Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mesa Energy Holdings, Inc. | v325008_8-k.htm |

EXHIBIT 99.1

Proposed Merger Overview Mesa Energy Holdings, Inc. and Armada Oil, Inc. Conference Call: Thursday, October 4 th , 2012 Armada Oil, Inc. Conventional Liquids with Significant Unconventional Upside

Legal Notice Regarding Forward Looking Statements Statements in this presentation of Armada Oil, Inc . (“Armada”) and Mesa Energy Holdings, Inc . (“Mesa”) that are not historical facts are "forward - looking statements" subject to risks/uncertainties . Such statements are based on current facts/analyses and other information that are based on forecasts of results, estimates of amounts not yet determined, and assumptions of management . Such statements are generally, but not always, identified by the words "expects," "plans,“ "anticipates," "believes," "intends," "estimates, "proposes," and similar expressions or that events or conditions "will", "would", "may", "can", "could" or "should" occur . Information concerning reserve estimates may also be deemed to be forward - looking statements, as it constitutes a prediction of what might be present when/if a project is actually developed . It is important to note that actual outcomes and results could differ materially from those in such statements due to numerous factors beyond the Company's (as used herein, the term "Company" may refer to Armada Oil, Inc . and/or Mesa Energy Holding, Inc . , as the context so requires) control including misinterpretation of data, inaccurate estimates of reserves, uncertainty of the requirements demanded by governmental agencies, Company's ability to raise financing, breach by third - parties, inability to retain employees/consultants, competition for equipment, inability to obtain permits, delays in operations, the likelihood that no commercial quantities of resources are found/recoverable, and our ability to participate in the exploration and completion of development programs . Additional information on these risks can be found in the Company's periodic filings filed with the United States Securities and Exchange Commission at www . sec . gov . This presentation does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States . The securities mentioned herein have not been, and will not be, registered under the Securities Act of 1933 , as amended . They may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act . Company undertakes no obligation to publicly release the results of any revisions to these statements that may be made to reflect the events or circumstances after the date hereof or to reflect the occurrence of unanticipated events . The execution of a definitive agreement is conditional on, among other things, the parties being satisfied with the results of their respective due diligence . Armada and Mesa can provide no assurances that this will happen . Management cautions investors against making investment decisions based on any expectation that the proposed transaction will be consummated, because, in its view, such expectations are speculative . If a transaction is to be proposed to the stockholders of Mesa Energy, Mesa Energy and Armada Oil would file with the Securities and Exchange Commission and distribute a Registration Statement on Form S - 4 covering securities to be issued in the transaction . It is expected that Mesa Energy shareholders would receive a prospectus and proxy statement or information statement, as applicable, in connection with such transaction . The final terms of the prospective transaction remain subject to change and would only be reflected in a binding definitive agreement that remains to be negotiated between the companies . A copy of the definitive merger agreement would be filed along with the prospectus and proxy statement /information statement . Mesa Energy stockholders would be urged to read these and any other related documents the corporation may issue . If and when these documents are filed, they will be available for free at the SEC’s website, www . sec . gov . Additional information on how to obtain these documents from Mesa Energy would be made available to stockholders if and when a transaction is to occur . Such documents are not currently available . 2

Executive Summary ▪ Armada Oil, Inc . ( OTCBB : AOIL ) (“Armada”) and Mesa Energy Holdings, Inc . ( OTCBB : MSEH ) (“Mesa”), both publicly quoted companies, have signed a non - binding letter of intent to merge their respective companies in a stock - for - stock transaction ▪ The combination would provide Armada shareholders access to stable, conventional production combined with a proven operational team ▪ The combination would provide Mesa shareholders with significant conventional and unconventional upside with a proven public company team ▪ The combined company would have a compelling “Public Company” story that should provide a better vehicle to maximize shareholder value via : • The combined company would become more attractive to different investor classes • The combined company would improve the prospects of a national exchange listing • Greater operational mass would lower the cost of being public, as a percentage of revenue • A combined shareholder base would create a platform to enhance liquidity • The combination would create a basis for a lower cost of capital (both future equity and debt) as needed 3

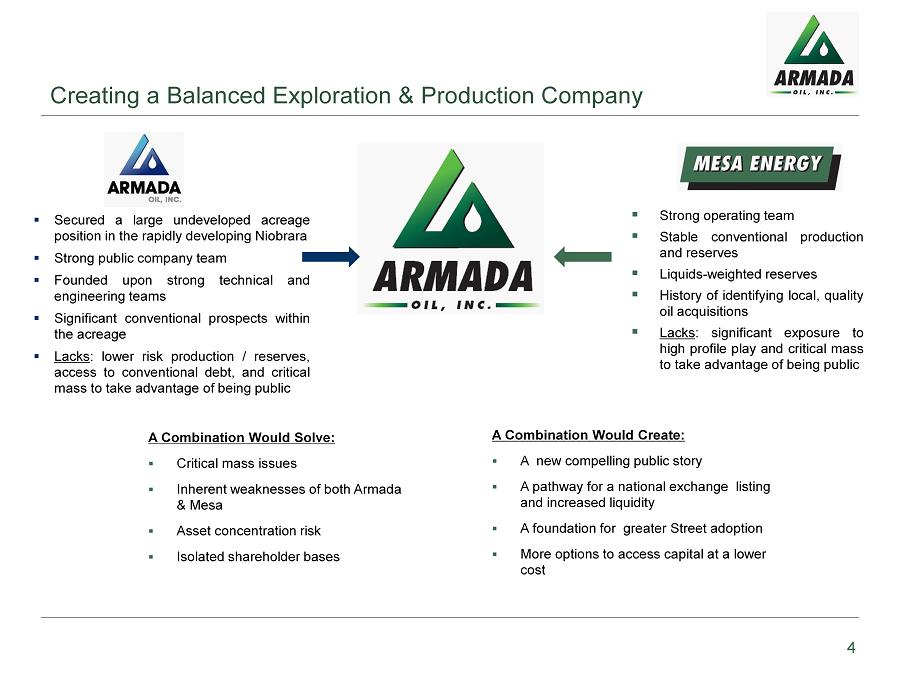

Creating a Balanced Exploration & Production Company 4 ▪ Secured a large undeveloped acreage position in the rapidly developing Niobrara ▪ Strong public company team ▪ Founded upon strong technical and engineering teams ▪ Significant conventional prospects within the acreage ▪ Lacks : lower risk production / reserves, access to conventional debt, and critical mass to take advantage of being public ▪ Strong operating team ▪ Stable conventional production and reserves ▪ Liquids - weighted reserves ▪ History of identifying local, quality oil acquisitions ▪ Lacks : significant exposure to high profile play and critical mass to take advantage of being public A Combination Would Solve: ▪ Critical mass issues ▪ Inherent weaknesses of both Armada & Mesa ▪ Asset concentration risk ▪ Isolated shareholder bases A Combination Would Create: ▪ A new compelling public story ▪ A pathway for a national exchange listing and increased liquidity ▪ A foundation for greater Street adoption ▪ More options to access capital at a lower cost

Merger Consideration Details ▪ Armada and Mesa have proposed a merger (the “Transaction”), resulting in Mesa's operating subsidiaries becoming wholly - owned subsidiaries of Armada, in exchange for a majority of Armada's stock ▪ Shareholders of Mesa would receive 0 . 325 shares of Armada for every share they hold of Mesa • As of the close on October 3 rd , 2012 , this represents approximately a 134 % premium to Mesa’s share price ▪ Upon closing of the Transaction, Mesa shareholders would own approximately 57 % of Armada (on an actual basis, assuming no exercise of warrants, options, or convertible securities) ▪ Armada and Mesa have engaged C . K . Cooper & Company as the financial advisor to the Transaction ▪ Expected to close by year end 2012 , subject to customary conditions : • Consummation of the Transaction remains contingent upon compliance with and/or full satisfaction or waiver of all of the following conditions : ▪ Satisfactory completion of legal, technical and financial due diligence by both Parties, in their sole discretion . ▪ Obtaining all consents and approvals of the Transaction, including all legal and regulatory approvals and all applicable shareholder, board of directors, company, and any other necessary approvals required by third parties, that may be required for both Parties to consummate the Transaction and execute the Definitive Agreements . ▪ Completion and agreement on all final terms and conditions of all documents and instruments required to conclude the Transaction including, without limitation, the Definitive Agreements, and the proper execution thereof . ▪ There having occurred no material adverse change in the business or condition, financial or otherwise, of either (a) Mesa and its subsidiaries, taken as a whole, or (b) Armada and its subsidiaries, taken as a whole, subsequent to October 1 , 2012 . ▪ Such other agreed and/or customary conditions to closing as may be set forth in the Definitive Agreements . ▪ No binding agreement has been signed, and the proposed terms are subject to change 5

Proposed New Management Team & Directors 6 Randy M . Griffin | Chief Executive Officer, Chairman ▪ 35 years of broad business development and management experience ▪ Co - founded Mesa Energy, LLC (later Mesa Energy, Inc . ) in 2003 ; took Mesa Energy, Inc . public in 2007 ▪ From 2001 to 2003 , held various executive positions in a group of affiliated oil and gas companies, including President of Southwest Land Management, L . P . and Americo Gas Pipeline, LLC ▪ Graduated from East Texas State University in 1975 with a degree in Finance and Business Management James J . Cerna, Jr . | President, Director ▪ 20 years experience in the energy industry and publicly traded companies ▪ From 2006 to 2009 , served as Chairman of the Board and CEO of Lucas Energy, Inc . (NYSE Amex : LEI) ▪ From 2004 to 2006 , served as President of the privately held Lucas Energy Resources ▪ Prior to joining Lucas Energy, was the Chief Oil and Gas Analyst and CFO of Petroleum Partners LLC from 2001 to 2004 ▪ Received five certificates of achievement from the Institute of Chartered Financial Analysts Ray L . Unruh | Chief Operating Officer, Director ▪ Over 40 years of experience in business management, finance and business development ▪ Served as Vice President of Santa Fe Petroleum, LLC and President of TexTron Southwest, LLC ▪ Performed management and financial consulting services for Texas Northern Oil Company and Phoenix Resources, LLC ▪ Owned and operated Red River Energy and Supply Company in the early 1980 ’s ▪ Attended Oklahoma State University, where he majored in Business Administration and Finance Rachel L . Dillard | Chief Financial Officer ▪ Began career with CDX Gas, LLC as a consultant to the CEO and CFO and later served as Director of Financial Services ▪ Served as an Accountant for Rising Star Energy, LLC ; Republic Energy, Inc .; and Longview Production Company ▪ Has provided accounting services to TransAtlantic Petroleum Corporation ; Westside Energy Corporation ; Crusader Energy Group, Inc .; and Luminant, a subsidiary of Energy Future Holdings (formerly TXU Corp . ) ▪ From 2009 to 2011 , served as the FDIC in various accounting capacities, including Financial Institution Accountant and Accounting Technical Monitor of a national servicer of a loan portfolio exceeding $ 1 billion ▪ Earned her degree in Business Administration with an Emphasis in Accounting, cum laude, from the University of Texas at Dallas ▪ Licensed by the State of Texas as a CPA

Proposed Non - Executive Board of Directors 7 David J . Moss | Director ▪ Director of Pegasi Energy Resources Corporation (OTCBB : PGSI) and was responsible for their initial capital raise and public listing ▪ Managing Director of Energi Management and Energi Drilling Partners, an active drilling fund ▪ Led the acquisition of Digital Orchid, Inc . and renamed the company Sorteo Games, LLC, which operates the only government - regulated, revenue - generating mobile national lottery systems and is a leading provider of server - based wireless, Web and electronic lottery systems ▪ Was instrumental in the purchase and restructuring of Mirapoint Software, Inc . and helped finance and take public CommerceTel (OTCBB : MFON) and Tonix Pharmaceuticals (OTCBB : TNXP) ▪ Previously served as a Managing Partner at a Seattle - based venture capital firm, The Phoenix Partners with $ 110 MM under management, where he ran their healthcare portfolio ▪ Holds an M . B . A . from Rice University and a B . A . in Economics from the University of California, San Diego Kenneth T . Hern | Director ▪ 25 - year career with independent oil giant Texaco, now part of Chevron, where he served as President of Texaco Saudi, Inc . from 1981 - 1984 ; as Vice Chairman and Managing Director of Texaco Nigeria Limited, from 1984 through 1989 ; and as President of Texaco Brazil from 1989 through 1993 ▪ Serves on the Board of Directors of Flotek Industries, Inc . , a supplier of drilling and production - related products and services to the energy and mining industries ▪ Previously served as Chairman of the Board and CEO of Nova Biosource Fuels, Inc . ▪ Earned a B . A . in Chemistry from Austin College and a Master of Science in Organic Chemistry from North Texas State University Two additional independent Board members to be mutually agreed on and selected

Combined Areas of Operations 8 Casper/Niobrara Gulf Coast Mississippian Lime Conventional Production Conventional and Unconventional Potential Unconventional Potential Corporate Headquarters Dallas

Combined Company Vision ▪ The new company would be focused on growing its cash flowing, conventional assets, while beginning the development of its unconventional properties : • Continue re - working and developing Louisiana properties • Begin drilling at least 1 Mississippian Lime well per quarter, while industry continues to prove up the play • Continue seismic shoot on Wyoming acreage to further identify conventional & unconventional sweet - spots • Start drilling Casper/Niobrara wells on the Wyoming acreage, while industry continues to prove up the play ▪ The combination of strong cash flowing assets and the significant upside potential of the two unconventional plays would make the combined company a balanced investment opportunity ▪ The combination would create a better platform to high - grade onto a national exchange, which would help facilitate investor awareness, transparency, and liquidity 9

Overview of Armada Oil, Inc.

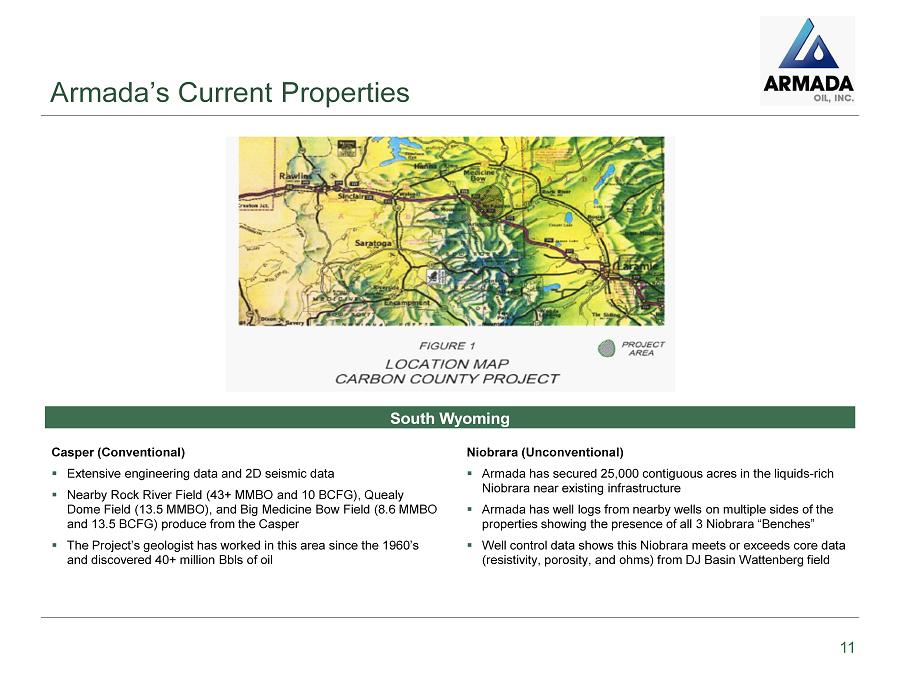

Armada’s Current Properties South Wyoming Casper (Conventional) ▪ Extensive engineering data and 2D seismic data ▪ Nearby Rock River Field (43+ MMBO and 10 BCFG), Quealy Dome Field (13.5 MMBO), and Big Medicine Bow Field (8.6 MMBO and 13.5 BCFG) produce from the Casper ▪ The Project’s geologist has worked in this area since the 1960’s and discovered 40+ million Bbls of oil Niobrara (Unconventional) ▪ Armada has secured 25,000 contiguous acres in the liquids - rich Niobrara near existing infrastructure ▪ Armada has well logs from nearby wells on multiple sides of the properties showing the presence of all 3 Niobrara “Benches” ▪ Well control data shows this Niobrara meets or exceeds core data (resistivity, porosity, and ohms) from DJ Basin Wattenberg field 11

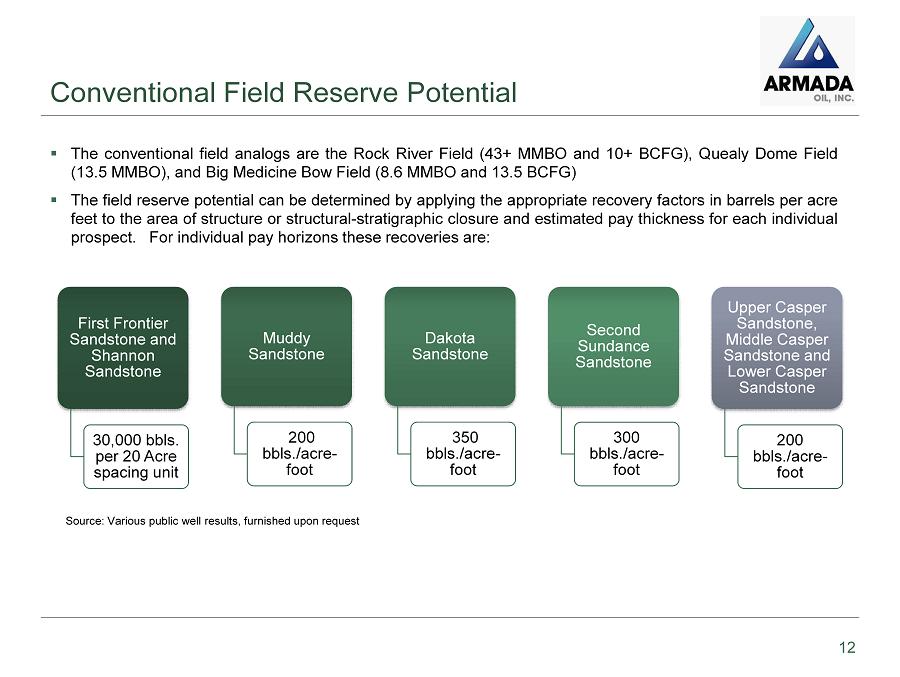

Conventional Field Reserve Potential 12 ▪ The conventional field analogs are the Rock River Field ( 43 + MMBO and 10 + BCFG), Quealy Dome Field ( 13 . 5 MMBO), and Big Medicine Bow Field ( 8 . 6 MMBO and 13 . 5 BCFG) ▪ The field reserve potential can be determined by applying the appropriate recovery factors in barrels per acre feet to the area of structure or structural - stratigraphic closure and estimated pay thickness for each individual prospect . For individual pay horizons these recoveries are : First Frontier Sandstone and Shannon Sandstone 30,000 bbls. per 20 Acre spacing unit Muddy Sandstone 200 bbls./acre - foot Dakota Sandstone 350 bbls./acre - foot Second Sundance Sandstone 300 bbls./acre - foot Upper Casper Sandstone, Middle Casper Sandstone and Lower Casper Sandstone 200 bbls./acre - foot Source: Various public well results, furnished upon request

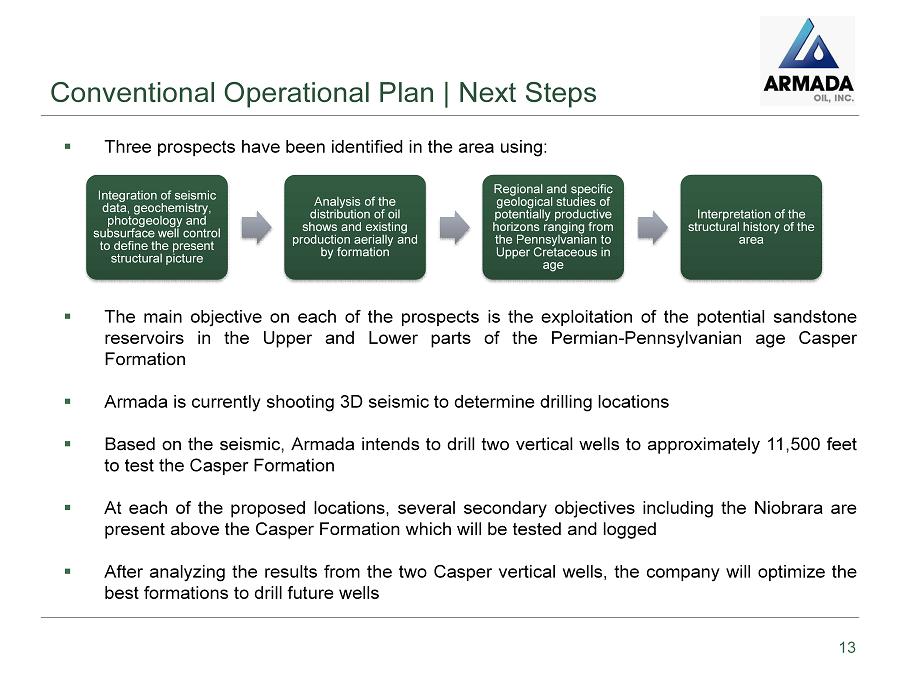

Conventional Operational Plan | Next Steps 13 ▪ Three prospects have been identified in the area using : ▪ The main objective on each of the prospects is the exploitation of the potential sandstone reservoirs in the Upper and Lower parts of the Permian - Pennsylvanian age Casper Formation ▪ Armada is currently shooting 3 D seismic to determine drilling locations ▪ Based on the seismic, Armada intends to drill two vertical wells to approximately 11 , 500 feet to test the Casper Formation ▪ At each of the proposed locations, several secondary objectives including the Niobrara are present above the Casper Formation which will be tested and logged ▪ After analyzing the results from the two Casper vertical wells, the company will optimize the best formations to drill future wells Integration of seismic data, geochemistry, photogeology and subsurface well control to define the present structural picture Analysis of the distribution of oil shows and existing production aerially and by formation Regional and specific geological studies of potentially productive horizons ranging from the Pennsylvanian to Upper Cretaceous in age Interpretation of the structural history of the area

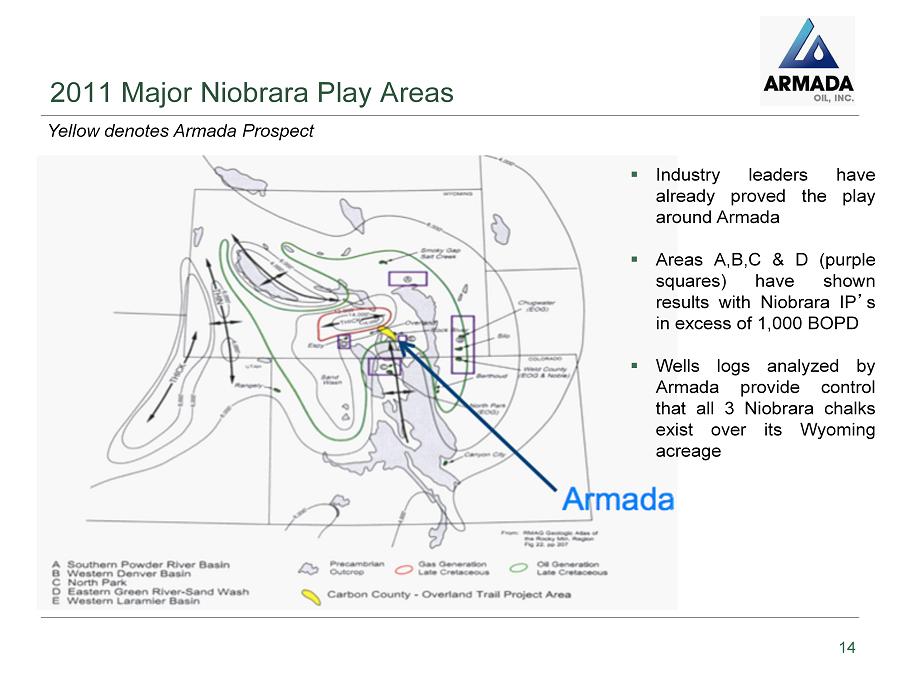

2011 Major Niobrara Play Areas 14 Yellow denotes Armada Prospect ▪ Industry leaders have already proved the play around Armada ▪ Areas A,B,C & D (purple squares) have shown results with Niobrara IP ’ s in excess of 1 , 000 BOPD ▪ Wells logs analyzed by Armada provide control that all 3 Niobrara chalks exist over its Wyoming acreage

Niobrara Horizontal | Dramatic Improvements Underway 15 PDC ENERGY ANADARKO NOBLE ▪ First 7 wells: EUR 300 MBOE, Capex per well: $4.2M ▪ Last 8 wells: EUR 500 MBOE, Capex per well: $ 4.2M ▪ EURs: 300 – 600 MBOE per well ▪ Initial well costs: $4.0 - $ 5.0M ▪ Liquids ratio: 70 % ▪ EURs: 355+ MBOE per well ▪ Liquids ratio: 60 - 80% Source: PDC Energy March 29, 2012 Presentation Source: Anadarko April 24, 2012 Press Release Source: Noble Energy February 2012 Presentation

Overview of Mesa Energy Holdings, Inc.

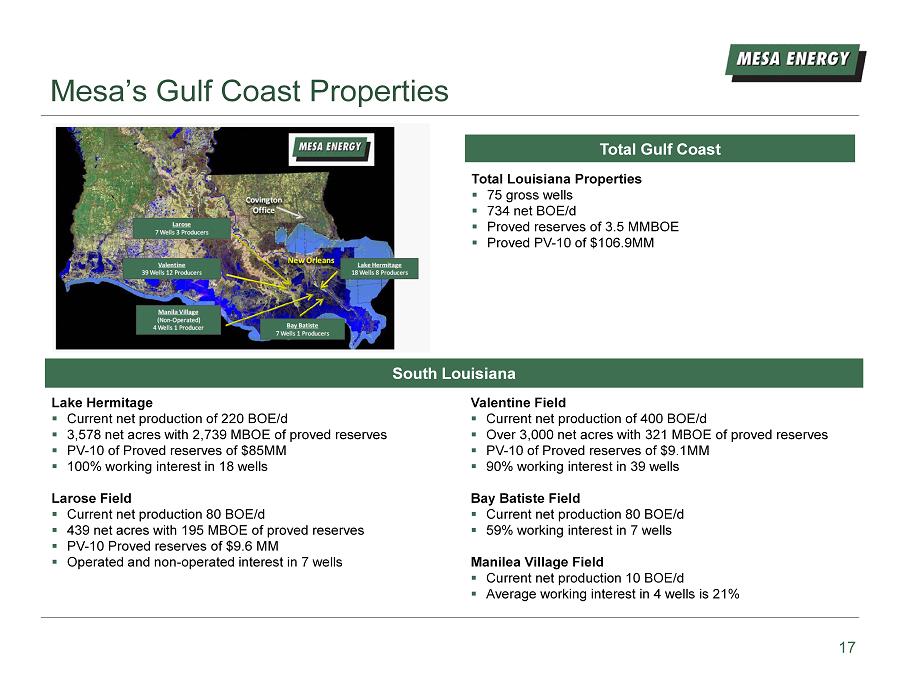

Mesa’s Gulf Coast Properties 17 South Louisiana Lake Hermitage ▪ Current net production of 220 BOE/d ▪ 3,578 net acres with 2,739 MBOE of proved reserves ▪ PV - 10 of Proved reserves of $85MM ▪ 100% working interest in 18 wells Larose Field ▪ Current net production 80 BOE/d ▪ 439 net acres with 195 MBOE of proved reserves ▪ PV - 10 Proved reserves of $9.6 MM ▪ Operated and non - operated interest in 7 wells Valentine Field ▪ Current net production of 400 BOE/d ▪ Over 3,000 net acres with 321 MBOE of proved reserves ▪ PV - 10 of Proved reserves of $9.1MM ▪ 90% working interest in 39 wells Bay Batiste Field ▪ Current net production 80 BOE/d ▪ 59% working interest in 7 wells Manilea Village Field ▪ Current net production 10 BOE/d ▪ Average working interest in 4 wells is 21% Total Gulf Coast Total Louisiana Properties ▪ 75 gross wells ▪ 734 net BOE/d ▪ Proved reserves of 3.5 MMBOE ▪ Proved PV - 10 of $106.9MM 17

Gulf Coast Reserves 18 Net Oil/NGL Net Gas PV-10 $ Millions (MBbl) (MMCF) ($MM) Proved Producing 545 2,611 $33.8 Proved Shut-in - 124 0.2 Proved Behind Pipe 54 710 4.9 Proved Undeveloped 1,601 4,424 68.8 Proved Abandonment - - (0.8) Total Proved Reserves (1) 2,200 7,869 $106.9 Probable Behind Pipe 10 75 $0.6 Probable Undeveloped 5,798 20,703 249.0 Probable Abandonment - - 2.0 Total Probable 5,807 20,778 $251.6 Possible 6,894 12,236 $272.5 Total 3P Reserves (1) 14,901 40,883 $631.1 (1) Reserves per engineering reports prepared by Collarini Associates; based on strip pricing as of 12/31/11 ▪ Mesa has identified 58 potential well sites in its Lake Heritage Field • 9 locations have significant proved undeveloped reserves with multiple stacked pay zones • Plans to develop 7 potential high - value drilling locations ▪ Several work - overs and recompletions can immediately enhance production

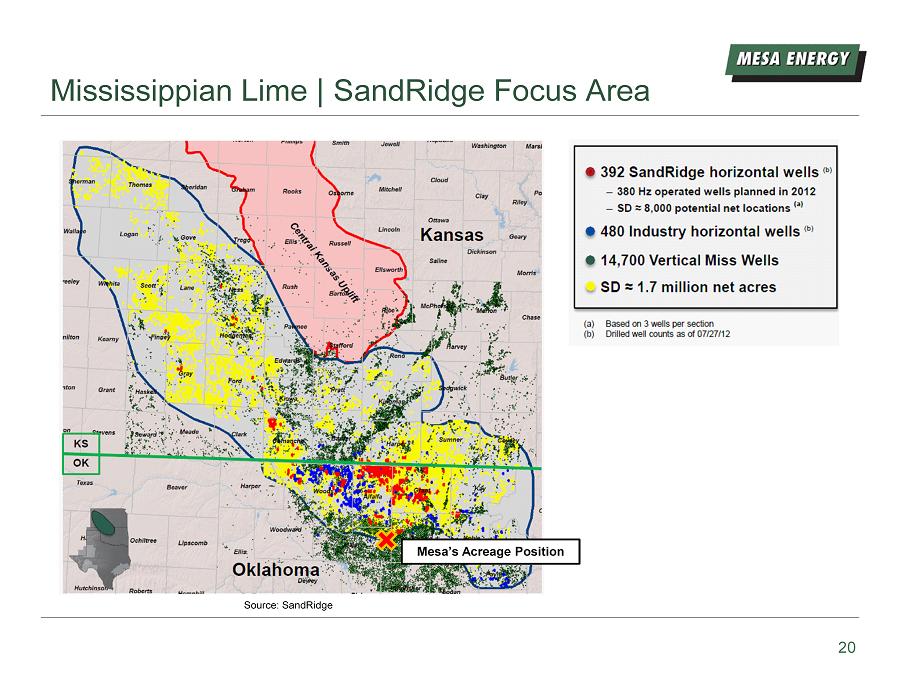

Overview of Mississippian Lime Mississippian Lime Play Map “ We compare the scope of this play to the Bakken and believe it will be transformational for the Mid - Continent region of the United States” – Tom Ward, CEO of SandRidge , Dec. 22, 2011 Sources: David Housh / Tulsa World and Mesa Mesa’s Acreage Position The Mississippian Lime is an oil - rich carbonate play covering 6 . 5 million acres in Oklahoma and Kansas ▪ The play has been developed with vertical wells for over 30 years ▪ Several thousand vertical wells surround Mesa’s acreage position and with current and past Mississippian production, have provided a wealth of data ▪ Eagle Energy reported the completion of the first horizontal Mississippian well in 2010 ▪ Chesapeake and SandRidge are the largest acreage holders with several significant players amassing positions (including Apache, Shell and Range Resources) ▪ Representative wells are 5 , 000 to 7 , 000 feet deep and generate IP rates of 300 - 600 barrels of oil per day and EURs of 250 - 500 MBOE 19 Mississippian Lime oil producing formations

Mississippian Lime | SandRidge Focus Area Source: SandRidge Mesa’s Acreage Position 20

Mesa’s Mississippian Lime Development Opportunity Turkey Creek Project Map Mesa has identified attractive oil - rich investment opportunities in the Mississippian Lime play in Oklahoma ▪ To date, Mesa has leased or is in the process of farming into approximately 3 , 215 acres in Major and Garfield Counties ▪ Mesa expects to lease additional acreage by the end of Q 4 2012 ▪ Partnered with a local operator, Wentworth Operating Company ▪ Lease terms are primarily 3 years with 2 year options, $ 350 /acre bonus and a 3 / 16 royalty ▪ Development plan consists of drilling 1 well each quarter, starting in Q 4 2012 ▪ Anticipate total drill and completion costs not to exceed $ 4 M per well 21

A New Company with Size and Development Runway

Proposed Merger Highlights 23 Would bring together a sound, proven management team with both operational and public company experience Strong conventional, producing assets would provide cash flow and an underlying value to the combined shareholders Low - cost entry into the Niobrara play with multiple underlying conventional prospects would leverage the combined company to significant upside An attractive foothold in the Mississippian Lime play in Oklahoma The combined company would have critical mass to help raise capital efficiently, facilitate liquidity and spur rapid growth, thereby creating a solid platform to recognize value for shareholders

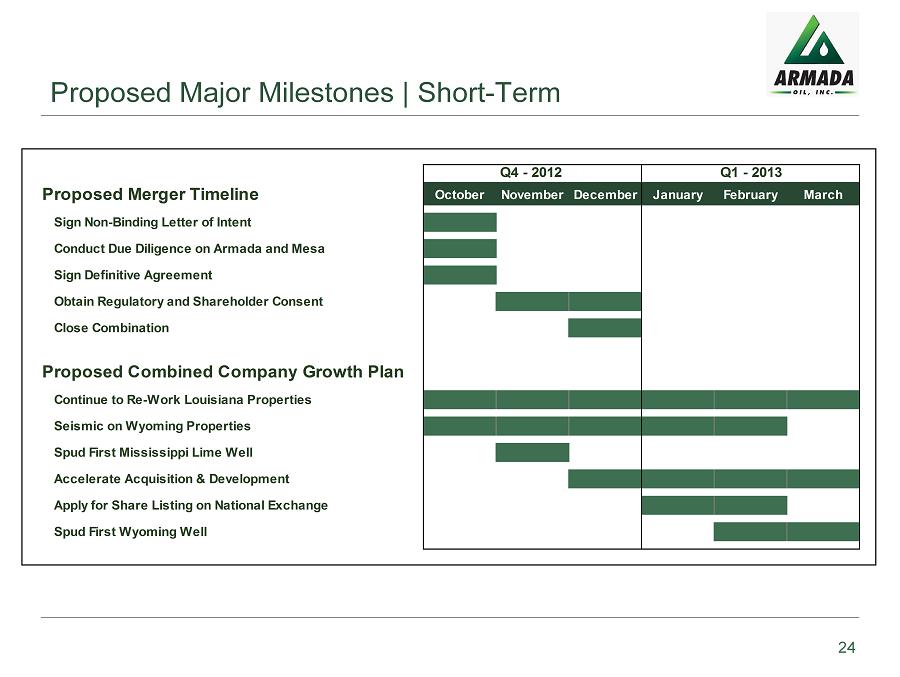

Proposed Major Milestones | Short - Term 24 Proposed Merger Timeline October November December January February March Sign Non-Binding Letter of Intent Conduct Due Diligence on Armada and Mesa Sign Definitive Agreement Obtain Regulatory and Shareholder Consent Close Combination Proposed Combined Company Growth Plan Continue to Re-Work Louisiana Properties Seismic on Wyoming Properties Spud First Mississippi Lime Well Accelerate Acquisition & Development Apply for Share Listing on National Exchange Spud First Wyoming Well Q4 - 2012 Q1 - 2013

Contact Information 25 Armada Oil, Inc. Investor Relations Briana Erickson 800.676.1006 Corporate Headquarters 10777 Westheimer Rd. | Suite 1100 Houston, TX 77042 800.676.1006 Website www.armadaoilinc.com Mesa Energy Holdings Inc. Investor Relations ir@mesaenergy.us 972.490.9595 Corporate Headquarters 5220 Spring Valley Rd.| Suite 615 Dallas, TX 75254 972.490.9595 Website www.mesaenergy.us