Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ZALE CORP | a50352200ex991.htm |

| 8-K - ZALE CORPORATION 8-K - ZALE CORP | a50352200.htm |

Exhibit 99.2

1 Debt Refinancing July 25, 2012

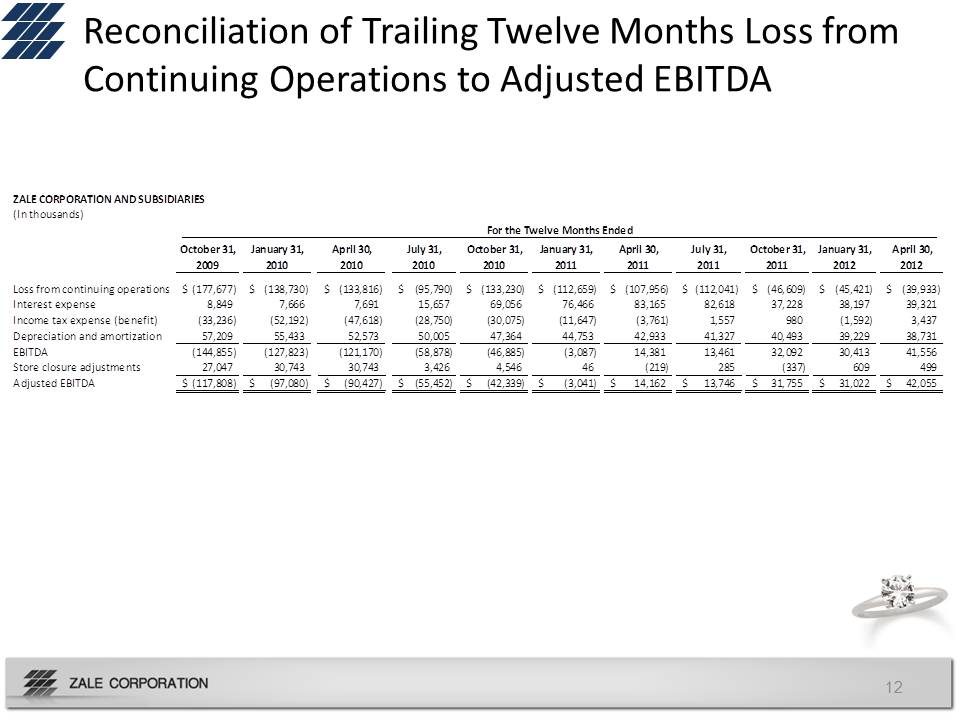

2 Forward-Looking Statements and Use of Non-GAAP Financial Measures This presentation contains forward-looking statements, including statements regarding our multi-year plan, future sales, expenses, margins, profitability, merchandising and marketing initiatives and industry growth forecasts. Forward-looking statements are not guarantees of future performance and a variety of factors could cause the Company's actual results to differ materially from the results expressed in the forward-looking statements. These factors include, but are not limited to: if the general economy continues to perform poorly, discretionary spending on goods that are, or are perceived to be, “luxuries” may decrease; the concentration of a substantial portion of the Company’s sales in three, relatively brief selling seasons means that the Company’s performance is more susceptible to disruptions; most of the Company’s sales are of products that include diamonds, precious metals and other commodities, and fluctuations in the availability and pricing of commodities could impact the Company’s ability to obtain and produce products at favorable prices; the Company’s sales are dependent upon mall traffic; the Company operates in a highly competitive industry; the financing market remains difficult, and if we are unable to meet the financial commitments in our current financing arrangements it will be difficult to replace or restructure these arrangements; and changes in regulatory requirements may increase the cost or adversely affect the Company’s operations and its ability to provide consumer credit and write credit insurance. For other factors, see the Company's filings with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the fiscal quarter ended April 30, 2012. The Company disclaims any obligation to update or revise publicly or otherwise any forward-looking statements to reflect subsequent events, new information or future circumstances, except as required by law. This presentation contains certain non-GAAP measures as defined by SEC rules. One of these non-GAAP measures is EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization. A second non-GAAP measure is adjusted EBITDA, which is further adjusted to exclude charges related to store closures. We use these measurements as part of our evaluation of the performance of the Company. In addition, we believe these measures provide useful information to investors. Please refer to the appendix at the back of this presentation for a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures.

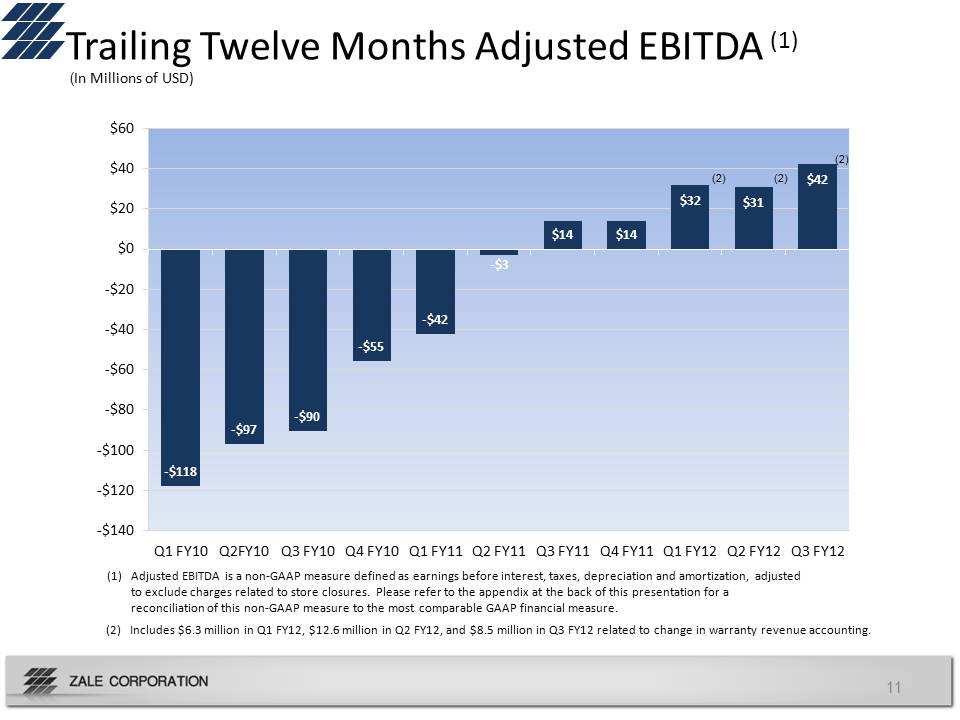

3 Debt Refinancing Represents Significant Milestone in Company’s Return to Profitability Confirmation from the financial marketplace of improvements made over past two years Reduced borrowing cost Improved covenants and overall liquidity position Will accelerate company’s return to profitability Future annual interest savings adds to momentum already established by the business Trailing Twelve Month Adjusted EBITDA improvement of $132 million over past two years Six consecutive quarters of positive comparable store sales (1) (1) Comparable Store Sales exclude revenue recognized from warranties. The sales results of new stores are included beginning with the thirteenth full month of operations, and the sales results of closed stores are excluded from the calculation.

4 Overview: New $665 Million Credit Facility Amended and extended Revolving Credit FacilityFacility size of $650 million Matures in five years, an increase of about three years from prior agreementPriced at LIBOR plus 175 to 225 basis points based on average availability, an improvement of 175 basis points from prior agreement Enhanced borrowing capacity; inventory collateral base increased by 2.5% to 90% New First-In, Last-Out (FILO) Credit Facility Facility size of $15 million Matures in five years Priced at LIBOR plus 350 to 400 basis points based on company’s average availability Enhanced borrowing capacity; inventory collateral base increased up to an additional 2.5%

5 Overview: Senior Secured Term Loan Utilized increased availability from the $665 million credit facility to fund prepayment of $60.5 million on the Term Loan Amended and extended the Senior Secured Term Loan agreement for remaining $80 million Matures in five years, an increase of about two years from prior agreement Fixed interest rate of 11%, a 400 basis point reduction from 15% in the prior agreement Eliminated store contribution covenants. Improved minimum liquidity requirement yielding approximately $50 million of additional availability Non-callable in year one, optional redemption with call premium of 4% in year two, 3% in year three and 2% in year four Golden Gate Capital continues to hold 11.1 million warrants, which expire in May 2017, and holds two seats on the company’s Board

6 Key Benefits of Debt Refinancing Significantly improved economics At current interest rates, average borrowing cost reduced from about 8% to 4% Expected annual pretax savings of approximately $17 million, beginning in Fiscal Year 2013 Eliminated financial maintenance covenants and created more operating flexibility Removed store contribution covenants from the Term Loan Extended maturity date to 2017; an increase of about two years on the Revolving Credit Facility and about three years on the Term Loan Agreements allow for greater operating flexibility Improved overall liquidity position Added additional 5% to our borrowing base (2.5% on Revolving Credit Facility and up to 2.5% on FILO) Improved minimum liquidity requirement in the Term Loan yielding approximately $50 million of additional availability Available liquidity expected to stand at approximately $140 million on July 31, 20126 Key Benefits of Debt Refinancing Significantly improved economics At current interest rates, average borrowing cost reduced from about 8% to 4% Expected annual pretax savings of approximately $17 million, beginning in Fiscal Year 2013 Eliminated financial maintenance covenants and created more operating flexibility Removed store contribution covenants from the Term Loan Extended maturity date to 2017; an increase of about two years on the Revolving Credit Facility and about three years on the Term Loan Agreements allow for greater operating flexibility Improved overall liquidity position Added additional 5% to our borrowing base (2.5% on Revolving Credit Facility and up to 2.5% on FILO) Improved minimum liquidity requirement in the Term Loan yielding approximately $50 million of additional availability Available liquidity expected to stand at approximately $140 million on July 31, 2012

7 Impact of Financing Fees Fees total approximately $13 million Approximately $5 million will be included in interest expense in Q4 FY12 Prepayment premium on Term Loan of $3 million Refinancing expenses and other fees of $2 million Remaining costs of approximately $8 million to be amortized over five year life of the agreements Amendment fee for Senior Secured Term Loan of $2 million Amendment fee for Revolving Credit Facility and other associated expenses of $6 million Unamortized costs related to prior financing transactions to be expensed over five year life of new agreements

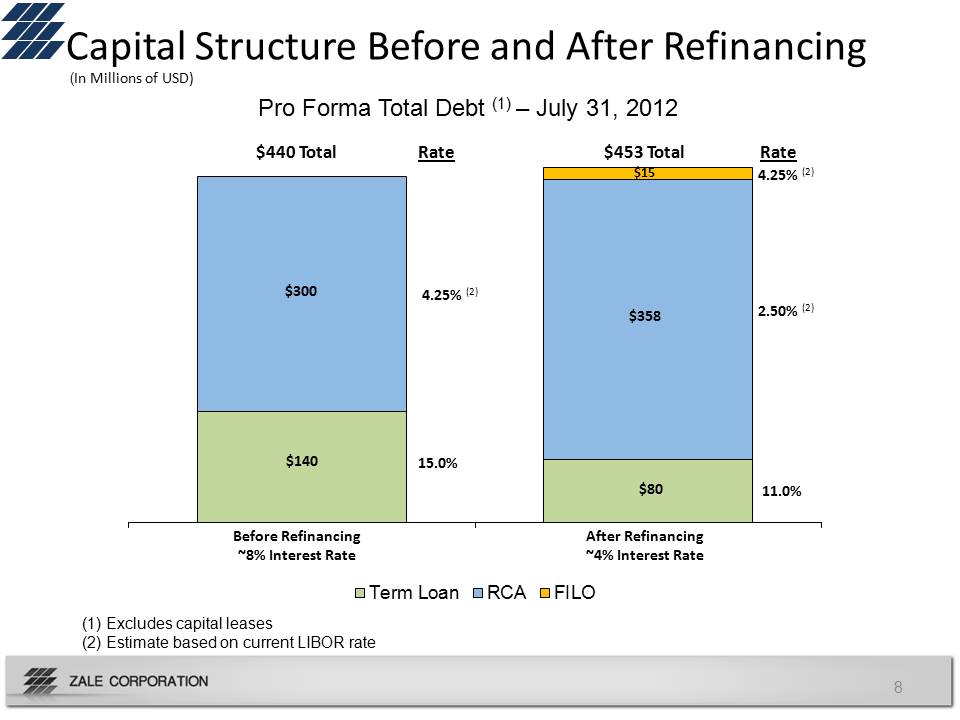

8 Capital Structure Before and After Refinancing ($ in Millions) (In Millions of USD) Excludes capital leases Estimate based on current LIBOR rate $440 Total Pro Forma Total Debt (1) – July 31, 2012 $440 Total Rate $453 Total Rate 4.25% (2) $300 2.50% (2) $358 $140 15.0% $80 11.0% Before Refinancing ~8% Interest Rate After Refinancing ~4% Interest Rate Excludes capital leases Estimate based on current LIBOR rate Term Loan RCA FILO

9 Q4 Fiscal 2012 Update Comparable Store Sales(1) Expected to be up about 8% in Q4 based on quarter-to-date results. Will represent the seventh consecutive quarter of positive comparable store sales. Expected to be up about 7% for full fiscal year 2012Q4 FY 2012 earnings conference call scheduled for August 29, 2012 at 9:00 a.m. ET. (1) Comparable Store Sales exclude revenue recognized from warranties. The sales results of new stores are included beginning with the thirteenth full month of operations, and the sales results of closed stores are excluded from the calculation.

10 Appendix

11 Trailing Twelve Months Adjusted EBITDA (1) ($ in Millions) Adjusted EBITDA is a non-GAAP measure defined as earnings before interest, taxes, depreciation and amortization, adjusted to exclude charges related to store closures. Please refer to the appendix at the back of this presentation for a reconciliation of this non-GAAP measure to the most comparable GAAP financial measure. (2) (2) Includes $6.3 million in Q1 FY12, $12.6 million in Q2 FY12, and $8.5 million in Q3 FY12 related to change in warranty revenue accounting. (In Millions of USD) (2) (2) -$118 -$97 -$90 -$55 -$42 -$3 $14 $14 $32 $31 $42 $60 $40$20 $0 -$20 -$40 -$60 -$80 -$100 -$120 -$140

11 Trailing Twelve Months Adjusted EBITDA (1) ($ in Millions) Adjusted EBITDA is a non-GAAP measure defined as earnings before interest, taxes, depreciation and amortization, adjusted to exclude charges related to store closures. Please refer to the appendix at the back of this presentation for a reconciliation of this non-GAAP measure to the most comparable GAAP financial measure. (2) (2) Includes $6.3 million in Q1 FY12, $12.6 million in Q2 FY12, and $8.5 million in Q3 FY12 related to change in warranty revenue accounting. (In Millions of USD) (2) (2) -$118 -$97 -$90 -$55 -$42 -$3 $14 $14 $32 $31 $42 $60 $40$20 $0 -$20 -$40 -$60 -$80 -$100 -$120 -$140

12 Reconciliation of Trailing Twelve Months Loss from Continuing Operations to Adjusted EBITDA ($ in Millions)