Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MATERION Corp | d342336d8k.htm |

| EX-99.1 - EX-99.1 - MATERION Corp | d342336dex991.htm |

2012 Annual Meeting of Shareholders

May 2, 2012

Materion Corporation

Exhibit 99.2 |

|

Forward-Looking Statements

These slides contain (and the accompanying oral discussion will contain)

“forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements involve known and unknown risks, uncertainties and other factors

that could cause the actual results of the Company to differ materially from

the results expressed or implied by these statements, including health

issues, litigation and regulation relating to our business, our ability to

achieve and/or maintain profitability, significant cyclical fluctuations in

our customers’ businesses, competitive substitutes for

our products, risks associated with our international operations, including foreign

currency rate fluctuations, energy costs and the availability and prices of

raw materials, the timing and ability to achieve further efficiencies and

synergies resulting from our name change and product line alignment under

the Materion name and brand, and other factors disclosed in periodic reports

filed with the Securities and Exchange Commission. Consequently these

forward-looking statements should be regarded as the Company’s

current plans, estimates and beliefs.

The Company does not undertake and specifically declines any obligation to publicly

release the results of any revisions to these forward-looking statements

that may be made to reflect any future events or circumstances after the

date of such statements or to reflect the occurrence of anticipated or

unanticipated events. 3 |

2012 Annual Meeting of Shareholders

May 2, 2012

Materion Corporation |

2011 Began In a

Solid Market Environment •

New highs in sales and earnings levels

•

Annualized earnings were above $2.00 per share for six

straight quarters

•

Continued healthy, broad-based end market demand

G-5

–

Consumer Electronics

–

Automotive Electronics

–

Telecom Infrastructure

–

Industrial & Aerospace

–

Energy

–

Medical

–

Optical Coatings |

In A Strong

Position To Leverage End Market Growth •

Scale larger

•

Markets diverse

•

Growth greater

•

Balance sheet strong

•

Higher profit levels, more sustainable

G-6 |

A Solid 2011

First Half •

First half sales up 29%

•

Organic growth of 11%

•

Net income up 26%

•

Margins expanding

G-7 |

A Dramatically

Different Second Half •

Demand dropped in consumer electronics

•

Widespread inventory adjustments

•

Other markets also weaker

•

Led to a disappointing fourth quarter

•

Business levels down 17%

•

Growth in Energy, Medical and Automotive

G-8 |

First Time To

Cross $1.5 Billion In Revenues •

Sales climbed 17% to $1.5 billion

•

Metal price pass-through accounted for the

majority

•

Organic was 2%, after 11% in the first half

•

Growth for the year in:

G-9

–

Telecom Infrastructure

–

Commercial Aerospace

–

Heavy Equipment

–

Energy

–

Medical

–

Automotive |

Profits, While

Not What We Expected, Were Solid •

Net income …

$40.0 million

•

EPS …

$1.93 per share

•

Included costs of three strategic initiatives

G-10

–

Rebranding

–

Beryllium Plant

–

Acquisition of EIS Optics |

A Strong Balance

Sheet and Added Financial Flexibility •

Invested $24 million in EIS Optics

•

Cumulative investment, more than $200 million, over 6

years

•

Debt-to-debt-plus-equity at 17%

•

Revolver and metal line expansions

•

On going positive cash generation

•

Flexibility to invest

G-11 |

Today, We Are

Initiating a Dividend •

Dividend is another milestone

•

Recognizing confidence in

•

Yield of 1.2%, is meaningful

G-12

–

Growth prospects

–

Convert growth to Earnings

–

Conversion of profit growth to cash

–

Fund organic growth and acquisitions

–

Return cash to shareholders |

First Quarter

2012 Off to a Better Start •

Business levels improving

•

Earnings improving

•

An increase of $19.3 million

•

Up 6% sequentially to $354.0 million

•

Demand improving, especially in consumer electronics

•

Expect stronger quarters going forward

G-13 |

First Quarter

Profits Improving •

Net income was $.30 per share

•

Compares to $.57 per share in 2011

•

And, to $.04 per share in Q-4, 2011

•

Included $.07 per share of costs

•

Business levels and mix changes

G-14

–

Hurt comparisons to Q-1, 2011

–

Helped comparisons to Q-4, 2011 |

Order Entry

Improving G-15

•

First Quarter orders up 12%

•

Yet, below what was initially anticipated

•

Still below early 2011 record levels

•

Markets unclear, mixed

•

Expect sequentially stronger quarters

•

Earnings range is $1.95 to $2.10 per share

•

Includes initiative costs

•

Should return to higher profit levels |

In Summary,

•

2011 ending, 2012 beginning in a weak market

environment

•

Markets now improving

•

Growth prospects are good

•

Cash flow is solid

•

Balance Sheet is strong

•

Balance of 2012 sequentially better

G-16 |

2012 Annual Meeting of Shareholders

May 2, 2012

Materion Corporation |

MATERION TODAY:

New Name, Same Strong Performance

18

12%*

CAGR

Sales

growth

(2005 –

2011)

19%

CAGR

Operating profit

growth

(2005 –

2011)

Successful

Repositioning

of company

* Excludes pass-through metal |

Successful Repositioning –

Snapshot

19

2002

2011

Revenues

$373M

$1.5B

Revenue % in

Advanced Materials

47%

76%

Sales per employee

(thousands)

$200

$506

Debt-to-Debt-Plus-Equity

43%

17%

Working capital *

% of sales

41%

23%

Cyclicality

High

Lower

Growth

Low

Higher

* A/R, Inventory & A/P |

THESIS

Positioned to Deliver Sustainable Long-Term Growth

20

A company

with a strong

platform…

…

Leveraging a

high value-added

business

model…

…

Executing

a focused

growth plan |

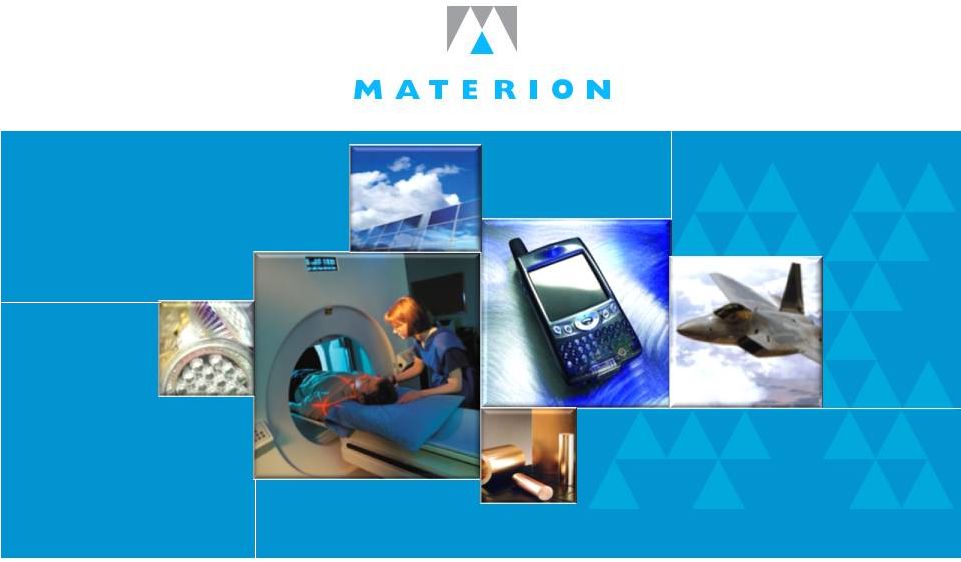

Positioned in Diverse Set of High-Growth Markets

21

Growth

Entered multiple leading-edge growth markets since 2002

Defense

Commercial Aerospace

Medical

Devices

Disk Drives

Optics

Telecom

Infrastructure

LED’s

Alternative

Energy

LCD

Space /

Science

Notebooks

Cellular phones

(smartphones),

Tablet computers

Heavy

Equipment

21 |

Operating from a Global Platform

Operations in US and

11 Other Countries

Significant International Sales*

Q-1 2012

38%

22

•

Customers in 50+ countries

•

Expanded presence in Asia

* Percentage of value added sales |

A

Unified Collaborative Organization •

Leveraging the power of Materion across technology,

production, procurement, materials and markets

•

Cross-unit teams established for the wireless, LED and

solar photovoltaic markets, with others to follow in 2013

•

Businesses are taking advantage of specialized expertise

and production capacity at other Materion locations

23 |

THESIS

Positioned to Deliver Sustainable Long-Term Growth

24

A company

with a strong

platform…

…

Leveraging a

high value-added

business

model…

…

Executing

a focused

growth plan |

High Value-Added Business Model

25

1.

Identify high growth

secular markets

2.

Target the fastest-growing

niches of those markets

3.

Expand with

innovative

products

4.

Add synergistic

acquisitions

5.

Ensure

financial

discipline |

1.

Identify High Growth Secular Markets 26

Market

Q1 2012

% of Value-

added Sales

2012

Trends

Key Drivers

Consumer Electronics

21%

•

Smartphone growth

•

Tablet computers & LEDs

•

Miniaturization

Industrial Components &

Commercial Aerospace

20%

•

New airplane builds & retrofits

•

Increasing air travel

•

Heavy equipment builds

Defense & Science

14%

•

DoD & foreign military budgets

•

Demand for communications satellites

•

High performance optical devices

Automotive Electronics

9%

•

Increasing global car production

•

HEV/EV lithium ion battery components

•

Engine control & electronic systems

Energy

8%

•

Directional drilling

•

Rig counts

•

Solar, batteries & smart grid devices

Medical

7%

•

Glucose testing

•

Blood analysis test coating for medical diagnosis

•

Diagnostics equipment

Telecommunications

Infrastructure

6%

•

Global 3G/4G builds

•

Base stations

•

Undersea fiber-optics expansion |

Unique Global Positions

•

Only Fully Integrated Producer of Beryllium and

Beryllium Alloys

–

Over 75 years of reserves at Utah

27

Leading Global

Position

•

Unique Copper-Nickel-Tin Material ToughMet®

–

multiple advanced applications growing at over 30%

annually

•

Precision Optical Coatings –

Visible to Infrared

Bandwith

–

“Go To”

Supplier for defense, thermal imaging, space

and medical applications

•

High Purity Gold products for Semiconductor

Fabrication (Wireless & LED)

–

Offering

“full

metal

management”

capabilities

•

Blood Analysis Test Coatings for Medical Diagnosis

27 |

Continually Develop Innovative Products

•

Customer-centric product development

•

Active research programs

•

New product areas include

–

LEDs

–

Medical

–

Commercial Optics

–

Computer Hard Drives

–

Alternative Energy

–

Science

–

Commercial Aerospace

–

Hybrid & Electric Vehicles

–

Wireless

28 |

A

Strong Record of Synergistic Acquisitions Add complementary

products / technology

Expand market

position

Accretive in

year 1

OMC –

shield kit cleaning

TFT –

thin film coatings

CERAC –

inorganic chemicals

Techni-Met –

thin film coatings

Barr –

thin film coatings

Academy –

precious metals

EIS Optics –

thin film coatings

TBD

AMC –

metal matrix composites

TBD

29

Added over $440M to sales and approximately 30% of company profit in 2011

Acquisitions 2005-2012 –

Impact |

Ensure Financial Discipline

30

Maintain strong

balance sheet

Debt-to-Debt-Plus-Equity

Maximum 30%

Strong

cash flow

•

Cash flow from operations

$30M -

$75M annually for

the past five years

•

Capex below depreciation

•

Reduction in working

capital goal to <20% sales

Resources to

finance

acquisitions of

$50M to $100M

annually

After $228M in acquisitions

21%

17%

12%

0%

10%

20%

30%

2005

2011

2012(F) |

THESIS

Positioned to Deliver Sustainable Long-Term Growth

31

A company

with a strong

platform…

…

Leveraging a

high value-added

business

model…

…

Executing

a focused

growth plan

1

2

3 |

Continuing to Execute Three-Point Strategy

32

1

Grow and diversify the revenue base

2

Expand margins

3

Improve fixed and working capital

utilization

Increasing Shareholder Value |

Financial Goals Next 3-5 Years

Past 3-5 Years

Next 3-5 years

Revenue growth –

organic

12%

>10%

Acquisitions

$35M -

$40M

Per year

$50 -

$100M

Per Year

Margins (OP % VA)

10% -

14%

14% -

18%

Working capital % sales

23% -

25%

<20%

Debt-to-Debt-Plus-Equity

16% -

18%

<30%

ROIC (pre-tax)

9% -

12%

>20%

33 |

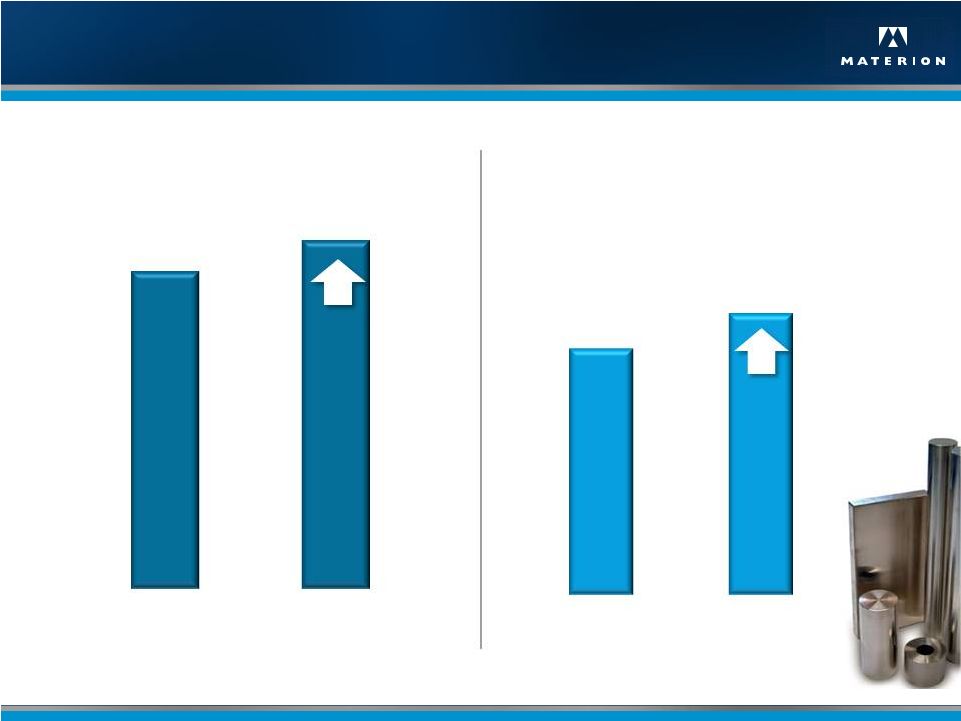

2012 Outlook and Guidance

Revenues

(Billions)

EPS

34

$1.5-$1.6

$1.95-$2.10

$1.93

2011

2012 (F)

$

1.5

2011

2012 (F) |

IN

SUMMARY Why Invest in Materion Corporation

35

Positioning

A leader in high-growth markets

Performance

Strong performance record

Growth

Executing three point strategy

•

Global player, strong secular market drivers

•

Sustainable long-term growth

•

Proven business model

•

Target, capture niche, then expand

•

Clear financial goals, performance

continuing to improve |

Questions |