Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VISTEON CORP | d375127d8k.htm |

| EX-99.1 - PRESS RELEASE OF VISTEON DATED JULY 4, 2012 - VISTEON CORP | d375127dex991.htm |

Visteon Acquisition of Remaining 30% Interest in Halla Climate Control Corporation

July 20125,

Strictly Private and Confidential

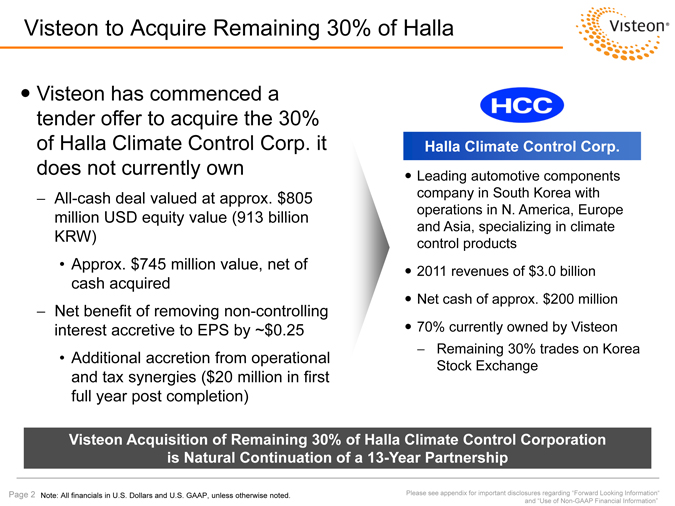

Visteon to Acquire Remaining 30% of Halla

Visteon has commenced a tender offer to acquire the 30% of Halla Climate Control Corp. it does not currently own

All-cash deal valued at approx. million USD equity value billion(913 KRW)

Approx. million value, net of cash acquired Net benefit of removing non-controlling interest accretive to EPS by ~ 25.0$

Additional accretion from operational and tax synergies ( million in first full year post completion)

Halla Climate Control Corp.

Leading automotive components company in South Korea with operations in N. America, Europe and Asia, specializing in climate control products 2011 revenues of 0.3$ billion Net cash of approx. million 70% currently owned by Visteon Remaining 30% trades on Korea Stock Exchange

Visteon Acquisition of Remaining 30% of Halla Climate Control Corporation is Natural Continuation of a 13-Year Partnership

Note: All financials in U Dollars. and U . GAAP, unless otherwise noted.

Please see appendix for important disclosures regarding “Forward Looking Information” and “Use of Non-GAAP Financial Information”

Page 2

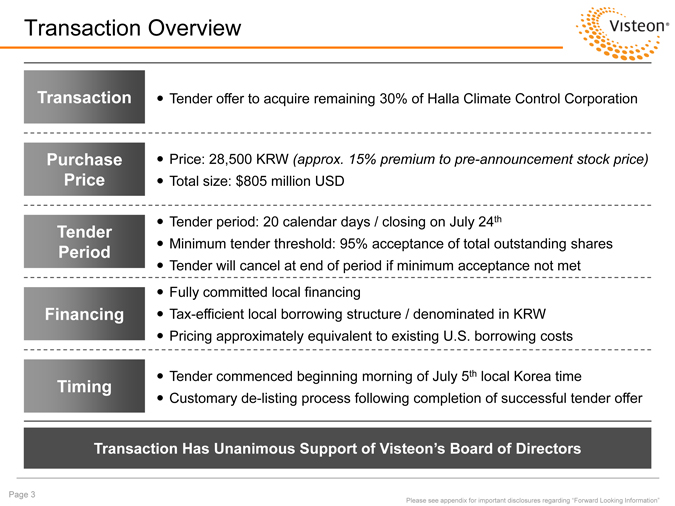

Transaction Overview

Transaction

Purchase Price

Tender Period

Financing

Timing

Tender offer to acquire remaining 30% of Halla Climate Control Corporation

Price: 28,500 KRW (approx. 15% premium to pre-announcement stock price)

Total size: million USD

Tender period: 20 calendar days / closing on July 24th

Minimum tender threshold: 95% acceptance of total outstanding shares Tender will cancel at end of period if minimum acceptance not met

Fully committed local financing Tax-efficient local borrowing structure / denominated in KRW

Pricing approximately equivalent to existing U borrowing. costs

Tender commenced beginning morning of July 5th local Korea time

Customary de-listing process following completion of successful tender offer

Transaction Has Unanimous Support of Visteon’s Board of Directors

Please see appendix for important disclosures regarding “Forward Looking Information”

Page 3

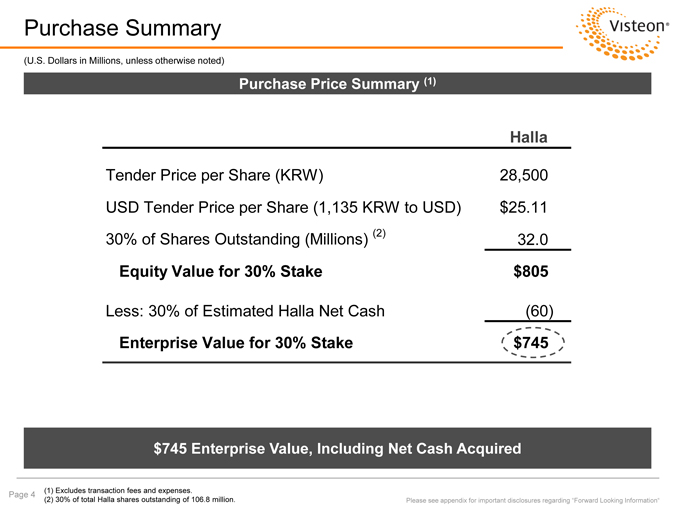

Purchase Summary

(U.S. Dollars. in Millions, unless otherwise noted)

Purchase Price Summary (1)

Halla

Tender Price per Share (KRW) 28, 500 USD Tender Price per Share (1,135 KRW to USD) $25.1130% of Shares Outstanding (Millions) (2)32.0 Equity Value for 30% Stake $805 Less: 30% of Estimated Halla Net Cash(60) Enterprise Value for 30% Stake

$745 Enterprise Value, Including Net Cash Acquired

Excludes transaction fees and expenses.(2) 30% of total Halla shares outstanding of 106.8 million.

Please see appendix for important disclosures regarding “Forward Looking Information”

Page 4

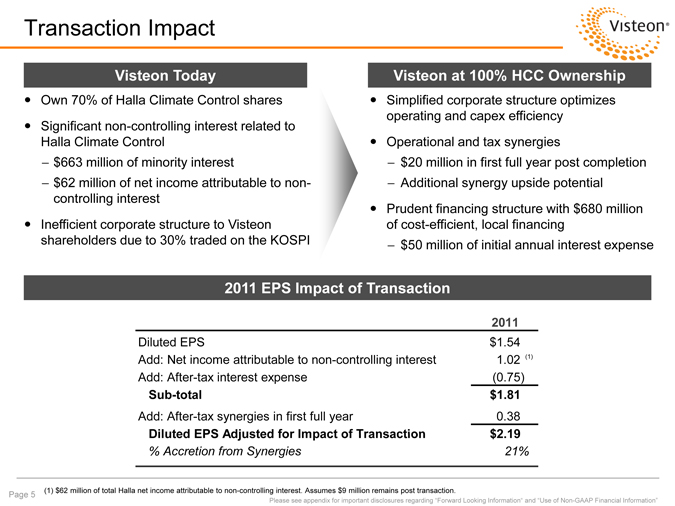

Transaction Impact

Visteon Today

Own 70% of Halla Climate Control shares Significant non-controlling interest related to

Halla Climate Control

$663 million of minority interest

$62 million of net income attributable to non-controlling interest Inefficient corporate structure to Visteon shareholders due to 30% traded on the KOSPI

Visteon at 100% HCC Ownership

Simplified corporate structure optimizes operating and capex efficiency

Operational and tax synergies

$20 million in first full year post completion

Additional synergy upside potential Prudent financing structure with $680 million of cost-efficient, local financing

??$50 million of initial annual interest expense

2011 EPS Impact of Transaction

2011

Diluted EPS $1.54

Add: Net income attributable to non-controlling interest 1.02 (1)

Add: After-tax interest expense (0.75)

Sub-total $1.81

Add: After-tax synergies in first full year 0.38

Diluted EPS Adjusted for Impact of Transaction $2.19

% Accretion from Synergies 21%

(1) $62 million of total Halla net income attributable to non-controlling interest. Assumes $9 million remains post transaction.

Please see appendix for important disclosures regarding “Forward Looking Information” and “Use of Non-GAAP Financial Information”

Page 5

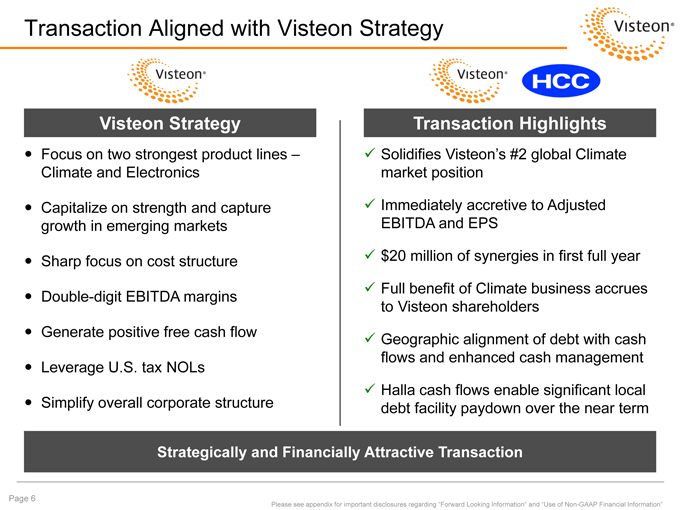

Transaction Aligned with Visteon Strategy

Visteon Strategy

Focus on two strongest product lines –Climate and Electronics

Capitalize on strength and capture growth in emerging markets

Sharp focus on cost structure Double-digit EBITDA margins Generate positive free cash flow Leverage U.S. tax NOLs Simplify overall corporate structure

Transaction Highlights

Solidifies Visteon’s #2 global Climate market position

Immediately accretive to Adjusted EBITDA and EPS

$20 million of synergies in first full year

Full benefit of Climate business accrues to Visteon shareholders

Geographic alignment of debt with cash flows and enhanced cash management

Halla cash flows enable significant local debt facility paydown over the near term

Strategically and Financially Attractive Transaction

Please see appendix for important disclosures regarding “Forward Looking Information” and “Use of Non-GAAP Financial Information”

Page 6

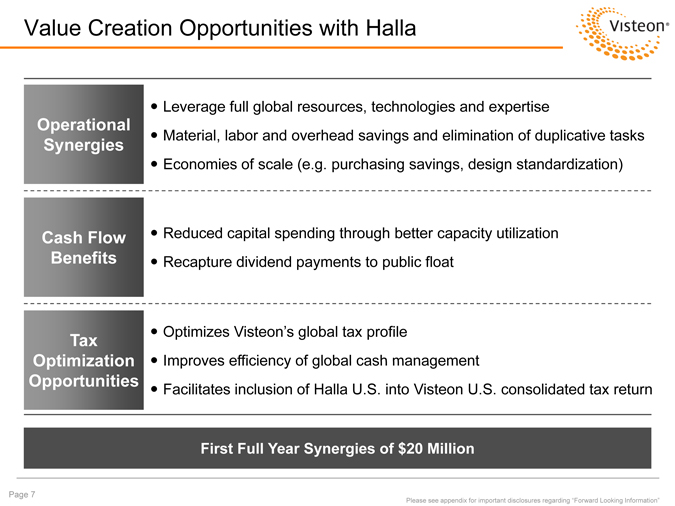

Value Creation Opportunities with Halla

Leverage full global resources, technologies and expertise

Operational

Synergies Material, labor and overhead savings and elimination of duplicative tasks

Economies of scale (e.g. purchasing savings, design standardization)

Cash Flow Reduced capital spending through better capacity utilization

Benefits Recapture dividend payments to public float

Tax Optimizes Visteon’s global tax profile

Optimization Improves efficiency of global cash management

Opportunities Facilitates inclusion of Halla U.S. into Visteon U.S. consolidated tax return

Leverage full global resources, technologies and expertise

Operational

Synergies Material, labor and overhead savings and elimination of duplicative tasks

Economies of scale (e.g. purchasing savings, design standardization)

Cash Flow Reduced capital spending through better capacity utilization

Benefits Recapture dividend payments to public float

Tax Optimizes Visteon’s global tax profile

Optimization Improves efficiency of global cash management

Opportunities Facilitates inclusion of Halla U.S. into Visteon U.S. consolidated tax return

First Full Year Synergies of $20 Million

Please see appendix for important disclosures regarding “Forward Looking Information”

Page 7

Halla Climate Control Corporation Overview

Strictly Private and Confidential

Halla Climate Control Corporation

Overview Leading automotive components company in South Korea with operations in North America, Europe and Asia

Develops and manufactures automotive climate control products, including air-conditioning systems, modules, compressors and heat exchangers

70% owned by Visteon with remaining 30% trading on Korea Stock Exchange

Strong Product Portfolio

HVAC System Front-End Module Compressor

Radiator Evaporator Core Heater Core

Condenser Intercooler Controller

Technology Leader with Complete Climate Solution

Page 9

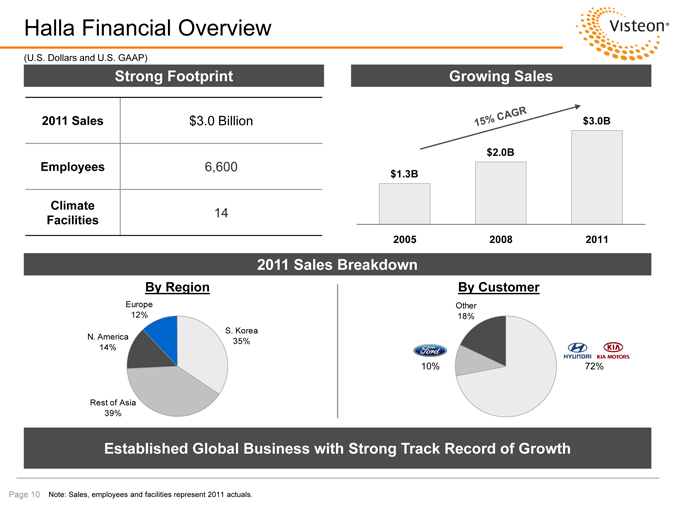

Halla Financial Overview

(U.S. Dollars and U.S. GAAP)

Strong Footprint Growing Sales

2011 Sales $3.0 Billion $3.0B

$2.0B

Employees 6,600 $1.3B

Climate 14

Facilities

2005 2008 2011

2011 Sales Breakdown

By Region By Customer

Europe Other

12% 18%

S. Korea

N. America 35%

14%

10% 72%

Rest of Asia

39%

Established Global Business with Strong Track Record of Growth

Note: Sales, employees and facilities represent 2011 actuals.

Page 10

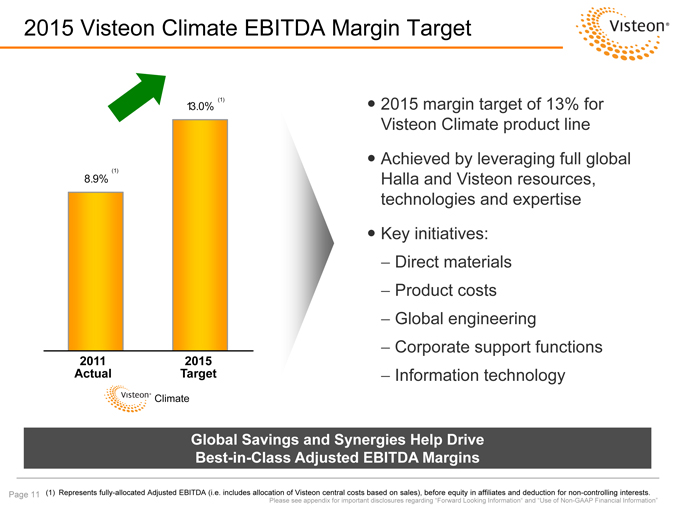

2015 Visteon Climate EBITDA Margin Target

2015 margin target of 13% for Visteon Climate product line

Achieved by leveraging full global Halla and Visteon resources, technologies and expertise

Key initiatives:

Direct materials

Product costs

Global engineering

Corporate support functions

Information technology

13.0% (1)

| (1) |

|

8.9%

2011 2015

Actual Target

Global Savings and Synergies Help Drive Best-in-Class Adjusted EBITDA Margins

(1) Represents fully-allocated Adjusted EBITDA (i.e. includes allocation of Visteon central costs based on sales), before equity in affiliates and deduction for non-controlling interests.

Please see appendix for important disclosures regarding “Forward Looking Information” and “Use of Non-GAAP Financial Information”

Page 11

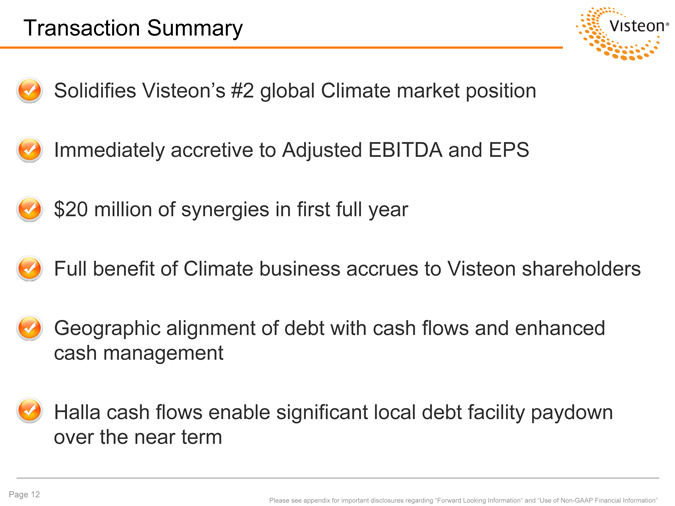

Transaction Summary

Solidifies Visteon’s #2 global Climate market position Immediately accretive to Adjusted EBITDA and EPS $20 million of synergies in first full year

Full benefit of Climate business accrues to Visteon shareholders

Geographic alignment of debt with cash flows and enhanced cash management

Halla cash flows enable significant local debt facility paydown over the near term

Please see appendix for important disclosures regarding “Forward Looking Information” and “Use of Non-GAAP Financial Information”

Page 12

Appendix

Strictly Private and Confidential

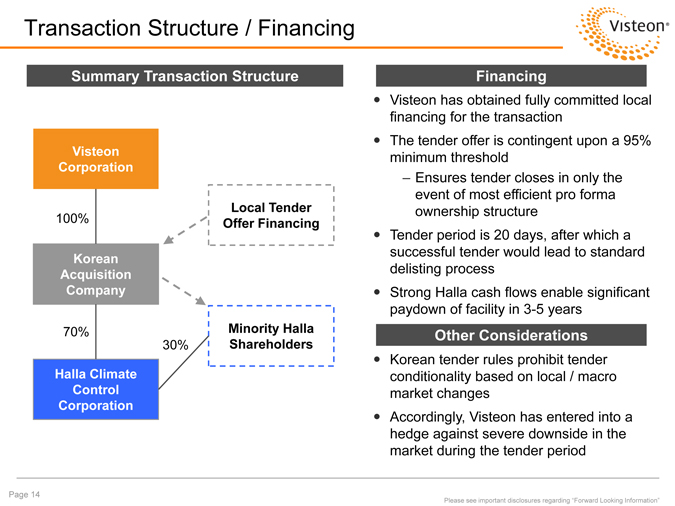

Transaction Structure / Financing

Summary Transaction Structure

Visteon

Corporation

Local Tender

100% Offer Financing

Korean

Acquisition

Company

70% Minority Halla

30% Shareholders

Halla Climate

Control

Corporation

Financing

Visteon has obtained fully committed local financing for the transaction y

The tender offer is contingent upon a 95% minimum threshold

Ensures tender closes in only the event of most efficient pro forma ownership structure y

Tender period is 20 days, after which a successful tender would lead to standard delisting process

Strong Halla cash flows enable significant paydown of facility in 3-5 years

Other Considerations

Korean tender rules prohibit tender conditionality based on local / macro market changes

Accordingly, Visteon has entered into a hedge against severe downside in the market during the tender period

Please see important disclosures regarding “Forward Looking Information”

Page 14

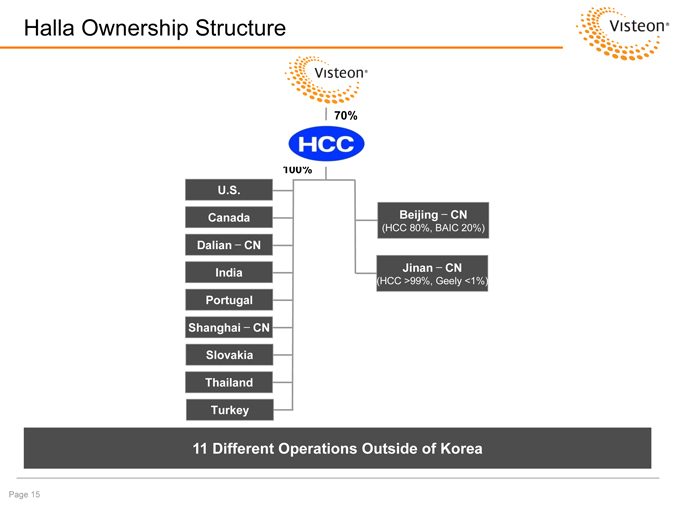

Halla Ownership Structure

70%

100%

U.S.

Canada Beijing CN

(HCC 80%, BAIC 20%)

Dalian CN

India Jinan CN

(HCC >99%, Geely <1%)

Portugal

Shanghai CN

Slovakia

Thailand

Turkey

11 Different Operations Outside of Korea

Page 15

Use of Non-GAAP Financial Information

Throughout this presentation, the Company has provided information regarding certain non-GAAP financial measures. These measures include “Adjusted EBITDA.” Adjusted EBITDA represents net income (loss) attributable to Visteon, plus net interest expense, provision for income taxes and depreciation and amortization, as further adjusted to eliminate the impact of asset impairments, gains or losses on divestitures, net restructuring expenses and other reimbursable costs, certain non-recurring employee charges and benefits, reorganization items, and other non-operating gains and losses.

Management believes Adjusted EBITDA is useful to investors because it provides meaningful supplemental information regarding the Company’s operating results because the excluded items may vary significantly in timing or amounts and/or may obscure trends useful in evaluating and comparing the Company’s continuing operating activities. Management uses this measure for planning and forecasting in future periods. Adjusted EBITDA is not a recognized term under accounting principles generally accepted in the United States and does not purport to be an alternative to net earnings (losses) as an indicator of operating performance or to cash flows from operating activities as a measure of liquidity. Because not all companies use identical calculations, this presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Additionally, Adjusted EBITDA is not intended to be a measure of cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements.

Page 16

Forward-Looking Information

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various factors, risks and uncertainties that could cause our actual results to differ materially from those expressed in these forward-looking statements, including, but not limited to, your ability to satisfy future capital and liquidity requirements; including our ability to access the credit and capital markets at the times and in the amounts needed and on terms acceptable to us; our ability to comply with financial and other covenants in our credit agreements; and the continuation of acceptable supplier payment terms; your ability to satisfy pension and other post-employment benefit obligations; your ability to access funds generated by foreign subsidiaries and joint ventures on a timely and cost effective basis; conditions within the automotive industry, including (i) the automotive vehicle production volumes and schedules of our customers, and in particular Ford’s and Hyundai-Kia’s vehicle production volumes, (ii) the financial condition of our customers or suppliers and the effects of any restructuring or reorganization plans that may be undertaken by our customers or suppliers or work stoppages at our customers or suppliers, and (iii) possible disruptions in the supply of commodities to us or our customers due to financial distress, work stoppages, natural disasters or civil unrest; yew business wins and re-wins do not represent firm orders or firm commitments from customers, but are based on various assumptions, including the timing and duration of product launches, vehicle productions levels, customer price reductions and currency exchange rates; general economic conditions, including changes in interest rates and fuel prices; the timing and expenses related to internal restructurings, employee reductions, acquisitions or dispositions and the effect of pension and other post-employment benefit obligations; increases in raw material and energy costs and our ability to offset or recover these costs, increases in our warranty, product liability and recall costs or the outcome of legal or regulatory proceedings to which we are or may become a party; and those factors identified in our filings with the SEC (including our Annual Report on Form 10-K for the fiscal year ended December 31, 2011).

Caution should be taken not to place undue reliance on our forward-looking statements, which represent our view only as of the date of this presentation, and which we assume no obligation to update.

Page 17

visteon

www.visteon.com