Attached files

| file | filename |

|---|---|

| 8-K - WAFD 8-K_JAN 17 2013 - WASHINGTON FEDERAL INC | wafd8-k.htm |

| EX-99.1 - EXHIBIT 99.1_INCOME STATEMENT - WASHINGTON FEDERAL INC | exhibit991dec2012incomes.htm |

| EX-99.1 - EXHIBIT 99.1_BALANCE SHEET - WASHINGTON FEDERAL INC | exhibit991dec2012balance.htm |

| EX-99.2 - EXHIBIT 99.2_DELINQUENCY SUMMARY - WASHINGTON FEDERAL INC | exhibit992dec2012delinqu.htm |

| EX-99.1 - EXHIBIT 99.1_PRESS RELEASE VERBIAGE - WASHINGTON FEDERAL INC | exhibit991dec2012pressre.htm |

| EX-99.2 - EXHIBIT 99.2_AVERAGE BALANCE SHEET - WASHINGTON FEDERAL INC | exhibit992dec2012average.htm |

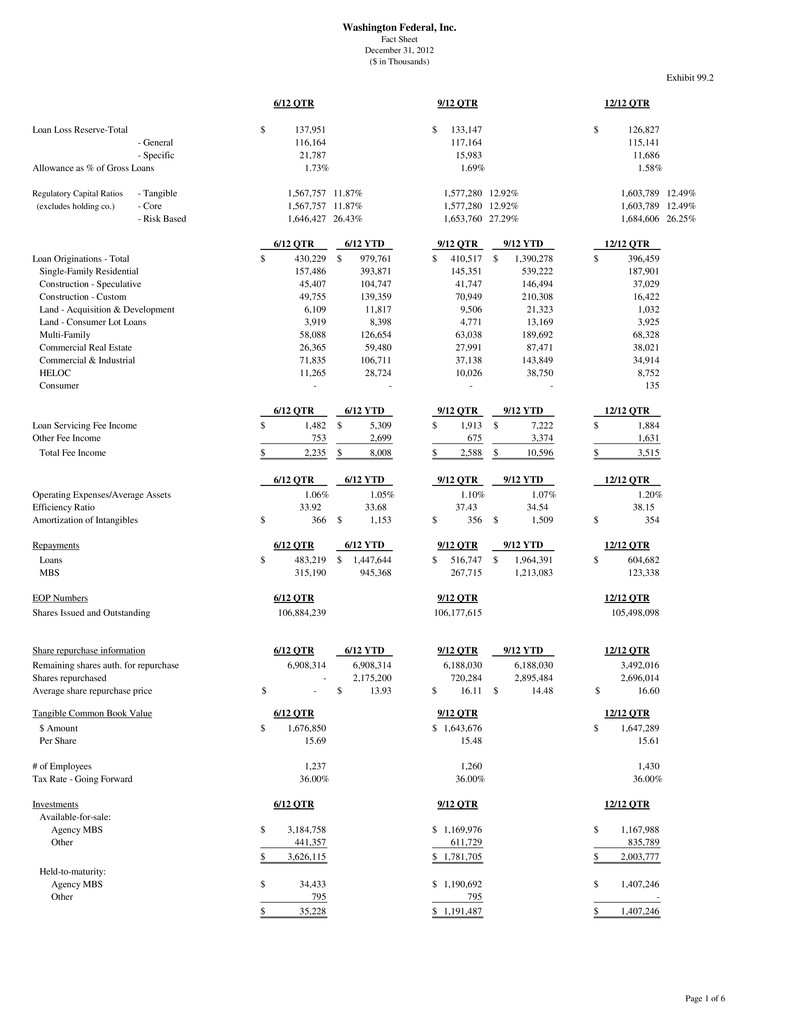

Washington Federal, Inc. Fact Sheet December 31, 2012 ($ in Thousands) Exhibit 99.2 6/12 QTR 9/12 QTR 12/12 QTR Loan Loss Reserve-Total 137,951$ 133,147$ 126,827$ - General 116,164 117,164 115,141 - Specific 21,787 15,983 11,686 Allowance as % of Gross Loans 1.73% 1.69% 1.58% Regulatory Capital Ratios - Tangible 1,567,757 11.87% 1,577,280 12.92% 1,603,789 12.49% (excludes holding co.) - Core 1,567,757 11.87% 1,577,280 12.92% 1,603,789 12.49% - Risk Based 1,646,427 26.43% 1,653,760 27.29% 1,684,606 26.25% 6/12 QTR 9/12 QTR 12/12 QTR Loan Originations - Total 430,229$ 410,517$ 396,459$ Single-Family Residential 157,486 145,351 187,901 Construction - Speculative 45,407 41,747 37,029 Construction - Custom 49,755 70,949 16,422 Land - Acquisition & Development 6,109 9,506 1,032 Land - Consumer Lot Loans 3,919 4,771 3,925 Multi-Family 58,088 63,038 68,328 Commercial Real Estate 26,365 27,991 38,021 Commercial & Industrial 71,835 37,138 34,914 HELOC 11,265 10,026 8,752 Consumer - - 135 6/12 QTR 9/12 QTR 12/12 QTR Loan Servicing Fee Income 1,482$ 1,913$ 1,884$ Other Fee Income 753 675 1,631 Total Fee Income 2,235$ 2,588$ 3,515$ 6/12 QTR 9/12 QTR 12/12 QTR Operating Expenses/Average Assets 1.06% 1.10% 1.20% Efficiency Ratio 33.92 37.43 38.15 Amortization of Intangibles 366$ 356$ 354$ Repayments 6/12 QTR 9/12 QTR 12/12 QTR Loans 483,219$ 516,747$ 604,682$ MBS 315,190 267,715 123,338 EOP Numbers 6/12 QTR 9/12 QTR 12/12 QTR Shares Issued and Outstanding 106,884,239 106,177,615 105,498,098 Share repurchase information 6/12 QTR 9/12 QTR 12/12 QTR Remaining shares auth. for repurchase 6,908,314 6,188,030 3,492,016 Shares repurchased - 720,284 2,696,014 Average share repurchase price -$ 16.11$ 16.60$ Tangible Common Book Value 6/12 QTR 9/12 QTR 12/12 QTR $ Amount 1,676,850$ 1,643,676$ 1,647,289$ Per Share 15.69 15.48 15.61 # of Employees 1,237 1,260 1,430 Tax Rate - Going Forward 36.00% 36.00% 36.00% Investments 6/12 QTR 9/12 QTR 12/12 QTR Available-for-sale: Agency MBS 3,184,758$ 1,169,976$ 1,167,988$ Other 441,357 611,729 835,789 3,626,115$ 1,781,705$ 2,003,777$ Held-to-maturity: Agency MBS 34,433$ 1,190,692$ 1,407,246$ Other 795 795 - 35,228$ 1,191,487$ 1,407,246$ 143,849 38,750 - 9/12 YTD 7,222$ 3,374 10,596$ 9/12 YTD 1.07% 1,213,083 9/12 YTD 6,188,030 2,895,484 14.48$ 9/12 YTD 1,390,278$ 539,222 146,494 210,308 13,169 189,692 87,471 8,008$ 8,398 126,654 59,480 106,711 28,724 - 6/12 YTD 5,309$ 2,699 6/12 YTD 945,368 6/12 YTD 6,908,314 2,175,200 13.93$ 1.05% 33.68 1,153$ 6/12 YTD 1,447,644$ 34.54 1,509$ 9/12 YTD 1,964,391$ 6/12 YTD 979,761$ 393,871 104,747 139,359 11,817 21,323 Page 1 of 6

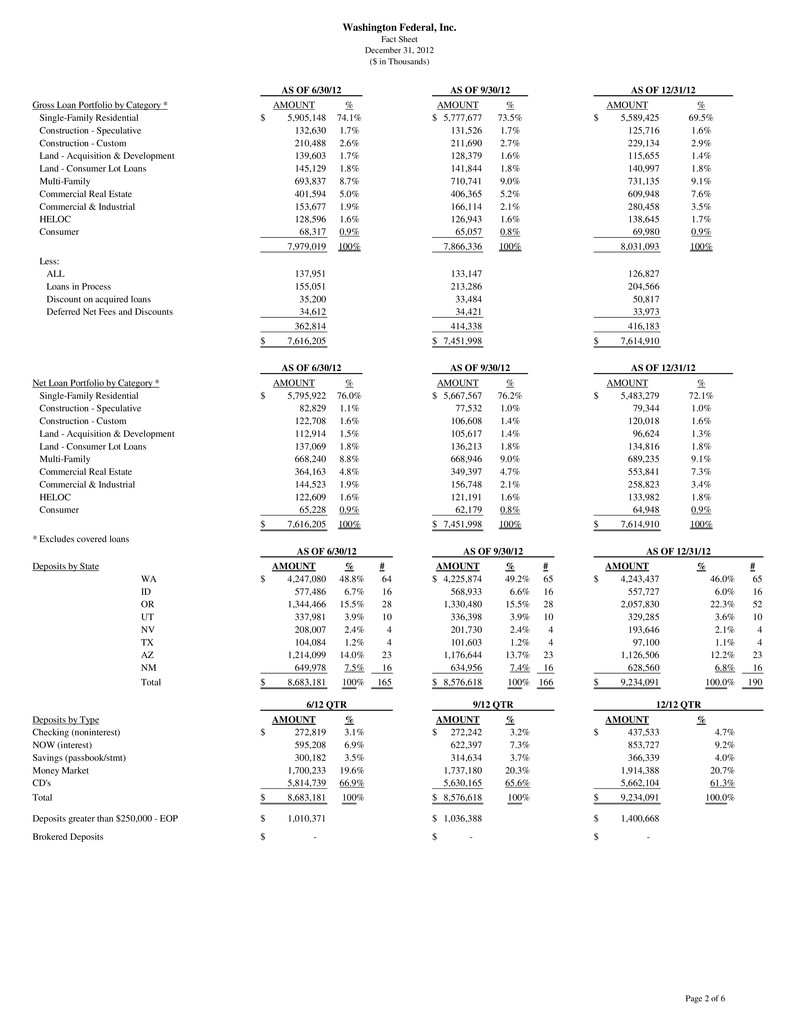

Washington Federal, Inc. Fact Sheet December 31, 2012 ($ in Thousands) Gross Loan Portfolio by Category * AMOUNT % AMOUNT % AMOUNT % Single-Family Residential 5,905,148$ 74.1% 5,777,677$ 73.5% 5,589,425$ 69.5% Construction - Speculative 132,630 1.7% 131,526 1.7% 125,716 1.6% Construction - Custom 210,488 2.6% 211,690 2.7% 229,134 2.9% Land - Acquisition & Development 139,603 1.7% 128,379 1.6% 115,655 1.4% Land - Consumer Lot Loans 145,129 1.8% 141,844 1.8% 140,997 1.8% Multi-Family 693,837 8.7% 710,741 9.0% 731,135 9.1% Commercial Real Estate 401,594 5.0% 406,365 5.2% 609,948 7.6% Commercial & Industrial 153,677 1.9% 166,114 2.1% 280,458 3.5% HELOC 128,596 1.6% 126,943 1.6% 138,645 1.7% Consumer 68,317 0.9% 65,057 0.8% 69,980 0.9% 7,979,019 100% 7,866,336 100% 8,031,093 100% Less: ALL 137,951 133,147 126,827 Loans in Process 155,051 213,286 204,566 Discount on acquired loans 35,200 33,484 50,817 Deferred Net Fees and Discounts 34,612 34,421 33,973 362,814 414,338 416,183 7,616,205$ 7,451,998$ 7,614,910$ Net Loan Portfolio by Category * AMOUNT % AMOUNT % AMOUNT % Single-Family Residential 5,795,922$ 76.0% 5,667,567$ 76.2% 5,483,279$ 72.1% Construction - Speculative 82,829 1.1% 77,532 1.0% 79,344 1.0% Construction - Custom 122,708 1.6% 106,608 1.4% 120,018 1.6% Land - Acquisition & Development 112,914 1.5% 105,617 1.4% 96,624 1.3% Land - Consumer Lot Loans 137,069 1.8% 136,213 1.8% 134,816 1.8% Multi-Family 668,240 8.8% 668,946 9.0% 689,235 9.1% Commercial Real Estate 364,163 4.8% 349,397 4.7% 553,841 7.3% Commercial & Industrial 144,523 1.9% 156,748 2.1% 258,823 3.4% HELOC 122,609 1.6% 121,191 1.6% 133,982 1.8% Consumer 65,228 0.9% 62,179 0.8% 64,948 0.9% 7,616,205$ 100% 7,451,998$ 100% 7,614,910$ 100% * Excludes covered loans Deposits by State AMOUNT % # AMOUNT % # AMOUNT % # WA 4,247,080$ 48.8% 64 4,225,874$ 49.2% 65 4,243,437$ 46.0% 65 ID 577,486 6.7% 16 568,933 6.6% 16 557,727 6.0% 16 OR 1,344,466 15.5% 28 1,330,480 15.5% 28 2,057,830 22.3% 52 UT 337,981 3.9% 10 336,398 3.9% 10 329,285 3.6% 10 NV 208,007 2.4% 4 201,730 2.4% 4 193,646 2.1% 4 TX 104,084 1.2% 4 101,603 1.2% 4 97,100 1.1% 4 AZ 1,214,099 14.0% 23 1,176,644 13.7% 23 1,126,506 12.2% 23 NM 649,978 7.5% 16 634,956 7.4% 16 628,560 6.8% 16 Total 8,683,181$ 100% 165 8,576,618$ 100% 166 9,234,091$ 100.0% 190 Deposits by Type AMOUNT % AMOUNT % AMOUNT % Checking (noninterest) 272,819$ 3.1% 272,242$ 3.2% 437,533$ 4.7% NOW (interest) 595,208 6.9% 622,397 7.3% 853,727 9.2% Savings (passbook/stmt) 300,182 3.5% 314,634 3.7% 366,339 4.0% Money Market 1,700,233 19.6% 1,737,180 20.3% 1,914,388 20.7% CD's 5,814,739 66.9% 5,630,165 65.6% 5,662,104 61.3% Total 8,683,181$ 100% 8,576,618$ 100% 9,234,091$ 100.0% Deposits greater than $250,000 - EOP 1,010,371$ 1,036,388$ 1,400,668$ Brokered Deposits -$ -$ -$ AS OF 9/30/12 AS OF 9/30/12 9/12 QTR AS OF 9/30/12 AS OF 6/30/12 6/12 QTR AS OF 12/31/12 AS OF 12/31/12 12/12 QTR AS OF 12/31/12 AS OF 6/30/12 AS OF 6/30/12 Page 2 of 6

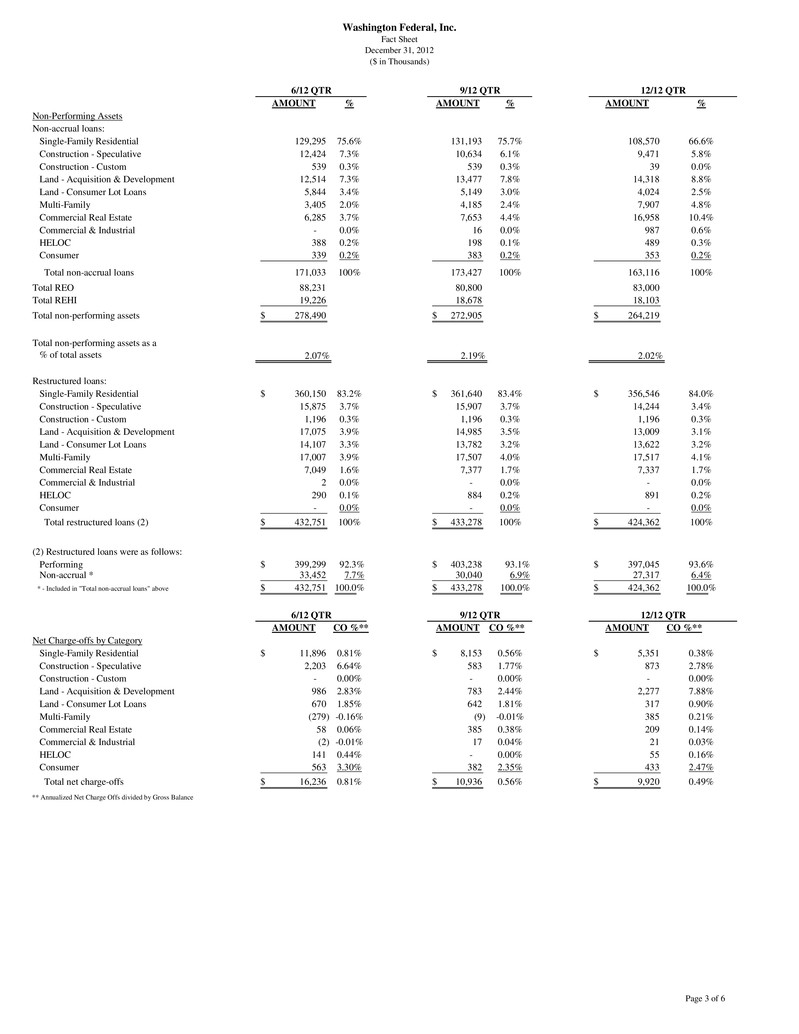

Washington Federal, Inc. Fact Sheet December 31, 2012 ($ in Thousands) 6/12 QTR 9/12 QTR 12/12 QTR AMOUNT % AMOUNT % AMOUNT % Non-Performing Assets Non-accrual loans: Single-Family Residential 129,295 75.6% 131,193 75.7% 108,570 66.6% Construction - Speculative 12,424 7.3% 10,634 6.1% 9,471 5.8% Construction - Custom 539 0.3% 539 0.3% 39 0.0% Land - Acquisition & Development 12,514 7.3% 13,477 7.8% 14,318 8.8% Land - Consumer Lot Loans 5,844 3.4% 5,149 3.0% 4,024 2.5% Multi-Family 3,405 2.0% 4,185 2.4% 7,907 4.8% Commercial Real Estate 6,285 3.7% 7,653 4.4% 16,958 10.4% Commercial & Industrial - 0.0% 16 0.0% 987 0.6% HELOC 388 0.2% 198 0.1% 489 0.3% Consumer 339 0.2% 383 0.2% 353 0.2% Total non-accrual loans 171,033 100% 173,427 100% 163,116 100% Total REO 88,231 80,800 83,000 Total REHI 19,226 18,678 18,103 Total non-performing assets 278,490$ 272,905$ 264,219$ Total non-performing assets as a % of total assets 2.07% 2.19% 2.02% Restructured loans: Single-Family Residential 360,150$ 83.2% 361,640$ 83.4% 356,546$ 84.0% Construction - Speculative 15,875 3.7% 15,907 3.7% 14,244 3.4% Construction - Custom 1,196 0.3% 1,196 0.3% 1,196 0.3% Land - Acquisition & Development 17,075 3.9% 14,985 3.5% 13,009 3.1% Land - Consumer Lot Loans 14,107 3.3% 13,782 3.2% 13,622 3.2% Multi-Family 17,007 3.9% 17,507 4.0% 17,517 4.1% Commercial Real Estate 7,049 1.6% 7,377 1.7% 7,337 1.7% Commercial & Industrial 2 0.0% - 0.0% - 0.0% HELOC 290 0.1% 884 0.2% 891 0.2% Consumer - 0.0% - 0.0% - 0.0% Total restructured loans (2) 432,751$ 100% 433,278$ 100% 424,362$ 100% (2) Restructured loans were as follows: Performing 399,299$ 92.3% 403,238$ 93.1% 397,045$ 93.6% Non-accrual * 33,452 7.7% 30,040 6.9% 27,317 6.4% * - Included in "Total non-accrual loans" above 432,751$ 100.0% 433,278$ 100.0% 424,362$ 100.0% 6/12 QTR 9/12 QTR 12/12 QTR AMOUNT CO %** AMOUNT CO %** AMOUNT CO %** Net Charge-offs by Category Single-Family Residential 11,896$ 0.81% 8,153$ 0.56% 5,351$ 0.38% Construction - Speculative 2,203 6.64% 583 1.77% 873 2.78% Construction - Custom - 0.00% - 0.00% - 0.00% Land - Acquisition & Development 986 2.83% 783 2.44% 2,277 7.88% Land - Consumer Lot Loans 670 1.85% 642 1.81% 317 0.90% Multi-Family (279) -0.16% (9) -0.01% 385 0.21% Commercial Real Estate 58 0.06% 385 0.38% 209 0.14% Commercial & Industrial (2) -0.01% 17 0.04% 21 0.03% HELOC 141 0.44% - 0.00% 55 0.16% Consumer 563 3.30% 382 2.35% 433 2.47% Total net charge-offs 16,236$ 0.81% 10,936$ 0.56% 9,920$ 0.49% ** Annualized Net Charge Offs divided by Gross Balance Page 3 of 6

Washington Federal, Inc. Fact Sheet December 31, 2012 ($ in Thousands) 6/12 QTR 9/12 QTR 12/12 QTR SOP 03-3 Accretable Yield 40,282$ 67,727$ 58,792$ Non-Accretable Yield 247,336 212,646 212,646 Total Contractual Payments 287,618$ 280,373$ 271,438$ Interest Rate Risk One Year GAP -8.8% -10.1% -12.3% NPV post 200 bps shock* 12.78% 15.00% 16.14% Change in NII after 200 bps shock* -1.4% -2.1% -1.7% * Assumes no balance sheet management 6/12 QTR 9/12 QTR 12/12 QTR CD's repricing Amount Rate Amount Rate Amount Rate within 3 months 1,009,301$ 0.94% 1,519,848$ 1.03% 972,519$ 1.21% from 4 to 6 months 1,496,971 1.05% 879,355 1.24% 907,260 0.62% from 7 to 9 months 626,115 1.63% 529,578 0.85% 984,981 0.93% from 10 to 12 monts 536,825 0.85% 613,190 0.90% 657,334 0.91% WAFD WAFD SFR Mortgages GSE MBS 6/30/2011 13.3% 12.1% 9/30/2011 17.1% 17.5% 12/31/2011 22.0% 32.6% 3/31/2012 19.5% 27.5% 6/30/2012 20.9% 30.7% 9/30/2012 22.9% 30.7% 12/31/2012 25.0% 18.2% *** The CPR Rate (conditional payment rate) is the rate that is equal to the proportion of the principal of a pool of loans that is paid off prematurely in each period. Also, the comparison is not precise in that Washington Federal is a portfolio lender and not required to follow GSE servicing rules/regulations. Read more: http://www.investopedia.com/terms/c/cpr.asp#ixzz1izGvRMBg Average for Quarter Ended Historical CPR Rates*** Page 4 of 6