Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended: December 31, 2009

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 000-51967

TRANSCEPT PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0960223 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1003 W. Cutting Blvd., Suite #110

Point Richmond, California 94804

(510) 215-3500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| Common Stock, par value $0.001 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock of the registrant held by non-affiliates of the registrant on June 30, 2009, the last business day of the registrant’s second fiscal quarter was: $30,755,586.

As of March 26, 2010 there were 13,413,391 shares of the registrant’s common stock outstanding.

Documents incorporated by reference: Items 10, 11, 12, 13, and 14 of Part III incorporate information by reference from the Proxy Statement to be filed with the Commission within 120 days of the end of our fiscal year pursuant to General Instruction G(3) to Form 10-K.

Table of Contents

| Item No. | Page No. | |||||

| PART I |

||||||

| 1. | Business | 3 | ||||

| 1A. | Risk Factors | 30 | ||||

| 1B. | Unresolved Staff Comments | 49 | ||||

| 2. | Properties | 49 | ||||

| 3. | Legal Proceedings | 50 | ||||

| 4. | Reserved | 50 | ||||

| PART II |

||||||

| 5. | 51 | |||||

| 6. | 53 | |||||

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

54 | ||||

| 7A. | 68 | |||||

| 8. | 69 | |||||

| 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

99 | ||||

| 9A(T). | 99 | |||||

| 9B. | 100 | |||||

| PART III |

||||||

| 10. | 101 | |||||

| 11. | 101 | |||||

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

101 | ||||

| 13. | Certain Relationships and Related Transactions, and Director Independence |

102 | ||||

| 14. | 102 | |||||

| PART IV |

||||||

| 15. | 103 | |||||

| 103 | ||||||

| 107 | ||||||

Table of Contents

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements that are based upon current expectations within the meaning of the Private Securities Litigation Reform Act of 1995. Transcept Pharmaceuticals, Inc., or Transcept, intends that such statements be protected by the safe harbor created thereby. Forward-looking statements involve risks and uncertainties and actual Transcept results and the timing of events may differ significantly from those results discussed in the forward-looking statements. Examples of such forward-looking statements include, but are not limited to, statements about or relating to:

| • | expectations regarding plans to conduct a highway driving study and modify the Intermezzo® package presentation, and the sufficiency of such plans, to support the potential resubmission of a New Drug Application, or NDA, with the U.S. Food and Drug Administration, or FDA, for Intermezzo®; |

| • | expectations regarding our ability to resubmit the NDA for Intermezzo®, the expected timing of any such resubmission, and the expected timing of FDA review of any such resubmission; |

| • | the potential for Intermezzo® to be the first sleep aid approved specifically for use for middle of the night awakenings; |

| • | expected activities and responsibilities of us and Purdue Pharmaceutical Products L.P., or Purdue, under our United States License and Collaboration Agreement, or the Collaboration Agreement; |

| • | our potential receipt of revenue under the Collaboration Agreement, including milestone and royalty revenue; |

| • | the satisfaction of conditions under the Collaboration Agreement with Purdue required for continued commercialization, and the payment of potential milestone payments, royalties and fulfillment of other Purdue obligations under the Collaboration Agreement; |

| • | the potential benefits of, and markets for, Intermezzo® and other product candidates; |

| • | our plans for the manufacturing of Intermezzo®, including the manufacture of validation batches; |

| • | potential competitors and competitive products; |

| • | expectations with respect to our ability to carry out plans to promote Intermezzo® to psychiatrists in the United States through our co-promote option, if exercised, under the Collaboration Agreement, including development of a potential sales and marketing capability and the required size of our sales force; |

| • | guidance with respect to expected cash, cash equivalents and marketable securities, research and development expenses, and general and administrative expenses; |

| • | our ability to satisfy liquidity requirements for at least the next twelve months; |

| • | losses, costs, expenses, expenditures and cash flows, including the period of time over which we expect to recognize the revenue associated with the up-front payment under the Collaboration Agreement; |

| • | capital requirements and our needs for additional financing; |

| • | the ability and degree to which we may obtain and maintain market exclusivity from the FDA for Intermezzo® under Section 505(b)(2) of the Federal Food and Drug Cosmetic Act; |

| • | future payments under lease obligations and equipment financing lines; |

| • | our ability to obtain and maintain patent protection for Intermezzo® without violating the intellectual property rights of others; and |

| • | expected future sources of revenue and capital. |

1

Table of Contents

Transcept undertakes no obligation to, and expressly disclaims any obligation to, revise or update the forward-looking statements made herein or the risk factors whether as a result of new information, future events or otherwise. Forward-looking statements involve risks and uncertainties, which are more fully discussed in the “Risk Factors” section and elsewhere in this Annual Report, including, but not limited to, those risks and uncertainties relating to:

| • | whether additional data exists or can be generated from existing or new clinical studies to demonstrate sufficiently to the FDA that Intermezzo® would not present an unacceptable risk of residual effects, including residual effects that impair next day driving ability; |

| • | our ability to sufficiently demonstrate to the FDA that we can reduce inadvertent dosing errors of Intermezzo® in the middle of the night or that such dosing errors will not lead to unacceptable next day residual effects; |

| • | the potential for delays in or the inability to complete commercial partnership relationships, including additional marketing alliances for Intermezzo® outside the United States; |

| • | positive results in our clinical trials may not be sufficient to obtain FDA regulatory approval of Intermezzo® or to grant marketing exclusivity for Intermezzo® under Hatch-Waxman; |

| • | potential termination of the Collaboration Agreement by Purdue; |

| • | our satisfaction of conditions under the Collaboration Agreement with Purdue required for Purdue to carry out its obligations under such agreement; |

| • | difficulties or delays in building a sales organization in connection with any exercise of our co-promote option to psychiatrists under the Collaboration Agreement; |

| • | physician or patient reluctance to use Intermezzo®, if approved; |

| • | changing standards of care and the introduction of products by competitors, including generic products whose introduction could reduce our royalty rates under the Collaboration Agreement, or alternative therapies for the treatment of indications we target; |

| • | unexpected adverse side effects or inadequate therapeutic efficacy of our product candidates that could slow or prevent product approval or approval for particular indications; |

| • | inability to obtain additional financing, if necessary; |

| • | the uncertainty of protection for our intellectual property, through patents, trade secrets or otherwise; |

| • | potential infringement of the intellectual property rights or trade secrets of third parties; and |

| • | other difficulties or delays in development, testing, obtaining regulatory approval for, and undertaking production and marketing of our product candidates. |

Intermezzo®, Bimucoral®, and Transcept Pharmaceuticals, Inc.TM are registered and unregistered trademarks of ours in the United States and other jurisdictions. Other trademarks and trade names referred to in this Annual Report on Form 10-K are the property of their respective owners.

2

Table of Contents

PART I

| Item 1. | Business |

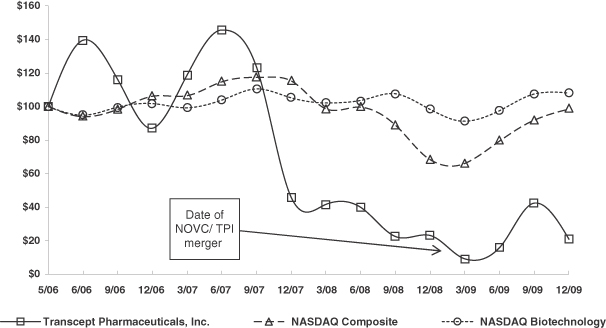

Merger of Novacea, Inc. and Transcept Pharmaceuticals, Inc.

Transcept Pharmaceuticals, Inc., or Transcept, was incorporated in Delaware in 2001 as Novacea, Inc., or Novacea. Novacea previously traded on the NASDAQ Global Market under the ticker symbol “NOVC.” On January 30, 2009, Novacea completed a business combination, or merger, with a privately held company, Transcept Pharmaceuticals, Inc., or TPI, pursuant to which TPI became a wholly owned subsidiary of Novacea and the corporate name of Novacea was changed to “Transcept Pharmaceuticals, Inc.” Prior to the merger, Novacea substantially ended its business of developing novel therapies for the treatment of cancer. Following the closing of the merger, the business conducted by TPI became the primary business of the combined entity and that business now operates through a wholly-owned subsidiary now known as Transcept Pharma, Inc. After the merger, former TPI stockholders, option holders and warrant holders as of January 30, 2009 owned approximately 61% of Transcept common stock on a fully-diluted basis. After the merger, the stockholders, option holders and warrant holders of Novacea prior to the merger owned approximately 39% of the Transcept common stock on a fully-diluted basis. Under generally accepted accounting principles in the United States, the merger is treated as a “reverse merger” under the purchase method of accounting. For accounting purposes, TPI is considered to have acquired Novacea.

Trading of Transcept Pharmaceuticals, Inc. securities on the NASDAQ Global Market under the ticker symbol “TSPT” commenced on February 2, 2009.

In this Annual Report, “Transcept,” “the Company,” “we,” “our” and “us” refers to the public company formerly known as Novacea and now known as Transcept Pharmaceuticals, Inc., and, as successor to the business of TPI, includes activities taking place with respect to the business of TPI prior to the merger of TPI and Novacea, as applicable.

Overview

Transcept Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on the development and commercialization of proprietary products that address important therapeutic needs in neuroscience. Our most advanced product candidate, Intermezzo® (zolpidem tartrate sublingual tablet), is a sublingual low dose formulation of zolpidem that we are developing for use in the middle of the night at the time a patient awakens and has difficulty returning to sleep.

We submitted an NDA to the FDA on September 30, 2008. On October 28, 2009, we received a Complete Response Letter from the FDA regarding our NDA indicating that the NDA was not approved. The FDA stated in its Complete Response Letter that it believes we submitted substantial evidence of the effectiveness of Intermezzo® for its proposed indication. However, the FDA also noted that the intended use of Intermezzo® in the middle of the night represents a unique insomnia indication and dosing strategy for which safety has not been previously established and that we had not adequately demonstrated to the FDA that Intermezzo® can be reliably used safely.

Our proposed label for Intermezzo® indicates that Intermezzo® should only be taken when patients have at least four hours remaining in bed before being active again. In its Complete Response Letter, the FDA recognized that the Intermezzo® data we submitted did not indicate significant next day residual effects at four hours. However, the FDA requested additional data demonstrating that Intermezzo®, when taken as directed in the middle of the night, would not present an unacceptable risk of residual effects, with particular reference to next day driving ability. Based on communications with the FDA, we plan to conduct a pre-approval highway driving study to assess the effect of Intermezzo® on next morning driving ability beginning at approximately three hours and four hours after dosing Intermezzo® in the middle of the night.

3

Table of Contents

In the Complete Response Letter, the FDA also expressed two concerns regarding the possibility of patient dosing errors in the middle of the night that could lead to next day residual effects with particular reference to next day driving ability. Specifically, the FDA asked us to address methods to avoid inadvertent re-dosing in a single night and inadvertent dosing with less than four hours of bedtime remaining. To address these concerns, we plan to change our originally proposed Intermezzo® packaging from a multi-dose unit package to a bedside, single unit-dose package with revised patient instructions designed to reduce the possibility of inadvertent patient dosing errors.

In communications with the FDA, we discussed our proposed new packaging and how to assess its adequacy to address FDA concerns regarding the potential for inadvertent dosing errors. The FDA indicated that the revised packaging appeared to reduce the potential for inadvertently taking more than one dose in a single night, but expressed continuing concern about the risk of inadvertent dosing with less than four hours of time remaining in bed. The FDA agreed that our plan to conduct a highway driving study is a reasonable way to measure potential next day driving impairment from dosing Intermezzo® with four hours or less remaining in bed. The FDA and Transcept also discussed whether a pre-approval patient use study might help to define patient ability to properly follow instructions under actual conditions of use. We have no current plans to conduct a patient use study because of the challenges and limitations of such a study, and have submitted to the FDA our position in this regard. The FDA indicated that it would consider our position as part of the overall resubmission of the Intermezzo® NDA. We also plan to include data from on-going studies of patient comprehension of label instructions in our planned resubmission.

According to IMS Health, an independent market research firm, the number of prescriptions filled in the United States to treat insomnia grew from approximately 54 million in 2004 to approximately 79 million in 2009. Data from a major study from the Stanford Sleep Epidemiology Center published in 2008 indicate that middle of the night awakening is the most common form of insomnia in the United States and affects approximately one-third of the population at least three times each week. Data from a study published in Population Health Management in 2010, based on information from the United States National Health and Wellness Survey to evaluate the economic and humanistic burden of chronic insomnia characterized by nighttime awakenings, indicate that this condition was associated with a significant negative impact in health care utilization, health-related quality of life and work productivity. Despite the prevalence of middle of the night awakening, there is no sleep aid currently approved for use specifically in the middle of the night when patients awaken and have difficulty returning to sleep.

On July 31, 2009, we entered into the Collaboration Agreement with Purdue that provides Purdue with an exclusive license to commercialize Intermezzo® in the United States. We retained an option to co-promote Intermezzo® to psychiatrists in the United States. We also granted Purdue and an associated company the right to negotiate for the commercialization of Intermezzo® in Mexico and Canada, respectively, and we retained rights to commercialize Intermezzo® in the rest of the world. We plan to develop and market Intermezzo® through one or more development and marketing alliances in major markets outside the United States.

We have incurred net losses since inception as we have devoted substantially all of our resources to research and development, including contract manufacturing and clinical trials. As of December 31, 2009, we had cash, cash equivalents, and marketable securities of $88.9 million, including working capital of $74.3 million, and an accumulated deficit of $86.9 million.

Our ability to generate near term revenue is dependent upon the receipt of milestone and royalty payments under our Collaboration Agreement with Purdue, which are dependent upon the regulatory approval by the FDA of Intermezzo®. To achieve profitable operations, we must successfully develop and commercialize Intermezzo® or we may need to identify, develop and commercialize future product candidates. Even if approved, our products may not achieve market acceptance and will face competition from both generic and branded pharmaceutical products.

4

Table of Contents

We believe that Intermezzo® is positioned to be the first commercially available sleep aid specifically for use in the middle of the night when patients awaken and have difficulty returning to sleep. Intermezzo® has been uniquely designed for this indication and employs the following product features:

| • | Known active agent. The active pharmaceutical ingredient in Intermezzo® is zolpidem tartrate, cited by IMS Health as the most commonly prescribed agent for the treatment of insomnia in the United States, with over one billion zolpidem tablets prescribed in 2009 in the United States. Approved in 1992 as the active ingredient in Ambien®, a branded prescription sleep aid, zolpidem has a well established record of safety and efficacy. |

| • | Rapid bioavailability. We believe that rapid bioavailability, the delivery of the active pharmaceutical ingredient into systemic circulation, is a key product feature for a sleep aid intended to be used in the middle of night. Intermezzo® is formulated as a sublingual tablet, or a dosage form that dissolves under the tongue, using our proprietary technology to facilitate more rapid absorption as compared to swallowed zolpidem tablet formulations, such as Ambien®. |

| • | Low dose. We expect Intermezzo® to be commercially available in doses that are 65% and 72% lower than the comparable doses of Ambien® and Ambien CR®, a controlled release version of Ambien®, respectively. In Phase 3 clinical studies, patients who took this low dose returned to sleep rapidly and, about four hours after taking their medication in the middle of the night, showed no evidence of next day residual effects as compared to placebo. We believe that Intermezzo® 1.75 mg and 3.5 mg doses are the lowest doses of zolpidem that have been reported to induce sleep in a manner statistically superior to placebo. |

Our Business Strategy

Our goal is to become a leading developer and marketer of pharmaceutical products that fill important therapeutic needs in the field of neuroscience. Our efforts to achieve this goal are driven by the following key strategies:

| • | Obtain FDA approval for Intermezzo®. We are working to resolve the issues identified in the Complete Response Letter to our NDA. We plan to resubmit the Intermezzo® NDA in the late fourth quarter of 2010 after we generate and analyze additional data from our planned highway driving study. We expect that our resubmitted Intermezzo® NDA will result in a six-month review period at the FDA under the Prescription Drug User Fee Act, or PDUFA. |

| • | Maximize the market opportunity for Intermezzo® through marketing alliances. We granted Purdue an exclusive license to commercialize Intermezzo® in the United States. We also granted Purdue and an associated company the right to negotiate for the commercialization of Intermezzo® in Mexico and Canada, respectively. We retained rights to commercialize Intermezzo® in the rest of the world and have an active effort underway to enter into one or more development and marketing alliances with established pharmaceutical companies in major markets outside the United States. |

| • | Develop a specialty commercial organization focused on neuroscience. If Intermezzo® is approved in the United States, we plan to build a sales team focused on psychiatrists in the United States to co-promote Intermezzo®. Our collaboration agreement with Purdue gives us the option to co-promote Intermezzo® to psychiatrists in the United States as early as the first anniversary of commercial launch of Intermezzo®. For the 12 months ended December 31, 2009, IMS Health reports that approximately 5,700 psychiatrists wrote 66% of all insomnia prescriptions written by psychiatrists. Transcept believes it can begin to promote to this prescribing audience with a sales force of 50 to 60 representatives that could expand to 100 representatives depending on revenue results. |

| • | Develop a product pipeline to address unmet needs in the field of neuroscience. We completed two single blind exploratory clinical studies to examine the use of low doses of ondansetron for the treatment of obsessive-compulsive disorder, or OCD. We believe the exploratory results were encouraging and are evaluating product development strategies to pursue this opportunity. |

5

Table of Contents

| • | Identify and evaluate strategic product licensing opportunities. We are seeking additional development stage and marketed pharmaceutical product licensing opportunities in order to leverage the specialty marketing infrastructure that we plan to build in support of Intermezzo®. |

The Intermezzo® Opportunity

Overview of the insomnia market

According to IMS Health, an independent market research firm, the number of prescriptions filled in the United States to treat insomnia grew from approximately 54 million in 2004 to approximately 79 million in 2009.

Middle of the night awakening: the most common insomnia symptom

The 2003 National Sleep Foundation, or NSF, “Sleep in America” poll of the U.S. population between the ages of 55 and 84 described waking up during the night as the most prevalent insomnia symptom, affecting 33% of respondents. Based on the 2005 NSF poll data, we estimate that middle of the night awakening is 50% more common than difficulty going to sleep at bedtime among the general population. The 2009 NSF poll found that 46% of respondents described being “awake a lot during the night.”

Based on a study published in 2008 of nearly 9,000 individuals, the Stanford Sleep Epidemiology Research Center has estimated that about one-third of adults in the United States experience middle of the night awakenings at least three times each week. The study concluded that more than 90% of those subjects who reported middle of the night awakenings reported that this insomnia symptom persisted for at least six months. In the Stanford study, fewer than 25% of this middle of the night awakening group reported difficulty going to sleep at bedtime.

Data from a study published in Population Health Management in 2010, based on information from the United States National Health and Wellness Survey to evaluate the economic and humanistic burden of chronic insomnia characterized by nighttime awakenings, indicate that this condition was associated with a significant negative impact in health care utilization, health-related quality of life and work productivity.

The FDA has not previously approved any sleep aid specifically for use in the middle of the night when patients awaken and have difficulty returning to sleep. The most commonly prescribed sleep aids are formulated at doses that are sufficiently high to produce seven to eight hours of sleep. Such seven to eight hour products can be used at bedtime to prevent a middle of the night awakening. However, their prolonged duration of action makes them unsuitable for use in the middle of the night when an awakening occurs, as this may increase the risk of residual sedative effects the following morning.

Middle of the night awakenings typically do not occur every night, thus bedtime use of a high dose sleep aid to prevent an awakening requires that the patient either predict which night an awakening might occur, or take a seven to eight hour product every night. The result is that patients may use their sleep aid more often than necessary, and at a higher dose than necessary, as compared to a fast-acting, low dose sleep aid that would be used only on the nights and at the time when an awakening actually occurs.

Intermezzo®—potential to be the first sleep aid approved specifically for use in the middle of the night when patients awaken and have difficulty returning to sleep

We believe that Intermezzo®, if approved, will be the first sleep aid approved specifically for use in the middle of the night when patients awaken and have difficulty returning to sleep. In clinical trials, the unique Intermezzo® characteristics of rapid bioavailability and low dose enabled patients to return to sleep quickly and, about four hours after taking their medication in the middle of the night, showed no evidence of the residual effects that have been reported when seven to eight hour zolpidem products were taken in the middle of the night.

6

Table of Contents

Intermezzo® is a sublingual tablet utilizing a proprietary formulation intended to enhance the absorption of the active sleep medication, zolpidem. Zolpidem is the most frequently prescribed sleep aid in the United States, with, according to IMS Health, over one billion tablets prescribed in 2009 in the United States. We believe that Intermezzo® contains the lowest dose of zolpidem that has been reported to induce sleep in a manner statistically superior to placebo, and is expected to be available in doses that are 65% and 72% lower than the comparable doses of Ambien® and Ambien CR®, respectively.

Intermezzo®: Bimucoral® Technology

Intermezzo® differs from previous formulations of zolpidem through its combination of lower dose and sublingual route of administration, and is designed to be the first sleep aid approved specifically for use in the middle of the night when patients awaken and have difficulty returning to sleep. The Intermezzo® sublingual dosage form is formulated to rapidly deliver zolpidem to allow patients to return to sleep quickly. In order to permit patients to take Intermezzo® in the middle of the night and yet potentially awaken four hours later without hangover effects, Intermezzo® employs a significantly reduced zolpidem dose of 3.5 mg for adults under age 65 and 1.75 mg for those patients over age 65. We believe they are the lowest doses of zolpidem reported to be effective in inducing sleep in a manner that demonstrates statistical superiority to placebo.

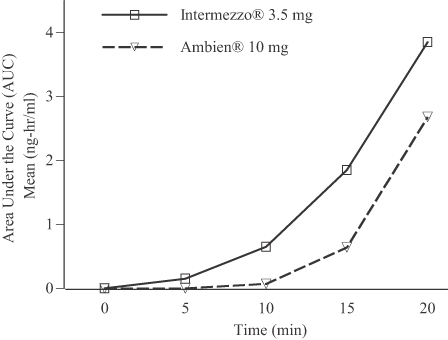

Intermezzo® utilizes Bimucoral® technology, a patented bicarbonate-carbonate binary buffer system, or a chemical combination that modifies the pH of saliva, to convert water-soluble zolpidem tartrate into its fat-soluble free-base form, which is more readily absorbed through the tissues of the mouth. We believe that this formulation facilitates rapid absorption, leading to measurable zolpidem blood levels within five minutes after administration of a 3.5 mg Intermezzo® tablet. Data from a comparative bioavailability study indicated that 10 to 20 minutes after dosing, zolpidem exposure, as delivered by Intermezzo®, was notably higher than that produced by a swallowed 10 mg zolpidem tablet. This occurred despite the fact that the 10 mg swallowed formulation contains nearly three times the Intermezzo® 3.5 mg dose. Data from this study demonstrating enhanced bioavailability, as demonstrated by the area under the curve, is illustrated below:

Bioavailability comparison study (n=33):

Intermezzo® 3.5 mg vs. Ambien® 10 mg (n=33)

7

Table of Contents

Intermezzo® Clinical Development Program

The Intermezzo® clinical development program that supported the filing of the NDA for Intermezzo® in September 2008 consisted of a total of 12 studies. Four studies were early stage bioavailability trials and utilized prototype formulations. These were completed prior to the submission of the investigational new drug application, or IND, in April 2005. Eight additional studies were conducted, including two Phase 3 clinical trials that were included in the Intermezzo® NDA submission.

The basis for clinical trial dose selection was initially provided by a pharmacokinetic and pharmacodynamic study, which demonstrated rapid bioavailability and also indicated that sedation reached peak levels within 20 minutes after dosing, as measured with the Digit Symbol Substitution Test, or DSST, a standard objective test of cognitive function to measure impairment. Despite this rapid effect, sedation levels returned to baseline within about three hours by most measures, suggesting that patients may be able to awaken without residual sedative effects four hours after taking a middle of the night dose of Intermezzo®.

The clinical safety and efficacy of Intermezzo® are supported by two Phase 3 clinical studies. The first Phase 3 trial was a double-blind crossover study conducted in sleep laboratories in 82 patients. This study analyzed both the objective and subjective effects of Intermezzo® on middle of the night awakenings. The second Phase 3 trial was a double-blind parallel group outpatient study in 294 patients which analyzed subjective outcomes when patients used Intermezzo® as needed at home at the time they awakened and had difficulty returning to sleep.

In both of these clinical trials, Intermezzo® met its primary clinical endpoint by enabling patients to return to sleep after a middle of the night awakening more rapidly than placebo. After going back to sleep, patients tended to remain asleep longer than those on placebo and awoke without evidence of residual effects as compared to placebo.

Pivotal Phase 3 sleep laboratory study

The Phase 3 sleep laboratory clinical trial was designed as an 82 patient randomized, double-blind, placebo controlled, three-way crossover study to evaluate the safety and efficacy of Intermezzo® 1.75 mg and 3.5 mg when taken for a scheduled middle of the night awakening in subjects with insomnia characterized by difficulty returning to sleep. The study was conducted in five U.S. clinical sites and each treatment period consisted of two consecutive nights of dosing followed by a 5 to 12 day washout period. The first period consisted of two baseline nights in the sleep laboratory, followed by randomized two night treatment periods using placebo and Intermezzo® 1.75 mg and 3.5 mg.

8

Table of Contents

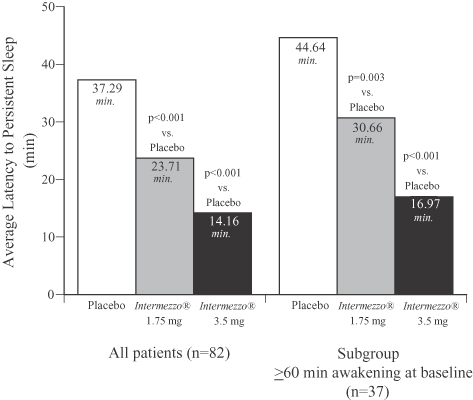

The figure below compares the time to sleep onset measured in the objective Phase 3 sleep laboratory study as produced by Intermezzo® 1.75 mg and 3.5 mg compared to placebo. The left hand bar graph compares sleep onset time in all patients in the study and demonstrates that 3.5 mg Intermezzo® returned patients to sleep in the middle of the night approximately 23 minutes faster than placebo. The right hand bar graph examines only those patients whose middle of the night awakenings were particularly prolonged, in that they experienced awakenings during the baseline observation period that lasted more than an hour. Despite the more prolonged middle of the night awakenings in this patient subset, the 3.5 mg Intermezzo® dose returned these patients to sleep approximately 28 minutes faster than placebo. All of these differences were statistically significant.

Phase 3 Sleep Laboratory Study (n=82)

Placebo vs. Intermezzo® 1.75 mg and 3.5 mg

Objective Latency to Persistent Sleep following a middle of the night awakening

9

Table of Contents

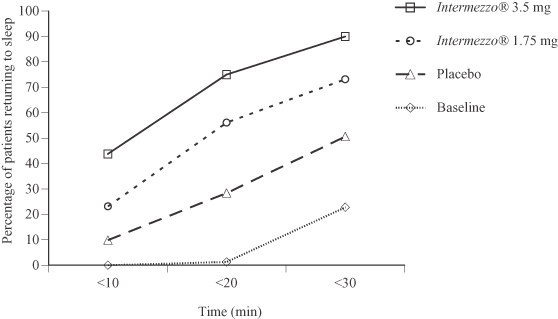

As the following figure shows, patients in the Phase 3 sleep laboratory study, when treated with either the 1.75 mg or 3.5 mg Intermezzo® dose, were more likely to fall asleep within 10 to 20 minutes than when these same patients received placebo. On the baseline nights, with one exception, no patients had returned to sleep within 20 minutes. However, on the subsequent treatment nights when patients were given Intermezzo® 3.5 mg, 75% of the same patients returned to sleep at or before the 20 minute time point.

Phase 3 Sleep Laboratory Study (n=82)

Baseline and placebo vs. Intermezzo® 1.75 mg and 3.5 mg:

Proportion of patients asleep vs. time following a middle of the night awakening

10

Table of Contents

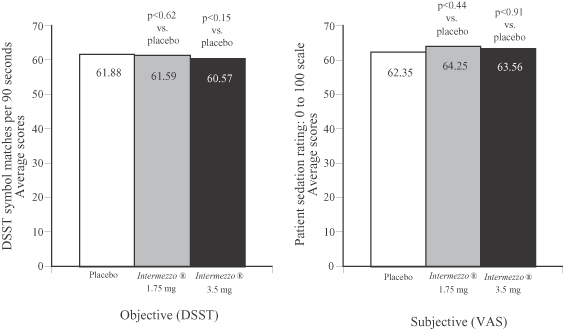

In the placebo-controlled sleep laboratory study, neither Intermezzo® dose produced residual hangover effects the morning after dosing. Residual hangover effects were measured objectively by the DSST and a subjective assessment of morning sleepiness and alertness utilizing a visual analog scale, or VAS. Results of the study are noted below.

Phase 3 Sleep Laboratory Study (n=82)

Residual effects of Intermezzo® 1.75 mg and 3.5 mg vs. placebo

DSST (objective) and VAS (subjective) scores

11

Table of Contents

Pivotal Phase 3 outpatient study

The Phase 3 outpatient clinical trial was designed as a 294-patient randomized, double-blind, placebo controlled study to evaluate the safety and efficacy of Intermezzo® 3.5 mg for use as-needed for the treatment of insomnia when a middle of the night awakening is followed by difficulty returning to sleep. The study was conducted in 25 U.S. clinical sites and the study duration included a two week baseline period, followed by a 28 day double-blind treatment period.

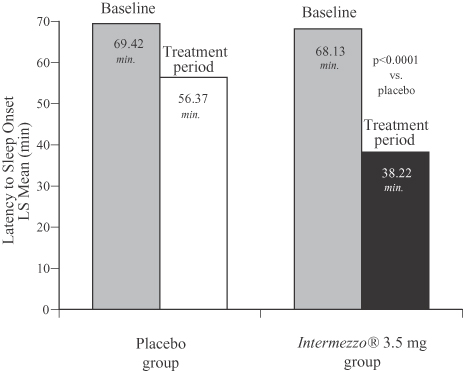

The Phase 3 outpatient study confirmed the positive results of the Phase 3 sleep laboratory study: Intermezzo® improved time to sleep onset after a middle of the night awakening by 18 minutes versus placebo, a difference that was statistically significant. The figure below compares the patient-reported time to sleep onset with Intermezzo® 3.5 mg as compared to that of placebo and at baseline.

Phase 3 Outpatient Study, Placebo vs. Intermezzo® 3.5 mg (n=294)

Latency to Sleep Onset (LSOMOTN) 4 week average

12

Table of Contents

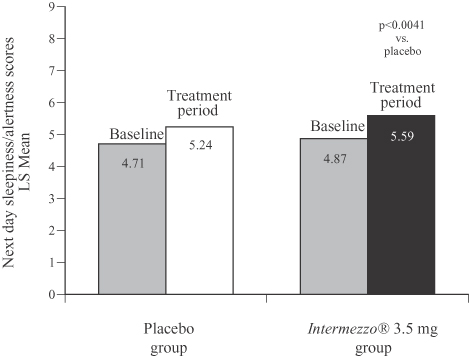

Each morning after awakening during the Phase 3 outpatient study patients reported their level of sleepiness on a nine-point scale. As the following graph shows, patients taking Intermezzo® 3.5 mg reported feeling less sleepy and more alert than patients taking placebo, a difference that was statistically significant.

Phase 3 Outpatient Study (n=294)

Next day sleepiness/alertness scores, 4-week average

(0 to 9 scale: 0 = sleepiness, 9 = awake and alert)

Intermezzo® Regulatory Review in the United States

Overview

On September 30, 2008, we submitted an NDA to the FDA to seek approval of Intermezzo® in the United States for use in the middle of the night at the time a patient awakens and has difficulty returning to sleep.

On October 28, 2009, we received a Complete Response Letter from the FDA regarding our NDA indicating that the NDA was not approved. The FDA stated in its Complete Response Letter that it believes we submitted substantial evidence of the effectiveness of Intermezzo® for its proposed indication. However, the FDA noted that the intended use of Intermezzo® in the middle of the night represents a unique insomnia indication and dosing strategy for which safety has not been previously established and that we had not adequately demonstrated to the FDA that Intermezzo® can be reliably used safely.

Our proposed label for Intermezzo® indicates that Intermezzo® should only be taken when patients have at least four hours remaining in bed before being active again. In its Complete Response Letter, the FDA recognized that the Intermezzo® data we submitted did not indicate significant next day residual effects at four hours, as measured by both the DSST and next day patient questionnaires. However, the FDA requested additional data demonstrating that Intermezzo®, when taken as directed in the middle of the night, would not present an unacceptable risk of residual effects, with particular reference to next day driving ability.

The FDA also expressed two concerns regarding the possibility of patient dosing errors in the middle of the night that could lead to next day residual effects with particular reference to next day driving ability. Specifically,

13

Table of Contents

the FDA asked us to address methods to avoid inadvertent dosing with less than four hours of bedtime remaining and inadvertent re-dosing in a single night.

On January 20, 2010, we met with the FDA to discuss the Complete Response Letter. In the briefing document submitted prior to the January 20, 2010 meeting, we proposed a new Intermezzo® bedside unit-dose package and patient instructions designed to reduce the possibility of inadvertent patient dosing errors. The FDA indicated in the meeting that the revised packaging appeared to reduce the potential for inadvertently taking more than one dose in a single night. However, the FDA expressed continuing concern that the revised packaging may not adequately address the risk of inadvertent dosing with less than four hours of time remaining in bed, with particular regard to the possibility of impaired driving.

On January 20, 2010, we also reviewed with the FDA the types of data that could support the evaluation of the proposed packaging and instructions, including data from pre-approval assessments of patient understanding of dosing instructions and a potential patient use study of the new Intermezzo® packaging.

On February 16, 2010, we proposed to the FDA to conduct a pre-approval highway driving study to assess the effect of Intermezzo® on driving ability beginning at approximately three hours and four hours post-dosing to further understand the safety of dosing Intermezzo® in the middle of the night. We also submitted additional supportive analyses of data from a 2005 Phase 1 Intermezzo® pharmacokinetic and pharmacodynamic study that measured cognitive effects through a battery of commonly recognized tests conducted at different time points up to five hours after dosing. As requested by the FDA, we also provided information on the challenges and limitations of pre-approval patient use studies, and submitted a plan to assess and optimize patient understanding of the new packaging and patient instructions.

On March 24, 2010, we had a teleconference with the FDA during which the FDA agreed that the proposal we submitted on February 16, 2010, to conduct a highway driving study, is a reasonable way to measure potential next day driving impairment as a result of dosing Intermezzo® in the middle of the night with four hours or less remaining in bed. During the teleconference, the FDA also indicated that it would consider, as part of the overall resubmission of the Intermezzo® NDA, our position on the challenges and limitations of a pre-approval patient use study. Such a study would seek to define patient ability to properly follow instructions under actual conditions of use. We have no current plans to conduct a patient use study because of the challenges and limitations of such a study. We submitted our position in this regard to the FDA on February 16, 2010 and currently plan to resubmit such position with the resubmission of the Intermezzo® NDA.

We plan to resubmit the Intermezzo® NDA in the late fourth quarter of 2010 after we generate and analyze additional data from our planned highway driving study. Because our planned resubmission will include additional clinical data, our resubmitted Intermezzo® NDA will result in a six-month review period at the FDA under the PDUFA.

Planned Highway Driving Study

We plan to conduct a pre-approval highway driving study to assess the effect of Intermezzo® on next morning driving ability beginning at approximately three hours and four hours after dosing Intermezzo® in the middle of the night. We believe this study will help to further characterize the safety profile of dosing Intermezzo® with four hours or less remaining in bed. The study will assess the potential residual effect of Intermezzo® on driving ability by tracking the deviation of subjects’ lateral position on the road over a one-hour driving period. The study is expected to assess the performance of 36 patients in a single center, double-blind, randomized, placebo-controlled crossover study design. We plan to conduct the study at the Maastricht University in the Netherlands, a leading center of research on the effects of drugs and alcohol on driving performance. Key comparisons to be analyzed in the study through their affect on subjects’ driving ability are:

| • | Intermezzo® 3.5mg verses placebo, 4 hours post-dose; |

| • | Intermezzo® 3.5mg verses placebo, 3 hours post-dose; and |

| • | Zopiclone 7.5mg verses placebo (positive control). |

14

Table of Contents

Phase 1 Safety Study

The Phase 1 study conducted in 2005 from which additional analyses were submitted to the FDA in February 2010, was conducted during the daytime in 24 normal healthy volunteers aged 21 to 44. Although not a measure of the presence or absence of potential driving impairment, the study did measure cognitive effects through a battery of commonly recognized objective and subjective measures of cognitive function. The tests included the Digit Symbol Substitution Test, or DSST, a standard objective test of cognitive function; a visual analog scale, or VAS, for subjective assessment of alertness; the Word Recall test, a generally accepted test of the effect of sedative hypnotics on memory; Choice Reaction Time, or CRT, a test that measures response time, lapses and errors, and is generally accepted as a test of performance on tasks that require sustained attention; and the Symbol Copying Test, or SCT, which is similar to DSST but without visual, search, memory or coding demands.

The Phase 1 study demonstrated that sedative activity was statistically different from placebo as early as 20 minutes in every test except SCT. SCT was not statistically different from placebo at any time-point. Scores returned to baseline at 2.5 hours or less as measured by DSST, VAS, Word Recall, CRT-response time and CRT-lapses. The CRT-error test scores were inconsistent. They were significantly different from placebo at 20 minutes and 3 hours after dosing, but not at hours 1, 1.5, 2.0, 2.5 and 4. Consistent with our proposed label for Intermezzo®, these results suggest that patients may be able to awaken without residual sedative effects four hours after taking a middle of the night dose of Intermezzo®.

Commercialization

Collaboration with Purdue

On July 31, 2009, we entered into the Collaboration Agreement with Purdue to commercialize Intermezzo® in the United States. Under the terms of our Collaboration Agreement:

| • | On August 4, 2009, Purdue paid us a $25.0 million non-refundable license fee; |

| • | We are obligated to seek FDA approval of Intermezzo® and to continue development of Intermezzo® at our expense until FDA approval; and |

| • | If Purdue elects not to terminate our collaboration after its review of an FDA approval of Intermezzo®: |

| • | Purdue is obligated to pay us up to $30.0 million, which amount is reduced by $2.0 million for each 30 day period that our receipt of an NDA approval for Intermezzo® is delayed beyond June 30, 2010; |

| • | We are obligated to transfer the Intermezzo® NDA to Purdue and Purdue is obligated to assume the expense associated with maintaining the NDA and further development of Intermezzo® in the United States, including any expense associated with post-approval studies; |

| • | Purdue is obligated to commercialize Intermezzo® in the United States at its expense; |

| • | Purdue is obligated to pay us tiered double-digit base royalties on net sales of Intermezzo® in the United States ranging up to the mid-twenty-percent level; |

| • | Purdue is obligated to pay us $10.0 million if either of two formulation patents are listed in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, or Orange Book; and |

| • | Purdue is potentially obligated to pay us up to an additional $80.0 million upon meeting certain intellectual property milestones and upon the achievement of certain net sales targets for Intermezzo® in the United States. |

We retained an option to co-promote Intermezzo® to psychiatrists in the United States as early as the first anniversary of commercial launch of Intermezzo® and as late as 55 months after commercial launch. Upon entry into the market under the co-promotion option, we would receive an additional double-digit royalty from Purdue

15

Table of Contents

on sales generated by psychiatrists in the United States. This royalty is in addition to the base royalty on total United States net sales, and is set according to the time interval between initiation of sales of Intermezzo® in the United States and the time that we initiate our sales efforts in the market under the co-promote option.

Purdue has the right to terminate the collaboration agreement at any time upon 180 days notice and after review of any final FDA approved label for Intermezzo®. Our co-promote option may also be terminated by Purdue upon our acquisition by a third party or in the event of entry of generic competition to Intermezzo®. The royalty payments discussed above are subject to reduction in connection with, among other things, the entry of generic competition to Intermezzo®. The collaboration agreement expires on the later of 15 years from the date of first commercial sale in the United States or the expiration of patent claims related to Intermezzo®. The collaboration agreement is also subject to termination by Purdue in the event of FDA or governmental action that materially impairs Purdue’s ability to commercialize Intermezzo® or the occurrence of a serious event with respect to the safety of Intermezzo®. The collaboration agreement may also be terminated by us upon Purdue commencing an action that challenges the validity of Intermezzo® related patents. We also have the right to terminate the collaboration agreement immediately if Purdue is excluded from participation in federal healthcare programs. The collaboration agreement may also be terminated by either party in the event of a material breach or insolvency of the other party.

We granted Purdue and an associated company the right to negotiate for the commercialization of Intermezzo® in Mexico and Canada, respectively, and retained rights to commercialize Intermezzo® in the rest of the world.

Sales and Marketing

In our collaboration agreement with Purdue, we retained an option to co-promote Intermezzo® to psychiatrists in the United States. We can exercise this option to enter the market as early as the first anniversary of the commercial launch of Intermezzo® in the United States. Upon entry into the market under the co-promotion option, we would receive an additional double-digit royalty from Purdue on sales generated by psychiatrists in the United States.

Our co-promote option with Purdue provides us with the potential to develop our own United States specialty sales and marketing capabilities focused on the promotion of Intermezzo® to psychiatrists and other products that address unmet needs in the field of neuroscience. To achieve our goal of developing our own sales and marketing infrastructure, we must first obtain FDA approval of Intermezzo®, in-license another product opportunity or develop and obtain approval for another product. To achieve commercial success in marketing and selling Intermezzo® in the United States, we must work with our partner, Purdue, to effectively integrate our sales and marketing infrastructure and implement our sales and marketing efforts.

For the 12 months ended December 31, 2009, IMS Health reports that approximately 5,700 psychiatrists wrote 66% of all insomnia prescriptions written by psychiatrists. Transcept believes it can begin to promote to this prescribing audience with an initial sales force of 50 to 60 representatives that could expand to 100 representatives depending on revenue results.

Intermezzo® Commercialization Outside the United States

We have not yet applied for regulatory approval to sell Intermezzo® in any country other than the United States. We plan to market and sell our products that receive regulatory approval outside the United States through pharmaceutical companies that are established in their respective markets. We granted Purdue and an associated company the right to negotiate for the commercialization of Intermezzo® in Mexico and Canada, respectively. We retained rights to commercialize Intermezzo® and our other potential products in the rest of the world. We have an active effort underway to enter into one or more development and marketing alliances to develop and commercialize Intermezzo® with established pharmaceutical companies in major markets outside the United States.

16

Table of Contents

Exploratory Clinical Development Programs

We are seeking additional product opportunities that can be of importance in the field of neuroscience. In this regard, we are evaluating drug product concepts for the treatment of OCD in patients who do not respond to conventional therapeutics. Our strategy is to augment the therapeutic effects of fluoxetine and other similar selective serotonin reuptake inhibitors (SSRI) in OCD patients by promoting down-regulation of dopamine with ondansetron, currently marketed as Zofran® by GlaxoSmithKline, to provide more effective treatments to control OCD in patients who are resistant to conventional therapies. We have completed two single blind exploratory clinical studies to examine the use of a range of low doses of ondansetron in the treatment of this disorder. These studies have yielded initial results that we and our advisors believe to be encouraging and we are currently evaluating product development strategies to pursue this opportunity.

In-Licensing

We have an in-licensing effort underway to identify and secure licenses to patents and development rights relating to the use of existing drugs in the field of neuroscience, and to identify and secure the rights to one or more approved products that can be effectively sold by the specialty sales and marketing team that we plan to build.

Competition

If Intermezzo® receives FDA marketing approval, it will compete against well-established products currently used in the treatment of insomnia, both branded and generic. Potentially competitive products include branded formulations of zolpidem, such as Ambien® and Ambien CR® marketed by Sanofi-Aventis, generic formulations of zolpidem, Lunesta®, marketed by Dainippon-Sumitomo Pharma Co., Ltd., RozeremTM, marketed by Takeda Pharmaceuticals Company Limited, Sonata®, marketed by King Pharmaceuticals, Inc. and generic forms of this product, and a number of other pharmaceutical agents, including antidepressants and antipsychotics, that are prescribed off-label. None of the currently marketed sleep aids that have FDA approval are specifically approved for use in the middle of the night when patients awaken and have difficulty returning to sleep. However, many of these products can be used to prevent middle of the night awakenings by prophylactic use at bedtime.

The market for prescription sleep products has evolved significantly over the last 30 years. Until about 30 years ago, the market was dominated by barbiturate sedative-hypnotics such as Seconal® and Nembutal®. These were superseded by the benzodiazepine class of sedative-hypnotics including Dalmane®, RestorilTM and Halcion®. Zolpidem, which is a selective modulator of GABAA receptor and is a member of the non-benzodiazepine class of sleep aids, was introduced in the United States in 1993 under the Ambien® brand, and, according to IMS Health, rapidly achieved the dominant position in the prescription sleep aid market. The patent for Ambien® expired in April 2007, and shortly thereafter the FDA approved the generic manufacture of zolpidem by multiple pharmaceutical companies. The pricing of generically manufactured zolpidem is significantly lower than branded formulations of zolpidem and other non-generic sleep aids. Combined sales of generic zolpidem products accounted for approximately 45% of the U.S. prescription market for sleep aids. According to IMS Health, over one billion branded and generic zolpidem tablets were prescribed in the United States in 2009. An extended release version of zolpidem was launched successfully as Ambien CR® in 2005, and, according to IMS Health, held a 7.9% U.S. prescription market share in December 2009.

Other branded prescription sleep aids include Lunesta® (eszopiclone), marketed by Dainippon-Sumitomo Pharma Co., Ltd., which was approved in December 2004 by the FDA and launched in the first quarter of 2005, and Rozerem® (ramelteon), which is marketed by Takeda Pharmaceuticals Company Limited. According to IMS Health, in December 2009, Lunesta® held a 6.3% U.S. prescription market share and Rozerem® held a 0.8% U.S. prescription market share.

There exist a number of other agents that are used to treat insomnia. These include Sonata®, a short-acting sleep aid marketed by King Pharmaceuticals, Inc., which lost patent protection in June 2008. Although not

17

Table of Contents

approved or promoted for the treatment of middle of the night awakenings, some physicians prescribe Sonata® off-label for this purpose. EdluarTM, for which Orexo AB received marketing approval in March 2009, was launched in the U.S. market by Meda Pharmaceutals, Inc. in September 2009. EdluarTM employs the same 5mg and 10mg zolpidem doses as generic Ambien® and is designed to be used in the same manner at bedtime to produce seven to eight hours of sleep. There are also a number of other pharmaceutical agents including antidepressants and antipsychotics that are not approved for the treatment of insomnia but are frequently prescribed off-label owing to their ancillary sedative effects. For example, the antidepressant generic trazadone is widely prescribed off-label for the treatment of insomnia.

In addition to current products for the treatment of insomnia, a number of new prescription products may enter the insomnia market over the next several years. These may include the following:

| • | ZolpimistTM, an orally administered spray containing zolpidem, received marketing approval from the FDA in December 2008. ZolpimistTM employs the same 5mg and 10mg zolpidem doses as generic Ambien® and is designed to be used in the same manner at bedtime to produce seven to eight hours of sleep. In November 2009, the developers of Zolpimist™, NovaDel Pharma, Inc., announced it had licensed the U.S. and Canadian marketing rights for ZolpimistTM to ECR Pharmaceuticals Company, Inc., a wholly owned subsidiary of Hi-Tech Pharmacal Co., Inc. ECR Pharmaceuticals Company, Inc. stated in its press release announcing the agreement that it intends to launch ZolpimistTM in the first half of 2010. NovaDel Pharma, Inc. also recently announced that it commenced development of a low-dose version of Zolpimist™ for the treatment of middle-of-the-night awakenings with the intent to enter such product candidate into clinical trials. |

| • | Tasimelteon (VEC-162), a melatonin agonist being developed by Vanda Pharmaceuticals Inc., received an orphan designation from the FDA in January 2010 for treatment of non-24 hour sleep/wake disorder in blind individuals without light perception. |

| • | Silenor®, a low dose doxepin formulation intended for use at bedtime, for which Somaxon Pharmaceuticals, Inc. announced FDA approval in March 2010 for the treatment of both transient (short term) and chronic (long term) insomnia characterized by difficulty with sleep maintenance in both adults and elderly patients. In clinical trials, Silenor demonstrated maintenance of sleep into the 7th and 8th hours of the night, with no meaningful evidence of next day residual effects. In March 2010, Somaxon announced that it is focused on seeking a U.S. commercial partnership, building a U.S. commercial presence and preparing to launch Silenor® in the second half of 2010. |

| • | Indiplon, another agent that belongs to the GABAA receptor modulator class of compounds, and which has not been approved by the FDA, is being developed by Neurocrine Biosciences, Inc. for the treatment of sleep initiation insomnia and middle of the night dosing. The potential approval of indiplon pursuant to an NDA submitted by Neurocrine Biosciences, Inc. has been delayed and the regulatory future of this product is uncertain. |

| • | Almorexant, an orexin receptor agonist, is being co-developed by GlaxoSmithKline plc and Actelion Pharmaceuticals, Inc. for the treatment of insomnia. In December 2009, Actelion announced positive efficacy results from the first Phase 3 study of almorexant and that certain safety observations required further evaluation in another Phase 3 study. |

| • | SKP-1041, a controlled-release zaleplon formulation is being developed by Somnus Therapeutics Inc. targeting treatment of middle of the night awakenings with a formulation that is administered at bed time. |

| • | MK-4305, an orexin antagonist, is in Phase 3 trials and is being developed by Merck & Co., Inc. for the treatment of insomnia. |

| • | AZ-007, an inhaled version of zaleplon, is being developed by Alexza Pharmaceuticals, Inc. for the treatment of insomnia. Alexza Pharmaceuticals has commented publicly that they are evaluating AZ-007 for its suitability to treat middle of the night awakenings. |

18

Table of Contents

There are a variety of other drugs intended as sleep aids under earlier stages of development. With the exceptions of indiplon and a possible new formulation of ZolpimistTM, as noted above, we believe that all of these product candidates are intended to be taken at bedtime, and are not being developed for the as-needed treatment of middle of the night awakenings at the time they occur.

Manufacturing

We do not have or intend to develop internal clinical supply or commercial manufacturing capabilities for Intermezzo®, or other product candidates. We entered into an agreement with Patheon Inc., or Patheon, for the manufacture of Intermezzo® tablets. We have also entered into agreements with Plantex USA, Inc., or Plantex, as the sole source supplier of a special form of zolpidem tartrate, a specially manufactured form of the active pharmaceutical ingredient of Intermezzo®, and with SPI Pharma, Inc., or SPI, as a supplier of buffered soda and Pharmaburst®, a spray dried sugar, key excipients used in Intermezzo®. We have agreements with Anderson Packaging Inc., or Anderson, and Sharp Corporation, or Sharp, for packaging of Intermezzo® and have entered into agreements with Mikart, Inc., or Mikart, to qualify them as a backup commercial supplier of finished product and as a backup commercial supplier of a key Intermezzo® excipient. All of these supply and manufacturing agreements contain customary commercial terms for pharmaceutical companies regarding forecasting, payment, pricing, ordering, current good manufacturing practices, or cGMP, compliance and quality. All such agreements provide for us to pay for supplies within 30 days of being invoiced upon their shipment, and, except for the agreements with Mikart as described below, none of these agreements contain minimum purchase requirements. Other than the agreements with Sharp and Patheon, all agreements set forth four quarters of forecasting, with the first such quarter’s forecast being a binding firm order. The agreements with Sharp and Patheon contain similar forecasting provisions, except that the Sharp agreement sets forth a 12-month rolling forecast, with the first three months of such forecast being a binding firm order, and the Patheon agreement sets forth 18-month, non-binding forecasting, but with a requirement that firm orders be separately placed three months prior to expected delivery. A further description of the termination provisions and certain other terms is set forth below.

When we entered into the collaboration agreement with Purdue we amended our supply agreements with Patheon, Plantex, SPI, and Sharp effective upon notice to be provided to such manufacturers that the NDA for Intermezzo® has been transferred from us to Purdue. Once such notice has been delivered, these amendments allow Purdue to enter into direct supply agreements with such manufacturers for product supplied and sold in the United States. In connection with any termination of the Purdue collaboration agreement, the territory changes set forth in the amendments also terminate, and all supply arrangements for the U.S. territory return to Transcept.

Manufacturing Services Agreement with Patheon

In October 2006, we entered into the Manufacturing Services Agreement with Patheon. Under the agreement, we are required to obtain Intermezzo® tablets from Patheon, provided that we retain the ability to qualify a secondary supplier for a portion of its supply requirements from that secondary supplier. The initial term of the Manufacturing Services Agreement expires in December 2014, but is automatically renewed for three year periods, subject to 24 month prior notice of an election not to renew. The agreement may be terminated prior to the end of term by either party for breach or insolvency of the other party, and by us on 30 days’ notice in the event of regulatory prevention from, or six month notice for a determination by us to cease, commercialization of Intermezzo®, or upon 24 months’ prior notice for any business reason.

Supply Agreement with Plantex

In March 2006, we entered into the Supply Agreement with Plantex. Under the agreement, we are required to obtain specially manufactured zolpidem tartrate from Plantex, provided that we retain the ability to qualify a secondary supplier for a portion of its supply requirements from that secondary supplier. The initial term of the Supply Agreement expires on the earlier to occur of five years from the launch of Intermezzo® or ten years from

19

Table of Contents

the date of the agreement. The agreement may be terminated prior to the end of the term by either party for breach or insolvency of the other party, and may be terminated by Plantex upon 24 months’ prior notice if Plantex discontinues production of a special form of zolpidem tartrate.

Agreements with SPI

In June 2006, we entered into a Supply and License Agreement with SPI for the manufacture and supply of Pharmaburst®, a key excipient used in the manufacture of Intermezzo®. SPI is our sole supplier of Pharmaburst®. The term of the Supply and License Agreement expires in June 2016. This agreement may be terminated prior to the end of the term by either party for breach or insolvency of the other party.

In July, 2007, we entered into a Supply Agreement with SPI for the manufacture and supply of buffered soda, a key excipient used in the manufacture of Intermezzo®. Under the Supply Agreement, we obtained a license to patent rights for buffered soda, are required to obtain a large portion of our supply of buffered soda from SPI and are permitted to obtain up to a certain portion of alternative supply of buffered soda from a secondary supplier. A further description of the license under the Supply Agreement is in the section entitled “Business—Intellectual Property and Proprietary Technology.” The initial term of the Supply Agreement expires on the earlier to occur of the 10th anniversary of commercial sale of Intermezzo® or the 13th anniversary of the date of the agreement. This agreement may be terminated prior to the end of the term by either party for breach or insolvency of the other party, and may be terminated by SPI on 90 days’ notice if minimum annual purchase requirements are not met, or upon 12 months’ notice with each such termination not being effective until the third anniversary of certain qualifications of an alternative supplier. We have made minimum annual purchase requirements under the agreement through 2010.

Packaging and Supply Agreement with Anderson

In September 2006, we entered into a Packaging and Supply Agreement with Anderson. We plan to amend this agreement or enter into a packaging and supply agreement with a new supplier because we plan to change the packaging of Intermezzo® from a multi-dose unit package to a bedside, single unit-dose package. The initial term of the Packaging and Supply Agreement expires on the fifth anniversary of the execution of the agreement, and thereafter automatically renews for one year periods unless one year prior notice is given by either party of an intent not to renew. This agreement may be terminated prior to the end of the term by either party for breach or insolvency of the other party.

Packaging and Supply Agreement with Sharp

In June 2008, we entered into a Packaging and Supply Agreement with Sharp. We plan to amend this agreement or enter into a packaging and supply agreement with a new supplier because we plan to change the packaging of Intermezzo® from a multi-dose unit package to a bedside, single unit-dose package. The initial term of the Packaging and Supply Agreement expires in June 2018, and is renewable for three year terms upon our mutual agreement with Sharp prior to 180 days before the end of the then current term. This agreement may be terminated prior to the end of the term by either party for breach or insolvency of the other party.

Agreements with Mikart

In January 2008, we entered into a Supply and Sublicense Agreement with Mikart. Pursuant to the terms of the Supply and Sublicense Agreement, we granted to Mikart a non-exlusive sublicense in accordance with the terms of the Supply Agreement between us and SPI described above to allow Mikart to act as a back-up supplier of buffered soda. Such agreement requires us to purchase at least two batches of buffered soda (a total of approximately 420 kilograms) from Mikart within 24 months following the initial commercial sale of Intermezzo®, with the first such batch required to be purchased within 12 months of such date. The term of the Supply and Sublicense Agreement expires on the earlier to occur of the 10th anniversary of the first commercial sale of Intermezzo® or the 13th anniversary of the date of the agreement. This agreement may be terminated prior

20

Table of Contents

to the end of the term by either party for breach by the other party. In addition, we can terminate the agreement upon 45 days’ prior notice to Mikart, and payment to Mikart of a termination fee, at any time after the second anniversary of the first commercial sale of Intermezzo®.

In August 2008, we entered into a Manufacturing and Supply Agreement with Mikart for back-up supply of manufactured Intermezzo® tablets. Within the first 12 months after the FDA qualifies and approves Mikart as a supplier of Intermezzo® tablets, such agreement requires us to purchase at least three batches of tablets from Mikart, with any individual batch either containing 1.75 mg of zolpidem (in which case a batch means 500,000 tablets) or 3.5 mg of zolpidem (in which case a batch means 1,500,000 tablets). We and Mikart may also mutually agree on an alternate number of Intermezzo® tablets constituting a batch for purposes of such agreement. The term of the Manufacturing and Supply Agreement expires on the 10th anniversary of FDA qualification and approval of Mikart as a supplier of Intermezzo® tablets, but is automatically renewed for three year periods, subject to 18-month prior notice of an election not to renew. This agreement may be terminated prior to the end of the term by either party for breach by the other party, or by us if the FDA does not qualify Mikart as a supplier of Intermezzo® tablets.

Manufacturers and suppliers of our product candidates are subject to current cGMP requirements, U.S. Drug Enforcement Administration, or DEA, regulations and other rules and regulations prescribed by foreign regulatory authorities. We depend on third party suppliers and manufacturers for continued compliance with cGMP requirements and applicable foreign standards. We identified alternates for certain of the above-listed suppliers and plans to have such alternate suppliers qualified by the FDA and other regulatory authorities after potential approval of the Intermezzo® NDA.

Government Regulation

Prescription drug products are subject to extensive regulation by the FDA, including regulations that govern the testing, manufacturing, safety, efficacy, labeling, storage, record keeping, distribution, import, export, advertising and promotion of such products under the Federal Food Drug and Cosmetic Act, or FFDCA, and its implementing regulations, and by comparable agencies and laws in foreign countries. Failure to comply with applicable FDA or other regulatory requirements may result in a variety of administrative or judicially imposed sanctions, including FDA refusal to approve pending applications, suspension or termination of clinical trials, Warning Letters, civil or criminal penalties, recall or seizure of products, partial or total suspension of production or withdrawal of a product from the market.

FDA approval is required before any new unapproved drug, including a new use or new dosage form of a previously approved drug, can be marketed in the United States. All applications for FDA approval must contain, among other things, information relating to safety and effectiveness, pharmaceutical formulation, stability, manufacturing, processing, packaging and labeling.

New Drug Approval

A new drug approval by the FDA generally involves, among other things:

| • | completion of extensive preclinical laboratory and animal testing in compliance with FDA good laboratory practice, or GLP, regulations; |

| • | submission to the FDA of an IND to conduct human clinical testing, which must become effective before human clinical trials may begin; |

| • | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug product for each indication; |

| • | satisfactory completion of an FDA pre-approval inspection of the facility or facilities at which the product is produced to assess compliance with FDA cGMP, regulations; and |

| • | submission to and approval by the FDA of an NDA. |

21

Table of Contents

The preclinical and clinical testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for our product candidates or any indications will be granted on a timely basis, if at all.

Preclinical tests include laboratory evaluation of product chemistry, formulation and stability, as well as studies to evaluate toxicity in animals. The results of preclinical tests, together with manufacturing information and analytical data, are submitted as part of an IND to the FDA. The IND automatically becomes effective 30 days after acceptance by the FDA, unless the FDA, within the 30 day time period, raises concerns or questions about the conduct of the clinical trial, including concerns that human research subjects will be exposed to unreasonable health risks. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. The submission of an IND may not result in FDA authorization to commence a clinical trial. Further, an independent institutional review board, or IRB, for each medical center proposing to conduct the clinical trial must review and approve the plan for any clinical trial before it commences at that center and it must monitor the study until completed. The FDA, the IRB, or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk. Clinical testing also must satisfy extensive Good Clinical Practice, or GCP, regulations, including regulations for obtaining informed consent by each patient.

For purposes of an NDA submission and approval, human clinical trials are typically conducted in the following four sequential phases, which may overlap:

| • | Phase 1: Studies are initially conducted in a limited population to test the product candidate for initial safety, dose tolerance, absorption, metabolism, distribution and excretion in healthy humans or, on occasion, in patients. |

| • | Phase 2: Studies are generally conducted in a limited patient population to identify adverse effects and safety risks, to determine initial efficacy of the product for specific targeted indications and to determine dose tolerance and optimal dosage. Multiple Phase 2 clinical trials may be conducted by the sponsor to obtain additional information prior to beginning larger, more expensive and time consuming Phase 3 clinical trials. In some cases, a sponsor may decide to run what is referred to as a “Phase 2b” evaluation, which is a second, confirmatory Phase 2 trial that could, in limited situations, be accepted by the FDA and serve as one of the pivotal trials in the approval of a product candidate if the study is positive. |

| • | Phase 3: These are commonly referred to as pivotal studies. When Phase 2 evaluations demonstrate that a dose range of the product is effective and has an acceptable safety profile, Phase 3 trials are undertaken in larger patient populations in the target indication to further evaluate dosage, to provide substantial evidence of clinical efficacy and to further test for safety in an expanded and diverse patient population, often at multiple, geographically-dispersed clinical trial sites. |

| • | Phase 4: In many cases, the FDA incorporates into the approval of an NDA the sponsor’s agreement to conduct additional clinical trials to further assess a drug’s safety and effectiveness after NDA approval. Such post approval trials are typically referred to as Phase 4 studies. |

Controlled clinical trials conducted for our drug candidates must be included in a clinical trials registry database that is available and accessible to the public through the internet. Failure to properly participate in the clinical trial database registry could result in significant civil monetary penalties.

The submission of an NDA is no guarantee that the FDA will find it complete and accept it for filing. The FDA reviews all NDAs submitted before it accepts them for filing. It may refuse to file the application and request additional information rather than accept the application for filing, in which case, the application must be resubmitted with the supplemental information. After the application is deemed filed by the FDA, agency staff of the FDA will review an NDA to determine, among other things, whether a product is safe and efficacious for its intended use.

22

Table of Contents