Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K Q4 2012 - KITE REALTY GROUP TRUST | form8k_q42012.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - KITE REALTY GROUP TRUST | exhibt99_1.htm |

EXHIBIT 99.2

QUARTERLY FINANCIAL SUPPLEMENT

DECEMBER 31, 2012

KITE REALTY GROUP TRUST

INVESTOR RELATIONS CONTACTS:

Dan Sink, Chief Financial Officer

Adam Basch, Investor Relations

30 S. MERIDIAN STREET • INDIANAPOLIS, INDIANA 46204 • 317.577.5600 • KITEREALTY.COM

SUPPLEMENTAL INFORMATION – DECEMBER 31, 2012

|

PAGE NO.

|

TABLE OF CONTENTS

|

|

|

3

|

Corporate Profile

|

|

|

4

|

Contact Information

|

|

|

5

|

Important Notes

|

|

|

6

|

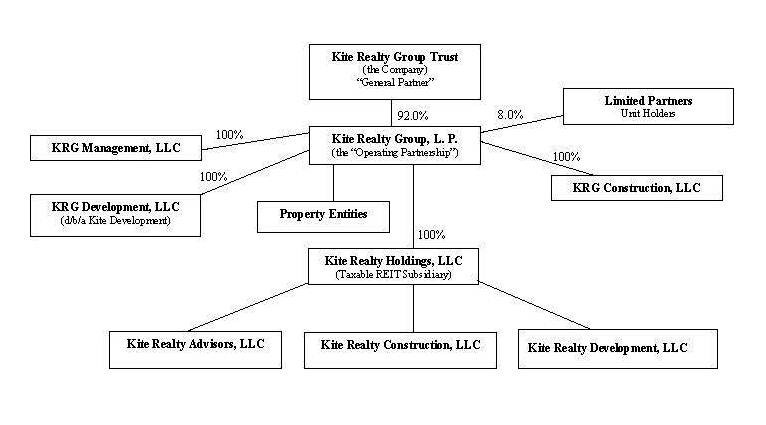

Corporate Structure Chart

|

|

|

7

|

Consolidated Balance Sheets

|

|

|

8

|

Consolidated Statements of Operations for the Three and Twelve Months Ended December 31

|

|

|

9

|

Funds from Operations and Other Financial Information for the Three and Twelve Months Ended December 31

|

|

|

10

|

Market Capitalization

|

|

|

10

|

Ratio of Debt to Total Undepreciated Assets as of December 31, 2012

|

|

|

11

|

Same Property Net Operating Income for the Three and Twelve Months Ended December 31

|

|

|

12

|

Net Operating Income by Quarter

|

|

|

13

|

Summary of Outstanding Debt as of December 31

|

|

|

14

|

Schedule of Outstanding Debt as of December 31

|

|

|

16

|

Top 10 Retail Tenants by Gross Leasable Area

|

|

|

17

|

Top 25 Tenants by Annualized Base Rent

|

|

|

18

|

Lease Expirations – Operating Portfolio

|

|

|

19

|

Lease Expirations – Retail Anchor Tenants

|

|

|

20

|

Lease Expirations – Retail Shops

|

|

|

21

|

Lease Expirations – Commercial Tenants

|

|

|

22

|

Summary Retail Portfolio Statistics Including Joint Venture Properties

|

|

|

23

|

Summary Commercial Portfolio Statistics

|

|

|

24

|

In-Process Development / Redevelopment Projects

|

|

|

25

|

Future Development / Redevelopment Projects

|

|

|

26

|

Property Acquisitions

|

|

|

27

|

Geographic Diversification – Operating Portfolio

|

|

|

28

|

Operating Retail Properties

|

|

|

32

|

Operating Commercial Properties

|

|

|

33

|

Retail Operating Portfolio – Tenant Breakdown

|

|

p. 2

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

CORPORATE PROFILE

General Description

Kite Realty Group Trust is a full-service, vertically integrated real estate company engaged primarily in the development, construction, acquisition, ownership and operation of high-quality neighborhood and community shopping centers in selected markets in the United States. We are organized as a real estate investment trust ("REIT") for federal income tax purposes. As of December 31, 2012, we owned interests in 60 properties totaling approximately 9.3 million square feet and an additional 0.5 million square feet in three properties currently under in-process development.

Our strategy is to maximize the cash flow of our operating properties, successfully complete the construction and lease-up of our development portfolio and identify additional growth opportunities in the form of acquisitions and redevelopments. New investments are focused in the shopping center sector, although we may selectively pursue commercial development or acquisition opportunities in markets where we currently operate and where we believe we can leverage existing infrastructure and relationships to generate attractive risk-adjusted returns.

Company Highlights as of December 31, 2012

|

·

|

Operating Retail Properties

|

54

|

||||

|

·

|

Operating Commercial Properties

|

2

|

||||

|

·

|

Total Properties Under Redevelopment

|

4

|

||||

|

Total Operating and Redevelopment Properties

|

60

|

|||||

|

·

|

Properties Under In-Process Development

|

3

|

||||

|

·

|

States

|

11

|

||||

|

·

|

Total GLA/NRA of 56 Operating Properties (excluding properties under redevelopment)

|

8,780,798

|

||||

|

·

|

Owned GLA/NRA of 56 Operating Properties (excluding properties under redevelopment)

|

6,205,042

|

||||

|

·

|

Projected Owned GLA of In-Process Development and Redevelopment Projects

|

854,088

|

||||

|

·

|

Percentage of Owned GLA/NRA Leased – Total Portfolio

|

94.2%

|

||||

|

·

|

Percentage of Owned GLA Leased – Retail Operating

|

94.2%

|

||||

|

·

|

Percentage of Owned NRA Leased – Commercial Operating

|

93.6%

|

||||

Stock Listing: New York Stock Exchange symbol: KRG

p. 3

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

CONTACT INFORMATION

Corporate Office

30 South Meridian Street, Suite 1100

Indianapolis, IN 46204

(888) 577-5600

(317) 577-5600

www.kiterealty.com

|

Investor Relations Contacts:

|

Analyst Coverage:

|

Analyst Coverage:

|

||

|

Dan Sink, Chief Financial Officer

|

Bank of America/Merrill Lynch

|

Raymond James

|

||

|

Kite Realty Group Trust

|

Mr. Jeffrey Spector / Mr. Craig Schmidt

|

Mr. Paul Puryear/Mr. R. J. Milligan

|

||

|

30 South Meridian Street, Suite 1100

|

(646) 855-1363/(646) 855-3640

|

(727) 567-2253/(727) 567-2660

|

||

|

Indianapolis, IN 46204

|

jeff.spector@baml.com

|

paul.puryear@raymondjames.com

|

||

|

(317) 577-5609

|

craig.schmidt@baml.com

|

Richard.milligan@raymondjames.com

|

||

|

dsink@kiterealty.com

|

||||

|

BMO Capital Markets

|

RBC Capital Markets

|

|||

|

Adam Basch, Investor Relations

|

Mr. Paul E. Adornato/Mr. Joshua Patinkin

|

Mr. Rich Moore/Mr. Wes Golladay

|

||

|

Kite Realty Group Trust

|

(212) 885-4170 /(212) 883-5102

|

(440) 715-2646/(440) 715-2650

|

||

|

30 South Meridian Street, Suite 1100

|

paul.adornato@bmo.com

|

rich.moore@rbccm.com

|

||

|

Indianapolis, IN 46204

|

josh.patinkin@bmo.com

|

wes.golladay@rbccm.com

|

||

|

(317) 578-5161

|

||||

|

abasch@kiterealty.com

|

Citigroup Global Markets

|

Stifel, Nicolaus & Company, Inc.

|

||

|

Mr. Michael Bilerman/Mr. Quentin Velleley

|

Mr. Nathan Isbee

|

|||

|

Transfer Agent:

|

(212) 816-1383/(212) 816-6981

|

(443) 224-1346

|

||

|

michael.bilerman@citigroup.com

|

nisbee@stifel.com

|

|||

|

Broadridge

|

Quentin.velleley@citi.com

|

|||

|

Ms. Rosanna Garofalo

|

Wells Fargo Securities, LLC

|

|||

|

51 Mercedes Way

|

Hilliard Lyons

|

Mr. Jeffrey J. Donnelly, CFA

|

||

|

Edgewood, NY 11717

|

Ms. Carol L. Kemple

|

(617) 603-4262

|

||

|

(631) 392-5810

|

(502) 588-1839

|

jeff.donnelly@wachovia.com

|

||

|

Ckemple@hilliard.com

|

||||

|

Stock Specialist:

|

||||

|

KeyBanc Capital Markets

|

||||

|

Barclays Capital

|

Mr. Jordan Sadler/Mr. Todd Thomas

|

|||

|

45 Broadway

|

(917) 368-2280/(917) 368-2286

|

|||

|

20th Floor

|

tthomas@keybanccm.com

|

|||

|

New York, NY 10006

|

jsadler@keybanccm.com

|

|||

|

(646) 333-7000

|

||||

p. 4

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

IMPORTANT NOTES

Interim Information

This Quarterly Financial Supplement contains historical information of Kite Realty Group Trust (“the Company” or “KRG”) and is intended to supplement the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 to be filed on or about March 15, 2013, which should be read in conjunction with this supplement. The supplemental information is unaudited, although it reflects all adjustments which, in the opinion of management, are necessary for a fair presentation of operating results for the interim periods.

Forward-Looking Statements

This supplemental information package contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to:

|

·

|

national and local economic, business, real estate and other market conditions, particularly in light of the current recession;

|

|

·

|

financing risks, including the availability of and costs associated with sources of liquidity;

|

|

·

|

the Company’s ability to refinance, or extend the maturity dates of, its indebtedness;

|

|

·

|

the level and volatility of interest rates;

|

|

·

|

the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies;

|

|

·

|

the competitive environment in which the Company operates;

|

|

·

|

acquisition, disposition, development and joint venture risks;

|

|

·

|

property ownership and management risks;

|

|

·

|

the Company’s ability to maintain its status as a real estate investment trust (“REIT”) for federal income tax purposes;

|

|

·

|

potential environmental and other liabilities;

|

|

·

|

impairment in the value of real estate property the Company owns;

|

|

·

|

risks related to the geographical concentration of our properties in Indiana, Florida and Texas;

|

|

·

|

other factors affecting the real estate industry generally; and

|

|

·

|

other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, and in our quarterly reports on Form 10-Q.

|

The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Funds from Operations

Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. We calculate FFO in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts (NAREIT), which we refer to as the White Paper. The White Paper defines FFO as net income (determined in accordance with generally accepted accounting principles (GAAP)), excluding gains (or losses) from sales and impairments of depreciated property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

Considering the nature of our business as a real estate owner and operator, we believe that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational purposes, we have also provided FFO adjusted for a litigation charge in the first quarter of 2012 and the write-off of deferred financing costs in the second quarter of 2012. We believe this supplemental information provides a meaningful measure of our operating performance. We believe our presentation of adjusted FFO provides investors with another financial measure that may facilitate comparison of operating performance between periods and among our peer companies. FFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indicator of our financial performance, is not an alternative to cash flow from operating activities (determined in accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to satisfy our cash needs, including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do.

Net Operating Income

Net operating income (NOI) is provided here as a supplemental measure of operating performance. NOI is defined as property revenues less property operating expenses, excluding depreciation and amortization, interest expense, impairment, and other items. We believe this presentation of NOI is helpful to investors as a measure of our operational performance because it is widely used in the real estate industry to measure the performance of real estate assets without regard to various items, included in net income, that do not relate to or are not indicative of operating performance, such as depreciation and amortization, which can vary depending upon accounting methods and book value of assets. We also believe NOI helps our investors to meaningfully compare the results of our operating performance from period to period by removing the impact of our capital structure (primarily interest expense on our outstanding indebtedness) and depreciation of the basis in our assets from our operating results. NOI should not, however, be considered as an alternative to net income (determined in accordance with GAAP) as an indicator of our financial performance.

p. 5

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

CORPORATE STRUCTURE CHART DECEMBER 31, 2012

p. 6

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

December 31,

2012

|

December 31,

2011

|

|||||||

|

Assets:

|

||||||||

|

Investment properties, at cost:

|

||||||||

|

Land

|

$ | 239,690,837 | $ | 238,129,092 | ||||

|

Land held for development

|

34,878,300 | 36,977,501 | ||||||

|

Buildings and improvements

|

892,508,729 | 845,173,680 | ||||||

|

Furniture, equipment and other

|

4,419,918 | 5,474,403 | ||||||

|

Construction in progress

|

223,135,354 | 147,973,380 | ||||||

| 1,394,633,138 | 1,273,728,056 | |||||||

|

Less: accumulated depreciation

|

(194,297,531 | ) | (178,006,632 | ) | ||||

| 1,200,335,607 | 1,095,721,424 | |||||||

|

Cash and cash equivalents

|

12,482,701 | 10,042,450 | ||||||

|

Tenant receivables, including accrued straight-line rent of $12,189,449 and $11,398,347, respectively, net of allowance for uncollectible accounts

|

21,210,754 | 20,413,671 | ||||||

|

Other receivables

|

4,946,219 | 2,978,225 | ||||||

|

Investments in unconsolidated entities, at equity

|

15,522 | 21,646,443 | ||||||

|

Escrow deposits

|

12,960,488 | 9,424,986 | ||||||

|

Deferred costs, net

|

34,536,474 | 31,079,129 | ||||||

|

Prepaid and other assets

|

2,169,140 | 1,959,790 | ||||||

|

Total Assets

|

$ | 1,288,656,905 | $ | 1,193,266,118 | ||||

|

Liabilities and Equity:

|

||||||||

|

Mortgage and other indebtedness

|

$ | 699,908,768 | $ | 689,122,933 | ||||

|

Accounts payable and accrued expenses

|

54,187,172 | 36,048,324 | ||||||

|

Deferred revenue and other liabilities,

|

20,269,501 | 12,636,228 | ||||||

|

Total Liabilities

|

774,365,441 | 737,807,485 | ||||||

|

Commitments and contingencies

|

||||||||

|

Redeemable noncontrolling interests in the Operating Partnership

|

37,669,803 | 41,836,613 | ||||||

|

Equity:

|

||||||||

|

Kite Realty Group Trust Shareholders’ Equity:

|

||||||||

|

Preferred Shares, $.01 par value, 40,000,000 shares authorized, 4,100,000 shares and 2,800,000 shares issued and outstanding, respectively

|

102,500,000 | 70,000,000 | ||||||

|

Common Shares, $.01 par value, 200,000,000 shares authorized 77,728,697 shares and 63,617,019 shares issued and outstanding, respectively

|

777,287 | 636,170 | ||||||

|

Additional paid in capital

|

513,111,877 | 449,763,528 | ||||||

|

Accumulated other comprehensive loss

|

(5,258,543 | ) | (1,524,095 | ) | ||||

|

Accumulated deficit

|

(138,044,264 | ) | (109,504,068 | ) | ||||

|

Total Kite Realty Group Trust Shareholders’ Equity

|

473,086,357 | 409,371,535 | ||||||

|

Noncontrolling Interests

|

3,535,304 | 4,250,485 | ||||||

|

Total Equity

|

476,621,661 | 413,662,020 | ||||||

|

Total Liabilities and Equity

|

$ | 1,288,656,905 | $ | 1,193,266,118 | ||||

p. 7

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

CONSOLIDATED STATEMENTS OF OPERATIONS – THREE AND TWELVE MONTHS (UNAUDITED)

|

Three Months Ended

December 31,

|

Twelve Months Ended

December 31,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

Revenue:

|

||||||||||||||||

|

Minimum rent

|

$ | 19,973,987 | $ | 18,425,849 | $ | 76,529,463 | $ | 70,471,652 | ||||||||

|

Tenant reimbursements

|

5,493,941 | 4,930,199 | 20,178,355 | 18,912,561 | ||||||||||||

|

Other property related revenue

|

1,110,082 | 1,097,130 | 4,051,442 | 4,250,647 | ||||||||||||

|

Construction and service fee revenue

|

144,062 | 106,285 | 294,610 | 373,104 | ||||||||||||

|

Total revenue

|

26,722,072 | 24,559,463 | 101,053,870 | 94,007,964 | ||||||||||||

|

Expenses:

|

||||||||||||||||

|

Property operating

|

4,631,500 | 4,383,556 | 17,391,918 | 17,554,804 | ||||||||||||

|

Real estate taxes

|

3,493,512 | 3,154,700 | 13,300,245 | 12,873,933 | ||||||||||||

|

Cost of construction and services

|

73,057 | 9,092 | 325,420 | 309,074 | ||||||||||||

|

General, administrative and other

|

1,862,783 | 1,619,235 | 7,124,078 | 6,280,294 | ||||||||||||

|

Acquisition costs

|

185,263 | — | 364,364 | — | ||||||||||||

|

Litigation charge, net

|

(281,995 | ) | — | 1,007,451 | — | |||||||||||

|

Depreciation and amortization

|

9,829,147 | 8,519,665 | 40,372,414 | 34,698,029 | ||||||||||||

|

Total expenses

|

19,793,267 | 17,686,248 | 79,885,890 | 71,716,134 | ||||||||||||

|

Operating income

|

6,928,805 | 6,873,215 | 21,167,980 | 22,291,830 | ||||||||||||

|

Interest expense

|

(6,495,927 | ) | (6,598,559 | ) | (25,660,381 | ) | (23,599,227 | ) | ||||||||

|

Income tax benefit of taxable REIT subsidiary

|

99,989 | 74,022 | 105,984 | 1,294 | ||||||||||||

|

(Loss) income from unconsolidated entities

|

(23 | ) | 89,181 | 91,452 | 333,628 | |||||||||||

|

Gain on sale of unconsolidated property, net

|

— | 4,320,155 | — | 4,320,155 | ||||||||||||

|

Remeasurement loss on consolidation of Parkside Town Commons, net

|

(7,979,626 | ) | — | (7,979,626 | ) | — | ||||||||||

|

Other income

|

39,881 | 25,397 | 148,506 | 208,813 | ||||||||||||

|

(Loss) income from continuing operations

|

(7,406,901 | ) | 4,783,411 | (12,126,085 | ) | 3,556,493 | ||||||||||

|

Discontinued operations1:

|

||||||||||||||||

|

Income from operations

|

255,851 | 530,244 | 1,327,063 | 1,826,156 | ||||||||||||

|

Gain (loss) on sale of operating properties, net of tax

expense

|

1,913,670 | (397,909 | ) | 7,094,238 | (397,909 | ) | ||||||||||

|

Income from discontinued operations

|

2,169,521 | 132,335 | 8,421,301 | 1,428,247 | ||||||||||||

|

Consolidated net (loss) income

|

(5,237,380 | ) | 4,915,746 | (3,704,784 | ) | 4,984,740 | ||||||||||

|

Net loss (income) attributable to noncontrolling interests

|

884,528 | (414,434 | ) | (629,063 | ) | (3,466 | ) | |||||||||

|

Net (loss) income attributable to Kite Realty Group Trust

|

(4,352,852 | ) | 4,501,312 | (4,333,847 | ) | 4,981,274 | ||||||||||

|

Dividends on preferred shares

|

(2,114,063 | ) | (1,443,750 | ) | (7,920,002 | ) | (5,775,000 | ) | ||||||||

|

Net loss attributable to common shareholders

|

$ | (6,466,915 | ) | $ | 3,057,562 | $ | (12,253,849 | ) | $ | (793,726 | ) | |||||

|

Net (loss) income per common share attributable to Kite Realty Group Trust common shareholders – basic and diluted

|

||||||||||||||||

|

(Loss) income from continuing operations attributable to common shareholders

|

$ | (0.12 | ) | $ | 0.05 | $ | (0.27 | ) | $ | (0.03 | ) | |||||

|

Income from discontinued operations attributable to common shareholders

|

0.03 | 0.00 | 0.09 | 0.02 | ||||||||||||

|

Net (loss) income attributable to common shareholders

|

$ | (0.09 | ) | $ | 0.05 | $ | (0.18 | ) | $ | (0.01 | ) | |||||

|

Weighted average common shares outstanding – basic

|

74,966,736 | 63,613,728 | 66,885,259 | 63,557,322 | ||||||||||||

|

Weighted average common shares outstanding – diluted

|

74,966,736 | 71,696,106 | 66,885,259 | 63,557,322 | ||||||||||||

|

Dividends declared per common share

|

$ | 0.06 | $ | 0.06 | $ | 0.24 | $ | 0.24 | ||||||||

|

(Loss) income attributable to Kite Realty Group Trust common shareholders:

|

||||||||||||||||

|

(Loss) income from continuing operations

|

$ | (8,684,021 | ) | $ | 2,939,703 | $ | (18,181,128 | ) | $ | (2,065,572 | ) | |||||

|

Income from discontinued operations

|

2,217,106 | 117,859 | 5,927,279 | 1,271,846 | ||||||||||||

|

Net (loss) income attributable to Kite Realty Group Trust common shareholders

|

$ | (6,466,915 | ) | $ | 3,057,562 | $ | (12,253,849 | ) | $ | (793,726 | ) | |||||

|

____________________

|

|

|

1

|

Discontinued operations reflects sales of the following operating properties: Pen Products, Indiana State Motor Pool, Sandifur Plaza, Preston Commons, and Zionsville Place in Q4 2012, Coral Springs and 50 South Morton in Q3 2012, South Elgin Commons in Q2 2012, and Gateway Shopping Center in Q1 2012. .

|

p. 8

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

FUNDS FROM OPERATIONS AND OTHER FINANCIAL INFORMATION - THREE AND TWELVE MONTHS

|

Three Months Ended

December 31,

|

Twelve Months Ended

December 31,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

Consolidated net (loss) income

|

$ | (5,237,380 | ) | $ | 4,915,746 | $ | (3,704,784 | ) | $ | 4,984,740 | ||||||

|

Less dividends on preferred shares

|

(2,114,063 | ) | (1,443,750 | ) | (7,920,002 | ) | (5,775,000 | ) | ||||||||

|

Less net (loss) income attributable to noncontrolling interests in properties

|

(25,910 | ) | (38,244 | ) | (137,552 | ) | (101,069 | ) | ||||||||

|

Less gain (loss) on sale of operating properties, net of tax expense

|

(1,913,670 | ) | 397,909 | (7,094,238 | ) | 397,909 | ||||||||||

|

Less gain on sale of unconsolidated property, net

|

— | (4,320,155 | ) | — | (4,320,155 | ) | ||||||||||

|

Add remeasurement loss on consolidation of Parkside Town Commons, net

|

7,979,626 | — | 7,979,626 | — | ||||||||||||

|

Add depreciation and amortization, net of noncontrolling interests

|

9,775,837 | 9,054,424 | 41,357,472 | 36,577,580 | ||||||||||||

|

Funds From Operations of the Kite Portfolio1

|

8,464,440 | 8,565,930 | 30,480,522 | 31,764,005 | ||||||||||||

|

Less redeemable noncontrolling interests in Funds From Operations

|

(696,033 | ) | (942,252 | ) | (3,020,454 | ) | (3,494,040 | ) | ||||||||

|

Funds From Operations allocable to the Company1

|

$ | 7,768,407 | $ | 7,623,678 | $ | 27,460,068 | $ | 28,269,965 | ||||||||

|

Basic FFO per share of the Kite Portfolio

|

$ | 0.10 | $ | 0.12 | $ | 0.41 | $ | 0.44 | ||||||||

|

Diluted FFO per share of the Kite Portfolio

|

$ | 0.10 | $ | 0.12 | $ | 0.41 | $ | 0.44 | ||||||||

|

Funds From Operations of the Kite Portfolio

|

$ | 8,464,440 | $ | 8,565,930 | $ | 30,480,522 | $ | 31,764,005 | ||||||||

|

Add litigation charge

|

(281,995 | ) | — | 1,007,451 | — | |||||||||||

|

Add accelerated amortization of deferred financing fees

|

— | — | 500,028 | — | ||||||||||||

|

Funds From Operations of the Kite Portfolio, as adjusted

|

$ | 8,182,445 | $ | 8,565,930 | $ | 31,988,001 | $ | 31,764,005 | ||||||||

|

Basic and Diluted FFO per share of the Kite Portfolio, as adjusted

|

$ | 0.10 | $ | 0.12 | $ | 0.43 | $ | 0.44 | ||||||||

|

Basic weighted average Common Shares outstanding

|

74,966,736 | 63,613,728 | 66,885,259 | 63,557,322 | ||||||||||||

|

Diluted weighted average Common Shares outstanding

|

75,332,552 | 63,852,565 | 67,226,023 | 63,828,582 | ||||||||||||

|

Basic weighted average Common Shares and Units outstanding

|

81,706,988 | 71,457,269 | 74,279,746 | 71,406,505 | ||||||||||||

|

Diluted weighted average Common Shares and Units outstanding

|

82,072,803 | 71,696,106 | 74,620,510 | 71,677,765 | ||||||||||||

|

Other Financial Information:

|

||||||||||||||||

|

Capital expenditures2

|

||||||||||||||||

|

Tenant improvements – Retail6 (Revenue Enhancing)

|

$ | 1,427,598 | $ | 2,067,241 | $ | 4,371,851 | $ | 3,740,846 | ||||||||

|

Tenant improvements – Commercial (Revenue Enhancing)

|

1,035,437 | — | 1,055,729 | 53,500 | ||||||||||||

|

Leasing commissions – Retail

|

278,835 | 231,943 | 876,010 | 1,251,118 | ||||||||||||

|

Leasing commissions – Commercial

|

733,181 | 40,351 | 773,282 | 40,351 | ||||||||||||

|

Capital improvements3

|

387,887 | 142,126 | 1,299,047 | 504,379 | ||||||||||||

|

Scheduled debt principal payments

|

1,653,808 | 1,642,750 | 6,553,283 | 5,245,847 | ||||||||||||

|

Straight line rent – total

|

490,374 | 783,779 | 1,875,168 | 2,690,710 | ||||||||||||

|

- term of lease

|

256,014 | |||||||||||||||

|

- pre-cash rent period – operating properties

|

175,054 | |||||||||||||||

|

- pre-cash rent period – development properties

|

59,306 | |||||||||||||||

|

Market rent amortization income from acquired leases

|

582,430 | 528,430 | 2,001,511 | 2,460,002 | ||||||||||||

|

Market debt adjustment

|

46,628 | 107,714 | 117,624 | 430,856 | ||||||||||||

|

Non-cash compensation expense

|

277,438 | 245,718 | 1,048,727 | 879,287 | ||||||||||||

|

Capitalized interest

|

2,052,082 | 1,997,641 | 7,444,472 | 8,486,590 | ||||||||||||

|

Mark to market lease amount in Deferred revenue and other liabilities on condensed consolidated balance sheet

|

10,359,484 | 8,637,607 | ||||||||||||||

|

Acreage of undeveloped, vacant land in the operating portfolio4

|

33.6 | |||||||||||||||

|

Mid-quarter rent commencement not recognized in income statement (annualized) 5

|

$ | 407,570 | ||||||||||||||

|

____________________

|

|

|

1

|

“Funds From Operations of the Operating Partnership” measures 100% of the operating performance of the Operating Partnership’s real estate properties and construction and service subsidiaries in which the Company owns an interest. “Funds From Operations allocable to the Company” reflects a reduction for the redeemable noncontrolling weighted average diluted interest in the Operating Partnership.

|

|

2

|

Excludes tenant improvements and leasing commissions relating to development and redevelopment projects and first-generation space.

|

|

3

|

A portion of these capital improvements are reimbursed by tenants and are revenue producing.

|

|

4

|

Not reflected in construction in progress and land held for development on the consolidated balance sheet (book value $7.0 million at December 31, 2012).

|

|

5

|

Reflects impact for full quarter for operating property tenants commencing cash rent in the quarter offset by terminated tenants.

|

p. 9

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

MARKET CAPITALIZATION AS OF DECEMBER 31, 2012

|

Total

|

Percent of

|

||||||||||||||

|

Percent of

|

Market

|

Total Market

|

|||||||||||||

|

Total Equity

|

Capitalization

|

Capitalization

|

|||||||||||||

|

Equity Capitalization:

|

|||||||||||||||

|

Total Common Shares Outstanding

|

92.0

|

%

|

77,728,697

|

||||||||||||

|

Operating Partnership ("OP") Units Outstanding

|

8.0

|

%

|

6,738,784

|

||||||||||||

|

Combined Common Shares and OP Units

|

100.0

|

%

|

84,467,481

|

||||||||||||

|

Market Price of Common Shares at December 31, 2012

|

$

|

5.59

|

|||||||||||||

|

Series A Preferred Shares

|

102,500,000

|

||||||||||||||

|

Total Equity Capitalization

|

574,673,219

|

46

|

%

|

||||||||||||

|

Debt Capitalization:

|

|||||||||||||||

|

Company Consolidated Outstanding Debt

|

699,908,768

|

||||||||||||||

|

Less: Partner Share of Consolidated Joint Venture Debt2

|

(11,331,849

|

)

|

|||||||||||||

|

Company Share of Outstanding Debt

|

688,576,919

|

||||||||||||||

|

Less: Cash and Cash Equivalents

|

(12,482,700

|

)

|

|||||||||||||

|

Total Net Debt Capitalization

|

676,094,219

|

54

|

%

|

||||||||||||

|

Total Enterprise Value as of December 31, 2012

|

$

|

1,250,767,438

|

100

|

%

|

|||||||||||

|

RATIO OF DEBT TO TOTAL UNDEPRECIATED ASSETS AS OF DECEMBER 31, 2012

|

|||||||||||||||

|

Consolidated Undepreciated Real Estate Assets

|

$

|

1,394,633,138

|

|||||||||||||

|

Escrow and Other Deposits

|

12,960,488

|

||||||||||||||

|

$

|

1,407,593,626

|

||||||||||||||

|

Total Consolidated Debt

|

$

|

699,908,768

|

|||||||||||||

|

Less: Cash

|

(12,482,700

|

)

|

|||||||||||||

|

|

$

|

687,426,068

|

|||||||||||||

|

Ratio of Net Debt to Total Undepreciated Real Estate Assets

|

48.8

|

%

|

|||||||||||||

|

RATIO OF COMPANY SHARE OF DEBT TO EBITDA AS OF DECEMBER 31, 2012

|

|||||||||||||||

|

Company share of consolidated debt

|

$

|

688,576,919

|

|||||||||||||

|

Less: Cash

|

(12,482,700

|

)

|

|||||||||||||

|

Less: Construction loans for In-Process Developments

|

(85,760,149

|

)

|

|||||||||||||

|

590,334,070

|

|||||||||||||||

|

Q4 2012 EBITDA, annualized:

|

|||||||||||||||

|

- consolidated

|

$

|

65,903,828

|

|||||||||||||

|

- pro forma adjustment1

|

2,672,579

|

||||||||||||||

|

- minority interest EBITDA

|

(183,332

|

)

|

68,393,075

|

||||||||||||

|

8.63x

|

|||||||||||||||

|

1

|

Represents full year effect of adjustments for seasonality of percentage rent, annualization of mid-fourth quarter rent commencement, annualizing Publix at Woodruff and Shoppes at Plaza Green acquisitions, normalizing other property related revenue and transaction costs.

|

||||||||||||||

|

2

|

Includes partners’ share of Fishers Station, Beacon Hill and Bayport Commons.

|

||||||||||||||

p. 10

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

SAME PROPERTY NET OPERATING INCOME (NOI)

|

Three Months Ended December 31,

|

Twelve Months Ended December 31,

|

|||||||||||||||

|

2012

|

2011

|

% Change

|

2012

|

2011

|

% Change

|

|||||||||||

|

Number of properties at period end1

|

48

|

48

|

48

|

48

|

||||||||||||

|

Leased percentage at period-end

|

93.7%

|

92.8%

|

93.7%

|

92.8%

|

||||||||||||

|

Minimum rent

|

$

|

17,357,625

|

$

|

17,219,688

|

$

|

66,456,075

|

$

|

65,828,563

|

||||||||

|

Tenant recoveries

|

4,894,778

|

4,513,786

|

17,732,610

|

17,103,699

|

||||||||||||

|

Other income

|

972,050

|

824,280

|

2,592,379

|

2,217,497

|

||||||||||||

|

23,224,453

|

22,557,754

|

86,781,064

|

85,149,759

|

|||||||||||||

|

Property operating expenses

|

5,122,710

|

4,962,551

|

17,660,550

|

18,035,095

|

||||||||||||

|

Real estate taxes

|

3,071,234

|

3,010,722

|

11,788,880

|

11,542,059

|

||||||||||||

|

8,193,944

|

7,973,273

|

29,449,430

|

29,577,154

|

|||||||||||||

|

Net operating income – same properties (48 properties)2

|

15,030,509

|

14,584,481

|

3.1

|

%

|

57,331,634

|

55,572,605

|

3.2

|

%

|

||||||||

|

Reconciliation to Most Directly Comparable GAAP Measure:

|

||||||||||||||||

|

Net operating income – same properties

|

$

|

15,030,509

|

$

|

14,584,481

|

$

|

57,331,634

|

$

|

55,572,605

|

||||||||

|

Net operating income – non-same properties

|

3,422,489

|

2,330,441

|

12,370,099

|

11,953,672

|

||||||||||||

|

Construction, net and other

|

210,852

|

285,793

|

315,132

|

607,765

|

||||||||||||

|

General, administrative and acquisition expenses

|

(2,048,046

|

)

|

(1,619,235

|

)

|

(7,124,078

|

)

|

(6,280,294

|

)

|

||||||||

|

Litigation charge

|

281,995

|

—

|

(1,007,451

|

)

|

—

|

|||||||||||

|

Depreciation expense

|

(9,829,147

|

)

|

(8,519,665

|

)

|

(40,372,414

|

)

|

(34,698,029

|

)

|

||||||||

|

Interest expense

|

(6,495,927

|

)

|

(6,598,559

|

)

|

(25,660,381

|

)

|

(23,599,227

|

)

|

||||||||

|

Discontinued operations

|

255,851

|

530,244

|

1,327,063

|

1,826,157

|

||||||||||||

|

Gain (loss) on sales of operating properties

|

1,913,670

|

3,922,246

|

7,094,238

|

(397,909

|

)

|

|||||||||||

|

Remeasurement loss on consolidation of Parkside Town Commons, net

|

(7,979,626

|

)

|

—

|

(7,979,626

|

)

|

—

|

||||||||||

|

Net loss (income) attributable to noncontrolling interests

|

884,528

|

(414,434

|

)

|

(629,063

|

)

|

(3,466

|

)

|

|||||||||

|

Dividends on preferred shares

|

(2,114,063

|

)

|

(1,443,750

|

)

|

(7,920,002

|

)

|

(5,775,000

|

)

|

||||||||

|

Net (loss) income attributable to common shareholders

|

$

|

(6,466,915)

|

)

|

$

|

3,057,562

|

$

|

(12,253,849

|

)

|

$

|

(793,726

|

)

|

|||||

|

____________________

|

|

|

1

|

Same Property analysis excludes Courthouse Shadows, Four Corner Square, Rangeline Crossing and Bolton Plaza as the Company pursues redevelopment of these properties.

|

|

2

|

Same Property net operating income is considered a non-GAAP measure because it excludes net gains from outlot sales, write offs of straight-line rent and lease intangibles, bad debt expense and related recoveries, lease termination fees and significant prior year expense recoveries and adjustments, if any.

|

The Company believes that Net Operating Income is helpful to investors as a measure of its operating performance because it excludes various items included in net income that do not relate to or are not indicative of its operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The Company believes that Same Property NOI is helpful to investors as a measure of its operating performance because it includes only the NOI of properties that have been owned for the full period presented, which eliminates disparities in net income due to the redevelopment, acquisition or disposition of properties during the particular period presented, and thus provides a more consistent metric for the comparison of the Company's properties. NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of the Company's financial performance.

p. 11

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

NET OPERATING INCOME BY QUARTER

|

Three Months Ended

|

|||||||||||||||||||||

|

December 31,

2012

|

September 30,

2012

|

June 30,

2012

|

March 31,

2012

|

December 31,

2011

|

|||||||||||||||||

|

Revenue:

|

|||||||||||||||||||||

|

Minimum rent

|

$

|

19,973,987

|

$

|

19,332,426

|

$

|

18,761,604

|

$

|

18,461,447

|

$

|

18,425,849

|

|||||||||||

|

Tenant reimbursements

|

5,493,941

|

5,033,632

|

4,541,108

|

5,109,674

|

4,930,199

|

||||||||||||||||

|

Other property related revenue

|

568,667

|

250,999

|

494,663

|

600,037

|

568,646

|

||||||||||||||||

|

Parking revenue, net1

|

139,057

|

208,418

|

(14,526

|

)

|

180,064

|

99,510

|

|||||||||||||||

|

26,175,652

|

24,825,475

|

23,782,849

|

24,351,222

|

24,024,204

|

|||||||||||||||||

|

Expenses:

|

|||||||||||||||||||||

|

Property operating – Recoverable2

|

3,966,644

|

3,420,691

|

3,172,620

|

3,363,621

|

3,331,274

|

||||||||||||||||

|

Property operating – Non-Recoverable2

|

450,565

|

535,934

|

707,764

|

884,192

|

813,019

|

||||||||||||||||

|

Real estate taxes

|

3,305,445

|

3,075,931

|

2,863,376

|

3,321,322

|

2,964,989

|

||||||||||||||||

|

7,722,654

|

7,032,556

|

6,743,760

|

7,569,135

|

7,109,282

|

|||||||||||||||||

|

Net Operating Income – Properties

|

18,452,998

|

17,792,919

|

17,039,089

|

16,782,087

|

16,914,922

|

||||||||||||||||

|

Other Income (Expense):

|

|||||||||||||||||||||

|

Construction and service fee revenue

|

144,062

|

52,531

|

54,613

|

43,403

|

106,285

|

||||||||||||||||

|

Cost of construction and services

|

(73,057

|

)

|

(77,901

|

)

|

(82,115

|

)

|

(92,348

|

)

|

(9,092

|

)

|

|||||||||||

|

General, administrative, and other

|

(1,862,783

|

)

|

(1,647,116

|

)

|

(1,792,472

|

)

|

(1,821,707

|

)

|

(1,619,234

|

)

|

|||||||||||

|

Acquisition costs

|

(185,263

|

)

|

(108,169

|

)

|

(70,933

|

)

|

—

|

—

|

|||||||||||||

|

(1,977,041

|

)

|

(1,780,655

|

)

|

(1,890,907

|

)

|

(1,870,652

|

)

|

(1,522,041

|

)

|

||||||||||||

|

Earnings Before Interest, Taxes, Depreciation and Amortization

|

16,475,957

|

16,012,264

|

15,148,182

|

14,911,435

|

15,392,881

|

||||||||||||||||

|

Litigation charge

|

281,995

|

—

|

—

|

(1,289,446

|

)

|

—

|

|||||||||||||||

|

Depreciation and amortization

|

(9,829,147

|

)

|

(11,183,187

|

)

|

(10,211,245

|

)

|

(9,148,836

|

)

|

(8,519,665

|

)

|

|||||||||||

|

Interest expense

|

(6,495,927

|

)

|

(6,481,825

|

)

|

(6,303,413

|

)

|

(6,379,217

|

)

|

(6,598,559

|

)

|

|||||||||||

|

Income tax benefit (expense) of taxable REIT subsidiary

|

99,989

|

13,385

|

30,174

|

(37,564

|

)

|

74,022

|

|||||||||||||||

|

(Loss) income from unconsolidated entities

|

(23

|

)

|

102,623

|

382

|

(11,529

|

)

|

89,181

|

||||||||||||||

|

Gain on sale of unconsolidated property, net

|

—

|

—

|

—

|

—

|

4,320,155

|

||||||||||||||||

|

Remeasurement loss on consolidation

|

(7,979,626

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Other income

|

39,881

|

22,688

|

47,823

|

38,118

|

25,396

|

||||||||||||||||

|

(Loss) income from continuing operations

|

(7,406,901

|

)

|

(1,514,052

|

)

|

(1,288,097

|

)

|

(1,917,039

|

)

|

4,783,411

|

||||||||||||

|

Discontinued operations4:

|

|||||||||||||||||||||

|

Operating income from discontinued operations

|

255,851

|

343,059

|

319,348

|

408,809

|

530,244

|

||||||||||||||||

|

Gain (loss) on sale of operating property, net of tax expense

|

1,913,670

|

(65,312

|

)

|

93,891

|

5,151,989

|

(397,909

|

)

|

||||||||||||||

|

Income from discontinued operations

|

2,169,521

|

277,747

|

413,329

|

5,560,798

|

132,335

|

||||||||||||||||

|

Net (loss) income

|

(5,237,380

|

)

|

(1,236,305

|

)

|

(874,858

|

)

|

3,643,759

|

4,915,746

|

|||||||||||||

|

Net loss (income) attributable to noncontrolling interest

|

884,528

|

312,208

|

271,221

|

(2,097,020

|

)

|

(414,434

|

)

|

||||||||||||||

|

Net income (loss) attributable to Kite Realty Group Trust

|

(4,352,852

|

)

|

(924,097

|

)

|

(603,637

|

)

|

1,546,739

|

4,501,312

|

|||||||||||||

|

Dividends on preferred shares

|

(2,114,063

|

)

|

(2,114,063

|

)

|

(2,114,063

|

)

|

(1,577,813

|

)

|

(1,443,750

|

)

|

|||||||||||

|

Net (loss) income attributable to common shareholders

|

$

|

(6,466,915

|

)

|

$

|

(3,038,160

|

)

|

$

|

(2,717,700

|

)

|

$

|

(31,074

|

)

|

$

|

3,057,562

|

|||||||

|

NOI/Revenue

|

70.5%

|

71.6%

|

71.6%

|

68.9%

|

70.4%

|

||||||||||||||||

|

Recovery Ratio3

|

|||||||||||||||||||||

|

– Retail Only

|

82.5%

|

86.4%

|

83.6%

|

84.5%

|

87.0%

|

||||||||||||||||

|

– Total Portfolio

|

75.5%

|

77.5%

|

75.2%

|

76.4%

|

78.3%

|

||||||||||||||||

|

____________________

|

|

|

1

|

Parking revenue, net, represents the net operating results of the Eddy Street Parking Garage and the Union Station Parking Garage.

|

|

2

|

Recoverable expenses include total management fee expense (or G&A expense of $0.5 million) allocable to the property operations in the three months ended December 31, 2012, a portion of which is recoverable. Non-recoverable expenses primarily include bad debt and legal expenses.

|

|

3

|

“Recovery Ratio” is computed by dividing tenant reimbursements by the sum of recoverable property operating expense and real estate tax expense.

|

|

4

|

Discontinued operations reflects sales of the following operating properties: Pen Products, Indiana State Motor Pool, Preston Commons, Sandifur Plaza, and Zionsville Place in Q4 2012, sales of Coral Springs and 50 South Morton in Q3 2012, South Elgin Commons in Q2 2012, and Gateway Shopping Center in Q1 2012.

|

p. 12

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

SUMMARY OF OUTSTANDING DEBT AS OF DECEMBER 31, 2012

|

TOTAL OUTSTANDING DEBT

|

|||||||||||

|

Outstanding

Amount

|

Ratio

|

Weighted

Average

Interest Rate1

|

Weighted Average

Maturity (in years)

|

||||||||

|

Fixed Rate Debt:

|

$

|

||||||||||

|

Consolidated

|

338,765,294

|

49%

|

5.77%

|

4.9

|

|||||||

|

Variable Rate Debt (Hedged)

|

164,318,838

|

23%

|

4.10%

|

6.0

|

|||||||

|

Total Fixed Rate Debt

|

503,084,132

|

72%

|

5.23%

|

5.2

|

|||||||

|

Variable Rate Debt:

|

|||||||||||

|

Construction Loans

|

72,156,149

|

10%

|

2.34%

|

2.1

|

|||||||

|

Other Variable

|

69,171,405

|

10%

|

2.82%

|

3.1

|

|||||||

|

Corporate Unsecured

|

219,624,200

|

31%

|

2.72%

|

5.5

|

|||||||

|

Variable Rate Debt (Hedged)

|

(164,318,838

|

)

|

(23%

|

)

|

(2.66%

|

)

|

(6.0)

|

||||

|

Total Variable Rate Debt

|

196,632,916

|

28%

|

2.66%

|

3.0

|

|||||||

|

Net Premiums

|

191,720

|

N/A

|

N/A

|

N/A

|

|||||||

|

Total

|

$

|

699,908,768

|

100%

|

4.51%

|

4.6

|

||||||

|

SCHEDULE OF MATURITIES BY YEAR

|

||||||||||

|

Mortgage Debt

|

Construction

Loans

|

Total Outstanding Debt

|

||||||||

|

Scheduled Principal Payments

|

Term

Maturities

|

Corporate

Debt2

|

||||||||

|

2013

|

$

|

5,644,218

|

$

|

28,987,268

|

$

|

-

|

$

|

-

|

$

|

34,631,486

|

|

2014

|

5,294,100

|

31,015,966

|

-

|

47,240,527

|

83,550,593

|

|||||

|

2015

|

5,105,649

|

38,301,942

|

-

|

24,915,622

|

68,323,213

|

|||||

|

2016

|

4,304,786

|

124,585,613

|

-

|

-

|

128,890,399

|

|||||

|

2017

|

2,674,439

|

52,461,609

|

94,624,200

|

-

|

149,760,248

|

|||||

|

2018

|

2,512,642

|

4,253,650

|

-

|

-

|

6,766,292

|

|||||

|

2019

|

2,327,383

|

-

|

125,000,000

|

-

|

127,327,383

|

|||||

|

2020

|

2,451,149

|

10,000,000

|

-

|

-

|

12,451,149

|

|||||

|

2021 and beyond

|

1,568,766

|

86,447,519

|

-

|

-

|

88,016,285

|

|||||

|

Net Premiums on Fixed Rate Debt

|

191,720

|

-

|

-

|

-

|

191,720

|

|||||

|

Total

|

$

|

32,074,852

|

$

|

376,053,567

|

$

|

219,624,200

|

$

|

72,156,149

|

$

|

699,908,768

|

|

____________________

|

|

|

1

|

Calculations on Hedged Debt assume a weighted average spread over LIBOR on all variable rate debt, consistent with the hedges’ designation.

|

|

2

|

This presentation reflects the Company’s exercise of its option to extend the maturity date by one year to April 30, 2017 for the Company’s revolving line of credit.

|

p. 13

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

SCHEDULE OF OUTSTANDING DEBT AS OF DECEMBER 31, 2012

|

Property

|

Lender

|

Loan Type

|

Interest Rate1

|

Maturity Date

|

Total Commitment

|

Balance as of

Dec. 31, 2012

|

Monthly Debt

Service as of

Dec. 31, 2012

|

|

|

12th Street Plaza

|

CMBS

|

Fixed Rate

|

5.67%

|

8/1/13

|

$ 7,765,978

|

$62,428

|

||

|

Parkside Town Commons

|

Bank of America

|

Other Variable

|

LIBOR + 275

|

8/31/13

|

13,604,000

|

—

|

||

|

951&41

|

KeyBank

|

Other Variable

|

LIBOR + 300

|

9/22/13

|

7,800,000

|

—

|

||

|

2013 Debt Maturities

|

29,169,978

|

4.2%

|

||||||

|

Thirty South

|

CMBS

|

Fixed Rate

|

6.09%

|

1/11/14

|

20,476,090

|

142,257

|

||

|

Beacon Hill Shopping Center2

|

Fifth Third Bank

|

Other Variable

|

LIBOR + 125

|

3/30/14

|

7,041,750

|

—

|

||

|

Rangeline Crossing

|

Associated Bank

|

Construction Variable

|

LIBOR + 225

|

10/31/14

|

18,425,000

|

4,014,582

|

—

|

|

|

50th & 12th

|

CMBS

|

Fixed Rate

|

5.67%

|

11/11/14

|

4,125,671

|

27,190

|

||

|

Delray Marketplace3

|

Bank of America/US Bank

|

Construction Variable

|

LIBOR + 200

|

11/18/14

|

62,000,000

|

43,225,945

|

—

|

|

|

2014 Debt Maturities

|

78,884,038

|

11.3%

|

||||||

|

Indian River Square

|

CMBS

|

Fixed Rate

|

5.42%

|

6/11/15

|

12,658,987

|

74,850

|

||

|

Plaza Volente

|

CMBS

|

Fixed Rate

|

5.42%

|

6/11/15

|

27,297,725

|

161,405

|

||

|

Zionsville Walgreens

|

Associated Bank

|

Construction Variable

|

LIBOR + 225

|

6/30/15

|

4,704,000

|

3,340,940

|

—

|

|

|

Four Corner Square

|

US Bank

|

Construction Variable

|

LIBOR + 225

|

7/10/15

|

22,800,000

|

12,625,273

|

—

|

|

|

Holly Springs Towne Center-Phase I

|

Bank of America

|

Construction Variable

|

LIBOR + 250

|

7/31/15

|

37,500,000

|

8,949,409

|

—

|

|

|

2015 Debt Maturities

|

64,872,334

|

9.3%

|

||||||

|

Cool Creek Commons

|

CMBS

|

Fixed Rate

|

5.88%

|

4/11/16

|

17,166,085

|

106,534

|

||

|

Sunland Towne Centre

|

CMBS

|

Fixed Rate

|

6.01%

|

7/1/16

|

24,599,344

|

150,048

|

||

|

Pine Ridge Crossing

|

CMBS

|

Fixed Rate

|

6.34%

|

10/11/16

|

17,285,953

|

108,823

|

||

|

Riverchase Plaza

|

CMBS

|

Fixed Rate

|

6.34%

|

10/11/16

|

10,371,572

|

65,294

|

||

|

Traders Point

|

CMBS

|

Fixed Rate

|

5.86%

|

10/11/16

|

45,091,190

|

283,478

|

||

|

Eastgate Pavilion

|

Associated Bank

|

Other Variable

|

LIBOR + 225

|

12/31/16

|

16,482,000

|

—

|

||

|

2016 Debt Maturities

|

130,996,144

|

18.7%

|

||||||

|

Geist Pavilion

|

CMBS

|

Fixed Rate

|

5.78%

|

1/1/17

|

11,003,937

|

65,135

|

||

|

Ridge Plaza

|

TD Bank

|

Other Variable

|

LIBOR + 325

|

1/3/17

|

14,243,655

|

—

|

||

|

Kedron Village

|

CMBS

|

Fixed Rate

|

5.70%

|

1/11/17

|

29,464,314

|

172,379

|

||

|

Unsecured Credit Facility4,5

|

KeyBank (Admin. Agent)

|

Corporate Unsecured

|

LIBOR + 240

|

4/30/17

|

94,624,200

|

—

|

||

|

2017 Debt Maturities

|

149,336,106

|

21.3%

|

||||||

|

Whitehall Pike

|

CMBS

|

Fixed Rate

|

6.71%

|

7/5/18

|

7,207,871

|

77,436

|

||

|

2018 Debt Maturities

|

7,207,871

|

|||||||

|

Unsecured Term Loan5

|

KeyBank (Admin. Agent)

|

Corporate Unsecured

|

LIBOR + 260

|

4/30/19

|

125,000,000

|

—

|

||

|

2019 Debt Maturities

|

125,000,000

|

|||||||

|

Fishers Station

|

Old National Bank

|

Other Variable

|

LIBOR + 269

|

1/4/20

|

8,000,000

|

—

|

||

|

Bridgewater Marketplace

|

Old National Bank

|

Other Variable

|

LIBOR + 294

|

1/4/20

|

2,000,000

|

—

|

||

|

2020 Debt Maturities

|

10,000,000

|

|||||||

|

International Speedway Square

|

CMBS

|

Fixed Rate

|

5.77%

|

4/1/21

|

20,577,546

|

122,817

|

||

|

Bayport Commons6

|

CMBS

|

Fixed Rate

|

5.44%

|

9/1/21

|

12,914,303

|

74,045

|

||

|

Eddy Street Commons

|

CMBS

|

Fixed Rate

|

5.44%

|

9/1/21

|

25,064,365

|

143,860

|

||

|

Four Property Pool Loan

|

CMBS

|

Fixed Rate

|

5.44%

|

9/1/21

|

42,658,566

|

244,843

|

||

|

Centre at Panola, Phase I

|

CMBS

|

Fixed Rate

|

6.78%

|

1/1/22

|

3,035,797

|

36,583

|

||

|

2021 and Beyond Debt Maturities

|

104,250,577

|

34.2%

|

||||||

|

TOTAL NET PREMIUMS ON ACQUIRED DEBT

|

191,720

|

|||||||

|

TOTAL DEBT PER CONSOLIDATED BALANCE SHEET

|

$ 699,908,768

|

|||||||

|

____________________

|

||||||||

|

1

|

At December 31, 2012, one-month LIBOR interest rate was 0.21%.

|

|||||||

|

2

|

The Company has a preferred return, then a 50% interest. This loan is guaranteed by Kite Realty Group, LP.

|

|||||||

|

3

|

The Company owns Delray Marketplace in a joint venture through which it earns a preferred return (which is expected to delvier over 95% of cash flow to the Company), and 50% thereafter. The loan is guaranteed by Kite Realty Group, LP.

|

|||||||

|

4

|

Assumes Company exercises its option to extend the maturity date by one year.

|

|||||||

|

5

|

The Company has 51 unencumbered properties of which 46 are wholly owned and are guarantors under the unsecured credit facility and unsecured term loan and three of which are owned in joint ventures. The major unencumbered properties include: Broadstone Station, Cobblestone Plaza, The Corner, Courthouse Shadows, Cove Center, Estero Town Commons, Fox Lake Crossing, Glendale Town Center, King's Lake, Lithia Crossing, Market Street Village, Oleander Place, Plaza at Cedar Hill, Shoppes at Plaza Green, Publix at Woodruff, Rivers Edge, Red Bank Commons, Shops at Eagle Creek, Tarpon Bay Plaza, Traders Point II, Union Station Parking Garage, Wal-Mart Plaza and Waterford Lakes.

|

|||||||

|

6

|

The Company has a preferred return, then a 60% interest.

|

|||||||

p. 14

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

SCHEDULE OF OUTSTANDING DEBT AS OF DECEMBER 31, 2012 (CONTINUED)

|

Floating Rate Debt (Hedged)1

|

|||||||||

|

Lender

|

Loan Type

|

LIBOR Hedge Rate

|

Maturity Date

|

Total Commitment

|

Balance as of

Dec. 31, 2012

|

Monthly Debt

Service as of

Dec. 31, 2012

|

|||

|

Associated Bank

|

Variable Rate (Hedged)

|

1.35%

|

12/31/16

|

$

|

15,100,000

|

$

|

16,954

|

||

|

TD Bank

|

Variable Rate (Hedged)

|

3.31%

|

1/3/17

|

14,218,838

|

39,220

|

||||

|

Various Banks

|

Variable Rate (Hedged)

|

1.52%

|

4/30/19

|

125,000,000

|

158,167

|

||||

|

Old National

|

Variable Rate (Hedged)

|

1.33%

|

1/4/20

|

10,000,000

|

11,083

|

||||

|

Subtotal

|

$

|

164,318,838

|

$

|

225,424

|

|||||

|

____________________

|

||

|

1

|

Calculations on Hedged Debt assume a weighted average spread over LIBOR on all variable rate debt, as the hedges are designated with various pieces of debt.

|

|

p. 15

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

TOP 10 RETAIL TENANTS BY GROSS LEASABLE AREA (GLA)

As of December 31, 2012

This table includes the following:

|

·

|

Operating retail properties;

|

|

·

|

Operating commercial properties; and

|

|

·

|

Development property tenants open for business or ground lease tenants who commenced paying rent as of December 31, 2012.

|

|

Tenant

|

Number of

Locations

|

Total GLA

|

Number of

Leases

|

Company

Owned GLA1

|

Number of Anchor

Owned Locations

|

Anchor

Owned GLA2

|

||||||

|

Lowe's Home Improvement3

|

6

|

832,630

|

2

|

128,997

|

4

|

703,633

|

||||||

|

Target

|

6

|

665,732

|

0

|

0

|

6

|

665,732

|

||||||

|

Publix

|

9

|

432,368

|

9

|

432,368

|

0

|

0

|

||||||

|

Wal-Mart

|

3

|

393,161

|

1

|

103,161

|

2

|

290,000

|

||||||

|

Bed Bath & Beyond4

|

9

|

263,816

|

9

|

263,816

|

0

|

0

|

||||||

|

Federated Department Stores

|

1

|

237,455

|

1

|

237,455

|

0

|

0

|

||||||

|

Beall's

|

4

|

186,607

|

3

|

150,163

|

1

|

36,444

|

||||||

|

Dick's Sporting Goods

|

3

|

171,737

|

3

|

171,737

|

0

|

0

|

||||||

|

Home Depot

|

1

|

140,000

|

0

|

0

|

1

|

140,000

|

||||||

|

Stein Mart

|

4

|

138,800

|

4

|

138,800

|

0

|

0

|

||||||

|

46

|

3,462,306

|

32

|

1,626,497

|

14

|

1,835,809

|

|

____________________

|

|

|

1

|

Excludes the estimated size of the structures located on land owned by the Company and ground leased to tenants.

|

|

2

|

Includes the estimated size of the structures located on land owned by the Company and ground leased to tenants.

|

|

3

|

The Company has entered into one ground lease with Lowe’s Home Improvement for a total of 163,000 square feet, which is included in Anchor Owned GLA.

|

|

4

|

Includes Buy Buy Baby and Christmas Tree Shops which are owned by the same parent company.

|

p. 16

Kite Realty Group Trust Supplemental Financial and Operating Statistics –12/31/12

TOP 25 TENANTS BY ANNUALIZED BASE RENT1,2

As of December 31, 2012

This table includes the following:

|

·

|

Operating retail properties;

|

|

·

|

Operating commercial properties; and

|

|

·

|

Development property tenants open for business or ground lease tenants who commenced paying rent as of December 31, 2012.

|

|

Tenant

|

Type of

Property

|

Number of

Locations

|

Leased GLA/NRA2

|

% of Owned

GLA/NRA

of the

Portfolio

|

Annualized

Base Rent1

|

Annualized

Base Rent

per Sq. Ft.3

|

% of Total

Portfolio

Annualized

Base Rent

|

|||||||||

|

Publix

|

Retail

|

9

|

432,368

|

7.0%

|

$

|

3,450,912

|

$

|

7.98

|

4.2%

|

|||||||

|

Bed Bath & Beyond 4

|

Retail

|

9

|

263,816

|

4.3%

|

2,804,872

|

10.63

|

3.4%

|

|||||||||

|

Lowe's Home Improvement

|

Retail

|

2

|

128,997

|

2.1%

|

1,764,000

|

6.04

|

2.1%

|

|||||||||

|

PetSmart

|

Retail

|

5

|

126,992

|

2.1%

|

1,725,033

|

13.58

|

2.1%

|

|||||||||

|

Marsh Supermarkets

|

Retail

|

2

|

124,902

|

2.0%

|

1,633,958

|

13.08

|

2.0%

|

|||||||||

|

Dick's Sporting Goods

|

Retail

|

3

|

171,737

|

2.8%

|

1,404,508

|

8.18

|

1.7%

|

|||||||||

|

Indiana Supreme Court

|

Commercial

|

1

|

75,488

|

1.2%

|

1,346,712

|

17.84

|

1.6%

|

|||||||||

|

Staples

|

Retail

|

4

|

89,797

|

1.5%

|

1,226,835

|

13.66

|

1.5%

|

|||||||||

|

Beall’s

|

Retail

|

3

|

150,163

|

2.4%

|

1,201,967

|

8.00

|

1.5%

|

|||||||||

|

Ross Stores

|

Retail

|

4

|

117,761

|

1.9%

|

1,188,144

|

10.09

|

1.4%

|

|||||||||

|

HEB Grocery Company

|

Retail

|

1

|

105,000

|

1.7%

|

1,155,000

|

11.00

|

1.4%

|

|||||||||

|

Whole Foods

|

Retail

|

2

|

66,144

|

1.1%

|

1,043,976

|

15.78

|

1.3%

|

|||||||||

|

Office Depot

|

Retail

|

4

|

96,060

|

1.6%

|

1,027,338

|

10.69

|

1.3%

|

|||||||||

|

Stein Mart

|

Retail

|

4

|

138,800

|

2.3%

|

936,346

|

6.75

|

1.1%

|

|||||||||

|

Best Buy

|

Retail

|

2

|

75,045

|

1.2%

|

911,993

|

12.15

|

1.1%

|

|||||||||

|

Walgreens

|

Retail

|

2

|

29,050

|

0.5%

|

901,000

|

31.02

|

1.1%

|

|||||||||

|

City Financial Corp

|

Commercial

|

1

|

52,151

|

0.8%

|

855,000

|

16.39

|

1.0%

|

|||||||||

|

Mattress Firm

|

Retail

|

8

|

33,465

|

0.5%

|

853,424

|

25.50

|

1.0%

|

|||||||||

|

Kmart

|

Retail

|

1

|

110,875

|

1.8%

|

850,379