Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | d356445d8k.htm |

Associated Banc-Corp

Investor Presentation

Second Quarter 2012

May 21, 2012

Exhibit 99.1 |

Forward-Looking Statements

1

Statements made in this presentation which are not purely historical are forward-looking

statements, as defined in the Private Securities Litigation Reform Act of 1995. This

includes any statements regarding management’s plans, objectives, or goals for future

operations, products or services, and forecasts of its revenues, earnings, or other

measures of performance. Such forward-looking statements may be identified by the

use of words such as “believe”, “expect”, “anticipate”,

“plan”, “estimate”, “should”, “will”,

“intend”, “outlook”, or similar expressions. Forward-looking statements

are based on current management expectations and, by their nature, are subject to risks and

uncertainties. Actual results may differ materially from those contained in the

forward- looking statements. Factors which may cause actual results to differ

materially from those contained in such forward-looking statements include those

indentified in the company’s most recent Form 10-K and subsequent SEC filings.

Such factors are incorporated herein by reference.

Important

note

regarding

forward-looking

statements: |

Leading Midwest Banking Franchise

2

•

Top 50 U.S. bank holding company with $22 billion in assets

•

Largest bank headquartered in Wisconsin

–

More than 250 banking offices serving over 150 communities

–

#1

mortgage

originator

in

Wisconsin

¹

–

#1

SBA

lender

in

Wisconsin

²

>$1bn

deposits

³

>$500m

deposits

³

>$250m

deposits

³

Operating in Attractive Midwest Markets

•

Wisconsin

and

Minnesota

continue

to

show

above

average

employment

levels

4

•

Midwest

Manufacturing

output

is

up

8.6%

year-over-year

(vs.

5.0%

nationally)

5

•

Midwest

Steel

output

is

up

11.2%

YoY;

Midwest

Machinery

output

is

up

10.4%

YoY

5

•

Midwest

Economy

Index

at

the

highest

level

since

March

1995

6

WI

MN

IL

U.S.

Unemployment

Rate

4

6.8%

5.8%

8.8%

8.1%

ASBC Deposits ($ in billions)

$10.7

$1.4

$3.6

$15.7

¹

Based

on

2010

number

of

funded

mortgage

loans

per

HMDA

data;

²

Based

on

2011

FY

number

of

funded

SBA loans;

3

FDIC

market

share

data

6/30/11;

4

Source:

U.S.

BLS,

Mar.

2012,

April

2012

(US);

5

Source:

FRB

Chicago Midwest

Manufacturing Index, Mar. 2012;

6

Source: FRB Midwest Economy Index, Mar. 2012 |

Core

Organic Loan Growth 3

Total Loans of $14.3 billion at March 31, 2012

Quarterly Net Loan Growth Trend

Total Loans ($ in billions)

+2% QoQ

Peak Loans (4Q 2008) $16.3 billion

Loan

Mix

–

1Q

2012

<1% QoQ

($ in millions)

$12.6

$12.7

$13.1

$13.5

$14.0

$14.3

$10.5

$11.5

$12.5

$13.5

$14.5

$15.5

$16.5

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

CRE Investor

19%

Construction

4%

Commercial

& Business

Lending

34%

Res Mtg

22%

Home Equity

17%

Consumer

4%

$244

$39

$434

$414

$528

$223

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012 |

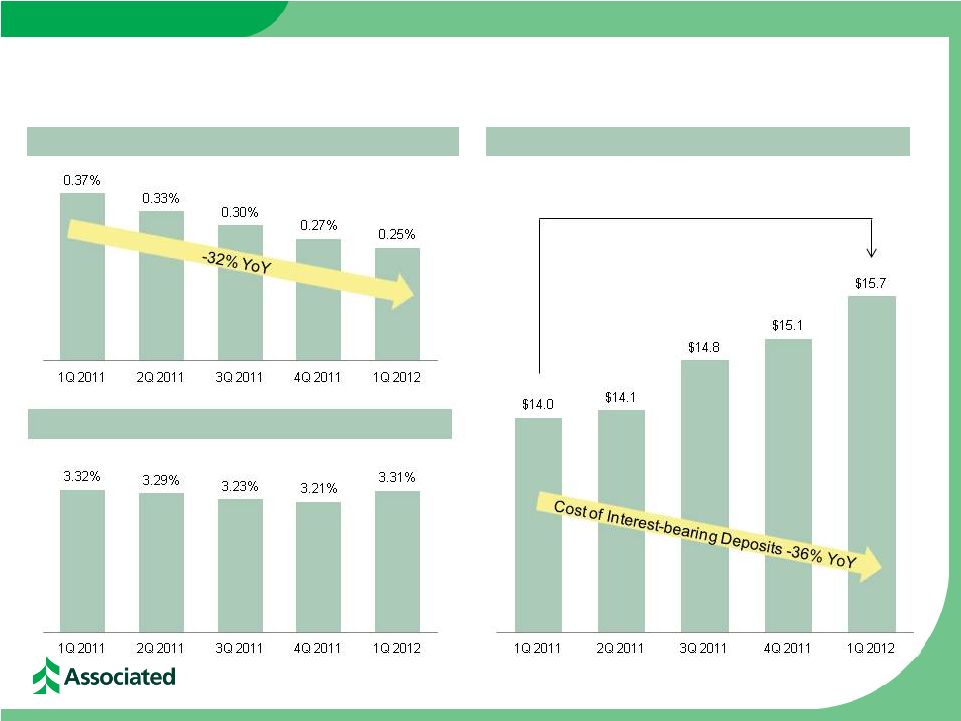

Disciplined Deposit Pricing and Stable Margins

4

Cost of Money Market Deposits

$6.2b

$5.0b

$5.0b

$5.2b

Total Deposits

($ balances in billions)

$5.2b

Total Deposits of $15.7 billion at March 31, 2012

+ 12% YoY

0.43%

0.67%

0.63%

0.56%

0.53%

Net Interest Margin |

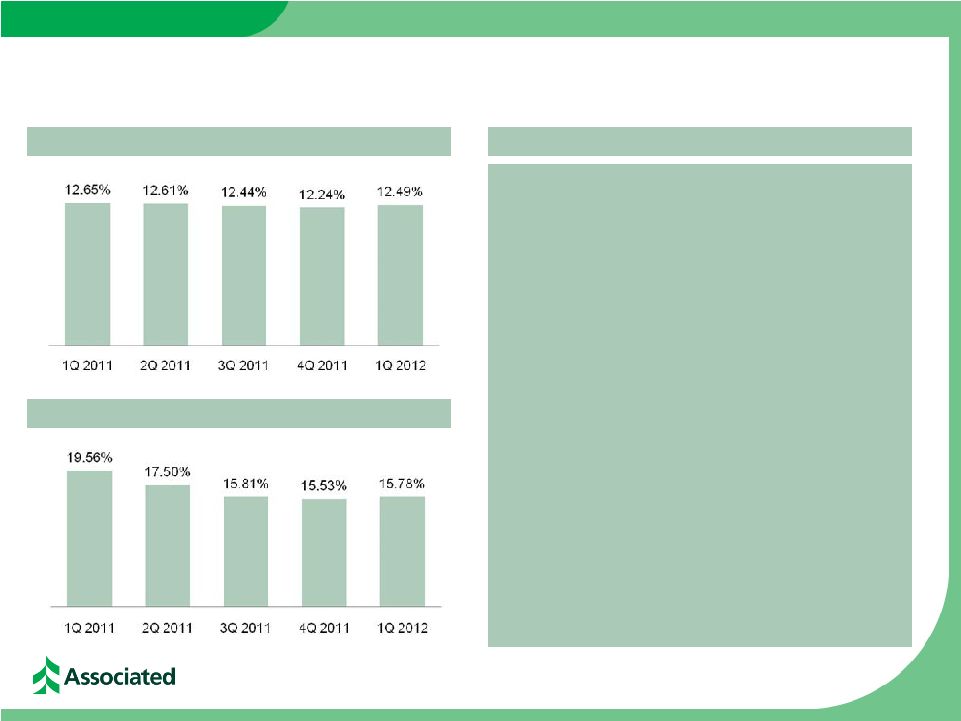

Strong Capital Profile

•

Funding organic growth

–

Re-mixing securities run-off

into loans

increases risk-weighted assets

–

Sufficient capital to fund contemplated

organic growth

•

Paying a competitive dividend

–

Increased quarterly dividend to $.05/share

•

M&A opportunities

–

Disciplined; in-market consolidation focus

•

Buy-backs of common stock & redemption of

other capital instruments

–

Announced $30 million common buy-back

& $25 million partial redemption of TOPrS

5

Tier 1 Common Equity Ratio

Total Risk-Based Capital Ratio

Capital Priorities |

Creating Shareholder Value

6

Loan Growth

•

Approximately 3% quarterly

growth

Deposit Growth

Fee Income

Expenses

NIM

Positioned for Growth; Full-Year 2012 Outlook

Footprint

Credit

Capital

•

Continued run-off of high cost

CDs & disciplined deposit pricing

•

Sustained focus on treasury

management solutions to drive

growth in commercial deposits

•

Relatively stable on a full-year

basis compared to FY 2011

•

Modest improvement YoY;

reduced mortgage banking

income going forward

•

Low single-digit YoY growth;

including the cost of BSA

enhancements & savings from

branch consolidations

•

Net consolidation in branch

network while remodeling and

renovations continue

•

Continuing to invest in growth

markets

•

Continuing improvement in

credit trends

•

Very modest provision outlook

•

Disciplined, value-added

approach to capital

deployment over time |

Why

Associated 7

Net Income

Available to

Common

($ in millions)

Return on Tier 1

Common Equity

Reasons to Invest

Net Income & ROT1CE

Management Team Focused on Creating

Shareholder Value

$15

$26

$34

$40

$41

3.76%

6.07%

7.83%

8.96%

9.23%

0.00%

5.00%

10.00%

15.00%

$0

$15

$30

$45

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

•

Leading Midwest Bank Operating in

Attractive Markets

•

Core Organic Growth Opportunity

•

Disciplined Deposit Pricing & Stable Margin •

Improving Credit Quality

•

Strong Capital Profile & Opportunities for

Capital Deployment

•

Improving Earnings Profile

|

Associated

Banc-Corp will be the most admired Midwestern financial services company,

distinguished by sound, value-added financial solutions with personal service for our

customers, built upon a strong commitment to our colleagues and the communities we serve,

resulting in exceptional value for our shareholders. |

Appendix

9 |

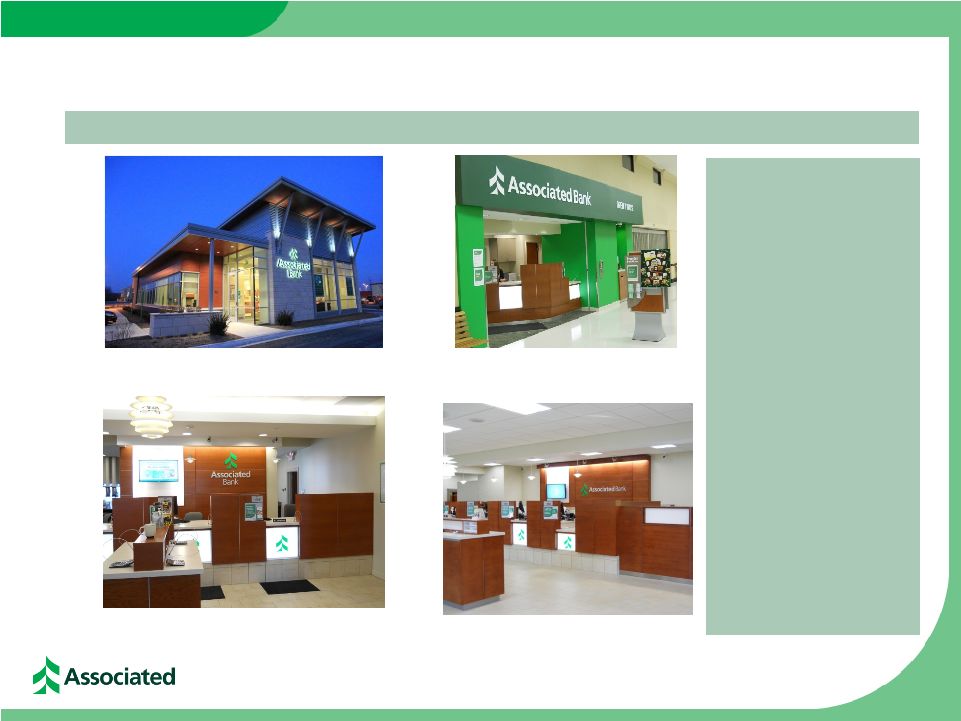

Footprint Update

10

Relocated office in Waukesha, WI

Janesville, WI Pick ‘N Save in-store remodel

Remodeled office in Muskego, WI

Remodeled office in St. Francis, WI

Differentiating Associated in Branch Banking

Highlights

•

Completed the remodel,

relocation, or new

construction of over 30

branches in 2011

•

FY 2011 PPE expense

of $77 million includes

ongoing investments in

franchise

•

Planned consolidation

of 21 branches in

1H2012

•

Announced three

additional branch sales in

Jan. 2012; these locations

are well outside of core

retail footprint

•

50 remodels planned in

2012 |

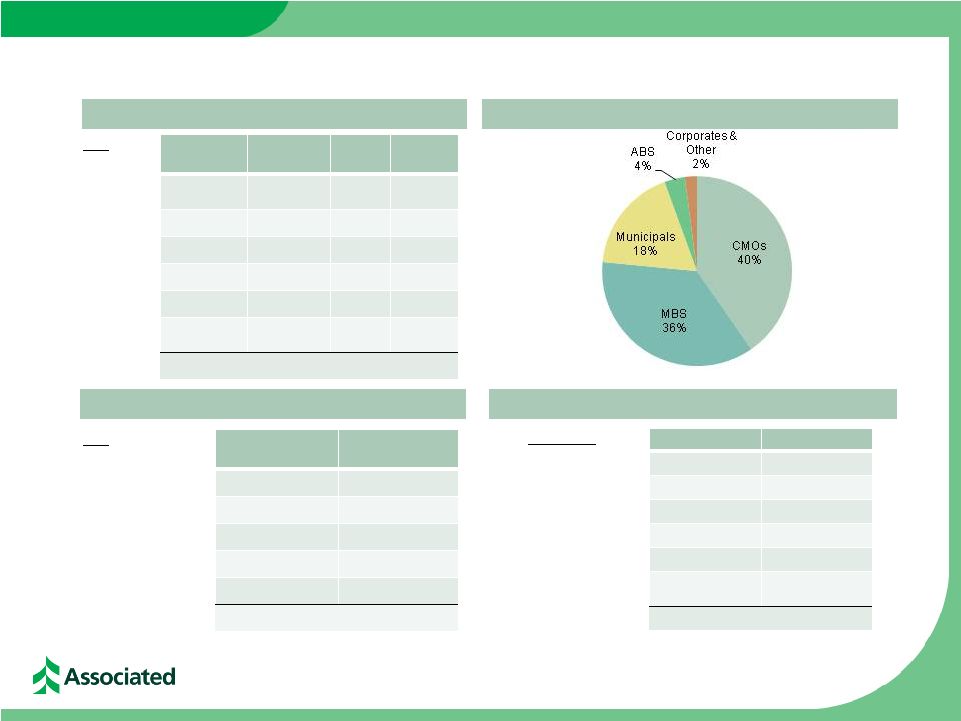

Credit Rating

Mkt Value (000’s)

% of Total

Govt & Agency

$ 3,566,112

76%

AAA

177,419

4%

AA

777,042

17%

A

104,671

2%

BAA1, BAA2 & BAA3

16,376

---

BA1 & Lower and

Non-rated

27,480

---

TOTAL

$4,669,100

100%

Market Value Composition –

March 31, 2012

Investment Portfolio –

March 31, 2012

High Quality Investment Securities Portfolio

Portfolio Composition Ratings –

March 31, 2012

Risk –

Weighted Profile –

March 31, 2012

11

Type

Mkt Value

(000’s)

% of Total

0% RWA

$ 32,241

1%

20% RWA

4,337,291

93%

50% RWA

40,116

1%

=>100% RWA

96,462

2%

Not subject to RW

162,990

3%

TOTAL

$4,669,100

100%

Type

Bk Value

(000’s)

Mkt Value

(000’s)

TEY

(%)

Duration

(Yrs)

Govt &

Agencies

$ 1,012

$ 1,008

0.34

2.35

MBS

1,604,801

1,690,263

4.12

2.35

CMOs

1,853,347

1,883,470

2.75

1.31

Municipals

792,854

835,664

5.60

4.59

ABS

163,466

163,014

0.75

0.19

Corporates &

Other

93,490

95,681

1.85

1.52

TOTAL AFS

$4,508,970

$4,669,100

3.65

2.24 |

Continued Improvement in Credit Quality Indicators

12

($ in millions)

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

Potential problem loans

$ 912

$ 699

$ 660

$ 566

$ 480

Nonaccruals

$ 488

$ 468

$ 403

$ 357

$ 327

Provision for loan losses

$ 31

$ 16

$ 4

$ 1

$ 0

Net charge offs

$ 53

$ 45

$ 30

$ 23

$ 22

ALLL/Total loans

3.59%

3.25%

2.96%

2.70%

2.50%

ALLL/Nonaccruals

93.07%

91.09%

99.09%

105.99%

108.93%

NPA/Assets

2.50%

2.33%

2.03%

1.82%

1.65%

Nonaccruals/Loans

3.86%

3.57%

2.99%

2.54%

2.29%

NCOs / Avg Loans

1.71%

1.37%

0.90%

0.64%

0.61% |

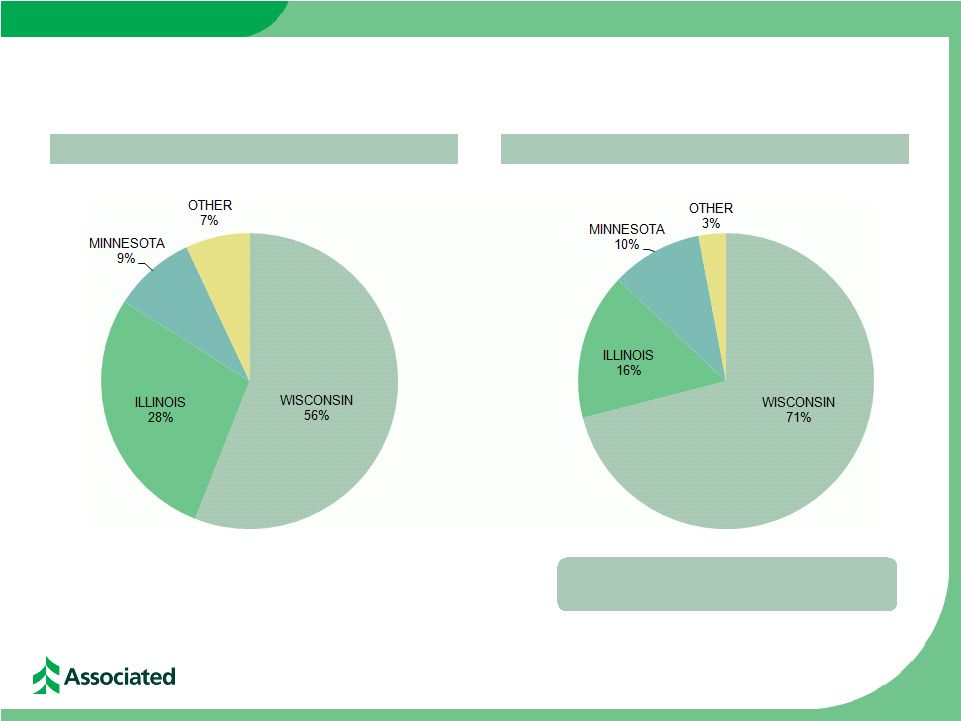

Consumer Loan Portfolios by Geography

13

(as of March 31, 2012)

Residential Mortgage Loans by State

Home Equity Loans by State

Approximately half of home equity

portfolio is in first-lien position |

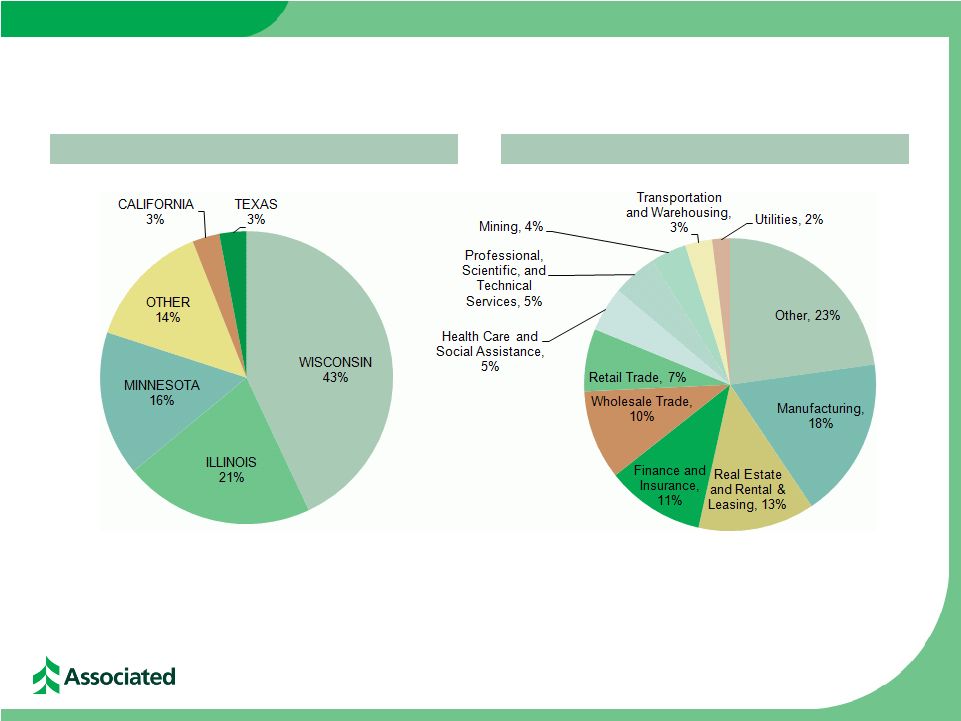

14

Commercial & Business Lending Loans

Commercial & Business Lending portfolio of $4.9 billion, or 34% of Total Loans,

at March 31, 2012 Commercial & Business Lending Loans by State

Commercial & Business Lending Loans by Industry |

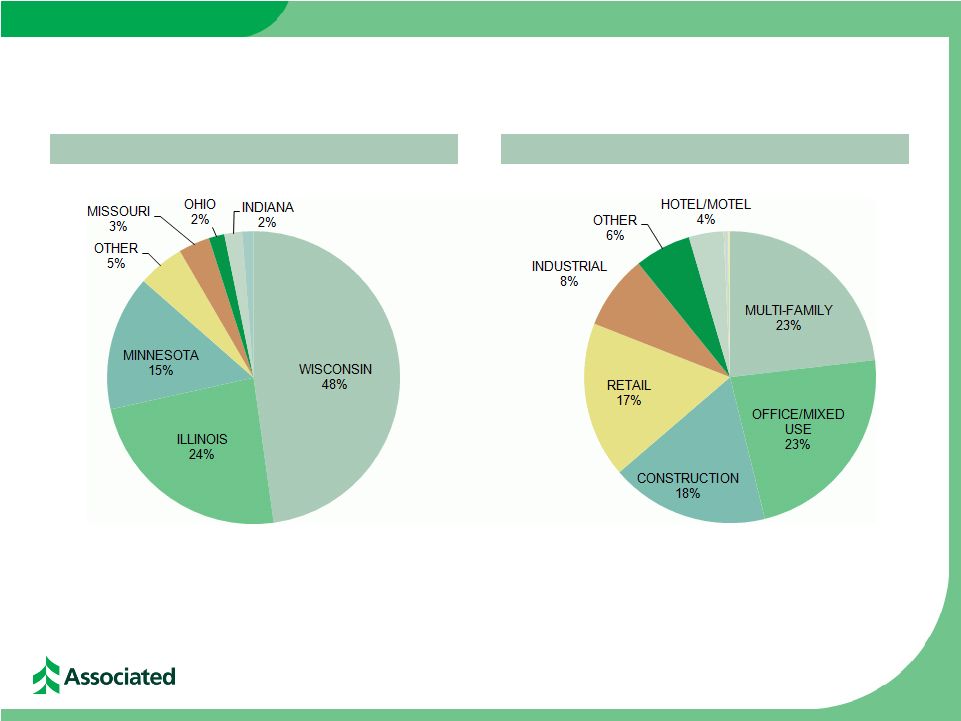

15

Commercial Real Estate Lending Loans

Commercial

Real

Estate

Lending

portfolio

of

$3.2

billion,

or

23%

of

Total

Loans,

at

March

31,

2012

Commercial Real Estate Lending Loans by State

Commercial Real Estate Lending Loans by Collateral |