Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Andatee China Marine Fuel Services Corp | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Andatee China Marine Fuel Services Corp | v309169_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Andatee China Marine Fuel Services Corp | v309169_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Andatee China Marine Fuel Services Corp | v309169_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Andatee China Marine Fuel Services Corp | v309169_ex32-2.htm |

| EX-23.2 - EXHIBIT 23.2 - Andatee China Marine Fuel Services Corp | v309169_ex23-2.htm |

| EX-21.1 - EXHIBIT 21.1 - Andatee China Marine Fuel Services Corp | v309169_ex21-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Andatee China Marine Fuel Services Corp | v309169_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ___ to ____

Commission File Number 001-34608

Andatee China Marine Fuel Services Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 80-0445030 | |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(IRS Employer Identification No.) |

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s Telephone Number, Including Area Code)

No. 1518 A-Building 504, Minsheng Road, Shanghai City

People’s Republic of China

(8621) 50152590

Securities registered under Section 12(b) of the Exchange Act:

Common Stock, par value $0.001

Name of each exchange on which registered:

The Nasdaq Global Market LLC

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-accelerated Filer ¨ Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ NO x

As of the close of business on June 30, 2011, the aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant was approximately $11.08 million based on the closing sale price of the Common stock on the Nasdaq Global Market on that date. The registrant does not have any non-voting common equity.

The Company had 9,610,159 shares of common stock issued and 9,518,967 outstanding as of March 15, 2012.

Documents Incorporated by Reference

None.

| 1 |

Table of Contents

| Part I | 3 | ||

| ITEM 1. | Business | 5 | |

| ITEM 1A. | Risk Factors | 15 | |

| ITEM 1b. | Unresolved Staff Comments | 26 | |

| ITEM 2. | Properties | 26 | |

| ITEM 3. | Legal Proceedings | 27 | |

| ITEM 4. | Mine Safety Disclosures | 28 | |

| Part II | 29 | ||

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 29 | |

| ITEM 6. | Selected Financial Data | 30 | |

| ITEM 7. | Discussion and Analysis of Financial Condition and Results of Operations | 30 | |

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 42 | |

| ITEM 8. | Financial Statements and Supplementary Data | 43 | |

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 46 | |

| ITEM 9A. | Controls and Procedures | 46 | |

| ITEM 9B. | Other Information | 46 | |

| Part III | 47 | ||

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 47 | |

| ITEM 11. | Executive Compensation | 52 | |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 53 | |

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 57 | |

| ITEM 14. | Principal Accounting Fees and Services | 58 | |

| Part IV | 60 | ||

| ITEM 15. | Exhibits and Financial Statement Schedules | 60 |

| 2 |

Part I

Cautionary Note Regarding Forward Looking Statements

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as information relating to Andatee China Marine Fuel Services Corporation that is based on management’s exercise of business judgment and assumptions made by and information currently available to management. Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. When used in this document and other documents, releases and reports released by us, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “the facts suggest” and words of similar import, are intended to identify any forward-looking statements. You should not place undue reliance on these forward-looking statements. These statements reflect our current view of future events and are subject to certain risks and uncertainties as noted below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. Actual events, transactions and results may materially differ from the anticipated events, transactions or results described in such statements. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward looking statements including those set forth in Item 1A of this report. Other unknown, unidentified or unpredictable factors could materially and adversely impact our future results. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to our forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events.

We file reports with the Securities and Exchange Commission (“SEC” or “Commission”). We make available on our website (http://www.andatee.com) free of charge our public reports filed pursuant to the Exchange Act and amendments to those reports as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. Information appearing at our website is not a part of this Annual Report on Form 10-K. You can also read and copy any materials we file with the Commission at its Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. In addition, the Commission maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission, including our reports.

Our fiscal year begins on January 1, and ends on December 31, and any references herein to “Fiscal 2011” mean the year ended December 31, 2011, and references to other “Fiscal” years mean the year ending December 31, of the year indicated.

We obtained statistical data, market data and other industry data and forecasts used in this Form 10-K from publicly available information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of that information.

Except where the context otherwise requires and for purposes of this Annual Report:

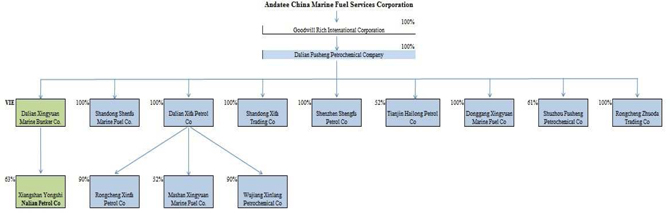

| · | the terms “we,” “us,” “our company,” “our” refer to Andatee China Marine Fuel Services Corporation, a Delaware corporation, its subsidiaries Goodwill Rich International Limited and Dalian Fusheng Consulting Co. Ltd., its subsidiaries, Donggang Xingyuan Marine Bunker Company Ltd., Rongcheng Xinfa Petrol Company Ltd., Rongcheng Mashan Xingyuan Marine Bunker Co. Ltd., Rongcheng Zhuoda Trading Co. Ltd, Suzhou Fusheng Petrol Co. Ltd., Wujiang Xinlang Petrol Co. Ltd, and its previous variable interest entity (VIE), Dalian Xingyuan Marine Bunker Co. Ltd., through which entity we conducted all of our business operations and since we have transferred most of them under the direct control of Dalian Fusheng Petrol Co. Ltd. , and only one subsidiary of the VIE, which is Xiangshan Yongshinanlian Petrol Company Ltd.; |

| · | the term “Andatee” refers to Andatee China Marine Fuel Services Corporation, the parent company; |

| · | the term Goodwill’’ refers to Goodwill Rich International Limited, a subsidiary of Andatee, which for financial reporting purposes is the predecessor to Andatee; and |

| · | “China” and “PRC” refer to the People’s Republic of China, and for the purpose of this Annual Report only, excluding Taiwan, Hong Kong and Macau. |

The standard barrel of 42 US gallons is used in the United States as a measure of crude oil, and the producers of other petroleum products as reported on the US commodities or stock exchanges tend to convert their production volumes into barrels for global reporting purposes. Elsewhere in the world, oil is commonly measured in liters or cubic meters (1,000 liters equals one cubic meter, and 159 liters equals one US 42 gallon barrel) or in tons (the latter customarily used by European oil companies). The fuel oils produced by the company, however, are qualitatively different products from crude oil. In its essence, they are types of heavy oil, with densities ranging from 0.82 to 0.95, thus, making it impracticable to use US barrels for measuring and reporting purposes. In addition, all of the company supply, vendor and client contracts are executed in tons, not in barrels.

| 3 |

The conversion chart below illustrates the conversions between barrels or liters and tons, as applied to our product line:

| Product# | Temperature | Density | Liters/Ton | Barrels/Ton | ||||

| 1# | 20°C | 0.844 | 1,184 | 7.45 | ||||

| 2# | 20°C | 0.850 | 1,176 | 7.40 | ||||

| 3# | 20°C | 0.895 | 1,117 | 7.03 | ||||

| 4# | 20°C | 0.947 | 1,056 | 6.64 | ||||

| 120CST | 20°C | 0.988 | 1,012 | 6.36 | ||||

| 180CST | 20°C | 0.988 | 1,012 | 6.36 |

This Annual Report contains translations of certain Renminbi, or RMB, the legal currency of China, amounts into U.S. dollars at the rate of RMB6.3009 to $1.00, the noon buying rate in effect on December 31, 2011 in New York City for cable transfers of Renminbi as certified for customs purposes by the Federal Reserve Bank of New York. We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or can be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On March 18, 2012, the noon buying rate was approximately RMB6.5668 to $1.00.

Unless the context indicates otherwise, all share and per share data in this report give effect to a 1-for-1.333334 reverse share split that became effective on October 19, 2009.

ITEM 1. Business

Overview of our Company

We carry out all of our business through our Hong Kong subsidiary, Goodwill Rich, its wholly-owned Chinese subsidiary, Fusheng, and Fusheng’s directly controlled subsidiaries, previous were Dalian Xingyuan’s subsidiaries and Fusheng’s variable interest entity (VIE), Dalian Xingyuan, and Dalian Xingyuan’s subsidiaries (Dalian Xingyuan and its subsidiaries being collectively referred to as the VIE entities). Through both directly controlled subsidiaries and VIE entities, we are engaged in the production, storage, distribution and wholesale purchases and sales of blended marine fuel oil for cargo and fishing vessels with operations mainly in Liaoning, Shandong, Jiangsu and Zhejiang Provinces in People’s Republic of China (PRC). We compete by providing our customers value added benefits, including single-supplier convenience, competitive pricing, logistical support and fuel quality control.

Our sales of marine oil for fishing boats represented approximately 75% of our total revenue for the period of 2011 as compared with the sale of marine oil for cargo vessels which represented the remaining 25% of our total revenue for the same periods. Currently, we sell approximately 53.06% of our products through distributors and approximately 46.94% to retail customers. Our products are substitutes for diesel used throughout east China fishing industry by small to medium sized cargo vessels. Our core facilities include as storage tanks, berths (the space allotted to a vessel at the wharf), marine fuel pumps, blending facilities and tankers. Our sales network covers major depots along the towns of Dandong, Shidao and Shipu, Suzhou along the east coast of China.

Our operations in China are conducted through our Wholly-Owned Foreign Enterprise ("WOFE"), Dalian Fusheng Petrochemical Company and its subsidiaries: Hailong Petrochemical Co., Limited(established in Tianjin City, on April 23, 2001), Donggang Xingyuan Marine Bunker Company, Ltd. (located in Dandong City, Liaoning Province, and established in April 2008 under the laws of the PRC), Rongcheng Xinfa Petrol Company, Ltd. (located in Rongcheng City, Shandong Province, and established in September 2007 under the laws of the PRC), and Rongcheng Mashan Marine Bunker Company(established in Rongcheng City, Shandong province, on March 12, 2010), Rongcheng Zhuoda Trading Co. acquired in Dec, 31, 2011 (located in Rongcheng city, Shandong Province, and established in Sep, 18, 2009 ), Suzhou Fusheng Petrochemical Company, acquired in Dec, 21, 2011 ( located in Suzhou city, Jiangsu Province and established in June, 8, 2011) and Wujiang Xinlang Petrochemical Company, acquired in Dec, 7, 2011( located in Wujiang city, Jiangsu Province and established in Apr 28, 1998) and our VIE, Dalian Xingyuan Marine Bunker Company, Ltd and its subsidiary:, Xiangshan Yongshi Nanlian Petrol Company, Ltd. (located in Xiangshan City, Zhejiang Province, and established in May 1997 under the laws of the PRC) .

Our marine fuel for cargo vessels is classified as CST180 and CST120; our marine fuel for fishing boats/vessels, #1 fuel (for engines with 2,000 rpm capacity), #2 fuel (for engines with 1,800 rpm capacity), #3 fuel (for engines with 1,600 rpm capacity) and #4 fuel (for engines with 1,400 rpm capacity). We also produce blended marine fuel according to customer specifications using our proprietary blending technology. Our own blend of Marine Diesel Oil, #3 fuel and #4 fuel are substitutes for the traditional diesel oil, commonly known as #0 diesel oil, used by most small to medium vessels. We generate virtually all of our revenues from our own brands of blended oil products.

| 4 |

Andatee China Marine Fuel Services Corporation is a Delaware corporation. Our executive offices are located in Shanghai City, a key international shipping hub and international logistics center in China. Our main offices are located in Shanghai City, No. 1518 A-Building 504# Minsheng Road, Our telephone and fax numbers are (8621) 50152590 and (8621) 50152530 respectively. Our website address is http://www.andatee.com. The information on our website is not part of this Annual Report.

Proposed Tender Offer and Subsequent Litigation Matters

On November 23, 2011, the Company announced that it had received notice from An Fengbin, Andatee’s majority shareholder and Chief Executive Officer, of his intention to launch a tender offer to acquire all of the outstanding shares of Andatee that he or his affiliates did not own at the time. Specifically, An Fengbin proposed to negotiate the acquisition of all such outstanding shares at a price of $4.21 per share in cash, subject to financing, the completion of due diligence, the negotiation of a definitive merger agreement with Andatee, and other customary conditions (the “Proposed Transaction”). The Company also announced the establishment of the Special Committee of the Board of Directors of the Company, consisting solely of independent directors, Francis N.S. Leong and Wen Jiang, to consider the terms of the Proposed Transaction. The Special Committee has retained Morris James LLP as its legal counsel. In addition, on March 21, 2012, the Special Committee also announced the engagement of Duff & Phelps, LLC as its independent financial advisor to assist the Special Committee in evaluating the foregoing proposal from Mr. An. As of the date of this filing, the proposed offer for the outstanding shares of Andatee has not yet commenced.

As discussed in detail under Item 3. Legal Proceedings in this Annual Report, during the period of November-December 2011, the Company and certain of its officers and directors have been named as defendants in several shareholder lawsuits filed in the Court of Chancery of the State of Delaware in connection with the Proposed Transaction. These litigation matters are in the early stages of their respective proceedings and the Company is yet to respond to the complaints.

Organizational Structure and Corporate History

Our WOFE, Dalian Fusheng Petrochemical Company, its subsidiaries: Hailong Petrochemical Co., Limited (established in Tianjin City, on April 23, 2001), Donggang Xingyuan Marine Bunker Company, Ltd. (located in Dandong City, Liaoning Province, and established in April 2008 under the laws of the PRC), Rongcheng Xinfa Petrol Company, Ltd. (located in Rongcheng City, Shandong Province, and established in September 2007 under the laws of the PRC), and Rongcheng Mashan Marine Bunker Company(established in Rongcheng City, Shandong province, on March 12, 2010), Rongcheng Zhuoda Trading Co. acquired in Dec, 31, 2011 (located in Rongcheng city, Shandong Province, and established in Sep, 18, 2009 ), Suzhou Fusheng Petrochemical Company, acquired in Dec, 21, 2011 ( located in Suzhou city, Jiangsu Province and established in June, 8, 2011) and Wujiang Xinlang Petrochemical Company, acquired in Dec, 7, 2011( located in Wujiang city, Jiangsu Province and established in Apr 28, 1998); Our VIE operating entity, Dalian Xingyuan, has one subsidiary: Donggang Xingyuan Marine Bunker Company Ltd. (located in Dandong City, Liaoning Province, and established in April 2008 under the laws of the PRC), Xiangshan Yongshinanlian Petrol Company Ltd. (located in Xiangshan City, Zhejiang Province, and established in May 1997 under the laws of the PRC), Dalian Xingyuan and its one subsidiary are collectively referred to as the ‘‘VIE’’. Dalian Xingyuan was established in September 2001 with a registered capital of RMB7 million and began providing refueling services to the marine vessels in Dalian Port in Dalian City. The Board of Directors of Dalian Xingyuan consists of 3 members, including An Fengbin, Wang Yu and Liu Shaoyuan. Mr. An is Chairman of the Board and General Manager of Dalian Xingyuan. Upon the October 28, 2008 incorporation of Goodwill, Goodwill and the shareholders of Dalian Xingyuan had entered into a series of separate agreements under which Goodwill and Dalian Xingyuan were deemed, until March 2009, to be under the common control of the shareholders of Dalian Xingyuan. The reason that we registered our VIE’s subsidiaries under the control of our WOFE was that we think it will be more appropriate all of our operating facilities are wholly controlled by our WOFE instead of VIE (control through contracts).

Prior to our corporate reorganization in 2011, we conducted all of our business operations through Dalian Xingyuan, our operating entity, wihch was established in September 2001 with a registered capital of RMB7 million and began providing refueling services to the marine vessels in Dalian Port in Dalian City. We do not own any equity interests in Dalian Xingyuan. Our relationships with Dalian Xingyuan and its shareholders are governed by a series of contractual arrangements Dalian Xingyuan has with our wholly-owned onshore subsidiary, Dalian Fusheng Petrochemical Company (“Fusheng”). Under Chinese laws, each of Fusheng and Dalian Xingyuan is an independent legal entity and neither of them is exposed to liabilities incurred by the other party. Other than pursuant to the contractual arrangements between Fusheng and Dalian Xingyuan, Dalian Xingyuan does not transfer any other funds generated from its operations to Fusheng. Fusheng entered into these contractual arrangements with Dalian Xingyuan in March 2009, as discussed in detail below. Subsequently, Fusheng assigned its rights under these contractual arrangements to us. Thus, we control and receive the economic benefits of their business operations through contractual arrangements. Dalian Xingyuan holds the licenses and approvals necessary to operate its business in China. We have contractual arrangements with Dalian Xingyuan and its shareholders pursuant to which we provide technology consulting and other general business operation services to Dalian Xingyuan. Through these contractual arrangements, we also have the ability to substantially influence Dalian Xingyuan’s daily operations and financial affairs, since we are able to appoint its senior executives and approve all matters requiring shareholder approval. As a result of these contractual arrangements which enable us to control Dalian Xingyuan and to receive, through our offshore subsidiary and VIE’s, all of Dalian Xingyuan’s profits, we are considered the primary beneficiary of Dalian Xingyuan. Accordingly, we consolidate Dalian Xingyuan’s results, assets and liabilities in our financial statements, which is a typical arrangement for companies that are traded and registered in the United States that maintain operations in the PRC.

| 5 |

In 2003, Xingyuan became the sole supplier of fuel oil to China Shipping Group Co., Ltd.’s vessels in Dalian. In 2005, through our partnership with the Dalian University of Technology, Xingyuan successfully developed its own blend of marine fuel as an alternative fuel substitute which, while reducing cost by approximately 20%, maintains the same energy efficiency as major marine fuel brands. Following the success of our fuel substitutes, we established distribution centers in Shandong Shidao, Liaoning Donggang and Zhejiang Nanlian. Before October 2007, we were a joint venture company through a subsidiary of China Petroleum in Northern China, which is the largest petroleum company in the PRC. We purchased 100% of the joint venture and commenced our operations as a private company. Xingyuan also developed the blending ability for CST120 and CST180 brands of its fuel which are used for cargo vessels. On January 26, 2010, the Company completed its initial public offering of common stock and its securities commence trading on the Nasdaq Stock Market.

In December 2008, Xingyuan entered into an agreement with the shareholder of Xiangshan Nanlian, which is located in the town of Shipu, Xiangshan county, Zhejiang Province. We purchased a 63% ownership stake in Xiangshan Nanlian for a purchase price of approximately $2.2 million (RMB15.12 million). Also in late December 2008, we entered into an agreement with shareholders of Rongcheng Xinfa to acquire its 90% ownership stake in the entity for a purchase price of approximately US$1.45 million (RMB9.9 million). The purpose of these agreements was to establish and extend our distribution network in an orderly and sustained way. Subsequently, on March 26, 2009, Fusheng, Xingyuan and the shareholders of Xingyuan entered into a series of agreements, including the Consulting Services Agreement, the Operating Agreement, the Equity Pledge Agreement, the Option Agreement and the Proxy and Voting Agreement. Xingyuan entered into these agreements with Fusheng because of the PRC laws and regulations restricting the ability of offshore entities to acquire or dispose of ownership of domestic companies. These agreements ensure that the original minority shareholders of Xingyuan will regain their respective pro rata ownership upon triggering of the conditions set forth in the agreements. Under these agreements, the Company obtained the ability to direct the operations of Xingyuan and its subsidiaries and to obtain the economic benefit of their operations. Therefore, management determined that Xingyuan became a variable interest entity and the Company was determined to be the primary beneficiary of Xingyuan and its subsidiaries. Accordingly, beginning March 26, 2009, the Company has consolidated the assets, liabilities, results of operations and cash flows of Xingyuan and its subsidiaries its financial statements.

In August 2009, Andatee entered into a share exchange agreement (the “Exchange Agreement”) with all of the shareholders of Goodwill Rich International Limited, a Hong Kong company (“Goodwill”). Pursuant to the Exchange Agreement, Andatee agreed to issue 6,000,000 shares of its common stock in exchange for all of the issued and outstanding securities of Goodwill (”Share Exchange”). The Goodwill shareholders included Star Blessing Enterprise Limited (“SBE”), a company organized under the laws of the British Virgin Islands, (i) Growing Sincere Limited (“GSL”) a company organized under the laws of the British Virgin Islands, (ii) White Bright Limited (“WBL”), a company organized under the laws of the British Virgin Islands, and (iii) Shining Joy Group Limited (“SJG”) a company organized under the laws of the British Virgin Islands. Prior to the Share Exchange, SBE, GSL, WBL and SJG beneficially owned 89.04%, 4%, 3% and 3.96% of equity securities in Goodwill, respectively. The Share Exchange closed on October 16, 2009. Andatee did not issue any fractional shares in connection with the Share Exchange. Upon the closing of the Share Exchange, Andatee (i) became the 100% parent of Goodwill, and its wholly-owned subsidiary, Dalian Fusheng Consulting Co., Ltd., and (ii) assumed the operations of Goodwill and its subsidiaries. The transactions contemplated by the Exchange Agreement, as amended, were intended to be a ‘‘tax-free’’ incorporation pursuant to the provisions of Section 351 of the Internal Revenue Code of 1986, as amended. The organization of Andatee and its acquisition of Goodwill Rich did nothing more than to change the name of Goodwill Rich to Andatee, change its place of incorporation/organization, and change its capital structure from 10,000 shares outstanding to 8,000,000 shares outstanding (prior to the October 2009 reverse stock split). For financial reporting purposes, the Share Exchange will be accounted for as a recapitalization of Goodwill affected through a combination of companies (Andatee and Goodwill) under common control, which will be recorded at historical cost. As a result, Goodwill is deemed to be the predecessor of Andatee for financial reporting purposes, and the historical financial statements of Goodwill presented in this report will become the historical financial statements of Andatee (after being adjusted to retroactively reflect the effects of the recapitalization to 6,000,000 issued and outstanding common shares) at such time as Andatee issues financial statements for the period that includes October 16, 2009.

On October 16, 2009, our Board approved a reverse split in the 1-for-1.333334 ratio. Following shareholder approval of the split, we effected the split on October 19, 2009. Immediately following the reverse stock split, all outstanding shares of our common stock was exchanged for the newly issued shares of common stock on the basis of the reverse split ratio. The par value of common stock was not affected by the split. As a result of the split, the number of shares available for future issuances has increased and the number of currently outstanding shares of our common stock decreased. The purpose of the split was to recapitalize all of our outstanding shares of capital stock into shares of the same class of common stock to be sold in the January 2010 initial public offering.

In May 2010, we entered into an agreement with shareholder of Mashan Xingyuan Marine Fuel Co., Ltd ("Mashan Xingyuan"), which is located in Rongcheng City, Shandong Province, PRC. Under the terms of the agreement, we acquired 52% of Mashan Xingyuan for a cash payment of RMB 3.64 million (approximately US$ 0.54 million). Through the acquisition, Andatee gained control of Mashan Xingyuan's assets, which include three 1,000 cubic meter storage tanks, three 500 cubic meter storage tanks, equipment and facilities, as well as 3,600 square meters of land use rights, along with the assumption of RMB 0.54 million (approximately US$ 0.08 million). Mashan Xingyuan was founded in Rongcheng, Shandong province and is an important blended marine fuel retail outlet in the region.

| 6 |

In July 2010, we entered into an agreement with shareholders of Hailong Petrochemical Co., Ltd ("Hailong"), which is located in Tianjin City engaged in retail and wholesale of fuel oil and petrochemical products. Under the terms of the agreement, we acquired 52% of Hailong's equity for a cash payment of RMB 3.64 million (approximately US$ 0.54 million). We will cooperate with Hailong on business development in the local market and provide capital for Hailong's expansion which will include four 1,000 cubic meter oil storage tanks, five storage tanks for raw materials with a total volume of 1,500 cubic meters, and 300 square meter plant used for slurry oil filtration.

In December 2011, we entered into an agreement with shareholders of Wujiang Xinlang Petrochemical Company (“Xinlang”), which is a river pump station, located in Wujiang City, Jiangsu Province engaged in retail and wholesale of fuel oil for small cargo boats. Under the terms of agreement, we acquired 90% of Xinlang’s equity for a cash payment of RMB 2.36 million (approximately US$ 0.37 million).

| 7 |

In December 2011, we entered into an agreement with shareholders of Suzhou Fusheng Petrochemical Company (“ Suzhou Fusheng”), which includes several storage tanks total volume of 16.5 thousand cubic meters and a river pump station. Under the terms of the agreement, we acquired 61% of the equity for a cash payment of RMB12.2million (approximately US$1.93million). We will cooperate with Suzhou Fusheng on business development in the local market.

In December 2011, we entered into an agreement with shareholders of Rongcheng Zhuoda Trading Co.(“Zhuoda”), which owned 13,000 cubic meters tanks, which is located in Rongcheng City, Shandong Province engaged in retail and wholesale of marine fuel oil for fishing boats. Under the terms of agreement, we acquired 100% of Zhuoda equity for a cash payment of RMB13million (approximately US$ 2million).

The following diagram illustrates our corporate structure:

Industry Overview

According to Oil & Gas Journal (OGJ), China had 18.3 billion barrels of proven oil reserves as of January 2006, flat from the previous year. EIA estimates that China will produce 3.8 million barrels per day (Mmbbl/d) of oil in 2006, slightly higher than the previous year. Of this, 96% is expected to be crude oil. EIA estimates that China will consume 7.4 Mmbbl/d of oil in 2006, representing nearly a half million barrels per day increase from 2005. For 2006, EIA data forecasts that China’s increase in oil demand will represent 38% of the world total increase in demand. China’s petroleum industry has undergone major changes over the last decade. In 1998, the Chinese government reorganized most state owned oil and gas assets into two vertically integrated firms: the China National Petroleum Corporation (CNPC) and the China Petroleum and Chemical Corporation (Sinopec). Each of these companies operates a range of local subsidiaries. The other major state sector firm is the China National Offshore Oil Corporation (CNOOC), which handles offshore exploration and production and accounts for roughly 15% of China’s domestic crude oil production.

According to OGJ, China had 6.2 Mmbbl/d of crude oil refining capacity as of January 2006. Sinopec and CNPC are the two dominant players in China’s oil refining sector. The expansive sector is undergoing modernization and consolidation, with dozens of small refineries shut down in recent years and larger refineries expanding and upgrading their existing facilities. In July 2006, PetroChina completed the expansion of its Dalian refining center, raising the plant’s capacity from 210,000 bbl/d to 410,000 bbl/d, making it the largest refinery in China. China has been ranked the highest in the world for the volume of the cargo and container output for the last 5 consecutive years. According to the National Development and Reform Commission and the National Bureau of Statistics of China, in 2007, total logistics industry output increased to RMB 75,228.3 billion, or by 26.2%. The same report estimated that by 2010, the total industry output will reach RMB 1.2 trillion, with 20% growth annually. By the end of 2007, China had 14 harbors with 100 million ton capacity, up from 12 in 2006. In total, there are over 1,400 harbors in China with more than 35,000 dock berth with cargo capacity of 3.4 billion tons and 61.5 million shipping containers. Also, in 2007, China sea infrastructure and logistics industries added RMB 341.4 billion in value, an increase of more than 21%. In 2007, the total fuel consumption in the PRC exceeded 40.7 billion tons; for the same period, the total consumption by region, including Liaoning, Shandong and Zhejiang Provinces, where we primarily operate, was in excess of 818 million tons.

The market for oil for small and medium size vessels, i.e. less than 3,000 tons, is very fragmented with no discernible market leader. It is characterized by intense price competition, uneven product and service quality and is dominated by many small fuel trading companies. Most of these trading companies do not have stable supply sources or a strong working capital to withstand market risk. Unstable supplies often lead to chronic shortages of oil in the market resulting in black market operations and counterfeit products. Boats and vessels operators when docking at berths for refueling are often at the mercy of oil merchants selling them assortments of fuel oil from various suppliers in the market.

| 8 |

Boat and vessel operators are at high risk when oil merchants market them poor quality oil or counterfeit products that have insufficient energy efficiency or cause damages to engines. Therefore, our experience has consistently shown that vessel operators are willing to pay a premium for consistent quality products and services.

Our Products and Services

We blend and supply marine fuel as an alternative fuel for Chinese cargo and fishing vessels. Our sales of marine oil for fishing boats represented approximately 75% of our total revenue during both fiscal 2010 and 2011, as compared with the sale of marine oil for cargo vessels which represented the remaining 25% of our total revenue for the same periods. Our cargo vessel fuel is designated as CST180 and CST120; fishing boat/vessel fuel #1 fuel (for engines with 2,000 rpm capacity), #2 fuel (for engines with 1,800 rpm capacity), #3 fuel (for engines with 1600 rpm capacity) and #4 fuel (for engines with 1400 rpm capacity). We also blend fuel to specific customer specifications using our proprietary blending technology. Our own blend of Marine Diesel Oil, #1, #2, #3 fuel oil and #4 fuel oil are able to replace the traditional diesel oil, commonly known as #0 diesel oil, used by most small to medium vessels and boats. Currently, we sell approximately 53.06% of our products through distributors and approximately 46.94% of our products to retail customers. Fuel is classified into 6 classes, numbered 1 through 6, each according to its boiling point, composition and purpose. The boiling point, in the range of 175 − 600°C, and carbon chain length, in the range of 20 − 70 atoms, of the fuel increases with fuel number, i.e. the higher the class number, the higher the boiling point and the carbon chain length as well as oil’s viscosity. Price of oil, on the other hand, usually decreases as the fuel number increases since higher number fuel must be heated to overcome its viscosity.

The following table represents the description of our sales organized by product and geographical markets for the periods 2009 − 2011:

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| Tons | % | Tons | % | Tons | % | |||||||||||||||||||

| (in thousands) | (in thousands) | (in thousands) | ||||||||||||||||||||||

| Products | ||||||||||||||||||||||||

| 1# | 32.10 | 10.74 | % | 40.10 | 13.70 | % | - | - | ||||||||||||||||

| 2# | 35.33 | 11.82 | % | 18.60 | 6.30 | % | 17.18 | 7.14 | % | |||||||||||||||

| 3# | 35.55 | 11.89 | % | 20.48 | 7.00 | % | 22.81 | 9.48 | % | |||||||||||||||

| 4# | 152.64 | 51.05 | % | 162.88 | 55.40 | % | 151.93 | 63.17 | % | |||||||||||||||

| 180CST | 23.53 | 7.87 | % | 26.47 | 9.00 | % | 31.47 | 13.08 | % | |||||||||||||||

| 120CST | 19.84 | 6.64 | % | 25.42 | 8.60 | % | 17.12 | 7.12 | % | |||||||||||||||

| Areas | ||||||||||||||||||||||||

| Dalian | 166.37 | 55.64 | % | 138.22 | 47.00 | % | 91.03 | 37.85 | % | |||||||||||||||

| Shandong | 86.73 | 29.01 | % | 129.80 | 44.20 | % | 109.48 | 45.52 | % | |||||||||||||||

| Donggang | 21.74 | 7.27 | % | 12.13 | 4.10 | % | 20.16 | 8.38 | % | |||||||||||||||

| Zhejiang | 24.17 | 8.08 | % | 13.63 | 4.60 | % | 19.85 | 8.25 | % | |||||||||||||||

Our Competitive Strengths

Our business objective is to become the premium ‘‘one-stop’’ marine service provider for cargo, fishing and other vessels in China through our integrated distribution networks. We believe that our business model offers competitive advantages over our current market competition through:

| · | Product Superiority and Price Competitiveness - our blended marine fuel is price competitive as compared with various brands of diesel oil available in the local PRC market. In fact, based on quarterly 2009 price data, our blended fuel (#4), while maintaining the same fuel efficiency, is, on average, US$144 per ton cheaper than the leading diesel fuel brand. |

| · | Brand Recognition - our consistent, what we believe to be superior product quality over the years has resulted in our dominance in the fishing boat and vessel market in the provinces where we maintain our operations. Through our VIE entities, we are the largest privately owned company engaged in marine fuel industry in northern China. We intend to take advantage of our brand to increase our customer base and to leverage our brand and build an integrated distribution system for our range of related oil products and services. We believe our strong branding has allowed us to develop a broad base of end-user customers, expand our sales channels and facilitate more rapid acceptance of our new products. |

| 9 |

| · | Reliability of Our Supplies of Raw Materials - We have stable and reliable raw material suppliers for our production. Our relationships with upstream suppliers enables us to be a low cost producer. We have a long-standing relationship with China Petroleum (particularly, Dalian, Panjin and Liaoyang Branched) which, combined, provided over 25% of all raw materials we require per year, in both fiscal 2010 and 2011, with other suppliers, including Beijing XSSB, Fushun XC, Qingdao Anbang, providing the remaining of our need for raw materials. We will continue to explore new suppliers to reduce supply risk as needed. |

| · | Extensive Sales and Distribution Network - Our distribution consists of approximately 35 distributors throughout China in six provinces, we believe our distribution network is one of the largest among marine fuel suppliers in China. We are acquiring and building new facilities, which consist of blending plants, storage tanks, and fueling ports, close to some of our end customers or to a particular market in order to improve our product distribution capacity. We focus on timely delivery and good customer service. In addition our storage facilities are located close to our customers, enabling us to sell directly to them resulting in lower logistics costs. It also allows us to provide better after sales service and to maintain a close relationship with our key distributors through regular meetings, discussions and customer visits. Among our distributors, in 2011, Longyu Petrochemical and Liaoning Fishing Company represent 9.81% and 8.69% of our sales, respectively. |

| · | Innovation and R&D capabilities - We strive to identify market trends and developments in the marine fuel industry and use our blending technology to produce quality oils to satisfy the market demand. In 2011, we have developed two new products as a result of our research and development capabilities. We operate several dedicated research and development facilities with 5 professionals and collaborate with universities and institutes, including Dalian University of Technology and Shandong Petrol University. We believe our investment in research and development has enabled us to continuously expand our product offerings and proactively anticipate market changes in our industry. |

| · | Stringent Quality Control - We have stringent quality control systems at all stages of the blending process. Our periodic quality tests of our blended products are conducted by the team of trained scientific personnel which represent the area’s leading technical institutes and universities. We test the consistency and quality of our blended products and adjust the various components on an ‘‘as needed’’ basis. In addition, the quality of our testing process is periodically and independently verified by the governmental agencies in charge of overseeing quality and safety standards of the oil products supplied in the marketplace. |

| · | Strong Management Team - We have key management staff that has extensive experience and technical skills in oil processing, refining and blending technology. |

Our Strategies

Our strategy is to capitalize on our competitive strengths to expand our current market penetration. We plan to grow our business by pursuing the following strategies:

| · | Expand our Product Offerings - We are focused on becoming a ‘‘one-stop’’ product supplier for our end-user customers. We plan to continue expanding our product offerings to increase the customization of marine fuels and address the key elements of our end-user customers’ needs for lower prices, easier access to fuel and a wide variety of complementary services. We believe offering these integrated systems will promote higher end-user customer satisfaction, higher margins, the establishment of long-term service contracts to maintain the systems and increased barriers to entry for potential competitors. |

| · | Focus on Advanced Technologies - We are currently utilizing our research and development capabilities to develop new blending processes and applications. We believe there will be a growing demand for products possessing such features as governments, businesses and consumers become increasingly focused on sustainable economic growth and environmental issues. We follow advanced project selection procedures prior to the development of new products, including the use of detailed market and technological analyses. All new products are subject to rigorous testing at our facilities prior to production and sample products are often delivered to end-user customers for their trial use. We begin manufacturing new products only after the sample product from a trial production passes internal inspection and achieves customer satisfaction. This integrated approach allows us to identify potential difficulties in commercializing our product and make adjustments as necessary to develop cost-efficient manufacturing processes prior to mass production. We recognize the importance of customer satisfaction for our newly-developed products and continue to seek feedback from our end-user customers even after the formal launch of a product. |

| · | Pursue Selective Strategic Acquisitions - While we have experienced substantial organic growth, we plan to pursue a disciplined and targeted acquisition strategy to accelerate our growth. Our strategy will focus on obtaining complementary product offerings and locations, product line extensions, research and development capabilities and access to new markets and customers. We seek vertical growth through the acquisition of retail facilities which increase revenue line by having these newly acquired facilities to purchase more goods from parent and enjoying the profit margin on wholesale and retail distribution. Our acquisitions have historically enabled us to increase our product and service offerings and expand into other geographies. We may continue to acquire companies that provide us with storage capacities, customer and distribution network access. We expect that our acquisition targets will have the same core expertise as we do, maintain suitable storage facilities/berth locations, an established customer base to market our existing line of products and services. We anticipate that this strategy will enhance our time to market and our customer base, and will reduce local market entry risk. We intend to target profitable companies with proper location and currently under poor operation and management. After our acquisition, we will utilize our strength, operation and low cost product to occupy the market. |

| 10 |

| · | Increase Our Market Share in China - We plan to continue to expand our market share of the industry in China. To do so, we are developing additional advanced products across our comprehensive product lines, which will further create cross-selling opportunities and production and marketing synergies. We also intend to increase our marketing activities and are actively seeking to increase the number of distributors carrying our products, specifically new distributors that will provide us with greater access to a wider range of end-user customers. |

| · | Expand Our Blending Capacity and Increase In-house Production - We currently plan to build new manufacturing and blending facilities and production lines to produce new brands of marine fuel products. We also plan to improve and upgrade our existing manufacturing facilities and production lines to enhance our quality control and to meet increasing demand for our current products. With the increased manufacturing capacity, we also expect to bring additional production steps in-house and increase the in-house manufacturing of certain core components to further improve our cost structure, the protection of our intellectual property, the quality and performance of our products and our operational efficiencies. |

Sales & Marketing

Our main customers are located in Tianjin City and Liaoning, Shandong, Jiangsu, Guangdong and Zhejiang Provinces. Currently, we have 135 full-time sales and marketing personnel responsible for promoting our products and services to our customers and distributors. We maintain close relationships with our key customers through regular meetings and discussions to keep them updated on the variety of products and services we offer. In addition, we maintain strong relationships in our local communities and government for favorable business expansion in each individual geographical area. Our sales and marketing approach varies depending on the peculiarities of a particular market.

Supply of Raw Materials

Although we intend to diversify our raw material supplies by engaging international sources, presently, we purchase all of our raw materials only from Chinese suppliers. Our operating companies, Xingyuan and Fusheng, maintain a contractual relationship with Panjin Liaohe Oil Field Dali Group Petrochemical Co., Ltd. (“Panjin”) for purchases of wax fuel oil, which we commenced in October 2005, which provides over 20% of all raw materials as we need every year. These contracts are renewed on a monthly basis whereby the quantities of oil purchased vary from period to period at then prevailing market prices. Xingyuan also purchases, at market prices, rubber filling oil from PetroChina Dalian Petrochemical Company in amounts of 3,000 − 5,000 tons per month, respectively, which provides over 25% of all raw materials as we need every year. These contracts are also renewed on a monthly basis whereby the quantities of oil purchased vary from period to period at then prevailing market prices. Similarly, Xingyuan maintains a contractual relationship with Qingdao Anbang Refining and Chemical Co., Ltd. (“Qingdao”) for our needs of catalytic diesel oil. These contracts are also renewed on a rolling monthly basis whereby the quantities of oil purchased vary from period to period at then prevailing market prices. The use of domestic, local suppliers in close proximity to our facilities enables us to closely monitor the quality of the raw supplies obtained from such suppliers, provide technical training relating to our raw material requirements and suggest technical improvements. We obtain raw materials and components from suppliers through non-exclusive purchase orders and supply contracts. The purchase order or contract specifies the price for the raw material. Although we allow for adjustments in the price for certain raw materials under extraordinary circumstances, the prices for our materials are generally fixed for the effective term of the purchase agreement. Our contracts with our suppliers are generally renewable on an annual basis, but the price is not fixed and remains flexible and reflective of the prevailing market conditions. We typically negotiate with our suppliers to renew supply contracts at the beginning of each year, taking into account the quality and consistency of the materials and services provided. We maintain multiple supply sources for each of our key raw materials so as to minimize any potential disruption of our operations and maintain sourcing stability.

In fiscal 2010 and 2011, purchases from PetroChina Dalian Petrochemical Company (as described above), our largest supplier, accounted for 25.4% and 14.1%, respectively, of our total purchases of raw materials. For the same periods, our ten largest suppliers combined accounted for 72% and 52%, respectively, of our total purchases of raw materials. The raw materials required for our products are low value crude oil refinement byproducts which conventionally are disposed of by the major oil producing and refining companies. We negotiate prices for our raw material supplies on a monthly basis to accommodate for our short-term production requirements.

We maintain a procurement team that has established relationships with various raw material suppliers to ensure constant and reliable supply. In addition, we have successfully employed and continue to employ a number of methods to hedge against the risks of fluctuations in the raw material prices. Namely, we:

| · | Shorten our production cycle; |

| · | Review raw material price agreements on a weekly basis; |

| · | Reduce purchase amounts, or buy on an ‘‘as needed’’ basis; |

| 11 |

| · | Place our blending facilities in close proximity to our customers to reduce delivery time; |

| · | Increase the proportion of direct sales to end users by building more infrastructure to reduce reliance on distributors; |

| · | Leverage our brand, i.e. seek customers who are willing to pay quality and brand premium. |

Quality Control

We have implemented a rigid quality control system and devote significant attention to quality control procedures at every stage of our process. We monitor our manufacturing process closely and conduct performance and reliability testing to ensure our products meet our end-user customer expectations. Our quality control group as of December 31, 2011 included 13 employees that implement various management systems to improve product quality programs. We inspect our raw materials to ensure compliance with quality standards. We also evaluate the quality and delivery performance of each supplier periodically and adjust quantity allocations accordingly. We also monitor in-process and outgoing stages of our processes.

Seasonality

The Chinese government prohibits fishing boats and vessels from fishing from June 15th to September 15th of each year, the breeding season for many varieties of fish, in order to protect marine resources and prevent overfishing. In addition, we are also subject to the reduced commercial activity during the Chinese New Year, the most important of the traditional Chinese holidays. During this time, both cargo and fishing traffic decrease and we expect the demand for our products to decrease accordingly.

Research & Development

As of December 31, 2011, we had 7 members in our research and development group. Our research and development activities are based in our research and development center located in the City of Dalian and Zibo City, Shandong Province, where we maintain 4 laboratories, including one at the Dalian University of Technology. Each of our laboratories is staffed with several support personnel and is headed by an experienced member of the faculty with whom we enter into contractual arrangements to provide research and development services to the Company. We own all rights, title and interest in any proprietary information resulting from the research work at our R & D facilities. In addition to improving our existing product offerings, our research and development efforts focus on the development of new products, as well as the development of new production methodologies to improve our manufacturing processes.

Competition

The market for oil for small and medium size vessels, i.e. less than 3,000 tons, is very fragmented with no discernible market leader. We estimate the total value of this market to be approximately US$2.3 billion as of December 31, 2011. It is characterized by intense price competition, uneven product and service quality and is dominated by many small fuel trading companies. Most of these trading companies do not have stable supply sources or a strong working capital to withstand market risk, which may lead to chronic shortages of oil in the market. Boat and vessel operators are at high risk when oil merchants market them poor quality oil or counterfeit products that have insufficient energy efficiency or cause damage to engines. Therefore, our experience and market research have consistently shown that boat and vessel operators are willing to pay a premium for consistent quality products and services. High barriers of entry for new entrants into this industry include heavy regulatory hurdles, scarcity of suitable operation and storage sites, capital intensity and skilled management. Most of the operational, business and other activities in the storage, refining and producing industries are heavily regulated and require layers of governmental consents and approvals. In addition, storage hubs must be located on sufficiently large sites in strategic locations with close proximity to industrial ports and harbors with deep water access. Most of the infrastructure requires significant upfront capital expenditures. Thus, we believe all of the foregoing factors fortify our competitive positions in the industry.

Our industry is characterized by the major national oil companies controlling the upstream refineries and supplying the end products to the downstream. In particular for marine fuel oil, China Marine Bunker (China Petrol) Co., Ltd. is a major participant in the market. In the downstream, there are many traders selling marine fuel oil in all the provinces feeding from the 1st tier manufacturers. There are only a limited number of credible manufacturers that have blending capability of and direct access to raw materials from national refineries. Our competitors are numerous, ranging from large multinational corporations, which have significantly greater capital resources, to relatively small and specialized firms. In addition to competing with fuel resellers, we also compete with the major oil producers that market fuel directly to the large shipping companies. Such major oil producers do not include the PRC oil companies since under the PRC laws, petroleum producers are precluded from blending oil and oil products. Our business could be adversely affected because of increased competition from the larger oil companies who may choose to directly market to shipping companies, or to provide less advantageous price and credit terms to us than our fuel reseller competitors.

We believe we have no significant competition in the fuel market for small and medium vessels. Potential competitors could include major domestic oil producing and refining companies, including as Sinopec, China Petrol and CNOOC, none of which are currently active in this marketplace or legally permitted to blend oil. However, we believe it is unlikely they would enter into this segment of the market in the near future since the entry opportunities diminish as we develop our integrated distribution system through acquiring resources and sites and strengthening our market position, thus creating high barriers to entry, including regulatory and compliance hurdles capital and storage scarcity, shortage of skilled management.

| 12 |

Insurance

The insurance industry in China is still at an early state of its development. Insurance companies in China offer limited business insurance products or offer them at a high price. Business interruption or similar types of insurance are not customary in China. We currently maintain insurance coverage with China People’s Insurance Company Limited of China, which, as of December 31, 2011, was approximately RMB10.5 million (US$1.67 million) on our property and facilities and approximately RMB89 million (US$14.1 million) on our inventory. We do not carry any third party liability insurance to cover claims in respect of personal injury, property or environmental damage arising from accidents on our property or relating to our operations other than on our transportation vehicles. We have not had a third party liability claim filed against us during the last five years.

Business, Ownership, Environmental and Other Regulations

Petroleum and Refining Industry Regulations

Although the Chinese government is liberalizing its control over the petroleum and petrochemical industries, significant government regulations remain. Central government agencies and their local or provincial level counterparts do not own or directly control our production facilities. However, they exercise significant control over the petrochemical industry in areas such as production quotas, quality standards, allocation of raw materials and finished products, allocation of foreign exchange and Renminbi loans for capital construction projects. Since 2003, at the national level, our operations are subject to the supervision and industrial oversight, to various extent, by the State Assets Regulatory and Management Commission, by the Ministry of Commerce and the National Development and Reform Committee. At the local level, we are subject to the supervision and oversight by the provincial branches of these national agencies as well as local governments and agencies.

Foreign Exchange and Dividend Distribution Regulations

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Control Regulations (1996), as amended. Under these regulations, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of the Renminbi for capital account items, such as direct investment, loans, repatriation of investment and investment in securities outside China, however, is still subject to the approval of the SAFE or its competent local branch. The dividends paid by a subsidiary to its shareholder are deemed income of the shareholder and are taxable in China. Pursuant to the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), foreign-invested enterprises in China may purchase or remit foreign exchange, subject to a cap approved by the SAFE, for settlement of current account transactions without the approval of the SAFE.

The principal regulations governing distribution of dividends of foreign holding companies include the Foreign Investment Enterprise Law (1986), as amended, and the Administrative Rules under the Foreign Investment Enterprise Law (2001). Under these regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, foreign-invested enterprises in China are required to allocate at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds unless these reserves have reached 50% of the registered capital of the enterprises. These reserves are not distributable as cash dividends. Our Chinese VIE’s and one PRC subsidiary, Fusheng, which are all foreign-invested enterprises, are restricted from distributing any dividends to us until they have met these requirements set out in the regulations.

According to the new EIT law and the implementation rules on the new EIT law, if a foreign legal person is not deemed to be a resident enterprise for Chinese tax purposes, dividends generated after January 1, 2008 and paid to this foreign legal person from business operations in China will be subject to a 10% withholding tax, unless such foreign legal person’s jurisdiction of incorporation has a tax treaty with the PRC that provides for a different withholding arrangement. Under the new EIT law and its implementation rules, if an enterprise incorporated outside China has its ‘‘de facto management organization’’ located within China, such enterprise would be classified as a resident enterprise and thus would be subject to an enterprise income tax rate of 25% on all of its income on a worldwide basis, with the possible exclusion of dividends received directly from another Chinese tax resident.

| 13 |

On December 25, 2006, the People’s Bank of China, or PBOC, issued the Administration Measures on Individual Foreign Exchange Control, and the corresponding Implementation Rules were issued by SAFE on January 5, 2007. Both of these regulations became effective on February 1, 2007. According to these regulations, all foreign exchange matters relating to employee stock holding plans, share option plans or similar plans in which PRC citizens’ participation require approval from the SAFE or its authorized branch. On March 28, 2007, SAFE promulgated the Application Procedure of Foreign Exchange Administration for Domestic Individuals Participating in Employee Stock Option Holding Plan or Stock Option Plan of Overseas Listed Company, or the Stock Option Rule. The purpose of the Stock Option Rule is to regulate foreign exchange administration of Chinese citizens who participate in employee stock holding plans and share option plans of offshore listed companies. According to the Stock Option Rule, if a Chinese citizen participates in any employee stock holding plans or share option plans of an offshore listed company, a Chinese domestic agent or the Chinese subsidiary of the offshore listed company is required to file, on behalf of the individual, an application with the SAFE to obtain approval for an annual allowance with respect to the purchase of foreign exchange in connection with stock holding or share option exercises. This restriction exists because a Chinese citizen may not directly use offshore funds to purchase stock or exercise share options. Concurrent with the filing of the required application with the SAFE, the Chinese domestic agent or the Chinese subsidiary must obtain approval from the SAFE to open a special foreign exchange account at a Chinese domestic bank to hold the funds required in connection with the stock purchase or option exercise, any returned principal profits upon sales of stock, any dividends issued on the stock and any other income or expenditures approved by the SAFE. The Chinese domestic agent or the Chinese subsidiary also is required to obtain approval from the SAFE to open an offshore special foreign exchange account at an offshore trust bank to hold offshore funds used in connection with any employee stock holding plans. All proceeds obtained by a Chinese citizen from dividends acquired from the offshore listed company through employee stock holding plans or share option plans, or sales of the offshore listed company’s stock acquired through other methods, must be remitted back to China after relevant offshore expenses are deducted. The foreign exchange proceeds from these sales can be converted into Renminbi or transferred to the individuals’ foreign exchange savings account after the proceeds have been remitted back to the special foreign exchange account opened at a Chinese bank. If share options are exercised in a cashless exercise, the Chinese individuals exercising them are required to remit the proceeds to the special foreign exchange account. Although the Stock Option Rule has been promulgated recently and many issues require further interpretation, we and our Chinese employees who have been or will be granted share options or shares will be subject to the Stock Option Rule, as an offshore listed company.

Employee Stock Option Regulations

Under SAFE Notice No. 106, employee stock holding plans of offshore special purpose companies must be filed with the SAFE, and employee share option plans of offshore special purpose companies must be filed with the SAFE while applying for the registration for the establishment of the offshore special purpose company. After the employees exercise their options, they must apply for the amendment to the registration for the offshore special purpose company with the SAFE. If we or our Chinese employees fail to comply with the Stock Option Rule, we and/or our Chinese employees may face sanctions imposed by foreign exchange authority or any other Chinese government authorities.

On August 8, 2006, six Chinese regulatory agencies, including the Ministry of Commerce, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the CSRC and the SAFE, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the New M&A Rule, which became effective on September 8, 2006. Under the New M&A Rule, equity or assets merger and acquisition of Chinese enterprises by foreign investors will be subject to the approval from the Ministry of Commerce or its competent local branches. This regulation also includes provisions that purport to require special purpose companies formed for purposes of offshore listing of equity interests in Chinese companies to obtain the approval of the CSRC prior to the listing and trading of their securities on any offshore stock exchange. As defined in the New M&A Rule, a special purpose vehicle is an offshore company that is directly or indirectly established or controlled by Chinese entities or individuals for the purposes of an overseas listing.

The CSRC approval procedures require the filing of a number of documents with the CSRC and it would take several months to complete the approval process. The application of the New M&A Rule with respect to offshore listings of special purpose companies remains unclear with no consensus currently existing among leading Chinese law firms regarding the scope of the applicability of the CSRC approval requirement. A loan made by foreign investors as shareholders in a foreign-invested enterprise is considered to be foreign debt in China and subject to several Chinese laws and regulations, including the Foreign Exchange Control Regulations of 1997, the Interim Measures on Foreign Debts of 2003, or the Interim Measures, the Statistical Monitoring of Foreign Debts Tentative Provisions of 1987 and its Implementing Rules of 1998, the Administration of the Settlement, Sale and Payment of Foreign Exchange Provisions of 1996, and the Notice of the SAFE in Respect of Perfection of Issues Relating Foreign Debts, dated October 21, 2005. Under these regulations, a shareholder loan in the form of foreign debt made to a Chinese entity does not require the prior approval of the SAFE. However, such foreign debt must be registered with and recorded by the SAFE or its local branch in accordance with relevant Chinese laws and regulations. Our Chinese VIE’s and our PRC subsidiary can legally borrow foreign exchange loans up to their borrowing limits, which is defined as the difference between the amount of their respective ‘‘total investment’’ and ‘‘registered capital’’ as approved by the Ministry of Commerce, or its local counterparts. Interest payments, if any, on the loans are subject to 10% withholding tax unless any such foreign shareholders’ jurisdiction of incorporation has a tax treaty with China that provides for a different withholding agreement. Pursuant to Article 18 of the Interim Measures, if the amount of foreign exchange debt of our Chinese VIE’s and our PRC subsidiary exceed their respective borrowing limits, we are required to apply to the relevant Chinese authorities to increase the total investment amount and registered capital to allow the excess foreign exchange debt to be registered with the SAFE.

Environmental Regulations

China’s rapid economic growth over the last two decades has also brought with it several energy related environmental problems. Environmental pollution from fossil fuel combustion is damaging human health, air and water quality, agriculture, and ultimately the economy. Many of China’s cities are among the most polluted in the world. China is the world’s second-largest source of carbon dioxide emissions behind the United States. EIA forecasts predict that China will experience the largest growth in carbon dioxide emissions between now and the year 2030. The Chinese government has taken several steps to improve environmental conditions in the country. Chief among these is the new Law on Renewable Energy, which took effect on January 1, 2006. The new law seeks to promote cleaner energy technologies, with a stated goal of increasing the use of renewable energy to 10% of the country’s electricity consumption by 2010 (up from roughly 3% in 2003).

| 14 |

We are subject to national and local environmental protection regulations, which currently impose a graduated schedule of fees for the discharge of waste substances, require the payment of fines for pollution and provide for the forced closure of any facility that fails to comply with orders requiring it to cease or cure certain environmentally damaging practices. We have established environmental protection systems which consist of pollution control facilities to treat certain of our waste materials and to safeguard against accidents. We believe our environmental protection facilities and systems are adequate for the existing national and local environmental protection regulations.

Employees

As of December 31, 2011, we had 210 employees, 45 of which are engaged in management, administration and related areas, and the remaining 165 are engaged in operations at various local sites throughout the east of China. None of our employees are represented by a labor union or collective bargaining agreements. We consider our employee relations to be good.

Intellectual Property

We rely on trademark and copyright laws, trade secret protection, non-competition and confidentiality and/or licensing agreements with our executive officers, clients, contractors, research and development personnel and others to protect our intellectual property rights. We do not possess any licenses to use third-party intellectual property rights nor do we license to third-parties any intellectual property rights we own. The protection afforded by our intellectual property may be inadequate. It may be possible for third parties to obtain and use, without our consent, intellectual property that we own or are licensed to use. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business. We may also be subject to litigation involving claims of violation of intellectual property rights of third parties.

ITEM 1A. Risk Factors

The Company faces many risks. The risks described below may not be the only risks the Company faces. Additional risks not yet known or currently believed to be immaterial may also impair the Company’s business. If any of the events or circumstances described in the following risks actually occurs, the Company’s business, financial condition or results of operations could suffer, and the trading price of its common stock could decline. You should consider the following risks, together with all of the other information in this Annual Report on Form 10-K, before making an investment decision with respect to the Company’s securities.

Risks Relating to Our Operations

Our limited operating history makes evaluation of our business difficult

We have a limited operating history and have encountered and expect to continue to encounter many of the difficulties and uncertainties often faced by early stage companies. Our limited operating history makes it difficult to evaluate our future prospects, including our ability to develop a wide customer and distribution network for our services, expand our operations to include additional services and control raw material costs, all of which are critical to our success. We may encounter unanticipated problems, expenses and delays in developing and marketing our services and securing additional blending and storage facilities. We may not be able to successfully address these risks. If we are unable to address these risks, our business may not grow, our stock price may suffer, and we may be unable to stay in business.

If the fuel we blend fails to meet the specifications we have agreed to supply to our customers, our relationship with our customers could be adversely affected

We blend marine fuel to meet customer specifications. If the fuel fails to meet the specifications we have agreed to supply to our customers, our relationship with our customers could be adversely affected, and we could be subject to claims and other liabilities which could have a material adverse effect on our business, financial condition and results of operations.

Our historical sales to significant customers have been concentrated

For the year ended December 31, 2011, two customers accounted for approximately 9.81% and 8.69% of total revenues, respectively. For the fiscal year ended December 31, 2011, one customer accounted for approximately 10.7% and 10.3% of our total revenues. No other customer contributed greater than 10% of the revenues. No other customer contributed greater than 10% of the revenues. In the event a substantial portion of such sales is disrupted, our results of operations may be adversely affected.

| 15 |

Our operations may be adversely affected by the cyclical nature of the petroleum and petrochemical market and by the volatility of prices of crude oil and petrochemical products