Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McEwen Mining Inc. | a12-23803_18k.htm |

Exhibit 99.1

MORE DRILLING SUCCESS AT EL GALLO PHASE 1 PRODUCTION AREA

PLUS ADDITIONAL ZINC, SILVER & LEAD INTERCEPT

2.9 GPT GOLD OVER 21.8 METERS, 1.3 GPT GOLD OVER 44.4 METERS &

10.9 GPT GOLD OVER 4.4 METERS

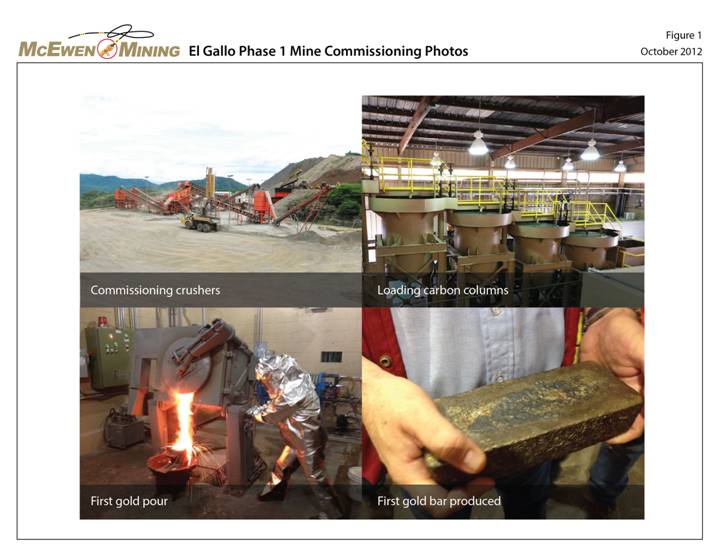

TORONTO, ONTARIO - (October 11, 2012) - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce additional exploration results from its 100% owned El Gallo Complex, in Sinaloa State, Mexico, where gold production has recently commenced (Fig. 1).

The best gold intersections in this news release include:

· 2.9 gpt gold over 21.8 m, including 6.7 gpt gold over 7.8 m

· 2.1 gpt gold over 46.1 m, including 9.9 gpt gold over 5.0 m

· 1.3 gpt gold over 44.4 m, including 21.3 gpt gold over 0.5 m

· 10.9 gpt gold over 4.4 m, including 52.9 gpt gold over 0.9 m

One new hole near poly-metallic mineralization recently encountered by McEwen Mining, returned:

· 6.0% Zinc, 1.0% Lead, 0.8 gpt gold and 8.0 gpt silver over 34.5 m

“Drilling at El Gallo continues to return positive results as we look to extend the life of Phase 1. Also, intriguing poly-metallic mineralization is being encountered in an area southeast of the open pit. With production scheduled to ramp up during the Fourth Quarter and three drills operating, we look forward to growing this asset,” stated Rob McEwen, Chief Owner.

El Gallo Phase 1 Exploration Drill Results

Drilling Expands Gold Resource

Drilling inside of El Gallo Phase 1 continues to be focused on extending the mine life by exploring for additional mineralization laterally and at depth. Since drilling began in July, a number of encouraging assays have been returned including previously announced intercepts of: 1.1 gpt gold over 71.3 m (MLX-013) and 1.3 gpt gold over 41.2 m (MLX-022).

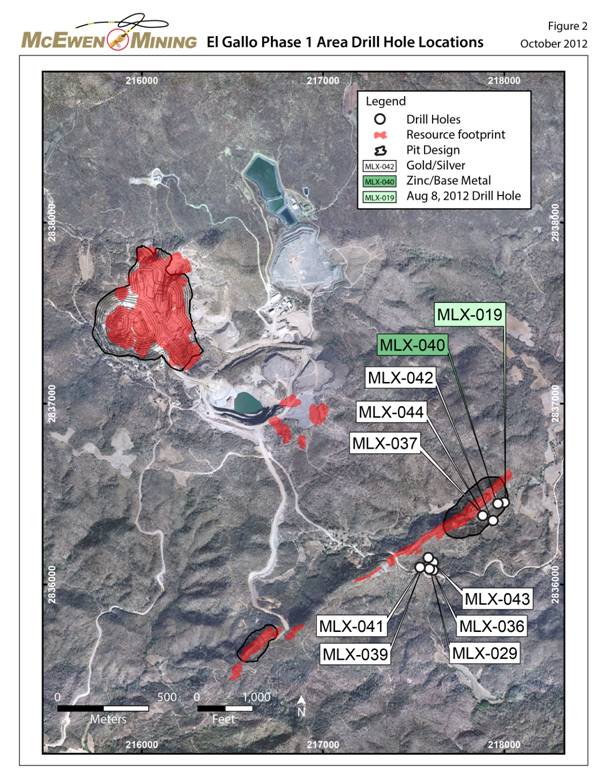

Recent drill results continue to be successful. Highlights include MLX-041 that returned 2.9 gpt gold over 21.8 m, including 6.7 gpt gold over 7.8 m. This hole is located between the results highlighted in the above paragraph and the planned open pit 100 meters to the northeast (where mining is

![]()

planned for 2013) (Fig. 2). Further drilling will look to infill these two areas. Should future drill results be positive, the Company will study the economics of mining the area as an enlarged open pit.

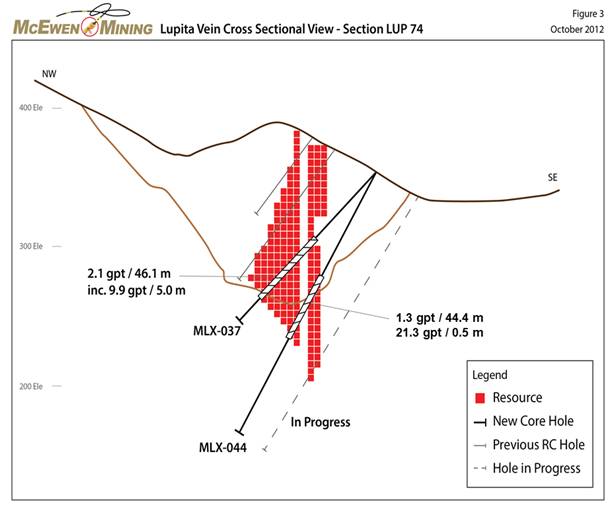

Holes MLX-037 and MLX-044 were drilled to determine 1) the continuity of the mineralization near the bottom of the pit design and, 2) to see if the zone continues deeper, which could potentially enlarge the pit size. Both holes were successful. MLX-037 demonstrated good continuity from the holes above it, intersecting 2.1 gpt gold over 46.1 m, including 9.9 gpt gold over 5.0 m. MLX-044, drilled below MLX-037, successfully showed that the zone continues deeper, returning 1.3 gpt gold over 44.4 m, including 21.3 gpt gold over 0.5 m.

Hole MLX-042, which returned 10.9 gpt gold over 4.4 m, was drilled approximately 50 meters below the proposed pit. The possibility of growing the resource at depth appears encouraging.

Table 1. Gold Intercepts — Lupita Vein

|

Hole |

|

From |

|

To |

|

Thickness |

|

Gold Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-029 |

|

124.9 |

|

190.1 |

|

65.3 |

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-036 |

|

184.9 |

|

191.5 |

|

6.7 |

|

0.9 |

|

|

And |

|

223.4 |

|

248.8 |

|

25.4 |

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-037 |

|

79.1 |

|

125.2 |

|

46.1 |

|

2.1 |

|

|

Including |

|

94.2 |

|

99.2 |

|

5.0 |

|

9.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-039 |

|

129.9 |

|

153.8 |

|

23.9 |

|

0.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-041 |

|

61.7 |

|

83.5 |

|

21.8 |

|

2.9 |

|

|

Including |

|

68.6 |

|

76.4 |

|

7.8 |

|

6.7 |

|

|

Including |

|

73.4 |

|

74.6 |

|

1.3 |

|

24.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-042 |

|

159.3 |

|

163.6 |

|

4.4 |

|

10.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-043 |

|

122.9 |

|

136.6 |

|

13.8 |

|

0.8 |

|

|

And |

|

163.5 |

|

175.2 |

|

11.7 |

|

0.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-044 |

|

91.5 |

|

135.8 |

|

44.4 |

|

1.3 |

|

|

Including |

|

115.2 |

|

117.7 |

|

0.5 |

|

21.3 |

|

|

Including |

|

134.1 |

|

134.6 |

|

0.5 |

|

16.3 |

|

In some cases the true width of the mineral zones has not been determined.

Additional Zinc, Lead and Silver Discovered

Although it has been known that the area contains elevated zinc and lead, base metal mineralization of this grade has not been previously encountered. On August 8th, the Company announced a surprising 41.0 m intercept returned 4.2% zinc, 0.9% lead, 0.5 gpt gold and 8.6 gpt silver, near the northeast corner of planned pit design (Fig. 2). The first follow-up hole, drilled approximately 38 m to the southwest, has returned higher zinc, lead and gold grades over a similar interval: 6.0% zinc, 1.0% lead, 0.8 gpt gold and 8.0 gpt silver over 34.5 m. The values are encouraging. There is no further drilling to the south and east area representing a new exploration target. Three additional holes are currently in progress to test for extensions of this mineralization.

About El Gallo

The El Gallo Complex is located in Sinaloa State, Mexico. Phase 1 has recently entered production and is forecasted to produce an average 30,000 ounces of gold per year. Phase 2, where a feasibility study has completed on September 10, 2012 is forecasted to add an additional 105,000 ounces of gold and gold equivalent. Combined both phases of production are scheduled to produce approximately 135,000 ounces of gold and gold equivalent.

About McEwen Mining (www.mcewenmining.com)

The goal of McEwen Mining is to qualify for inclusion in the S&P 500 by 2015 by creating a high growth, low-cost, mid-tier silver and gold producer focused in the Americas. McEwen Mining’s principal assets consist of the San José mine in Santa Cruz, Argentina (49% interest); the El Gallo complex in Sinaloa, Mexico; the Gold Bar project in Nevada, US; the Los Azules Copper project in San Juan, Argentina and a large portfolio of exploration properties in Argentina, Nevada and Mexico.

McEwen Mining has 267,084,203 shares issued and outstanding. Rob McEwen, Chairman, President and CEO, owns approximately 25% of the shares of the Company. As of June 30, 2012, McEwen Mining had cash and liquid assets of US$38 million and is debt free.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking statements and information, including “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this press release, McEwen Mining Inc.’s (the “Company”) estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, risks related to business integration as a result of the business combination between the Company and Minera Andes, factors associated with fluctuations

in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation including specifically but not limited to ongoing litigation with respect to the Los Azules property which if resolved adversely to the Company, would materially affect the Company’s ability to develop the Los Azules project, property title, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011 and other filings with the Securities and Exchange Commission, under the caption “Risk Factors”, for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

TECHNICAL INFORMATION:

This news release has been reviewed and approved by John Read, CPG, McEwen Mining’s consulting geologist, who is a Qualified Person as defined by National Instrument 43-101 and is responsible for program design and quality control of exploration undertaken by the Company at its Mexican exploration properties. Samples from the core drilling were split on-site at the Company’s El Gallo complex. One half of the split drill core is shipped to ALS Chemex for sample preparation and analysis by 4-acid digestion with ICP determination for silver and fire assay for gold. Samples returning greater than 1500 ppm silver or 10 ppm gold were re-analyzed using gravimetric fire assay. Standards and blanks were inserted every 20 samples. All holes were drilled with HQ bits and reduced to NTW where required. Samples were taken based on lithologic and/or mineralized intervals and vary in length. In some cases the true width of the mineral zones has not been determined. For additional information about the El Gallo complex see the “Resource Estimate for the El Gallo Complex, Sinaloa State, Mexico” dated July 18, 2012 and prepared by John Read, CPG of McEwen Mining Inc., Richard J. Kehmeier, CPG and Brian S. Hartman, P.Geo of Pincock, Allen & Holt and Aaron M. McMahon P.G., formerly employed by Pincock, Allen & Holt. All individuals, except Mr. Read, are Qualified Persons as defined by NI 43-101 and are independent of McEwen Mining Inc. as defined in Section 1.4 of NI 43-101 and Section 3.5 of Companion Policy 43-101CP. Mr. Read verified the mineral resource data contained in the El Gallo resource estimate by conducting a site visit, which included verifying drill hole locations and survey data, reviewing sampling handling, data collection procedures, partial audit of the assay database, review of the QA/QC data and analysis of core recovery and drill logs and their relations to assay values. The El Gallo complex resource is available on SEDAR (www.sedar.com).

CAUTIONARY NOTE TO US INVESTORS

McEwen Mining prepares its resource estimates in accordance with standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 (NI 43-101). These standards are different from the standards generally permitted in reports filed with the SEC. Under NI 43-101, McEwen Mining reports measured, indicated and inferred resources,

measurements which are generally not permitted in filings made with the SEC. The estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that any part of measured or indicated resources will ever be converted into economically mineable reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

|

For further information contact: |

|

|

|

|

|

Jenya Meshcheryakova

Facebook: www.facebook.com/McEwenRob Twitter: www.twitter.com/McEwenMining |

Mailing Address 181 Bay Street Suite 4750 Toronto, ON M5J 2T3 PO box 792 E-mail: info@mcewenmining.com |

Table 2. All Holes From Lupita Vein

|

Hole |

|

From |

|

To |

|

Thickness |

|

Gold |

|

Dip |

|

Azimuth |

|

Easting |

|

Northing |

|

MLX-029 |

|

124.9 |

|

190.1 |

|

65.3 |

|

0.5 |

|

-50 |

|

325 |

|

2175886 |

|

2836101 |

|

Including |

|

150.8 |

|

151.4 |

|

0.6 |

|

4.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-036 |

|

184.9 |

|

191.5 |

|

6.7 |

|

0.9 |

|

-55 |

|

325 |

|

217607 |

|

2836080 |

|

Including |

|

189.3 |

|

191.5 |

|

2.3 |

|

1.8 |

|

|

|

|

|

|

|

|

|

And |

|

223.4 |

|

248.8 |

|

25.4 |

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-037 |

|

79.1 |

|

125.2 |

|

46.1 |

|

2.1 |

|

-45 |

|

325 |

|

217890 |

|

2836380 |

|

Including |

|

94.2 |

|

99.2 |

|

5.0 |

|

9.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-039 |

|

129.9 |

|

153.8 |

|

23.9 |

|

0.6 |

|

-50 |

|

325 |

|

217556 |

|

2836109 |

|

Including |

|

144.1 |

|

146.4 |

|

2.3 |

|

1.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-041 |

|

61.7 |

|

83.5 |

|

21.8 |

|

2.9 |

|

-50 |

|

325 |

|

217582 |

|

2836158 |

|

Including |

|

68.6 |

|

76.4 |

|

7.8 |

|

6.7 |

|

|

|

|

|

|

|

|

|

Including |

|

73.4 |

|

74.6 |

|

1.3 |

|

24.3 |

|

|

|

|

|

|

|

|

|

And |

|

109.7 |

|

113.9 |

|

4.2 |

|

0.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-042 |

|

159.3 |

|

163.6 |

|

4.4 |

|

10.9 |

|

-50 |

|

325 |

|

217933 |

|

2836354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-043 |

|

122.9 |

|

136.6 |

|

13.8 |

|

0.8 |

|

-50 |

|

325 |

|

217607 |

|

2836123 |

|

And |

|

163.5 |

|

175.2 |

|

11.7 |

|

0.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLX-044 |

|

91.5 |

|

135.8 |

|

44.4 |

|

1.3 |

|

-60 |

|

325 |

|

217890 |

|

2836380 |

|

Including |

|

115.2 |

|

117.7 |

|

0.5 |

|

21.3 |

|

|

|

|

|

|

|

|

|

Including |

|

134.1 |

|

134.6 |

|

0.5 |

|

16.3 |

|

|

|

|

|

|

|

|

In some cases the true width of the mineral zones has not been determined.

Table 3. All Holes From Lupita Vein (Zinc, Lead, Gold and Silver)

|

Hole |

|

From |

|

To |

|

Thickness |

|

Zinc |

|

Lead |

|

Gold |

|

Silver |

|

Dip |

|

Azimuth |

|

Easting |

|

Northing |

|

|

MLX-040 |

|

112.2 |

|

146.6 |

|

34.5 |

|

6.0 |

|

1.0 |

|

0.8 |

|

8.0 |

|

-57 |

|

325 |

|

217960 |

|

283 |

|

In some cases the true width of the mineral zones has not been determined.