Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - OFG BANCORP | d373065dex991.htm |

| EX-99.3 - EX-99.3 - OFG BANCORP | d373065dex993.htm |

| 8-K - FORM 8-K - OFG BANCORP | d373065d8k.htm |

Acquisition of

BBVA’s Puerto Rico Operations Investor Conference Call

June 28, 2012

1

Exhibit 99.2 |

2

Disclaimer

The information contained in this presentation (the “Presentation”) is preliminary,

may not be complete and may be changed. Unless otherwise indicated or unless the

context requires otherwise, all references to “Oriental,” “we,” “us,” “our” or similar references means Oriental Financial Group Inc.

The Presentation includes forward-looking statements about Oriental. These

forward-looking statements may relate to Oriental’s financial condition, results of

operations, plans, objectives, future performance and business, including, but not limited to,

statements with respect to the proposed acquisition described herein, the pro forma

effect of such acquisition and related transactions, and our ability to finance such acquisition. All statements contained herein that are not clearly

historical in nature are forward-looking, and the words “anticipate,”

“believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions and

future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “can,” “may,” or similar expressions are generally intended to identify forward-looking

statements.

Forward-looking statements provide our expectations or predictions of future conditions,

events or results. They are not guarantees of future performance, and actual results

may differ materially. By their nature, these forward-looking statements involve numerous assumptions and uncertainties, both general and specific, including

those discussed in Oriental’s Annual Report on Form 10-K for the year ended December

31, 2011 (the “2011 10-K”), Oriental’s Quarterly Report on Form 10-Q for the

three-month period ended March 31, 2012 (the “1Q 10-Q”), and other filings

we make with the Securities and Exchange Commission. These statements speak only as of

the date they are made. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date

the forward looking statements were made. These statements are not

guarantees of future performance and involve certain risks, uncertainties, estimates and assumptions by management that are difficult to

predict. Various factors, some of which, by their nature are beyond Oriental’s control,

could cause actual results to differ materially from those expressed in, or implied

by, such forward-looking statements, including with respect to market conditions. Factors that might cause such a difference include, but are not limited to

those included under the “Risk Factors” section of the 2011 10-K and the 1Q

10-Q or the risk factors included in the materials provided to you in connection with this

transaction. You are urged to read the “Risk Factors” section of the 2011 10-K

and the 1Q 10-Q as well as the risk factors included in the materials provided to you in

connection with this transaction. Market data used in the

Presentation has been obtained from industry sources and publications as well as from research reports prepared for other purposes.

Furthermore, certain information has been obtained from Banco Bilbao Vizcaya Argentaria, S.A.

(“BBVA”) and BBVA does not assume any responsibility therefore. We have not

independently verified any the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. In addition,

information regarding the combined company included in this presentation is based in part on

certain assumptions regarding the transaction and the value of the acquired assets and

liabilities that we believe are reasonable. We cannot assure you that our assumptions will prove to be accurate over time.

This Presentation does not constitute an offer to sell, or a solicitation of an offer to buy,

any securities by any person in any jurisdiction in which it is unlawful for such

person to make an offer or solicitation.

The Presentation contains unaudited non-GAAP financial and other performance measures.

Oriental presents non-GAAP and other performance measures when its management

believes that the additional information is useful and meaningful to investors. Non-GAAP and other performance measures do not have any standardized

meaning and are therefore unlikely to be comparable to similar measures presented by other

companies. The presentation of non-GAAP and other performance measures is not

intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See Appendix

for definitions and reconciliations of certain non-GAAP measures to the comparable GAAP

measures and for definitions of certain other performance measures used in this

presentation. |

3

I. Transaction Overview and Rationale |

4

Acquisition Overview and Rationale

Signed

definitive

agreement

to

purchase

BBVA’s

Puerto

Rico

operations

(1)

for

$500 million in cash

–

Closing (subject to customary regulatory approvals) targeted before December 31, 2012

Effective use of excess capital which enhances financial performance, franchise

and shareholder value

–

Generates significant earnings per share accretion (over 50% in 2014)

–

Combines two of the healthiest lenders in Puerto Rico to create a market leading bank

–

Provides an expanded customer base and complementary products and services

–

Enhances Oriental’s competitive position on the Island with #2 core deposit share

Accelerates the transformation of Oriental’s balance sheet

–

Larger and more diversified loan portfolio

–

Far less reliance on investment securities and wholesale funding

–

Improves earnings stability

Well timed: Puerto Rico’s economy has stabilized and fiscal situation has

improved (1)

Acquisition targets include BBVA PR’s commercial bank and insurance brokerage which are

subsidiaries of BBVA PR Holding Corporation, a bank holding company, and BBVA

Securities of Puerto Rico, Inc. which is a separate subsidiary.

Description

Rationale |

5

Pricing and Financing

Oriental /

BBVA PR

Comparable

Transactions

(2)

Price / Tangible Book Value Per Share

1.03x

1.65x

Price / Marked Tangible Book Value Per Share

1.37x

2.01x

Price / Earnings

(1)

14.0x

27.5x

Attractive

Purchase

Valuation for

Healthy

Commercial

Bank Target

Financing

Designed to

Minimize

Shareholder

Dilution and

Maximize EPS

Accretion

$350 million of balance sheet cash

Signing

of

purchase

agreements

for

$84

million

private

placement

of

noncumulative

convertible perpetual preferred stock occurred in connection with the signing of the

acquisition agreement

–

Conversion price of $11.77 and dividend of 8.75%

Incremental

$65-$70

million

of

Tier

1

capital

to

be

raised

before

closing

of

the

acquisition

–

Approximately equal amounts of non-convertible perpetual preferred equity and

common equity

$1.8

billion

deleveraging

of

the

investment

securities

portfolio

and

wholesale

funding

emphasizes shift towards core commercial banking platform

Source: SNL Financial, regulatory filings.

(1)

Annualized earnings for BBVA PR in 1Q 2012 and the most recent quarter prior to announcement

of comparable transactions. (2)

Includes U.S. nationwide transactions announced since June 30, 2010 with deal value between

$200 million and $6 billion. Median metrics. |

6

Acquisition Benefits

Financial

Metrics Are

Very Favorable

EPS Accretion

~35% accretive to 2013 EPS (Assumes 12/31/12 close)

(1)

~52% accretive to 2014 EPS

Tangible Book

Value per Share

and Earn Back

Period

Tangible book value per share dilution of ~23% at close

Less

than

2

years

earn-back

period

(2)

based

on

combined

company’s

earnings

Less

than

5

years

earn-back

period

(3)

based

on

earnings

contributed

by

acquisition

IRR

~20%

Pro Forma

Accretion and

Profitability

Provide

Attractive

Relative

Valuation

Oriental

Median of

Current

Pro Forma

U.S. Bank Peers

(5)

Price to:

2014E EPS

7.3x

4.8x

11.1x

Tangible Book Value

0.66

0.86

1.41

2014E Profitability Metrics

ROAA

0.90%

1.07%

1.13%

ROATCE

8.2

16.8

10.7

Note: Financial metrics and pro forma capital ratios assume December 31, 2012 transaction

close. Combined metrics include acquisition adjustments and are pro forma for $150 million capital raise and $1.8

billion in deleverage transactions to be conducted at time of acquisition close. Assumes

constant OFG stock price of $10.46 as of June 27, 2012. (1) Excludes impact of one-time restructuring costs.

(2) Tangible book value per share earn-back period defined as

tangible book value per share dilution at acquisition close divided by 2014 EPS.

(3) Tangible book value per share earn-back period defined as

tangible book value per share dilution at acquisition close divided by dollars of 2014 EPS accretion.

(4) Oriental current EPS assumes First Call 2013 median estimated

diluted EPS of $1.32 grown at the First Call median long-term EPS growth rate of 8%.

(5) Includes publicly-traded U.S. banks between $5 billion and $15

billion in assets. 2014E profitability metrics reflect First Call median estimates.

(4) |

7

II. Overview of BBVA’s Puerto Rico Operations |

8

BBVA PR Presents a Complementary Franchise with an Established History of Over 45

Years Serving Puerto Rico

BBVA PR

Operations

Highly

Complementary

to Oriental

Acquisition includes commercial bank, insurance agency business and securities brokerage

(1)

$5.2 billion in assets, $3.7 billion in loans, $3.3 billion in deposits and 36 branches

Specialist in commercial banking and auto lending with excellent

corporate banking services

Also strong in residential mortgages and consumer loans

Management team of local executives with significant retail and commercial banking

experience Foundation of

Banco de

Mayagüez

Acquisition of 98.8% of Banco de

Mayagüez by Banco Occidental

(Banco Occidental was acquired

by Banco Vizcaya in 1982)

Renamed as BBV PR

Headquarters moved

to San Juan

Acquisition of 20% of

General Electric Capital

Acquisition of

Royal Bank of PR

Acquisition of Las

Americas Trust & Co

Acquisition of Ponce

Bank and acquisition of

assets and liabilities of

Chase Manhattan Bank

Merger between BBV

and Argentaria

Renamed as BBVA PR

Acquisition of part of

Citibank’s auto

financing business

(1)

Acquisition targets include BBVA PR’s commercial bank and insurance brokerage which are

subsidiaries of BBVA PR Holding Corporation, a bank holding company, and BBVA

Securities of Puerto Rico, Inc. which is a separate subsidiary.

1967

1979

1992

1993

1994

1998

1999

2000

2001

2011

BBVA PR Historical Timeline |

9

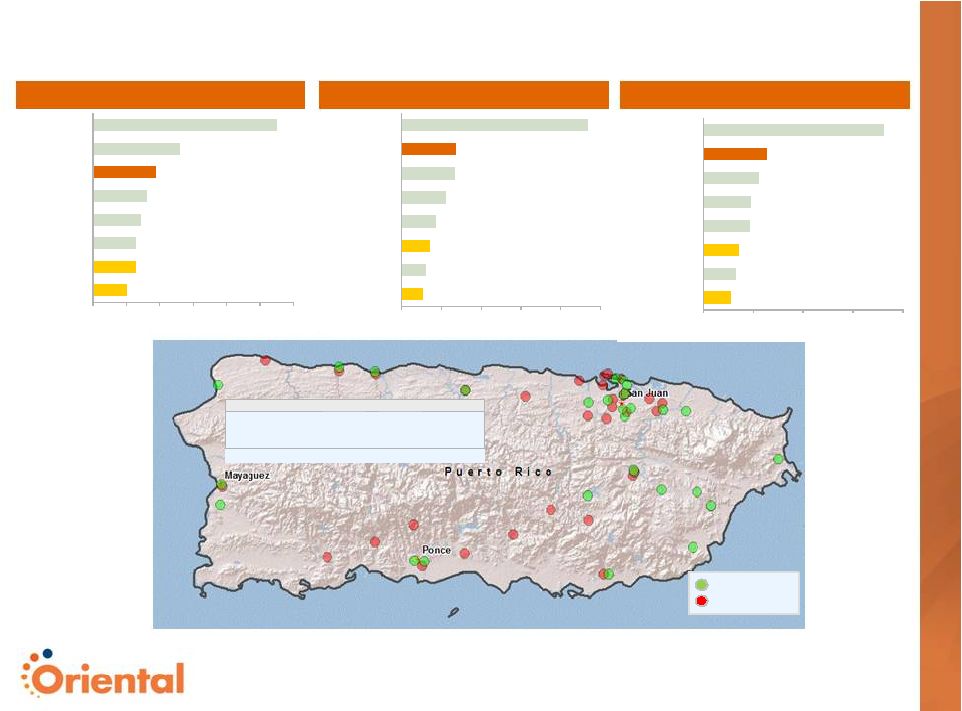

BBVA PR’s Credit Quality Has Stabilized

BBVA PR

Peer

Median

(1)

Source: SNL Financial and BBVA PR regulatory filings as of March

31, 2012.

(1)

Nonperforming asset formation has declined to

normalized levels

BBVA PR’s loan portfolio has consistently earned a

considerably higher yield than U.S. national peers

BBVA

PR’s

nonperforming

loan

balance

has

declined

27% since peaking in 3Q 2010

BBVA PR has been aggressive in addressing problem

assets

with

a

reserve

to

nonperforming

loans

ratio of

52%

Key Points

BBVA PR Exhibits Higher Loan Yields Versus Peers

(1)

Nonperforming Loans Have Declined and Stabilized

NPA Formation Has Declined Significantly from Peak Levels

Peers

defined

as

U.S.

banks

with

assets

between

$3

and

$10

billion.

6

7

8

9

10%

2009

Q4

2010

Q1

2010

Q2

2010

Q3

2010

Q4

2011

Q1

2011

Q2

2011

Q3

2011

Q4

2012

Q1

0.0

6.0

12.0

18.0%

2009

Q4

2010

Q1

2010

Q2

2010

Q3

2010

Q4

2011

Q1

2011

Q2

2011

Q3

2011

Q4

2012

Q1

5.0

5.5

6.0

6.5

7.0%

2009

Q4

2010

Q1

2010

Q2

2010

Q3

2010

Q4

2011

Q1

2011

Q2

2011

Q3

2011

Q4

2012

Q1 |

10

Oriental performed extensive credit review

Process utilized Oriental’s extensive knowledge

of Puerto Rico market to generate conservative

loss estimates

Commercial loan file review covered

–

79% of construction portfolio

–

74% of nonperforming commercial real estate

–

52% of auto dealer

–

47% of corporate loans

Total nonperforming loans marked by nearly

50%

Aggregate loan mark of 7.5%

Implied cumulative losses of 16.5%

Extensive Credit Due Diligence and Conservative Loan Marks

($ in millions)

1/1/08 - 3/31/12 Average Loans, HFI Balance

$3,852

NCOs taken 1/1/08 - 3/31/12

($357)

(9.3%)

Cumulative Losses

($635)

(16.5%)

Gross Loan

Performing

Balance

Mark $

Mark %

Mortgage

$852

($37)

(4.4%)

Autos

963

0

0.0

CRE

186

(24)

(12.7)

Construction

29

(8)

(26.2)

Commercial

1,228

(69)

(5.6)

Consumer

198

(18)

(9.1)

Total Performing

$3,456

($155)

(4.5%)

Gross Loan

Non Performing

Balance

Mark $

Mark %

Mortgage

$84

($50)

(59.9%)

Autos

8

(3)

(41.4)

CRE

17

(5)

(30.1)

Construction

59

(26)

(43.2)

Commercial

79

(36)

(45.8)

Consumer

3

(2)

(73.7)

Total Nonperforming

$250

($123)

(49.0%)

Total

$3,706

($278)

(7.5%) |

11

III. Pro Forma Impact of Acquisition |

12

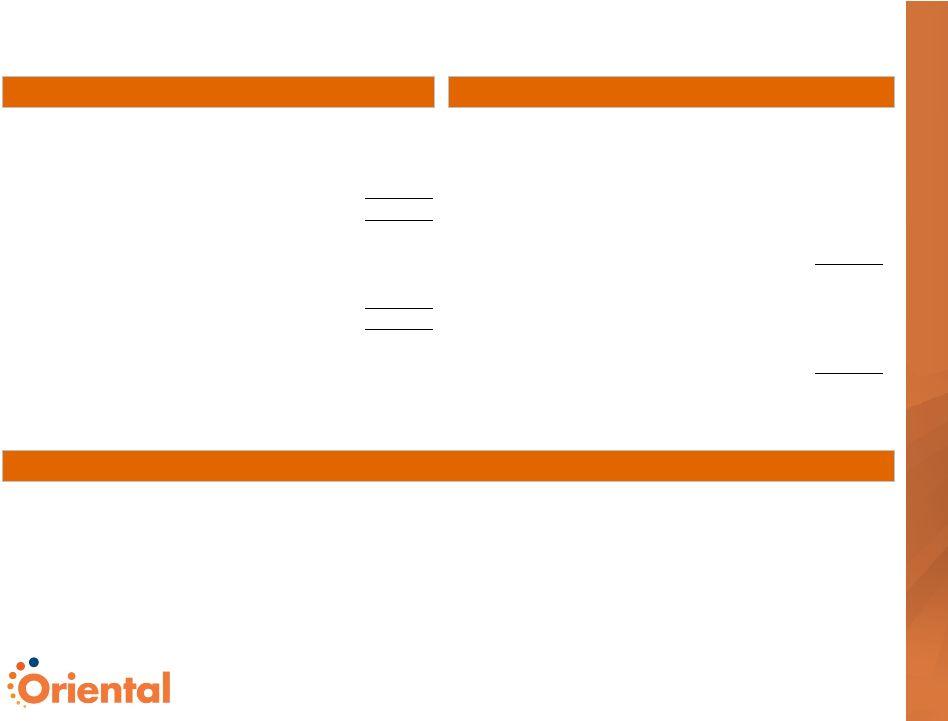

Transaction Significantly Enhances the Competitive Position of the Oriental Franchise

Core Deposit Funded

Enhanced Scale

Island-wide Retail Branch Network

12

(1)

Puerto Rico core deposits are estimated on a pro-rata basis based on proportion of Puerto

Rico deposits to total deposits disclosed in 2012 Q1 10-Q and 2011 10-K for Popular and First BanCorp.,

respectively. Actual Puerto Rico core deposits may differ.

Source: SNL Financial, public SEC and regulatory filings.

Note: Companies shown include Puerto Rico-based banks. Data as of March 31, 2012. Pro

forma data represented as if financing and acquisition transactions occurred March 31, 2012, included for illustrative purposes.

Combined metrics include acquisition adjustments and are pro forma for $150 million capital

raise and $1.8 billion in deleverage transactions to be conducted at time of acquisition close. See page 20 and 21 for key

pro forma and deleverage assumptions, respectively.

47%

14%

14%

11%

9%

7%

6%

6%

0%

10%

20%

30%

40%

50%

Popular

PF Oriental / BBVA PR

Banco Santander

First BanCorp

Scotia

BBVA PR

Doral

Oriental

Market Share of Core Deposits

$28

$13

$9

$8

$7

$7

$6

$5

$0

$5

$10

$15

$20

$25

$30

Popular

First BanCorp.

PF Oriental / BBVA PR

Doral

Banco Santander

Scotia

Oriental

BBVA PR

Total Assets ($B)

182

64

56

48

47

36

33

28

0

50

100

150

200

Popular

PF Oriental / BBVA PR

Banco Santander

First BanCorp.

Scotia

BBVA PR

Doral

Oriental

Branches

($ mm)

OFG

BBVA PR

Pro Forma

Deposits

$2,275

$3,269

$5,544

Branches

28

36

64

Dep. / Branch

$81

$91

$87

(1)

(1)

OFG

BBVA PR |

13

60%

34%

36%

57%

4%

9%

1Q 2012

Standalone

Pro Forma

Brokered Deposits

Core Deposits

Borrowings

Acquisition of BBVA PR Accelerates Ongoing Transformation of Oriental

Source: SNL Financial, public SEC and regulatory filings.

Note: Combined metrics include acquisition adjustments and are pro forma for $150 million

capital raise and $1.8 billion in deleverage transactions to be conducted at time of acquisition close. See page 20 and 21 for

key pro forma and deleverage assumptions, respectively.

(1)Pro forma data as if financing and acquisition transactions occurred March 31, 2012

included for illustrative purposes. (2)Covered loans benefit from FDIC loss share

agreements. Earning Asset Composition

Funding Composition

(1)

The transaction creates a more attractive earning asset and funding composition, with an

increased proportion of loans and core deposits

–

Includes $1.8 billion deleveraging of investment securities portfolio and wholesale

funding 14%

22%

57%

15%

21%

15%

9%

6%

41%

1Q 2012

Standalone

Pro Forma

Marked Loans

Covered Loans

Non-Covered Loans

Government Sponsored RMBS

Other Securities and Cash Equivalents |

14

Source: SNL Financial, Oriental and BBVA PR SEC and regulatory filings.

Note: Financial data as of March 31, 2012.

(1)

Pro forma data as if financing and acquisition transactions occurred March 31, 2012 included

for illustrative purposes. Combined metrics include acquisition adjustments and are pro

forma for $150 million capital raise and $1.8 billion in deleverage transactions to be

conducted at time of acquisition close. See page 20 and 21 for key pro forma and deleverage assumptions, respectively.

(2)

Other loans and leases include home equity, agricultural production, institutional /

government, and floor plan loans. BBVA PR Diversifies Oriental’s Loan Portfolio and

Enhances its Funding Base 14

Pro Forma

Total: $5.2 BN

Autos

19%

Commercial

Banking

30%

Residential

Mortgages

35%

Consumer

and

Other

(2)

Loans &

Leases

17%

Oriental

Total: $1.8 BN

Commercial

Banking

37%

Residential

Mortgages

55%

Consumer

and Other

Loans &

Leases

(2)

8%

Diversifies Loan Composition Across Commercial and Retail Credits

(1)

Oriental

Total: $2.3 BN

Jumbo

Time

16%

Retail Time

29%

Non-

Interest

Bearing

8%

Other

Interest

Bearing

47%

Pro Forma

Total: $5.5 BN

Jumbo

Time

23%

Retail Time

23%

Non-

Interest

Bearing

17%

Other

Interest

Bearing

37%

(1)

Deposit Composition is Improved with Additional Core Deposits |

15

Source: SNL Financial, public SEC and regulatory filings.

Note: Financial data as of March 31, 2012. Pro forma data as if financing and acquisition

transactions occurred March 31, 2012, included for illustrative purposes. Combined metrics include acquisition adjustments and are

pro forma for $150 million capital raise and $1.8 billion in deleverage transactions to be

conducted at time of acquisition close. See page 20 and 21 for key pro forma and deleverage assumptions, respectively.

NPAs / Total Assets

Marked Loans / Total Loans

Loans / Deposits

Pro Forma Company Has a Low-Risk Balance Sheet

2.4%

2.6%

3.7%

5.3%

6.2%

6.3%

9.5%

11.7%

0%

2%

4%

6%

8%

10%

12%

14%

Oriental

Scotia

PF Oriental /

BBVA PR

Santander

BBVA PR

Popular

First BanCorp.

Doral

76%

56%

30%

22%

0%

0%

0%

0%

0%

20%

40%

60%

80%

100%

PF Oriental / BBVA PR

Scotiabank

Oriental

Popular

Doral

First BanCorp.

BBVA PR

Santander

77%

92%

93%

104%

104%

113%

139%

139%

0%

50%

100%

150%

Oriental

Popular

PF Oriental /

BBVA PR

First BanCorp.

Santander

BBVA PR

Scotiabank

Doral |

16

Transaction Results in a Well-Capitalized Balance Sheet

Capital Ratios

Reported

Oriental (3/31/12A)

Pro Forma with

BBVA PR (12/31/12E)

TCE / TA

9.6%

5.6% -

5.8%

Tier 1 Common Capital

27.3%

7.9% -

8.2%

Tier 1 Risk Based Capital

32.3%

12.2% -

12.5%

Tier 1 Leverage

10.3%

6.8% -

7.0%

Summary Key Balance Sheet Items

($ in billions)

3/31/12A

12/31/12E

Oriental

BBVA PR

Pro Forma

Assets

Gross Loans

$1.8

$3.7

$5.2

Securities

3.6

0.7

2.2

Intangible Assets

0.0

0.1

0.1

Liabilities and Equity

Deposits

$2.3

$3.3

$5.5

Borrowings

3.4

1.2

2.9

Equity

0.7

0.6

0.8 |

17

IV. Conclusions |

18

Acquisition Highlights and Strategic Rationale

Repositions

balance

sheet

composition

away

from

wholesale

assets

and

liabilities

to

predominately loans and deposits

Well capitalized and over 75% of loans will have been marked by purchase accounting

Strong

credit

quality

and

asset

and

liability

composition

create

a

more

stable,

higher

quality

earnings stream

Creates a More

Stable Balance

Sheet and

Consistent

Earnings

Accelerates

Strategic

Transformation

Oriental avoided significant asset quality problems through the financial crisis and has been

generating organic growth in commercial banking

The acquisition of BBVA PR accelerates strategy with the addition of a large, profitable and

diversified institution

Purchase price of 1.03x tangible book value

(1)

and 14x MRQ net income is well below

comparable transactions

BBVA PR has produced six straight quarters of profitability

Estimated post acquisition EPS increases over 50% in 2014

Improves all key profitability ratios

Attractive

Valuation for a

Healthy Bank

Target Generates

Positive Financial

Impact

Establishes Oriental as a winner in the Puerto Rico bank recovery and consolidation cycle

|

19

V. Appendix |

20

Key Assumptions Underlying Pro Forma Analysis

Transaction Assumptions

Consideration

100% cash consideration to BBVA of $500 million

Financing

$150 million Tier 1 Capital issuance by Oriental

Remaining funds to be paid from cash on Oriental Bank & Trust’s balance sheet at

consummation of the transaction

Assumes 2.8% pre-tax cost of cash

Loan Credit Mark

7.5% of loans outstanding on March 31, 2012 ($278 million)

Core Deposit Intangibles

1.25% of core deposits, amortized on a straight line basis over 10 years

Balance Sheet Restructuring

$454

million

and

$1.3

billion

deleverage

from

BBVA

PR

and

OFG’s

respective

balance

sheets

(1)

Assumptions on Acquired BBVA PR Operations

Net Interest Margin

4.3% -

4.8%

Non-Interest Income

~$35 million per annum

Cost Savings

20% of BBVA PR’s non-interest expense

50% realized in 2013, 100% thereafter

Restructuring Expenses

~$40 million (pre-tax)

Deposit Run-off

$250 million; 8% of BBVA PR’s total deposits

Taxes

30% tax rate

Closing

December 31, 2012 closing date

(1)

See page 21 for transaction deleverage details. |

21

Anticipated Deleverage Allocates Capital for Building Oriental’s Core Banking Business

$1.3 billion in securities sold to delever liabilities

consisting of hedged repurchase agreements and FHLB

advances

One time after-tax loss on settlement of repurchase

agreements estimated at $9 million

Estimated net income impact of:

($12) million in 2013

($8) million in 2014

Oriental’s Balance Sheet

$454 million in securities sold to delever liabilities

consisting of repurchase agreements

Mark to market loss on early settlement of repurchase

agreements estimated at $23 million (purchase

accounting mark)

Estimated net income impact of:

$7 million in 2013

Acquired BBVA PR Balance Sheet

$1.8 billion in combined deleverage from both

companies’

balance sheets

Deleverage expected to occur at acquisition close

Assets and liabilities sold are selected based upon

expected cost to unwind

Leverages core funding base to support higher yielding

assets

Optimizes Oriental’s utilization of capital

Reduces interest rate sensitivity

Deleverage

Strategic Rationale |

22

Conservative Loan Mark

Source: SNL Financial, SEC and regulatory filings.

(1)

Cumulative mark based on gross loan mark and total NCOs since January 1, 2008 through

announcement of acquisition. (2)

Includes nationwide transactions since June 30, 2010 with deal value between $200 million and

$6 billion. Data at announcement of acquisition. (3)

Includes “Recent Transactions”

referenced in footnote 2 above with seller over 5% NPLs / Loans. Data at announcement of

acquisition. BBVA PR’s loan portfolio exhibits a higher loan yield and lower loss

severity than precedent targets Precedent Transaction Credit Mark Analysis

BBVA PR

Recent Transaction

Median

(2)

Comparable

Transaction Median

(3)

Gross Loan Mark / Loans

7.5 %

4.4 %

12.2 %

Cumulative Mark / Average Loans

(1)

16.5

8.1

14.7

NPLs / Loans

6.9

1.9

6.8

LTM NCOs / Average Loans

1.7

0.8

2.7

LTM NCOs / Average NPLs

22.9

31.3

42.5

Loan Yield

6.4

5.3

4.6 |

23

Tier 1 Common Equity:

Common Stockholders' Equity

$621

Unrealized Gains on Available-for-Sale Securties

(74)

Unrealized Losses on Cash Flow Hedges

44

Disallowed Deferred Tax Assets

(25)

Disallowed Servicing Assets

(1)

Intangible Assets

(4)

Total Tier 1 common equity

$561

Risk-weighted assets:

Balance sheet items

$2,000

Off-balance sheet items

53

Total Risk-Weighted Assets

$2,053

Tier 1 Common Equity to Risk-Weighted Assets

27.3%

Definitions/Reconciliation of Non-GAAP and Other Performance Measures

TCE / TA

Tier 1 Common Capital

($ in millions)

Tangible Common Equity:

Total Stockholders' Equity

$689

Preferred Stock

(68)

Intangible Assets

(4)

Total Tangible Common Equity

$617

Tangible Assets:

Total Assets

$6,461

Intangible Assets

(4)

Total Tangible Assets

$6,458

Tangible Common Equity to Tangible Assets

9.6%

Source: SNL Financial, Oriental public SEC filings, regulatory filings.

Other Non-GAAP and Performance Measures

•

Tangible book value and tangible common equity are defined as total common equity less total

intangible assets. •

Marked tangible book value defined as total common equity less total intangible assets and

mark-to-market adjustments. •

Internal Rate of Return (“IRR”) represents the annualized effective rate of return

on investment. •

Return on average assets (“ROAA”) is calculated as projected 2014 net income

available to common shareholders divided by projected 2014 average assets. Assets are

assumed to grow consistently over the course of 2014. •

Return on average tangible common equity (“ROATCE”) calculated as projected 2014 net

income available to common shareholders divided by average projected 2014 tangible

common equity. Tangible common equity is assumed to grow consistently over the course of 2014.

•

Nonperforming loans defined as nonaccrual loans and loans over 90 days past due.

•

NPA formation defined as the gross amount of loans placed on nonaccrual status since prior

period end annualized, expressed as a percentage of average total assets.

•

Core deposits defined as total deposits less brokered deposits.

•

Nonperforming assets are defined as nonaccrual loans and other real estate owned.

|