Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | d312878d8k.htm |

Exhibit 99.1

| Synthesis Energy Systems 24th Annual ROTH Conference March 14, 2012 NASDAQ: SYMX UNLOCKING VALUE THROUGH CLEAN ENERGY TECHNOLOGY |

| Forward-Looking Statements This presentation includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Among those risks, trends and uncertainties are the early stage of development of SES, its estimate of the sufficiency of existing capital sources, its ability to successfully develop its licensing business, its ability to raise additional capital to fund cash requirements for future investments and operations, its ability to reduce operating costs, the limited history and viability of its technology, the effect of the current international financial crisis on its business, commodity prices and the availability and terms of financing opportunities, its results of operations in foreign countries and its ability to diversify, its ability to maintain production from its first plant in the ZZ joint venture, its ability to complete the expansion of the ZZ project, its ability to obtain the necessary approvals and permits for its Yima project and other future projects, the estimated timetables for achieving mechanical completion and commencing commercial operations for the Yima project, its ability to negotiate the terms of the conversion of the Yima project from methanol to glycol, the sufficiency of internal controls and procedures and the ability of SES to grow its business as a result of the China Energy and Zuari transactions as well as its joint venture with Midas Resource Partners. Although SES believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. SES cannot assure you that the assumptions upon which these statements are based will prove to have been correct. |

| Alternative energy company with global business interests Proprietary U-GAS(r) gasification technology to convert low cost, low rank coal and biomass into high-value energy and chemical products to help drive global economic growth Executing three-pronged value-creation strategy: Technology licensing, engineering services and equipment sales Equity partnerships in projects Integrate coal assets with U-GAS(r) projects through investment in low quality, low cost coal resources Commercialization strategy focused on emerging markets worldwide 4 years of commercial operation in China 2nd project coming online in China - Summer 2012 China business platform: ZJX India business development platform: Zuari Highly experienced senior leadership team with decades of energy industry and gasification experience About SES |

| Experienced Leadership Team Robert W. Rigdon - President & CEO 30 years industry experience in manufacturing, engineering and technology with 15 years in gasification technology, project development and business development at ChevronTexaco and GE Francis Lau - SVP, Chief Technology Officer Renowned technology expert with 40 years R&D and industry experience. Previously Executive Director of Gasification and Gas Processing at GTI and primary developer of U-GAS(r) William E. Preston - SVP, Business Development & Global Licensing 30 years of business development, project management, and operations including successful execution of the Cool Water Coal Gasification Program and Eastman Chemical's gasification plant Dr. John Winter - SVP, Engineering and Project Operations +30 years of petrochemicals experience including +15 years of gasification technology research, engineering design, technical services, and gasification plant operations Kevin Kelly - Chief Accounting Officer +25 years of audit experience and controllership and treasury management positions with a variety of publicly traded companies |

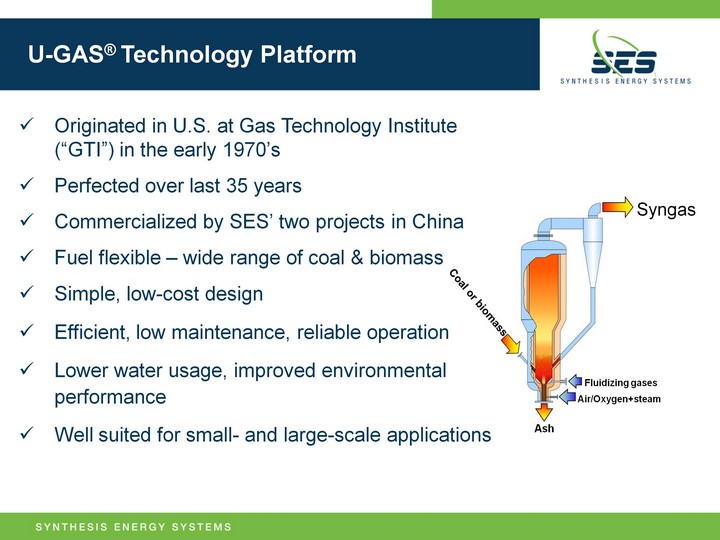

| U-GAS(r) Technology Platform Syngas Originated in U.S. at Gas Technology Institute ("GTI") in the early 1970's Perfected over last 35 years Commercialized by SES' two projects in China Fuel flexible - wide range of coal & biomass Simple, low-cost design Efficient, low maintenance, reliable operation Lower water usage, improved environmental performance Well suited for small- and large-scale applications |

| Creating Value Clean Energy Products from Low Cost, Low Quality Coals Coal... a critical natural resource to meet the world's growing energy needs Abundant and found in almost every country on Earth; typically lowest cost fossil fuel; ~50% of total recoverable global coal reserves are low rank sub- bituminous and lignite - SES' target feedstocks Low rank coals typically not mined due to poor performance characteristics and lack of suitable gasification technology Compelling economics: low cost, low rank coal yielding high value products provides increased margins over conventional coal to energy uses Sources: BP Statistical Review of World Energy 2010; Business Monitor International - China Oil & Gas Report Q4 2010; and, Jim Jordan & Associates - Global Methanol Report November 12, 2010 / Issue 390 |

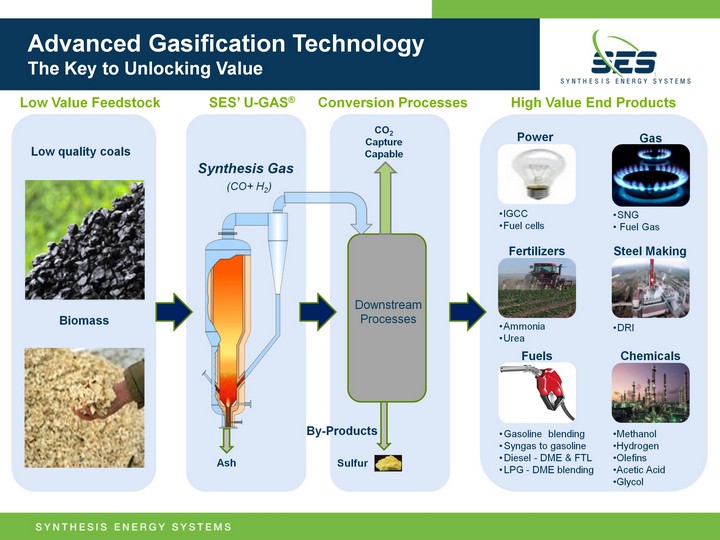

| Advanced Gasification Technology The Key to Unlocking Value CO2 Capture Capable Low Value Feedstock High Value End Products Gasoline blending Syngas to gasoline Diesel - DME & FTL LPG - DME blending SNG Fuel Gas IGCC Fuel cells Methanol Hydrogen Olefins Acetic Acid Glycol Low quality coals Biomass Downstream Processes By-Products Synthesis Gas (CO+ H2) Sulfur Ash Chemicals Fuels Fertilizers Power Gas Steel Making Ammonia Urea DRI SES' U-GAS(r) Conversion Processes |

| Representative Economics China SNG Case Base Case Assumptions Representative 4B Nm3/yr SNG project in China Low rank coal feedstock Natural gas prices are estimated at China East Coast pricing; Total invested capital: $2.3B; coal price net of VAT, RMB85 per tonne ($16/tonne) SES provides a clean, efficient & lower cost solution for SNG China Synthetic Natural Gas - SNG Attractive economics Encouraged by Chinese government Large scale "mega" projects planned (Typically 4B Nm3/yr built in 1B Nm3/yr phases) Target fuel - low cost, low quality coal SES technology can unlock value in lignite coal vs. other gasification technologies which can be limited to higher grade coal U-GAS(r) Economics for SNG in China Net Profit Potential from SNG $/mmbtu |

| Attractive Economics Low Quality Coal to High Value Products Production Capacity (tonnes or Nm3) End Product Gross Selling Price Projected Annual Revenues (millions) Projected Annual EBITDA (millions) SNG 4B Nm3/a total project 1.3 B Nm3/a phases ~$9 - $13/mmbtu ~$1,575 Project ~$525 per phase ~$1,150 Project ~$375 per phase Ammonia (fertilizer) 600K t/pa $500 - $550/tonne ~$315 ~$155 Methanol 300K t/pa $400 - $450/tonne ~$130 ~$60 Ethylene Glycol 300K t/pa $1,400 - $1,550/tonne ~$440 ~$305 Assumptions Region Asia/China; low quality coal priced between $15/tonne and $20/tonne Project capital costs: SNG ~ $2.3B; Ammonia ~$250~$300MM; Methanol ~$225 ~$275MM; Ethylene Glycol ~ $670~$720MM; Capex/Opex Source: Chinese Design Institute Feasibility Study Reports and SES internal engineering studies Product selling prices are gross and pre-VAT. Prices based on China market spot price. Source: Chem99 Consulting, http://coalchem.chem99.com Potential to grow in multiple energy and chemical market segments with attractive economics based on low cost coals and U-GAS(r) technology |

| Multiple Paths to Growth and Profitability SES Advanced Gasification Technology Technology & Equipment Supply Selective Project Investments Integrated Coal Resource Projects Three Pronged Global Growth Strategy Technology, Equipment Supply & Services Rapid U-GAS(r) Commercialization Grow installed base Near term earnings Project Investments Equity Carries & Options Selective Investments Earnings from product sales Integrating Coal Resources Vertical integration Links low cost feedstock |

| Technology, Equipment Supply & Services Licensing Potential to be a sustained revenue generator Technology royalty is typically a one time fee collected across project design, construction & startup Typical project cycle...24 to 48 months Typical transaction range $3MM to $30MM+ (1) Specialized Equipment & Technical Services Pre-Order Engineering Services...coal testing, feasibility studies PDPs...engineered by SES & delivered prior to detailed design Equipment...proprietary equipment orders placed during detailed design Technical Services...training, commissioning, start-up, ongoing support Technical Services Specialized Equipment Gasification Technology SES Scope of Supply 1 Typically based on the project's daily capacity to produce CO & H2 (syngas) and methane as well as consideration for syngas energy content |

| Project Investments Capital Investment - JVs with equity investment & carried interest Syngas plants, SNG, integrated methanol/glycol facilities, fertilizer businesses Build Own Operate ("BOO") model Build Own Transfer ("BOT") model Modular units; engineering, equipment and construction partnerships Operating and technical services Revenue Sources Syngas sales End product sales - SNG, Fuels, Chemicals, etc Majority Control/Minority Interest Positions Focus - targeting high growth, high product demand, emerging markets Greenfield development and acquisitions |

| Integrating Coal Resources - SRS JV Vertically integrates and/or links under utilized, low quality coal resources to SES projects globally SES' U-GAS(r) technology facilitates monetization of low commercial value "stranded" coals that are otherwise difficult or impossible to commercialize Secures long-term low cost fuel for projects Positions SES to be global leader in captive low rank coal resources Targeted regions include Asia, Eastern Europe, Eurasia, and parts of Africa |

| Implementing Strategy Through Regional Growth Platforms Strategic partnering key to SES global growth Emerging markets focus, high demand, significant commercial potential Regional approach leverages SES technology position |

| Building Momentum ZJX Investment (China) $84 million investment into SES (Pending) Collaboration leverages position in China Facilitates multiple development opportunities Zuari Investment (India) Initial $5 million investment into SES Establishes key position in new, high growth, high demand marketplace Development, licensing initiatives underway Zao Zhuang Joint Venture (China) SES and Hai Hua negotiating restructured ZZ Joint Venture agreement Would integrate the ZZ plant with Hai Hua's methanol unit Goal is for plant to be cash flow positive |

| Building Momentum - continued SES/Midas Joint Venture (SES Resource Solutions) Vertical integration of feedstock resources with projects to enhance competitive advantage Ncondezi feasibility study SES' Engineering Study for Ambre Energy Evaluating application of U-GAS(r) in large scale Queensland CTL project Potential new opportunity for licensing, equipment supply, and other technical services arrangements |

| Zao Zhuang (ZZ) - Shandong Province (operating 4 years) JV with Shandong Hai Hua Coal & Chemical Co. Ltd (96% SES / 4% HH) Proven U-GAS(r) performance with successful commercial operation Proven feedstock flexibility with wide range of coal and coal wastes processed Historically high syngas availability Yima Plant - Henan Province (under construction) JV with Yima Coal Industry Group (75% Yima / 25% SES, option to increase to 49%) Phase 1 of planned $4B Mazhuang Coal Chemical and Energy Industrial Park Converts 2,400 mtpd coal (up to 45% ash) to 300,000 mtpa methanol equivalent products Syngas generation planned for mid-2012 Existing Operations and Investments |

| Financial Snapshot (in millions) Sufficient capital resources $24.4 MM cash as of December 31, 2011 $84 MM stock sale agreement with ZJX/China Energy (close pending) Favorable operating trends Gaining traction on licensing business Near-term opportunities in China, India and Australia Increased partnership opportunities to develop projects through SRS JV Ncondezi Six Months Ended December 31 (in $MM) Six Months Ended December 31 (in $MM) Six Months Ended December 31 (in $MM) 1H FY12 1H FY11 Revenues $2.7 $4.5 Operating Loss (9.2) (7.4) |

| Investment Summary Compelling Growth Story, Building Value Large market opportunities, particularly in Asia Regional platforms - China and India Equity platforms - project participation and coal resources Only commercially available gasification technology to address low cost, low rank coal and biomass Proprietary processes and technology (U-GAS(r)) Proven on a commercial scale in China (4 yrs) 2nd plant coming online in China - Summer 2012 Business model provides multiple revenue streams Pure play in low rank coal and biomass gasification Technological and feedstock advantages on a global scale drives our growth |