Attached files

| file | filename |

|---|---|

| 8-K - HGR 2012 SHAREHOLDER MEETING & PRESENTATION - HGR Liquidating Trust | hgr_2012meeting.htm |

Exhibit 99.1

2011 Shareholder Meeting Hines Real Estate Investment Trust , Inc. Charles Hazen President and CEO Charles Hazen President and CEO Charles Hazen President and CEO 2012 Shareholder Meeting Hines Global REIT President and CEO Charles Hazen

Investment Strategy Overview Total Return Pay regular cash distributions Achieve attractive total returns upon the ultimate liquidity event U.S. and International International properties play an important role in well-diversified real estate portfolios Currencies provide an additional level of diversification Multiple Classes Office Retail Industrial Multi-family residential Moderate Leverage Hines Global REIT 2012 Shareholder Meeting *

Market Overview Global transaction volume down 23% year-over-year in the first six months of 2012 In U.S., volume down 3% year-over-year in the first six months of 2012 Office volume up 14% in H1’12 Overall, U.S. still best performer among global zones European transactions down 22% year-over-year in the first six months of 2012 Investors continue to gravitate to the best assets Core assets in gateway markets ─ lower cap rates but higher liquidity U.S. commercial real estate recovery should steadily continue Economy in Europe is probably in recession UK, Germany, France, Poland, Russia and Australia expected to out-perform Hines Global REIT 2012 Shareholder Meeting *

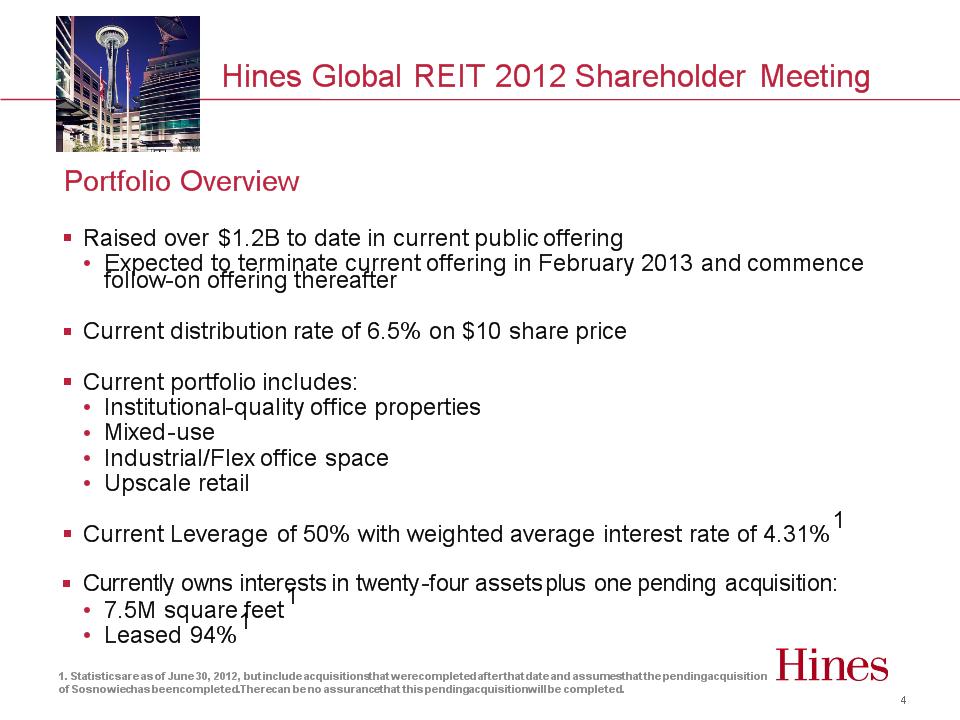

Portfolio Overview Raised over $1.2B to date in current public offering Expected to terminate current offering in February 2013 and commence follow-on offering thereafter Current distribution rate of 6.5% on $10 share price Current portfolio includes: Institutional-quality office properties Mixed-use Industrial/Flex office space Upscale retail Current Leverage of 50% with weighted average interest rate of 4.31%1 Currently owns interests in twenty-four assets plus one pending acquisition: 7.5M square feet1 Leased 94%1 Hines Global REIT 2012 Shareholder Meeting * 1. Statistics are as of June 30, 2012, but include acquisitions that were completed after that date and assumes that the pending acquisition of Sosnowiec has been completed. There can be no assurance that this pending acquisition will be completed.

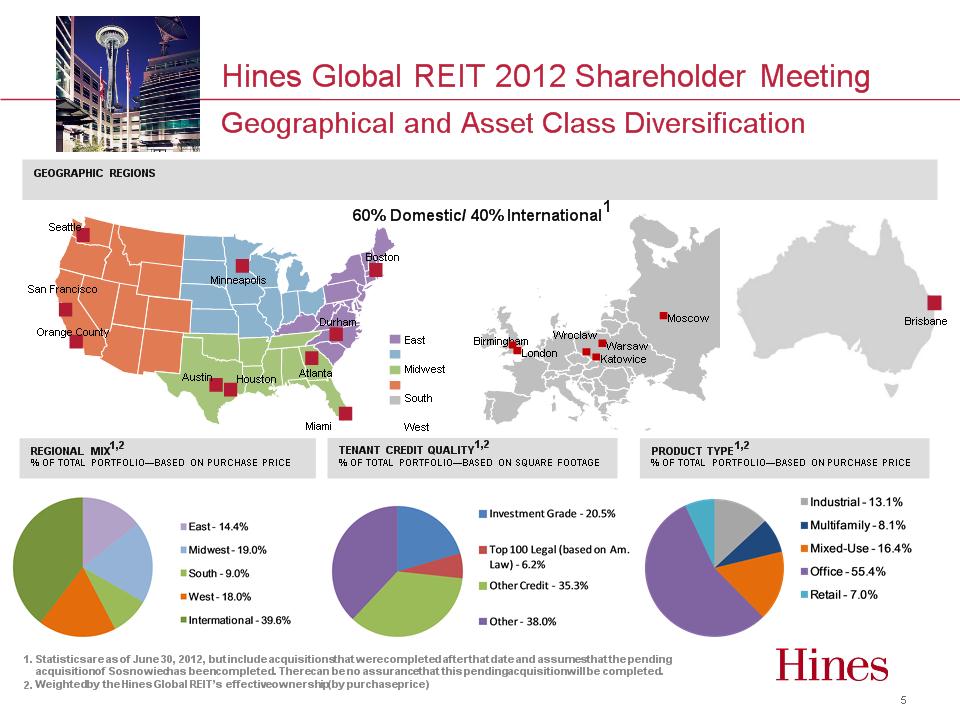

* Statistics are as of June 30, 2012, but include acquisitions that were completed after that date and assumes that the pending acquisition of Sosnowiec has been completed. There can be no assurance that this pending acquisition will be completed. Weighted by the Hines Global REIT’s effective ownership (by purchase price) REGIONAL MIX1,2 % OF TOTAL PORTFOLIO—BASED ON PURCHASE PRICE PRODUCT TYPE1,2 % OF TOTAL PORTFOLIO—BASED ON PURCHASE PRICE 60% Domestic/ 40% International1 1 Katowice Warsaw East Midwest South West International Austin Orange County Durham Minneapolis Boston Atlanta Houston Seattle Brisbane Wroclaw Miami San Francisco Hines Global REIT 2012 Shareholder Meeting Geographical and Asset Class Diversification GEOGRAPHIC REGIONS TENANT CREDIT QUALITY1,2 % OF TOTAL PORTFOLIO—BASED ON SQUARE FOOTAGE

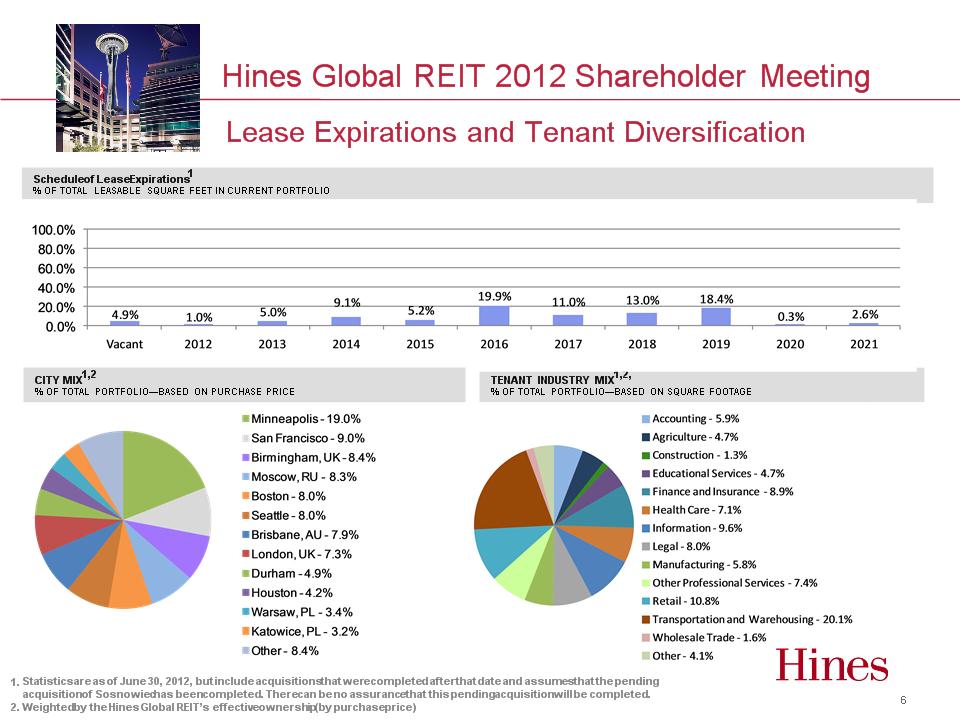

Lease Expirations and Tenant Diversification * Hines Global REIT 2012 Shareholder Meeting Schedule of Lease Expirations1 % OF TOTAL LEASABLE SQUARE FEET IN CURRENT PORTFOLIO TENANT INDUSTRY MIX1,2, % OF TOTAL PORTFOLIO—BASED ON SQUARE FOOTAGE Statistics are as of June 30, 2012, but include acquisitions that were completed after that date and assumes that the pending acquisition of Sosnowiec has been completed. There can be no assurance that this pending acquisition will be completed. Weighted by the Hines Global REIT’s effective ownership (by purchase price) CITY MIX1,2 % OF TOTAL PORTFOLIO—BASED ON PURCHASE PRICE

Investment Portfolio * Hines Global REIT 2012 Shareholder Meeting Brindleyplace – Birmingham, England Acquired July 2010 $282.5 million/£186.2 million, JV-60% Hines Global REIT/40% Moorfield 566,048 s.f. - 73% leased Major tenants: The Royal Bank of Scotland and Deloitte LLP Debt: $189.0 million; blended rate of 3.58% Estimated going-in cap rate: 7.0% Hock Plaza – Durham, NC Acquired September 2010 $97.9 million 327,160 s.f. - 99% leased Major tenants: Duke University & Duke University Health System Debt: $78.5 million; 5.58% Estimated going-in cap rate: 7.20%

Investment Portfolio * Hines Global REIT 2012 Shareholder Meeting Fifty South Sixth – Minneapolis, MN Acquired November 2010 $185.0 million 698,783 s.f. - 96% leased Major tenants: Dorsey & Whitney and Deloitte LLP Debt: $95.0 million; 3.62% via interest rate swap Estimated going-in cap rate: 7.40% Stonecutter Court – London, UK Acquired March 2011 $146.8 million/£90.9 million 152,808 s.f. - 100% leased Major tenant: Deloitte LLP through April 2019 Debt: $86.6 million; 4.79% fixed via interest rate swap Estimated going-in cap rate: 6.76%

Investment Portfolio * Hines Global REIT 2012 Shareholder Meeting Gogolevsky 11 – Moscow, RUS Acquired August 2011 $96.1 million 85,740 s.f. - 100% leased Major tenant: Cameron McKenna Debt: $38.6 million; blended rate of 6.72% Estimated going-in cap rate: 8.93% FM Logistic Industrial Park – Moscow, RUS Acquired April 2011 $70.8 million; all equity 748,578 s.f. - 100% leased Major tenant: FM Logistic through March 2016 Estimated going-in cap rate: 11.15%

Investment Portfolio * Hines Global REIT 2012 Shareholder Meeting Poland Logistics Portfolio – Katowice, Wroclaw & Warsaw, PL Acquired March 2012 $157.4 million; €118.5 million 2,270,055 s.f. - 92% leased Major tenants: Carrefour, Fagor Master Cook, and ABC Data Debt: $80.5 million; variable, capped at 4.80% Estimated going-in cap rate: 8.03% Campus at Marlborough – Boston, MA Acquired October 2011 $103.0 million 532,246 s.f. - 100% leased Major tenants: Hologic, Hewlett Packard and Wellington Management Debt: $56.5 million; 5.21% Estimated going-in cap rate: 8.04%

Investment Portfolio * Hines Global REIT 2012 Shareholder Meeting Minneapolis Retail Center – Edina, MN Acquired August 2012 $125.3 million 381,031 s.f. - 95% leased Major tenants: Gabbert’s, Barnes & Noble, Crate & Barrel, Pottery Barn, Tiffany & Co. and Louis Vuitton Debt: $65.5 million; 3.50% Estimated going-in cap rate: 6.5% 100 Brookes Street – Brisbane, AU Acquired July 2012 $67.6 million USD, $66.5 million AUD 105,637 s.f. - 100% leased Major tenant: Bechtel Corp. through 2018 Debt: $43.9 million; BBSY + 2.65% Estimated going-in cap rate: 10.46%

Investment Portfolio * Hines Global REIT 2012 Shareholder Meeting 550 Terry Francois – San Francisco, CA Acquired September 2012 $180.0 million; all equity 282,773 s.f. - 100% leased Major tenant: Gap Inc. through 2017 Estimated going-in cap rate: 8.20%

* Hines Global REIT 2012 Shareholder Meeting Modifications to fee structure: Eliminated debt financing fee; made acquisition fee 2.25% Waived (not deferred) asset management fee for each quarter in 2012 and 2013 to the extent that our MFFO, as reported each quarter, is less than 100% of the aggregate distributions declared for such quarter Waived $4.6 million through Q2 2012 Alignment of Interest with Shareholders

* Hines Global REIT 2012 Shareholder Meeting Markets are still compelling for investment Continue to raise capital and invest in the U.S. and internationally in attractive opportunities Current Priorities