Attached files

| file | filename |

|---|---|

| 8-K - FORMAT 8-K - INTERSECTIONS INC | intersections_8k-080912.htm |

| EX-99.1 - PRESS RELEASE DATED AUGUST 9, 2012 - INTERSECTIONS INC | intersections_ex991-080912.htm |

Q2 2012 Investor Update August 9, 2012 *

Intersections’ Forward Looking Statements Statements in this presentation relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements.” These forward-looking statements involve known and unknown risks and are subject to change based on various factors and uncertainties that may cause actual results to differ materially from those expressed or implied by these statements. Factors and uncertainties that may cause actual results to differ include, but are not limited to, the risks disclosed in the company’s filings with the U.S. Securities and Exchange Commission. The company undertakes no obligation to revise or update any forward-looking statements. *

About Intersections Inc. Intersections Inc. (Nasdaq: INTX) is a leading provider of consumer and corporate identity risk management services. Intersections’ services are offered through North America's leading financial institutions, directly to consumers under Intersections’ award-winning IDENTITY GUARD® brand, and through the company’s exclusive partnership with ITAC, the Identity Theft Assistance Center. Since 1996, Intersections has protected the identities of more than 35 million consumers. Founded: 1996 NASDAQ Symbol: INTX Headquarters: Chantilly, VA Employees: 875 Consumers Protected To Date: More than 35 million Adjusted EBITDA From Continuing Operations * ($ millions) * Latest Twelve Months (LTM) consolidated adjusted EBITDA from continuing operations before share related compensation. Severance related expenses of $1.6 million and $465 thousand included in Q4 2011 and Q1 2012 respectfully. Fast Facts LTM Adjusted EBITDA ($MM) *

Q2 2012 Investor Update Consolidated Highlights Revenue for Q2 2012 was $87.9 million, a 6.6% decrease compared to the Q2 2011 and a 2.6% decrease from Q1 2012. Adjusted EBITDA from continuing operations before share related compensation for Q2 2012 was $16.4 million, a 13.9% increase over Q2 2011 and a slight increase from Q1 2012. Net income for the quarter ended June 30, 2012 was $6.2 million, as compared to $5.2 million for the quarter ended Q2 2011. Diluted earnings per share increased to $0.33 per share in Q2 2012 from $0.28 for Q2 2011. This represents our second consecutive quarter of record diluted earnings per share from continuing operations of $0.33. Cash flow provided by operations for the six months ending June 30, 2012 was $24.7 million compared to $11.5 million for the six months ending June 30, 2011. Ended the quarter as of June 30, 2012 with $21.2M in Cash and Equivalents, no outstanding balance on the revolving credit facility, and additional $25.0 million available for future borrowing. Please see the company’s release and website at www.intersections.com for additional details on quarterly results. *

Consumer Product and Services (CP&S) Highlights We ended Q2 2012 with 4.7 million subscribers from 4.9 million as of December 31, 2011. New Subscriber sales were down primarily due to the previously announced cessation of marketing with Bank of America (BAC) and reduced banking client marketing due to the uncertain regulatory environment. Results for our direct to consumer business were promising, with continued growth in revenue and positive contribution to earnings. CP&S Revenue for Q2 2012 was $87.2 million, a 6.5% decrease compared to Q2 2011 and a decrease of 2.5% from Q1 2012. The decrease in revenue is primarily due to BAC’s decision to stop marketing our services, this was offset by a new indirect banking client that began in May 2011 and steady growth in our direct-to-consumer business. We expect to acquire less new subscriber revenue through financial institutions in 2012 compared to 2011, as certain of our clients delay, suspend or terminate marketing in light of the changing regulatory environment Year-to-date retention rates for our BAC subscriber population continue to exceed forecast assumptions. CP&S Income from operations for Q2 2012 was $11.2 million, an increase of 16.2% percent from Q2 2011 and 1.0% from Q1 2012. The increase in income from operations is primarily due to the cessation of marketing of our services by BAC, which has resulted in decreased marketing and commission expenses. G&A expenses were higher in Q2 2012 compared to Q2 2011 due to a decreased portion of our software development that was capitalized, legal settlement, new software license costs, and higher costs related to compliance. Please see the company’s release and website at www.intersections.com for additional details on quarterly results. * Q2 2012 Investor Update

Q2 2012 Return of Capital To Shareholders Investor Update On August 8, 2012, Intersections’ Board declared a quarterly cash dividend of $0.20 per share. The dividend will be paid on September 10, 2012 to stockholders of record as of Friday August 31, 2012. This is our 9th consecutive quarterly cash dividend. Based on the closing price on August 8, 2012 of $13.45 this represents an effective annual yield of approximately 5.9% We have $19.8 million authorized by our board and permitted under our current Credit Agreement for share repurchase During the three months ended June 30, 2012 we repurchased 21 thousand shares of common stock at an average rate of $13.06 Please see the company’s release and website at www.intersections.com for additional details on quarterly results. *

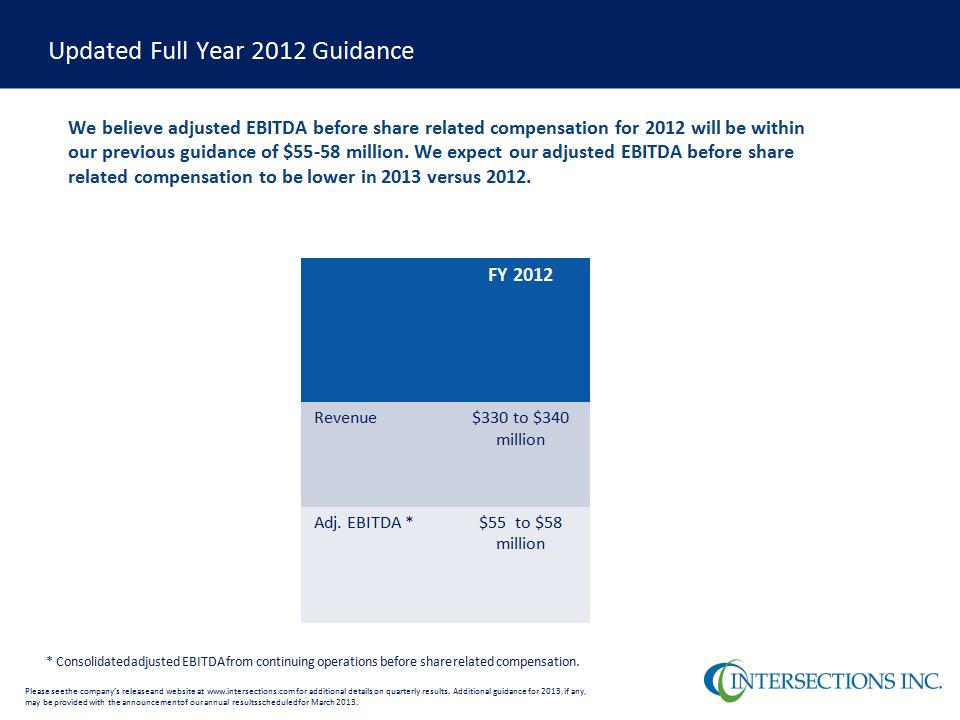

Please see the company’s release and website at www.intersections.com for additional details on quarterly results. Additional guidance for 2013, if any, may be provided with the announcement of our annual results scheduled for March 2013. * Consolidated adjusted EBITDA from continuing operations before share related compensation. FY 2012 Revenue $330 to $340 million Adj. EBITDA * $55 to $58 million Updated Full Year 2012 Guidance We believe adjusted EBITDA before share related compensation for 2012 will be within our previous guidance of $55-58 million. We expect our adjusted EBITDA before share related compensation to be lower in 2013 versus 2012.

Corporate Headquarters Intersections Inc. 3901 Stonecroft Boulevard Chantilly, VA 20151 Toll-free: 800.695.7536 www.intersections.com NASDAQ : INTX Thank You Investor Relations Eric Miller Senior Vice President Corporate Finance and Investor Relations Tel: 703.488.6100 emiller@intersections.com