Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Cibolan Gold Corp | gnmt_ex231.htm |

| EX-31.2 - CERTIFICATION - Cibolan Gold Corp | gnmt_ex312.htm |

| EX-32.1 - CERTIFICATION - Cibolan Gold Corp | gnmt_ex321.htm |

| EX-32.2 - CERTIFICATION - Cibolan Gold Corp | gnmt_ex322.htm |

| EX-31.1 - CERTIFICATION - Cibolan Gold Corp | gnmt_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended April 30, 2010

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ______________________ to ______________________

Commission file number 000-30230

|

General Metals Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

65-0488983

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

615 Sierra Rose Drive, Suite 1, Reno, NV

|

89511

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

|

775-583-4636

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

|

N/A

|

|

(Title of class)

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act.

|

||||||

|

Yes o No þ

|

||||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

|

||||||

|

Yes o No þ

|

||||||

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.

|

||||||

|

Yes þ No o

|

||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

||||||

|

Yes o No o

|

||||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

||||||

|

o

|

||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

||||||

|

Large accelerated filer

|

o

|

Accelerated filer

|

o |

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

||||||

|

Yes o Noþ

|

||||||

The aggregate market value of Common Stock held by non-affiliates of the Registrant on October 31, 2009 was $11,743,255 based on a $0.06 closing price for the Common Stock on October 30, 2009. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

|

|

219,821,625 shares of common stock issued & outstanding as of August 11, 2010

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| Item 1. | Business | 1 | |||

| Item 1A. | Risk Factors | 3 | |||

| Item 2. | Properties | 7 | |||

| Item 3. | Legal Proceedings | 10 | |||

| Item 4. | Submissions of Matters to a Vote of Security Holders | 10 | |||

| Item 5. | Market for Common Equity and Related Stockholder Matters | 11 | |||

| Item 6. | Selected Financial Data | 15 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 | |||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 26 | |||

| Item 8. | Financial Statements and Supplementary Data | 26 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 59 | |||

| Item 9A (T). | Controls and Procedures | 50 | |||

| Item 9B. | Other Information | 52 | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 53 | |||

| Item 11. | Executive Compensation | 59 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 61 | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 61 | |||

| Item 14. | Principal Accountants Fees and Services | 62 | |||

| Item 15. | Exhibits, Financial Statement Schedules | 63 |

i

PART I

|

ITEM 1.

|

BUSINESS

|

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our company”, mean General Metals Corporation a Delaware corporation and our subsidiary, General Gold Corporation, a Nevada corporation, unless otherwise indicated.

Corporate History

We were organized in the State of New Jersey on March 4, 1995 under the name Interactive Multimedia Network, Inc. We were reincorporated in the State of Delaware on September 13, 1995. We changed our name to RECOV Energy Corp. effective March 29, 2005. On or about January 12, 2006 we changed our name to General Metals Corporation.

On January 20, 2006, we entered into a Share Purchase Agreement with General Gold Corporation, a Nevada company incorporated on July 17, 1998, and the former shareholders of General Gold set out in the Agreement. The closing of the transactions contemplated in the Agreement and the acquisition by our company of all of the issued and outstanding and convertible securities of General Gold occurred on March 15, 2006.

Our business office is located at 615 Sierra Rose Drive, Suite 1, Reno, NV 89511. This is our mailing address as well. Our telephone number is 775-583-4636.

There is no assurance that a commercially viable mineral deposit exists on the property and further exploration will be required before a final evaluation as to the economic feasibility is determined.

We have no plans to change its business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans.

1

Our Current Business

We are a junior mineral resource company engaged in the acquisition, exploration, development and mining of gold, silver and other precious and base metal properties.

In April 2005, we acquired through the assignment of a lease certain unpatented mining claims located in the Battle Mountain District, Lander County, State of Nevada, as more particularly described in the lease, known also as the “Independence Mine”. In August 2007 we expanded the Independence Mine by adding four mining claims and 2 additional easements. These claims cover the area where the existing cyanide decantation mill and operating facilities are currently sited and the area where the Pioneer haul road to and from the Sunshine pit crosses the Independence claims; specifically, Independence #1, #2, DC#83 and An Old Glory. Since acquiring the lease, and additional mining claims and easements, our exploration and development activities have been focused on getting the Independence Mine into production. See Item 2 Properties for a more detailed discussion.

The purchase price paid by us to Gold Range, LLC in consideration for the assignment of the lease was $75,000, 5,000,000 of our restricted common shares and a 1% net smelter return royalty payable to Gold Range, LLC in addition to other underlying net smelter return requirements.

On March 15, 2007, we acquired a 100% interest in Mikite Gold Resources, a Ghanaian corporation with exclusive exploration rights to the 150 square kilometer Nyinahin mining concession near Bibiani, Ghana. On October 31, 2008 we sold all of our interest in the Nyinahin mining concession for $500,000 in cash, and 2,000,000 restricted shares of common stock of Sunergy Inc. On November 3, 2008, we received a partial payment of $12,500 due on the principal payment as noted under the agreement for the sale of the Nyinahin Mining. On December 5, 2008, we amended the agreement with Sunergy to allow for the remainder of the initial payment to be made on or before December 31, 2008. On December 30, 2008, we accepted 500,000 freely tradable shares as a $250,000 payment on the purchase price in lieu of cash. As of April 30, 2009, we received stock consideration from Sunergy as noted in the agreements above. On or about July 29, 2009, we entered into an agreement with Sunergy, Inc for the final terms for the sale of the Nyinahin Mining Concession to Sunergy. Pursuant to the agreement with General Metals, as amended, the outstanding consideration payable by Sunergy consisted of 2,000,000 shares of common stock of Sunergy in satisfaction of $237,500, which was due on April 30, 2010. Subsequent to April 30, 2010, General Metals sold its rights to collect the $237,500 or the 2,000,000 shares remaining outstanding on the agreement to third parties for $75,000. The Company retains a 5% Net Smelter Return Royalty in the property.

In addition to the on-going development of the Independence Mine, we are continually seeking to acquire other mining claims, as our funding permits.

Competition

The mining industry is intensely competitive. We compete with numerous individuals and companies, including many major mining companies, which have substantially greater technical, financial and operational resources and staffs. Accordingly, there is a high degree of competition for access to funds. There are other competitors that have operations in the area and the presence of these competitors could adversely affect our ability to compete for financing and obtain the service providers, staff or equipment necessary for the exploration and exploitation of our properties.

Compliance with Government Regulation

Mining operations and exploration activities are subject to various national, state, provincial and local laws and regulations in the United States, as well as other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters.

We believe that we are and will continue to be in compliance in all material respects with applicable statutes and the regulations passed in the United States. There are no current orders or directions relating to our company with respect to the foregoing laws and regulations.

2

Employees

Currently our only employees are our directors, officers, office administrator and an investor relations consultant. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

Going Concern

We anticipate that additional funding will be required in the form of equity financing from the sale of our common stock. At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations over the next twelve months. We do not have any definitive arrangements in place for any future equity financing.

Subsidiaries

General Gold Corporation, a Nevada corporation is our wholly owned subsidiary.

REPORTS TO SECURITY HOLDERS

We are not required to deliver an annual report to our stockholders but will voluntarily send this form 10-K report which includes our annual audited financial statements upon request. We are required to file annual, quarterly and current reports, proxy statements, and other information with the Securities and Exchange Commission. Our Securities and Exchange Commission filings are available to the public over the Internet at the SEC's website at http://www.sec.gov.

The public may read and copy any materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Internet address of the site is http://www.sec.gov.

|

ITEM 1A.

|

RISK FACTORS

|

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections and estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results may vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”.

Risks Related To Our Business:

We do not expect positive cash flow from operations in the near term. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business.

We do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that:

- drilling, exploration and completion costs for our Independence mine project increase beyond our expectations; or

- we encounter greater costs associated with general and administrative expenses or offering costs.

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

3

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed.

Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have no history of revenues from operations and limited tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. The success of our company is significantly dependent on a successful acquisition, drilling, completion and production program. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted, developing commercial reserves of gold and silver. Our properties are in the exploration stage only and are without known reserves of gold and silver. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of gold, silver or other minerals, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

As our properties are in the exploration and development stage there can be no assurance that we will establish commercial discoveries on our properties.

Exploration for mineral reserves is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing mines. Our properties are in the exploration and development stage only and are without proven reserves. We may not establish commercial discoveries on any of our properties.

4

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration programs do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue exploration on our mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of precious metals on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

If our exploration costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with exploration of our mineral properties on the basis of estimated exploration costs. If our exploration costs are greater than anticipated, then we will not be able to carry out all the exploration of the properties that we intend to carry out. Factors that could cause exploration costs to increase are: adverse weather conditions, difficult terrain and shortages of qualified personnel.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

5

As we undertake exploration of our mineral claim, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several Federal and State governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Nevada and the regulations of the Bureau of Land Management as we carry out our exploration programs. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Our By-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares for significant amount of services or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 500,000,000 shares of common stock with a par value of $0.001 and 50,000,000 preferred shares with a par value of $0.001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

Some of our directors and officers are residents of countries other than the United States and investors may have difficulty enforcing any judgments against such persons within the United States.

Some of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

6

Risks Associated With Our Common Stock:

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations and the Financial Industry Regulatory Authority’s sales practice requirements, which may limit a stockholder's ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

As a “smaller reporting company”, we are not required to provide the information required by this Item.

ITEM 2. PROPERTIES

On April 28, 2009, we purchased a 480 acre of private land which will be used for mineral processing, equipment storage and maintenance. The full purchase price was $67,767 with 30% down and the balance by way of seller. The financing carries an interest rate of 10% per annum for a period of 10 years with quarterly payments of $1,874 with no pre-payment penalty. Legal Description: Township 30 North, Range 43 East, M.D.M., Section 17 N/2, SW/4 comprising 480 acres.

Our principal business offices are located 615 Sierra Rose Drive, Suite 1, Reno, NV 89511. We currently lease our space at an annual cost of $32,256. We believe that our current lease arrangements provide adequate space for our foreseeable future needs.

7

The Independence Mine Property

We currently control a 100% undivided leasehold interest in the Wilson-Independence Gold – Silver Mine, situated in the Battle Mountain Mining District, Lander County, Nevada. The property consists of 14 whole and fractional mining claims encompassing 240 acres. Due diligence completed by our company shows that all claims are valid and in good standing through and for the assessment year ending August 31, 2010.

The Wilson-Independence project is wholly owned by General Metals though it subsidiary company General Gold Corporation under a mining lease/option agreement with Independence Gold Silver Mines of Seattle, Washington. Under the terms of the agreement General Metals was required to expend a minimum of $625,000 towards exploration development and commercial production of ores, minerals or materials which expenditure was fulfilled prior to our fiscal year ended April 30, 2008. During the year ended April, 30, 2010, we spent approximately $910,000 on exploration and development including the initiation of the permitting process.

The term of the lease is for a period of 20 years commencing October 1, 2005. There is a production royalty payable for the sale of all gold, silver or platinum based upon the average daily price of gold on the London Metal Exchange as follows: 3% when the price of gold per ounce is less than $375, 4% when the price of gold per ounce is between $375 and $475 and 5% when the price of gold is over $475. There is also a production royalty of 3% payable on the sale of all substances other than gold, silver and platinum. In addition, any future production is subject to a 1% net smelter royalty obligation payable to Gold Range, LLC.

We have the option to purchase the property for $3.0 million (which eliminates the royalty described above) within 10 years of the date the lease commenced provided all obligations have been met.

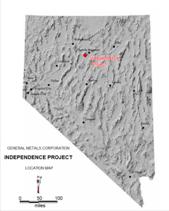

Location and Access

|

All infrastructure necessary for the exploration, development and operation of a mine is readily available. The property is accessed via federal, state and county maintained all weather paved and gravel roads from the nearby town of Battle Mountain. A well-trained work force is available in the town of Battle Mountain, situated 30 miles north of the property along Interstate highway 80. Adequate ground water is available for diversion for future mining operations which enjoy special treatment as temporary or interim uses under Nevada water laws. Electrical power has recently been extended to within one mile of the project to service the Phoenix project, and the transcontinental natural gas line passes within 1.5 miles of the property. | |

| The property has been the site of intermittent historic exploration and mining activities since the late 1920s. Past mining operations extracted 65,000 tons of high grade gold and silver ores from the property. The bulk of this activity occurred during two periods, the first from high grade ores shipped for direct smelting during the late 1940s and early 1950s, and a second from 1975 to 1983 when a significant amount of underground development took place, and a mill erected on the property. During its peak period of production in 1976 the mine shipped up to 1 ton of gold and silver bullion per month. |

The Independence Mines property consists of 14 whole and fractional unpatented lode mining claims, which cover approximately 240 acres.

8

Core and reverse circulation drilling to date indicate two targets. These two targets are referred to as the Independence Deep (A Target), and the Independence Surface (B Target). Historic mining operations have generated in excess of 70,000 tons of waste dumps, mill tailings, and other waste rock products on the property. Samples of this material contain gold and silver values which suggest potential to recover gold and silver values.

The Wilson-Independence Property covers a mineralized zone on strike with the World Class, Fortitude / Phoenix Gold Skarn Deposit. The property has potential to develop a high grade underground resource in the Antler Sequence, together with a shallow, near surface resource in the overlying Pumpernickel Formation. Situated at the intersection of the Battle Mountain-Eureka Gold Trend and the Northern Nevada Rift (Twin Creeks-McCoy lineament), the Independence Project, like Fortitude and Cove/McCoy, is one of a number of Gold Skarns which occur along the Battle Mountain – Eureka and Northern Nevada Rift Zone mineral lineaments.

Mineralized outcrops are common on the property. Many on the southern part of the property have been prospected by shallow prospect shafts, pits and trenches. In addition, over 100 Reverse Circulation and Core holes, and extensive shallow underground mine workings in the Independence Mine indicate wide spread, shallow, near surface mineralization which we feel represents a valid exploration target for potential future surface, bulk mining operations

Historic drilling and underground mine workings indicate wide spread mineralization, both in shallow, near surface, and deep targets. There are presently no identified reserves or resources on the property. We intend to conduct phased exploration programs to evaluate the mineral potential of this property, with the objective of identifying and developing mineral resources and reserves reportable under SEC Industry Guide 7.

Independence Deep Target

A large body of mineralized material is clearly indicated by previous drilling in the Deep Target. It is likely that proper logging and subsequent geologic modeling has potential to result in the identification of an economic resource. All core, approximately 25,000 feet, is stored on site, and re-logging was completed during the summer of 2006

Mineralization identified in the deep target to date is contained in the lower plate of the Golconda Thrust in rocks of the Battle Mountain and Edna Formations of the Antler Sequence.

Independence Shallow Target

Promising shallow and near surface mineralization has been identified. The Shallow Target contains an oxide target hosted entirely in the Pumpernickel Formation. To date over 130 drill holes and roughly eight (8) miles of underground workings have penetrated portions of this target, all of which have encountered highly anomalous to high grade mineralization. The principle limiting factor for surface/ shallow resources has been the lack of drilling information. . In addition, review of the work done by those which held interests in the property previously has identified a total of 8 shallow near surface mineralized targets on the property with 4 of those being north of the Canyon Fault and 3 others where no mining has been performed and minimal geologic sampling and drilling work completed. To date, we spent over $1.0 million drilling sampling and evaluating these targets. A report on the detailed review of these targets and the results of the exploration and development program follows in Item 7 Management's Discussion and Analysis or Plan of Operation.

Mill & Building On Site

A relatively intact 50 to 75 ton per day Counter Current – Decantation cyanide mill is situated on the property. The present condition of the jaw crusher, cone crusher and ball mill are being evaluated and could possibly be returned to serviceable condition. A complete set of new rubber liners for the ball mill are on site. The mill is housed in a metal clad building erected in 1987.

Mineral Ownership

The Wilson-Independence claims are 100% controlled by our company.

9

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

ITEM 4. [ REMOVED AND RESERVED ]

10

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The high and low bid prices of our common stock for the periods indicated below are as follows:

|

National Association of Securities Dealers OTC Bulletin Board(1)

|

||

|

Quarter Ended

|

High

|

Low

|

|

April 30, 2010

|

$0.05

|

$0.03

|

|

January 31, 2010

|

$0.07

|

$0.04

|

|

October 31, 2009

|

$0.09

|

$0.04

|

|

July 31, 2009

|

$0.09

|

$0.02

|

|

April 30, 2009

|

$0.05

|

$0.02

|

|

January 31, 2009

|

$0.034

|

$0.012

|

|

October 31, 2008

|

$0.11

|

$0.025

|

|

July 31, 2008

|

$0.16

|

$0.071

|

|

April 30, 2008

|

$0.23

|

$0.09

|

|

January 31, 2008

|

$0.22

|

$0.14

|

|

October 31, 2007

|

$0.23

|

$0.12

|

|

July 31, 2007

|

$0.51

|

$0.20

|

|

April 30, 2007

|

$0.29

|

$0.082

|

(1) Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions.

Our shares of common stock are issued in registered form. The registrar and transfer agent for our shares of common stock is Nevada Agency and Transfer Company, 50 West Liberty Street, Suite 880, Reno, NV 89501 (Telephone: 1-775-322 0626; Facsimile: 1-775-322 5623).On August 7, 2010, the list of stockholders for our shares of common stock showed 338 registered stockholders and 219,821,625 shares of common stock outstanding.

Dividends

We have not declared any dividends on our common stock since the inception of our company on March 4, 1995. There is no restriction in our Articles of Incorporation and Bylaws that will limit our ability to pay dividends on our common stock. However, we do not anticipate declaring and paying dividends to our shareholders in the near future.

11

Equity Compensation Plan Information

We have no formal authorized Equity Compensation Plans. The Board grants warrants and/or stock when it deems appropriate. The following table provides a summary of the warrants outstanding, the weighted average price and number of securities remaining available for issuance, all as at April 30, 2010.

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|||

|

(a)

|

(b)

|

(c)

|

||||

|

Equity compensation plans approved by security holders

|

Nil

|

Nil

|

Nil

|

|||

|

Equity compensation plans not approved by security holders

|

Nil

|

Nil

|

Nil

|

|||

|

Total

|

Nil

|

Nil

|

Nil

|

|

Outstanding Equity Awards at Fiscal Year-End

|

The following table sets forth for each named executive officer and director certain information concerning the outstanding equity awards as of April 30, 2010.

|

Option Awards

|

Stock Awards

|

||||||||

|

Name

|

Number of Securities Underlying Unexercised Options Exercisable

|

Number of Securities Underlying Unexercised Options Unexercisable

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options

|

Option Exercise Price

|

Option Expiration Date

|

Number of Shares or Units of Stock that Have Not Vested

|

Market Value of Shares or Units of Stock that Have Not Vested

|

Equity Incentive Plan Awards : Number of Unearned Shares, Units or Other Rights that Have Not Vested

|

Equity Incentive Plan Awards : Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested

|

|

Stephen Parent(1)

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Robert Carrington(2)

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Paul Wang (3)

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Daniel Forbush

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

David Salari

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Larry M. Bigler

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

(1)

|

Mr. Parent resigned as President and a director January 28, 2010.

|

|

(2)

|

Mr. Carrington was appointed President and a director on January 28, 2010.

|

|

(3)

|

Mr. Wang was appointed a Director on March 11, 2010.

|

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during the year ended April 30, 2010.

12

Recent Sales of Unregistered Securities

The table below summarized the issuance of shares during the year ended April 30, 2008

|

Description

|

# of shares

|

|||

|

Common Stock issued to convert Debt at $0.075 per share

|

513,333 | |||

|

Common Stock Issued for Cash at $0.125 In Private Placement

|

667,040 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.075

|

2,520,979 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.20

|

654,500 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.125

|

44,000 | |||

|

Common Stock Issued for purchase of asset at $0.125

|

132,000 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.20

|

216,000 | |||

|

Common Stock Issued for Cash at $0.125 In Private Placement

|

52,470 | |||

|

Common Stock Issued for Cash at $0.20 In Private Placement

|

2,503,000 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.07

|

733,334 | |||

|

Common Stock Issued for Cash at $0.15 In Private Placement

|

900,000 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.068

|

146,667 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.10

|

110,000 | |||

|

Common Stock Issued in Exercise of Share Purchase warrants at $0.114

|

176,000 | |||

|

Common Stock Issued for services to the advisory board at $0.15

|

2,000,000 | |||

|

Common Stock Issued for Cash at $0.15 In Private Placement

|

100,000 | |||

|

Common Stock Issued in Exercise of Share Purchase warrants at $0.075

|

86,667 | |||

|

Common Stock Issued in Exercise of Share Purchase warrants at $0.114

|

2,200 | |||

|

Common Stock Issued for Cash at $0.20 In Private Placement

|

590,000 | |||

|

Common Shares issued for Cash at $0.15 In Private Placement

|

44,299 | |||

|

Common Stock Issued in Exercise of Share Purchase warrants at $0.068

|

146,300 | |||

|

Common Stock Issued for services at $0.125

|

100,000 | |||

|

Common Stock Issued for Cash at $0.20 In Private Placement

|

100,000 | |||

|

Common Stock Issued for Cash at $0.05 In Private Placement

|

400,000 | |||

|

Common Stock Issued in Exercise of Share Purchase warrants at $0.05

|

275,000 | |||

|

Common Stock Issued in Exercise of Share Purchase warrants at $0.085

|

29,412 | |||

|

Total

|

13,243,201 | |||

We issued the securities to accredited investor pursuant to exemptions from registration as set out in Rule 506 of Regulation D and/or Section 4(2) of the Securities Act of 1933, as amended.

13

The table below summarized the issuance of shares during the year ended April 30, 2009

|

Description

|

# of shares

|

|||

|

Cancellation of previously issued common stock

|

(180,000 | ) | ||

|

Common Stock Issued for Cash at $0.014 In Private Placement

|

7,000,000 | |||

|

Common Stock Issued for Cash at $0.015 In Private Placement

|

2,000,000 | |||

|

Common Stock Issued for Cash at $0.018 In Private Placement

|

1,000,000 | |||

|

Common Stock Issued for Cash at $0.02 In Private Placement

|

8,400,000 | |||

|

Common Stock Issued for Cash at $0.025 In Private Placement

|

2,502,000 | |||

|

Common Stock Issued for Cash at $0.05 In Private Placement

|

8,274,000 | |||

|

Common Stock Issued for Cash at $0.075 In Private Placement

|

870,000 | |||

|

Common Stock Issued for Cash at $0.10 In Private Placement

|

150,000 | |||

|

Common Stock Issued for Cash at $0.15 In Private Placement

|

416,000 | |||

|

Common Stock Issued for services at $0.017

|

750,000 | |||

|

Common Stock Issued for services at $0.02

|

3,500,000 | |||

|

Common Stock Issued for services at $0.021

|

4,250,000 | |||

|

Common Stock Issued for services at $0.024

|

2,500,000 | |||

|

Common Stock Issued for services at $0.025

|

1,000,000 | |||

|

Common Stock Issued for services at $0.029

|

581,396 | |||

|

Common Stock Issued for services at $0.03

|

10,000,000 | |||

|

Common Stock Issued for services at $0.036

|

11,000,000 | |||

|

Common Stock Issued for services at $0.05

|

3,100,000 | |||

|

Common Stock Issued for services at $0.075

|

838,000 | |||

|

Common Stock Issued for services at $0.08

|

4,147,000 | |||

|

Common Stock Issued for services at $0.086

|

2,000,000 | |||

|

Common Stock Issued for services at $0.10

|

150,000 | |||

|

Common Stock Issued in Exercise of Share Purchase Warrants at $0.085

|

33,930 | |||

|

Total

|

74,282,326 | |||

The table below summarized the issuance of shares during the year ended April 30, 2010

|

Description

|

# of shares

|

|||

|

Common Stock Issued for Cash at $0.15 in Private Placement

|

17,561,665 | |||

|

Common Stock Issued for Cash at $0.02 in Private Placement

|

1,605,000 | |||

|

Common Stock Issued for Cash at $0.022 in Private Placement

|

3,050,000 | |||

|

Common Stock Issued for Cash at $0.025 in Private Placement

|

700,000 | |||

|

Common Stock Issued for Cash at $0.033 in Private Placement

|

300,000 | |||

|

Common Stock Issued for Cash at $0.035 in Private Placement

|

240,000 | |||

|

Common Stock Issued for Cash at $0.04 in Private Placement

|

1,125,000 | |||

|

Common Stock Issued for Cash at $0.045 in Private Placement

|

7,047,300 | |||

|

Common Stock Issued for Cash at $0.05 in Private Placement

|

1,090,000 | |||

|

Common Stock Issued for services at $0.02

|

1,000,000 | |||

|

Common Stock Issued for services at $0.028

|

8,400,000 | |||

|

Common Stock Issued for services at $0.032

|

1,500,000 | |||

|

Common Stock Issued for services at $0.035

|

12,500 | |||

|

Common Stock Issued for services at $0.047

|

100,000 | |||

|

Common Stock Issued for services at $0.050

|

750,000 | |||

|

Common Stock Issued for services at $0.065

|

60,000 | |||

|

Common Stock Issued for services at $0.083

|

66,666 | |||

|

Common Stock Issued for Cash at $0.035 in Private Placement

|

314,300 | |||

|

Common Stock Issued for Cash at $0.045 in Private Placement

|

2,872,400 | |||

|

Common Stock Issued for services at $0.041

|

1,850,000 | |||

|

Common Stock Issued for services at $0.050

|

250,000 | |||

|

Common Stock Issued for Cash at $0.05 in Private Placement

|

440,000 | |||

|

Common Stock Issued for settlement of lawsuit at $0.05

|

1,000,000 | |||

|

Common Stock Issued for services at $0.048

|

500,000 | |||

|

Cancellation of Issued Common Stock due to non-payment on receivable

|

(996,700 | ) | ||

|

Common Stock Issued for services at $0.043

|

300,000 | |||

|

Total

|

51,138,131 | |||

14

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company”, we are not required to provide the information required by this Item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended April 30, 2010 and April 30, 2009 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this registration statement, particularly in the section entitled "Risk Factors" beginning on page 7 of this annual report.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Successes and Accomplishments Fiscal Year 2010

During the quarter ended July 31, 2009, our company:

|

1.

|

located all of the sample pulps from the historic (1985-1987) Noranda Minerals drilling in the Independence Gold Skarn target in the Independence Deep Target on our Independence Mine Property and inventoried this pulp library.

|

|

2.

|

validated the data base for the Independence Skarn assays.

|

|

3.

|

released the diamond drill results from the high grade Independence Gold Skarn Target at our Independence property in the Battle Mountain Mining District of Nevada. These intercepts are historic in nature and from diamond drilling conducted by Noranda Minerals from 1985 through 1989 and Great Basin Gold Corp. in 1998. Except for Great Basin Gold drill hole WI-001, none of these results have been previously disclosed.

|

|

4.

|

secured Great Basin Pulps from the High Grade Independence Gold Skarn Target

|

|

5.

|

through analysis and modeling of the Noranda and Great Basin Gold drilling in the Independence Gold Skarn system, identified a target more than half a mile wide and three quarters of a mile long which contains three highly prospective structural / stratigraphic zones.

|

|

6.

|

completed the baseline environmental surveys recently including flora, fauna and bat studies. The reports of these studies are in our company’s files.

|

|

7.

|

collected characterization samples to define appropriate material for bulk samples to be used in advanced metallurgical studies, received the assay results and selected the appropriate material for two bulk samples

|

|

8.

|

received the check assay results required to validate the 2007-2008 drilling results under evaluation for the Independent Report. These results are being evaluated by our company's independent qualified person.

|

|

9.

|

appointed Henry S. Brock, CPA, MBA, CLU, ChFC to our Advisory Board and as Vice President of our company

|

15

During the quarter ended October 31, 2009, our company:

|

1.

|

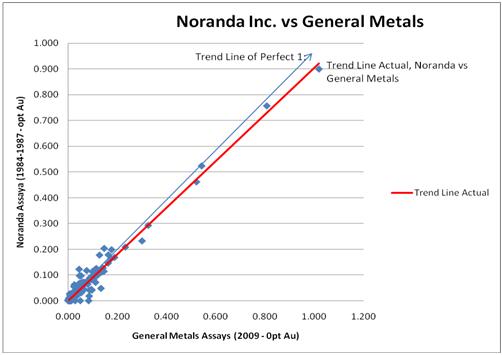

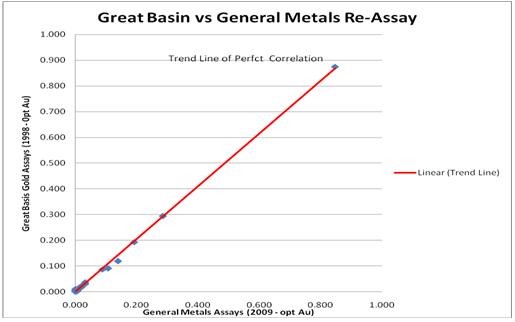

completed the QA/QC on all final re-assays for the major mineralized drill intercepts in the Independence Gold Skarn in the Independence Deep Target. The results correlate exceptionally well with original drill data by Noranda Exploration and Great Basin Gold. Re-assay of Noranda Exploration pulps from their 1984 - 1987 diamond core drilling program returned results that were consistently higher than original assays and on average four percent (4%) higher in grade than the original assays. Importantly, drift in higher grade samples consistently showed that the original Noranda assays underreported the gold content of the gold skarn as shown in Chart 1 below.

|

|

2.

|

collected and delivered two bulk samples of surface oxide mineralization for metallurgical testing including column leach tests at the Independence. The samples were collected under the supervision of personnel from McClelland Laboratories Inc. (McClelland) of Sparks, Nevada. Each sample weighed approximately 2 1/2 tons and both samples have been delivered to McClelland for processing.

|

|

3.

|

through General Gold Corporation, our wholly owned subsidiary, received a grant of water rights for portions of Sections 28 and 33 (T31N, R43E), in Lander County, NV, the proposed center of the Independence Mine's process area.

|

|

4.

|

received initial metallurgical characterization results for bulk samples of surface and near surface, oxide mineralization were completed by McClelland Metallurgical Laboratories of Sparks, Nevada during the quarter ended October 31, 2009. Both the Hill Zone and Independence South Zone samples indicate excellent solution access regardless of feed size with the 2 inch material returning essentially identical gold extraction and recovery in the same leach time as the minus 10 mesh material as seen in the following table.

|

16

Table 1. Gold and Silver Recovery Independence Bottle Roll Tests

|

Au

|

Ag

|

|||||

|

Feed

|

Recovery,

|

Recovery,

|

||||

|

Composite

|

Size

|

%

|

%

|

|||

|

Sample #1 (Hill Zone)

|

2"

|

82.5

|

22.2

|

|||

|

Sample #1 (Hill Zone)

|

1"

|

84.2

|

23.1

|

|||

|

Sample #1 (Hill Zone)

|

1/2"

|

81

|

21.4

|

|||

|

Sample #1 (Hill Zone)

|

10M

|

82.2

|

48.1

|

|||

|

Average

|

82.5

|

28.7

|

||||

|

Sample #2 (South Zone)

|

2"

|

63

|

22.2

|

|||

|

Sample #2 (South Zone)

|

1"

|

58.8

|

27.6

|

|||

|

Sample #2 (South Zone)

|

1/2"

|

61.1

|

30.8

|

|||

|

Sample #2 (South Zone)

|

10M

|

63.6

|

54.7

|

|||

|

Average

|

61.6

|

33.8

|

Test Results Suggest Improved Economics: All test results to date suggest that expensive crushing can be minimized and that Carbon column recovery may be a less expensive processing solution than the previously discussed Merrill Crowe system. Project economics may have improved substantially with these results.

|

5.

|

instructed McClelland to proceed immediately with a large diameter column leach test on the Hill Zone. McClelland will be conducting additional analytical and characterization work to better characterize the leach parameters to optimize leach results for the large diameter column leach in the South Zone. Due to the exceptional recovery in the coarse fractions of the bottle rolls, column leach tests of each sample will be conducted at 2 and 6 inch.

|

|

6.

|

received final approval and has satisfied the required bonding of the drilling permits with the Bureau of Land Management (BLM).

|

|

7.

|

completed 5 of the planned 44 hole 2009 drilling which is designed with three specific objectives:

|

|

a.

|

upgrade all the Hill Zone gold-silver mineralization into measured and indicated categories,

|

|

b.

|

provide sufficient drill density to identify higher grade zones within the Hill Zone mineralization, and

|

|

c.

|

provide sufficient detail to facilitate pit design and detailed mine planning.

|

17

During the quarter ended January 31, 2010, we:

|

1.

|

successfully completed the Company's 2009 - 2010 drilling program of 12,895 feet in 44 drill holes. This drilling program augmented our drilling and added drill density to the Hill Zone area to confirm continuity of grade. Results of the program will be released as pending final assays are received, reviewed and interpreted.

|

|

2.

|

the significant intercepts contained in holes GM 85, 86, 87, 88, 89, 90, 91 and 92

|

|

Drill Hole

|

From (ft)

|

To (ft)

|

Length

|

opt Au

|

opt Ag

|

|

GM-85

|

25

|

40

|

15

|

0.034

|

0.298

|

|

Also

|

75

|

175

|

100

|

0.013

|

0.269

|

|

GM-86

|

0

|

120

|

120

|

0.015

|

0.303

|

|

including

|

65

|

85

|

20

|

0.022

|

0.298

|

|

GM-87

|

0

|

75

|

75

|

0.014

|

0.308

|

|

Also

|

100

|

115

|

15

|

0.023

|

1.372

|

|

GM-88

|

95

|

290

|

195

|

0.035

|

0.527

|

|

Including

|

95

|

110

|

15

|

0.069

|

0.462

|

|

Including

|

140

|

150

|

10

|

0.223

|

14.24

|

|

GM-89

|

325

|

360

|

35

|

0.008

|

0.84

|

|

GM-90

|

340

|

425

|

85

|

0.18

|

0.49

|

|

Bottomed at 425 feet in

|

0.020

|

0.29

|

|||

|

GM-91

|

0

|

85

|

85

|

0.021

|

0.37

|

|

GM-92

|

0

|

30

|

30

|

0.024

|

0.23

|

|

GM-95

|

0

|

90

|

90

|

0.010

|

0.33

|

|

GM-99

|

60

|

195

|

135

|

0.020

|

0.264

|

|

Including

|

115

|

140

|

25

|

0.044

|

1.49

|

|

3.

|

announced that, in keeping with its historic and ongoing efforts to maximize shareholder value, it has been reviewing highly qualified candidates to transition the Company from its current status as a junior explorer to an effective and profitable producing company. To facilitate this transition, Steve Parent has joined the Company's Advisory Board and stepped down from the Board of Directors and as President and CEO. The Board of Directors has appointed Robert Carrington to the Board of Directors and as President to assist in the transition.

|

18

During the quarter ended April 30, 2010, our company:

|

1.

|

completed large diameter column leach tests on coarse crushed ore from the Independence which yielded greater than 90% gold extraction after a 140 day leach cycle.

|

|

2.

|

announced the significant intercepts contained in holes GM 93, 94, 96 thru 102, 111, 112, 115, 116, 121, 122, 124,127, and 128. These results improved the potential economics of the project.

|

|

Drill Hole

|

From

|

To

|

Intercept

|

Gold

|

Silver

|

|||||

|

feet

|

meters

|

feet

|

meters

|

feet

|

meters

|

opt

|

g/T

|

opt

|

g/T

|

|

|

GM-93

|

180

|

54.9

|

245

|

74.7

|

65

|

19.8

|

0.019

|

0.710

|

0.2

|

7.471

|

|

GM-94

|

0

|

0

|

40

|

12

|

40

|

12

|

0.011

|

0.42

|

0.47

|

17.57

|

|

GM-96

|

0

|

0.0

|

25

|

7.6

|

25

|

7.6

|

0.014

|

0.53

|

0.34

|

12.85

|

|

GM-97

|

35

|

10.7

|

65

|

19.8

|

30

|

9.1

|

0.015

|

0.57

|

0.28

|

10.58

|

|

GM-98

|

110

|

34

|

200

|

61

|

90

|

27

|

0.020

|

0.76

|

0.42

|

15.52

|

|

Including

|

110

|

34

|

135

|

41

|

25

|

8

|

0.035

|

1.32

|

0.47

|

17.46

|

|

And

|

155

|

47

|

180

|

55

|

25

|

8

|

0.030

|

1.13

|

0.57

|

21.28

|

|

GM-100

|

45

|

13.7

|

85

|

25.9

|

40

|

12.2

|

0.013

|

0.49

|

0.48

|

18.14

|

|

GM-101

|

155

|

47.3

|

185

|

56.4

|

30

|

9.1

|

0.019

|

0.72

|

0.20

|

7.56

|

|

GM-102

|

145

|

44

|

170

|

52

|

25

|

8

|

0.009

|

0.34

|

0.42

|

15.71

|

|

GM-111

|

305

|

93

|

405

|

123

|

100

|

30

|

0.058

|

2.19

|

0.88

|

32.91

|

|

Including

|

320

|

98

|

355

|

108

|

35

|

11

|

0.080

|

3.02

|

1.33

|

49.73

|

|

GM-112

|

215

|

66

|

300

|

91

|

85

|

26

|

0.028

|

1.06

|

0.38

|

14.21

|

|

Including

|

230

|

70

|

265

|

81

|

35

|

11

|

0.047

|

1.78

|

0.37

|

13.84

|

|

GM-115

|

Bottomed at 135 feet, did not reach target

|

|||||||||

|

GM-116

|

150

|

45.7

|

260

|

79.3

|

110

|

33.5

|

0.018

|

0.68

|

0.16

|

6.05

|

|

Including

|

230

|

70.1

|

245

|

74.7

|

15

|

4.6

|

0.051

|

1.93

|

0.31

|

11.71

|

|

GM-121

|

295

|

89.9

|

310

|

94.5

|

15

|

4.6

|

0.02

|

0.747

|

0.14

|

5.229

|

|

And

|

345

|

105.2

|

400

|

122.0

|

55

|

16.8

|

0.02

|

0.747

|

0.54

|

20.171

|

|

GM-122

|

245

|

75

|

270

|

82

|

25

|

8

|

0.023

|

0.87

|

0.18

|

6.77

|

|

Including

|

335

|

102

|

380

|

116

|

45

|

14

|

0.017

|

0.64

|

0.40

|

15.07

|

|

GM-124

|

275

|

83.8

|

375

|

114.3

|

100

|

30.5

|

0.019

|

0.72

|

0.11

|

4.16

|

|

Including

|

295

|

89.9

|

340

|

103.7

|

45

|

13.7

|

0.034

|

1.28

|

0.13

|

4.91

|

|

GM-127

|

80

|

24.4

|

95

|

29.0

|

15

|

4.6

|

0.027

|

1.02

|

0.18

|

6.80

|

|

Also

|

155

|

47.3

|

200

|

61.0

|

45

|

13.7

|

0.260

|

9.83

|

0.13

|

4.91

|

|

Including

|

155

|

47.3

|

165

|

50.3

|

10

|

3.0

|

0.908

|

34.31

|

0.36

|

13.60

|

|

GM-128

|

295

|

89.9

|

525

|

160.1

|

230

|

70.1

|

0.079

|

2.99

|

0.24

|

9.07

|

|

Including

|

310

|

94.5

|

325

|

991

|

15

|

4.6

|

1.019

|

38.51

|

.99

|

37.42

|

|

3.

|

reported that the State of Nevada, Division of Water Resources (NDWR) formally awarded General Metals water rights which will be immediately available to the Company upon completion of a well.

|

|

4.

|

completed the independent Quality Assurance – Quality Control (QA – QC) assessment which confirmed that the reported results were accurate.

|

|

5.

|

appointed Paul Wang to the Company's board of directors

|

19

Plan of Operation

Fiscal Year 2011 –Permitting and Development Program

During fiscal year 2011, the Company continues an aggressive program, restricted by available funds, to rapidly move the Independence project toward production. We anticipate being able to secure necessary studies and permits to allow us to proceed to production in the near term. On May 5, 2010, we announced completion of a current, independent, technical report and resource calculation compliant with Canadian National Instrument 43-101. The report was submitted to Canadian authorities for review and approval preparatory to the Company being able to use the report with Canadian investment firms to assist the Company in acquiring the resources necessary to complete our aggressive program. This report does not meet SEC Industry Guide 7 guidelines but will provide information in a familiar format for our Canadian and European investors.

Dyer Engineering of Reno, Nevada continues the permitting process necessary to place the Independence Mine into commercial production

Additional extractive metallurgical studies will be undertaken. When these studies are completed, a mine plan will be developed which the Company believes will see much of the mineralization identified in its drilling converted into reserve categories.