Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Cibolan Gold Corp | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Cibolan Gold Corp | ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Cibolan Gold Corp | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Cibolan Gold Corp | ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Cibolan Gold Corp | ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended January 31, 2012

or

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from___________________to____________________

Commission File Number 000-30230

|

GENERAL METALS

CORPORATION

|

||

|

(Exact name of registrant as specified in its

charter)

|

|

Delaware

|

65-0488983

|

|||

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification No.)

|

|

1155 W 4TH St Ste 210, Reno, NV

89503

|

89511

|

|||

|

(Address of principal executive offices)

|

(Zip Code)

|

|

775.583.4636

|

||

|

(Registrant’s telephone number,

including area code)

|

|

N/A

|

||

|

(Former name, former address and former

fiscal year, if changed since last report)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ YESo NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. o YES þ NO

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court.

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

292,227,346 common shares issued and outstanding as of March 21, 2012.

1

PART 1 – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

General Metals Corporation

(An Exploration Stage Company)

Unaudited Condensed Consolidated Balance Sheet

|

January 31

|

April 30,

|

|||||||

|

2012

|

2011

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$ | 13,641 | $ | 14,157 | ||||

|

Prepaid expenses

|

17,059 | 39,791 | ||||||

|

Total current assets

|

30,700 | 53,948 | ||||||

|

Other assets

|

||||||||

|

Land

|

67,742 | 67,742 | ||||||

|

Mineral property

|

613,941 | 613,941 | ||||||

|

Property and equipment, net

|

6,933 | 10,946 | ||||||

|

Other assets

|

35,238 | 35,238 | ||||||

|

Total other assets

|

723,854 | 727,867 | ||||||

|

Total assets

|

$ | 754,554 | $ | 781,815 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Notes payable, current portion

|

$ | 6,698 | $ | 6,331 | ||||

|

Accounts payable

|

335,500 | 354,055 | ||||||

|

Accrued liabilities

|

83,804 | 93,262 | ||||||

|

Accounts payable to related parties

|

163,432 | 124,976 | ||||||

|

Loan from related parties

|

28,800 | 28,800 | ||||||

|

Total current liabilities

|

618,234 | 607,424 | ||||||

|

Long-term liabilities

|

||||||||

|

Notes payable, net of current portion

|

34,720 | 38,342 | ||||||

|

Total long-term liabilities

|

34,720 | 38,342 | ||||||

|

Total liabilities

|

652,954 | 645,766 | ||||||

|

Commitments and Contingencies

|

||||||||

|

Stockholders' equity

|

||||||||

|

Preferred stock, authorized 50,000,000 shares, par value $0.001, zero issued and outstanding

|

- | - | ||||||

|

Common stock, authorized 550,000,000 shares, par value $0.001, issued and outstanding on January 31, 2012 and April 30, 2011 is 292,227,942 and 267,703,983 respectively

|

292,227 | 267,705 | ||||||

|

Additional paid-in capital

|

10,939,720 | 10,349,877 | ||||||

|

Accumulated deficit during exploration stage

|

(11,130,347 | ) | (10,481,533 | ) | ||||

|

Total stockholders' equity

|

101,600 | 136,049 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 754,554 | $ | 781,815 | ||||

The accompanying notes are an integral part of these statements

2

General Metals Corporation

(An Exploration Stage Company)

Unaudited Condensed Consolidated Statements of Operations

|

March 15, 2006

|

||||||||||||||||||||

|

(Inception)

|

||||||||||||||||||||

|

Three Months January 31,

|

Nine Months Ended January 31,

|

to January 31,

|

||||||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

2012

|

||||||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Operating expenses

|

||||||||||||||||||||

|

Depreciation and amortization

|

1,338 | 1,338 | 4,013 | 4,013 | 33,933 | |||||||||||||||

|

General and administrative

|

20,496 | 5,764 | 66,402 | 49,817 | 1,460,765 | |||||||||||||||

|

Management and consulting

|

139,688 | 68,084 | 410,293 | 186,305 | 5,833,717 | |||||||||||||||

|

Exploration and development

|

(948 | ) | 16,981 | 71,128 | 81,746 | 2,944,970 | ||||||||||||||

|

Professional fees

|

19,958 | 39,642 | 90,830 | 99,467 | 754,723 | |||||||||||||||

|

Total expenses

|

180,532 | 131,809 | 642,666 | 421,348 | 11,028,108 | |||||||||||||||

|

(Loss) from operations

|

(180,532 | ) | (131,809 | ) | (642,666 | ) | (421,348 | ) | (11,028,108 | ) | ||||||||||

|

Other income (expenses)

|

||||||||||||||||||||

|

Interest expense

|

(2,010 | ) | (509 | ) | (6,148 | ) | (3,873 | ) | (35,955 | ) | ||||||||||

|

Other income

|

- | 2,500 | - | 2,500 | 14,700 | |||||||||||||||

|

Gain on sale of mineral properties

|

- | - | - | - | 1,249,072 | |||||||||||||||

|

Realized gain/(loss) on sale of investments

|

- | - | - | (32,152 | ) | (112,204 | ) | |||||||||||||

|

Other than temporary impairment of investments

|

- | - | - | - | (1,224,302 | ) | ||||||||||||||

|

Gain/(loss) on foreign currency exchange

|

- | 12 | - | (796 | ) | 6,450 | ||||||||||||||

|

(Loss) before income taxes

|

(182,542 | ) | (129,806 | ) | (648,814 | ) | (455,669 | ) | (11,130,347 | ) | ||||||||||

|

Provision for income taxes

|

- | - | - | - | - | |||||||||||||||

|

Net (loss)

|

$ | (182,542 | ) | $ | (129,806 | ) | $ | (648,814 | ) | $ | (455,669 | ) | $ | (11,130,347 | ) | |||||

|

Loss per common share:

|

||||||||||||||||||||

|

Basic & Diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

|

Weighted average shares outstanding:

|

||||||||||||||||||||

|

Basic & Diluted

|

289,171,604 | 253,712,980 | 279,960,685 | 246,815,823 | ||||||||||||||||

The accompanying notes are an integral part of these statements

3

General Metals Corporation

(An Exploration Stage Company)

Unaudited Condensed Consolidated Statements of Cash Flows

|

March 15, 2006

|

||||||||||||

|

Nine months ended January 31,

|

(Inception)

|

|||||||||||

|

to January 31,

|

||||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Operating activities

|

||||||||||||

|

Net loss

|

$ | (648,814 | ) | $ | (455,669 | ) | $ | (11,130,347 | ) | |||

|

Adjustments to reconcile net loss

|

||||||||||||

|

Stock issued for services

|

193,647 | 33,004 | 2,928,622 | |||||||||

|

Stock issued for payment of interest on debt

|

- | - | 12,750 | |||||||||

|

Non-cash financing costs

|

- | - | 46,234 | |||||||||

|

Realized loss on sale of investments

|

- | 32,152 | 112,204 | |||||||||

|

Gain on sale of mineral property

|

- | - | (1,249,072 | ) | ||||||||

|

Depreciation and amortization

|

4,013 | 4,013 | 33,933 | |||||||||

|

Stock-based compensation

|

- | 62,000 | 1,781,171 | |||||||||

|

Other-than-temporary impairment of investments

|

- | - | 1,224,302 | |||||||||

|

Impairment of long-lived assets

|

- | - | 17,500 | |||||||||

|

Bad debt expense

|

- | - | 22,387 | |||||||||

|

Gain on sale of fixed asset

|

- | - | (1,250 | ) | ||||||||

|

Change in assets and liabilities

|

||||||||||||

|

(Increase)/decrease in other current assets

|

- | - | (22,387 | ) | ||||||||

|

(Increase)/decrease in prepaid expenses

|

9,046 | (46,372 | ) | (16,629 | ) | |||||||

|

Increase/(decrease) in accounts payable

|

19,901 | (142,332 | ) | 573,832 | ||||||||

|

Increase/(decrease) in accrued liabilities

|

10,947 | 45,491 | 348,313 | |||||||||

|

Net cash used by operating activities

|

(411,260 | ) | (467,713 | ) | (5,318,437 | ) | ||||||

|

Investment activities

|

||||||||||||

|

Investments:

|

||||||||||||

|

Purchases

|

- | - | (1,357 | ) | ||||||||

|

Proceeds from sales

|

- | 145,644 | 154,914 | |||||||||

|

Acquisition of mineral property

|

- | - | (78,091 | ) | ||||||||

|

Investment in General Copper

|

- | - | (17,500 | ) | ||||||||

|

Investment in Lahontan

|

- | - | (2,563 | ) | ||||||||

|

Deposit on water rights

|

- | - | (800 | ) | ||||||||

|

Deposit on reclamation bond

|

- | - | (34,438 | ) | ||||||||

|

Proceeds from sale of mineral property

|

- | - | 12,500 | |||||||||

|

Proceeds from sale of fixed asset

|

- | - | 8,000 | |||||||||

|

Purchase of land

|

- | - | (67,742 | ) | ||||||||

|

Purchase of equipment

|

- | - | (17,616 | ) | ||||||||

|

Net cash provided/(used) by investment activities

|

- | 145,644 | (44,693 | ) | ||||||||

|

Financing activities

|

||||||||||||

|

Proceeds from loans from related parties

|

- | - | 121,864 | |||||||||

|

Repayments of loans from related parties

|

- | (5,000 | ) | (43,064 | ) | |||||||

|

Proceeds from issuance of debt

|

- | - | 149,841 | |||||||||

|

Repayments of debt

|

(3,256 | ) | (3,423 | ) | (8,424 | ) | ||||||

|

Proceeds from the sale of stock

|

414,000 | 530,600 | 5,156,554 | |||||||||

|

Net cash provided by financing activities

|

410,744 | 522,177 | 5,376,771 | |||||||||

|

Net increase / (decrease) in cash

|

(516 | ) | 200,108 | 13,641 | ||||||||

|

Cash, beginning of period

|

14,157 | 9,636 | - | |||||||||

|

Cash, end of period

|

$ | 13,641 | $ | 209,744 | $ | 13,641 | ||||||

|

Supplemental Information:

|

||||||||||||

|

Interest paid

|

$ | 6,148 | $ | 3,873 | $ | 16,282 | ||||||

|

Income taxes paid

|

$ | - | $ | - | $ | - | ||||||

|

Non-cash activities:

|

||||||||||||

|

Stock issued for service as prepaid expenses

|

$ | 12,259 | $ | 79,295 | $ | 12,259 | ||||||

|

Stock issued to acquire mineral property lease

|

$ | - | $ | - | $ | 783,687 | ||||||

|

Stock issued for payment of interest on debt

|

$ | - | $ | - | $ | 12,750 | ||||||

|

Stock issued as reduction of accrued expenses

|

$ | 20,405 | $ | 69,500 | $ | 353,539 | ||||||

|

Stock issued as reduction of contingent liability

|

$ | - | $ | - | $ | 50,000 | ||||||

|

Stock issued as reduction of related party loans

|

$ | - | $ | 15,000 | $ | 15,000 | ||||||

|

Stock issued as reduction of short-term note payable

|

$ | - | $ | 100,000 | $ | 100,000 | ||||||

The accompanying notes are an integral part of these statements

4

General Metals Corporation

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

NOTE 1 - CONDENSED FINANCIAL STATEMENTS

The accompanying financial statements have been prepared by the Company without audit. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations, and cash flows at January 31, 2012, and for all periods presented herein, have been made.

In accordance with Article 8-03 of Regulation S-X certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted. It is suggested that these condensed financial statements be read in conjunction with the financial statements and notes thereto included in the Company's April 30, 2011 audited financial statements. The results of operations for the period ended January 31, 2012 are not necessarily indicative of the operating results for the full year.

The accompanying condensed consolidated financial statements include the accounts of General Metals Corporation and its wholly owned subsidiary, General Gold Corporation. Collectively, they are referred herein as the Company. All inter-company balances and transactions have been eliminated on consolidation.

The Company is considered a development (exploration) stage entity for financial reporting purposes by United States generally accepted accounting principles (US GAAP) since it has not generated material revenue from its principal business activities.

Use of estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash and short term deposits with original maturities of three months or less when purchased. As of January 31, 2012, the Company had $13,641 in cash and cash equivalents.

Recently Issued Accounting Pronouncements

No new accounting pronouncements have been issued since the filing of the Company’s Form 10-K on August 15, 2011 for the fiscal year ended April 30, 2011 that are likely to have a material impact on the Company’s financial position, results of operations, or cash flows.

NOTE 2 - GOING CONCERN

The Company's financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management's plan is to obtain such resources for the Company by obtaining capital from management and significant shareholders sufficient to meet its minimal operating expenses and seeking equity and/or debt financing. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

5

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 3 – STOCKHOLDERS’ EQUITY

The following provides additional information for certain stock transactions that occurred during the nine months ended January 31, 2012. For additional details for all stock transactions, prior to the beginning of the fiscal year ended April 30, 2012, please see the consolidated statement of changes in stockholders’ equity as reported in the Company’s 10-K for the period ended April 30, 2011 and filed with the Securities Exchange Commission on August 15, 2011.

During the three months ended July 31, 2011, we issued a total of 6,444,444 shares; 2,000,000 shares were issued for services valued at $76,000; and 4,444,444 shares were issued to an investor in a private placement at $0.0225 per share for receipt of cash totaling $100,000.

During the three months ended October 31, 2011, we issued a total of 10,788,339 shares; 2,160,562 shares were issued for services valued at $60,503; 6,327,777 shares were issued to investors in private placements at $0.0225 per share for receipt of cash totaling $142,375; and 2,300,000 shares were issued to investors in private placements at $0.025 per share for receipt of cash totaling $57,500.

During the three months ended January 31, 2012, we issued a total of 7,291,180 shares; 2,485,625 shares were issued for services valued at $63,862; 2,405,555 shares were issued to investors in private placements at $0.0225 per share for receipt of cash totaling $54,125; and 2,400,000 shares were issued to investors in private placements at $0.025 per share for receipt of cash totaling $60,000.

NOTE 4 – SUBSEQUENT EVENTS

Management evaluated subsequent events through the date of the filing and identified no events requiring disclosure.

NOTE 5 – RELATED PARTY

Our former CEO and President, Mr. Carrington, provided ongoing contract geologic services to the Company at the rate of $550 per day plus expenses. During the nine months ended January 31, 2012, the Company did not accrue expenses as he provided no services to the Company. As of January 31, 2012 and April 30, 2011, $71,771 is recorded as due to related parties for Mr. Carrington. Mr. Carrington did not charge the Company for services related to his position as the Company's prior President. Mr. Carrington is also a member of Gold Range LLC which retains a 1% net smelter royalty on the Independence project.

Forbush and Associates, of which Dan Forbush, CEO, President, and CFO, is the Principal, provides accounting support and bookkeeping services to the Company on a billed by hour incurred basis. Forbush and Associates is owed $7,245 at January 31, 2012 and $6,583 at April 30, 2011 relating to hours incurred and reimbursable expenses paid by Forbush and Associates on behalf of the Company. In the nine months ended January 31, 2012, Forbush and Associates charged $289 for reimbursable expenses included in General and administrative expenses and $28,745 for services rendered in relation to the preparation of the 10-K for year ended April 30, 2011 and Forms 10-Q for the periods ended July 31 and October 31, 2011 as well as clerical and office administrative support.

Mr. Forbush also receives wages from the Company in accordance with his employment as an officer of the Company. During the period ended January 31, 2012, Mr. Forbush received 770,000 shares valued at $20,405 for net payroll wages on gross wages of $30,000. Mr. Forbush is owed $70,000 and $65,000 in unpaid gross wages as of January 31, 2012 and April 30, 2011 respectively, and $4,176 and $0 for unreimbursed expenses as of January 31, 2012 and April 30, 2011 respectively, which is reflected in accrued liabilities in the respective periods.

6

Our former President, Mr. Paul Wang, had entered into an employment agreement with the Company to receive an annual salary of $80,000 ($6,667 per month). Mr. Wang received payment in full for all wages due under the employment agreement as of the date of his release as President of the Company totaling $23,950 and certain reimbursable expenses in the amount of $11,959 related to travel expenses remain unpaid as of January 31, 2012 and April 30, 2011. Additionally, Mr. Wang received compensation for his services as a member of the Board of Directors at the rate of $1,000 per month recommencing in May of 2011 and ending in August 2011 when he was not reappointed for election to the Board of Directors at the Annual Meeting held on September 16, 2011. As of January 31, 2012, and April 30, 2011, respectively, we have outstanding payables of $11,959 and $11,959 respectively for reimbursable expenses in the due to related parties account classification.

As of January 31, 2012 and April 30, 2011, $24,000 and $0 respectively is due to Larry Bigler, Shane K. Dyer, Walter “Del” Marting Jr., and P.K. “Rana” Medhi for reimbursable expenses incurred in their position as members of the Board of Directors and compensation related thereto. Beginning May 2011, compensation related to services provided as a member of the Board of Directors was reinstated at $1,000 per month plus $1,000 for serving on any additional subcommittees with a maximum compensation of $2,000 per month.

On December 17, 2010, Dan Dyer was appointed as a member of the Board of Directors and is also a principal in Dyer Engineering Consultants. Dan Dyer resigned from the Board effective June 30, 2011. On September 16, 2011, Shane Dyer, Vice-President of Dyer Engineering was appointed and elected to the Board of Directors. Dyer Engineering Consultants provides mine permitting, engineering and leach pad design services at the Independence project. As of January 31, 2012 and April 30, 2011 respectively, Dyer Engineering Consultants is owed $44,281 and $34,663 for services rendered.

The President, CFO, former and current members of the Board of Directors, and members of the Advisory Board have provided short-term financing to the company in the form of demand notes with no fixed or determinable repayment dates. The amounts are recorded as current liabilities with the balance as of January 31, 2012 and April 30, 2011 of $28,800.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This quarterly report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors", that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our unaudited condensed financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles and Article 8-03 of Regulation S-X. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this quarterly report, particularly in the section entitled "Risk Factors".

7

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars. All references to "common shares" refer to the common shares in our capital stock.

As used in this quarterly report, the terms "we", "us" and "our" mean General Metals Corporation and our wholly owned subsidiary General Gold Corporation, unless otherwise indicated.

OVERVIEW

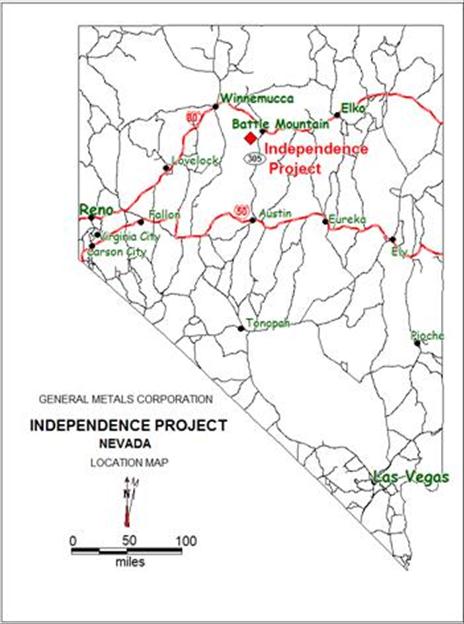

We are an exploration stage company engaged in the acquisition, exploration and development of mineral properties currently with an emphasis on gold and silver mineralization, presently focused on our Independence Project located in Battle Mountain, Nevada.

We are presently conducting an aggressive program to rapidly move the Independence project toward production, which is dependent upon obtaining further financing.

In addition to the on-going development of the Independence Mine, we are continually seeking to acquire other mining claims, as our funding allows.

The continuation of our Company is dependent upon us attaining and maintaining profitable operations and raising additional capital as needed. In this regard we have raised additional capital through equity offerings and loan transactions. We have been successful in structuring deals in which expenses are paid through the issuances of common shares. In addition, we have raised additional funds and expect to continue to raise additional funds through private placement equity offerings sufficient to fund our current plan of operations.

The Independence Mine Property

|

We currently control a 100% undivided leasehold interest in the Independence Mine, situated in the Battle Mountain Mining District, Lander County, Nevada. The property consists of 14 whole and fractional mining claims encompassing 240 acres. Our Due diligence shows that all claims are valid and in good standing through and for the assessment year ending August 31, 2012 .

The Independence Mine project is wholly owned by our company through our subsidiary company General Gold Corporation under a mining lease/option agreement with Independence Gold Silver Mines of Seattle, Washington. Under the terms of the agreement we were required to expend a minimum of $625,000 towards exploration development and commercial production of ores, minerals or materials. This expenditure requirement was fulfilled prior to the year ended April 30, 2008, as we expended approximately $760,000 through that date. During the year ended April, 30, 2011, we spent approximately $312,000 on exploration and development including the initiation of the permitting process and $2,873,842 since inception to April 30, 2011. Through the nine months ended January 31, 2012, we spent an additional $71,128 in drilling and permitting of the Independence project.

|

8

The term of the lease is for a period of 20 years commencing October 1, 2005. There is a production royalty payable for the sale of all gold, silver or platinum based upon the average daily price of gold on the London Metal Exchange as follows: 3% when the price of gold per ounce is less than $375; 4% when the price of gold per ounce is between $375 and $475; and 5% when the price of gold is over $475. There is also a production royalty of 3% payable on the sale of all substances other than gold, silver and platinum. In addition, any future production is subject to a 1% net smelter royalty obligation payable to Gold Range, LLC.

We have the option to purchase the property for $3.0 million (which eliminates the royalty described above) within 10 years of the date the lease commenced provided all obligations have been met.

Location and Access

All infrastructures necessary for the exploration, development and operation of a mine is readily available. The property is accessed via federal, state and county maintained all weather paved and gravel roads from the nearby town of Battle Mountain. A well-trained work force is available in the town of Battle Mountain, situated 30 miles north of the property along Interstate highway 80. Adequate ground water is available for diversion for future mining operations which enjoy special treatment as temporary or interim uses under Nevada water laws. Electrical power has recently been extended to within one mile of the project and the transcontinental natural gas line passes within 1.5 miles of the property.

The property has been the site of intermittent historic exploration and mining activities since the late 1920s. Past mining operations extracted 65,000 tons of high grade gold and silver ores from the property. The bulk of this activity occurred during two periods, the first from high grade ores shipped for direct smelting during the late 1940s and early 1950s, and a second from 1975 to 1983 when a significant amount of underground development took place, and a mill was erected on the property.

Independence Deep Target

A large body of mineralized material is clearly indicated by previous drilling in the Deep Target. We completed interpretation of the logs and geologic modeling in the fall of 2009 which identified mineralized material in the deep target. We retained all of the core samples, approximately 25,000 feet, and stored it on site.

Mineralization identified in the deep target to date is contained in the lower plate of the Golconda Thrust in rocks of the Battle Mountain and Edna Formations of the Antler Sequence.

Independence Shallow Target

Promising shallow and near surface mineralization has been identified. The Shallow Target contains an oxide target hosted entirely in the Pumpernickel Formation. To date over 130 drill holes and roughly eight (8) miles of underground workings have penetrated portions of this target, all of which have encountered highly anomalous to high grade mineralization. The principle limiting factor for surface/ shallow resources has been the lack of drilling information. In addition, review of the work done by those which held interests in the property previously has identified a total of 8 shallow near surface mineralized targets on the property with 4 of those being north of the Canyon Fault and 3 others where no mining has been performed and minimal geologic sampling and drilling work completed. To date, we have spent over $2.8 million drilling, sampling and evaluating these targets.

9

Independence Hill Zone

The Hill Zone, discovered in 2008, is a large, highly mineralized area north of the Canyon Fault and the Independence Shallow Target. Unlike the Independence Shallow Target, there is no historic mining in the high grade areas of the Hill zone, so all the mineral is still in place. This discovery significantly enhances the mineral potential of the 60% of the property which lies north of the Canyon Fault. Drilling in the Hill Zone indicates three parallel zones of mineralization, each of which is comparable in width and grade to the single mineralized zone found in the Independence Shallow Target to the south.

Mill & Building On Site

A relatively intact 50 to 75 ton per day Counter Current – Decantation cyanide mill was situated on the property. We determined that the equipment contributes no value to the future operations of the Company and was removed from the property and discarded during the quarter ended January 31, 2012.

Mineral Ownership

The Wilson-Independence claims are 100% controlled by our Company.

Accomplishments

During the quarter ended January 31, 2012, our Company:

|

1.

|

engaged Mine Development Associates of Reno, Nevada to complete a pit optimization study.

|

|

|

2.

|

updated Technical report in the Canadian National Instrument 43-101 format from the qualified person responding to the letter of requested clarifications from TSX-V. Resubmission is projected prior to the close of the 2012 fiscal year.

|

|

|

3.

|

received approval on the completion of the plan to remediate the old Independence Mill site by the Bureau of Land Management.

|

|

|

4.

|

laid the foundation for further significant progress in the project and received approximately $115,000 in additional funding.

|

|

|

5.

|

initiated the preparation of the Preliminary Economic Assessment for the Independence Project (PEA), which will indicate initial capital requirements and operating costs and identifies potential areas to increase economic value.

|

Plan of Operations- Permitting and Development Program

During the next twelve months, our company is undertaking a program to move the Independence project toward production. We anticipate being able to secure necessary studies and permits to allow us to proceed to production.

We anticipate initially mining the Hill Zone and are completing all necessary work to be able to finalize permits to allow us to begin there. Additional drilling and assaying planned to further delineate the Hill Zone mineralization will allow us to maximize our cash flows early in the production cycle.

10

The following budget outline presents the anticipated and necessary expenditures for the next twelve month period to move the Independence Project forward to the brink of production in the coming twelve months.

|

Direct exploration and development costs

|

||||

|

QA-QC assay work

|

$

|

57,000

|

||

|

Land payments

|

120,000

|

|||

|

Preliminary economic assessment (PEA)

|

400,000

|

|||

|

Geostatistics, block modeling and pit design

|

||||

|

Metallurgical testing programs

|

||||

|

Mine scheduling and costing

|

||||

|

Project permitting, State and County Permits

|

100,000

|

|||

|

Engineering and design

|

68,000

|

|||

|

Environmental Studies and additional permitting costs

|

50,000

|

|||

|

Assay program on core from deep target drilling

|

225,000

|

|||

|

Drill, and case water well

|

35,000

|

|||

|

Report completion costs

|

25,000

|

|||

|

Contingency

|

300,000

|

|||

|

Total direct exploration and development costs

|

$

|

1,380,000

|

||

|

Indirect costs

|

||||

|

Office rent and other operating expenses

|

$

|

80,000

|

||

|

Wages and salaries and payroll related expenses

|

200,000

|

|||

|

Investor relations expenses

|

50,000

|

|||

|

Insurance expenses

|

40,000

|

|||

|

Other general and administrative expenses

|

20,000

|

|||

|

Legal expenses

|

30,000

|

|||

|

Total indirect costs

|

$

|

420,000

|

||

|

Total budget for next twelve months

|

$

|

1,800,000

|

||

Liquidity and Capital Requirements

We anticipate that to proceed with our plan of operations we will require additional funds of approximately $2.0 million over the next twelve months, exclusive of any acquisition costs. As we do not have the funds necessary to cover our projected operating expenses for the next twelve month period, we will be required to raise additional funds through the issuance of equity securities, through loans or through debt financing. There can be no assurance that we will be successful in raising the required capital or that actual cash requirements will not exceed our estimates. We intend to fulfill any additional cash requirement through the sale of our equity securities.

If we are not able to obtain the additional financing on a timely basis, if and when it is needed, we will be forced to scale down or perhaps even cease the operation of our business.

The continuation of our business is dependent upon obtaining further financing, a successful program of exploration and/or development, and, finally, achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to obtain further funds required for our continued operations. As noted herein, we are pursuing various financing alternatives to meet our immediate and long-term financial requirements. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our other obligations as they become due. In such event, we will be forced to scale down or perhaps even cease our operations.

We continue to explore opportunities for the receipt of funding in either equity or financing transactions. As we receive these funds, the Board of Directors and Management evaluate the best use of the funding received so as to continue on the path to production while maintaining compliance with applicable laws and regulations.

11

Capital Expenditures

We do not intend to invest in capital expenditures during the twelve-month period ending January 31, 2013.

General and Administrative/Management and Consulting Expenses

We expect to spend up to $420,000 during the twelve-month period ending January 31, 2013 on general and administrative and investor relations expenses including legal and auditing fees, rent, office equipment and other administrative related expenses.

Exploration and Development

The exploration and development program currently being executed by our company includes the beginning of the permitting process to move the Independence Project toward production. We expect to expedite this process which will require additional funds of approximately $1.38 million over the next twelve months, exclusive of any acquisition or construction costs.

Corporate Offices

Our principal business offices are located at 1155 West Fourth Street, Suite 210, Reno, NV 89503. We currently obtain our space rent free. We believe that our current arrangements provide adequate space for our foreseeable future needs.

On April 28, 2009, we purchased a 480 acre parcel of private land which will be used for mineral processing, equipment storage and maintenance. The full purchase price was $67,767 with 30% down and the balance by way of seller financing at 10% per annum for a period of 10 years with quarterly payments of $1,874 with no pre-payment penalty. Legal Description: Township 30 North, Range 43 East, M.D.M., Section 17 N/2, SW/4 comprising 480 acres.

Employees

We anticipate adding two part time employees during the next quarter and one fulltime operations professional in the next 12 month period. We do and will continue to outsource services as needed. As at January 31, 2012, our only employee was our President, CEO, and CFO.

Critical Accounting Estimates

There have been no material changes to our critical accounting estimates since the end of our 2011 fiscal year. For detailed information on our critical accounting policies and estimates, see our Annual Report on Form 10-K for the fiscal year ended April 30, 2011.

Results of Operations – Three Months Ended January 31, 2012 and 2011

The following summary of our results of operations should be read in conjunction with our financial statements for the quarter months ended January 31, 2012 which are included herein.

Our operating results for the three months ended January 31, 2012 and 2011 and the changes between those periods for the respective items are summarized as follows:

|

Three Months Ended

January 31

|

||||||||||||

|

2012

|

2011

|

Change

|

||||||||||

|

Revenue

|

$

|

Nil

|

$

|

Nil

|

$

|

Nil

|

||||||

|

Operating expenses

|

$

|

180,532

|

$

|

131,809

|

$

|

48,723

|

|

|||||

|

Net (loss)

|

$

|

(182,542

|

)

|

$

|

(129,806

|

)

|

$

|

52,736

|

|

|||

12

Revenues

We have not earned any revenues from our primary activities since our inception and we do not anticipate earning revenues in the near future.

Net Loss

The increase in net loss from the period ended January 31, 2011 compared to January 31, 2012 relates primarily to the increased Board of Directors Compensation fees and fees paid to investor relation consultants and fundraising expenses. We anticipate net losses in future periods as we continue to work toward our goal of near term production at the Independence mine site.

Operating Expenses

Our operating expenses for the three months ended January 31, 2012 and 2011 are outlined in the table below:

|

Three Months Ended

January 31

|

||||||||||||

|

2012

|

2011

|

Change

|

||||||||||

|

Depreciation and amortization

|

$

|

1,338

|

$

|

1,338

|

$

|

-

|

||||||

|

General and administrative

|

$

|

20,496

|

$

|

5,764

|

$

|

14,732

|

|

|||||

|

Management and consulting

|

$

|

139,668

|

$

|

68,084

|

$

|

71,584

|

|

|||||

|

Exploration and development

|

$

|

(948

|

)

|

$

|

16,981

|

$

|

(17,929

|

) | ||||

|

Professional fees

|

$

|

19,958

|

$

|

39,642

|

$

|

(19,684

|

) | |||||

The increase in operating expenses for the three months ended January 31, 2012, compared to the same period in fiscal 2011, was mainly due to an increase in general and administrative expenses of $15,000 from increased premise rent. Management and consulting increased $71,584 as a result of expenditures on fundraising expenses and in travel and meals expenses not spent in the three months ended January 31, 2011. Exploration costs decreased by $17,929 from the three months ended January 31, 2011 compared to the three months ended January 31, 2012 due to a reduction in a prior period accrual.

Results of Operations – Nine Months Ended January 31, 2012 and 2011

The following summary of our results of operations should be read in conjunction with our financial statements nine months ended January 31, 2012 which are included herein.

Our operating results for the nine months ended January 31, 2012 and 2011 and the changes between those periods for the respective items are summarized as follows:

|

Nine Months Ended

January 31

|

||||||||||||

|

2012

|

2011

|

Change

|

||||||||||

|

Revenue

|

$

|

Nil

|

$

|

Nil

|

$

|

Nil

|

||||||

|

Operating expenses

|

$

|

642,666

|

$

|

421,348

|

$

|

221,318

|

|

|||||

|

Net (loss)

|

$

|

(648,814

|

)

|

$

|

(455,669

|

)

|

$

|

193,145

|

|

|||

Revenues

We have not earned any revenues from our primary activities since our inception and we do not anticipate earning revenues in the near future.

13

Net Loss

The increase in net loss from the nine months ended January 31, 2012 to January 31, 2011 relates primarily to the increased Board of Directors Compensation fees and fees paid to investor relation consultants and fundraising expenses. We anticipate net losses in future periods as we continue to work toward our goal of near term production at the Independence mine site.

Operating Expenses

Our operating expenses for the nine months ended January 31, 2012 and 2011 are outlined in the table below:

|

Nine Months Ended

January 31

|

||||||||||||

|

2012

|

2011

|

Change

|

||||||||||

|

Depreciation and amortization

|

$

|

4,013

|

$

|

4,013

|

$

|

-

|

||||||

|

General and administrative

|

$

|

66,402

|

$

|

49,817

|

$

|

16,585

|

|

|||||

|

Management and consulting

|

$

|

410,293

|

$

|

186,305

|

$

|

223,988

|

|

|||||

|

Exploration and development

|

$

|

71,128

|

$

|

81,746

|

$

|

(10,618

|

) | |||||

|

Professional fees

|

$

|

90,830

|

$

|

99,467

|

$

|

(8,637

|

) | |||||

The increase in operating expenses for the nine months ended January 31, 2012, compared to the same period in fiscal 2011, was mainly due to an increase in management and consulting of $223,988 which related to $80,000 in Directors fees, $90,000 on investor relations, $30,000 on fundraising expenses and $23,000 in travel and meals expenses. Exploration costs decreased by $10,618 for the nine months ended January 31, 2012 compared to the nine months ended January 31, 2011 on a reduction of a prior period accrual. Professional fees decreased due to a reduction in legal fees.

We have focused our energy during this quarter on securing financing and energizing the permitting process with all charges being classified as development, in order to bring the Independence Project closer to production. We anticipate that management and consulting costs will decrease in the future as we do not anticipate entering into additional significant investor relations contracts.

Liquidity and Financial Condition

Working Capital

|

|

January 31,

2012

|

April 30,

2011

|

Change

|

|||||||||

|

Current assets

|

$

|

30,700

|

$

|

53,948

|

$

|

(23,248

|

)

|

|||||

|

Current liabilities

|

$

|

618,234

|

$

|

607,424

|

$

|

10,810

|

|

|||||

|

Working Capital

|

$

|

(587,534

|

)

|

$

|

(553,476

|

)

|

$

|

(34,058

|

)

|

|||

Cashflow

|

Nine Months Ended

January 31

|

||||||||||||

|

2012

|

2011

|

Change

|

||||||||||

|

Net cash used in operating activities

|

$

|

(411,260

|

)

|

$

|

(467,713

|

)

|

$

|

(56,453

|

) | |||

|

Net cash provided/(used) in investing activities

|

$

|

-

|

$

|

145,644

|

$

|

(145,644

|

)

|

|||||

|

Net cash provided/(used) by financing activities

|

$

|

410,744

|

$

|

522,177

|

$

|

(111,433

|

)

|

|||||

Our total assets at January 31, 2012 were $754,554. Our financial statements report a net loss of $648,814 for the nine months ended January 31, 2012 and a net loss of $11,130,347 for the period from March 15, 2006 (date of inception) to January 31, 2012. We had a cash balance of $13,641 as of January 31, 2012.

We have suffered recurring losses from operations. The continuation of our company is dependent upon our company attaining and maintaining profitable operations and raising additional capital as needed. In this regard we have raised additional capital through equity offerings and loan transactions. We have been successful in structuring deals in which expenses are paid for through the issuances of common shares.

14

We continue to explore and seek for funding opportunities through either equity or loan transactions. As we receive funding, the use of available funding is evaluated by Management and the Board of Directors for its priority of use.

Our principal sources of funds have been from sales of our common stock.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Recently Issued Accounting Standards

No new accounting pronouncements have been issued since the filing of the Company’s Form 10-K on August 15, 2011 for the fiscal year ended April 30, 2011 that are likely to have a material impact on the Company’s financial position, results of operations, or cash flows.

ITEM 4. CONTROLS AND PROCEDURES

Management’s Report on Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to our management, including our president (also our principal executive officer) and our chief financial officer (also our principal financial officer and principal accounting officer) to allow for timely decisions regarding required disclosure.

As of January 31, 2012, the end of our quarter covered by this report, we carried out an evaluation, under the supervision and with the participation of our president (also our principal executive officer) and our chief financial officer (also our principal financial and accounting officer), of the effectiveness of the design and operation of our disclosure controls and procedures. Based on the foregoing, our President (who is acting as our principal executive officer) and our Chief Financial Officer (who is acting as our principal financial officer and principle accounting officer) concluded that our disclosure controls and procedures were effective as of the end of the period covered by this quarterly report.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal controls over financial reporting that occurred during our quarter ended January 31, 2012 that have materially or are reasonably likely to materially affect, our internal controls over financial reporting.

PART II

OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

Our company is not a party to any pending legal proceeding and no legal proceeding is contemplated or threatened as of the date of this quarterly report.

15

ITEM 1A. RISK FACTORS

Risks Related To Our Business:

We do not expect positive cash flow from operations in the near term. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business.

We do not expect positive cash flow from operations in this fiscal year. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that:

- drilling, exploration and completion costs for our Independence mine project increase beyond our expectations; or

- we encounter greater costs associated with general and administrative expenses or offering costs.

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed.

Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us which is dependent upon the Company receiving shareholder approval for an increase in the number of authorized shares.. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have no history of revenues from operations and have no significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. The success of our company is significantly dependent on a successful acquisition, drilling, completion and production program. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted, developing commercial reserves of gold and silver.

16

Our properties are in the exploration stage only and are without known reserves of gold and silver. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of gold, silver or other minerals, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

As our properties are in the exploration and development stage there can be no assurance that we will establish commercial discoveries on our properties.

Exploration for mineral reserves is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing mines. Our properties are in the exploration and development stage only and are without proven reserves. We may not establish commercial discoveries on any of our properties.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration programs do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue exploration on our Nevada mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of precious metals on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

17

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

If our exploration costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with exploration of our mineral properties on the basis of estimated exploration costs. If our exploration costs are greater than anticipated, then we will not be able to carry out all the exploration of the properties that we intend to carry out. Factors that could cause exploration costs to increase are: adverse weather conditions, difficult terrain and shortages of qualified personnel.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

As we undertake exploration of our mineral claim, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Our By-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

18

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 550,000,000 shares of common stock with a par value of $0.001 and 50,000,000 preferred shares with a par value of $0.001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

Some of our directors and officers are residents of countries other than the United States and investors may have difficulty enforcing any judgments against such persons within the United States.

Some of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Risks Associated With Our Common Stock:

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations and the Financial Industry Regulatory Authority’s sales practice requirements, which may limit a stockholder's ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

19

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

The following provides additional information for certain stock transactions that occurred during the nine months ended January 31, 2012. For additional details for all stock transactions, prior to the beginning of the fiscal year ended April 30, 2012, please see the consolidated statement of changes in stockholders’ equity as reported in the Company’s 10-K for the period ended April 30, 2011 and filed with the Securities Exchange Commission on August 15, 2011.

During the three months ended July 31, 2012, we issued a total of 6,444,444 shares; 2,000,000 shares were issued for services valued at $76,000; and 4,444,444 shares were issued to an investor in a private placement at $0.0225 per share for receipt of cash totaling $100,000.

During the three months ended October 31, 2012, we issued a total of 10,788,339 shares; 2,160,562 shares were issued for services valued at $60,503; 6,327,777 shares were issued to investors in private placements at $0.0225 per share for receipt of cash totaling $142,375; and 2,300,000 shares were issued to investors in private placements at $0.025 per share for receipt of cash totaling $57,500.

During the three months ended January 31, 2012, we issued a total of 7,291,180 shares; 2,485,625 shares were issued for services valued at $63,862; 2,405,555 shares were issued to investors in private placements at $0.0225 per share for receipt of cash totaling $54,125; and 2,400,000 shares were issued to investors in private placements at $0.025 per share for receipt of cash totaling $60,000.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. [REMOVED AND RESERVED]

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

|

Item

|

Description

|

|

|

(3)

|

Articles of Incorporation and By-laws

|

|

|

3.1

|

Certificate of Incorporation (incorporated by reference from our Registration Statement on Form 10-SB12G filed on August 24, 1999)

|

|

|

3.2

|

By-Laws (incorporated by reference from our Registration Statement on Form 10-SB12G filed on August 24, 1999)

|

|

|

3.3

|

Amendment to Certificate of Incorporation (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

|

|

(10)

|

Material Contracts

|

|

|

10.1

|

Letter of Intent between General Gold Corporation and Gold Range, LLC dated November 14, 2004 (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

20

|

10.2

|

Amendment to Letter of Intent between General Gold Corporation and Gold Range, LLC dated December 31, 2004 (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006).=

|

|

|

10.3

|

Assignment of Lease Agreement between General Gold Corporation and Gold Range Company, LLC dated April 29, 2005 (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

|

|

10.4

|

Assignment of Lease and Consent Agreement between Independence Gold-Silver Mines Inc., Gold Range Company, LLC and General Gold Corporation dated June 29, 2005 (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

|

|

10.5

|

Lease Agreement between Independence Gold-Silver Mines Inc. and Gold Range Company, LLC dated July 13, 2005 (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

|

|

10.6

|

Share Purchase Agreement dated July 20, 2006 among General Gold Corporation, Recov Energy Corp. and the selling shareholders of General Gold Corporation (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

|

|

10.7

|

Share Purchase Agreement dated March 15, 2007 between our company and Sanibel Investments Ltd. (incorporated by reference from our Current Report on Form 8-K filed on March 22, 2007).

|

|

|

(14)

|

Code of Ethics

|

|

|

14.1

|

Code of Ethics (incorporated by reference from our Annual Report on Form 10-KSB filed on August 15, 2006)

|

|

|

(21)

|

Subsidiaries

|

|

|

General Gold Corporation, a Nevada company

|

||

|

(31)

|

Section 302 Certification

|

|

|

31.1

|

Section 302 Certification of the Sarbanes-Oxley Act of 2002 (filed herewith)

|

|

|

31.2

|

Section 302 Certification of the Sarbanes-Oxley Act of 2002 (filed herewith)

|

|

|

(32)

|

Section 906 Certification

|

|

|

32.1

|

Section 906 Certification of the Sarbanes-Oxley Act of 2002 (filed herewith)

|

|

|

32.2

|