Attached files

| file | filename |

|---|---|

| EX-31.2 - Mesa Energy Holdings, Inc. | v224844_ex31-2.htm |

| EX-31.1 - Mesa Energy Holdings, Inc. | v224844_ex31-1.htm |

| EX-32.1 - Mesa Energy Holdings, Inc. | v224844_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2010

Commission file number: 0-53972

MESA ENERGY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

98-0506246

|

|

|

(State or other jurisdiction of incorporation

or organization)

|

(IRS Employer Identification No.)

|

|

|

5220 Spring Valley Road, Suite 525

Dallas, Texas

|

75254

|

(972) 490-9595

|

|

(Address of principal executive office)

|

(Zip Code)

|

(Registrant’s telephone number, Including area code)

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes¨ Nox

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2010, based on the closing sales price of the Common Stock as quoted on the OTCBB was $8,565,991. For purposes of this computation, all officers, directors, and 5 percent beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such directors, officers, or 5 percent beneficial owners are, in fact, affiliates of the registrant.

As of June 2, 2011, there were 48,704,159 shares of registrant’s common stock outstanding.

Table of Contents

|

|

Page

|

|

| Part I | ||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

19

|

|

Item 1B.

|

Unresolved Staff Comments

|

32

|

|

Item 2.

|

Properties

|

32

|

|

Item 3.

|

Legal Proceedings

|

32

|

|

Item 4.

|

(Removed and Reserved)

|

32

|

|

Part II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

33

|

|

Item 6.

|

Selected Financial Data

|

34

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

35 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

42

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

42

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

42 |

|

Item 9A.

|

Controls and Procedures

|

42

|

|

Item 9B.

|

Other Information

|

43

|

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

44

|

|

Item 11.

|

Executive Compensation

|

47

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

49

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

51 |

|

Item 14.

|

Principal Accounting Fees and Services

|

52

|

|

Part IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

53

|

|

Signatures.

|

55

|

|

2

PART I

|

ITEM 1.

|

BUSINESS

|

This Annual Report on Form 10-K (including the section regarding Management's Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our Management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading "Risks Factors” below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission ("SEC"). We make available on our website under "Investor Relations/SEC Filings," free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. Our website address is www.wpcs.com. You can also read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

This Annual Report on Form 10-K includes the accounts of Mesa Energy Holdings, Inc. and its wholly-owned subsidiaries, Mesa Energy, Inc. (“MEI”) and Mesa Energy Operating, LLC (“Mesa Operating”), collectively referred to as “we”, “us” or the "Company".

For definitions of certain oil and gas industry terms used in this Annual Report on Form 10-K, please see the Glossary beginning on page 16.

Overview of Our Business

We are an exploration stage company engaged primarily in the acquisition, development, and rehabilitation of oil and gas properties.

Our business plan is to build a strong, balanced and diversified portfolio of oil and gas reserves and production revenue through the development of highly diversified, multi-well developmental and defined-risk exploratory drilling opportunities and the acquisition of solid, long-term existing production with enhancement potential.

We are constantly evaluating opportunities in the United States’ most productive basins, and we currently have interests in two oil and gas projects:

|

|

·

|

Java Field, a natural gas development project in Wyoming County in western New York; and

|

|

|

·

|

Coal Creek Prospect, a natural gas developmental prospect in the Arkoma Basin of eastern Oklahoma.

|

3

Our operations have generated minimal revenues to date, with the first such revenues occurring in the third quarter of fiscal 2009.

History

MEI is a company whose predecessor entity, Mesa Energy, LLC, was formed in April 2003 to engage in the oil and gas industry. MEI’s primary oil and gas operations have historically been conducted through its wholly owned subsidiary, Mesa Operating. Mesa Operating is a qualified operator in the states of Texas, Oklahoma, and Wyoming. MEI is a qualified operator in the State of New York. Prior to our reverse merger, all of our historic field operations had been conducted by Mesa Operating. However, to avoid duplication of expense, we decided that MEI should be the operator of the Java Field and related properties in New York. Our operating entities have historically employed, and will continue in the future to employ, on an as-needed basis, the services of drilling contractors, other drilling related vendors, field service companies and professional petroleum engineers, geologists and landmen as required in connection with future drilling and future production operations.

On August 31, 2009, we closed a reverse merger transaction pursuant to which a wholly owned subsidiary of Mesa Energy Holdings, Inc. merged with and into MEI, and MEI, as the surviving corporation, became a wholly owned subsidiary of Mesa Energy Holdings, Inc.

Immediately following the closing of the reverse merger, under the terms of a Split-Off Agreement and a General Release Agreement, we transferred all of our pre-merger operating assets and liabilities to a wholly owned subsidiary of ours. Thereafter, pursuant to the Split-Off Agreement, we transferred all of the outstanding shares of capital stock of such subsidiary to Beverly Frederick, our pre-reverse merger majority stockholder, in exchange for (i) the surrender and cancellation of all 21,000,000 shares of our common stock held by that stockholder and (ii) certain representations, covenants and indemnities.

After the reverse merger and the split-off, Mesa Energy Holdings, Inc. succeeded to the business of MEI as its sole line of business, and all of Mesa Energy Holdings, Inc.’s then-current officers and directors resigned and were replaced by MEI’s officers and directors.

The reverse merger was accounted for as a reverse acquisition and recapitalization of MEI for financial accounting purposes. Consequently, the assets and liabilities and the historical operations that are reflected in Mesa Energy Holdings, Inc.’s financial statements for periods prior to the reverse merger are those of MEI and have been recorded at the historical cost basis of MEI, and Mesa Energy Holdings, Inc.’s consolidated financial statements for periods after completion of the reverse merger include both Mesa Energy Holdings, Inc.’s and MEI’s assets and liabilities, the historical operations of MEI prior to the reverse merger and Mesa Energy Holdings, Inc.’s operations from and after the closing date of the reverse merger.

General Philosophy

Our business plan is to build a strong, balanced and diversified portfolio of oil and gas reserves and production revenue through the development of highly diversified, multi-well developmental and defined-risk exploratory drilling opportunities and the acquisition of solid, long-term existing production with enhancement potential. We believe this approach may enable us to achieve steady reserve growth, strong earnings, and significant capital appreciation.

With the exception of the Coal Creek Project, as discussed below, we intend to operate, or directly control the operation of, through our wholly-owned subsidiaries or their designees, all properties that we own or acquire. In our opinion, the lack of control resulting from leaving operational control in the hands of third parties substantially increases the risks associated with oil and gas drilling, development and production.

We believe that a successful oil and gas development program should include:

|

|

·

|

Diversification – variety of location, depth, supporting data, oil vs. gas;

|

|

|

·

|

Volume – ownership of and/or participation in a large number of wells; and

|

|

|

·

|

Potential – the possibility of multiple payback of the initial investment.

|

4

We plan for our portfolio to ultimately consist of a balanced and diversified mix of multiple asset components that will include existing production plus developmental and defined-risk exploratory drilling opportunities with special emphasis on the three keys to success as outlined above. The developmental drilling program, we believe, should provide a relatively low risk method of achieving stable, repeatable growth in revenue and reserves. The existing production acquisition component in our business plan should provide a strong revenue base resulting in long-term stability. The exploratory drilling component, although higher risk than the other two components, provides an opportunity for significant growth due to higher rates of return on capital (in the form of multiple payback of the initial investment). We generally look for exploratory projects with multiple well development potential and an estimated payback of at least four times the amount of capital invested.

Various federal and state regulations regarding the discharge of materials into the environment are applicable to our operations. We maintain strict compliance with these regulations and endeavor to do all we can to make certain that the environment is protected in and around our operations. The cost of environmental control facilities and efforts is included as a line item in the budget of each operation as appropriate. We anticipate no extraordinary capital expenditures for environmental control facilities related to any of our existing operations for the current fiscal year.

Oil and Gas Industry Overview

E&P companies explore for and develop oil and natural gas reserves in various basins around the world. The capital spending budgets of domestic E&P companies have grown in recent years as tight supply conditions and strong global demand have spurred companies to expand their operations. According to various industry publications, drilling and completion spending grew by an estimated 29% from 2002 to 2008. Following a 22% projected decline in spending from 2008 to 2009, drilling and completion spending is again projected to grow at a compound annual growth rate of approximately 5% from 2009 to 2014. Much of this growth is expected to come from a need to compensate for accelerating depletion rates in existing domestic oil and natural gas reservoirs, improved E&P technologies and an increase in demand for natural gas, especially from power generation.

Due to the unprecedented level of exploration expenditures in recent years, U.S. and Canadian rig counts increased dramatically between 2002 and 2008. According to a report prepared by Spears & Associates, Inc., following an approximately 14% and 7% projected decline in U.S. and Canadian rig counts respectively from 2008 to 2009, U.S. and Canadian rig counts are again expected to increase at a compound annual growth rate of approximately 3% and 1%, respectively, between 2009 and 2014. Furthermore, more technically sophisticated drilling methods, such as horizontal drilling, combined with higher oil and natural gas prices relative to long term averages, are making E&P in previously underdeveloped areas like Appalachia and the Rockies more economically feasible. As part of this trend, there has been growing commercial interest in several shale deposit areas in the U.S., including the Bakken, Barnett, Fayetteville, Haynesville and Marcellus shales.

The Shale Gas Business

Natural gas production from hydrocarbon rich shale formations, known as “shale gas,” is one of the most rapidly expanding trends in onshore domestic oil and gas exploration and production today. In some areas, this has included bringing drilling and production to regions of the country that have seen little or no activity in the past. Natural gas plays a key role in meeting U.S. energy demands. Natural gas, coal and oil supply about 85% of the nation’s energy, with natural gas supplying about 22% of the total. The percent contribution of natural gas to the U.S. energy supply is expected to remain fairly constant for the next 20 years. The United States has abundant natural gas resources. The Energy Information Administration estimates that the U.S. has more than 1,744 trillion cubic feet (tcf) of technically recoverable natural gas, including 211 tcf of proved reserves (the discovered, economically recoverable fraction of the original gas-in-place). Technically recoverable unconventional gas (shale gas, tight sands, and coalbed methane) accounts for 60% of the onshore recoverable resource.

Although forecasts vary in their outlook for future demand for natural gas, they all have one thing in common: natural gas will continue to play a significant role in the U.S. energy picture for some time to come. The lower 48 States have a wide distribution of highly organic shales containing vast resources of natural gas. Already, the Barnett Shale play in Texas produces 6% of all natural gas produced in the lower 48 States.

Three factors have come together in recent years to make shale gas production economically viable: (1) advances in horizontal drilling, (2) advances in hydraulic fracturing, and (3) increases in natural gas prices in the last several years as a result of significant supply and demand pressures. Analysts have estimated that by 2011, most new reserves growth (50% to 60%, or approximately 3 bcf/day) will come from unconventional shale gas reservoirs. The total recoverable gas resources in four shale gas plays (the Haynesville, Fayetteville, Marcellus, and Woodford) may be over 550 tcf. This potential for production in the known onshore shale basins, combined with other unconventional gas plays, is predicted to contribute significantly to the U.S.’s domestic energy outlook.

5

Shale gas is natural gas produced from shale formations that typically function as both the reservoir and source for the natural gas. Gas shales are organic-rich shale formations that were previously regarded only as source rocks and seals for gas accumulating in the stratigraphically-associated sandstone and carbonate reservoirs of traditional onshore gas development. Shale is a sedimentary rock that is predominantly comprised of consolidated clay-sized particles. Shales are deposited as mud in low-energy depositional environments such as tidal flats and deep water basins where the fine-grained clay particles fall out of suspension in these quiet waters. The clay grains tend to lie flat as the sediments accumulate and subsequently become compacted as a result of additional sediment deposition. This results in mud with thin laminar bedding that lithifies (solidifies) into thinly layered shale rock. The very fine sheet-like clay mineral grains and laminated layers of sediment result in a rock that has limited horizontal permeability and extremely limited vertical permeability. This low permeability means that gas trapped in shale cannot move easily within the rock except over geologic expanses of time (millions of years). Shale gas is stored both as free gas in fractures and as absorbed gas on kerogen and clay surfaces within the shale matrix.

Oil and Natural Gas Leases

General

The typical oil and natural gas lease agreement provides for the payment of royalties to the mineral owner for all oil and natural gas produced from any well(s) drilled on the leased premises. This amount will typically range from 1/8th (12.5%) resulting in a 87.5% net revenue interest to us to 3/16th (18.75%) resulting in an 81.25% net revenue interest to us for most leases we directly acquire.

Because the acquisition of leases is a very competitive process and involves certain geological and business risks to identify productive areas, prospective leases are often held by other oil and natural gas companies. In order to gain the right to drill these leases, we may elect to farm-in leases and/or purchase leases from other oil and natural gas companies. Many times, the assignor of such leases and/or lease brokers or finders will reserve an overriding royalty interest (an “ORRI”), which may further reduce the net revenue interest available to us to between 75% and 80%.

Oil and natural gas leases generally have a primary term of three to five years but provide that if wells on the property are producing or drilling is underway, the lease continues and is said to be “held by production” for as long as the production continues.

Participations

On rare occasions, the mineral owner may elect to joint venture with us and participate for his royalty interest in the drilling unit. In this event, our working interest ownership would be reduced by the amount retained by the third party. In all other instances, we anticipate owning a 100% working interest in newly drilled wells.

Commodity Price Environment

Generally, the demand for and the price of natural gas increases during the colder winter months and decreases during the warmer summer months. Pipelines, utilities, local distribution companies and industrial users utilize natural gas storage facilities and purchase some of their anticipated winter requirements during the summer, which can lessen seasonal demand fluctuations. Crude oil and the demand for heating oil are also impacted by seasonal factors, with generally higher prices in the winter. Seasonal anomalies, such as mild winters, sometimes lessen these fluctuations.

Our results of operations and financial condition are significantly affected by oil and natural gas commodity prices, which can fluctuate dramatically. Commodity prices are beyond our control and are difficult to predict. Although we do not currently plan to hedge any of our production, it is likely that hedges will be a requirement of any senior debt facility that we put in place for future acquisitions.

6

Java Field Natural Gas Development Project – Wyoming County, New York

Overview

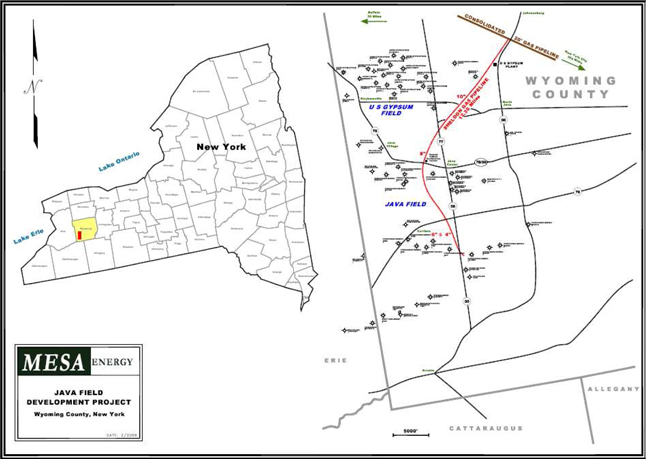

On August 31, 2009, we acquired the Java Field, a natural gas development project in Wyoming County in western New York. The acquisition included a 100% working interest in 19 leases held by production covering approximately 3,235 mineral acres, 19 existing natural gas wells, two tracts of land totaling approximately 36 acres and two pipeline systems, including a 12.4 mile pipeline and gathering system that serves the existing field as well as a separate 2.5 mile system located east of the field. Our average net revenue interest (NRI) in the leases is approximately 78%. The following map shows the location of the Java Field.

History

The wells in the Java Field were originally drilled in the 1970s through the Devonian Shales to the Medina Sandstone at around 3,000 feet in depth. The primary intent at that time was to access natural gas production to be used locally to heat homes, businesses and farms. Many of these wells had strong gas shows in the Devonian Shale, but the prevailing attitude of the day was that the shales were not economically viable. The Barnett Shale of north central Texas was viewed the same way for decades until Mitchell Energy Company decided in the mid 1990’s to try a new frac technology on one of the wells they had drilled through the shale. Since then, thousands of wells have been drilled in the Barnett Shale, and it has become one of the largest natural gas fields in the United States. It is our belief that a similar situation may exist in the northern Appalachian basin, and specifically in the area of the Java Field.

7

Area Overview

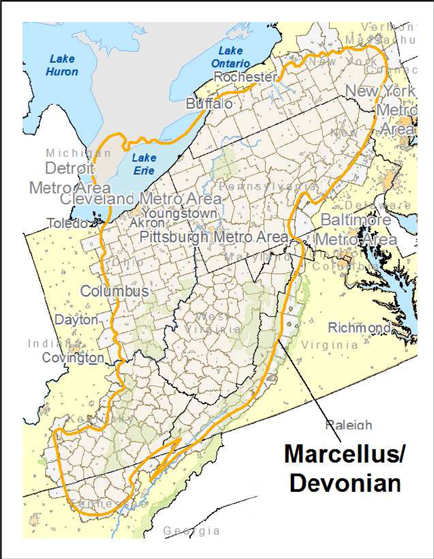

The Java Field is at the northern end of the Marcellus Shale trend which spans approximately 600 miles extending from West Virginia to western New York. In April 2009, the United States Department of Energy estimated the Marcellus to contain 262 trillion cubic feet of recoverable gas. Most of the existing activity is farther south in Pennsylvania and West Virginia. Companies such as Range Resources, Chesapeake Energy and Atlas Resources hold significant Marcellus acreage positions in Pennsylvania and West Virginia. They have spent the last few years leasing acreage and refining their drilling and fracturing techniques and, according to various industry publications and company news releases, have recently experienced significant increases in initial production rates from their Marcellus Shale wells. The Marcellus Shale is deeper in that area, generally being found at 6,000 to 7,000 feet. However, the shallower, more northern portion of the play in northern Pennsylvania and western New York has not yet been extensively explored. The northern portion of the play is not as deep (resulting in lower drilling costs) and is close to large domestic markets with extensive pipeline infrastructure already in place.

Marcellus Shale in the Appalachian Basin

Geologic Analysis

Currently, the principal producing zone of the Java Field is the Medina Sandstone. The Medina Sandstone is a blanket, gas-producing sand at approximately 3,000 feet that is widely produced in the area. We believe the Medina has significant potential for expansion using modern fracturing and/or horizontal technology.

In addition, there have recently been new wells drilled to the Theresa Sandstone at approximately 6,000 feet to the southwest of the Java Field, and we believe that the Theresa fairway may extend southwest to northeast across the southern portion of the Java Field acreage.

8

Uphole from the Medina is the Hamilton Group. Although the primary target is the Marcellus Shale, which is the deepest member of the Hamilton Group, there are at least three shale members above the Marcellus, each of which, we believe, has significant production potential.

Reserve Information

This presentation of proved reserve quantities provides estimates only and should be read in connection with Note 11 to our consolidated financial statements – “Supplemental Information on Oil and Gas Exploration, Development and Production Activities (Unaudited).” These estimates are consistent with current knowledge of the characteristics and production history of the reserves. We emphasize that reserve estimates are inherently imprecise and that estimates of new discoveries are more imprecise than those of producing oil and gas properties. Accordingly, significant changes to these estimates can be expected as future information becomes available.

Proved reserves are those estimated reserves of crude oil (including condensate and natural gas liquids) and natural gas that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. Proved developed reserves are those expected to be recovered through existing wells, equipment, and operating methods.

The reserve estimates set forth below were prepared by Chadwick Energy Consulting, Inc. (Chadwick), using reserve definitions and pricing requirements prescribed by the SEC. Chadwick is a professional engineering firm specializing in the technical and financial evaluation of oil and gas assets. Chadwick’s report was conducted under the direction of Jeffrey A. Chadwick, President of Chadwick. Chadwick used a combination of production performance, offset analogies, seismic data and their interpretation, subsurface geologic data and core data, along with estimated future operating and development costs as provided by the Company and based upon historical costs adjusted for known future changes in operations or development plans, to estimate our reserves.

We had total estimated proved developed reserves of 122,986 mcf, and no estimated proved undeveloped reserves, of natural gas at December 31, 2010.

Project Potential

Operators in Pennsylvania and West Virginia have had success drilling and completing the Marcellus Shale using techniques similar to those used in the Barnett Shale. Although we would not expect the reserves and initial production rates in the Java Field to be as favorable as the wells being drilled in Pennsylvania and West Virginia, the drilling and completion costs in our area should be significantly lower due to the shallower depths, which, we believe, will result in economics that rival the deeper wells.

We believe we can potentially drill and complete up to 80 vertical Marcellus Shale wells on the project acreage at an estimated per well cost of less than $500,000 with very little risk of dry holes. We do not have the capital, however, to begin drilling these wells at this time and we will need to raise capital through the sale of our debt or equity to obtain the needed development funds. There can be no assurance that additional financing will be available in amounts or on terms acceptable to us, if at all.

Many of the wells drilled in the Marcellus Shale in Pennsylvania and West Virginia are horizontal, and, at some point, we expect to drill a horizontal well to test the concept in this field. We believe that a horizontal well at this depth could be drilled and completed for $1.0 million to $1.2 million and that it could reasonably be expected to produce at much higher rates than the vertical wells. However, because Marcellus Shale wells have not yet been drilled on the property, formal proved reserve reports relating to the Java Field are not yet possible and there can be no assurance that our expectations will prove out. In addition, the State of New York is not currently issuing permits for horizontal drilling in the Marcellus Shale pending the outcome of an environmental review of the impacts of hydraulic fracturing in the Marcellus shale in New York.

The current production on the Java Field is being sold to a local manufacturing plant that accepts gas deliveries an average of 18 days per month. However, higher levels of production generated as a result of field expansion and development would be sold, we expect, not only to the manufacturing plant but also into a public intrastate transportation line located approximately 12 miles north of the Java Field. Our Java Field pipeline system has an existing tap into that line, which leads directly to the New York City area. Natural gas pricing in the area historically has averaged above posted NYMEX pricing and has occasionally been significantly above NYMEX pricing in peak winter months.

9

We believe the shale in the Java Field and surrounding area could provide an excellent opportunity to achieve significant daily production rates at a relatively low cost. In addition, the project offers the opportunity to drill a large number of wells in this “blanket” formation, resulting, we believe, in the potential to book significant reserves and develop a long term, repeatable drilling program.

Economic Factors

The Java Field and the associated pipeline systems were acquired on August 31, 2009. In addition to landowner royalties, a number of the leases carry additional burdens in the form of ORRI’s. As a result, the average NRI of the leases prior to closing was approximately 81%. As a part of the overall consideration, the purchase and sale agreement provided that the seller retain a 1% ORRI on each lease. We paid a finder’s fee for the Java Field of $110,000 to a finder as well as a 2% ORRI on the existing leases. As a result, the overall average NRI to us going forward will be approximately 78%.

Based on our internal estimates, we believe that the finding cost of natural gas to be produced from the Marcellus and associated shales in the Java Field will be approximately $1/mcf.

Plans for Development

We initially evaluated a number of the existing wells in order to determine the viability of the re-entry of existing wellbores for plug-back and re-completion of the wells in the Marcellus Shale. As a result of this evaluation, we selected the Reisdorf Unit #1 and the Ludwig #1 as our initial targets and these two wells were re-completed in the Marcellus Shale and fracked in May and June of 2010. The initial round of testing and analysis provided a solid foundation of data that strongly supports further development of the Marcellus in western New York. Formation pressures and flow-back rates were much higher than expected providing a clear indication of the potential of the resource. We now believe that shallow horizontal drilling, as is currently being done successfully at this depth in the Fayetteville Shale in northern Arkansas, is ultimately what is needed to maximize the resource. However, as indicated above, the current regulatory limits in New York regarding water volumes for hydraulic fracturing have rendered that approach unfeasible for the time being. As soon as the New York Department of Environmental Conservation has completed its work relative to permitting of horizontal wells and is prepared to issue permits, we expect to proceed with the next phase of development of the property and the expansion of our acreage position in western New York. However, no assurances can be given that such permits will be granted by the State of New York this year, if at all. If we are unable to obtain a permit for horizontal Fracturing, our wells may not be commercially viable. In the mean time, enhancement of the existing wells and pipeline systems in the field is ongoing.

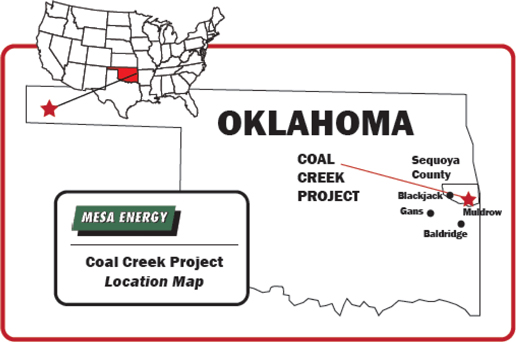

Coal Creek Prospect – Sequoyah County, Oklahoma

The Coal Creek Prospect is a developmental prospect targeting the Brent Sand, a shallow gas reservoir present in the Arkoma Basin of eastern Oklahoma. We have approximately 677 gross acres under lease near the town of Muldrow, Oklahoma. The following map shows the location of the Coal Creek Prospect.

10

We previously closed a “farm-out” transaction with Wentworth Operating Company of Edmond, OK (“Wentworth”), wherein we sold Wentworth our pipeline right-of-way and agreed to grant Wentworth an undivided 70% interest in all the leases following completion by Wentworth of construction of a natural gas gathering system and approximately three miles of pipeline to connect the Cook #1 and future wells to an Arkansas Oklahoma Gas Company (AOG) pipeline to the south. In addition, Wentworth agreed to fund, drill, and complete the Gipson #1, a direct offset to the Cook #1 and a twin well to the Eglinger #1 well.

As a result of amendments to the farm-out agreement with Wentworth, we own 35% of the working interest in the Cook #1 and 25% of the working interest in the Gipson #1, with Wentworth and other industry partners owning the balance. We believe there are multiple offset drilling locations and expect those locations to be drilled in the future as part of the overall development plan for the Coal Creek prospect.

Although our general philosophy is to operate all of our properties, we have a long-standing relationship with Wentworth and are comfortable with it as the operator of this property. Wentworth has a similar property that is only a few miles away and, as a result of this arrangement, both projects will be able to share a pipeline tap and processing facilities resulting in a significant cost savings to us. We believe other operational efficiencies will also result from this arrangement.

Plan of Operation for the Remainder of 2011

Two wells in our Coal Creek project have been completed and are currently producing and 17 wells in the Java Field are currently producing. In addition to our planned development program for the Java Field, and contingent upon our ability to raise additional capital, we may engage in additional expenditures over the next 12 months for the acquisition of producing properties and the drilling and/or re-completion of additional wells on owned or acquired acreage.

On June 1, 2011, we entered into an acquisition agreement wherein we will issue 20,000,000 common shares to acquire a 100% membership interest in a Louisiana company that owns and operates a producing field and has properties in four other fields under a Purchase and Sale Agreement. We expect this transaction to close on or before June 30, 2011. Acquisitions of this type could accelerate our growth, add proved developed reserves to our asset base and provide a strong foundation for future growth. There can be no assurance, however, that any acquisitions of the types described above will be consummated or, if consummated, will prove productive or profitable.

11

If the acquisition referenced above is successful, then we anticipate multiple workovers and re-completions in those fields in the second half of 2011 at an aggregate cost of approximately $1,300,000 and we will likely hire additional administrative and field personnel in the third quarter of 2011 to support that effort.

There can be no assurance, however, that the acquisition of these properties will be successful or that financing for the future development of these properties or the Java Field will be available to us or, if it is available, that it will be available on terms acceptable to us and that it will be sufficient to fund our needs. If we are unable to obtain the financing necessary to support these expenditures, we may not be able to proceed with our plan of operation.

Government Regulations

General

Our business is affected by numerous laws and regulations, including energy, environmental, conservation, tax and other laws and regulations relating to the energy industry. Most of our drilling operations will require permit or authorizations from federal, state or local agencies. Changes in any of these laws and regulations or the denial or vacating of permits could have a material adverse effect on our business. In view of the many uncertainties with respect to current and future laws and regulations, including their applicability to us, we cannot predict the overall effect of such laws and regulations on our future operations.

We believe that our operations comply in all material respects with applicable laws and regulations. There are no pending or threatened enforcement actions related to any such laws or regulations. We further believe that the existence and enforcement of such laws and regulations will have no more restrictive an effect on our operations than on other similar companies in the energy industry.

Proposals and proceedings that might affect the oil and gas industry are pending before Congress, the Federal Energy Regulatory Commission (“FERC”), state legislatures and commissions and the courts. We cannot predict when or whether any such proposals may become effective. In the past, the natural gas industry has been heavily regulated. There is no assurance that the regulatory approach currently pursued by various agencies will continue indefinitely. Notwithstanding the foregoing, we do not anticipate that compliance with existing federal, state and local laws, rules and regulations will have a material adverse effect upon our capital expenditures, earnings, or competitive position.

Historically, the transportation and sale of natural gas and its component parts in interstate commerce has been regulated under several laws enacted by Congress and the regulations passed under these laws by FERC. Our sales of natural gas, including condensate and liquids, may be affected by the availability, terms, and cost of transportation. The price and terms of access to pipeline transportation are subject to extensive federal and state regulation. From 1985 to the present, several major regulatory changes have been implemented by Congress and FERC that affect the economics of natural gas production, transportation and sales. In addition, FERC is continually proposing and implementing new rules and regulations affecting those segments of the natural gas industry, most notably interstate natural gas transmission companies that remain subject to FERC’s jurisdiction. These initiatives may also affect the intrastate transportation of gas under certain circumstances. The stated purpose of many of these regulatory changes is to promote competition among the various sectors of the natural gas industry.

The ultimate impact of the complex rules and regulations issued by FERC cannot be predicted. In addition, many aspects of these regulatory developments have not become final but are still pending judicial and final FERC decisions. We cannot predict what further action FERC will take on these matters. Some of FERC’s more recent proposals may, however, adversely affect the availability and reliability of interruptible transportation service on interstate pipelines. We do not believe that we will be affected by any action taken materially differently than other natural gas producers, gatherers and marketers with whom we compete.

12

State Regulation

Our operations are also subject to regulation at the state and in some cases, county, municipal and local governmental levels. Such regulation includes requiring permits for the drilling of wells, maintaining bonding requirements in order to drill or operate wells and regulating the location of wells, the method of drilling and casing wells, the surface use and restoration of properties upon which wells are drilled, the plugging and abandonment of wells, and the disposal of fluids used and produced in connection with operations. Our operations are also subject to various conservation laws and regulations pertaining to the size of drilling and spacing units or proration units and the unitization or pooling of oil and gas properties.

State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements, but, except as noted above, does not generally entail rate regulation. These regulatory burdens may affect profitability, but we are unable to predict the future cost or impact of complying with such regulations.

Environmental Matters

Our operations are subject to numerous federal, state and local laws and regulations controlling the generation, use, storage, and discharge of materials into the environment or otherwise relating to the protection of the environment. These laws and regulations may require the acquisition of a permit or other authorization before construction or drilling commences; restrict the types, quantities, and concentrations of various substances that can be released into the environment in connection with drilling, production, and natural gas processing activities; suspend, limit or prohibit construction, drilling and other activities in certain lands lying within wilderness, wetlands, and other protected areas; require remedial measures to mitigate pollution from historical and on-going operations such as use of pits and plugging of abandoned wells; restrict injection of liquids into subsurface strata that may contaminate groundwater; and impose substantial liabilities for pollution resulting from our operations. Environmental permits required for our operations may be subject to revocation, modification, and renewal by issuing authorities. Governmental authorities have the power to enforce compliance with their regulations and permits, and violations are subject to injunction, civil fines, and even criminal penalties. We believe that we are in substantial compliance with current environmental laws and regulations, and that we will not be required to make material capital expenditures to comply with existing laws.

Nevertheless, changes in existing environmental laws and regulations or interpretations thereof could have a significant impact on us as well as the natural gas and crude oil industry in general, and thus we are unable to predict the ultimate cost and effects of future changes in environmental laws and regulations.

We are not currently involved in any administrative, judicial or legal proceedings arising under domestic or foreign federal, state, or local environmental protection laws and regulations, or under federal or state common law, which would have a material adverse effect on our consolidated financial position or results of operations. Moreover, we maintain insurance against costs of clean-up operations, but we are not fully insured against all such risks. A serious incident of pollution may result in the suspension or cessation of operations in the affected area.

Superfund

The Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA"), also known as "Superfund," and comparable state statutes impose strict, joint, and several liability on certain classes of persons who are considered to have contributed to the release of a “hazardous substance" into the environment. These persons include the owner or operator of a disposal site or sites where a release occurred and companies that generated, disposed, or arranged for the disposal of the hazardous substances released at the site. Under CERCLA, such persons or companies may be retroactively liable for the costs of cleaning up the hazardous substances that have been released into the environment and for damages to natural resources, and it is common for neighboring land owners and other third parties to file claims for personal injury, property damage, and recovery of response costs allegedly caused by the hazardous substances released into the environment. In the course of our operations, we may generate waste that may fall within CERCLA's definition of a "hazardous substance." We may be jointly and severally liable under CERCLA or comparable state statutes for all or part of the costs required to clean up sites at which these wastes have been disposed. Although CERCLA currently contains a "petroleum exclusion" from the definition of “hazardous,” state laws affecting our operations impose cleanup liability relating to petroleum related products, including crude oil cleanups. In addition, although the Resource Conservation and Recovery Act of 1976, as amended (“RCRA”) regulations currently classify certain wastes which are uniquely associated with field operations as "non-hazardous," such exploration, development and production wastes could be reclassified by regulation as hazardous wastes thereby administratively making such wastes subject to more stringent handling and disposal requirements.

13

We currently own or lease, and have in the past owned or leased, numerous properties that for many years have been used for the exploration and production of natural gas and crude oil. Although we utilized standard industry operating and disposal practices at the time, hydrocarbons or other wastes may have been disposed of or released on or under the properties we owned or leased or on or under other locations where such wastes have been taken for disposal. In addition, many of these properties have been operated by third parties whose treatment and disposal or release of hydrocarbons or other wastes was not under our control. These properties and the wastes disposed thereon may be subject to CERCLA, RCRA, and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes, including wastes disposed or released by prior owners or operators; to clean up contaminated property, including contaminated groundwater; or to perform remedial operations to prevent future contamination.

Oil Pollution Act of 1990

United States federal regulations also require certain owners and operators of facilities that store or otherwise handle crude oil, such as us, to prepare and implement spill prevention, control and countermeasure plans and spill response plans relating to possible discharge of crude oil into surface waters. The federal Oil Pollution Act ("OPA") contains numerous requirements relating to prevention of, reporting of, and response to crude oil spills into waters of the United States. For facilities that may affect state waters, OPA requires an operator to demonstrate $10 million in financial responsibility. State laws mandate crude oil cleanup programs with respect to contaminated soil. A failure to comply with OPA's requirements or inadequate cooperation during a spill response action may subject a responsible party to civil or criminal enforcement actions. We are not aware of any action or event that would subject us to liability under OPA, and we believe that compliance with OPA's financial responsibility and other operating requirements will not have a material adverse effect on us.

U.S. Environmental Protection Agency

U.S. Environmental Protection Agency regulations address the disposal of crude oil and natural gas operational wastes under three federal acts more fully discussed in the paragraphs that follow. The RCRA provides a framework for the safe disposal of discarded materials and the management of solid and hazardous wastes. The direct disposal of operational wastes into offshore waters is also limited under the authority of the Clean Water Act. When injected underground, crude oil and natural gas wastes are regulated by the Underground Injection Control program under the Safe Drinking Water Act. If wastes are classified as hazardous, they must be properly transported, using a uniform hazardous waste manifest, documented, and disposed of at an approved hazardous waste facility. We have coverage under the applicable Clean Water Act permitting requirements for discharges associated with exploration and development activities.

Resource Conservation and Recovery Act

RCRA is the principal federal statute governing the treatment, storage and disposal of hazardous wastes. RCRA imposes stringent operating requirements, and liability for failure to meet such requirements, on a person who is either a "generator" or "transporter" of hazardous waste or an "owner" or "operator" of a hazardous waste treatment, storage or disposal facility. At present, RCRA includes a statutory exemption that allows most crude oil and natural gas exploration and production waste to be classified as nonhazardous waste. A similar exemption is contained in many of the state counterparts to RCRA. As a result, we are not required to comply with a substantial portion of RCRA's requirements because our operations generate minimal quantities of hazardous wastes. At various times in the past, proposals have been made to amend RCRA to rescind the exemption that excludes crude oil and natural gas exploration and production wastes from regulation as hazardous waste. Repeal or modification of the exemption by administrative, legislative or judicial process, or modification of similar exemptions in applicable state statutes, would increase the volume of hazardous waste we are required to manage and dispose of and would cause us to incur increased operating expenses.

14

Clean Water Act

The Clean Water Act imposes restrictions and controls on the discharge of produced waters and other wastes into navigable waters. Permits must be obtained to discharge pollutants into state and federal waters and to conduct construction activities in waters and wetlands. Certain state regulations and the general permits issued under the Federal National Pollutant Discharge Elimination System program prohibit the discharge of produced waters and sand, drilling fluids, drill cuttings and certain other substances related to the crude oil and natural gas industry into certain coastal and offshore waters. Further, the Environmental Protection Agency has adopted regulations requiring certain crude oil and natural gas exploration and production facilities to obtain permits for storm water discharges. Costs may be associated with the treatment of wastewater or developing and implementing storm water pollution prevention plans. The Clean Water Act and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges for crude oil and other pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release. We believe that our operations comply in all material respects with the requirements of the Clean Water Act and state statutes enacted to control water pollution.

Safe Drinking Water Act

Underground injection is the subsurface placement of fluid through a well, such as the reinjection of brine produced and separated from crude oil and natural gas production. The Safe Drinking Water Act of 1974, as amended establishes a regulatory framework for underground injection, with the main goal being the protection of usable aquifers. The primary objective of injection well operating requirements is to ensure the mechanical integrity of the injection apparatus and to prevent migration of fluids from the injection zone into underground sources of drinking water. Hazardous-waste injection well operations are strictly controlled, and certain wastes, absent an exemption, cannot be injected into underground injection control wells. In Texas, no underground injection may take place except as authorized by permit or rule. We currently own and operate various underground injection wells. Failure to abide by our permits could subject us to civil and/or criminal enforcement. We believe that we are in compliance in all material respects with the requirements of applicable state underground injection control programs and our permits.

Air Pollution Control

The Clean Air Act and state air pollution laws adopted to fulfill its mandate provide a framework for national, state and local efforts to protect air quality. Our operations utilize equipment that emits air pollutants which may be subject to federal and state air pollution control laws. These laws require utilization of air emissions abatement equipment to achieve prescribed emissions limitations and ambient air quality standards, as well as operating permits for existing equipment and construction permits for new and modified equipment. We believe that we are in compliance in all material respects with the requirements of applicable federal and state air pollution control laws.

Naturally Occurring Radioactive Materials ("NORM")

NORM are materials not covered by the Atomic Energy Act, whose radioactivity is enhanced by technological processing such as mineral extraction or processing through exploration and production conducted by the crude oil and natural gas industry. NORM wastes are regulated under the RCRA framework, but primary responsibility for NORM regulation has been a state function. Standards have been developed for worker protection; treatment, storage and disposal of NORM waste; management of waste piles, containers and tanks; and limitations upon the release of NORM contaminated land for unrestricted use. We believe that our operations are in material compliance with all applicable NORM standards established by the State of Texas.

Abandonment Costs

All of our crude oil and natural gas wells will require proper plugging and abandonment when they are no longer producing. As necessary, we post financial assurance deposits with regulatory agencies to ensure compliance with our plugging responsibility. Plugging and abandonment operations and associated reclamation of the surface production site are important components of our environmental management system. We plan accordingly for the ultimate disposition of properties that are no longer producing.

15

Competition

The oil and gas industry is intensely competitive with respect to the acquisition of prospective oil and natural gas properties and oil and natural gas reserves. Our ability to effectively compete is dependent on our geological, geophysical and engineering expertise and our financial resources. We must compete against a substantial number of major and independent oil and natural gas companies that have larger technical staffs and greater financial and operational resources than we do. Many of these companies not only engage in the acquisition, exploration, development and production of oil and natural gas reserves, but also have refining operations, market refined products and generate electricity. We also compete with other oil and natural gas companies to secure drilling rigs and other equipment necessary for drilling and completion of wells. Consequently, drilling equipment may be in short supply from time to time. With the recent decline in crude oil and natural gas prices, access to drilling equipment is currently more available.

Employees

As of June 2, 2011, we had two full-time employees and two part-time employees, including our executive officers, as well as two consultants working on a consistent basis. We believe the relationship we have with our employees is good. We anticipate the need for additional accounting and technical personnel and, although demand for quality staff is high in the oil and gas industry, we believe we will be able to fill these positions in a timely manner.

The following are the meanings of some of the oil and gas industry terms that may be used in this annual report.

2-D seismic: (two-dimensional seismic data) Geophysical data that depicts the subsurface strata in two dimensions. A vertical section of seismic data consisting of numerous adjacent traces acquired sequentially.

3-D seismic: A set of numerous closely-spaced seismic lines that provide a high spatially sampled measure of subsurface reflectivity. Events are placed in their proper vertical and horizontal positions, providing more accurate subsurface maps than can be constructed on the basis of more widely spaced 2D seismic lines. In particular, 3D seismic data provide detailed information about fault distribution and subsurface structures.

Arkoma Basin: A structural feature located in southern Oklahoma and western Arkansas consisting of Middle Cambrian to Late Mississippian age carbonate, shale, and sandstone sediments.

Barnett Shale: A geological formation consisting of sedimentary rocks of Mississippian age (354–323 million years ago) in north central Texas.

Basin: A depression of the earth's surface into which sediments are deposited, usually characterized by sediment accumulation over a long interval; a broad area of the earth beneath which layers of rock are inclined, usually from the sides toward the center.

BCF: Billion cubic feet.

Block: Subdivision of an area for the purpose of licensing to a company or companies for exploration/production rights.

Brent Sand: A sandstone member of the Pennsylvanian age Atoka Group, a sequence of marine, silty sandstones and shales generally located in eastern Oklahoma and western Arkansas.

Completion: The installation of permanent equipment for the production of oil or natural gas, or in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Crude oil: A general term for unrefined petroleum or liquid petroleum.

16

Defined-risk: Projects defined by multiple evaluation techniques in order to estimate more reasonably the potential for success. These techniques may include 2-D or 3-D seismic, geo-chemistry, subsurface geology, surface mapping, data from surrounding wells, and/or satellite imagery.

Developmental drilling: Drilling that occurs after the initial discovery of hydrocarbons in a reservoir.

Devonian Shale: Shale formed from organic mud deposited during the Devonian Period (416–359 million years ago).

Dry hole: A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production would exceed production expenses and taxes.

E&P: Exploration and production.

Exploration: The initial phase in petroleum operations that includes generation of a prospect or play or both, and drilling of an exploration well. Appraisal, development and production phases follow successful exploration.

Exploratory well: A well drilled to find and produce oil and gas reserves that is not a development well.

Fairway: A term used in the industry to describe an area believed to contain the most productive mineral acreage in a play.

Farm-out: An agreement whereby the owner of a lease (farmor) agrees to assign part or all of a leasehold interest to a third party (farmee) in return for drilling of a well or wells and/or the performance of other required activities. The farmee is said to “farm-in.”

Field: An area consisting of either a single reservoir or multiple reservoirs, all grouped on or related to the same individual geological structural feature and/or stratigraphic condition.

Finding cost: The total cost to drill, complete and hook up a well divided by the mcf or barrels of proved reserves.

Formation: An identifiable layer of rocks named after the geographical location of its first discovery and dominant rock type.

Fracturing: Hydraulic fracturing is a method used to create fractures that extend from a borehole into rock formations, which are typically maintained by a proppant, a material such as grains of sand, ceramic beads or other material which prevent the fractures from closing. The method is informally called fracking or hydro-fracking. The technique of hydraulic fracturing is used to increase or restore the rate at which fluids, such as oil, gas or water, can be produced from the desired formation. By creating fractures, the reservoir surface area exposed to the borehole is increased.

Gas show: While drilling a well through different rock formations, gas may appear in the drilling mud which is circulating through the drill pipe, which indicates the presence of gas in the formation being drilled; drillers call this a “gas show”.

Hamilton Group: A bedrock unit in New York, Pennsylvania, Maryland and West Virginia; the oldest strata of the Devonian gas shale sequence. In the interior lowlands of New York, the Hamilton Group contains the Marcellus, Skaneateles, Ludlowville, and Moscow Formations, in ascending order, with the Tully Limestone above.

Horizontal well: a well in which the borehole is deviated from vertical at least 80 degrees so that the borehole penetrates a productive formation in a manner parallel to the formation. A single horizontal lateral can effectively drain a reservoir and eliminate the need for several vertical boreholes.

Hunton Sand: A Devonian-Silurian age group of interbedded limestone members primarily found in eastern Oklahoma. The Hunton typically produces a significant volume of water with initial production with increasing volumes of gas and decreasing volumes of water as production matures.

17

Hydrocarbon: A naturally occurring organic compound comprising hydrogen and carbon. Hydrocarbons can be as simple as methane [CH4], but many are highly complex molecules, and can occur as gases, liquids or solids. The molecules can have the shape of chains, branching chains, rings or other structures. Petroleum is a complex mixture of hydrocarbons. The most common hydrocarbons are natural gas, oil and coal.

Lead: a possible prospect.

Marcellus Shale: The lowest unit of the Devonian age Hamilton Group; a unit of marine sedimentary rock found in eastern North America. Named for a distinctive outcrop near the village of Marcellus, New York, it extends throughout much of the Appalachian Basin. The shale contains largely untapped natural gas reserves, and its proximity to the high-demand markets along the East Coast of the United States makes it an attractive target for energy development.

MCF: Thousand cubic feet.

Medina Sandstone: The Lower Silurian age Medina Group sandstones comprise the dominant tight gas sandstone play in western and southwestern New York. Depths vary from 1,800 feet in the west central part of the state to 4,500 feet in the western part of the state.

Net revenue interest (NRI): The portion of oil and gas production revenue remaining after the deduction of royalty and overriding royalty interests.

NYMEX: The New York Mercantile Exchange, the world's largest physical commodity futures exchange, located in New York City.

Operator: The individual or company responsible for the exploration and/or exploitation and/or production of an oil or gas well or lease.

Overriding royalty interest (ORRI): an interest carved out of the lessee’s working interest that entitles its owner to a fraction of production free of any production or operating expense, but not free of production or severance tax levied on the production. An overriding interest’s duration derives from the lease in which it was created.

Participation interest: The proportion of exploration and production costs each party will bear and the proportion of production each party will receive, as set out in an operating agreement.

Play: A group of oil or gas fields or prospects in the same region that are controlled by the same set of geological circumstances.

Production: The phase that occurs after successful exploration and development and during which hydrocarbons are drained from an oil or gas field.

Prospect: A specific geographic area, which based on supporting geological, geophysical or other data and also preliminary economic analysis using reasonably anticipated prices and costs, is deemed to have potential for the discovery of commercial hydrocarbons.

Recompletion: After the initial completion of a well, the action and technique of re-entering the well and repairing the original completion or completing the well in a different formation to restore the well’s productivity.

Reservoir: A subsurface, porous, permeable rock formation in which oil and gas are found.

Royalty interest: An ownership interest in the portion of oil, gas and/or minerals produced from a well that is retained by the lessor upon execution of a lease or to one who has acquired possession of the royalty rights, based on a percentage of the gross production from the property free and clear of all costs except taxes.

Seismic: Pertaining to waves of elastic energy, such as that transmitted by P-waves and S-waves, in the frequency range of approximately 1 to 100 Hz. Seismic energy is studied by scientists to interpret the composition, fluid content, extent and geometry of rocks in the subsurface. "Seismic," used as an adjective, is preferable to "seismics," although "seismic" is used commonly as a noun.

18

Shale: A fine-grained sedimentary rock composed of flakes of clay minerals and tiny fragments of other minerals, especially quartz and calcite. Shale is characterized by thin laminate, or parallel layering or bedding less than one centimeter in thickness.

Shut in: Not currently producing.

TCF: Trillion cubic feet.

Theresa Sandstone: An Upper Cambrian age sandstone underlying most of western New York at depths ranging from 3,000 feet to 13,000 feet. Theresa wells are typically drilled to depths ranging from 5,000 feet to 7,000 feet.

Twin well: A well drilled on the same location as another well or closely offsetting it.

Working interest: The interest in oil or gas that includes the responsibility for all drilling, developing and operating costs.

Workover: The performance of one or more of a variety of remedial operations on a producing well to try to increase or restore production.

ITEM 1A. RISK FACTORS

Risks Relating to Our Business:

We have a history of losses which may continue and which may negatively impact our ability to achieve our business objectives.

Although we incurred net income of $6,561,235 for the year ended December 31, 2010 compared to a net loss of $1,931,539 for the year ended December 31, 2009, the net income for the year ended December 31, 2010 was the result of a noncash unrealized gain on change in derivative value related to conversion features in our debt instruments in the amount of $10,773,500 primarily offset by our loss from operations of $3,138,801 and interest expense of $1,077,269. In addition, at December 31, 2010, we had a working capital deficit of $2,344,735 and a stockholders’ deficit of $3,463,007. We can provide no assurance that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. Revenues and profits, if any, will depend upon various factors, including whether we will be able to continue expansion of our revenue. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

We received a modified report from our independent registered public accounting firm with an emphasis of matter paragraph for the year ended December 31, 2010 with respect to our ability to continue as a going concern. The existence of such a report may adversely affect our stock price and our ability to raise capital. There is no assurance that we will not receive a similar emphasis of matter paragraph for our year ended December 31, 2011.

Our independent registered public accounting firm expressed substantial doubt about our ability to continue as a going concern as we have incurred losses from operations, negative cash flows from operating activities and have a working capital deficiency. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing revenues or obtaining loans and grants from various financial institutions where possible. Our continued net operating losses from operations increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

19

We are an exploration stage company and have minimal current revenues. Our business plan depends on our ability to acquire producing reserves and/or explore for and develop oil and gas reserves and place any such reserves into production. Because we have a limited operating history, it is difficult to predict our future performance.

We have been and continue to be an exploration stage company. Therefore, we have limited operating and financial history available to help potential investors evaluate our past performance and the risks of investing in us. Moreover, our limited historical financial results may not accurately predict our future performance. Companies in their initial stages of development present substantial business and financial risks and may suffer significant losses. As a result of the risks specific to our new business and those associated with new companies in general, it is possible that we may not be successful in implementing our business strategy.

Until the third fiscal quarter of 2009, we had no revenues from operations. We have yet to generate positive earnings from operations and there can be no assurance that we will ever operate profitably. Our success is significantly dependent on raising sufficient capital to develop our existing properties and acquire new properties and the execution of a successful drilling, completion and production program. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in the Company.

If we are unable to obtain additional funding, business operations will be harmed and if we do obtain additional financing, existing shareholders may suffer substantial dilution.

We will require additional funds to complete pending acquisitions and drill or re-complete wells on our existing properties. We anticipate that we will require up to approximately $11,000,000 to adequately fund our acquisitions and projected operations for the next twelve months, depending on revenue, if any, from operations. Additional capital will likely be required to effectively support the operations and to otherwise implement our overall business strategy. We have raised some capital to date, including through the sale of the Debentures (discussed below), but we currently do not have any contracts or firm commitments for additional financing. There can be no assurance that additional financing will be available in amounts or on terms acceptable to us, if at all. An inability to obtain additional capital would restrict our ability to grow and could diminish our ability to continue to conduct our business operations. If we are unable to obtain additional financing, we will likely be required to curtail drilling and development plans and possibly cease operations. Any additional equity financing may involve substantial dilution to then existing shareholders.

Our lack of diversification will increase the risk of an investment in our company, and our consolidated financial condition and results of operations may deteriorate if we fail to diversify.

Our business focus is on the oil and gas industry in a limited number of properties, initially in the Java Field in New York and Coal Creek in Oklahoma. Larger companies have the ability to manage their risk by geographic diversification. However, we will lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Because we are small and do not have much capital, we may have to limit our exploration and developmental drilling activity which may result in a loss of your investment.

Because we are a small, exploration stage company and do not have much capital, we must limit our drilling activity. As such, we may not be able to complete a drilling program that is as thorough as we would like. In that event, existing reserves may go undiscovered. Without finding reserves, we cannot generate revenues and you may lose any investment you make in our shares.

20

Investment in exploration projects increases the risks inherent in our oil and gas activities and our drilling operations may not be successful.

While we intend a develop a portfolio consisting of a balanced and diversified mix of existing production, developmental, and exploration drilling opportunities, to the extent that we invest in exploration, there are much greater risks than in acquisitions and developmental drilling. Any particular success in exploration does not assure that we will discover meaningful levels of reserves. There can be no assurance that future exploration and drilling activities will be successful. We cannot be sure that an overall drilling success rate or production operations within a particular area will ever come to fruition and, in any event, production rates inevitably decline over time. We may not recover all or any portion of the capital investment in our wells or the underlying leaseholds. Unsuccessful drilling activities would have a material adverse effect upon our results of operations and financial condition. Additionally, there are significant uncertainties as to the future costs and timing of drilling, completing, and producing wells. Our drilling operations may be curtailed, delayed, or canceled as a result of a variety of factors, including:

|

|

·

|

unexpected drilling conditions;

|

|

|

·

|

equipment failures or accidents;

|

|

|

·

|

adverse weather conditions;

|

|

|

·

|

compliance with governmental requirements; and

|

|

|

·

|

shortages or delays in the availability of drilling rigs and the delivery of equipment or materials.

|

Because we may not operate all of our properties, we could have limited influence over their development.