Attached files

| file | filename |

|---|---|

| 8-K - URANIUM RESOURCES, INC. 8-K - WESTWATER RESOURCES, INC. | a50519111.htm |

| EX-99.1 - EXHIBIT 99.1 - WESTWATER RESOURCES, INC. | a50519111-ex991.htm |

Exhibit 99.2

Uranium Resources, Inc. NASDAQ: URRE © 2012 by Uranium Resources, Inc. Churchrock Section 8 Feasibility Study December 2012

Inc. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “estimates,” “projects,” “anticipates,” “believes,” “could,” and other similar words. All statements addressing operating performance, events, or developments that the Company expects or anticipates will occur in the future, including but not limited to statements relating to the Company’s mineralized uranium materials, the Company’s ability to access the Churchrock Section 8 property, timing of receipt of mining permits, production capacity of the Churchrock Section 8 mining property, planned dates for commencement of production, revenue, operating costs, capital costs, cash generation and profits are forward-looking statements. Because they are forwardlooking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties include, but are not limited to, the spot price and long-term contract price of uranium, the outcome of ongoing settlement negotiations with the Navajo Nation, weather conditions, operating conditions at the Company’s mining projects, government and tribal regulation of the mining industry and the nuclear power industry, world-wide uranium supply and demand, availability of capital, timely receipt of mining and other permits from regulatory agents and other factors which are more fully described in the Company’s documents filed with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of the Company’s underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on the Company’s forward-looking statements. Except as required by law, the Company disclaims any obligation to update or publicly announce any revisions to any of the forwardlooking statements contained in this presentation. © 2012 by Uranium Resources, Inc. 2 Safe Harbor Statement

3 The purpose of the feasibility study was to determine the technical and economic viability of developing the deposit as a uranium in situ recovery (ISR) project. The study was compiled by: Behre Dolbear & Company, an internationally-recognized mineral advisory and engineering firm TREC, Inc., a US-based process engineering and design consultancy Western States Mining Consultants, Inc. Uranium Resources technical staff Feasibility Study Highlights: 6.5 million pounds of mineralized uranium material at a grade of 0.11% U3O8 Deposit is amenable to ISR Estimated recovery rate of 67% results in production of 4.4 million pounds Direct operating costs estimated to be $20 to $23 per pound of U3O8 produced © 2012 by Uranium Resources, Inc. Summary

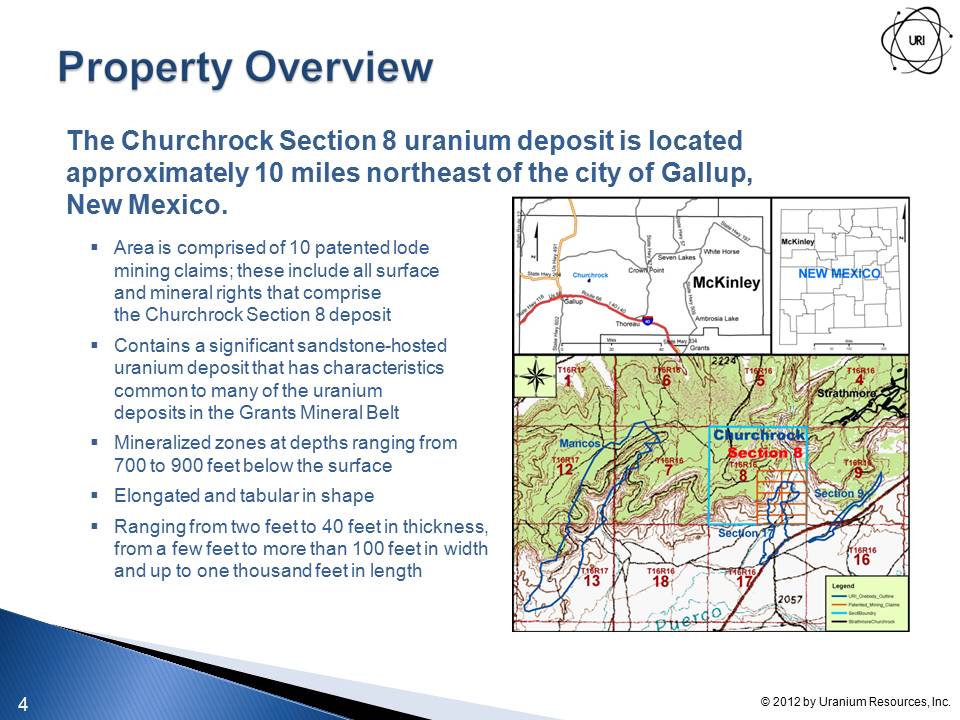

The Churchrock Section 8 uranium deposit is located approximately 10 miles northeast of the city of Gallup, New Mexico. Area is comprised of 10 patented lode mining claims; these include all surface and mineral rights that comprise the Churchrock Section 8 deposit Contains a significant sandstone-hosted uranium deposit that has characteristics common to many of the uranium deposits in the Grants Mineral Belt Mineralized zones at depths ranging from 700 to 900 feet below the surface Elongated and tabular in shape Ranging from two feet to 40 feet in thickness, from a few feet to more than 100 feet in width and up to one thousand feet in length Property Overview 4 © 2012 by Uranium Resources, Inc.

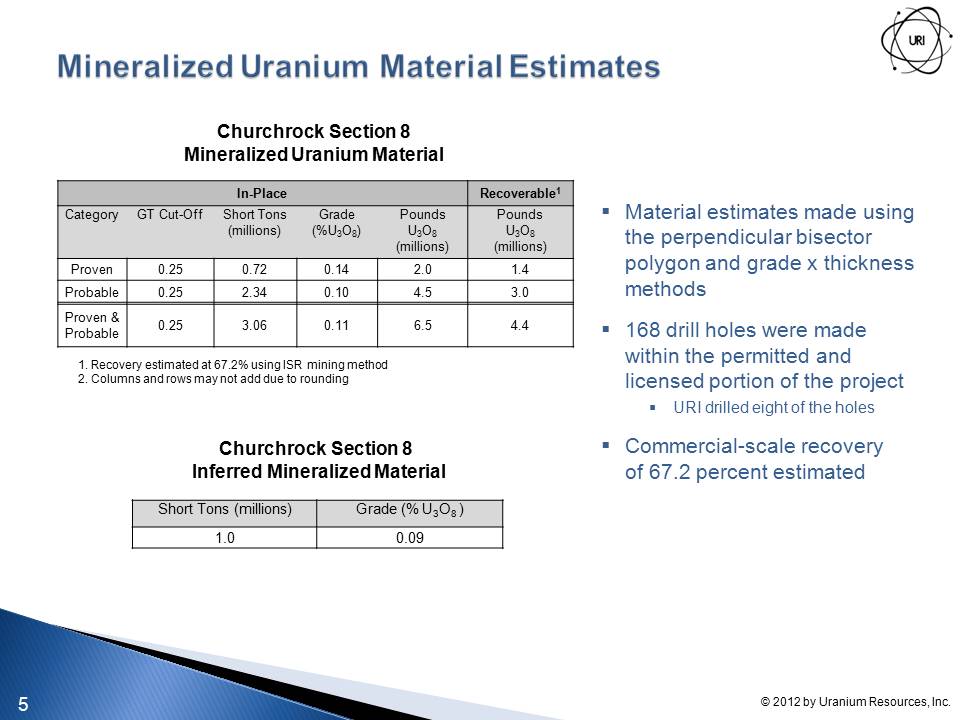

5 Churchrock Section 8 Mineralized Uranium Material In-Place Recoverable1 Category GT Cut-Off Short Tons (millions) Grade (%U3O8) Pounds U3O8 (millions) Pounds U3O8 (millions) Proven 0.25 0.72 0.14 2.0 1.4 Probable 0.25 2.34 0.10 4.5 3.0 Proven & Probable 0.25 3.06 0.11 6.5 4.4 1. Recovery estimated at 67.2% using ISR mining method 2. Columns and rows may not add due to rounding Short Tons (millions) Grade (% U3O8 ) 1.0 0.09 Churchrock Section 8 Mineralized Uranium Material Churchrock Section 8 Inferred Mineralized Material Material estimates made using the perpendicular bisector polygon and grade x thickness methods 168 drill holes were made within the permitted and licensed portion of the project URI drilled eight of the holes Commercial-scale recovery of 67.2 percent estimated © 2012 by Uranium Resources, Inc. Mineralized Uranium Material Estimates

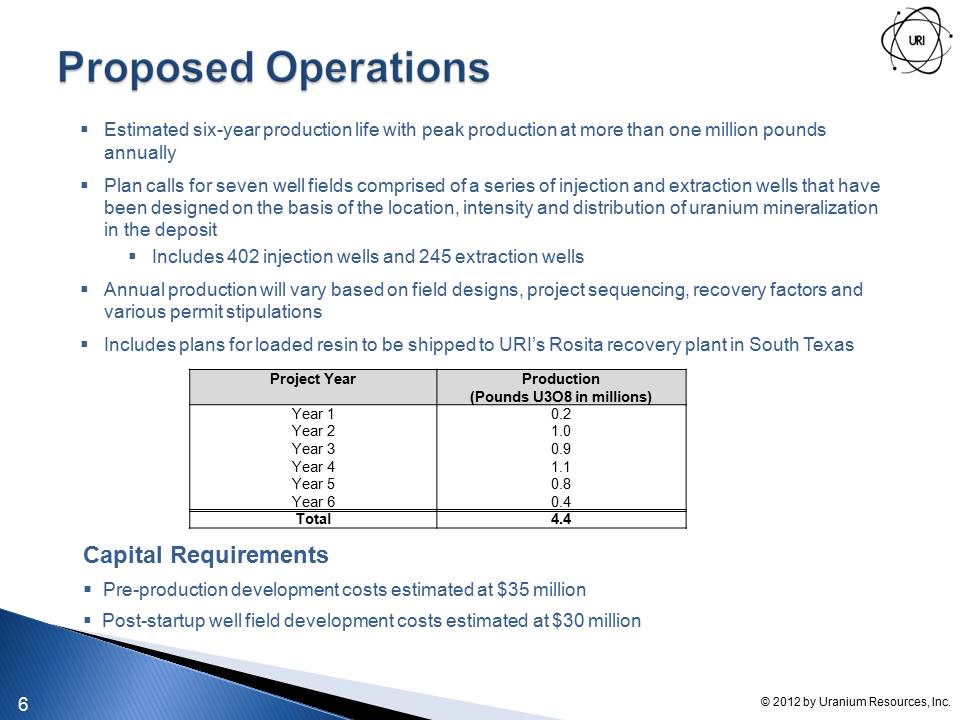

6 Estimated six-year production life with peak production at more than one million pounds annually Plan calls for seven well fields comprised of a series of injection and extraction wells that have been designed on the basis of the location, intensity and distribution of uranium mineralization in the deposit Includes 402 injection wells and 245 extraction wells Annual production will vary based on field designs, project sequencing, recovery factors and various permit stipulations Includes plans for loaded resin to be shipped to URI’s Rosita recovery plant in South Texas Project Year Production (Pounds U3O8 in millions) Year 1 0.2 Year 2 1.0 Year 3 0.9 Year 4 1.1 Year 5 0.8 Year 6 0.4 Total 4.4 Capital Requirements Pre-production development costs estimated at $35 million Post-startup well field development costs estimated at $30 million Proposed Operations © 2012 by Uranium Resources, Inc.

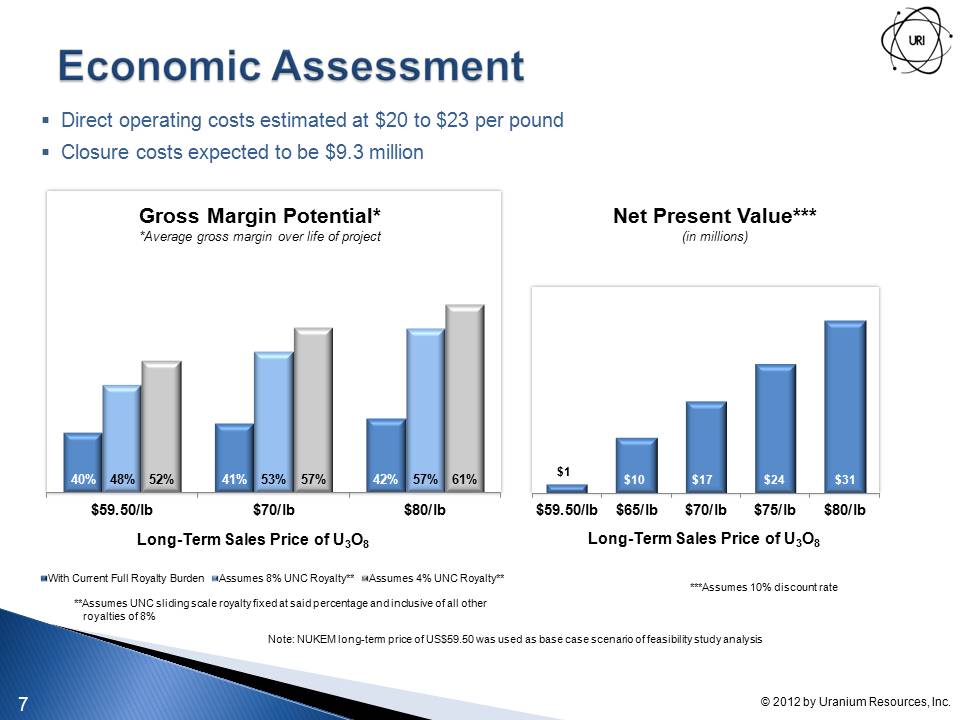

7 Direct operating costs estimated at $20 to $23 per pound Closure costs expected to be $9.3 million Gross Margin Potential* *Average gross margin over life of project Net Present Value*** (in millions) 40% 41% 42% 48% 53% 57% 52% 57% 61% $59.50/lb $70/lb $80/lb Long-Term Sales Price of U3O8 With Current Full Royalty Burden Assumes 8% UNC Royalty** Assumes 4% UNC Royalty** $1 $10 $17 $24 $31 $59.50/lb $65/lb $70/lb $75/lb $80/lb Long-Term Sales Price of U3O8 With Current Full Royalty Burden Assumes 8% UNC Royalty** Assumes 4% UNC Royalty** ***Assumes 10% discount rate **Assumes UNC sliding scale royalty fixed at said percentage and inclusive of all other royalties of 8% Note: NUKEM long-term price of US$59.50 was used as base case scenario of feasibility study analysis © 2012 by Uranium Resources, Inc. Economic Assessment

8 Permitting & Licensing Churchrock Section 8 NRC Radioactive Materials License* US EPA Aquifer Exception for ISR mining NMED Discharge Permit* Rosita Recovery Plant in Texas Currently licensed by the Texas Commission on Environmental Quality Access As previously disclosed, the Company has a temporary access agreement to the project site with the Navajo Nation and is positioning itself to maximize the potential for successfully negotiating a long-term access agreement. *In timely renewal *In timely renewal © 2012 by Uranium Resources, Inc.

9 Summary Highlights 6.5 million pounds of mineralized uranium material at a grade of 0.11% U3O8 Deposit is amenable to ISR Assumed recovery rate of 67% results in production of 4.4 million pounds Projected six-year production life with peak production at more than one million pounds annually Pre-production development costs estimated at $35 million Direct operating costs estimated to be $20 to $23 per pound of U3O8 produced © 2012 by Uranium Resources, Inc.