Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d467465d8k.htm |

| EX-99.1 - EX-99.1 - ASSOCIATED BANC-CORP | d467465dex991.htm |

Associated Banc-Corp

4Q 2012 Earnings Presentation

January 17, 2013

EXHIBIT 99.2 |

Forward-Looking Statements

1

Statements made in this presentation which are not purely historical are

forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations,

products

or

services,

and

forecasts

of

its

revenues,

earnings,

or

other

measures of performance.

Such forward-looking statements may be identified by the

use of words such as “believe”, “expect”,

“anticipate”, “plan”, “estimate”, “should”, “will”,

“intend”, “outlook”, or similar expressions.

Forward-looking statements are based on

current management expectations and, by their nature, are subject to risks and

uncertainties. Actual results may differ materially from those contained in

the forward- looking statements.

Factors which may cause actual results to differ materially from

those contained in such forward-looking statements include those identified in

the company’s

most

recent

Form

10-K

and

subsequent

SEC

filings.

Such

factors

are

incorporated herein by reference.

Important

note

regarding

forward-looking

statements: |

Fourth Quarter 2012 Highlights

•

Net income available to common shareholders of $45 million or $0.26 per

share •

Return on Tier 1 common equity of 9.6%, compared to 9.0% a year ago

2

Solid Results Driven by Fundamental Strength in Core Businesses

Net Income

&

ROT1CE

Loan Growth

Net Interest Income

&

Net Interest Margin

•

Total loans of $15.4 billion were up $445 million, or 3% from the third

quarter –

Total commercial loan balances grew by $426 million, or 5% from the prior

quarter •

Net interest income increased by $6 million from the third quarter to $161

million –

Net interest margin of 3.32%

Capital

•

Increased quarterly dividend to $0.08/share

•

Repurchased $30 million of stock during the fourth quarter

•

Capital ratios remain very strong with a Tier 1 common equity ratio of

11.58% Deposit Growth

•

Average deposits increased by $1.0 billion, or 7% QoQ

–

Period-end noninterest-bearing deposits grew by $439 million, or 10%

QoQ |

•

Defended the margin despite interest rate headwinds

–

Full year NIM of 3.30%

–

Deposit rates & interest-bearing liability costs managed lower throughout

the year 2012 Full Year Recap

3

•

Credit quality continued to improve at a steady pace

–

Nonaccruals down 29% YoY

•

Total loans up $1.4 billion, or 10% YoY to $15.4 billion

Execution of Growth Initiatives & Delivering Shareholder Value

•

Redeemed all outstanding Trust Preferred Securities

•

Increased the dividend twice during 2012 ($0.01 to $0.05 to $0.08)

•

Repurchased

$60

million

of

stock

during

2012;

$30

million

(2Q12)

&

$30

million

(4Q12)

•

FY 2012 earnings of $174 million or $1.00/share

–

Compared to $115 million in FY 2011 or $0.66/share

•

FY 2012 ROT1CE of 9.5% compared to 6.7% for FY 2011

Net Income

&

ROT1CE

Loan Growth

Credit

Capital

Net Interest Margin |

4

2011 –

A Year of

Transition

•

Repaid TARP

•

OCC MOU terminated

•

Began executing on

our strategic initiatives

for growth

•

FY 2012 earnings up

51%

•

Loan balances up 10%

YoY

•

Defended the margin

•

Credit quality continued

to improve

•

Increased dividend

twice; $.01 -

$.05 -

$.08

•

$60 million of shares

repurchased

•

7% increase in

TBV/share

2012 –

Execution of

Growth Initiatives

2013 –

Growing the

Franchise &

Creating Long-Term

Shareholder Value

•

Continued focus on

organic growth

opportunities

•

Defending NIM

compression in low-

rate environment

•

Strong focus on

efficiency & expense

management

•

Disciplined focus on

deploying capital to

drive long-term

shareholder value

Executing on Strategic Plan

–

Loans +11% YoY

–

Improving retail

footprint

–

Investing in

Commercial Deposit

& Treasury

Management

Solutions |

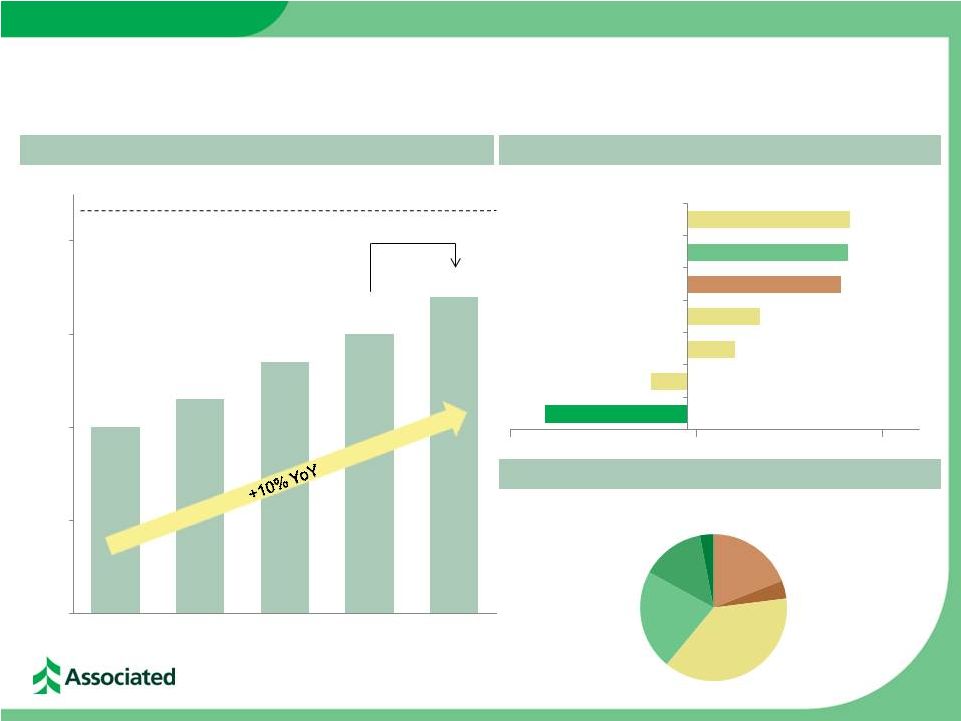

Loan

Portfolio Growth and Composition 5

Total Loans of $15.4 billion at December 31, 2012

4Q 2012 Net Loan Growth of $445 million

Total Loans ($ in billions)

+3% QoQ

Peak Loans (4Q 2008) $16.3 billion

Loan

Mix

–

4Q

2012

($ balances in millions)

Home Equity & Installment

Commercial Real Estate

Residential Mortgage

Power & Utilities

Oil & Gas

Mortgage Warehouse

General Commercial Loans

$14.0

$14.3

$14.7

$15.0

$15.4

$12.0

$13.0

$14.0

$15.0

$16.0

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

CRE Investor

19%

Construction

4%

Commercial

& Business

Lending

38%

Res Mtg

22%

Home Equity

14%

Installment

3%

($153)

($39)

$50

$77

$164

$172

$174 |

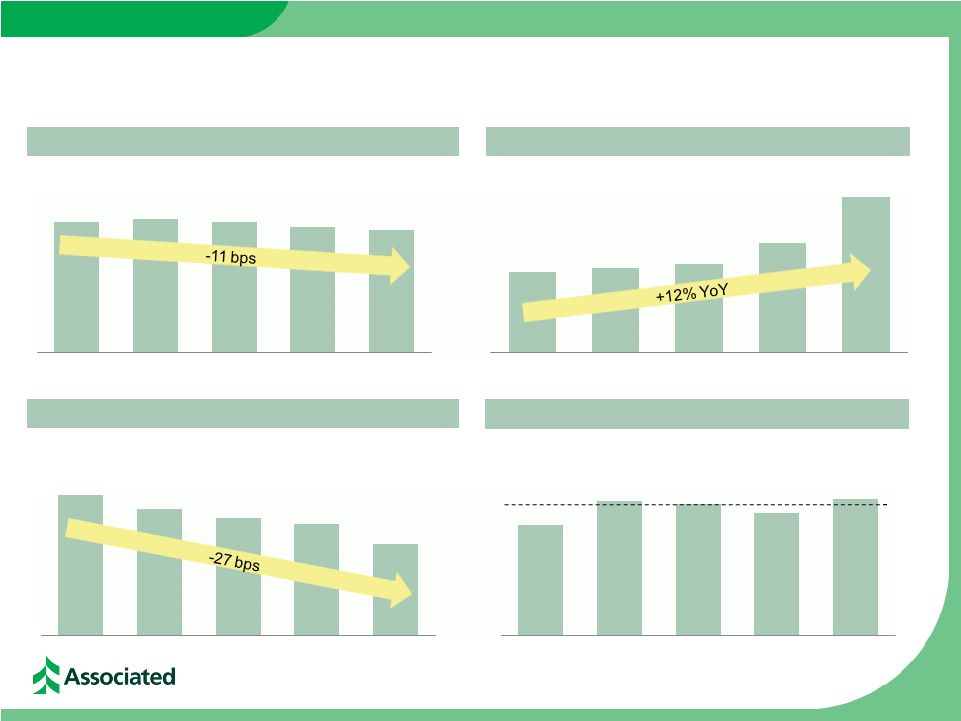

Managing the Cost of Funds & Margin

6

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Average Deposits

FY2012:

3.30%

Net Interest Margin

($ balances in billions)

3.81%

3.85%

3.80%

3.73%

3.70%

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

$14.9

$15.0

$15.1

$15.6

$16.7

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

0.78%

0.70%

0.65%

0.62%

0.51%

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

3.21%

3.31%

3.30%

3.26%

3.32%

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012 |

Continued Improvement in Credit Quality Indicators

7

($ in millions)

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

Potential problem loans

$ 566

$ 480

$ 410

$ 404

$ 361

Nonaccruals

$ 357

$ 327

$ 318

$ 278

$ 253

Provision for loan losses

$ 1

$ 0

$ 0

$ 0

$ 3

Net charge offs

$ 23

$ 22

$ 24

$ 18

$ 21

ALLL/Total loans

2.70%

2.50%

2.26%

2.11%

1.93%

ALLL/Nonaccruals

105.99%

108.93%

104.65%

113.29%

117.61%

NPA/Assets

1.82%

1.65%

1.62%

1.38%

1.22%

Nonaccruals/Loans

2.54%

2.29%

2.16%

1.86%

1.64%

NCOs / Avg Loans

0.64%

0.61%

0.65%

0.47%

0.55% |

Strong Capital Profile & Improving Earnings

8

Tier 1 Common Equity Ratio

Net

Income

Available

to

Common

&

ROT1CE

Net Income

($ in millions)

Return on Tier 1

Common Equity

•

Current capital levels are well in excess of

“well-capitalized”

regulatory benchmarks

–

Existing capital levels are already above

proposed Basel III capital levels

12.24%

12.49%

12.04%

12.01%

11.58%

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

$40

$41

$42

$45

$45

9.0%

9.2%

9.3%

9.7%

9.6%

0.00%

2.50%

5.00%

7.50%

10.00%

12.50%

$0

$10

$20

$30

$40

$50

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012 |

9

2013 Full Year Outlook

Growing the Franchise & Creating Long-Term Shareholder Value

Loan Growth

Deposit Growth

Fee Income

NIM

•

High single digit FY loan growth,

with seasonally low 1Q 2013

•

Continued disciplined deposit

pricing

•

Sustained focus on treasury

management solutions to drive

growth in commercial deposits

•

Modest compression over the

course of the year

•

$500 million of relatively high

cost FHLB advances maturing

during 1H 2013

•

Modest improvement in core fee-

based revenues with lower net

mortgage banking revenues

Expenses

Footprint

Credit

Capital

•

Flat year-over-year

•

Reduced regulatory costs offset by

continued franchise investments

•

Continuing to invest in our

branches while optimizing our

network

•

Consolidating in downtown

Green Bay and Chicago loop

•

Continuing improvement in credit

trends

•

Provision expense to increase

based on new loan growth in 2013

•

Disciplined focus on

deploying capital to drive

long-term shareholder value |