Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTWATER RESOURCES, INC. | a2210899z8-k.htm |

| EX-23.1 - EX-23.1 - WESTWATER RESOURCES, INC. | a2210899zex-23_1.htm |

| EX-99.1 - EX-99.1 - WESTWATER RESOURCES, INC. | a2210899zex-99_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

INFORMATION RELATED TO NEUTRON

Description of Business

Company Overview

Neutron began operations as an unincorporated entity on March 25, 2005 and was incorporated on March 29, 2005 under the laws of the State of Wyoming. On April 26, 2007, Neutron transferred its state of domicile from Wyoming to Nevada. Neutron was formed to capitalize on its management's extensive knowledge and experience in uranium exploration, development and production, as well as Neutron's geologic and engineering data bases covering several uranium districts that historically have been uranium producers. On August 31, 2012, Neutron became an indirect wholly-owned subsidiary of URI through the merger of URI Merger Corporation with and into Neutron.

Neutron is a natural resource company engaged in the acquisition and exploration of uranium properties in the United States. Neutron's strategy has been to acquire properties that (i) have undergone some degree of historical uranium exploration and on which uranium mineralized material, but not reserves, have been located, and (ii) are located in mineralized districts that have undergone some degree of historical uranium exploration and are thought to be prospective for further uranium exploration, but on which no uranium mineralized material has been located. Neutron has acquired interests in 63,312 net acres of leased or staked properties in New Mexico, South Dakota and Wyoming.

Neutron also holds residual mineral interests that Neutron received in the disposition of properties in Arizona and South Dakota. These residual interests were received in consideration of the sale of Neutron's ownership interests in the properties and are primarily comprised of royalty interest, net proceeds interest and Neutron's ability to convert the royalty interest into a working interest in the properties.

Properties

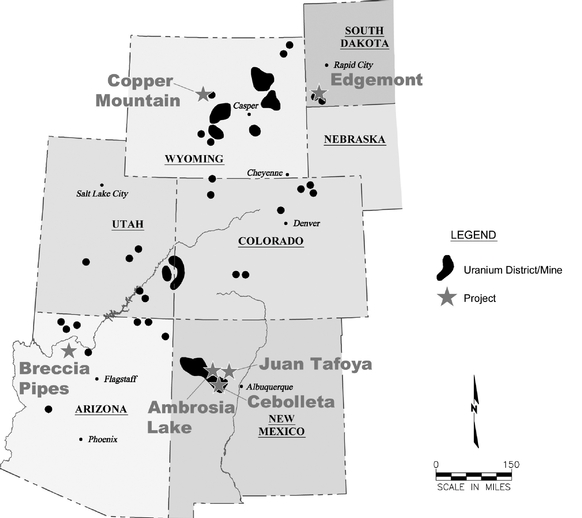

As of April 2012, Neutron has interests in properties located in the states of New Mexico, South Dakota, Wyoming, and Arizona as shown in the Figure 2.1. All of Neutron's projects are at the exploration stage without known reserves and there can be no assurance that a commercially viable mineral deposit, or reserve, exists on any of Neutron's properties until appropriate exploratory work is done and a comprehensive evaluation based on such work concludes legal and economic feasibility. Further exploration will be required before a final evaluation as to the economic, technical and legal feasibility of mining of any of Neutron's properties is determined. There is no assurance that further exploration will result in a final evaluation that a commercially viable mineral deposit, or reserve, exists on any of Neutron's mineral properties.

1

Figure 2.1. Location map of mineral properties (April 2012)

2

The Table below lists Neutron's Mineral Properties in which Neutron has an interest.

Property (location/project/target) |

Nature of Interest | Acreage (net) |

||||

|---|---|---|---|---|---|---|

New Mexico |

||||||

Cibola Project |

||||||

Juan Tafoya |

Lease-fee minerals within Spanish Land Grant | 4,097 | ||||

Cebolleta |

Lease-fee minerals within Spanish Land Grant | 6,717 | ||||

Ambrosia Lake |

||||||

Deep Rock |

Unpatented mining claims | 1,632 | ||||

Elizabeth |

Lease-patented and unpatented mining claims | 179 | ||||

Mesa Redonda |

Lease-unpatented mining claims | 1,748 | ||||

West Endy |

Lease-unpatented mining claims, state lease | 3,026 | ||||

West Ranch |

Unpatented mining claims | 4,117 | ||||

Other |

||||||

Hogan |

Unpatented mining claims | 1,108 | ||||

Rio Puerco |

Unpatented mining claims | 1,325 | ||||

South Dakota |

||||||

Edgemont |

Unpatented mining claims, leased fee and state leases | 19,062 | ||||

Wyoming |

||||||

Copper Mountain |

Unpatented mining claims, lease fee and state leases | 9,313 | ||||

Black Hills |

State lease | 3,638 | ||||

Shirley Basin |

Unpatented mining claims and state leases | 1,709 | ||||

Sundance |

State leases | 5,641 | ||||

|

Total | 63,312 | ||||

Other Residual Mineral Interests |

||||||

Arizona |

||||||

Breccia Pipes |

Royalty interest and option to participate | 2,898 | ||||

South Dakota |

||||||

Dewy-Burdock |

Net proceeds interest | 6,288 | ||||

General

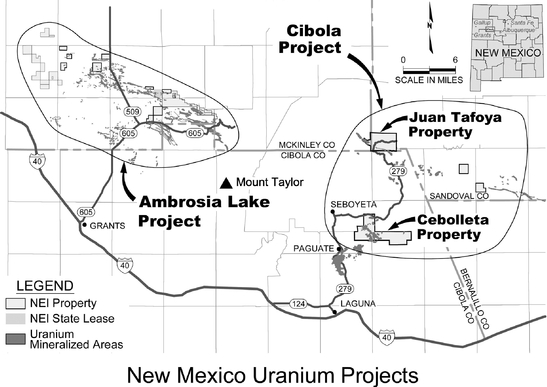

Neutron's mineral properties located in the State of New Mexico are subdivided into two separate groups and consist of the Cibola Project and the Ambrosia Lake Project. Neutron's principal mineral project is the Cibola Project which consists of the Juan Tafoya Property and the Cebolleta Property. Within the lands that comprise the Ambrosia Lake Project, Neutron has identified five principal target areas: Deep Rock, Elizabeth, Mesa Redonda, West Endy, and West Ranch properties. Figure 2.2. below shows the location of Neutron's Cibola and Ambrosia Lake Projects.

3

Figure 2.2. Location Map of New Mexico Properties (April 2012)

Regional Geologic Setting

The properties in the Cibola Project and the Ambrosia Lake Project are situated within the Grants mineral belt. The principal uranium mineralized areas of the Grants mineral belt are hosted in sandstones of the Jurassic-aged Morrison Formation. This belt of mineralized areas includes mining districts north of Laguna, the Ambrosia Lake-San Mateo area (north of Grants), Smith Lake, Crownpoint, and Church Rock. According to Wright, 1980, published in the New Mexico Bureau of Mines and Mineral Resources Memoir 38, the collective mineralized areas of the belt have produced more that 348 million pounds of uranium which was more than 44% of all uranium produced in the United States through 1980. One of the districts in the mineral belt, Ambrosia Lake, has been reported by Chenoweth, 1989, in the New Mexico Geological Society 40th Conference Guidebook to have produced nearly 190 million pounds of U3O8.

Cibola Project

General

The Cibola Project is located approximately 45 miles (72.4 kilometers) west-northwest of the city of Albuquerque, New Mexico. Neutron controls leases covering approximately 10,814 acres (4,376 hectares) of privately owned surface and mineral rights, in two separate, non-contiguous blocks that are separated by a distance of approximately 10 miles (16.1 kilometers), owned by the Cebolleta Land Grant, the JTLC and various private property owners. The properties that comprise the Cibola Project consist of the Cebolleta Property and the Juan Tafoya Property.

4

Mining Lease Descriptions

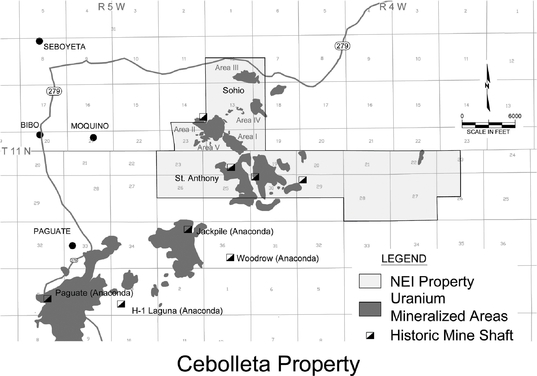

Cebolleta Property

In March 2007, Neutron entered into the Cebolleta Lease with the Cebolleta Land Grant, a privately held land grant, to lease the Cebolleta Property, which is composed of approximately 6,717 acres (2,718 hectares) of fee (deeded) surface and mineral rights. The Cebolleta Lease was affirmed by the New Mexico District Court in Cibola County in April 2007. The Cebolleta Lease provides for: (i) a term of ten years and so long thereafter as Neutron is conducting operations on the Cebolleta Property; (ii) initial payments to the Cebolleta Land Grant of $5,000,000; (iii) a recoverable reserve payment equal to $1.00 multiplied by the number of pounds of recoverable uranium reserves upon completion of a feasibility study to be completed within six years, less (a) the $5,000,000 referred to in (ii) above, and (b) not more than $1,500,000 in annual advance royalties previously paid pursuant to (iv); (iv) annual advanced royalty payments of $500,000; (v) gross proceeds royalties from 4.50% to 8.00% based on the then current price of uranium; (vi) employment opportunities and job-skills training for the members of the Cebolleta Land Grant; and (vii) funding of annual higher education scholarships for the members of the Cebolleta Land Grant. The Cebolleta Lease provides Cibola with the right to explore for, mine, and process uranium deposits present on the Cebolleta Property. In February 2012, Neutron entered into an Amendment of its Mining Lease Agreement amending the Cebolleta Lease, subject to approval of the Thirteenth Judicial District. Pursuant to the amendment, the date by which Neutron must complete a feasibility study was extended from April 2013 to April 2015. In addition, the date may be further extended subject to a reduction in the $6,500,000 initial payment and annual advance royalty payments deduction to the recoverable reserve payment.

Through March 31, 2012 Neutron has spent $22.3 million on the Cebolleta Property. This property was developed and uranium was mined in the past. However, all plant and equipment have been removed from the Cebolleta Property and the Cebolleta Property has no significant plant or equipment, including subsurface improvements and equipment. Electric power is available for mining activities at the Cebolleta Property. Two high voltage electrical transmission lines cross the region several miles north of the Cebolleta Property and electrical lines have been constructed to the site of the former Sohio L-Bar uranium mine.

Figure 2.3. Cebolleta Property (April 2012)

5

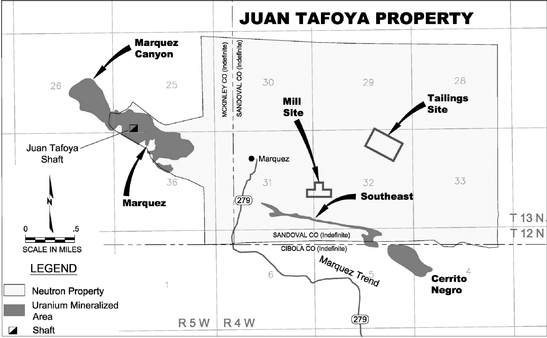

Juan Tafoya Property

In October 2006, Neutron entered into the Juan Tafoya Lease with the JTLC in which Neutron leased the Juan Tafoya Property, which consists of 4,097 acres (1,658 hectares) of fee (deeded) surface and mineral rights owned by the JTLC. The Juan Tafoya Lease provides for a term of ten years and will be extended on a year-to-year basis thereafter so long as Neutron is conducting operations on the Juan Tafoya Property. Additionally, the Juan Tafoya Lease, provides for: (i) an initial payment to JTLC of $1,250,000; (ii) annual rental payments of $225,000 for the first five years of the lease and $337,500 for the second five years; (iii) after the second five years, annual base rent of $75 per acre; (iv) gross proceeds royalties of 4.65% to 6.5% based on the then current price of uranium; (v) employment opportunities and job-skills training programs for shareholders of the JTLC or heirs of the JTLG; (vi) periodic contributions to a community projects fund if mineral production commences from the Juan Tafoya Property; and (vii) funding of a scholarship program for the shareholders of the JTLC or heirs of the JTLG. Neutron is obligated to make the first ten years' annual rental payments notwithstanding Neutron's right to terminate the Juan Tafoya Lease at any time, unless (a) the market value of uranium drops below $25 per pound, (b) a government authority bans uranium mining on the Juan Tafoya Property, or (c) the deposit is deemed uneconomical by an independent engineering firm.

In 2007, Neutron acquired infill fee mineral leases within the boundaries of the Juan Tafoya Lease. Neutron is obligated to make annual lease payments and pay production royalties ranging from 4.65% to 6.5% based on the then current price of uranium. The infill fee mineral leases covering the individually-owned small tracts have similar business terms and royalty provisions as the Juan Tafoya Lease.

The Juan Tafoya Lease and the infill fee mineral leases provide Neutron with the right to explore for, mine, and process uranium deposits present on the leased premises.

In January 2007, Neutron entered into a letter agreement with International Nuclear, Inc. Pursuant to the letter agreement Neutron acquired a database of information on the Marquez Canyon deposit located on the Juan Tafoya Property in consideration of a cash payment and a perpetual royalty of $0.25 per pound of uranium recovered from the Juan Tafoya Property with a maximum payout of $1,000,000.

Through March 31, 2012 Neutron has spent $7.7 million on the Juan Tafoya Property. Historically, the Juan Tafoya Property was almost fully developed for uranium mining and processing with the construction of a mill and related mine infrastructure. However, all plant and equipment have been removed from the Juan Tafoya Property and the Juan Tafoya Property has no significant plant or equipment, including subsurface improvements and equipment. Electrical power is available for both mining and milling activities at Juan Tafoya. A high voltage electrical transmission line exists south of the Juan Tafoya Property and separate electrical power lines have been constructed to the former shaft site and mill site.

6

Figure 2.4. Juan Tafoya Property (April 2012)

Accessibility

The Cibola Project is located in west-central New Mexico, approximately 45 miles (72.4 kilometers) west-northwest of the city of Albuquerque, and from 10 to 25 miles (16.1 to 40.2 kilometers) northeast of the town of Laguna. Access to the project area from Albuquerque is over a paved Interstate highway to the town of Laguna (a distance of approximately 45 miles, or 72.4 kilometers) and a paved two-lane highway (for a distance of 15 miles, or 24.1 kilometers) to the village of Seboyeta and a further 3 to 16 miles (4.8 to 25.7 kilometers) over a well-maintained graded county-owned gravel road. Several private roads of varying quality cross the project lands and provide access to nearly all parts of the project area. Rail service is available from the BNSF Railroad at Grants and Milan, and regularly scheduled air service is available in Albuquerque.

History

The Cibola Project area has been of considerable interest to the U.S. uranium industry since the original discovery of the Jackpile uranium mineralized area (located immediately southwest of the southern boundary of the Cibola Project) in late 1951. Exploration was carried out by the Anaconda Company during the 1950's on the southern portion of the Cibola Project area. The following companies have conducted exploration or mining on the Cibola Project: Climax Uranium Company, United Nuclear Corporation, Reserve Oil and Minerals, Sohio Western (then a subsidiary of Standard Oil Company), Rodney Devilliers, Bokum Resources Corporation and Exxon Minerals Corporation.

Mineralization

In accordance with SEC guidance on non-reserve mineralized material, Neutron shows the estimate of in-place non-reserve mineralized uranium material for Neutron's Cibola Project in the following table. The estimate of mineralized material for each of the mineralized areas listed below was obtained from the Technical Report on the Uranium Resources at The Cibola Project, Cibola, McKinley and Sandoval Counties, New Mexico, USA. The technical report is dated January 14, 2011 and was completed by Broad Oak Associates, an independent engineer. The Cebolleta property

7

includes five distinct mineralized areas: Areas I, II, III, IV, and V (see Figure 2.3) and the Juan Tafoya Property hosts the Marquez and the Southeast mineralized areas as shown in Figure 2.4.

The following in-place non-reserve mineralized material has been modeled and calculated utilizing the digital data base of the verified historical data discussed above and reported in the technical report.

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED MATERIAL IN THE CIBOLA PROJECT

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED

MATERIAL IN THE CIBOLA PROJECT

Mineralized Area

|

Tonnage Millions |

Grade Percent |

Non-Reserve Mineralized Material Millions of Lbs. U3O8 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Marquez |

3.2 | 0.15 | % | 9.6 | ||||||

Southeast |

0.6 | 0.14 | % | 1.7 | ||||||

Area I |

1.4 | 0.16 | % | 4.4 | ||||||

Area II |

3.1 | 0.18 | % | 11.0 | ||||||

Area III |

1.5 | 0.17 | % | 5.1 | ||||||

Area V |

0.7 | 0.21 | % | 3.0 | ||||||

Total |

34.8 | |||||||||

Additionally, as described in the Technical Report on the Uranium Resources at the Cibola Project, Neutron has historical reports prepared by prior operators and their independent consultants that show the St. Anthony area contains 4.5 million tons of non-reserve mineralized material at an average grade of 0.09% which equals non-reserve mineralized material of 8.1 million pounds of U3O8. This non-reserve mineralized material is considered historical in nature and no other calculations have yet been completed because the St. Anthony digital data base preparation and modeling is continuing. Upon completion of the modeling Neutron anticipates the technical report will be updated by the independent engineer.

Environmental and Permits

Neutron has completed archaeological, biological, and radiological surveys of the Marquez mineralized area, as well as the Sohio Areas I and III and portions of the St. Anthony mine area in support of its application for drilling permits, and has completed several environmental evaluations required to support license applications for a proposed mill and tailings storage area. Several other baseline studies are underway or planned to provide all additional data needed for the source material license application for the mill and tailings sites. In March 2012, Neutron submitted a Sampling and Analysis Plan to the Mining and Minerals Division of the New Mexico Energy, Minerals and Natural Resources Department ("MMD"). This is the first step in submitting a mine permit application.

Ambrosia Lake Project

General

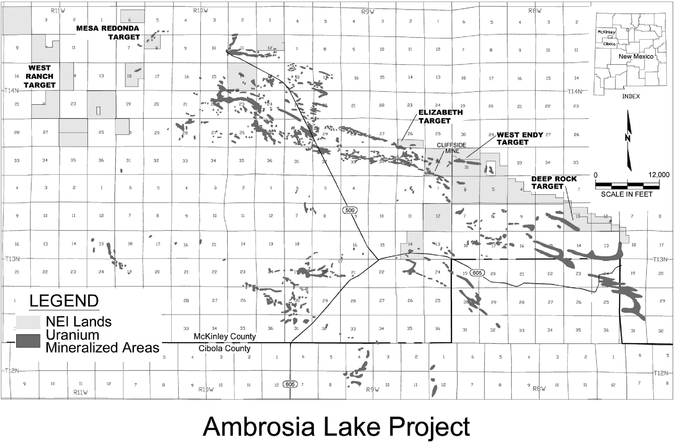

The Ambrosia Lake area historically was the largest and most significant uranium producing area in the United States. Within the lands that comprise the Ambrosia Lake Project, Neutron has identified five principal target areas: Deep Rock, Elizabeth, Mesa Redonda, West Endy, and West Ranch as shown in Figure 2.5.

8

Figure 2.5. Ambrosia Lake Targets (April 2012)

Uranium mineralized areas on Neutron's properties and elsewhere in the Grants mineral belt are primarily hosted in sandstones within the Poison Canyon sandstone and the Westwater Canyon Member of the Jurassic-aged Morrison Formation.

Properties

The Ambrosia Lake Project of Neutron is located approximately 60 miles (96.5 kilometers) west-northwest of the city of Albuquerque, New Mexico. The project is comprised of the (i) Endy Lease which is comprised of 167 unpatented lode mining claims and covers 3,382 acres (1,369 hectares) in the eastern portion of the Ambrosia Lake Project; (ii) Bonner Lease which is comprised of 181 unpatented lode mining claims and one state of New Mexico general mining lease covering a further 4,132 acres (1,672 hectares); (iii) the Elizabeth Lease which is comprised of eight patented and one unpatented lode mining claims covering 179 acres (72 hectares); and (iv) 292 unpatented lode mining claims for 5,442 acres (2,202 hectares) that are owned directly by Neutron. Collectively, the Endy Lease, Bonner Lease, Elizabeth Lease and the claims owned by Neutron cover an area of approximately 13,135 acres (5,316 hectares). The surface lands covering the patented and unpatented mining claims are managed by the U.S. Bureau of Land Management ("BLM"), the U.S. Forest Service ("USFS") or a private land owner.

In February 2006, Neutron entered into the Endy Lease covering 3,382 acres (1,369 hectares) comprised of 167 unpatented lode mining claims in the eastern portion of the Ambrosia Lake mining district. Pursuant to the terms of the Endy Lease, Neutron paid $315,000 upon signing, $100,000 in February 2007 and February 2008, and is obligated to pay an additional $75,000 as an advance royalty each year thereafter through the term of the Endy Lease. The Endy Lease has a primary term of ten years, but may be extended up to an additional 65 years provided that Neutron continue to make

9

advance or production royalty payments. Neutron may terminate the lease at any time without further lease obligations. A 5% production royalty, based on the gross market value of all minerals extracted, is payable for any production from the Endy Lease properties.

In June 2006, Neutron entered into the Bonner Lease covering 181 unpatented lode mining claims and one state of New Mexico general mining lease, covering a further 4,132 acres (1,672 hectares) of mineral rights in the Ambrosia Lake mining district in the state of New Mexico. Pursuant to the terms of the Bonner Lease, upon signing Neutron paid a rental payment of $180,000 and issued 65,000 shares of Neutron's common stock. Neutron also paid a rental payment of $180,000 on the first anniversary and is obligated to pay an annual rental payment of $120,000 on the second through fifth anniversaries of the Bonner Lease. On the sixth anniversary and each anniversary thereafter Neutron is obligated to pay an annual advance royalty of $240,000. In the event commercial production is achieved during the rental period, then all future rental payments received after commercial production begins will be credited as minimum advance royalty payments. The Bonner Lease has a primary term of ten years but may be extended up to an additional 65 years provided that Neutron continue to make advance or production royalty payments. Neutron may terminate the lease at any time without future lease obligations. A 5% production royalty based on the gross market value of all minerals extracted is payable for any production from the Bonner Lease properties. The surface overlying the New Mexico general mining lease is owned by the State of New Mexico.

In January 2008, Neutron entered into the Elizabeth Lease covering 179 acres (72 hectares) comprised of eight patented and one unpatented lode mining claims in the eastern portion of the Ambrosia Lake mining district in the state of New Mexico. Pursuant to the terms of the Elizabeth Lease, Neutron paid a $315,000 bonus upon signing, $100,000 in advance royalties on December 1, 2008 and December 1, 2009 and Neutron is obligated to pay $75,000 in advanced royalties every twelve months thereafter so long as the lease is in effect. The Elizabeth Lease has a primary term of ten years, but may be extended up to an additional 65 years provided that Neutron continue to make advance or production royalty payments. Neutron may terminate the lease at any time without future lease obligations. A 5% production royalty, based on the gross market value of all minerals extracted, is payable for any production from the Elizabeth Lease properties. Most of the properties covered by the Elizabeth Lease are patented lode mining claims in which the surface is privately owned.

The 292 unpatented lode mining claims owned directly by Neutron do not have any royalty obligations attached to them. The surface estate covering portions of West Endy and Deep Rock targets is managed by the USFS. Surface management responsibilities for Mesa Redonda and portions of West Endy are vested with the BLM. All the unpatented mining claims in the project area are subject to a $140 annual claim maintenance fee payable on each claim to the BLM.

Accessibility

The project is approximately 60 miles (96.5 kilometers) west-northwest of the city of Albuquerque, and 20 miles (32.2 kilometers) north-northeast of the town of Grants. A paved highway from the town of Milan (Grants) to the village of San Mateo and the Ambrosia Lake area provides excellent access to eastern and northern parts of the project area. Numerous dirt USFS and private ranch roads cross the project lands and provide access to nearly all parts of the project area. Rail service is available from the BNSF Railroad at Grants and Milan, and scheduled air service is available in Albuquerque.

10

The project area is located in the Ambrosia Lake mining district, which had numerous underground mines and uranium processing mills. Electrical lines cross the project area and provided electricity to the historic mills and mines. All of the historic mills have been dismantled and removed but the remaining electrical power lines could be a source of power. There are no plant facilities or equipment on the properties of the project, including subsurface improvements and equipment. Through March 31, 2012 Neutron has spent $4.0 million on the Ambrosia Lake Project.

History

In the Ambrosia Lake area mineral exploration and development programs (including underground and small-scale open pit mining and milling) commenced in the early 1950's and continued into the 1990's. During that period of time, as reported by Chenoweth, 1989, in the New Mexico Geological Society 40th Conference Guidebook, nearly 190 million pounds of U3O8 were produced from sandstone and limestone-hosted mineralized areas in the district, and a significant amount of uranium mineralization remains in place in the district. During the period of operation of the Ambrosia Lake mining district, underground uranium mines were discovered, developed and operated by numerous companies, including Kerr McGee Nuclear, Homestake Mining Company, United Nuclear/UNC Resources, Phillips Petroleum, Ranchers Exploration, Gulf Mineral Resources, and others.

Lands that comprise Neutron's Ambrosia Lake Project have been explored by several firms (including Conoco, Homestake Mining, Kerr-McGee, Bokum Resources, Pathfinder Mines and United Nuclear Corporation) periodically since the mid 1950's, and numerous exploration holes have been drilled on Neutron's leased properties. Much of the drilling and related data from several of these historical programs are currently in the possession of Neutron, and have served as a portion of the basis of evaluating the mineral potential of the properties.

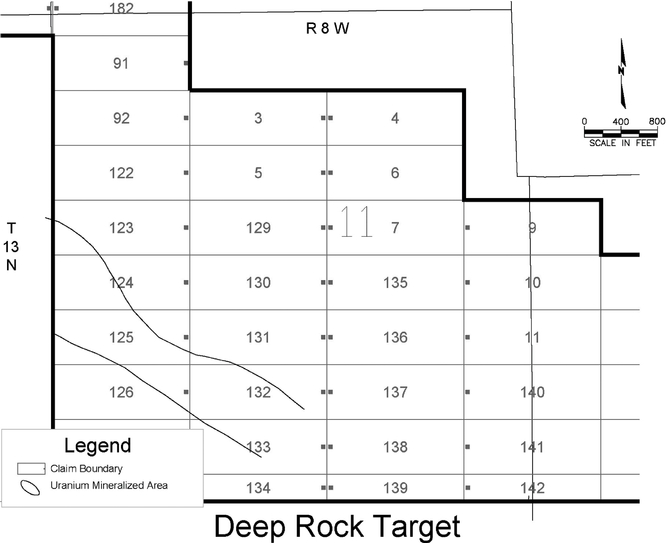

Deep Rock Target

The Deep Rock exploration target is situated on leased unpatented lode mining claims. The target area is located immediately west-northwest of the Mount Taylor mine (developed by Gulf Mineral Resources, and now owned by Rio Grande Resources) and adjoins the eastern edge of the Roca Honda project of Strathmore Minerals Corp. While some initial exploration drilling was carried out on the target by the Anaconda Company (who drilled three holes), the target area was first explored in a comprehensive way by the minerals division of Continental Oil Company (Conoco) in the late 1970's. Conoco drilled 14 holes (one hole was terminated prior to reaching the target horizon), and encountered uranium mineralization in Westwater Canyon sandstones, although Conoco did not follow-up on this work due to a precipitous drop in the uranium price. During the 1980's, Homestake Mining Company drilled one additional hole in the mineralized zone, and encountered similar mineralization to what had been intersected by Conoco in the same area. There has been no physical work on the Deep Rock target since the completion of the Homestake drilling program.

11

Figure 2.6. Deep Rock Target (April 2012)

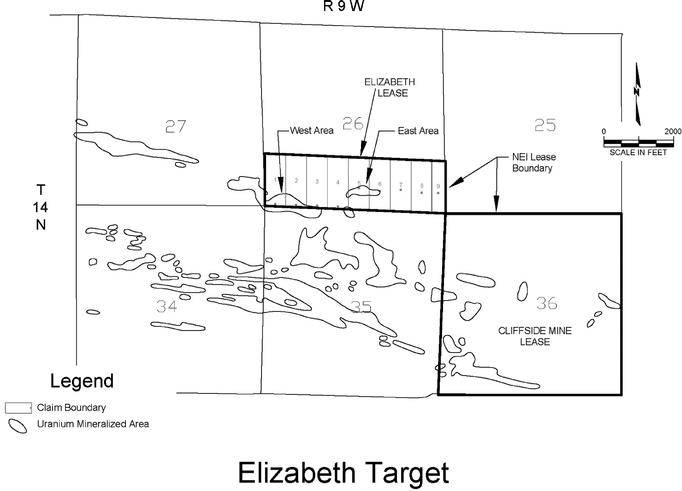

Elizabeth Target

Considerable exploration drilling was carried out by several companies on the Elizabeth claims between the mid-1950's and the early 1980's. The adjoining Section 35 mineralized area was formerly operated by Kerr McGee, the major historical operator in the Ambrosia Lake district, and the Ann Lee/Section 27 underground mines were formerly operated by Phillips Petroleum and United Nuclear/UNC Resources. A portion of the Elizabeth southwest uranium mineralized area was mined by Kerr McGee and United Nuclear. Various 'historical' operators of the Elizabeth claims have prepared mineral resource estimates for the two uranium mineralized areas situated on Neutron's claims at the Elizabeth target.

12

Figure 2.7. Elizabeth Target (April 2012)

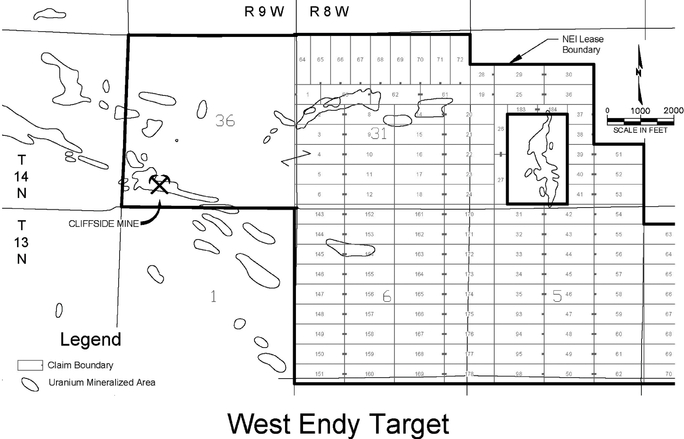

West Endy Target

The West Endy target is comprised of two contiguous blocks of unpatented lode mining claims and one State of New Mexico general mining lease (site of the inactive Cliffside mine). At least 97 exploration holes have been drilled on the West Endy target by various companies, in particular Enerdyne Corporation, Homestake Mining Company and United Nuclear. Zones of uranium mineralization have been outlined by drilling on the target. The New Mexico general mining lease is the site of the inactive Cliffside underground mine that was discovered in 1956, and brought into production in 1960. The Cliffside mine was one of the last underground mines to operate in the district and was closed in 1985. According to McLemore and Chenoweth, 1991, in the New Mexico Bureau of Mines and Mineral Resources Open-File Report 353, total production from the mine has been reported to be over 6 million pounds of U3O8 at an average grade of 0.41% U3O8. Data in Neutron's possession, as well as the results from Neutron's confirmation drilling program, demonstrate that the West Endy uranium mineralized area extends onto the northeast portion of the New Mexico general mining lease.

13

Figure 2.8. West Endy Target (April 2012)

Mesa Redonda Target

The Mesa Redonda target is on the western edge of the Ambrosia Lake mining district. Detailed exploration drilling was carried out in the Mesa Redonda area by Pathfinder Mines, Devilliers Nuclear, Homestake Mining/UNC Resources and private interests in the 1970's and early 1980's. This work resulted in the discovery of uranium mineralization on the properties held by Neutron.

West Ranch Target

The West Ranch target, which is on the western part of the Ambrosia Lake mining district, is comprised of 223 lode mining claims. In the vicinity of these claims are several small-scale uranium mines that are reported to have operated in the 1950's and 1960's. Additionally there is considerable evidence of exploration conducted by Energy Fuels Nuclear, Phillips Petroleum and United Nuclear during the 1970's.

14

Mineralization

In accordance with SEC guidance on non-reserve mineralized material, Neutron shows the estimate of in-place non-reserve mineralized uranium material for Neutron's Ambrosia Project in the following table. The estimate of non-reserve mineralized material for each of the mineralized areas listed below was obtained from the Technical Report on the Uranium Resources at The Ambrosia Lake Project, McKinley County, New Mexico, USA. The technical report is dated January 18, 2011 and was completed by Broad Oak Associates, an independent engineer.

Additionally, as described in the Technical Report on the Uranium Resources at the Ambrosia Lake Project, Neutron has historical reports that show the mineralized areas in this project contain non-reserve mineralized material listed in the table below. The calculation of non-reserve mineralized material was prepared by prior mining companies and their independent consultants and is considered historical in nature and no other calculations have yet been completed because the digital data base has not been prepared for modeling.

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED

MATERIAL IN THE AMBROSIA LAKE PROJECT

Mineralized Area

|

Tonnage Millions |

Grade Percent |

Non-Reserve Mineralized Material Millions of Lbs. U3O8 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Elizabeth |

1.1 | 0.19 | % | 4.2 | ||||||

Mesa Redonda |

0.7 | 0.16 | % | 2.4 | ||||||

West Endy |

0.9 | 0.11 | % | 2.0 | ||||||

Total |

8.6 | |||||||||

Environmental and Permits

Exploration and mining activities conducted on lands managed by the USFS and BLM are governed by agency rules and regulations. Additional permits are required from the MMD. The BLM, USFS and MMD entered into a Memorandum of Understanding (MOU), effective January 20, 2004, to provide for cooperation between the agencies and elimination of duplication of efforts between the agencies in the assessment and processing of exploration and mining permit applications. In addition to the requirements for permits to conduct exploration and mining activities, the State requires that all drill holes be "plugged" to prevent contamination of ground water aquifers or communication between aquifers.

Neutron has a permit to drill 28 drill holes at the Elizabeth target.

Neutron formerly held a "minimal impact" exploration permit (MK013EM), issued by the MMD on February 21, 2007 for drilling on Section 36, Township 14 North, Range 9 West, McKinley County, New Mexico, the location of the inactive Cliffside mine. Neutron carried out a drilling program at this area (which covers a portion of the West Endy uranium mineralized area), as outlined in this permit. All of the drill holes in Neutron's drilling program were completed, "plugged" and abandoned in compliance with applicable State regulations, and under supervision of the New Mexico regulatory authorities. All surface disturbances related to this work program were reclaimed in compliance with applicable State rules and regulations, and this work has been inspected and found to be in full compliance with the applicable regulations.

15

South Dakota

Neutron initiated an exploration and acquisition program in southwestern South Dakota in 2005. Neutron identified two areas of interest, as described below. Through March 31, 2012, Neutron has spent $1.9 million in South Dakota. Neutron does not consider any of Neutron's South Dakota property interests to be material to Neutron's business and plan of operations and have not confirmed title to such property through the preparation of title opinions.

Powertech Uranium Corp Transaction

Neutron holds a 30% net proceeds interest from future uranium production from certain unpatented lode mining claims, fee leases and State leases (all formerly held by Neutron) currently controlled by Powertech Uranium (USA) ("Powertech") in the Dewey-Burdock area, which is located approximately six miles (9.7 kilometers) northwest of Neutron's current Edgemont Project property holdings in South Dakota. Neutron transferred Neutron's property interest in the Dewy-Burdock area to Powertech for which Neutron received (i) a 30% net proceeds interest of future uranium production and sales from Neutron's former lands, (ii) 327 acres (132 hectares) of mining claims and state leases along with associated historical drilling logs near Neutron's Edgemont Project, (iii) 4,117acres (1,666 hectares) of mining claims in the Ambrosia Lake mining district in New Mexico, and (iv) 1,709 acres (692 hectares) of mining claims and leases in the Shirley Basin area of Wyoming. Powertech has filed permit applications with the NRC and USEPA and submitted a Plan of Operation to the BLM for its Dewy-Burdock uranium ISR project.

Neutron's former acreage that is subject to the 30% net proceeds interest payable to Neutron consists of approximately 1,620 acres (656 hectares) of claims and leases within the Powertech's proposed Dewy-Burdock permit area and an additional 4,667 acres (1,888 hectares) of prospective claims and leases adjacent to their project permit area. This acreage had historical drilling and adds future development potential to the project.

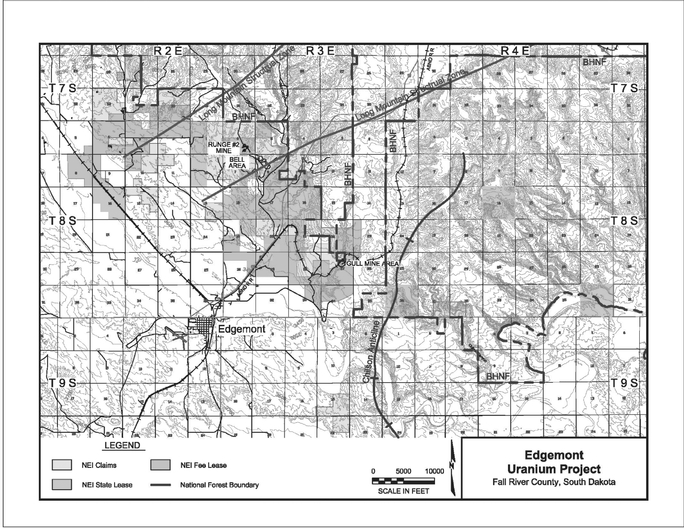

Edgemont Project

General

Uranium and vanadium mineralization in the Edgemont Project area occurs as sandstone-hosted small, tabular mineralized "pods" and substantial and wide-spread roll-front systems in the Fall River and Lakota Formations. Neutron controls a significant land position in the Edgemont mining district of southwestern South Dakota. Neutron's land holdings in the district, which include more than 19,062 acres (7,714 hectares) of mineral rights, cover several zones of historically-identified and undeveloped uranium mineralization. While there has been historic uranium mining from the project area, there are no facilities or equipment remaining on the property, including subsurface improvements and equipment.

Property

The Edgemont Project is located on the southwest flank of the Black Hills, about 55 miles (88.5 kilometers) southwest of Rapid City, South Dakota and 8 miles (12.9 kilometers) north-northwest of the city of Edgemont. Neutron holds 11 State of South Dakota mineral leases, totaling 3,875 acres (1,568 hectares). These parcels were acquired through various competitive lease auctions in 2005, 2006, 2007, and 2008. The leases require annual rental payments to maintain the properties, and a 2% "gross returns" royalty (which has provisions for the deduction of mineral processing and transportation costs) on production from the property. The state leases provide for up to a 15 year term with escalating annual payments that range from the current $2.00 per acre to $50.00 per acre in year 15.

16

Neutron also holds 416 unpatented lode mining claims, covering an area of approximately 7,087 acres (2,868 hectares) in the project area. Certain of Neutron's mining claims in the project area are situated on deeded (fee) surface over federal-managed minerals. Neutron has acquired access to these "split estate" lands for exploration and production purposes by negotiating Surface Use and Disturbance Agreements (SUDA's) with the surface owners of the properties. The SUDA agreements have provisions for the payment of a 2% net proceeds royalty to the surface owners for any production from the claims that underlie the private surface. Neutron holds 14 fee (deeded) mineral leases covering 8,100 net acres (3,278 hectares) within the project area. These leases have primary terms of ten years each and generally require $1.00 per acre annual rental payments. Production royalties on the private mineral parcels are set at the level of 5% of net proceeds for production from the leased lands.

Figure 2.9. Edgemont Project Property Map (April 2012)

Accessibility

The Edgemont Project is located in Fall River County on the southwestern flank of the Black Hills, a major physiographic feature in southwest South Dakota. Access to the project area is very good, with paved highways located several miles to the west and south, and by well-maintained gravel roads that traverse much of the area. Private agricultural access roads are also available for use. U.S. Highway 18 runs east-west through Edgemont, and connects the area with Newcastle, Wyoming to the west and with Hot Springs, South Dakota to the east. The nearest major population center and airport is at Rapid City, located about 55 miles (88.5 kilometers) to the northeast of the project area. A main

17

line of the Burlington Northern Santa Fe Railroad, connecting Alliance, Nebraska and Gillette, Wyoming is situated on the western side of the project area.

History

Uranium mineralization was first discovered at Craven Canyon, about eight miles (12.9 kilometers) north of the town of Edgemont, in 1951. During the 1950's, 1960's, and 1970's numerous small to medium scale uranium mineralized areas were mined by open pit and underground methods near Edgemont, and farther northwest in the Dewey-Burdock area.

Ore from these modest mining operations in the Black Hills was initially shipped to the Union Carbide mill at Rifle, Colorado, and later to a U.S. Atomic Energy Commission ore-buying station located at Edgemont. Susquehanna-Western, Inc., constructed a mill to recover uranium and vanadium in 1956 and it operated through 1968. The mill has since been decommissioned and dismantled, and the mill site is managed by the Department of Energy. In the mid-to late-1970s and early 1980's, the Tennessee Valley Authority (TVA) carried out a comprehensive exploration drilling program down-dip (west and southwest) from mines, prospects, and surface exposures of uranium. Prior companies working in the Edgemont District include: Federal Resources, Homestake Mining Company, Susquehanna-Western, Union Carbide, and Wyoming Minerals.

Mineralization

In accordance with SEC guidance on non-reserve mineralized material, Neutron shows the estimate of in-place mineralized uranium material for Neutron's Edgemont Project. The estimate of non-reserve mineralized material was obtained from the Technical Report on the Uranium Resources on The Edgemont Project, Fall River County, South Dakota, USA. The technical report is dated January 18, 2011 and was completed by Broad Oak Associates, an independent engineer. All of the mineralized material estimates quoted in the Technical Report on the Uranium Resources on the Edgemont Project are historical in nature, and were based on data and reports prepared by the previous operators of the properties or their independent consultants. As described in the Technical Report Neutron has historical reports prepared by the prior operator and its independent consultant that show Neutron's Edgemont Project area contains 197 thousand tons of non-reserve mineralized material at an average grade of 0.17%, containing non-reserve in-place mineralized material of 685 thousand pounds of U3O8. The calculation of non-reserve mineralized material was prepared by prior mining companies and is considered historical in nature and no other calculations have yet been completed because the digital data base is not available for modeling.

Wyoming

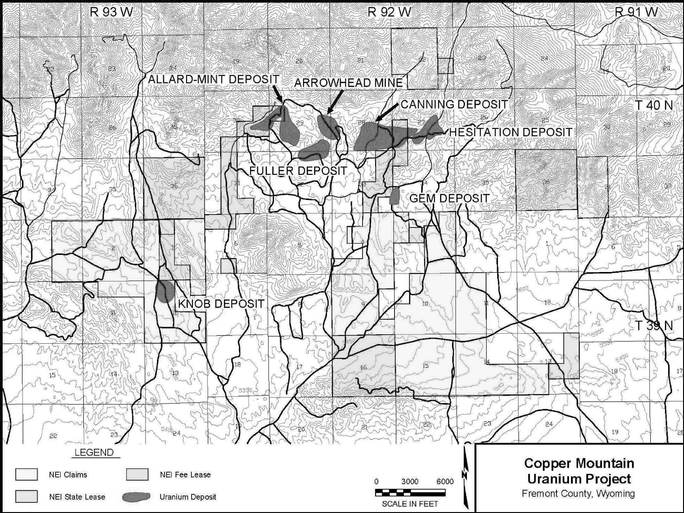

Copper Mountain Project

Property

Neutron has approximately 9,313 net acres (3,769 hectares) of mineral rights, through mining claims, fee leases, and mineral leases granted by the State of Wyoming, in the Copper Mountain area of central Wyoming. Included in this package of properties are six "Uranium and Associated Minerals" leases granted by the State of Wyoming covering 2,200 acres (890 hectares), 17 fee (deeded) mineral leases covering an area of 644 net acres (261 hectares), and 366 unpatented lode mining claims covering an area of approximately 6,468 acres (2,618 hectares). The state leases have a primary term of ten years. Annual rental payments of $1.00 per acre per year are for the first five years and $2.00 per acre per year from the sixth year through the twentieth year. Once the discovery of commercial quantities of minerals on the leased lands has been made, the annual rental will be $2.00 per acre. A royalty of 5% of the gross value ("fair market value") of uranium mined from the properties is payable to the State of Wyoming, and the State has the right to take its royalty "in kind." Through March 31, 2012, Neutron has spent $832,000 on

18

the Copper Mountain Project. There are no plant facilities or equipment located on the property, including subsurface improvements and equipment.

Figure 2.10. Copper Mountain Project Map (April 2012)

Accessibility

The property is located approximately 35 miles (56.3 kilometers) east-northeast of the city of Riverton, which is the county seat of Fremont County, and about 70 miles (112.7 kilometers) west of the city of Casper. Access to the Copper Mountain Project is good. An east-west paved highway (NEUTRON 20-26) between Riverton and Casper is located 14 miles (22.5 kilometers) south of the project area, and a north-south paved highway (NEUTRON 20), between the towns of Shoshoni and Thermopolis is located 11 miles (17.7 kilometers) west. The immediate project area is accessible from a network of graded county roads and unimproved ranch roads which traverse a broad valley along the south flank of the Owl Creek Mountains and enter the mineralized areas from the south.

History

The Copper Mountain district hosts five significant low-grade uranium mineralized areas. The Copper Mountain area has had a long history of exploration, prospecting, and minor mineral production, beginning in the late 1800's. This initial phase of prospecting activity was focused upon copper, gold and silver prospects. Uranium mineralization was first discovered in the Copper Mountain area in 1953 by a local rancher-prospector, at a locality that was later to become the Arrowhead Mine.

19

Additional work was conducted in the area by Kerr McGee, who discovered mineralization in the district in 1953 and in 1955 by the U. S. Atomic Energy Commission. Uranium mining commenced at the Arrowhead Mine of Susquehanna Western in March, 1955, and ore was shipped to Susquehanna's mill near Riverton, Wyoming periodically until 1971, when the mine was closed. Utah Construction and Mining discovered the Fuller mineralized area in the late 1950's, and in 1965 Kerr McGee discovered the Knob mineralized area. Other companies that carried out uranium exploration programs in the Copper Mountain area include the Anaconda Copper Company, Nuclear Dynamics, Teton Exploration, Urania Exploration, and Western Nuclear. The most comprehensive exploration program in the Copper Mountain Project area was undertaken by Rocky Mountain Energy Company, previously known as Union Pacific Mining

Geology and Mineralization

Uranium mineralization at the Copper Mountain Project occurs in two distinct geologic environments: fracture-controlled uranium mineralization. and as disseminated mineralization.

Arizona

In 2006, Neutron undertook an exploration and acquisition program for breccia pipe hosted uranium mineralized areas in northern Arizona. Breccia pipe uranium mineralized areas represent some of the highest grade uranium mineralized areas in the United States. Several of the targets Neutron acquired had evidence of historical drilling by several companies that were primarily active in the late 1970's and 1980's, including Energy Fuels, Energy Reserves Group, Pathfinder Mines and Rocky Mountain Energy Company.

Breccia pipes in northern Arizona were formed as the result of the collapse of dissolution caverns in the Redwall Limestone. This collapse formed pipes containing broken sedimentary rock which in turn provided an excellent setting for uranium deposition.

In 2009, Neutron terminated its breccias pipe exploration activities and transferred certain properties, in two separate transactions, to VANE Minerals Company and Arizona Strip Partners LLC. Neutron transferred acreage to VANE Minerals (NEUTRON) LLC and reserved a 2% royalty, unless production is from a state lease with a base royalty greater than 5%, then the royalty is reduced to 1%. Neutron transferred acreage to Arizona Strip Partners LLC, a venture between Energy Fuels and Royal Resources from Australia and reserved a 2% royalty. In both transactions Neutron has the option to back-in for a 30% interest should a feasibility study be completed.

20

INFORMATION RELATED TO NEUTRON

Table of Properties

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED MATERIAL IN THE CIBOLA PROJECT

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED MATERIAL IN THE CIBOLA PROJECT

Figure 2.6. Deep Rock Target (April 2012)

Figure 2.7. Elizabeth Target (April 2012)

Figure 2.8. West Endy Target (April 2012)

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED MATERIAL IN THE AMBROSIA LAKE PROJECT