Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT311 - SOUTH AMERICAN GOLD CORP. | exhibit311.htm |

| EX-32.1 - EXHIBIT321 - SOUTH AMERICAN GOLD CORP. | exhibit321.htm |

| EX-32.2 - EXHIBIT322 - SOUTH AMERICAN GOLD CORP. | exhibit322.htm |

| EX-10.5 - EXHIBIT105 - SOUTH AMERICAN GOLD CORP. | exhibit105.htm |

| EX-31.2 - EXHIBIT312 - SOUTH AMERICAN GOLD CORP. | exhibit312.htm |

| EX-21.1 - EXHIBIT211 - SOUTH AMERICAN GOLD CORP. | exhibit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to _________.

Commission file number: 000-52156

South American Gold Corp.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0486676

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

3645 E. Main Street, Suite 119, Richmond, IN 47374

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

Registrant’s telephone, including area code: (765) 356-9726

|

||

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act:

|

Common Stock, $0.001 par value

|

Not Applicable

|

|

|

(Title of class)

|

(Name of each exchange on which registered)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated

filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of December 31, 2010, the aggregate market value of the Company’s common equity held by non-affiliates computed by reference to the closing price of $1.10 was: $69,753,079

The number of shares of our common stock outstanding as of September 15, 2011 was: 79,211,890

Documents Incorporated by Reference: None

FORM 10-K

SOUTH AMERICAN GOLD CORP.

JUNE 30, 2011

PART I

| Page | |

|

Item 1. Business.

|

5

|

|

Item 1A. Risk Factors.

|

11

|

|

Item 1B. Unresolved Staff Comments.

|

20

|

|

Item 2. Properties.

|

21

|

|

Item 3. Legal Proceedings.

|

28

|

|

Item 4. (Removed and Reserved).

|

28

|

|

PART II

|

|

29

|

|

|

Item 6. Selected Financial Data.

|

31

|

|

32

|

|

|

37

|

|

|

37

|

|

|

37

|

|

|

Item 9A. Controls and Procedures.

|

37

|

|

Item 9B. Other Information.

|

38

|

|

PART III

|

|

39

|

||

|

Item 11. Executive Compensation.

|

42

|

|

|

47

|

||

|

47

|

||

|

48

|

||

|

PART IV

|

Cautionary Note Regarding Forward Looking Statements

This annual report contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “intends,” and other variations of these words or comparable words. In addition, any statements that refer to expectations, projections or other

characterizations of events, circumstances or trends and that do not relate to historical matters are forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

|

●

|

risk that we will not be able to remediate identified material weaknesses in our disclosure controls and procedures and internal control over financial reporting;

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our contemplated acquisition and exploration and development projects;

|

|

●

|

risk that Kata, through its subsidiary, fails to close a transaction by February 25, 2012 providing for registration in the National Mining Registry of Colombia of certain mining concessions located in the Nariño province of Colombia covered by concession application IKE-10421X (the “Mining Concessions”) in favor of Kata’s subsidiary resulting in us not having acquired any direct or indirect interest in the Mining Concessions and not be entitled to recover any of our exploration expenditures of other expenses incurred in connection with acquiring the 25% Stake;

|

|

●

|

risk that we are unable to acquire more than twenty-five percent (25%) of the outstanding capital stock of Kata Enterprises Inc., a company incorporated under the laws of Panama (“Kata”), by completing the acquisition of a portion or all of the remaining seventy-five percent (75%) of the outstanding capital stock of Kata resulting in us holding only a minority interest in Kata;

|

|

●

|

risk that efforts to reclassify the entire area, or a portion thereof, that is the subject of the concession contract applied for so that it is no longer is classified as a forestry reserve fail resulting in the inability to commence any exploration or mining activities causing any significant surface disturbance on the area subject to the concession contact and our investment in Kata having no value;

|

|

●

|

risk that changes to Colombian mining laws, which include a comprehensive overhaul of rules applicable to companies engaged in mining activities, will adversely impact our operations in Colombia;

|

|

●

|

risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations in Colombia;

|

|

●

|

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

|

|

●

|

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration or development activities or the completion of feasibility studies;

|

|

●

|

risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our history of losses;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and

|

|

●

|

other risks and uncertainties related to our prospects, properties and business strategy.

|

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

As used in this annual report, “South American,” the “Company,” “we,” “us,” or “our” refer to South American Gold Corp., unless otherwise indicated.

If you are not familiar with the mineral exploration terms used in this report, please refer to the definitions of these terms under the caption “Glossary” at the end of Item 15 of this report.

PART I

Overview

We were incorporated in the state of Nevada on March 25, 2005 and previously operated under the name Grosvenor Explorations Inc. Effective October 18, 2010, we changed our name to “South American Gold Corp.” pursuant to a parent/subsidiary merger with our wholly-owned non-operating subsidiary, South American Gold Corp., which was established for the purpose of giving effect to this name change. Our current focus is the acquisition, exploration, and potential development of mining properties.

We previously acquired mineral claims situated in British Columbia, Canada, but allowed these mineral claims to lapse during the year ended June 30, 2008. As a result, we no longer have any rights to these mineral claims in British Columbia, Canada. In January 2008, we entered into an assignment agreement where we were assigned a 100% interest in a 7-unit claim block containing 92.8 hectares located in Vietnam, referred to herein as the “Kon Tum Gold Claim.” The Kon Tum Gold Claim has been staked and recorded with the Mineral Resources Department of Energy and Mineral Resources of the government of the Republic of Vietnam. We did not conduct any exploration

work on the Kon Tum Gold Claim.

In light of some of the potential opportunities recently presented to our management to acquire interests in certain mineral claims and mining rights on properties located in Colombia, South America, our management decided to reassess its proposed plan for exploration for the Kon Tum Gold Claim and the overall desirability of maintaining an ownership interest in mineral claims and mining rights located in Vietnam. We reviewed current economic conditions within Vietnam and globally and concluded that it is more likely that favorable economic trends can be sustained over an extended period of time within Colombia, as compared to Vietnam. Our management also believes that the emergence of a strong

mineral exploration industry within Colombia will make it easier for us to attract, retain and motivate qualified personnel and access the equipment necessary for exploration. For the foregoing reasons, our management has determined that it would be in our best interest to focus our efforts exclusively on the acquisition and development of mining properties in Colombia, a geographical area in which our management believes offers a more promising opportunity for our company.

We reviewed our available alternatives and canvassed a number of qualified parties in an attempt to dispose of our interests in the Kon Tum Gold Claim for value. As a result of our inability to locate an interested party to enter into a transaction to dispose of our interests in the Kon Tum Gold Claim for value and a determination that further canvassing of the market would likely be fruitless, we made a determination to abandon our interests in the Kon Tum Gold Claim and sent a notice indicating such to the appropriate governmental body in Vietnam.

We are considered an exploration or exploratory stage company because our business plan is to engage in the examination, investigation and exploration of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. We have not acquired any mineral property interests at the present and there is no assurance that a commercially viable mineral deposit will exist on any of the properties underlying any mineral property interests that we may acquire in the future. In order to make any final evaluation as to the economic and legal feasibility of placing any exploration project into

production, a great deal of exploration is required. We possess no known reserves of any type of mineral, have not discovered an economically viable mineral deposit and there is no assurance that we will ever discover one. If we cannot acquire or locate mineral deposits, or if it is not economical to recover any mineral deposits that we do find, our business and operations will be materially and adversely affected and we may have to cease operations.

Substantially all of our assets will be put into commercializing mining rights and mineral claims located within a limited geographical area. Accordingly, any adverse circumstances that affect these areas would affect us and your entire investment in shares of our common stock. If any adverse circumstances were to arise, we would need to consider alternatives, both in terms of our prospective operations and for the financing of our activities. Management cannot provide assurance that we will ultimately achieve profitable operations or become cash-flow positive, or raise additional debt and/or equity capital. If we are unable to raise additional capital, we will continue to

experience liquidity problems and management expects that we will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures including ceasing operations. We may also consider entering into a joint venture arrangement to provide the required funding to acquire and explore any mineral property interests. We have not undertaken any efforts to locate a joint venture participant. Even if we determine to pursue a joint venture participant, there is no assurance that any third party would enter into a joint venture agreement with us in order to fund the acquisition and exploration of mineral property interests. If we enter into a joint venture arrangement, we would likely have to assign a percentage of any mineral property interest we may hold to the joint venture

participant. For more information on the risks involved in this offering, see “Special Note Regarding Forward-Looking Statements” and “Risk Factors.”

Agreement with Minera Kata S.A. for Acquisition of Equity Interest in Kata Enterprises Inc.

On February 25, 2011 (the “Effective Date”), we entered into a Stock Purchase Agreement with Minera Kata S.A., a corporation organized under the laws of the Republic of Panama (“Seller”), as amended and supplemented by Amendment No. 1 (the “Amendment”) dated April 25, 2011 (collectively, the “Agreement”), and acquired from Seller twenty-five percent (25%) of the outstanding capital stock (the “25% Stake”) of Kata Enterprises Inc., a corporation organized under the laws of the Republic of Panama (“Kata”), with an option to acquire from Seller the remaining seventy-five percent (75%) of the outstanding capital stock of Kata in exchange for total

consideration of $550,000. We paid Seller partial consideration of $500,000 in cash (the “Closing Payment”) on the Effective Date and the remaining $50,000 in cash upon execution of the Amendment.

In November 2010, Kata entered into an agreement to acquire, through its subsidiary, an eighty-five percent (85%) interest in certain mining concessions located in the Nariño province of Colombia covering the area that is the subject of the IKE-10421X concession application (the “Mining Concessions”), but has not successfully closed that transaction as of this time (the “Kata Transaction”). Kata is an entity that has nominal operations and was recently incorporated. Our understanding is that closing of the Kata Transaction is conditioned upon the transferor of the Mining Concessions receiving acceptance of an application for a concession contract, executing a

concession contract with Ingeominas (the entity authorized by the Colombian Ministry of Mines and Energy to grant mining concession contracts), registration of that contract at the National Mining Registry and securing the requisite approvals and governmental consents for the transfer of the Mining Concessions to Kata’s subsidiary. We can provide no assurance that Kata, through its subsidiary, will be able to successfully close the Kata Transaction. In the event that Kata, through its subsidiary, fails to close the Kata Transaction and thus fails by February 25, 2012 to have the Mining Concessions registered in the National Mining Registry of Colombia in favor of Kata’s subsidiary, the Agreement provides that Seller will be obligated to deliver to us one-hundred percent (100%) of the outstanding capital stock of Kata (the “100% Stake”) without any additional

consideration being paid. In such event, we will not have acquired any direct or indirect interest in the Mining Concessions and not be entitled to recover any of our exploration expenditures of other expenses incurred in connection with acquiring the 25% Stake, other than our entitlement, indirectly through our subsidiary, to the return of the $500,000 Closing Payment.

We currently do not have any interest, directly or indirectly, in mining properties located in Colombia and our acquisition of an interest in the Mining Concession is subject to the certain conditions and contingencies for which we can provide no assurance that they will ever be satisfied. Our ownership interest in the Mining Concessions will occur, if at all, indirectly through our ownership of an equity interest in Kata. We can provide no assurance that a concession contract will be approved based on the IKE-10421X concession application or that Kata, through its subsidiary, will be able to successfully close the Kata Transaction. In the event that the Kata Transaction does not

close and a concession contract is not approved based on the IKE-10421X concession application, we will have not acquired any direct or indirect interest in the Mining Concessions.

Under the terms of the Agreement, we are entitled to also acquire from Seller the remaining seventy-five percent (75%) of the outstanding capital stock of Kata as follows:

|

·

|

We can exercise our option to acquire an additional 25% stake in Kata, resulting in the acquisition of fifty percent (50%) of the outstanding capital stock of Kata (the “50% Stake”), beginning five (5) business days following such time that we receive written notice that the Mining Concessions are registered in the National Mining Registry of Colombia in favor of Kata’s subsidiary in accordance with the regulations set forth in the Colombian Mining Code (the “Registration”) and ending no later than March 2, 2012 by:

|

|

(i)

|

paying Seller $450,000 in cash on or before five (5) business days following the Company’s receipt of notice that the Registration was completed;

|

|

(ii)

|

paying Seller $1,000,000 in cash on or before sixty (60) days following our receipt of notice that the Registration was completed or twelve (12) months following the Closing Date of the Agreement (February 25, 2012), whichever is earlier; and

|

|

(iii)

|

issuing to Seller 2,000,000 shares of our common stock.

|

|

·

|

Provided that we have acquired the 50% Stake, we can exercise our option to acquire an additional 25% stake in Kata, resulting in the acquisition of seventy-five percent (75%) of the outstanding capital stock of Kata (the “75% Stake”), within thirteen months of the Effective Date of the Agreement (March 25, 2012) by:

|

|

(i)

|

paying Seller $1,000,000 in cash; and

|

|

(ii)

|

issuing to Seller 1,000,000 shares of our common stock.

|

|

·

|

Provided that we have acquired the 75% Stake, we can exercise our option to acquire an additional 25% stake of Kata, resulting in the acquisition of the 100% Stake, by:

|

|

(i)

|

paying Seller $1,000,000 in cash; and

|

|

(ii)

|

issuing to Seller 1,000,000 shares of our common stock within eighteen months of the Effective Date of the Agreement (August 25, 2012).

|

Under the terms of the Agreement, if we exercise all of the foregoing options and acquire the entire 100% Stake, we would pay Seller an aggregate of $4,000,000 in cash and issue to Seller 4,000,000 shares of our common stock in order to acquire one hundred percent (100%) of the outstanding capital stock of Kata.

In connection with due diligence conducted prior to entering into the Agreement, we determined that the entire area encompassing the Mining Concessions overlaps with a forestry reserve. Under Colombia law, only prospecting activities which would not result in any significant surface disturbance can be undertaken in an area classified as a forestry reserve. In order to commence any exploration and mining activities that would result in any significant surface disturbance in the area that is the subject of a concession contract, it will be necessary to initiate a proceeding before the competent environmental authority to reclassify the entire area, or a portion thereof, that is the subject of the

Mining Concessions so that it is no longer classified as a forestry reserve. We anticipate, but cannot provide any assurance, that efforts to declassify a portion or all of the subject area as a forestry reserve will be successful. In the unanticipated event that we are unable to succeed in reclassifying a portion or all of the area that is the subject of the Mining Concessions so that it is no longer classified as a forestry reserve, we will be unable to commence any exploration or mining activities causing any significant surface disturbance on the area subject to the Mining Concessions resulting in our investment in Kata being without any value. In the event this were to occur, there is a substantial risk that we would not be entitled to any return of the Closing Payment paid to Seller, our investment in Kata would be without any value, we may be forced to

delay, scale back, or eliminate our planned activities and there is a substantial risk that our business would fail. In addition, even if the effort to reclassify the entire area that is the subject of the Mining Concessions so that it is no longer classified as a forestry reserve is successful, there may be significant delay adversely impacting our prospects.

As a part of our business plan, we intend to seek out and acquire interests in other mineral exploration properties which, in the opinion of our management, offer attractive mineral exploration opportunities. Presently, we are considering the acquisition of other exploration properties, but have not entered into any letters of intent or agreements providing for the acquisition of other exploration properties as of the date of this report.

Summary of Property Underlying the IKE-10421X Concession Application

A description of the property underlying the IKE-10421X concession application referred to as the “Santacruz Gold Project” is set forth in Item 2 of this annual report. We caution that we not have any interest, directly or indirectly, in the property referenced herein as the Santacruz Gold Project. Our field work in the Santacruz Gold project area is being undertaken in order to gather data for the purpose of placing us in a better position to develop and execute a plan for exploration and development of the Santacruz Gold Project, should we be successful in acquiring an indirect interest in a mining concession contract underlying the Santacruz gold project. We acquired a 25% equity interest

in Kata, with an option to increase our ownership interest to 100%. Kata, through its subsidiary owns an 85% equity interest in Minera Narino, which has a contractual right, subject to the satisfaction of certain conditions, to acquire a mining concession contract covering the Santacruz Gold Project. We can provide no assurance that the conditions required for Minera Narino to acquire a mining concession contract covering the Santacruz Gold Project will ever be satisfied. If for any reason a mining concession contract covering the Santacruz Gold Project is not granted and assigned to Minera Narino, we will have not acquired any direct or indirect interest in a mining concession contract underlying the Santacruz Gold Project. If this were to occur, there is a substantial risk that our business would fail.

Existing and Probable Governmental Regulation

Mining in Colombia is governed by the Mining Law 685 of 2001. It was modified by Law 1382 of February 9, 2010, which was declared unconstitutional through ruling C-366 of the Constitutional Court, but it will remain in force as Colombian law until September 2013. The mining authorities in Colombia are as follows:

|

·

|

Ministry of Mines and Energy (“MME”).

|

|

·

|

INGEOMINAS (Colombian Institute of Geology and Mining): The MME had delegated the administration of mineral resources to INGEOMINAS and some Department (Provincial) Mining Delegations. INGEOMINAS has two departments, the Geological Survey, and the Mines Department which is responsible for all mining contracts except where responsibility for the administration has been passed to the Departmental (Provincial) Mining Delegations.

|

|

·

|

Departmental Mining Delegations (Gobernaciones Delegadas): Administers mining contracts in the Departments with the most mining activity.

|

|

·

|

Mining Energy Planning Unit (UPME): Provides technical advice to the MME regarding planning for the development of the mining and energy sector and maintains the System of Colombian Mining Information (SIMCO).

|

All mineral resources belong to the state and can be explored and exploited by means of concession contracts granted by the state. Under the Mining Law of 2001, there is a single type of concession contract covering exploration, construction and mining which is valid for 30 years and can be extended for another 20 years.

Concession contract areas are defined on a map with reference to a starting point (punto arcifinio) and distances and bearings, or by map coordinates.

A surface tax (canon superficiario) has to be paid annually in advance during the exploration and construction phases of the concession contract. This is defined as 1 minimum daily wage per hectare per year for years 1 to 5, 1.25 minimum daily wages per hectare per year for years 6 and 7, and 1.5 minimum daily wages per hectare per year since year 8 and henceforth according to an interpretation by the MME. Based on this calculation the fee per hectare currently is US$10.29, or a total of US$18,892 for the area covered by concession application IKE-10421X.

The application process for a concession contract is as follows:

|

1.

|

Application submitted.

|

|

2.

|

Technical study by the mining authority to determine whether there is any overlap with other contracts or applications. The applicant is notified.

|

|

3.

|

Under the modifications to the Mining Law of 2010, the surface tax has to be paid within three days of the notification of the technical study of free areas.

|

|

4.

|

Once the surface tax is paid, the contract is prepared and signed.

|

|

5.

|

The contract is inscribed in the National Mining Register.

|

Once the concession is approved, if at all, we intend to apply for permission to reclassify sections of the property that are currently classified as a forest reserve. We have already begun preparatory work for this process.

The concession contract has three phases:

|

|

1.

|

Exploration Phase.

|

|

·

|

Starts once the contract is inscribed in the National Mining Registry.

|

|

·

|

Valid for 3 years plus up to 4 extensions of 2 years each, for a maximum of 11 years.

|

|

·

|

Annual surface tax payable.

|

|

·

|

Requires an annual Environmental Mining Insurance Policy for 5% of the value of the planned exploration expenditure for the year.

|

|

·

|

Present a mine plan (PTO) and an Environmental Impact Study (or EIA) for the next phase.

|

|

·

|

Need of Environmental License only when the exploration activities comprise the construction of roads.

|

|

|

2.

|

Construction Phase.

|

|

·

|

Valid for 3 years plus a 1 year extension.

|

|

·

|

Annual surface tax payments continue as in Exploration Phase.

|

|

·

|

Requires an annual Environmental Mining Insurance Policy for 5% of the value of the planned investment as defined in the PTO for the year.

|

|

·

|

Environmental License issued on approval of Environmental Impact Study.

|

|

·

|

Environmental License required to initiate the construction activities.

|

|

|

3.

|

Exploitation Phase.

|

|

·

|

Valid for 30 years minus the time taken in the exploration and construction phases, and is renewable for 30 years.

|

|

·

|

Annual Environmental Mining Insurance Policy required.

|

|

·

|

No annual surface tax.

|

|

·

|

Pay royalty based on regulations at time of granting of the Contract.

|

Royalties payable to the state are 4% of gross value at the mine mouth for gold and silver and 5% for copper (Law 141 of 1994, modified by Law 756 of 2002). .

The most important changes in the Mining Law of 2010 are:

|

·

|

The exploration phase can now be up to 11 years, rather than 5 years.

|

|

·

|

The contract length is reduced to 50 years (30 years + 20 year extension) from 60 years (30 + 30).

|

|

·

|

The surface tax is the same for all sizes of concession, and increases from year 6.

|

|

·

|

The surface tax for year 1 has to be paid within three days of notification of the free areas.

|

|

·

|

Once an application or contract is dropped or expires for whatever reason, the area does not become free for staking again for a period of 30 days.

|

As indicated above, the modification set forth in Law 1382 of February 9, 2010 to Mining Law 685 of 2001 was declared unconstitutional through ruling C-366 of the Constitutional Court, but it will remain in force as Colombian law until September 2013. We are unable to ascertain the impact of this change and other future changes to the current mining laws at this time, which include a comprehensive overhaul of rules applicable to companies engaged in mining activities. In addition, the Colombian government recently a temporary moratorium on new application approvals, which we believe will not impact prior applications such as the IKE-10421X concession application, but we can provide no assurance

that the temporary moratorium will not be extended or adversely impact the IKE-10421X concession application.

Competition

We are an exploration stage mineral resource exploration company that competes with other mineral resource exploration companies for financing and for the acquisition of mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This

competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to acquire mineral property interests and conduct exploration activities. We will also compete with other mineral exploration companies for financing from a limited number of investors that are prepared to make investments in mineral exploration companies. The presence of competing mineral exploration companies may adversely impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We

will also be compete with other mineral companies for available resources, including, but not limited to, professional geologists, camp staff, mineral exploration supplies and drill rigs.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Employees

We have no full-time employees at the present time, but our Chief Executive Officer, Raymond DeMotte, and our Chief Financial Officer, Camilo Velasquez, are presently providing us with consulting services on the full-time basis. We engage contractors on an as-needed basis to assist us in conducting exploration activities, planning for exploration and reviewing other exploration properties for diligence purposes in determining whether to pursue acquisitions.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

During the last fiscal year, we incorporated, South American Gold Corp., as a subsidiary entity. As described above, this subsidiary will be merged into us and out of existence effective October 11, 2010 effectuating a change in our corporate name to South American Gold Corp.

We own a 25% interest in the issued and outstanding stock of Kata Enterprises Inc., a corporation organized under the laws of the Republic of Panama.

ITEM 1A. Risk Factors.

You should carefully consider the following risk factors in evaluating our business and us. The factors listed below represent certain important factors that we believe could cause our business results to differ. These factors are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. You should also consider the other

information included in this Annual Report and subsequent quarterly reports filed with the SEC.

Risk Factors

Risks Associated With Our Business

Our accountants have raised substantial doubt with respect to our ability to continue as a going concern.

As noted in our financial statements, we have incurred a net loss of $3,854,622 for the period from inception on March 25, 2005 to June 30, 2011 and have presently no source of revenue. At June 30, 2011, we had a working capital deficit of $131,725. As of June 30, 2011, we had cash and cash equivalents in the amount of US $120,537. We will have to raise additional funds in order to sustain any level of operations and commence any recommended exploration activities.

The audit report of Madsen & Associates, CPA’s Inc.’s for the fiscal year ended June 30, 2011 contained a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This is a significant risk that we may not be able to generate or raise enough capital to remain operational for an indefinite period of time.

In preparing our consolidated financial statements for fiscal 2010, our management identified material weaknesses in our internal control over financial reporting, and our failure to complete the process of remediating these material weaknesses by the end of the period covered by this Annual Report could result in material misstatements in our consolidated financial statements and the loss of investor confidence in our reported financial information.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. Our management identified material weaknesses in our internal control over financial reporting as of June 30, 2011. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis.

The material weaknesses identified by management as of June 30, 2010 was based primarily on the occurrence of a significant number of out-of-period adjustments and the magnitude of such that were identified during the quarterly closing process for the periods ended December 31, 2009 and March 31, 2010, which we believe primarily stems from the fact that we had limited accounting and financial staff during the year ended June 30, 2010 which did not possess the requisite qualifications, and has not be remediated as of the end of the period covered by this Annual Report.

As a result of management’s assessment of internal control over financial reporting, our Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures were not effective to ensure that the information required to be disclosed by us in the reports that we file or submit under the Exchange Act was recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and that such information required to be disclosed is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

We are in the process of implementing the appropriate remedial measures to address these material weaknesses, but have not completed this process. We cannot be certain that the measures we take will be effective or will ensure that restatements will not occur in the future. If remedial measures are insufficient to address these material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control are

discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results. Any future restatement of consolidated financial statements could place a significant strain on our internal resources and harm our operating results. Further, any additional or unremedied material weakness may preclude us from meeting our reporting obligations on a timely basis.

Any failure to complete the process of addressing the identified material weaknesses or any additional material weaknesses in our internal control could also adversely affect the results of the periodic management evaluations regarding the effectiveness of our internal control over financial reporting that are required to be included in our annual reports on Form 10-K. Internal control deficiencies could also cause investors to lose confidence in our reported financial information. We can give no assurance that the measures we may take in the future will remediate the material weaknesses identified or that any additional material weaknesses

or restatements of financial results will not arise in the future due to a failure to implement and maintain adequate internal control over financial reporting or circumvention of these controls. In addition, even if we are successful in strengthening our controls and procedures, in the future those controls and procedures may not be adequate to prevent or identify irregularities or errors or to facilitate the fair presentation of our consolidated financial statements.

We will not be entitled to recover any exploration expenditures or other expenses incurred in connection with acquiring a twenty-five percent (25%) of the outstanding capital stock (the “25% Stake”) of Kata Enterprises Inc. (“Kata”) should Kata, through its subsidiary, fail to secure the rights to mining concessions located in the Nariño province of Colombia covered by concession application IKE-10421X.

On February 25, 2011 (the “Effective Date”), we entered into a Stock Purchase Agreement with Minera Kata S.A., a corporation organized under the laws of the Republic of Panama (“Seller”), as amended and supplemented by Amendment No. 1 (the “Amendment”) dated April 25, 2011 (collectively, the “Agreement”), and acquired from Seller a 25% Stake in Kata, with an option to acquire from Seller the remaining seventy-five percent (75%) of the outstanding capital stock of Kata. Kata has entered into an agreement to acquire, through its subsidiary, an eighty-five percent (85%) interest in certain mining concessions located in the Nariño province of Colombia covering the

area that is the subject of the IKE-10421X concession application (the “Mining Concessions”), but has not successfully closed that transaction as of this time (the “Kata Transaction”). Our ownership interest in the Mining Concessions will occur, if at all, indirectly through our ownership of an equity interest in Kata. We currently do not have any interest, directly or indirectly, in mining properties located in Colombia and our acquisition of an interest in the Mining Concession is subject to the certain conditions and contingencies for which we can provide no assurance that they will ever be satisfied. We can provide no assurance that a concession contract will be approved based on the IKE-10421X concession application or that Kata, through its subsidiary, will be able to successfully close the Kata Transaction. In

the event that the Kata Transaction does not close and a concession contract is not approved based on the IKE-10421X concession application, we will have not acquired any direct or indirect interest in the Mining Concessions and not be entitled to recover any of our exploration expenditures of other expenses incurred in connection with acquiring the 25% Stake. If this were to occur, there is a substantial risk that our business would fail.

Because the entire area covered by the application for a concession contract by the transferor to Kata contains an area classified as a forestry reserve, there is a risk that exploration and mining activities causing any significant surface disturbance cannot be undertaken which would result in any investment in Kata having no value.

Under Colombia law, only prospecting activities which would not result in any significant surface disturbance can be undertaken in an area classified as a forestry reserve. In order to commence any exploration and mining activities causing any significant surface disturbance in the area that is the subject of a concession contract, it will be necessary to initiate a proceeding before the competent environmental authority to reclassify the entire area, or a portion thereof, that is the subject of the Mining Concessions so that it is no longer classified as a forestry reserve. We anticipate, but cannot provide any assurance, that efforts to declassify a portion or all of the subject area as

a forestry reserve will be successful. Assuming a concession contract is approved based on the IKE-10421X concession application and Kata, through its subsidiary, successfully closes the Kata Transaction, but we are unable to succeed in reclassifying a portion or all of the area that is the subject of the Mining Concessions so that it is no longer classified as a forestry reserve, we will be unable to commence any exploration or mining activities causing any significant surface disturbance on the area subject to the Mining Concessions resulting in our investment in Kata being without any value. In the event this were to occur, there is a substantial risk that we would not be entitled to

any return of the $500,000 paid to Seller upon execution of the Agreement, our investment in Kata would be without any value, we may be forced to delay, scale back, or eliminate our planned activities and there is a substantial risk that our business would fail. In addition, even if the effort to reclassify the entire area that is the subject of the Mining Concessions so that it is no longer classified as a forestry reserve is successful, there may be significant delay adversely impacting our prospects.

If we are unable to acquire more than twenty-five percent (25%) of the outstanding capital stock of Kata resulting in our acquisition of a majority interest in the outstanding capital stock of Kata, our interests may not be protected as a minority shareholder in Kata.

In the event we are unable to acquire more than twenty-five percent (25%) of the outstanding capital stock of Kata resulting in our acquisition of a majority interest in the outstanding capital stock of Kata, we will be a minority shareholder in Kata. As a minority shareholder, our interests may differ from the majority shareholder and we will not be able to control the business and operations of Kata. If the interest of the majority shareholder and its decisions regarding Kata differ from our interests, our interest may not be protected.

We have a limited operating history and have incurred losses that we expect to continue into the future.

We have never had any revenues from our operations. In addition, we have a very limited operating history upon which an evaluation of our future success or failure can be made. We have only recently taken steps in a plan to engage in the acquisition of interests in exploration and development properties, and it is too early to determine whether such steps will prove successful. Our business plan is in its early stages and faces numerous regulatory, practical, legal and other obstacles. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at

the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties, and our failure to do so could have a materially adverse effect on our financial condition.

No assurances can be given that we will be able to successfully complete the purchase of any mineral property interests, Our ability to achieve and maintain profitability and positive cash flow over time will be dependent upon, among other things, our ability to (i) identify and acquire properties or interests therein that ultimately have probable or proven mineral reserves, (ii) sell such mining properties or interests to strategic partners or third parties or commence the production of a mineral deposit, (iii) produce and sell minerals at profitable margins and (iv) raise the necessary capital to operate during this possible extended period of

time. At this stage in our development, it cannot be predicted how much financing will be required to accomplish these objectives.

We have no known reserves and we may not find any mineral reserves or, if we find mineral reserves, the deposits may be uneconomic or production from those deposits may not be profitable.

Our due diligence activities have been limited, and to a great extent, have relied upon information provided to us by third parties. We have not established that any of the properties for which we intend to acquire an interest contain adequate amounts of gold or other mineral reserves to make mining any of these properties economically feasible to recover that gold or other mineral reserves, or to make a profit in doing so. If we do not, our business will fail. If we cannot find economic mineral reserves or if it is not economic to recover the mineral reserves, we will have to cease operations.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment, such as bulldozers and excavators, that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. Provided we are successful in securing additional financing, we will attempt to locate products, equipment and materials. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Our success is dependent upon a limited number of people.

The ability to identify, negotiate and consummate transactions that will benefit us is dependent upon the efforts of our management team. The loss of the services of any member of our management could have a material adverse effect on us.

Our business will be harmed if we are unable to manage growth.

Our business may experience periods of rapid growth that will place significant demands on our managerial, operational and financial resources. In order to manage this possible growth, we must continue to improve and expand our management, operational and financial systems and controls. We will need to hire, train and manage our employee base. We must carefully manage our mining exploration activities. No assurance can be given that we will be able to timely and effectively meet such demands.

We may not be able to attract and retain qualified personnel necessary for the implementation of our business strategy and mineral exploration programs.

Our future success depends largely upon the continued service of board members, executive officers and other key personnel. Our success also depends on our ability to continue to attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations. Personnel represents a significant asset, and the competition for such personnel is intense in the mineral exploration industry. We may have particular difficulty attracting and retaining key personnel in the initial phases of our operations.

Our officers and directors may have outside interests diverting their attention from our business.

Our officers and directors may have outside interests in that they are and may become affiliated with other mining companies. If the demands of these other mining companies require significant business time of our officers and directors, it is possible that our officers and directors may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

As some of our officers and directors are located outside of the United States, you may have no effective recourse against our us or our management for misconduct and may not be able to enforce judgment and civil liabilities against our officers, directors, experts and agents.

Some of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Indemnification of officers and directors.

Our Articles of Incorporation and Bylaws contain broad indemnification and liability limiting provisions regarding our officers, directors and employees, including the limitation of liability for certain violations of fiduciary duties. Our stockholders therefore will have only limited recourse against the individuals.

Risks Associated With Mining

There is no assurance that we can establish the existence of any mineral reserve on any mineral property interest we may acquire in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business will fail.

We cannot provide any assurance that any mineral property interest we may acquire will contain any commercially exploitable mineral reserve. If we cannot establish the existence of any commercially exploitable mineral reserve, our business will fail. A mineral reserve is defined by the SEC in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual

prospect ever having a “reserve” that meets the requirements of the SEC’s Industry Guide 7 is extremely remote; in all probability any mineral resource property that we may acquire will not contain any ‘reserve’ and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on any mineral property interest we may hold, there can be no assurance that we will be able to develop any such properties into producing mines and extract those reserves. Both mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. If we do discover mineral reserves in commercially exploitable quantities on any mineral property interest we may hold, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing

facilities and infrastructure.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the reserve to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral reserve in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral deposit. If we cannot exploit any mineral deposit that we might discover on any mineral property interest we may hold, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration or for the construction and operation of a mine on any mineral property interest we may hold at economically viable

costs. If we cannot accomplish these objectives, our business could fail.

Current laws and regulations could be amended making it more difficult for us to comply with them, as amended. For example, changes to Colombian mining laws, which include a comprehensive overhaul of rules applicable to companies engaged in mining activities, could adversely impact our operations in Colombia. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development

activities.

If we establish the existence of a mineral reserve on any mineral property interest we may acquire, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve and our business could fail.

If we do discover a mineral reserve on any mineral property interest we may acquire, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a reserve, there can be no assurance that it will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and

infrastructure, our business may fail.

Because mineral exploration activities are subject to political, economic and other uncertainties, situations may arise that could have a significantly adverse material impact on us.

Our ongoing and proposed activities will be subject to political, economic and other uncertainties, including the risk of expropriation, nationalization, renegotiation or nullification of existing contracts, mining licenses and permits or other agreements, changes in laws or taxation policies, currency exchange restrictions, changing political conditions and international monetary fluctuations. Future government actions concerning the economy, taxation, or the operation and regulation of nationally important facilities such as mines could have a significant effect on our plans and on our ability to operate. No assurances can be given that our

plans and operations will not be adversely affected by future developments in those jurisdictions where we may hold property interests.

Because we do not plan to secure any title insurance in the future, we are vulnerable to loss of title.

We do not plan to maintain insurance against title. Title on mineral properties and mining rights involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mining properties. Disputes over land ownership are common, especially in the context of resource developments. We cannot give any assurance that title to any such properties we may acquire will not be challenged or impugned and cannot be certain that we will have acquired valid title to these mining properties. The possibility also

exists that title to future prospective properties may be lost due to an omission in the claim of title. As a result, any claims against us may result in liabilities we will not be able to afford, resulting in the failure of our business.

Because we are subject to various governmental regulations and environmental risks, we may incur substantial costs to remain in compliance.

Our planned activities are subject to laws and regulations regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials. Any significant mining operations will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. We may be required by government regulations to obtain insurance against environmental risks. It is possible that we not be able to obtain any required insurance policies or experience

significant delays and costs in obtaining such insurance. No assurances can be given that these issues relating to environmental matters will not cause our operations in the future to fail.

The government in those jurisdictions where we may hold property interests could require us to remedy any negative environmental impact. The costs of such remediation could cause us to fail. Future environmental laws and regulations could impose increased capital or operating costs on us and could restrict the development or operation of any mines.

We will in the future, engage consultants to assist us with addressing the various regulatory and governmental agencies, and the rules and regulations of such agencies, in connection with our planned activities. No assurances can be given that we will be successful in our efforts. Further, in order for us to operate and grow our business, we need to continually conform to the laws, rules and regulations of such country and local jurisdiction where we operate. It is possible that the legal and regulatory environment pertaining to the exploration and development of mining properties will change. Uncertainty and new regulations

and rules could dramatically increase our cost of doing business, or prevent us from conducting our business; both situations could cause us to fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liabilities may exceed our resources, which could cause our business to fail.

Mineral exploration, development and production involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our proposed operations will be subject to all the hazards and risks inherent in the exploration, development and production of reserves, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that

arise from any such occurrence could cause us to fail.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, from the extraction and sale of precious and base metals such as gold. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and, therefore, the economic viability of any of our exploration

projects, cannot accurately be predicted.

The mining industry is highly competitive and if we cannot continue to acquire interests in properties to explore for mineral reserves, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and license mineral resource properties, we will not compete with them for the removal or sales of mineral products if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of gold and other mineral products. Therefore, we will likely be able to sell any gold or mineral products that we identify and

produce.

We compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future as well as our ability to recruit and retain qualified personnel. Accordingly, there can be no assurance that we will acquire any interest in mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Relating to our Common Stock

Our Securities are not currently eligible for sale under Rule 144 and any future sales of our securities may be adversely affected by our failure to file all reports required by the Exchange Act.

Rule 144 as promulgated under the Securities Act is not available for the resale of securities initially issued by a shell company (reporting or non-reporting) or a former shell company, unless certain conditions are satisfied. We are a former shell company. As a result, our securities cannot be resold under Rule 144 unless certain conditions are met. These conditions are:

|

·

|

the issuer of the securities has ceased to be a shell company;

|

|

·

|

the issuer is subject to the reporting requirements of section 13 or 15(d) of the Exchange Act;

|

|

·

|

the issuer has filed all reports and other materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months, other than Form 8-K reports; and

|

|

·

|

one year has elapsed since the issuer has filed current ‘‘Form 10 information’’ with the Commission reflecting its status as an entity that is no longer a shell company.

|

One year has not elapsed since we filed current ‘‘Form 10 information’’ with the Commission reflecting our status as an entity that is no longer a shell company. One year must elapse from the filing date of ‘‘Form 10 information’’ in order for our securities to be eligible for sale under Rule 144, provided the other conditions set forth above are satisfied. No assurance can be provided that we will be compliant with these conditions. If after one year has elapsed from the filing date of the complete ‘‘Form 10 information’’ we, as a former shell company, ever fail to file all reports and other materials required to

be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months, our securities will not be eligible to be resold under Rule 144.

Trading on the over-the-counter bulletin board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the over-the-counter bulletin board service of the Financial Industry Regulatory Authority (the “OTCBB”). Trading in stock quoted on the OTCBB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTCBB is not a stock exchange, and trading of securities on the OTCBB is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or

a stock exchange like Amex. These factors may result in investors having difficulty reselling any shares of our common stock.

Because our common stock is quoted and traded on the OTCBB, short selling could increase the volatility of our stock price.

Short selling occurs when a person sells shares of stock which the person does not yet own and promises to buy stock in the future to cover the sale. The general objective of the person selling the shares short is to make a profit by buying the shares later, at a lower price, to cover the sale. Significant amounts of short selling, or the perception that a significant amount of short sales could occur, could depress the market price of our common stock. In contrast, purchases to cover a short position may have the effect of preventing or retarding a decline in the market price of our common stock, and together with the imposition of the penalty

bid, may stabilize, maintain or otherwise affect the market price of our common stock. As a result, the price of our common stock may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued at any time. These transactions may be effected on the OTCBB or any other available markets or exchanges. Such short selling if it were to occur could impact the value of our stock in an extreme and volatile manner to the detriment of our shareholders who may seek to sell the “restricted” shares purchased in this offering; provided the shareholder meets the requirements of Rule 144 promulgated under the Securities Act.

We have never paid dividends and have no plans to in the future.

Holders of shares of our common stock are entitled to receive such dividends as may be declared by our board of directors. To date, we have paid no cash dividends on our shares of common stock and we do not expect to pay cash dividends on our common stock in the foreseeable future. We intend to retain future earnings, if any, to provide funds for operation of our business. Therefore, any return investors in our common stock will have to be in the form of appreciation, if any, in the market value of their shares of common stock.

We have additional securities available for issuance, which, if issued, could adversely affect the rights of the holders of our common stock.

Our Articles of Incorporation authorize the issuance of 450,000,000 shares of our common stock. The common stock can be issued by our board of directors, without stockholder approval. Any future issuances of our common stock would further dilute the percentage ownership of our common stock held by public stockholders.

Because the SEC imposes additional sales practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty in reselling your shares and may cause the price of the shares to decline.

Our stock is a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual

income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing

before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

In addition to the “penny stock” rules promulgated by the SEC, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative, low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA

requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock. These factors may result in an investor who satisfies the conditions of Rule 144 promulgated under the Securities Act being unable or having difficulty liquidating his or her “restricted” shares purchased in this offering.

Our stock price is likely to be highly volatile because of several factors, including a limited public float.

The market price of our common stock is likely to be highly volatile because there has been a relatively thin trading market for our stock, which causes trades of small blocks of stock to have a significant impact on our stock price. You may not be able to resell shares of our common stock following periods of volatility because of the market’s adverse reaction to volatility.

Other factors that could cause such volatility may include, among other things:

|

·

|

actual or anticipated fluctuations in our operating results;

|

|

·

|

the absence of securities analysts covering us and distributing research and recommendations about us;

|

|

·

|

we expect our actual operating results to continue to fluctuate;

|

|

·

|

we may have a low trading volume for a number of reasons, including that a large amount of our stock is closely held;

|

|

·

|

overall stock market fluctuations;

|

|

·

|

economic conditions generally and in the mining industries in particular;

|

|

·

|

announcements concerning our business or those of our competitors or vendors;

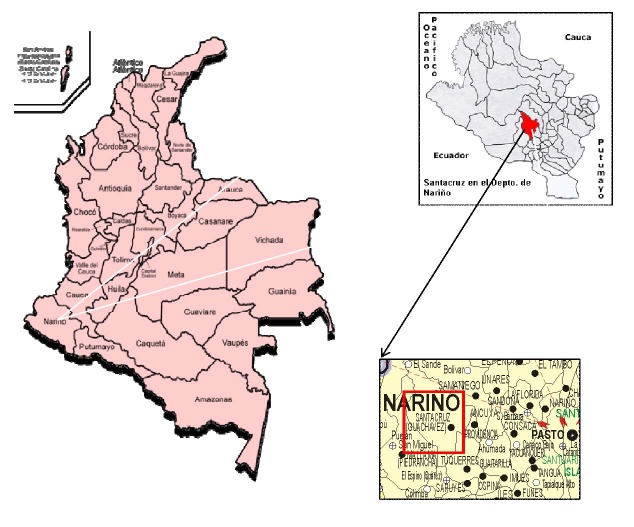

|