capabilities of a number of strong companies, as well as important smaller companies and minority businesses to meet the full requirements of the procurement.

James Naklicki - Citigroup - Analyst

Okay. Thanks guys.

Rich Montoni - MAXIMUS Inc - CEO

Next question please.

Operator

(Operator Instructions)

Frank Sparacino of First Analysis.

Frank Sparacino - First Analysis Securities - Analyst

Hello, guys. Just one follow-up.

On the call center operations for the exchanges, relative to Medicaid enrollment -- is there a different level of sophistication or skill set that's required there? Given -- I assume the exchanges are going to be fairly more complex than the traditional operation.

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

That's a great question, Frank.

And honestly, it speaks to some of the fundamental requirements of the Act, which is that there be no wrong point of entry in a state. So, let's talk about state-based exchanges first very briefly. A number of state clients want to ensure that individuals can come through either a county-based office or an existing Maximus call center where we may be handling Medicaid intake and eligibility or CHIP intake and eligibility, but also through a state HIX call center.

I would say that the characteristics of helping an individual through that process are really not materially different from what we do presently in the Medicaid program. And in fact, the administrations work very hard to simplify by the process by moving toward things like modified adjusted gross income as a key eligibility determinant for most Medicaid categories. So we'd expect less of a missing information chase, if you will, and more of a movement toward a streamlined application and a streamlined process. Does that help?

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

13

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

Frank Sparacino - First Analysis Securities - Analyst

That does. Thank you Bruce.

Rich Montoni - MAXIMUS Inc - CEO

Next question please.

Operator

Brian Kinstlinger of Sidoti & Company.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Two follow-ups.

The first one is, you mentioned the 1800 Medicare re-compete. Can you tell me who the incumbent is on that?

Rich Montoni - MAXIMUS Inc - CEO

I think so.

Bruce Caswell - MAXIMUS Inc - President & GM, Health Services

Yes, the incumbent is Vangent, which is owned by General Dynamics Information Technology.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. And then the second question -- you mentioned, Dave, the Human Services award fees or royalty fees that will not repeat. Did you give a size of revenue and profit that, that contributed to that segment? Would you if you didn't?

David Walker - MAXIMUS Inc - CFO

We didn't. But it's about $0.03 in the quarter. So, if you normalize it out, Human Services margin would have been about 10.8%.

Brian Kinstlinger - Sidoti & Company - Analyst

And can you give a revenue number? So we can -- was it relatively small?

David Walker - MAXIMUS Inc - CFO

Yes.

Brian Kinstlinger - Sidoti & Company - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

14

|

FEBRUARY 07, 2013 / 02:00PM GMT, MMS - Q1 2013 MAXIMUS, Inc. Earnings Conference Call

|

So just pure award that had no cost?

David Walker - MAXIMUS Inc - CFO

It was highly accretive.

Brian Kinstlinger - Sidoti & Company - Analyst

Got it. Thank you.

Rich Montoni - MAXIMUS Inc - CEO

You're welcome. Next question please.

Operator

It appears we have no further questions at this time. I would now like to pass the floor back to Management for closing comments.

Lisa Miles - MAXIMUS Inc - SVP of IR

I would like to thank everyone for joining us today, and have a great day.

Operator

This concludes today's teleconference. You may now disconnect your lines at this time, and thank you for your participation.

|

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2013 Thomson Reuters. All Rights Reserved.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

15

David N. Walker Chief Financial Officer and Treasurer February 7, 2013 Fiscal 2013 First Quarter Earnings A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Selected Financial Results from Continuing Operations Q1 FY13 results in line with expectationsRevenue grew 19%, driven by solid growth in both domestic and international operations and across both SegmentsRevenue grew 5% organicallyBetter-than-expected earnings driven principally by accretive, transaction-based work in the Health Segment (primarily appeals work) and stronger-than-expected results in a domestic workforce services contract in the Human Services SegmentTotal segment operating income, excluding legal, settlement and acquisition-related expense, totaled $34.3 million (operating margin of 12.0%)Income from continuing ops, net of taxes, totaled $21.8 million (or $0.62 per diluted share) and included $0.01 per share of net legal, settlement and acquisition-related expensesExcluding net legal, settlement and acquisition-related expenses, adjusted EPS grew 24% to $0.63

Health Services Segment Revenue Q1 revenue increased 11% to $176.0 million, driven by the PSI acquisition, as well as organic growth resulting from new work and expansion of existing contractsOperating Income & MarginsQ1 operating income increased 23% to $20.6 million, with an operating margin of 11.7%, benefitting from growth on existing contracts and higher volumes in our Medicare appeals work. Last year’s Q1 operating margin was tempered by the timing of a change order that was delayed until Q3 FY12 and margin dilution from the managed care expansion in Texas, where we experienced a temporary spike in low-margin revenueHealth Segment Over DeliveryThe Health Services Segment performed ahead of our expectations for Q1 FY13, driven principally by increased volumes in transaction-based programs, such as Medicare appeals where higher volumes resulted primarily from the growing activity from RAC contractors, a trend we expect to continue for the remainder of the fiscal yearWe’ve also started to see revenue materialize a little bit sooner than expected from work related to health insurance exchanges as states progress towards meeting implementation deadlines in late 2013 and 2014

Human Services Segment Revenue Q1 revenue increased 35% to $110.3 million, driven by the PSI acquisition, as well as organic growth principally from international operations, including the expected ramp of the UK Work Programme and new programs in Canada and Saudi ArabiaOperating Income & MarginsQ1 operating income increased 33% to $13.7 million, with an operating margin of 12.4%The Human Services Segment benefitted from some performance-based payments on a large domestic welfare-to-work program, which we do not expect to see on this scale going forward. As expected, the UK contract was fully profitable in Q1 and remains on track to achieve full-year target operating margins. These contributions were offset by the anticipated lower margin from the Australia program resulting from economic and regulatory factors that were discussed last quarter; this margin change is expected to continue for the foreseeable future

Balance Sheet and Cash Flows *The Company defines free cash flow as cash provided by operating activities from continuing operations less cash paid for property, equipment and capitalized software Cash Flows Q1 cash flow was consistent with seasonal expectationsAs expected, cash flow was dampened as a result of normal government payment slowdowns during the holidays and resulted in DSOs of 67 days; we do expect DSOs to continue at a similar level next quarter as a result of a couple of large programs that both have administrative processing challenges unrelated to fundingCash provided by operating activities from continuing operations totaled $10.1 million, with negative free cash flow* of approximately half a million dollars that reflected an expected increase in capital expenditures related to a high level of project start ups and the cash flow impact from the change in DSOsShare BuybacksIn Q1, we used $14.6 million to purchase 249,549 shares of MMS common stockAt December 31, 2012, we had $114.6 million available for future purchasesBuyback program is opportunistic in nature and the Company will continue to execute repurchases in this mannerCash and Use of CashAt December 31, 2012 with cash and cash equivalents of $167.1 million, of which approximately 75% is held overseasCommitted to sensible cash deployment where dividends and buybacks are part of overall strategy, with recent focus heavily weighted towards M&A opportunities in current geographies, including international markets, where we see increased demand for our core servicesThis aligns with our investments in business development to also drive organic growth over the next 3-5 years

Balance Sheet and Cash Flows *The Company defines free cash flow as cash provided by operating activities from continuing operations less cash paid for property, equipment and capitalized software Cash Flows Q1 cash flow was consistent with seasonal expectationsAs expected, cash flow was dampened as a result of normal government payment slowdowns during the holidays and resulted in DSOs of 67 days; we do expect DSOs to continue at a similar level next quarter as a result of a couple of large programs that both have administrative processing challenges unrelated to fundingCash provided by operating activities from continuing operations totaled $10.1 million, with negative free cash flow* of approximately half a million dollars that reflected an expected increase in capital expenditures related to a high level of project start ups and the cash flow impact from the change in DSOsShare BuybacksIn Q1, we used $14.6 million to purchase 249,549 shares of MMS common stockAt December 31, 2012, we had $114.6 million available for future purchasesBuyback program is opportunistic in nature and the Company will continue to execute repurchases in this mannerCash and Use of CashAt December 31, 2012 with cash and cash equivalents of $167.1 million, of which approximately 75% is held overseasCommitted to sensible cash deployment where dividends and buybacks are part of overall strategy, with recent focus heavily weighted towards M&A opportunities in current geographies, including international markets, where we see increased demand for our core servicesThis aligns with our investments in business development to also drive organic growth over the next 3-5 years

Richard A. Montoni President and Chief Executive Officer February 7, 2013 Fiscal 2013 First Quarter Earnings

Solid Start to Fiscal 2013 Kicked off fiscal 2013 with strong performances from both SegmentsStarting to benefit from secular trends that are driving increasing demand for our servicesAn unprecedented number of start-up programs are going largely as plannedAll-in-all, these tailwinds position us for exceptional top- and bottom-line growth in fiscal 2013 and give us the confidence to be raising our revenue and earnings estimates so early in the year

Health Care Reform as Primary Growth Driver Health care reform continues to serve as our primary domestic growth driver in the U.S.; making steady progress towards securing our fair share of the workAs a reminder, management continues to believe that a reasonable target for HIX market share in the early years is approximately 20-25% of the $500 million (annually) in total addressable market that we’ve laid out; and we would expect this to grow over timeThree RFPs for the Federal Exchange that could be of interest to MAXIMUS:Eligibility support, including paper-based support tasks for verifying and processing applications for enrollment into qualified health plans or insurance affordability programs, as well as SHOP applications and requests for exemptions Call center operations of the federal exchange, folded into the 1-800-Medicare rebid Eligibility appeals; however, a vendor cannot win both the eligibility support bid and the eligibility appeals workFor competitive reasons, we have not provided further granularity on the expected size or our intent to bid on any of these We also continue to see activity pick up at the state level for ACA-related work We are actively monitoring all opportunities and identifying where MAXIMUS can best add value.

Supporting the NY Health Insurance Exchange New York State is leveraging and transforming the existing centralized Enrollment Center operated by MAXIMUS into a single entry point for all public health insurance programsThe Enrollment Center will serve as the foundation for customer service and back room operations of the NY health insurance exchange, with MAXIMUS as the selected vendor partner The MAXIMUS Enrollment Center contract was modified to include planning and early implementation work:Expanding our customer call center scope to respond to inquires from consumers, small businesses and other exchange stakeholdersWill handle consumer inquiries about premium tax credits, as well as questions from employers and employees about the small business exchange (SHOP)Look forward to helping the state realize its goals of providing more people with access to coverage and establishing a place where they can shop knowledgeably for insurance MAXIMUS was also recently selected for the HIX service center operations for two small states and will share more details when contract negotiations are complete.

States Declare Initial HIX Models States remain at various stages of preparation to meet October’s open enrollment deadline Last month, the U.S. Department of Health and Human Services announced that it will waive or extend deadlines for states that want to operate their own exchanges or regulate insurance offered through the federal exchange A recent analysis by the Kaiser Family Foundation indicated that 19 states (which includes the District of Columbia) have declared intent for a state-based exchange, 7 states are planning for a partnership exchange, and 25 states will participate in the federally facilitated exchange We are clearly monitoring any future adjustments to deadlines or requirements, as well as the decisions made by states

The HIX Landscape in 2013 and Beyond As expected, new entrants coming into the state-based exchange market, such as commercial call center companiesWe see an increasing presence in certain states from unions representing government employees; California is likely to use a combination of county and state workers for the majority of its HIX service center operationsOver the long term, the market may follow a similar path as both the Medicaid and CHIP markets where states shifted administrative functions to private vendors as a way to alleviate the work burden on state staff and achieve efficiencies by managing labor resources more effectivelyLooking beyond initial HIX deadlines, we see future waves of procurement opportunities, such as BPO support to states moving from the federal exchange to their own state-based exchanges in 2015 and beyondThis results in a steady glide path for HIX opportunities As governments make progress for ensuring citizens have improved access to health insurance, they still must address issues like quality and cost. Health reform will be a multi-year, long-term growth driver.

International Operations Meeting Expectations Pilot program in Saudi Arabia is fully operational and meeting our expectationsWork Programme contract in the UK remains fundamentally on track; continue to optimize our operations to meet caseload demands During the quarter, the UK Department of Work and Pensions published initial performance statistics for the Work ProgrammeReport represented a snapshot in time and did not include all job outcomes secured to dateMAXIMUS performed very well when compared to other vendors Our team in the Thames Valley region achieved the highest rating for percentage of outcomes achieved

International Growth Strategy Longer-term international growth strategy focuses on tracking reform efforts where we see emerging opportunities for MAXIMUSNext 12 to 24 months may be the right time to expand core health services offerings to markets where our past focus has been on welfare-to-workFuture opportunities in the BPO market dovetail nicely with our core capabilities as governments continue to look for solutions to control costs and improve their benefit programsPolicy-level discussions taking place today could lead to RFP activity as soon as the end of this calendar year or early calendar year 2014We believe it’s an opportune time to take a good look at bringing our health capabilities to new markets, either through a partnership or an acquisition

Contract Rebids and Option Years For fiscal 2013, we have 14 contracts up for rebid with a total value of approximately $475 million Includes Texas Enrollment Broker and MassHealth contracts, which have a combined value of approx. $320 millionOn January 7, the TX Health and Human Services Commission announced a tentative contract award to MAXIMUSCurrent MassHealth contract runs through June, so we hope to share something in the next 30 to 60 days

New Awards and Sales Pipeline At December 31, 2012:MAXIMUS signed $178 million in new contract awardsWe also had approximately $460 million of “awarded but unsigned” contracts where we’ve received notification of award and are in contract negotiations, but have not yet signed At February 1, 2013: Total sales pipeline of opportunities remained robust at $2.7 billion, which includes opportunities across multiple geographies and both segments; this underscores our confidence that secular trends will continue to drive demand over a multi-year period Routine fluctuations between the pipeline and award categories are driven by the stages in the procurement process and the timing of when contracts are awarded and signed

Conclusion Governments are dealing with growing case volumes, aging populations and the increasingly complex benefits programs Companies like MAXIMUS can provide much-needed support as governments strive to address these issues MAXIMUS is gaining additional traction in the Health Segment as governments look for more efficient ways to run programs, while also tackling the implementation requirements under the Affordable Care Act Look forward to continuing progress on our long-term goals: Expanding our global operations Securing our fair share of health care reform work in the United States Growing our federal operations