Attached files

| file | filename |

|---|---|

| 8-K - MAINBODY.HTM - SOUTH AMERICAN GOLD CORP. | mainbody.htm |

| EX-99.1 - EXHIBIT991 - SOUTH AMERICAN GOLD CORP. | exhibit991.htm |

Exhibit 10.1

Lease with Option to Purchase the Baltimore Silver Mine

This agreement is by and between Western Continental,Inc. (“Western”) and South American Gold Corporation (“SAGD”) for a lease with option to purchase the Baltimore Mine in western Montana. This agreement sets the terms of a lease with option to purchase the Baltimore Mine project as described herein.

Whereas Western is the owner of three patented mining claims described further in Exhibit A to this agreement, and desires to lease the property with an option to purchase,

Whereas SAGD wishes to lease said property with an option to purchase,

Therefore, Western and SAGD agree that:

|

1.

|

Property Ownership: Western hereby affirms it is the sole owner free and clear of all liens and encumbrances of the project known as the Baltimore Mine further described in Exhibit A. Western affirms there are no known environmental liabilities, nor requests from relevant government agencies in regards to environmental matters.

|

|

2.

|

Lease: SAGD agrees to lease the project effective August 2, 2012. The lease will be for a term of ten years beginning August 2, 2012, and may be extended for an additional 15 years with a payment of one hundred thousand dollars ($100,000) at any time. During the term of this lease SAGD will be responsible for the payment of any property taxes, and indemnify Western for any and all activities SAGD conducts on the property, and secure all required permits and operating licenses for SAGD activities on the property. The lease payment will be $10,000 per year plus $500 per quarter or $2,000 per year in restricted stock as SAGD’s option provided such restricted

stock has a market bid price in excess of $20,000 for the twenty days bid price for the stock prior to payment. Payment will be on July 31 of each year beginning July 31, 2013.SAGD may terminate the lease with ninety days notice, and however such determination has no bearing on cash payments or issuance of stock to Western prior to the termination of the lease option.

|

|

3.

|

Production Royalties: SAGD will pay a production royalty of all minerals mined form the property in the form of a Net Smelter Return with the Net Smelter Return to Western of three percent (3%).

|

|

4.

|

Option to Purchase: SAGD will have for the term of this agreement an option to purchase the property free and clear of any lien or encumbrance in the amount of five hundred thousand dollars ($500,000) at which time the lease would terminate and no royalty would be due afterwards from the property.

|

|

5.

|

Bonus for Reserve Determination: Should SAGD cause to be issued a property report meeting the industry guidelines indicating probable or proven reserves in excess of two million ounces of silver on the property, Western shall receive an additional thirty thousand dollars in cash or restricted shares value determined as (3) above, within thirty days of publication of such report.

|

- 1 -

|

6.

|

Payment of Entering into Lease and Option Agreement :

|

|

(a.)

|

SAGD will issue ten million (10,000,000) shares of restricted common stock to Western, subject to Rule 144 and the requirements of this agreement.

|

|

(b.)

|

Western affirms that it has experience in the mining industry and penny mining stocks, and that it has carefully reviewed the company’s filings with the SEC including the risk factors described in the company’s most recent 10k filing. Western furthermore affirms it is aware that shares received may not be re-sold absent a registration statement filed with the SEC, or in accordance with exemptions from registration and any other requirements of the company’s transfer agent, the Company may require a legal opinion if in the opinion of counsel it is recommended.

|

|

(c.)

|

SAGD in the period January 1, 2013 through July 1, 2013 make an additional payment of $25,000 in the form of cash or restricted common stock, at SAGD’s option, valued at the ten day average bid price for the company’s common stock subject to the same terms as outlined in (6a. and 6.b.) above.

|

|

(d.)

|

Western affirms it is an accredited investor, and this contract and share issuance has not been accompanied by any form of advertising.

|

|

(e.)

|

Western (“We”) has reviewed the public filings of the Company. We understand that all documents, records and books pertaining to this investment have been made available by the Company for inspection by our attorney and accountant. We are familiar with the Company’s business objectives and the financial arrangements in connection therewith. The stock we are accepting as consideration under the Agreement are the kind of securities that we wish to hold for investment and the nature of the stocks are consistent with my investment

program. Our advisor(s) and us have had a reasonable opportunity to ask questions of and receive answers from the officers and directors of the Company concerning the Company and the Units. All such questions have been answered to my full satisfaction. We, or our representatives, have made such investigation of the facts and circumstances set forth in the Company’s public filings thereto in connection with any acceptance of the Units as we have deemed necessary. No representations have been made or information furnished to us or our advisor(s) relating to the Company or the Units that are in any way inconsistent with the Agreement or public

filings.

|

|

(f.)

|

We understand that the certificates for the shares of common stock will bear a legend substantially to the following effect:

|

The Securities represented by this instrument have not been registered under the Securities Act of 1933, as amended, or the securities laws of any state and may not be sold, pledged, hypothecated or otherwise transferred, except upon delivery to the Company of an opinion of counsel, satisfactory to the Board of Directors, that an exemption from such registration is available and that such transfer will not result in any violation of the law.

- 2 -

|

(g.)

|

At no time were we presented with or solicited by or through any leaflet, public promotional meeting, circular, newspaper or magazine article, radio or television advertisement or any other form of general advertising in connection with such communicated offer.

|

|

(h.)

|

We recognize that acceptance of the shares as consideration involves certain risks and we have taken full cognizance of and understand all of the risk factors related to the business objectives of the Company and the purchase of the Units, including those risk factors set forth under the caption “RISK FACTORS” in our 10k report filed with the SEC as amended by subsequent 10q and 8k reports filed.

|

|

(i.)

|

The deemed value of the shares issued is the asking price of the Stock as of August 17, 2012 of $.0029 or twenty nine thousand dollars ($29,000).

|

|

7.

|

Property Taxes: SAGD will be liable for all property taxes subsequent to August 2, 2012.

|

|

8.

|

Permits: SAGD is responsible for any and all permits required to operate on the property, and indemnify Western for any activities subsequent to the date of the signing of this agreement.

|

|

9.

|

Definitive Agreement: This agreement is the definitive agreement supersedes any prior agreement.

|

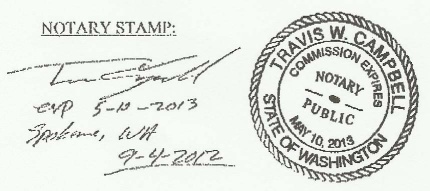

Effective Date: September 4, 2012

For Western:

/s/ J. Campbell

Name: J. Campbel

Title: President

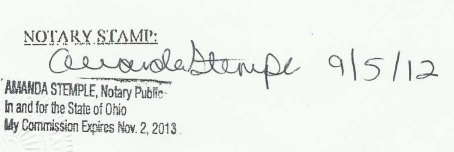

For SAGD:

/s/ Raymond DeMotte

Name: Raymond DeMotte

Title: Chief Executive Officer

- 3 -

Exhibit A: Property Description

Patented Mining Claims:

Last Hope Mineral Survey #9689

Baltimore Mineral Survey # 1540

Mona Mineral Survey # 9689

Located in:

Section 7, Township 6 N, Range 4W, Jefferson County, Montana

Tax Parcel # : 0000001365

A - 1