Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a50483392.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a50483392ex99_1.htm |

Exhibit 99.2

|

THOMSON REUTERS STREETEVENTS

|

|

EDITED TRANSCRIPT

|

|

MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

|

EVENT DATE/TIME: NOVEMBER 15, 2012 / 02:00PM GMT

|

|

OVERVIEW:

|

|

Co. reported FY12 revenues of $1.05b and GAAP income from continuing operations (net of taxes) of $76.1m or $2.19 per diluted share. 4Q12 total Co. revenues from continuing operations were $300.7m and GAAP income from continuing operations (net of taxes) was $23.8m or $0.68 per diluted share. Expects FY13 revenues to be $1.225-1.275b and adjusted diluted EPS from continuing operations to be $2.85-3.05. Also expects 1Q13 revenues to be $280-290m and adjusted diluted EPS to be $0.53-0.57.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

1

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles MAXIMUS Inc - VP of IR

David Walker MAXIMUS Inc - CFO

Rich Montoni MAXIMUS Inc - CEO, President and Director

Bruce Caswell MAXIMUS Inc - President, Health Services

CONFERENCE CALL PARTICIPANTS

Brian Kinstlinger Sidoti & Company - Analyst

Charles Strauzer CJS Securities - Analyst

Scott Green BofA Merrill Lynch - Analyst

PRESENTATION

Greetings and welcome to the MAXIMUS fiscal 2012 fourth quarter and year-end conference call. At this time all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation.

(Operator Instructions)

As a reminder this conference is being recorded. It is now my pleasure to introduce your host Lisa Miles, Vice President for Investor Relations for MAXIMUS. Thank you, Ms Miles. You may begin.

Lisa Miles - MAXIMUS Inc - VP of IR

Good morning. Thank you for joining us on today's conference call. I would like to point out we have posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A. Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions, and actual events or results may differ materially as a result of risks we face including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks and our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

And, with that, I'll turn the call over to Dave.

David Walker - MAXIMUS Inc - CFO

Thanks, Lisa. We are pleased to report another solid year of financial results which reflects the Company's healthy portfolio of projects. Fiscal 2012 was highlighted by strong growth in core markets, the acquisition and integration of PSI and the successful ramp up on the work program contract in the UK which achieved break even in the fourth quarter. As we kick off fiscal '13, we remain committed to winning our fair share of Health Care Reform contracts, securing new profitable work and strategically deploying cash to derive long term shareholder value. So let's move into the financial details for the quarter and the full year.

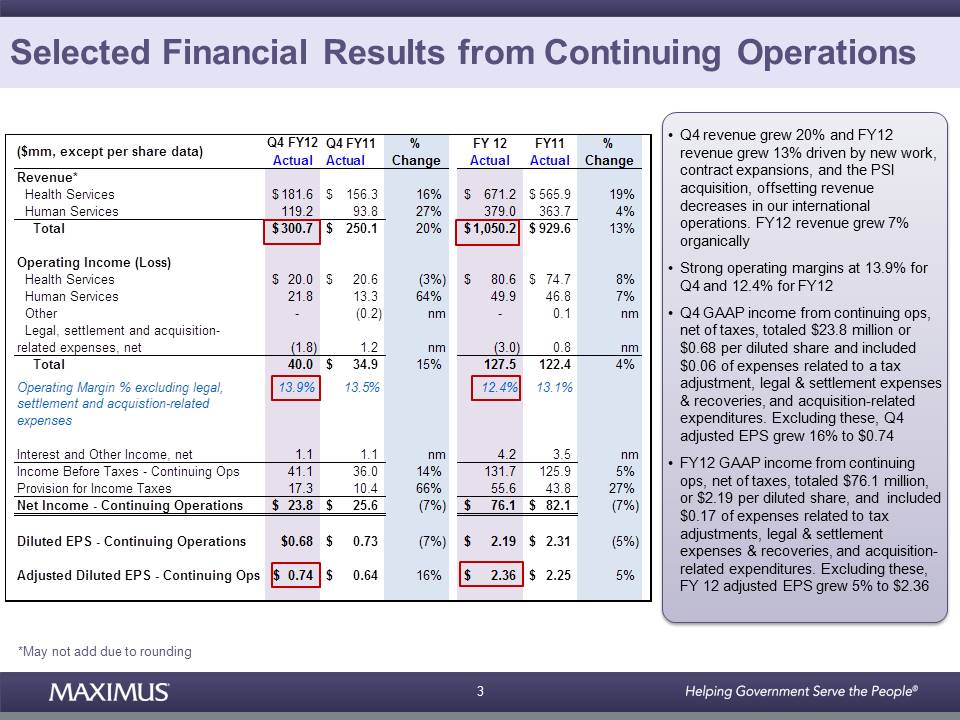

For the fourth quarter, total Company revenue from continuing operations grew 20% to $300.7 million. For the full fiscal year, revenue increased 13% to $1.05 billion. Growth for the full year was driven principally by new work, the expansion of existing contracts, and the acquisition of PSI, which offset the expected revenue decreases in our international human services operations. Full-year revenue grew 7% organically compared to last year. Total Company operating margins were strong and in line with expectations at 13.9% for the fourth quarter and 12.4% for the full fiscal year.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

2

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

The tax rate in the fourth quarter was 42.1% and includes a year-end tax true up of approximately $1.2 million. As a result, fourth quarter GAAP income from continuing operations, net of taxes, totalled $23.8 million, or $0.68 per diluted share. This included costs of $0.06 per share related to the tax adjustment, legal and settlement expenses and recoveries and acquisition related expenditures. Excluding these costs, fourth quarter adjusted diluted earnings per share from continuing operations totalled $0.74, a 16% increase compared to $0.64 reported for the same period last year. For the full year, GAAP income from continuing operations, net of taxes, totalled $76.1 million, or $2.19 per diluted share. This also included expenses of approximately $0.17 per diluted share related to the tax adjustment, legal and settlement expenses and recoveries, and acquisition-related expenditures. Excluding these costs adjusted diluted earnings per share from continuing operations for the full year totalled $2.36, an increase of 5% compared to $2.25 in fiscal 2011. Since adjusted EPS is a non-GAAP view of our earnings, as always we have included a normalization table providing details of our adjustments in the financial schedules of the press release.

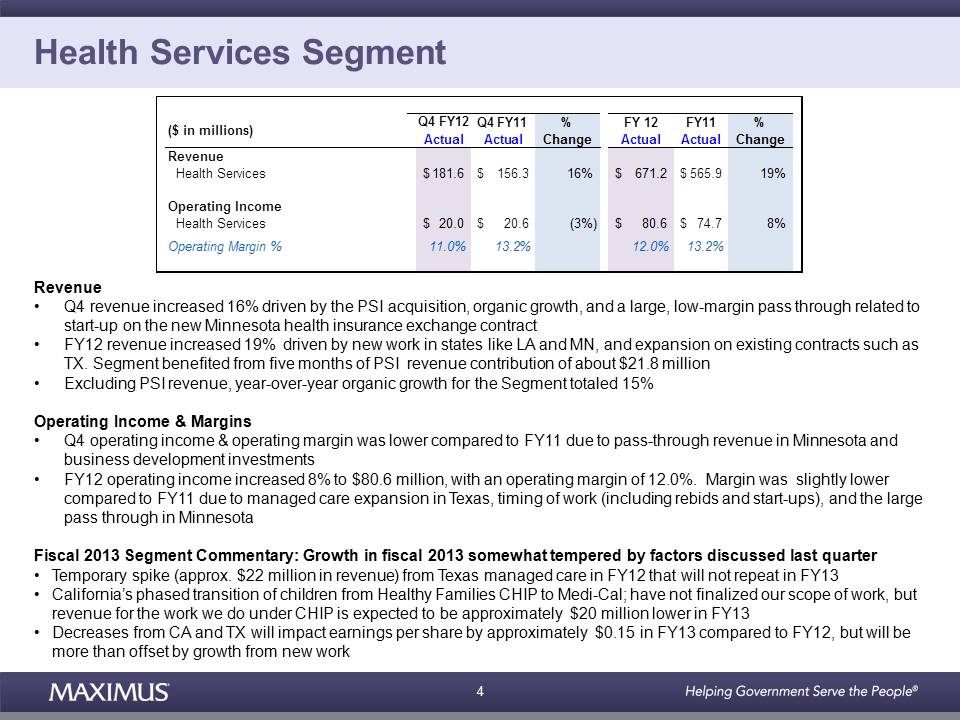

Let's turn to results by segment, starting with health services. The health services segment continues to deliver consistently solid results. For the fourth quarter, revenue increased 16% to $181.6 million compared to the same period last year. The increase was driven by the PSI acquisition, organic growth, and a large low-margin pass through related to start-up operations on the new Minnesota health insurance exchange contract. For the full fiscal year, revenue grew 19% to $671.2 million due to new work in states like Louisiana and Minnesota, as well as expansion on existing contracts, such as in Texas where we experienced a temporary spike in revenue as we supported the state's managed care expansion initiative.

This segment also benefited from five months of revenue, or about $21.8 million from the PSI acquisition. Excluding PSI revenue year over year organic growth for the health services segment totalled 15%. For the fourth quarter of 2012, operating income for the health services segment totalled $20 million compared to $20.6 million for the same period last year. Fourth quarter operating margin was lower compared to the prior year due to pass-through revenue in Minnesota and investment in business development. For the full fiscal year, the health services segment achieved operating income of $80.6 million, an 8% increase over fiscal 2011 and provided a full year operating margin of 12%. The margin was slightly lower than last year due to the managed care expansion in Texas, the timing of work, including rebids and start-ups as well as the large Minnesota pass-through. All in all, another great year for the health segment.

Looking ahead to fiscal '13, we see it as another overall solid growth year for the segment but it is important to keep in mind that the health segment growth drivers will be somewhat tempered by factors that we discussed last quarter. First, the Texas expansion of managed care caused a temporary spike of approximately $22 million in revenue in fiscal 2012, which will not repeat in fiscal '13. Second, California plans to terminate its stand-alone healthy families CHIP program and move the CHIP kids into the state's Medicaid program known as Medi-Cal. The phase transition is still expected to begin in January and may last all of calendar year 2013. As we discussed last quarter, while MAXIMUS also supports the state's Medicaid program, the population shift from one program to another won't be a one to one revenue match for MAXIMUS.

Healthy families was also a mature program generating strong margins. We are still working on the transition plan with the state and have not finalized our contractual scope of work, but at that point in time we think that revenue for the work we do under CHIP will be approximately $20 million lower in fiscal '13. So, from a bottom line perspective, we expect the decreases from the California and Texas programs will impact earnings per share by approximately $0.15 in fiscal '13 compared to fiscal year '12. We also expect that this will be more than offset by growth from new work. Nevertheless, we feel it's important for investors to understand the puts and takes to the segment's numbers.

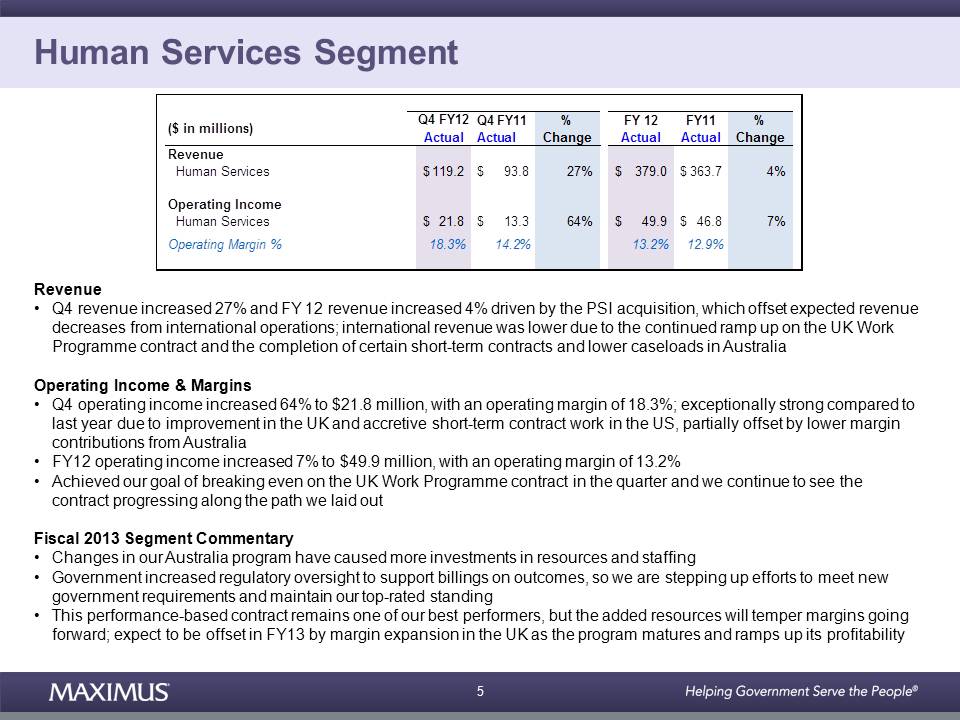

Let's turn our attention to financial results for the human services segment. For the fourth quarter, revenue for the human services segment grew 27% to $119.2 million compared to the fourth quarter of last year. For the full fiscal year, revenue grew 4% to $379 million compared to fiscal 2011. Revenue growth was driven principally by the acquisition of PSI, which offset expected revenue decreases from our international operations. International revenue was lower compared to last year due to the continued ramp-up on the new work program contract in the United Kingdom as well as the completion of certain short-term government program contracts and lower case loads in our largest job services contract in Australia.

For the fourth quarter, segment operating income increased 64% to $21.8 million, delivering an operating margin of 18.3%. The quarter was exceptionally strong compared to last year due to the ongoing improvement in the UK and short-term contract work in our US operations that was quite accretive. This was partially offset by lower margin contributions from Australia. For the full year, operating income for the human services segment increased 7% to $49.9 million resulting in a full year operating margin of 13.2% compared to 12.9% last year. We are very pleased that we achieved our goal of breaking even on the UK work program contract during the fourth quarter, and we continue to see the contract progressing along the plan we laid out.

Moving forward, we will no longer break out financial results for the stand-alone work program contract primarily for competitive reasons. We will continue to provide investors with operational granularity when it is relevant and appropriate. Moving into fiscal 2013, this segment is in a very solid position but we have experienced changes in our Australian program that have caused us to invest more in resources and staffing. Over the last several months the Australian government has increased its regulatory oversight to support billings on outcomes on all vendors across the board. In response, we've stepped up our efforts to ensure that we meet the new government requirements and maintain our top-rated standing. Despite this increased contract support spending in Australia, this performance-based contract still remains one of our most solid performers in the portfolio but the added resources will somewhat temper margins going forward. For fiscal 2013, this is expected to be offset by the margin expansion in the UK as that program continues to mature and ramp up its profitability in fiscal '13.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

3

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

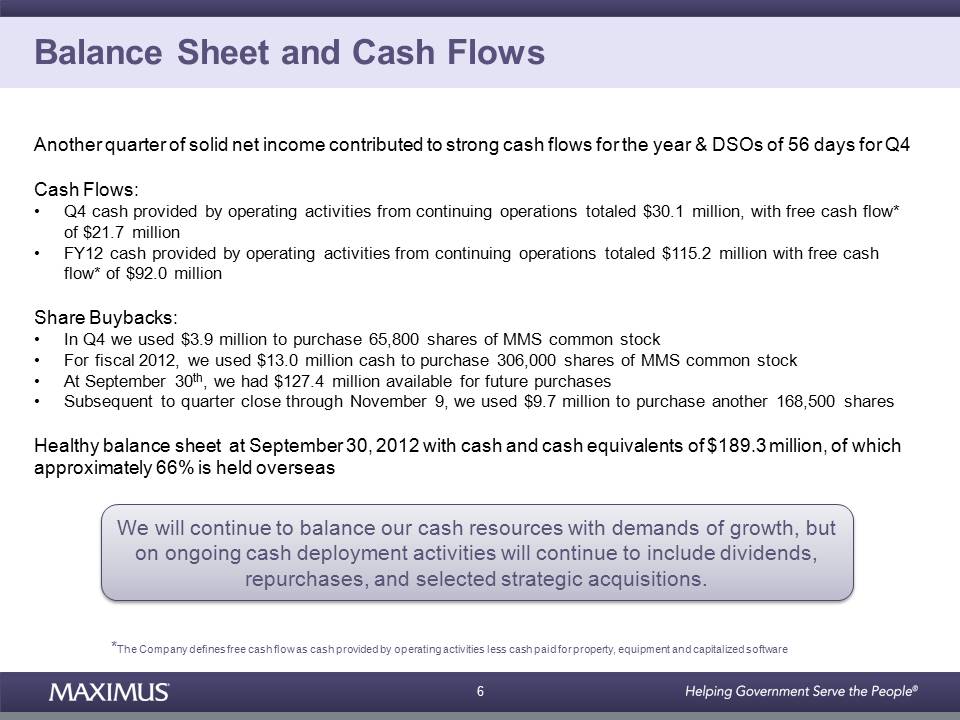

Moving on to cash flow and balance sheet items. Another quarter of solid net income contributed to strong cash flows for the fiscal year. As a result of strong earnings and low day sales outstanding of 56 days, cash flow for the year was at the high end of our expectations. For the full fiscal year, cash provided by operating activities from continuing operations totalled $115.2 million with free cash flow of $92 million, and, for the quarter, cash provided from operating activities from continuing operations totalled $30.1 million with free cash flow of $21.7 million. During the fourth quarter of fiscal 2012, MAXIMUS used $3.9 million to purchase 65,800 shares of MAXIMUS common stock under our share repurchase program, and for the full year we repurchased a total of 306,000 shares using cash of $13 million for buyback activity.

At September 30, 2012, the Company had $127.4 million available for future repurchases. Subsequent to quarter close through November 9, we remained active under our share buyback program, buying another 168,500 shares of common stock for $9.7 million. We will continue to balance our cash resources with the demands of growth, but our ongoing cash deployment activities will continue to include dividends, repurchases, and selected strategic acquisitions. Our balance sheet remains healthy, and we exited the fiscal year with cash and cash equivalents totaling $189.3 million of which 66% is held overseas.

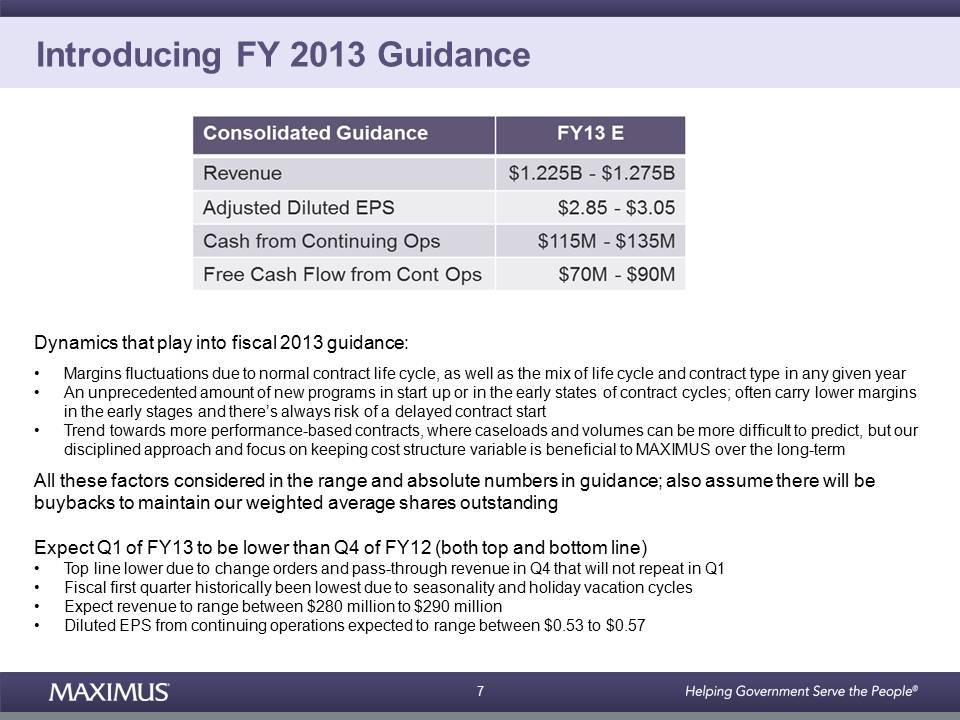

Moving on to guidance. For fiscal 2013, we anticipate revenue to grow between 17% and 21% with an expected range of $1.225 billion to $1.275 billion driven by strong growth in both segments. In addition, approximately 90% of our forecasted fiscal year 2013 revenue is in the form of bag log or contract option periods. We enter fiscal 2013 with backlog at September 30 of $2.9 billion. On the bottom line, we expect adjusted diluted EPS from continuing operations to grow between 21% and 29% with a range between $2.85 and $3.05 per diluted share for fiscal 2013.

We have some dynamics that play into our guidance for fiscal '13. First, in the normal course we do see margin fluctuations due to the normal contract life cycle as well as the mix of cycle and contract type if any given year, for example, as I mentioned earlier in the segment discussions we have some anticipated margin reductions coming from lower revenue in a couple of mature contracts in California and Texas. Second, we have an unprecedented amount of new programs in start-up or in the early stages of contract cycles. These often carry lower margins in the early stages, and there is always the risk that a contract start gets delayed. Third, our clients are evolving and the nature of the business is trending towards more performance-based contracts. With these volume-based contracts, case loads and volumes can be more difficult to predict precisely. That being said, our disciplined approach and focus on keeping our cost structure as variable as possible is beneficial to MAXIMUS over the long term.

And lastly, we also have some really promising tail winds, such as the swing to profitability in the United Kingdom as well as margin expansion on existing contracts which provides some uplift. We considered all these factors in the range in absolute numbers in our guidance. So when you add it all up we believe we've laid out a guidance range that is achievable and realistic. Our guidance also assumes that there will be buybacks in order to maintain our weighted average shares outstanding. It's early on and as things progress, throughout the year we'll likely, look to narrow the guidance range.

On a sequential basis, we expect that the first quarter of fiscal '13 will be lower compared to the fourth quarter of fiscal '12 on both the top line and bottom line. The top line is expected to be lower due to change orders and pass-through revenue that occurred in the fourth quarter and will not repeat in Q1 of fiscal '13. In addition, our fiscal first quarter has historically been our lowest due to seasonality in certain businesses and the holiday vacation cycles. So, for the first quarter of fiscal 2013, we expect revenues to be in the range of $280 million to $290 million and adjusted diluted earnings per share in the range of $0.53 to $0.57.

Moving on to cash flow guidelines, we expect cash provided by operating activities derived from continuing operations to be in the range of $115 million to $135 million for fiscal 2013. In fiscal 2013, we expect that our capital expenditures will nearly double compared to fiscal 2012 driven by the required investments in new contracts and related infrastructure. As a result, we expect free cash flow from continuing operation to range between $70 million and $90 million. So, all in all, MAXIMUS wrapped up another year of great financial results.

Thanks for your continued interest, and now I'll turn the call over to Rich.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Thanks, David. And good morning, everyone. We are proud of our achievements in fiscal 2012 as we continue to grow the business and maximize shareholder value. We completed the acquisition of PSI, this expanded our domestic footprint. We achieved break even on our UK work program contract, this sets the table for continued growth in fiscal 2013. And, most notably, our fiscal year-to-date signed awards were exceptional, and our pipeline of opportunities remains robust. As David mentioned, many new contracts are just getting underway, and they will add a recurring stream of long-term revenue and deliver profitable growth as they mature. We are equally excited that our first health insurance exchange win is in the book, and the implementation is progressing largely as expected. This is a major step in achieving our goal of securing our fair share of Health Care Reform work here in the US.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

4

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

As a result of the re-election of President Obama last week, the implementation of the Affordable Care Act will likely continue as planned. Now that the election cycle is complete, states can focus on meeting future implementation deadlines. Following this Summer's Supreme Court decision, states continue to weigh their options and timelines for expanding their Medicaid programs. Although the US Department of Health and Human Services has not set a deadline for these decisions, states can expand their Medicaid programs at any time. Organizations like the National Conference of State Legislators are expecting state lawmakers to play a key role in deciding whether to expand Medicaid when they convene this winter and next spring.

For our Medicaid expansion book of business, our outlook remains the same. We still estimate an addressable market growth of $130 million to $200 million annually. Similarly, our outlook for individual health insurance exchanges remains the same. We still estimate a $500 million annual addressable market growth for exchange business operations. At this juncture, there are three possible paths that states can take in setting up their exchanges.

The first is a state-based exchange where states operate nearly all exchange activities with minimal assistance from the federal government for certain tasks. These tasks include determining the premium tax credit and cost sharing as well as administering risk adjustment and reinsurance programs. The second model, called the state partnership exchange, offers states the opportunity to operate certain functions such as health plan management and in-person customer assistance while partnering with the federal government for all other required services. And the third option is simply to use the federally facilitated exchange also known as the FFE.

Last week the US Department of Health and Human Services gave states new deadlines to finish their exchange planning. States that plan to set up state-based exchanges still have to notify HHS by tomorrow, but their actual exchange blueprints are not due until December 14. Those states that want to pursue a partnership exchange now have until February 15 to submit their declaration of intent as well as their plans. There has been a lot of press coverage about the state's plans and which path they might choose, but groups like the Kaiser family foundation believe many states may start with a federal exchange and then move to a partnership or a state-based model in later years.

At the state level we are seeing active Hicks procurements among two groups of states. The first group of states includes those seeking customer contact services for their state-based exchange following the completion of the one-year requirements. The second group of states includes those planning ahead for their transition from the federal exchange. Under either scenario we believe we remain uniquely suited to operate a state's exchange. As we mentioned last quarter, the federal government is in the process of issuing procurements for the operations and other support functions of the federal exchange. CMS has estimated that 35 states will participate in the federal exchange during year one. And we expect to see some procurement movement on the FFE in the first half of calendar year 2013.

We continue to believe MAXIMUS is well positioned to support federal exchange initiatives. It's an opportunity that we are monitoring closely, but it's still early days, and we don't typically speak to specific business development opportunities in process. Our bid decision will ultimately depend upon the scope of the work and the terms and conditions outlined in the request for proposal, which has not yet been released. Regardless of the model our path states choose, it's important to remember that Health Care Reform is a multi-year effort and that revenue from health insurance exchanges will not reach mature levels until fiscal 2015 or 2016.

In the meantime, we continue to develop relationships with new states as we expand our portfolio of health service offerings to new geographies. As most of you already know, we have two new contract awards in Illinois. The first contract is referred to as enhanced eligibility verification, or EEV. Under this program, we help state case workers verify the continued eligibility of individuals for medical assistance programs. This process adds electronic data sources to assist the state in ensuring that eligible individuals are not denied re-enrollment, and that individuals who do not meet eligibility requirements are not reenrolled. MAXIMUS partnered with HMS for data verification using HMS's Iintegri-Match solution. The two year, $77 million contract began in September and contains two additional one-year option periods.

The second contract in Illinois is for Medicaid enrollment services. MAXIMUS will educate Medicare managed participants on their choice of health plans and facilitate enrollments based on these choices. The contract is still pending final negotiations, so we look forward to providing more details once the contract is fully executed. During the quarter, we also announced a new contract with the Oklahoma health care authority. We are operating a customer relationship management solution for the Ensure Oklahoma and Sooner care, the state's Medicaid program. The one-year contract includes five one-year renewal periods for a total contract value of $23.5 million if all the renewal periods are exercised. As a result of these two new enrollment broker wins, MAXIMUS now operates 19 Medicaid-managed care programs serving more than 22 million beneficiaries nationwide.

Moving on to our federal operations, over the last few years we have taken steps to position our federal operations for new opportunities and growth. We have brought in new leadership and made investments in business development resources. As a result, we have some exciting news to share today. MAXIMUS received notification of award for new independent medical review contract with the state of California. The contract is part of a comprehensive workers' compensation reform effort. The state expects to realize hundreds of millions of dollars in cost savings. We look forward to providing additional details once negotiations are complete and the contract is signed.

Under the contract MAXIMUS will provide independent medical reviews of denied authorization requests or payments for medical services. We will also provide review services for payment disputes between providers and claims administrators. This work is right in our wheel house, and we are pleased to see an expansion to our independent review book of business. We maintain our positive outlook for extending our core services to new programs in federal agencies.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

5

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

Moving now onto international operations. As David mentioned, our UK operations team deserves recognition for achieving break even on the work program contract during the fourth quarter. In addition, MAXIMUS also won a small but strategic new win in the UK The program called Day One Support For Young People Trail Blazer is a one-year pilot program to secure wok for youth between the ages of 18 and 24. This win is another example of our land and expand strategy and is confirmation that MAXIMUS is a go-to partner for welfare reform efforts in the UK.

We recently announced our expanded disability employment services known as DES contract in Australia h MAXIMUS will help individuals with permanent disabilities transition to sustainable employment and independence. The five-year performance based contract could produce total revenue up to $150 million. This latest contract win is a result of our strong performance in the market. Our Australian team has already placed 5,000 participants with disabilities in employment under a companion contract. The team has also achieved an average of more than four stars under the Australian government's most recent DES star ratings.

Last quarter we shared the exciting news that MAXIMUS expanded its global work force services with a new pilot program in Saudi Arabia. I'm pleased to report that we're making good progress on this new contract. We have opened and fully staffed six sites, enrolled more than 8,000 Saudis in the program and have already placed more than 500 job seekers into employment.

Moving on to rebids -- fiscal 2012 was a relatively light year for rebids. We had 14 contracts worth approximately $400 million up for rebid, and we won or received extensions on 99% of the total value of those contracts. We successfully secured all of our option years for fiscal '12 for a total of approximately $100 million. Clearly, a very successful year in regards to rebids and option renewals. For fiscal 2013, we have 14 contracts up for rebid for a total value of approximately $475 million. This includes our Texas Medicaid enrollment and our mass health contracts where we received extensions in fiscal '12. We have submitted our proposals for these two important contracts and remain cautiously optimistic as to a positive outcome. The combined value of these two contracts is $320 million, so it's the lion's share of the total value up for bid this year. We expect to hear results for these two programs by the end of the calendar year.

Turning now to new awards in sales pipeline, we had another strong year of contract awards. At September 30, we had $1.44 billion worth of new signed awards. This compares to last year where we signed awards totaling $1.6 billion, but this included nearly $1 billion of awards related to existing contracts. Further, at September 30, we had awarded but unsigned contracts totaling approximately $128 million. These are contracts where we've received notification of award but have not yet signed the contract. At November 7, our total sales pipeline of opportunities remains robust at $2.6 billion, underscoring our confidence for continued growth into fiscal 2013. As a reminder, investors should expect routine fluctuations between the pipeline and new sales categories. These shifts are driven by different stages in the procurement process as well as a timing of when contracts are awarded and ultimately signed.

Before I close today's call, I would like to recognize our more than 8,000 employees around the globe for another great year of hard work, dedication to customer service, and diligent focus all adding value to the public programs we operate. The high-quality services they provide played an important role in helping us achieve our objectives this fiscal year. Further, we established a solid foundation in winning our fair share of Health Care Reform as well as other health and human services opportunities around the world. The need for high-quality, efficient social services is a universal one and continues to drive growth for companies like MAXIMUS that can operate government programs and achieve those outcomes that matter. As we launch fiscal 2013, we are very excited and determined to deliver another year of strong growth, and we will continue to focus on our long-term strategy to expand our global operations, continue to pursue and deliver new health opportunities in the US, and grow our federal book of business. With our fiscal 2013 guidance now in place, we look forward to driving results for our clients and our shareholders.

And with that let's open it up for questions. Operator.

QUESTION AND ANSWER

Operator

Thank you. We will now be conducting a question-and-answer session.

(Operator Instructions

Brian Kinstinger, Sidoti and Company.

Brian Kinstlinger - Sidoti & Company - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

6

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

For the first questions I want to talk about the exchanges, of course. I want to understand the $500 million you talk about on the exchanges. That assumes if every state outsourced. Is that accurate? And then can you sort of talk about the small business exchanges that -- I know you haven't touched on much in the market opportunity there?

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Brian, we'd be glad to do that. And I'd like to say that Bruce Caswell, who is the President and General Manager of our health segment, and, as you very well know Bruce has been very, very involved in the US health business and very close to our pursuits in the health insurance exchange marketplace. So I'm going to ask Bruce to answer that question.

Bruce Caswell - MAXIMUS Inc - President, Health Services

Happy to do that. Good morning, Brian. To answer your first question related to the $500 million in total addressable market opportunity, that really incorporates the decision path that the states currently face, whether it's to do a state-based exchange or a state partnership exchange or a facility exchange. We developed the model to allow for multiple paths. It is an addressable market regardless of whether the state provides the service or they ultimately have the service provided by the federal government. That's the first question. Then the second question -- could you repeat the second question for me, Brian, related to the small business?

Brian Kinstlinger - Sidoti & Company - Analyst

The timing and maybe the market size of that opportunity.

Bruce Caswell - MAXIMUS Inc - President, Health Services

We've not quantified the total addressable market for the small business exchange. But the timing is such that as states look at the federally facilitated exchange option, the scope of the small business exchange will be incorporated into that. So as we look at the opportunities to support the federal government in that area, that would be an element of the support we would be providing. So for the shop exchanges in those states. And, as Rich noted in his comments, CMS estimates that as many as 35 states may take that federally facilitated exchange path. Separately, it's going to be a state-by-state decision with some states procuring the shop exchanges separate from the individual exchanges. Next question, please?

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Next question, please.

Operator

Charles Strauzer, CJS securities.

Charles Strauzer - CJS Securities - Analyst

I was hoping you could share with us the organic growth rates in Q4 and maybe what kind of assumptions you have built into '13. And then touching upon the workers comp contract you won in California, can you expand a little bit more on what, you know, kind of caused the states to move that way and how you were able to win the contract? Thanks.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Good morning, Charles. This is Rich. Dave Walker, we're going to ask him to talk about organic growth. I think Charles was asking about Q4 organic growth dynamics as well as fiscal '13, and then we will turn it over to Bruce on the California opportunity, of which we are very excited.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

7

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

David Walker - MAXIMUS Inc - CFO

Sure. I will start with '13 prospective. Overall, the PSI revenue this year is about $60 million. In fiscal '12, the majority of it happened in Q4;, we will give you the breakout in a second. And when we look at next year, fiscal '13, we expect PSI to be in the $120 million to $130 million range. So that's down from the current run rate. And that was expected when we did the acquisition. So, when you back up, our overall growth rate is expected to be somewhere in the neighborhood of 17% to 21%. So that puts the -- I guess the organic growth rate between 11% and 17%.

Charles Strauzer - CJS Securities - Analyst

For fiscal '13?

David Walker - MAXIMUS Inc - CFO

For fiscal '13. For the fourth quarter of the year, we had a total growth rate of 20%, and the organic growth rate was 5.5% with PSI contributing approximately $37 million.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Bruce, the California contract?

Bruce Caswell - MAXIMUS Inc - President, Health Services

Sure. To explain a little bit more about the services that we're providing there, there are two elements to it. There are the independent medical reviews and the independent billing reviews. And I'll just give you a little color on what that really covers. The independent billing reviews would be, for example, in situations where a payment has been denied for out of network services, or there is a billing dispute between a provider as it relates to services that have either already been provided or are being pre-authorized. The payment for -- and often, as you would expect, the provider services are billed on a bundled basis -- or unbundled basis, and the payers seek to pay on a bundled basis. Those independent billing reviews are one element. The independent medical reviews, an example might be an individual seeking pre-authorization for services related to a workers' compensation claim or medical condition that they have such as back surgery.

So to go into the details, the opportunity evolved really over the course of a number of years and really was called for by state legislation. So there's a statutory requirement to implement the program by January of this coming year. And it really is a new process for the state where the reviews that we'll be providing will be a new review between the claimant and what historically has been the administrative law judge process, or ALJ process. So the state expects the savings to accrue from the administrative savings in that process and the new review capabilities that we can be -- providing. So the IMR and IBR -- excuse me. Let me step and get a glass of water. Thank you. So fundamentally there will be fewer administrative law judge hearings as part of that process.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

The other point that I want to add is just this is very, very complimentary of what we already do in the federal appeals business. So we really see it as an extension of the same offering. Just to a different geography. We also do the appeals work for a number of states. So it's essentially an offering to a new client, and we're very excited about it. Next question, please.

Operator

The next question is from the line of Scott Green of Bank of America Merrill Lynch. Please proceed with your question.

Scott Green - BofA Merrill Lynch - Analyst

First maybe for Dave on free cash flow guidance for next year, maybe you could just talk about -- elaborate a little more on the step up in CapEx. How you see that trending with revenue growth over the next few years, or is there anything temporary with the step up in CapEx?

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

8

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

David Walker - MAXIMUS Inc - CFO

Well, that's a great question. So the free cash flow is down because of the CapEx. So you're quite right. So we gave an operating cash flow of the $115 million to $135 million range. By the way, the biggest driver there is just DSO. So a growing company ties up money in receivables. So that's a factor there. But the same factor, growth, which we think to be a good problem, ties up CapEx. And the BPO, the IT part, when you win a lot of work you've got to invest a lot on the front end for leasehold improvements for offices, you're equipping for the system install.

And so you typically capitalize them and amortize them over the life of the contract. So what you see is virtually a doubling of our CapEx and capital software spend from $23 million in fiscal '12 to about $45 million. We have about 10 startups, which is an unprecedented level, and about 5 more in the pipe, we think. So the question is, do we foresee this as a trend? We do think in general we are a growth rate at double-digit. So the next year's growth rate is a much higher percentage than just 10%-11%. So, it would -- could modestly come down. On the other hand, if this growth trajectory continues, I actually think that's a good thing.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Next question, please.

Operator

Brian Kintslinger, Sidoti

Brian Kinstlinger - Sidoti & Company - Analyst

To follow up on the RFPs for exchanges, maybe you could talk about the timing of when they will start coming out. I think a while back you thought awards would happen sometime in this early calendar year coming. Then will the federal exchanges changes dominate your ability to maintain market share given the estimation of so many starting in that?

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Two great questions. First on the timing of the these RFPs and then the federal exchange, does it impact our ability to dominate the market as it relates to --

David Walker - MAXIMUS Inc - CFO

Sure. First of all, in terms of the timing of the RFPs, as Rich mentioned in his call notes, we are already seeing for those states that are opting for the state-based exchanges a flow of RFPs related to the customer contact centers. So those timing -- the timing of those RFPs are really as expected. But it's also important to note that states are going to turn to existing contract vehicles to satisfy the demand for those services. So we would expect and have seen initial conversations with states around task orders to add on to existing contracts to support those types of services -- call center customer contact center services. That is as expected. As it relates to your second question, with the federally facilitated exchange, many states -- and in fact in CMS -- would say that it's not their intent to stay on that exchange indefinitely. There is a one-year requirement to remain on the federally facilitated exchange before you can then move to a state-based exchange.

So, in our modeling and in our estimation, many states will, just because of the lack of time right now to get a state-based exchange completed opt for the FedEx change to begin with. But then get on a glide path where they could take essential operations of those exchanges in the out years. I think that's consistent with the revenue ramp up in this business where you start to see some revenue in the FY13 and FY14 period but it really doesn't reach maturity until the FY15, FY16 period.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

I would add to that, that I do think underlying all of this in terms of where do these states end up vis-a-vis the federal exchange, I think there is a long standing value that states very much want to control their own destiny, serve the people, handle all of the beneficiary one-on-one type communications. In this system, it's really where the touch occurs. And the federal government, on the other hand, fully recognizes that it's very difficult for them to provide that level of touch and sensitivity that really is critical in an effective program. So while I think for convenience and time purposes more states will go towards the federal exchange, our belief is, over the long run, even those that do, will look more back to the state-based model. And, hence, to answer -- to close out your question in terms of our position with the states, I really don't see it as a concern as it relates to our position. In fact, I think it's an interesting opportunity to help those states that first go with the federal exchange to then transition back to a state-based model. Next question, please.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

9

|

NOVEMBER 15, 2012 / 02:00PM GMT, MMS - Q4 2012 MAXIMUS, Inc. Earnings Conference Call

|

Operator

This concludes today's teleconference. You may disconnect your lines at this time. We thank you for your participation.

Rich Montoni - MAXIMUS Inc - CEO, President and Director

Thank you very much, folks.

|

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2012 Thomson Reuters. All Rights Reserved.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

10

Slide: 1 Title: David N. Walker Chief Financial Officer and Treasurer November 15, 2012 Fiscal 2012 Fourth Quarter & Full Year Earnings A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Slide: 2 Title: Fiscal 2012 Highlights Another solid year of financial results, reflecting the Company’s healthy portfolio of projects. Highlights include: Strong growth in core markets, The acquisition and integration of PSI, And the successful ramp up on the Work Programme contract in the UK, which achieved breakeven in the fourth quarterFor fiscal 2013, we remain committed to winning our fair share of health care reform contracts, securing new profitable work, and strategically deploying cash to drive long-term shareholder value

Slide: 3 Title: Selected Financial Results from Continuing Operations Q4 revenue grew 20% and FY12 revenue grew 13% driven by new work, contract expansions, and the PSI acquisition, offsetting revenue decreases in our international operations. FY12 revenue grew 7% organicallyStrong operating margins at 13.9% for Q4 and 12.4% for FY12Q4 GAAP income from continuing ops, net of taxes, totaled $23.8 million or $0.68 per diluted share and included $0.06 of expenses related to a tax adjustment, legal & settlement expenses & recoveries, and acquisition-related expenditures. Excluding these, Q4 adjusted EPS grew 16% to $0.74FY12 GAAP income from continuing ops, net of taxes, totaled $76.1 million, or $2.19 per diluted share, and included $0.17 of expenses related to tax adjustments, legal & settlement expenses & recoveries, and acquisition-related expenditures. Excluding these, FY 12 adjusted EPS grew 5% to $2.36 *May not add due to rounding

Slide: 4 Title: Health Services Segment Revenue Q4 revenue increased 16% driven by the PSI acquisition, organic growth, and a large, low-margin pass through related to start-up on the new Minnesota health insurance exchange contractFY12 revenue increased 19% driven by new work in states like LA and MN, and expansion on existing contracts such as TX. Segment benefited from five months of PSI revenue contribution of about $21.8 millionExcluding PSI revenue, year-over-year organic growth for the Segment totaled 15%Operating Income & MarginsQ4 operating income & operating margin was lower compared to FY11 due to pass-through revenue in Minnesota and business development investmentsFY12 operating income increased 8% to $80.6 million, with an operating margin of 12.0%. Margin was slightly lower compared to FY11 due to managed care expansion in Texas, timing of work (including rebids and start-ups), and the large pass through in MinnesotaFiscal 2013 Segment Commentary: Growth in fiscal 2013 somewhat tempered by factors discussed last quarterTemporary spike (approx. $22 million in revenue) from Texas managed care in FY12 that will not repeat in FY13 California’s phased transition of children from Healthy Families CHIP to Medi-Cal; have not finalized our scope of work, but revenue for the work we do under CHIP is expected to be approximately $20 million lower in FY13Decreases from CA and TX will impact earnings per share by approximately $0.15 in FY13 compared to FY12, but will be more than offset by growth from new work

Slide: 5 Title: Human Services Segment RevenueQ4 revenue increased 27% and FY 12 revenue increased 4% driven by the PSI acquisition, which offset expected revenue decreases from international operations; international revenue was lower due to the continued ramp up on the UK Work Programme contract and the completion of certain short-term contracts and lower caseloads in AustraliaOperating Income & MarginsQ4 operating income increased 64% to $21.8 million, with an operating margin of 18.3%; exceptionally strong compared to last year due to improvement in the UK and accretive short-term contract work in the US, partially offset by lower margin contributions from AustraliaFY12 operating income increased 7% to $49.9 million, with an operating margin of 13.2%Achieved our goal of breaking even on the UK Work Programme contract in the quarter and we continue to see the contract progressing along the path we laid outFiscal 2013 Segment Commentary Changes in our Australia program have caused more investments in resources and staffingGovernment increased regulatory oversight to support billings on outcomes, so we are stepping up efforts to meet new government requirements and maintain our top-rated standingThis performance-based contract remains one of our best performers, but the added resources will temper margins going forward; expect to be offset in FY13 by margin expansion in the UK as the program matures and ramps up its profitability

Slide: 6 Title: Balance Sheet and Cash Flows *The Company defines free cash flow as cash provided by operating activities less cash paid for property, equipment and capitalized softwareWe will continue to balance our cash resources with demands of growth, but on ongoing cash deployment activities will continue to include dividends, repurchases, and selected strategic acquisitions. Another quarter of solid net income contributed to strong cash flows for the year & DSOs of 56 days for Q4Cash Flows: Q4 cash provided by operating activities from continuing operations totaled $30.1 million, with free cash flow* of $21.7 millionFY12 cash provided by operating activities from continuing operations totaled $115.2 million with free cash flow* of $92.0 millionShare Buybacks:In Q4 we used $3.9 million to purchase 65,800 shares of MMS common stockFor fiscal 2012, we used $13.0 million cash to purchase 306,000 shares of MMS common stockAt September 30th, we had $127.4 million available for future purchasesSubsequent to quarter close through November 9, we used $9.7 million to purchase another 168,500 sharesHealthy balance sheet at September 30, 2012 with cash and cash equivalents of $189.3 million, of which approximately 66% is held overseas

Slide: 7 Title: Introducing FY 2013 Guidance Dynamics that play into fiscal 2013 guidance:Margins fluctuations due to normal contract life cycle, as well as the mix of life cycle and contract type in any given yearAn unprecedented amount of new programs in start up or in the early states of contract cycles; often carry lower margins in the early stages and there’s always risk of a delayed contract startTrend towards more performance-based contracts, where caseloads and volumes can be more difficult to predict, but our disciplined approach and focus on keeping cost structure variable is beneficial to MAXIMUS over the long-termAll these factors considered in the range and absolute numbers in guidance; also assume there will be buybacks to maintain our weighted average shares outstandingExpect Q1 of FY13 to be lower than Q4 of FY12 (both top and bottom line)Top line lower due to change orders and pass-through revenue in Q4 that will not repeat in Q1Fiscal first quarter historically been lowest due to seasonality and holiday vacation cyclesExpect revenue to range between $280 million to $290 millionDiluted EPS from continuing operations expected to range between $0.53 to $0.57

Slide: 8 Title: Richard A. Montoni President and Chief Executive Officer November 15, 2012 Fiscal 2012 Fourth Quarter & Full Year Earnings

Slide: 9 Title: Solid Performance in Fiscal 2012 Proud of our achievements in fiscal 2012 as we continue to grow the business and maximize shareholder value:Completed the acquisition of PSI, expanding our domestic footprintAchieved breakeven on our UK Work Programme contract, setting the table for growth in FY13Exceptional fiscal year-to-date signed awards and robust pipeline of opportunities Many new contracts are just getting underway and will add a recurring stream of long-term revenue and deliver profitable growth as they matureExcited that the first health insurance exchange win is in the books and implementation is progressing as expected, a major step in achieving our goal of securing our fair share of health care reform work

Slide: 10 Title: Health Care Reform UpdateFollowing last week’s elections, ACA will likely continue as planned and states can focus on meeting future implementation deadlinesStates continue to weigh their options and timelines for Medicaid expansionThree possible paths that states can take in setting up exchanges: State-based exchange State partnership exchange Federally Facilitated Exchange (FFE)HHS gave states new deadlines to finish their exchange planning:States that plan to set up a state-based exchange still have to notify HHS by 11/16/12, but actual exchange blueprints are not due until 12/14/12States that want to pursue a partnership exchange now have until 2/15/13 to submit their declarations of intent and plans Groups like the Kaiser Family Foundation believe that many states may start with a federal exchange and then move to a partnership or state-based model in later yearsOur total addressable market growth under ACA remain unchanged: $130 million to $200 million annually for Medicaid expansion and $500 million annually for Health Insurance Exchanges

Slide: 11 Title: HIX Procurement Update Active HIX procurements among two groups of states:States seeking customer contact services for state-based HIX States planning ahead for their transition from the federal exchange following the completion of the one year requirementFederal government is in the process of issuing RFPs for the operations and support functions of the FFEUp to 35 states may participate in the FFE during year one and MMS expects to see some FFE procurement movement in the 1H of CY13We are monitoring procurements closely, but any bid decision will depend on the scope of the work and the terms and conditions outlined in the RFP (which is not yet released) Regardless of the model or path states choose, health care reform is a multi-year effort and revenue from health insurance exchanges will not reach mature levels until FY15 or FY16

Slide: 12 Title: Expanded Domestic Health Services Portfolio Illinois Enhanced Eligibility VerificationProviding assistance to state caseworkers who verify the continued eligibility of individuals for medical assistance programsTwo-year, $77 million contract began in September and contains two additional one-year option periodsIllinois Medicaid Enrollment ServicesEducating Medicaid managed care participants on their choice of health plans and facilitating enrollments based on these choicesContract is still pending final negotiations; more details available once fully executed Oklahoma Customer Relationship ManagementAssisting participants of SoonerCare (Medicaid) and Insure Oklahoma programsOne-year contract includes five one-year renewal periods, for a total contract value of $23.5 million if all renewal periods are exercised

Slide: 13 Title: Extending Core Federal Services to New Markets California Workers Compensation Reviews Part of a comprehensive workers compensation reform effort that the state expects to bring hundreds of millions of dollars in cost savingsProviding independent medical reviews of denied authorization requests or payments for medical services, as well as review services for payment disputes between providers and claims administratorsContract is still pending final negotiations; more details available once fully executed Pleased to see an expansion to our independent review book of business; maintain our positive outlook for extending our core services to new programs and federal agencies

Slide: 14 Title: International Operations Update United KingdomWork Programme contract achieved breakeven in Q4 of FY12MAXIMUS also won a small but strategic new contract for the Day One Support for Young People Trailblazer one-year pilot program to secure work experience for youthThis is another example of our “land and expand” strategy and confirmation that MMS is a “go to” partner for welfare reform efforts in the UKAustraliaExpanded Disability Employment Services (DES) contractFive-year, performance-based contract (total revenue up to $150 million) to help individuals with permanent disabilities transition to sustainable employmentAustralia team has already placed 5,000 participants with disabilities in employment under a companion contract and achieved an average of 4+ stars under the most recent DES Star Ratings Saudi ArabiaMaking good progress on new contractOpened and fully staffed six sites; enrolled more than 8,000 Saudis in the program; and placed more than 500 job seekers into employment

Slide: 15 Title: Contract Rebids and Option Years Fiscal 2012 was a relatively light, but successful year for rebids and option periodsWon or received extensions on 99% of the approximately $400 million total value of the 14 contracts up for rebidSuccessfully secured all of our option years for FY 12 for a total value of approximately $100 millionFor fiscal 2013, we have 14 contracts up for rebid with a total value of approximately $475 million Includes Texas Enrollment Broker and MassHealth contracts that received extensions in FY 12Combined value of these two contracts is roughly $320 million, so it’s the lion’s share of the total value up for bid in FY 13 Submitted our proposals for these two contracts and remain cautiously optimistic on a positive outcome; expect to hear results by the end of the calendar year

Slide: 16 Title: New Awards and Sales Pipeline At September 30, 2012:Another strong year of contract awards with YTD signed awards of $1.44 billion compared to $1.61 billion at the end of FY11Awarded but unsigned contracts totaling approximately $128 millionAt November 7, 2012: Total sales pipeline of opportunities remained robust at $2.6 billion, underscoring our confidence for continued growth into fiscal 2013Routine fluctuations between the pipeline and new sales categories are driven by the stages in the procurement process and the timing of when contracts are awarded and signed

Slide: 17 Title: Conclusion Thank you to our more than 8,000 employees for their hard work, dedication to customer service, and diligent focus on adding value played an important part in helping us achieve our objectives in fiscal 2012We established a solid foundation in winning our fair share of health care reform work, as well as other health and human services opportunities around the world The need for high quality, efficient social services is a universal one and continues to drive growth for companies like MAXIMUS that can operate government programs and achieve those outcomes that matterAs we launch fiscal 2013, we are very excited and determined to deliver another year of growth; we will continue to focus on our long-term strategy to:Expand our global operations Continue to pursue and deliver new health opportunities in the U.S.Grow our federal book of business With our fiscal 2013 guidance now in place, we look forward to driving results for our clients and our shareholders