Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Paratek Pharmaceuticals, Inc. | d313745d8k.htm |

March 2012

March 2012

A specialty pharmaceutical company focused on the development

and commercialization of proprietary products to address important

therapeutic needs in the field of neuroscience

Exhibit 99.1 |

Forward

looking

statements

Forward

looking

statements

2

This presentation contains forward-looking statements that involve substantial risks and

uncertainties. All statements, other than statements of historical facts, included in

this presentation are forward-looking statements. Examples

of

such

statements

include

our

expectation

regarding

the

potential

market

for

Intermezzo

®

and

the

potential market size for a middle of the night sleep aid; our expectations regarding an

ideal therapeutic; the average value of a branded insomnia prescription and the

resulting revenue for each 1% of market share; Purdue plans to hire 275 sales

representatives to exclusively promote Intermezzo; Purdue plans to invest approximately

$100 million to support sales and marketing over the first 12 months of commercialization of

Intermezzo in the U.S.; the expected timing for and the success of the commercial

launch of Intermezzo by Purdue in the U.S.; the receipt of royalty and milestone

payments from Purdue pursuant to our Collaboration Agreement; anticipated

reimbursement coverage; intellectual property protection being obtained and maintained;

plans for the Phase 2 study of TO-2061, including the expected timing of clinical

trial results; and our expectations regarding the potential market size for

TO-2061 as augmentation treatment for patients with OCD. All of these forward-looking

statements are based on estimates and assumptions by our management that, although we

believe to be reasonable, are inherently uncertain. Forward-looking statements

involve risks and uncertainties, including, but not limited to, achieving acceptance

of Intermezzo by physicians, patients and third-party payors; supplying

sufficient quantities of Intermezzo from third-party manufacturers and suppliers to meet

anticipated market demand; the impact of competitive products and the market for

Intermezzo generally; our dependence on Purdue’s

commercialization

efforts

and

our

Collaboration

Agreement

with

Purdue;

obtaining,

maintaining

and

protecting regulatory exclusivity and intellectual property protection for Intermezzo;

competitive product commercialization; manufacturing and supply risks for

TO-2061; adverse patent decisions at the USPTO or in court; and variability in

the business of Transcept generally. These and other risks are described in greater detail

in the "Risk Factors" section of Transcept periodic reports filed with the

Securities and Exchange Commission. Forward-looking statements do not reflect the

potential impact of any future in-licensing, collaborations, acquisitions,

mergers, dispositions, joint ventures, or investments Transcept may enter into or make. Transcept

does not assume any obligation to update any forward-looking statements, except as may

be required by law. |

Therapeutic

focus Large markets,

unmet needs

Commercial

platform

U.S. primary care partnership: Purdue Pharma

Option

to

co-promote

Intermezzo

®

1

yr

post

launch

9/30/11: ~$54 M cash, equivalents & investments

$10M

milestone

payment

from

Purdue:

Q4

2011

No debt

Neuroscience / psychiatry

Intermezzo:

middle of the night awakenings : treatment resistant OCD

Transcept: preparing for Intermezzo

®

commercialization

Transcept: preparing for Intermezzo

®

commercialization

3

Strong balance

sheet

Intermezzo

product launch: early April 2012

Phase

2

results:

estimated

Q1

2013

Near term

catalysts

TO-2061

TO-2061 |

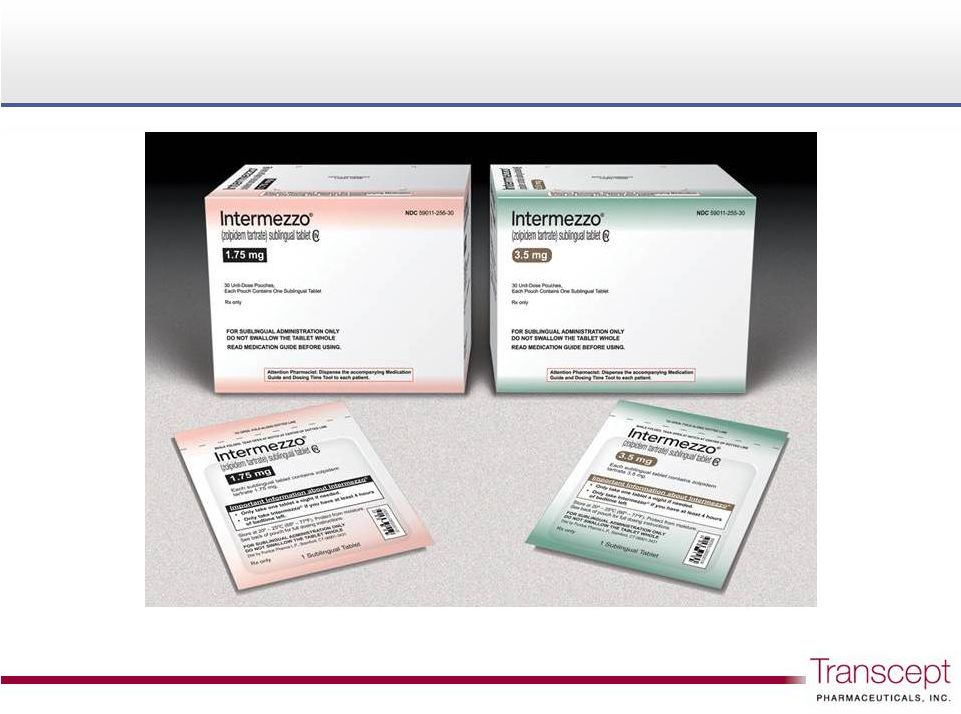

Intermezzo

®

(zolpidem tartrate) sublingual tablet C-IV

Intermezzo

®

(zolpidem tartrate) sublingual tablet C-IV

4 |

Intermezzo:

the first and only prescription sleep aid approved for middle-of-the-night

dosing Intermezzo: the first and only prescription sleep aid

approved for middle-of-the-night dosing

Indication statement as approved by FDA:

–

Intermezzo

is indicated for use as needed for the

treatment of insomnia when a middle-of-the-night

awakening is followed by difficulty returning to sleep.

–

Intermezzo

is not indicated for the treatment of middle-

of-the-night insomnia when the patient has fewer than 4

hours of bedtime remaining before the planned time of

waking.

5 |

Intermezzo:

the first and only prescription sleep aid approved for middle-of-the-night

dosing Intermezzo: the first and only prescription sleep aid

approved for middle-of-the-night dosing

6 |

Middle of the

night (MOTN) awakening: a major unmet medical need in the insomnia category

Middle of the night (MOTN) awakening:

a major unmet medical need in the insomnia category

Large U.S. insomnia market

–

79

million

new

and

refill

prescriptions

(1)

Insomnia is an under-treated condition

(2)

–

11

million

patients

receive

Rx

(3)

–

4x

to

6x

more

are

not

diagnosed

or

treated

by

a

physician

(3)

MOTN awakening: the most common insomnia symptom

(4)

–

35%

of

Americans

suffer

from

MOTN

awakenings

at

least

3x

/

week

(4)

–

>90% report awakenings persist more than six months;

50%

report

awakenings

persist

more

than

five

years

(5)

7

(1)

IMS

Oct

2010

to

Sep

2011;

(2)

Institutes

of

Medicine

-

Sleep

disorders

and

sleep

deprivation

Apr.

2006;

(3)

BluePrint

Research

Group;

(4) Ohayon,

Nocturnal awakenings and comorbid disorders in the American general population. J of Psych

Research (2009); (5) Ohayon, Difficulty in

resuming

or

inability

to

resume

sleep

and

the

links

to

daytime

impairment,

J

of

Psych

Research

(2009). |

Commonly

prescribed sleep aids are indicated only for bedtime use

Commonly prescribed sleep aids are indicated

only for bedtime use

MOTN awakenings typically do not occur every night

7-8 hr sleep aids (Ambien

®

, Ambien CR

®

, Lunesta

®

) require

bedtime prophylactic dosing to prevent awakenings

An ideal therapeutic would:

–

Be used only at the time patients need help returning to sleep,

not every night in advance of a problem that may not occur

–

Return patients to sleep rapidly

–

Be effective despite the low dose necessary to avoid next day

residual effects when used in the middle of the night

8 |

Intermezzo:

the first and only sleep aid approved for middle-of-the night dosing

Intermezzo: the first and only sleep aid approved for

middle-of-the night dosing

Novel zolpidem formulation

–

Sublingual tablet

–

Bicarbonate-carbonate buffers

Approved dose

–

1.75 mg in women & patients > 65 years

–

3.5 mg in non-elderly men

Rapidly absorbed in both men and women

Effective vs. placebo in sleep laboratory & outpatient studies

Instructions to patients

–

Take Intermezzo “while in bed”

–

“When you wake up in the morning, be sure that at least 4 hours have passed

since you have taken Intermezzo

and you feel fully awake before driving. Do

not do dangerous activities until you know how

Intermezzo affects you.”

9 |

|

Significant

Rx insomnia market opportunity: each

1%

share

$130M

at

branded

prices

Significant Rx insomnia market opportunity:

each

1%

share

$130M

at

branded

prices

11

U.S. insomnia market

Hypothetical market

(1) IMS Health, National Prescription Audit, Sept 2011; (2) Wolters Kluwer WAC pricing

(branded) Jan 2011, $5.05 to

$5.67

(products

evaluated:

Ambien

®

,

Ambien

CR

®

,

Lunesta

®

,

Silenor

®

;

Ambien

®

and

Ambien

CR

®

are

currently

available

in

generic

form;

Lunesta

®

WAC

pricing

was

$6.13);

(3)

Transcept

estimate

based

on

IMS

Health,

National Prescription Audit, Sept 2011.

Branded pricing

penetration

Average

Rx

value:

$165

30

tablets

per

Rx

3

~$5

to

$6

per

tablet

2

79

million

TRx

per

year

1

1% Intermezzo share

790,000 TRx, approx $130M sales |

Initial

shipments and physician

promotion planned for early April 2012

Purdue plans to invest ~$100M

during

first 12 months of Intermezzo launch

~275 field representatives in new

national

sales force devoted exclusively to the promotion of

Intermezzo to highest insomnia prescribers

Purdue began contacting drug wholesaler, retailer and

managed care decision makers in early 2012

Intermezzo launch plans

Intermezzo launch plans

12 |

Purdue

commercialization agreement: key Transcept benefits

Purdue commercialization agreement:

key Transcept benefits

Co-promote option: foundation for a commercial future

–

Transcept option: co-promote to psychiatrists can begin as early

as 1 year and as late as 4.5 years after Purdue launch

Royalty structure

–

Base royalty: mid-teens up to mid 20% level on net sales

–

Co-promote royalty:

•

22% to 40% on psychiatrist Rx net sales, based on timing of opt-in

•

Net revenue qualifying for this additional co-promote royalty is

capped at 15% of total Intermezzo annual net U.S. sales

Milestone payments

–

$10M

for

first

formulation

patent

listed

in

Orange

Book,

paid

in

Q4

2011

–

Up to $80M additional upon the achievement of certain patent

milestones and net sales targets

13 |

Intermezzo

managed markets advisory board with decision makers covering >170M lives

Intermezzo managed markets advisory board with

decision makers covering >170M lives

Broad formulary access expected

Unmet medical need generally recognized by payers

–

Unique insomnia indication

–

Low dose used less often

–

Rapidly absorbed

Tier 3 formulary placement anticipated by most plans

Utilization management criteria consistent with other brands

Intermezzo

brand parity pricing not viewed as a major barrier

with managed markets

14 |

Intermezzo:

intellectual property

Intermezzo:

intellectual property |

Two U.S.

patents issued, additional patent applications pending

Two U.S. patents issued, additional patent

applications pending

Two issued U.S. patents -

7,682,628 and 7,658,945

16

–

Claims are not limited to use of buffers

–

Compositions and methods of treating middle of the night

awakenings

–

Any patents issuing from these applications would expire no sooner

than February 2025

Patent applications pending

–

Buffered formulations

–

Compositions and methods of treating insomnia

–

Claims require absorption of zolpidem across the oral mucosa

–

Patents expire no sooner than February 2025 |

TO-2061

(low dose ondansetron)

TO-2061

(low dose ondansetron)

17

Proposed indication: adjunctive therapy in adult patients

with obsessive compulsive disorder (OCD) not adequately

responsive to currently approved OCD medication |

Significant

unmet medical need: OCD patients not responding adequately to approved

medication Significant unmet medical need: OCD patients not

responding adequately to approved medication

Obsessive Compulsive Disorder

–

Intrusive thoughts and repetitive actions to reduce distress

–

Affects 1% to 2% of U.S. adult population, 40% to 50% seek treatment

–

Significantly impacts everyday life activities of patients and their families

–

40% to 60% of OCD patients do not respond adequately to approved

medications,

which

include

the

SSRIs

Prozac

®

,

Luvox

®

,

Paxil

®

,

Zoloft

®

–

Atypical antipsychotics are often used off-label to augment approved

medications

•

~68% of treatment resistant OCD patients do not respond

•

Frequently reported adverse events: weight gain, metabolic disorder

18

No FDA approved medication for treatment resistant

OCD |

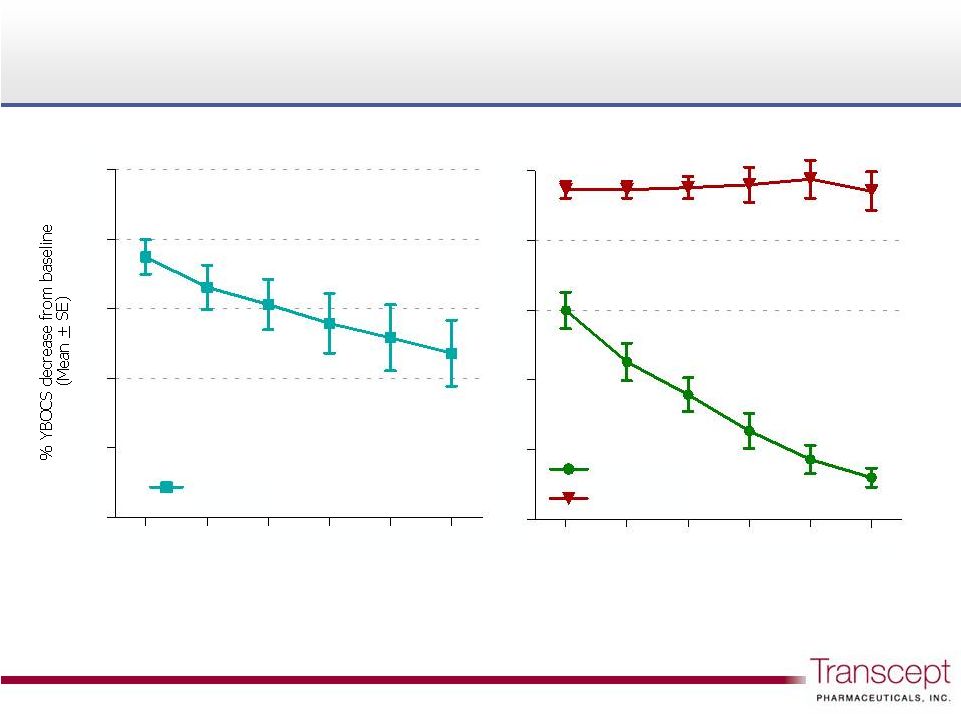

Pilot Study

B: Improvement measured as % decrease below baseline

Pilot Study B:

Improvement measured as % decrease below baseline

19

All Patients: n=21

26.3% improvement at 12 weeks

Responders: n=12 of 21 (57%)

44.3% improvement at 12 weeks

Pilot Study B, n=21

Week

2

Week

4

Week

6

Week

8

Week

10

Week

12

50%

40%

30%

20%

10%

0%

All patients

Week

2

Week

4

Week

6

Week

8

Week

10

Week

12

50%

40%

30%

20%

10%

0%

Responders

Non-responders |

:

development

overview

:

development

overview

505b2 NDA pathway

Phase

2

double

blind,

placebo

controlled

study,

n

150,

complete enrollment est. Fall 2012, top line data est. Q1 2013

Intellectual property

–

Method of use patent application filed, priority date May 19, 2009

–

Ondansetron, up to ~1.5 mg/day

–

Pending claims for treating SSRI resistant OCD with ondansetron augmentation

Strategic fit: psychiatry

–

~87% of patient visits for OCD were to psychiatrists in 2009

*

–

Complementary to Intermezzo

psychiatry co-promote option with Purdue

20

* SDI Physician Drug and Diagnosis Audit

TO-2061

Managed care survey (~108M lives): unmet medical need

acknowledged, Tier 3 formulary placement expected |

Financial

overview Financial overview |

Financial

position – Q4 2011 release and

teleconference on 3/14/12 at 1:30 PM PT

Financial position –

Q4 2011 release and

teleconference on 3/14/12 at 1:30 PM PT

9/30/11

22

*During Q3 2011, Transcept paid severance of approximately $1.0 million to former

employees whose positions were eliminated in the July 15, 2011 reduction in force.

Excluding this severance payout, cash use during the quarter averaged approximately

$1.5 million per month.

Milestone payment recvd (12/21/11):

$10.0 M

Shares outstanding:

13.9 M

Options / warrants / other:

3.6

Total:

17.5 M

Employees:

2/1/12 update

Cash & investments:

$54.1 M

Q3 2011 cash burn rate*:

$ 1.9 M / month

18 |

Intermezzo

®

is a registered trademark of Transcept Pharmaceuticals, Inc.

Ambien

®

and Ambien CR

®

are registered trademarks of sanofi-aventis

Lunesta

®

is a registered trademark of Sunovion Pharmaceuticals Inc.

Zofran

®

and

Paxil

®

are registered trademarks of The GlaxoSmithKline Group of Companies

Prozac

®

is a registered trademark of Eli Lilly & Co.

Luvox

®

is a registered trademark of Solvay Pharmaceuticals, Inc.

Zoloft

®

is a registered trademark of Pfizer Inc. |