Attached files

| file | filename |

|---|---|

| 8-K - VERSO PAPER CORP. 8-K - Verso Corp | a50329518.htm |

| EX-99.1 - EXHIBIT 99.1 - Verso Corp | a50329518ex99_1.htm |

| EX-99.3 - EXHIBIT 99.3 - Verso Corp | a50329518ex99_3.htm |

Exhibit 99.2

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Project Renaissance Discussion Materials June 18, 2012

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY This term sheet summarizes certain principal terms related to a hypothetical transaction between Naples and Venice (the “Summary”) and is not an offer with respect to any securities or a solicitation of acceptances or rejection of a Chapter 11 plan of reorganization pursuant to the bankruptcy code. Any such offer or solicitation will be made only in compliance with all applicable securities laws and the provisions of the bankruptcy code. This Summary is non-binding and being provided in furtherance of settlement discussions and is entitled to protection pursuant to rule 408 of the federal rules of evidence and any similar federal or state rule of evidence. The transactions described in this Summary are subject in all respects to, among other things, execution and delivery of definitive documentation and satisfaction or waiver of the conditions precedent set forth therein. The terms and implementation of transactions, if any, arising from this Summary are subject in all respects to the results of ongoing financial, legal, tax and business due diligence. This Summary is for discussion purposes only and remains subject to consideration by Venice’s board of directors. This Summary (including the identity of the parties and the existence of this Summary) is to be kept strictly confidential and is not to be shared or disclosed in any manner or form other than to Naples and its legal and financial advisors on a need-to-know basis, without Venice’s prior written consent.

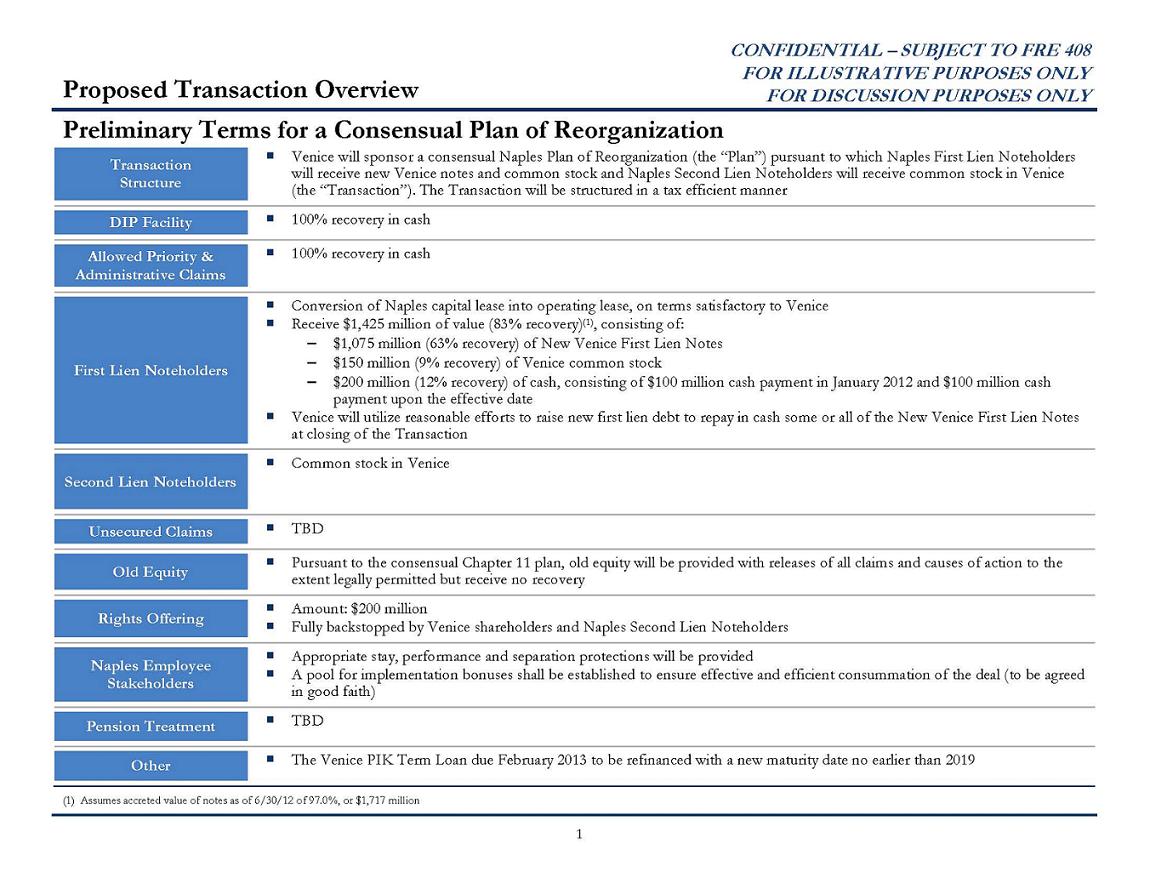

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Transaction Structure Venice will sponsor a consensual Naples Plan of Reorganization (the “Plan”) pursuant to which Naples First Lien Noteholders will receive new Venice notes and common stock and Naples Second Lien Noteholders will receive common stock in Venice (the “Transaction”). The Transaction will be structured in a tax efficient manner DIP Facility 100% recovery in cash Allowed Priority & Administrative Claims 100% recovery in cash First Lien Noteholders Conversion of Naples capital lease into operating lease, on terms satisfactory to Venice Receive $1,425 million of value (83% recovery)(1), consisting of: – $1,075 million (63% recovery) of New Venice First Lien Notes – $150 million (9% recovery) of Venice common stock – $200 million (12% recovery) of cash, consisting of $100 million cash payment in January 2012 and $100 million cash payment upon the effective date Venice will utilize reasonable efforts to raise new first lien debt to repay in cash some or all of the New Venice First Lien Notes at closing of the Transaction Second Lien Noteholders Common stock in Venice Unsecured Claims TBD Old Equity Pursuant to the consensual Chapter 11 plan, old equity will be provided with releases of all claims and causes of action to the extent legally permitted but receive no recovery Rights Offering Amount: $200 million Fully backstopped by Venice shareholders and Naples Second Lien Noteholders Naples Employee Stakeholders Appropriate stay, performance and separation protections will be provided A pool for implementation bonuses shall be established to ensure effective and efficient consummation of the deal (to be agreed in good faith) Pension Treatment TBD Other The Venice PIK Term Loan due February 2013 to be refinanced with a new maturity date no earlier than 2019 Preliminary Terms for a Consensual Plan of Reorganization 1 Proposed Transaction Overview (1) Assumes accreted value of notes as of 6/30/12 of 97.0%, or $1,717 million

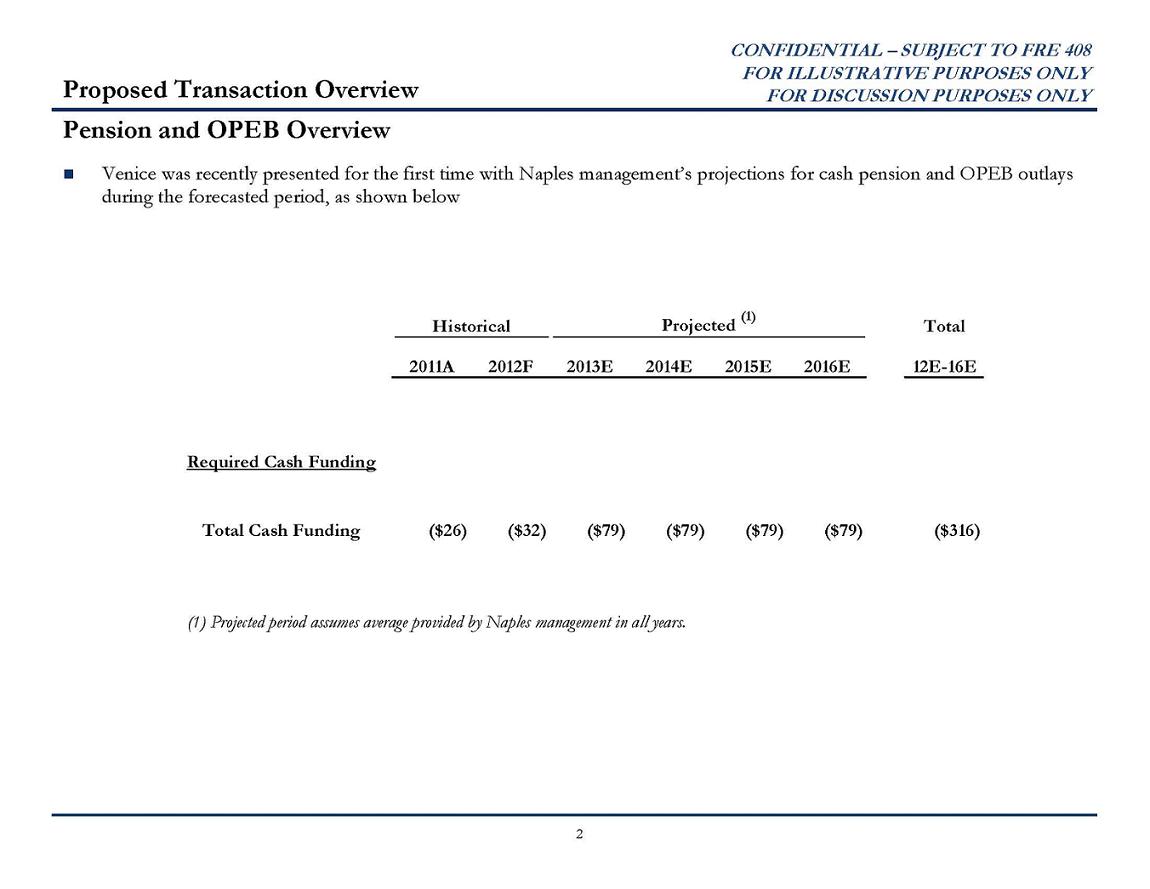

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Pension and OPEB Overview 2 Proposed Transaction Overview Venice was recently presented for the first time with Naples management’s projections for cash pension and OPEB outlays during the forecasted period, as shown below Historical Projected (1) Total 2011A 2012F 2013E 2014E 2015E 2016E 12E-16E Required Cash Funding Total Cash Funding ($26) ($32) ($79) ($79) ($79) ($79) ($316) (1) Projected period assumes average provided by Naples management in all years.

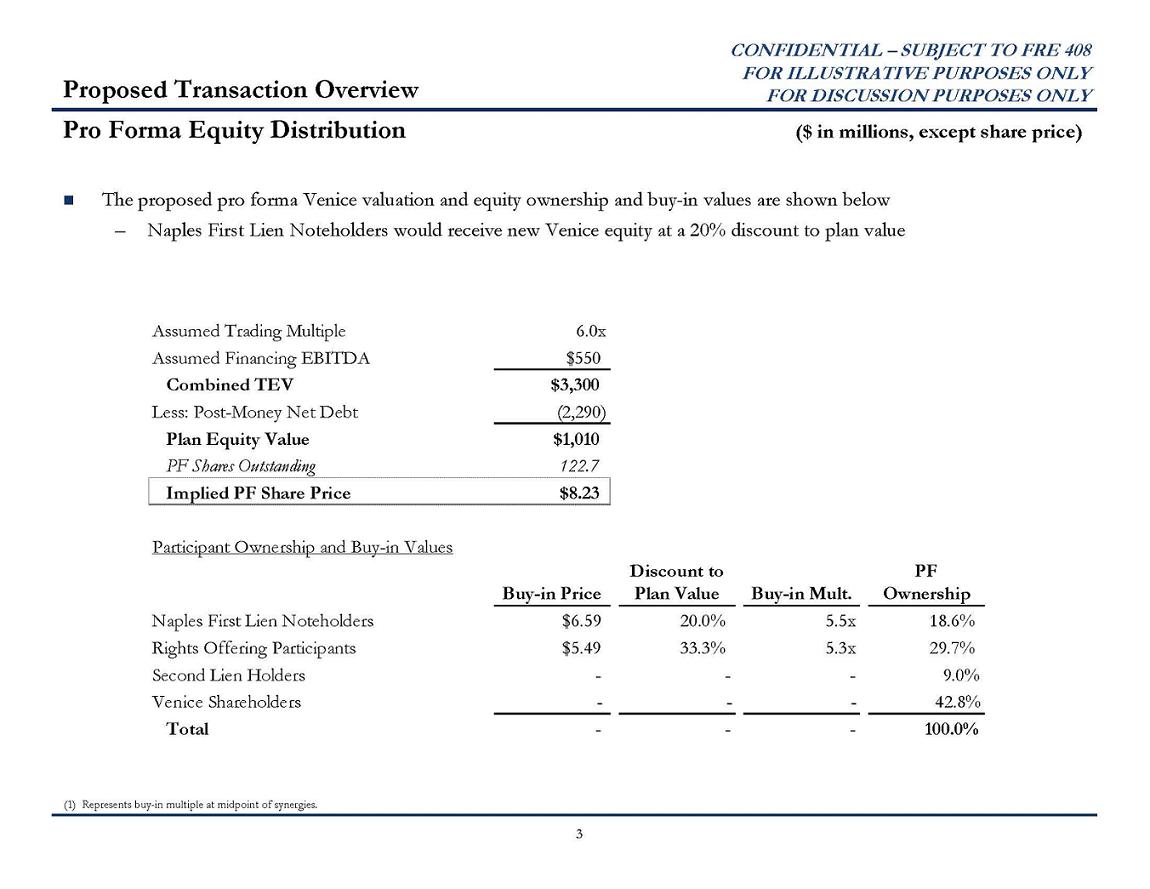

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Pro Forma Equity Distribution ($ in millions, except share price) 3 Proposed Transaction Overview The proposed pro forma Venice valuation and equity ownership and buy-in values are shown below – Naples First Lien Noteholders would receive new Venice equity at a 20% discount to plan value (1) Represents buy-in multiple at midpoint of synergies. Assumed Trading Multiple 6.0x Assumed Financing EBITDA $550 Combined TEV $3,300 Less: Post-Money Net Debt (2,290) Plan Equity Value $1,010 PF Shares Outstanding 122.7 Implied PF Share Price $8.23 Participant Ownership and Buy-in Values Buy-in Price Discount to Plan Value Buy-in Mult. PF Ownership Naples First Lien Noteholders $6.59 20.0% 5.5x 18.6% Rights Offering Participants $5.49 33.3% 5.3x 29.7% Second Lien Holders - - - 9.0% Venice Shareholders - 42.8% Total - - - 100.0%

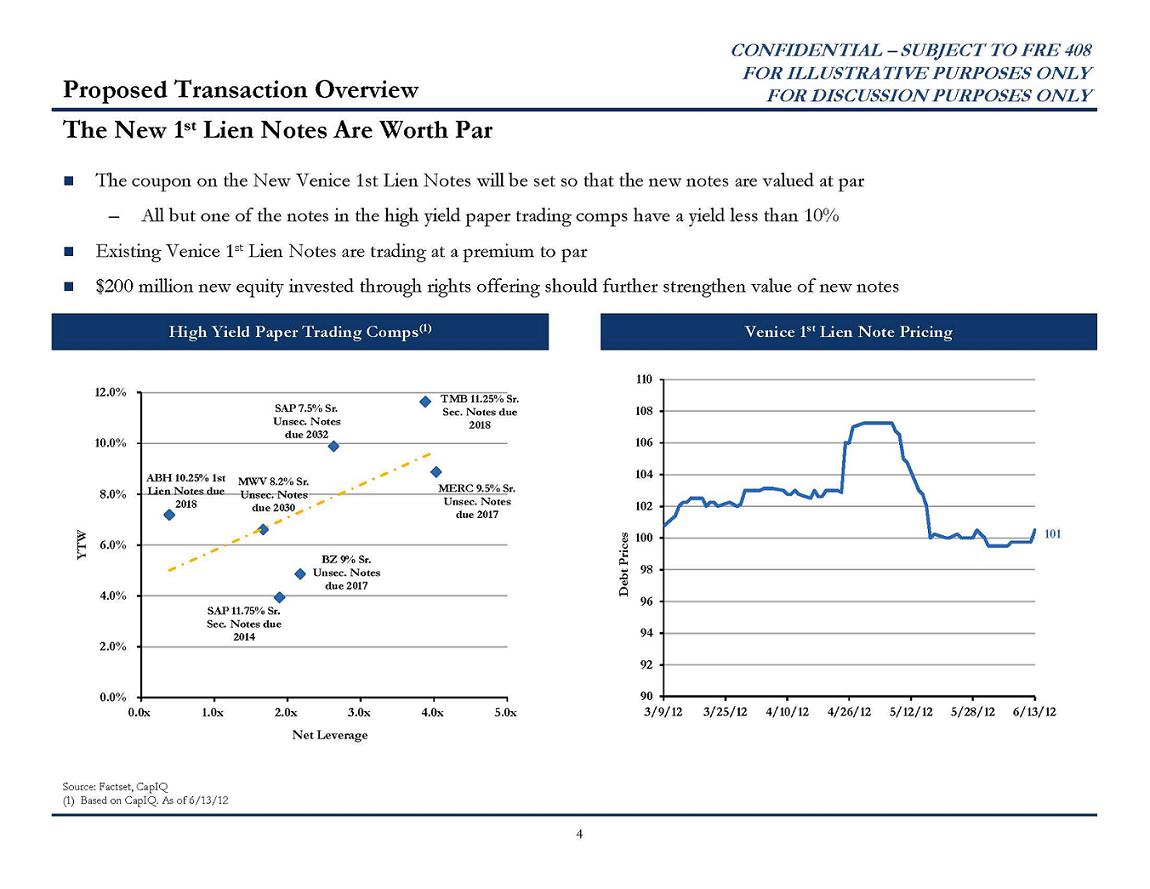

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY The coupon on the New Venice 1st Lien Notes will be set so that the new notes are valued at par – All but one of the notes in the high yield paper trading comps have a yield less than 10% Existing Venice 1st Lien Notes are trading at a premium to par $200 million new equity invested through rights offering should further strengthen value of new notes The New 1st Lien Notes Are Worth Par Source: Factset, CapIQ (1) Based on CapIQ. As of 6/13/12 Venice 1st Lien Note Pricing High Yield Paper Trading Comps(1) ABH 10.25% 1st Lien Notes due 2018 BZ 9% Sr. Unsec. Notes due 2017 MWV 8.2% Sr. Unsec. Notes due 2030 MERC 9.5% Sr. Unsec. Notes due 2017 SAP 11.75% Sr. Sec. Notes due 2014 SAP 7.5% Sr. Unsec. Notes due 2032 TMB 11.25% Sr. Sec. Notes due 2018 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x YTW Net Leverage Proposed Transaction Overview 4 101 90 92 94 96 98 100 102 104 106 108 110 3/9/12 3/25/12 4/10/12 4/26/12 5/12/12 5/28/12 6/13/12 Debt Prices

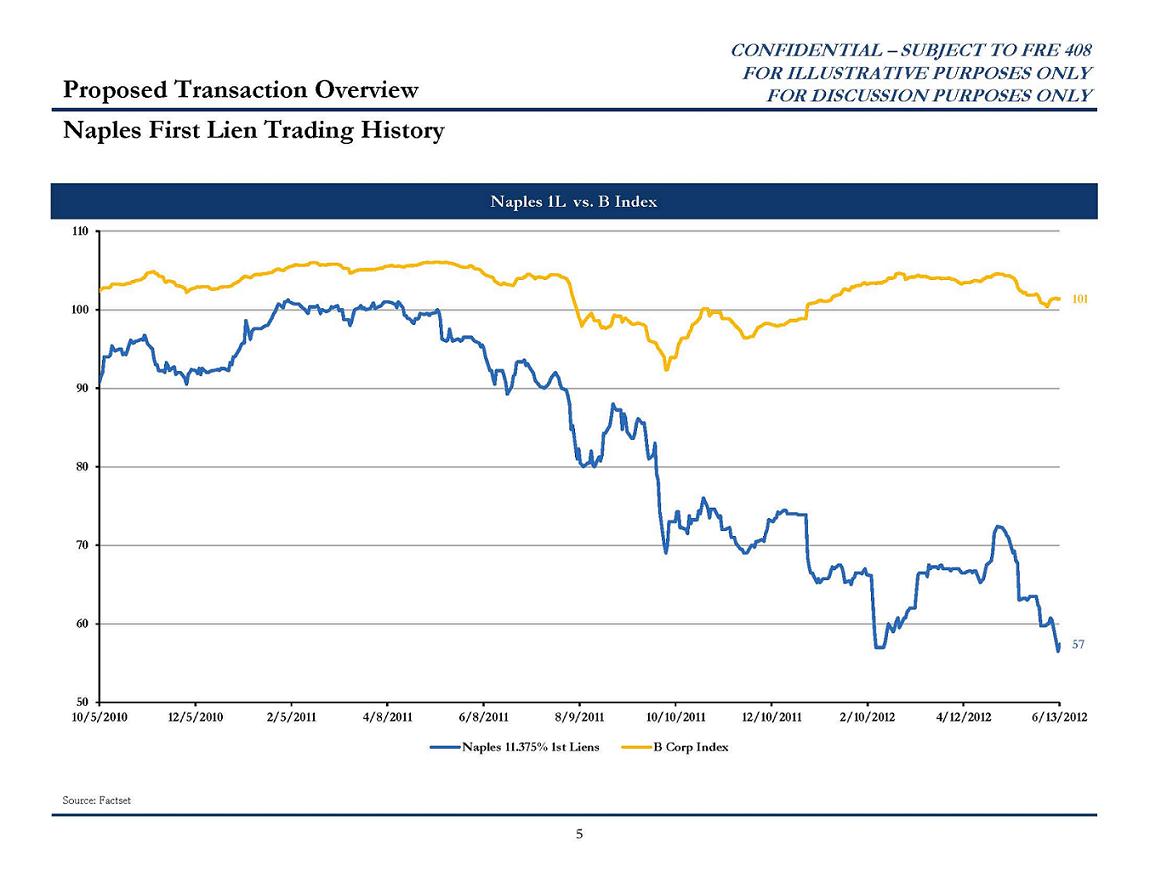

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Naples First Lien Trading History Naples 1L vs. B Index Source: Factset Proposed Transaction Overview 5 57 101 50 60 70 80 90 100 110 10/5/2010 12/5/2010 2/5/2011 4/8/2011 6/8/2011 8/9/2011 10/10/2011 12/10/2011 2/10/2012 4/12/2012 6/13/2012 Naples 11.375% 1st Liens B Corp Index

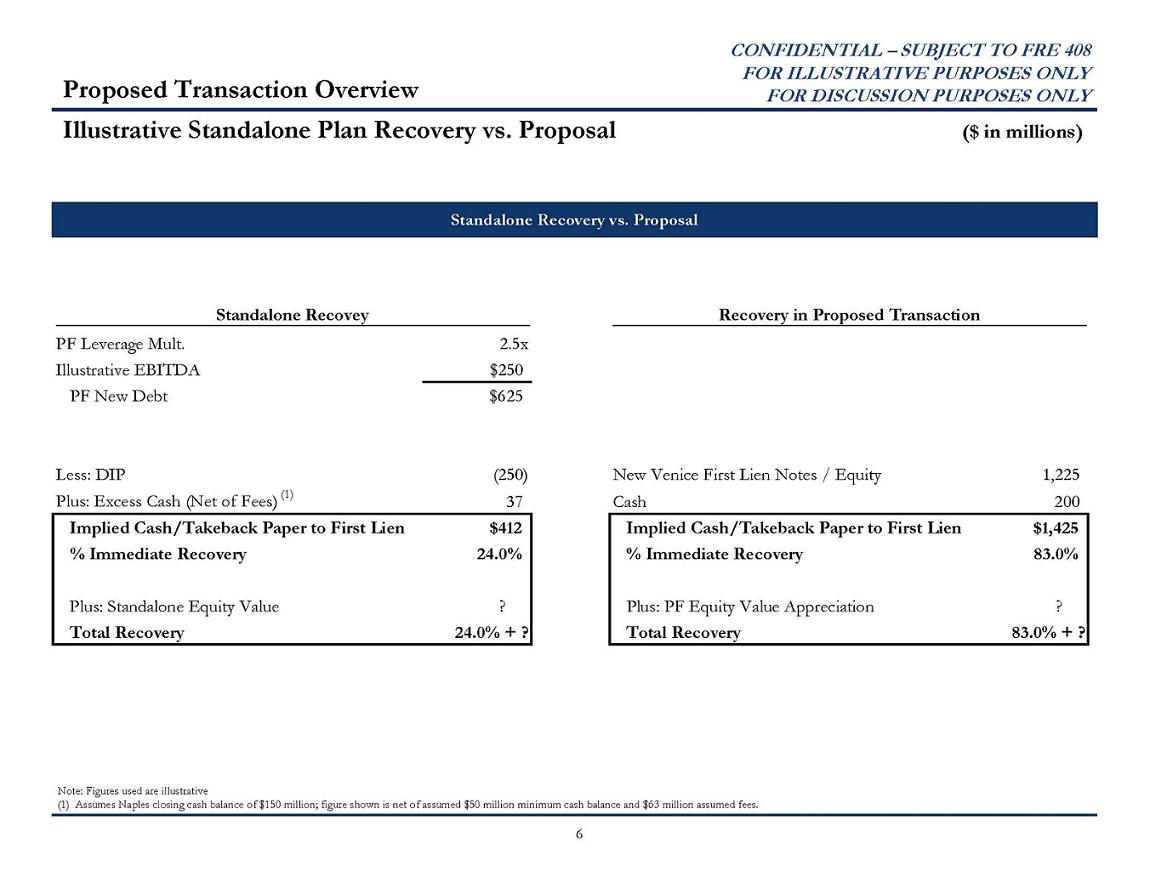

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Illustrative Standalone Plan Recovery vs. Proposal ($ in millions) Note: Figures used are illustrative (1) Assumes Naples closing cash balance of $150 million; figure shown is net of assumed $50 million minimum cash balance and $63 million assumed fees. 6 Standalone Recovery vs. Proposal Proposed Transaction Overview Standalone Recovey Recovery in Proposed Transaction PF Leverage Mult. 2.5x Illustrative EBITDA $250 PF New Debt $625 Less: DIP (250) New Venice First Lien Notes / Equity 1,225 Plus: Excess Cash (Net of Fees) (1) 37 Cash 200 Implied Cash/Takeback Paper to First Lien $412 Implied Cash/Takeback Paper to First Lien $1,425 % Immediate Recovery 24.0% % Immediate Recovery 83.0% Plus: Standalone Equity Value ? Plus: PF Equity Value Appreciation ? Total Recovery 24.0% + ? Total Recovery 83.0% + ?

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY Based on its knowledge of its own business and publicly available information on Naples, Venice management has estimated that there are $125 - 150 million of identifiable cost synergies from the Venice/Naples combination The preliminary synergy estimate is comprised of: – Distribution Expense: $7 - $10 million – Direct Costs: $46 - $61 million – Indirect Costs: $2 - $3 million – SG&A / Overhead: $20 - $26 million – Operations Optimization: $50 million This estimate equates to 2.4% - 2.9% of combined sales and $24.0 - $28.8 per combined ton – With access to diligence Venice could refine this estimate – Based on past diligence exercises, we believe diligence will uncover more savings opportunities Venice would expect to work with Naples to find ways to coordinate production, reduce changeovers and increase production runs so that the combined company can produce more product on the same assets Summary of Synergy Analysis 7 Overview of Estimated Synergies

CONFIDENTIAL – SUBJECT TO FRE 408 FOR ILLUSTRATIVE PURPOSES ONLY FOR DISCUSSION PURPOSES ONLY The proposed transaction provides Naples 1st Lien Noteholders with a higher and more liquid recovery than could otherwise be achieved through a Naples standalone plan of reorganization – Naples 1st Lien Noteholders receive 83% recovery including $200 million in cash (including $100 million payment upon effective date) – Significant credit improvement for Naples creditors facilitated by fully backstopped $200 million equity Rights Offering and reduction in net leverage through 1st lien debt to approximately 2.5x pro forma for the combination – Ability to participate in equity upside of pro forma Venice for select holders – Part of large liquid capital structure vs. illiquidity of Naples, which will likely trade poorly due to expected negative operating trends – Method and timing of exit of reorganized debt and equity in standalone Naples is highly uncertain The proposed transaction delivers a potential consensual plan to Naples creditors that would reduce the risks of a lengthy, costly, and uncertain plan confirmation process Conclusion Proposed Transaction Overview