Attached files

| file | filename |

|---|---|

| 8-K - VERSO PAPER CORP. 8-K - Verso Corp | a50329518.htm |

| EX-99.1 - EXHIBIT 99.1 - Verso Corp | a50329518ex99_1.htm |

| EX-99.2 - EXHIBIT 99.2 - Verso Corp | a50329518ex99_2.htm |

Exhibit 99.3

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Project Renaissance Revised Naples/Venice Transaction Proposal May 30, 2012

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY This term sheet summarizes certain principal terms related to a hypothetical transaction between Naples and Venice (the “Summary”) and is not an offer with respect to any securities or a solicitation of acceptances or rejection of a Chapter 11 plan of reorganization pursuant to the bankruptcy code. Any such offer or solicitation will be made only in compliance with all applicable securities laws and the provisions of the bankruptcy code. This Summary is non-binding and being provided in furtherance of settlement discussions and is entitled to protection pursuant to rule 408 of the federal rules of evidence and any similar federal or state rule of evidence. The transactions described in this Summary are subject in all respects to, among other things, execution and delivery of definitive documentation and satisfaction or waiver of the conditions precedent set forth therein. The terms and implementation of transactions, if any, arising from this Summary are subject in all respects to the results of ongoing financial, legal, tax and business due diligence. This Summary is for discussion purposes only and remains subject to consideration by Venice’s board of directors. This Summary (including the identity of the parties and the existence of this Summary) is to be kept strictly confidential and is not to be shared or disclosed in any manner or form other than to Naples and its legal and financial advisors on a need-to-know basis, without Venice’s prior written consent.

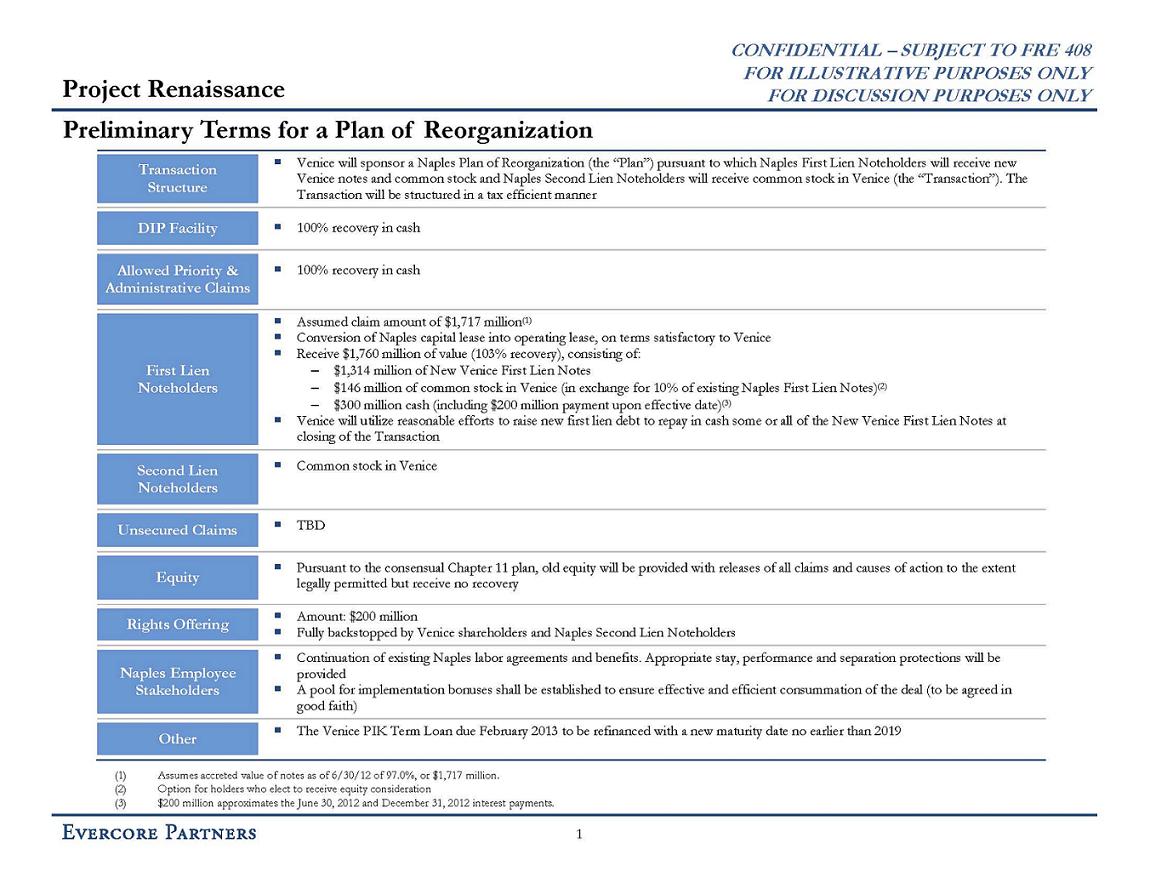

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Transaction Structure _ Venice will sponsor a Naples Plan of Reorganization (the “Plan”) pursuant to which Naples First Lien Noteholders will receive new Venice notes and common stock and Naples Second Lien Noteholders will receive common stock in Venice (the “Transaction”). The Transaction will be structured in a tax efficient manner DIP Facility _ 100% recovery in cash Allowed Priority & Administrative Claims _ 100% recovery in cash First Lien Noteholders _ Assumed claim amount of $1,717 million(1) _ Conversion of Naples capital lease into operating lease, on terms satisfactory to Venice _ Receive $1,760 million of value (103% recovery), consisting of: – $1,314 million of New Venice First Lien Notes – $146 million of common stock in Venice (in exchange for 10% of existing Naples First Lien Notes)(2) – $300 million cash (including $200 million payment upon effective date)(3) _ Venice will utilize reasonable efforts to raise new first lien debt to repay in cash some or all of the New Venice First Lien Notes at closing of the Transaction Second Lien Noteholders _ Common stock in Venice Unsecured Claims _ TBD Equity _ Pursuant to the consensual Chapter 11 plan, old equity will be provided with releases of all claims and causes of action to the extent legally permitted but receive no RATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Sources and Uses and Pro Forma Capitalization ($ in millions) 2 (1) Includes cash flow through transaction closing (2) $200 million approximates the June 30, 2012 and December 31, 2012 adequate protection payments Project Renaissance _ $600 – 650 million pro forma EBITDA, including $100 – 150 million of assumed synergies Sources & Uses Debt Capitalization Sources Cash Sources Cash(1) $426 Rights Offering Proceeds 200 Total Cash Sources $626 Uses Cash Uses Naples DIP Facility $250 First Lien Cash Payment(2) 200 Priority, Admin, Fees & Expenses 126 Contingency & Cash Cushion 50 Total Cash Uses $626 Pro Forma Venice Naples/ Standalone Adjustment Venice Total Debt Revolver $-- $-- 1st Lien Notes 345 $1,314 1,659 1.5 Lien Notes 272 272 2nd Lien Notes 409 409 Senior Sub Notes 143 143 Holdco PIK 86 86 Total Debt $1,254 $2,568 Net Debt 1,180 2,518 Net Debt /EBITDA $100 $150 Pro Forma Naples/Venice Synergies Synergies 1st Lien Debt 2.68x 2.48x 1.5 Lien Debt 3.13x 2.89x 2nd Lien Debt 3.82x 3.52x Senior Sub Debt 4.05x 3.74x Holdco PIK 4.20x 3.87x EBITDA/Interest 2.42x 2.62x Memo: Total EBITDA incl. Synergies $600 $650