Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended: December 31, 2016

or

|

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 001-36066

PARATEK PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

33-0960223 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

75 Park Plaza

Boston, MA 02116

(617) 807-6600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of exchange on which registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

|

|

|

|

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock of the registrant held by non-affiliates of the registrant on June 30, 2016, the last business day of the registrant’s second fiscal quarter was: $259,770,210.

As of February 28, 2017 there were 24,286,212 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the registrant’s 2017 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A within 120 days of the registrant’s year ended December 31, 2016 are incorporated herein by reference into Part III of this Annual Report on Form 10-K.

|

|

Item No. |

|

|

|

Page No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

1. |

|

|

1 |

||

|

|

|

|

|

|

|

|

|

|

1A. |

|

|

41 |

||

|

|

|

|

|

|

|

|

|

|

1B. |

|

|

68 |

||

|

|

|

|

|

|

|

|

|

|

2. |

|

|

68 |

||

|

|

|

|

|

|

|

|

|

|

3. |

|

|

68 |

||

|

|

|

|

|

|

|

|

|

|

4. |

|

|

69 |

||

|

|

|

|

|

|

|

|

|

|

|

70 |

||||

|

|

|

|

|

|

|

|

|

|

5. |

|

|

70 |

||

|

|

|

|

|

|

|

|

|

|

6. |

|

|

72 |

||

|

|

|

|

|

|

|

|

|

|

7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

74 |

|

|

|

|

|

|

|

|

|

|

|

7A. |

|

|

92 |

||

|

|

|

|

|

|

|

|

|

|

8. |

|

|

93 |

||

|

|

|

|

|

|

|

|

|

|

9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

139 |

|

|

|

|

|

|

|

|

|

|

|

9A. |

|

|

139 |

||

|

|

|

|

|

|

|

|

|

|

9B. |

|

|

141 |

||

|

|

|

|

|

|

|

|

|

|

|

142 |

||||

|

|

|

|

|

|

|

|

|

|

10. |

|

|

142 |

||

|

|

|

|

|

|

|

|

|

|

11. |

|

|

142 |

||

|

|

|

|

|

|

|

|

|

|

12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

142 |

|

|

|

|

|

|

|

|

|

|

|

13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

142 |

|

|

|

|

|

|

|

|

|

|

|

14. |

|

|

142 |

||

|

|

|

|

|

|

|

|

|

|

|

143 |

||||

|

|

|

|

|

|

|

|

|

|

15. |

|

|

143 |

||

|

|

|

|

|

|

|

|

|

|

16. |

|

|

143 |

||

|

|

|

|

|

|

|

|

|

|

144 |

|||||

|

|

|

|

|

|

|

|

|

|

145 |

|||||

i

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are based upon current expectations within the meaning of the Private Securities Litigation Reform Act of 1995. Paratek Pharmaceuticals, Inc. intends that such statements be protected by the safe harbor created thereby. Forward-looking statements involve risks and uncertainties and actual results and the timing of events may differ significantly from those results discussed in the forward-looking statements. Examples of such forward-looking statements include, but are not limited to, statements about or relating to:

|

|

• |

The timing, scope and anticipated initiation, enrollment and completion of our ongoing and planned clinical trials and any other future clinical trials that we or our development partners may conduct |

|

|

• |

the plans, strategies and objectives of management for future operations |

|

|

• |

proposed new products or developments; |

|

|

• |

future economic conditions or performance; |

|

|

• |

the therapeutic and commercial potential of our product candidates; |

|

|

• |

the timing of regulatory discussions and submissions, and the anticipated timing, scope and outcome of related regulatory actions or guidance; |

|

|

• |

our ability to establish and maintain potential new collaborative, partnering or other strategic arrangements for the development and commercialization of our product candidates; |

|

|

• |

the anticipated progress of our clinical programs, including whether our ongoing clinical trials will achieve clinically relevant results; |

|

|

• |

our ability to obtain regulatory approvals of our product candidates and any related restrictions, limitations and/or warnings in the label of an approved product candidate; |

|

|

• |

our ability to market, commercialize and achieve market acceptance for our product candidates, if approved; |

|

|

• |

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others; |

|

|

• |

our estimates regarding the sufficiency of our cash resources, expenses, capital requirements and needs for additional financing, and our ability to obtain additional financing; and |

|

|

• |

our projected financial performance. |

In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, time frames or achievements to be materially different from the information set forth in these forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement, we caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. We discuss many of these risks in the “Risk Factors” section and elsewhere in this Annual Report on Form 10-K. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Any of the events anticipated by the forward-looking statements may not occur or, if any of them do, the impact they will have on our business, results of operations and financial condition is uncertain. We hereby qualify all of our forward-looking statements by these cautionary statements.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Paratek Pharmaceuticals, Inc. is our registered and unregistered trademark in the United States and other jurisdictions. Intermezzo is a registered and unregistered trademark of Purdue Pharmaceutical Products L.P. and associated companies in the United States and other jurisdictions and is a registered and unregistered trademark of ours in certain other jurisdictions. Other trademarks and trade names referred to in this Annual Report on Form 10-K are the property of their respective owners.

All references to “Paratek,” “we,” “us,” “our” or the “Company” in this Annual Report on Form 10-K mean Paratek Pharmaceuticals, Inc. and its subsidiaries.

ii

Overview

We are a clinical stage biopharmaceutical company focused on the development and commercialization of innovative therapeutics based upon tetracycline chemistry. We have used our expertise in biology and tetracycline chemistry to create chemically diverse and biologically distinct small molecules derived from the minocycline core structure. Our two lead product candidates are the antibacterials omadacycline and sarecycline.

We have generated innovative small molecule therapeutic candidates based upon medicinal chemistry-based modifications, according to structure-based activity, of all positions of the core tetracycline molecule. These efforts have yielded molecules with broad-spectrum antibiotic properties and narrow-spectrum antibiotic properties, and molecules with potent anti-inflammatory properties to fit specific therapeutic applications. This proprietary chemistry platform has produced many compounds that have shown interesting characteristics in various in vitro and in vivo efficacy models. Omadacycline and sarecycline are examples of molecules that were synthesized from this chemistry discovery platform.

The following table summarizes the primary therapeutic applications for our product candidates:

Omadacycline

Omadacycline is the first in a new class of aminomethylcycline antibiotics. Omadacycline is a broad-spectrum, well-tolerated once-daily oral and intravenous, or IV, antibiotic. We believe that omadacycline has the potential to become the primary antibiotic choice of physicians for use as a broad-spectrum monotherapy antibiotic for acute bacterial skin and skin structure infections, or ABSSSI, community-acquired bacterial pneumonia, or CABP, urinary tract infection, or UTI, and other serious community-acquired bacterial infections, where resistance is of concern. We believe omadacycline, if approved, will be used in the emergency room, hospital and community care settings. We have designed omadacycline to provide potential advantages over existing antibiotics, including activity against resistant bacteria, broad spectrum antibacterial activity, oral and IV formulations with once-daily dosing, no known drug interactions, and a favorable safety and tolerability profile.

In the fall of 2013, the U.S. Food and Drug Administration, or the FDA, agreed to the design of our omadacycline Phase 3 studies for ABSSSI and CABP through the Special Protocol Assessment, or SPA, process. In addition, the FDA confirmed that positive data from the individual studies for ABSSSI and CABP would be sufficient to support approval of omadacycline for each indication and for both oral and IV formulations in the United States. In addition to Qualified Infectious Disease Product, or QIDP, designation, on November 4, 2015, the FDA granted omadacycline Fast Track designation for the development of omadacycline in ABSSSI, CABP, and complicated Urinary Tract Infections, or cUTI. Fast Track designation facilitates the development, and expedites the review of drugs that treat serious or life-threatening conditions and that fills an unmet medical need. In February 2016, we reached

1

agreement with the FDA on the terms of a pediatric program associated with the Pediatric Research and Equity Act. The FDA has granted Paratek a waiver from conducting studies with omadacycline in children less than eight years old due the risk of teeth discoloration, a known class effects of tetracyclines. In addition, the FDA has granted a deferral on conducting studies in children eight years and older until safety and efficacy is established in adults. In May 2016, we received confirmation from the FDA that the oral-only ABSSSI study design was acceptable and consistent with the currently posted guidance for industry.

Scientific advice received through the centralized procedure in Europe confirmed general agreement on the design and choice of comparators of the Phase 3 trials for ABSSSI and CABP and noted that approval based on a single study in each indication could be possible but would be subject to more stringent statistical standards than Market Authorization Applications, or MAA, programs that conduct two pivotal Phase 3 studies per indication. We believe that the inclusion of the second Phase 3 oral-only study in ABSSSI, if positive, strengthens the data package for submission of an MAA filing for approval in European Union, or EU.

Omadacycline entered Phase 3 clinical development in June 2015 for the treatment of ABSSSI and in November 2015 for the treatment of CABP. Both of these studies utilized initiation of IV therapy with transitions to oral based treatment on clinical response. During the conduct of these studies, an independent data safety monitoring board, or DSMB, completed multiple planned reviews of the safety data. Following each meeting, the DSMB recommended that the studies continue without modification to the protocols or study conduct. In June 2016, we announced positive top-line efficacy and safety data for the ABSSSI study, and we initiated a Phase 3 clinical study with oral-only administration of omadacycline in ABSSSI compared to oral-only linezolid in August 2016. In January 2017, we announced completion of enrollment in the CABP study, and we anticipate top-line results early in the second quarter of 2017. We anticipate top-line results for the oral-only ABSSSI study as early as the late second quarter of 2017

We recently completed several clinical Phase 1 studies with omadacycline. In these Phase 1 studies, omadacycline was generally safe and well-tolerated, consistent with prior Phase 1 studies. In May 2016, we initiated our first oral-only and IV-to-oral study of omadacycline dosed for five days in a Phase 1b clinical study in patients with a UTI. This Phase 1b UTI study was recently completed. Data from this study showed that omadacycline achieved proof of principle, by demonstrating high concentration levels of omadacycline in urine, across IV-to-oral and oral-only dosing regimens.

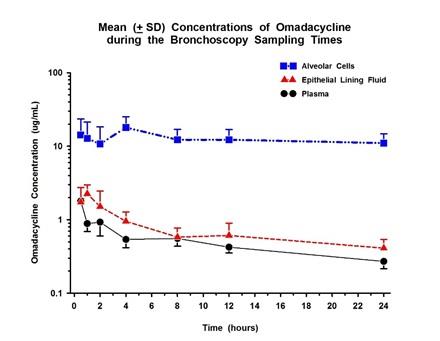

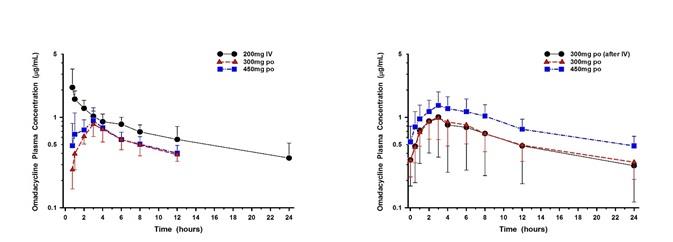

We have also recently completed clinical Phase 1 studies with omadacycline that are needed for inclusion in the planned New Drug Application, or NDA, regulatory filing with the FDA. These studies include pharmacokinetic, or PK, studies in special populations (end-stage renal disease subjects, or ESRD subjects) and PK-lung penetration studies in healthy volunteers. A recently completed Phase 1 study of ESRD subjects was designed to evaluate the absorption and elimination of omadacycline compared to matched healthy control subjects. Results from this study showed that the absorption and elimination of omadacycline in ESRD subjects appears to be similar to healthy control subjects, suggesting that dose adjustments should not be required in subjects who have severe renal disease. In another recently completed Phase 1 study in healthy volunteers, which was designed to evaluate the PK relationship between human plasma concentrations and lung concentrations, omadacycline demonstrated higher concentration levels in bronchoalveolar lavage, or BAL, lung fluid when compared with plasma concentrations. This result supports the potential utility of omadacycline in the treatment of lower respiratory tract bacterial infections caused by susceptible pathogens. A third Phase 1 study in healthy volunteers has been completed that evaluated the PK exposure profile of three oral-only dosing regimens of omadacycline administered for five days in healthy volunteers. In this Phase 1 study, across three oral dosing regimens of omadacycline, PK plasma levels increased with higher doses of omadacycline, demonstrating dose proportionality. Assuming positive Phase 3 study results, we plan to include and submit these data in an NDA for the treatment of ABSSSI and CABP in the first half of 2018. We also recently completed clinical Phase 1 studies with omadacycline that are needed for inclusion in the planned New Drug Application, or NDA, regulatory filing with the FDA, which are discussed further below.

In October 2016, we announced that we entered into a Cooperative Research and Development Agreement, or CRADA, with the U.S. Army Medical Research Institute of Infectious Diseases, or USAMRIID, to study omadacycline against pathogenic agents causing infectious diseases of public health and biodefense importance. These studies are designed to confirm humanized dosing regimens of omadacycline in order to study the efficacy of omadacycline against biodefense pathogens, including Yersinia pestis, or plague, and Bacillus anthracis, or anthrax. Funding support for the trial has been made available through the Defense Threat Reduction Agency, or DTRA/ Joint Science and Technology Office and Joint Program Executive Office for Chemical and Biological Defense / Joint Project Manager Medical Countermeasure Systems / BioDefense Therapeutics.

Sarecycline

Our second Phase 3 antibacterial product candidate, sarecycline, also known as WC3035, is a new, once-daily, tetracycline-derived compound designed for use in the treatment of acne and rosacea. We believe that, based upon the data generated to-date, sarecycline possesses favorable anti-inflammatory activity, plus narrow-spectrum antibacterial activity relative to other tetracycline-derived molecules, oral bioavailability, does not cross the blood-brain barrier, and favorable PK properties that we believe make it particularly well-suited for the treatment of inflammatory acne in the community setting. We have exclusively licensed U.S.

2

development and commercialization rights to sarecycline for the treatment of acne to Allergan plc, or Allergan, while retaining development and commercialization rights in the rest of the world. Allergan has informed us that sarecycline entered Phase 3 clinical trials for the treatment of acne vulgaris in December 2014 and anticipates that top-line data from the Phase 3 trial of sarecycline will be available in the first half of 2017. We also granted Allergan an exclusive license to develop and commercialize sarecycline for the treatment of rosacea in the United States, which converted to a non-exclusive license in December 2014 after Allergan did not exercise its development option with respect to rosacea. There are currently no clinical trials with sarecycline in rosacea under way.

Corporate History

Merger of Novacea, Inc. and Transcept Pharmaceuticals, Inc.

We are a Delaware corporation that was incorporated in February 2001 as D-Novo Therapeutics, Inc., which later changed its corporate name to Novacea, Inc., or Novacea. Novacea previously traded on The NASDAQ Global Market under the ticker symbol “NOVC.” On January 30, 2009, Novacea completed a business combination with privately-held Transcept Pharmaceuticals, Inc., or Old Transcept, pursuant to which Old Transcept became a wholly-owned subsidiary of Novacea, and the corporate name of Novacea was changed to Transcept Pharmaceuticals, Inc., or Transcept. In connection with the closing of such transaction, Transcept common stock began trading on The NASDAQ Global Market under the ticker symbol “TSPT” on February 3, 2009.

Merger of Transcept Pharmaceuticals, Inc. and Paratek Pharmaceuticals, Inc.

On October 30, 2014, Transcept completed a business combination with privately-held Paratek Pharmaceuticals, Inc., or Old Paratek, in accordance with the terms of the Agreement and Plan of Merger and Reorganization, dated as of June 30, 2014, by and among Transcept, Tigris Merger Sub, Inc., or Merger Sub, Tigris Acquisition Sub, LLC, or Merger LLC, and Old Paratek, or the Merger Agreement, pursuant to which Merger Sub merged with and into Old Paratek, with Old Paratek surviving as a wholly-owned subsidiary of Transcept, followed by the Merger of Old Paratek with and into Merger LLC, with Merger LLC surviving as a wholly-owned subsidiary of Transcept (we refer to these mergers together as the Merger). Immediately following the Merger, Transcept changed its name to “Paratek Pharmaceuticals, Inc.”, and Merger LLC changed its name to “Paratek Pharma, LLC.” In connection with the closing of the Merger, our common stock began trading on The NASDAQ Global Market under the ticker symbol “PRTK” on October 31, 2014.

The Antibiotics Market and Limitations of Current Therapies

Physicians commonly prescribe antibiotics to treat patients with acute and chronic infectious diseases that are either known, or presumed, to be caused by bacteria. The World Health Organization has identified the development of worldwide resistance to currently available antibacterial agents as being one of the three greatest threats to human health in this decade. In data issued by the Alliance for the Prudent Use of Antibiotics, or APUA, and Cook County Hospital in October 2009 titled “Hospital and Societal Costs of Antimicrobial Resistant Infections in a Chicago Teaching Hospital: Implications for Antibiotic Stewardship,” it was estimated that antibiotic-resistant infections cost the U.S. healthcare system in excess of $20.0 billion annually. In addition, these infections result in more than $35.0 billion in societal costs and over eight million additional days spent in the hospital. Historically, the majority of life-threatening infections resulting from antibiotic-resistant bacteria were acquired in the hospital setting. According to two recent reports issued by Decision Resources Group, “Hospital-Treated Infections” published in 2014 and “Community Acquired Bacterial Pneumonia” published in 2012, approximately seven million antibiotic-treated events occur annually in the three combined indications of ABSSSI, UTI, and CABP in U.S. hospitals. Furthermore, research conducted by us suggests that in ABSSSI, there are approximately 1.1 million and 2.4 million patients treated in the U.S hospital and community settings, respectively, who have elevated risk factors (defined as elderly, immuno-compromised, co-morbidity e.g., diabetes, history of treatment failure, recent hospitalization, resident of a nursing home) and who have a known or suspected antibiotic resistant pathogen such as Methicillin-resistant Staphylococcus aureus, or MRSA. In CABP, the same research suggests that there are approximately 460 thousand and 540 thousand patients in the U.S. hospital and community settings, respectively, that have these same elevated risk factors and a known or suspected anti-biotic resistant pathogen such as penicillin-resistant S. pneumonia, or PRSP. The evolving emergence of multi-drug resistant pathogens in the community setting further emphasizes the need for novel agents capable of overcoming antibiotic resistance. IMS Health data issued in 2014 reported that approximately 75 million retail prescriptions for the top five generic broad spectrum oral antibiotics, levofloxacin, co-amoxyclav, azithromycin, ciprofloxacin, and clarithromycin, were written in 2013 in the United States alone, with approximately two-thirds being in respiratory indications. Global sales in 2010 for these five antibiotics ranged from $3.4 billion for levofloxacin, the only one of these agents still under patent protection that year, to $1.4 billion for clarithromycin, and approximately 65% or more of these sales were generated for their oral formulations as a result of step-down therapy or oral use only.

Bacteria are often broadly classified as gram-positive bacteria, including antibiotic-resistant bacteria such as MRSA and multi-drug resistant Streptococcus pneumoniae, or MDR-SP; gram-negative bacteria, including antibiotic-resistant bacteria such as extended-spectrum beta-lactamases, or ESBL, producing Enterobacteriaceae; atypical bacteria, including Chlamydophila pneumoniae and Legionella pneumophila; and anaerobic bacteria, including Bacteroides and Clostridia. Antibiotics that are active against both

3

gram-positive and gram-negative bacteria are referred to as “broad spectrum,” while antibiotics that are active only against a select subset of gram-positive or gram-negative bacteria are referred to as “narrow spectrum”. Today, because many of the currently prescribed antibiotics that have activity against resistant organisms typically are “narrow spectrum,” they cannot be used as an empiric monotherapy treatment of serious infections where gram-negative, atypical or anaerobic bacteria may also be involved. Empiric monotherapy refers to the use of a single, antibacterial agent to begin treatment of an infection before the specific pathogen causing the infection has been identified. We believe omadacycline, if approved, will be used in the emergency room, hospital and community care settings. Based on studies published by the Cleveland Clinic Foundation, the National Institutes of Health, or NIH, and American Academy of Family Physicians, rates of infections involving organisms other than gram-positive bacteria have been found to be as much as 15% in ABSSSI, up to 40% in CABP and 70% to 90% in UTI.

When a patient goes to the emergency room or hospital for treatment of a serious infection, the physician’s selection of which IV antibiotic to use is often based on the severity of infection, the pathogen(s) believed most likely to be involved and the probability of a resistant pathogen(s) being present. After initial IV therapy and once the infection begins to respond to treatment, hospitals and physicians face strong pressures to discharge patients from the hospital in order to reduce costs, limit hospital-acquired infections and improve the patient’s quality of life. In order to transition patients out of the hospital and home to complete the course of therapy, physicians typically prefer to have the option to prescribe a bioequivalent oral formulation of the same antibiotic.

Antibiotics used to treat ABSSSI, CABP, UTI and other serious, community-acquired bacterial infections must satisfy a wide range of criteria on a cost-effective basis. For example, we believe that existing treatment options for ABSSSI, including vancomycin, linezolid, daptomycin and tigecycline; for CABP, including levofloxacin, moxifloxacin, azithromycin, ceftriaxone, ceftaroline and tigecycline; and for UTI, including levofloxacin, ciprofloxacin, and trimethoprim/sulfamethoxazole, have one or more of the following significant limitations:

|

|

• |

Limited spectrum of antibacterial activity. Since it may take as long as 48 to 72 hours to identify the pathogen(s) causing an infection and most of the currently available options that cover resistant pathogens are narrow-spectrum treatments, physicians frequently prescribe two or more antibiotics to treat a broad spectrum of potential pathogens. For example, vancomycin, linezolid and daptomycin, the most frequently prescribed treatments for certain serious bacterial skin infections, are narrow-spectrum treatments active only against gram-positive bacteria. The currently available treatment with a more appropriate spectrum for use as a monotherapy against serious and antibiotic-resistant bacterial infections is tigecycline, but it has other significant limitations, most notably dose limiting tolerability of nausea and vomiting |

|

|

• |

Lack of both oral and IV formulations. The most common treatments for serious bacterial infections, vancomycin, daptomycin, ceftriaxone, piperacillin tazobactam, and tigecycline are only available as injectable or IV formulations. The lack of an effective bioequivalent oral formulation of these and many other commonly prescribed antibiotics requires continued IV therapy, which is inconvenient for the patient and may result in longer hospital stays and greater cost. Alternatively, because of the absence of the same antibiotic in an oral, well-tolerated formulation, physicians may switch the patient to a different orally available antibiotic at the time of hospital discharge. This carries the risk of new side effects and possible treatment failure if the oral antibiotic does not cover the same bacteria that were being effectively treated by the IV antibiotic therapy. While linezolid is a twice-daily IV and oral therapy, it is a narrow-spectrum treatment that is associated with increasing bacterial resistance, side effects from interactions with other therapies and other serious safety concerns. |

4

|

|

arrhythmia, which is often predicted by a prolongation of the corrected QT interval, or QTc. The FDA issued a Drug Safety Communication on March 12, 2013 titled “Azithromycin (Zithromax or Zmax) and the risk of potentially fatal heart rhythms,” and the azithromycin drug label warnings were strengthened to address this concern. |

|

|

• |

Increasing bacterial resistance. Bacterial resistance to the most frequently prescribed antibiotics (branded or generic) has limited their potential to treat infections, which often prevents their use as an empiric monotherapy. We believe that MRSA and MDR-SP, in the community have posed treatment challenges because of resistance to penicillins (resistance rate up to 100% for both), cephalosporins (100% and 11%, respectively, for ceftriaxone), macrolides (83% and 86%, respectively, for erythromycin/azithromycin) and quinolones (73% and 2%, respectively, for levofloxacin), particularly in ABSSSI and CABP. There have also been recent reports of resistance developing during treatment with daptomycin and concerns about an increasing frequency of strains of Staphylococcus aureus with reduced susceptibility to vancomycin. Additionally, linezolid use has been associated with drug resistance, including reports of outbreaks of resistance among Staphylococcus aureus and Enterococcus strains. The increasing occurrence of multi-drug resistant, ESBL-producing, gram-negative bacteria in community-acquired UTIs has severely curtailed the oral antibiotic treatment options available to physicians for these UTIs. For example, in a recent survey, 95% and 76% of the ESBL isolates of Escherichia coli found in UTIs, respectively, were resistant to ceftriaxone and levofloxacin. |

These limitations can ultimately lead to longer hospital stays, greater healthcare costs and increased morbidity and mortality due to lower cure rates and additional side effects. While certain antibiotics address some of these outcomes, we do not believe there is one superior treatment option that satisfies all outcomes. We believe that it is essential for the treatment of patients with serious, community-acquired bacterial infections that physicians prescribe the right antibiotic the first time, as ineffective antibiotics can quickly lead to progressively more severe and invasive infections or even death.

Our Product Candidates

Omadacycline

|

|

• |

Bioequivalent Once-daily oral and IV formulations to support transition therapy. Previous to the two on-going clinical trials, we have studied once-daily IV and oral formulations of omadacycline in approximately 1100 subjects to-date across multiple Phase 1, Phase 2 and Phase 3 clinical trials, and we are using each of these formulations in our Phase 3 clinical trials. The bioequivalence of the IV and oral formulations may permit transition therapy, which could allow patients to start treatment on the IV formulation in the hospital setting then “transition” to the oral formulation of the same bioequivalent antibacterial agent once the infection is responding enabling the patient to be released from the hospital to complete the full course of therapy at home. We believe that transition therapy has the potential to avoid the concerns that can accompany switching from an IV agent to a different class of oral antibiotic and to facilitate the continuance of curative therapy at home. We believe that our SPA agreements with the FDA will permit us to submit for approval of both IV and oral formulations of omadacycline. |

|

|

• |

Broad spectrum of antibacterial activity. Omadacycline has demonstrated in vitro activity against all common pathogens found in ABSSSI, such as Staphylococcus aureus, including MRSA, Streptococci (including Group A Streptococci), anaerobic pathogens and many gram-negative organisms. Omadacycline is also active in vitro against the key pathogens found in CABP, such as Streptococcus pneumoniae, including MDR-SP, Staphylococcus aureus, Haemophilus influenzae and atypical bacteria, including Legionella pneumophila. On the basis of the in vitro spectrum of activity demonstrated by omadacycline against a range of pathogens in our pre-clinical testing, we believe omadacycline has the in vitro spectrum of coverage needed to potentially become the primary antibiotic choice of physicians and serve as an empiric monotherapy option for ABSSSI, CABP, UTI and other serious, community-acquired bacterial infections where resistance is of concern, if approved by the FDA. |

|

|

• |

Favorable safety and tolerability profile. To date, we have observed omadacycline to be generally well tolerated in studies involving approximately 1100 subjects. We have conducted a thorough QTc study, as defined by FDA guidance to assess prolongation of QTc, an indicator of cardiac arrhythmia. This study suggests no prolongation of QTc by omadacycline at three times the therapeutic exposure. There have been observations of a transient, self-limited increase in heart rate, primarily in normal healthy volunteer subjects. These effects appear to be related to peak plasma concentration, or Cmax, and to a specific antagonist effect on the M2 subtype of the muscarinic receptor. These heart rate changes are not accompanied by changes in blood pressure, nor concurrent complaints of palpitations, shortness of breath nor chest pain. There have been no Adverse Events, or AEs, of ventricular arrhythmia, QT prolongation, seizures, syncope, or sudden death in the completed studies. Further, in clinical studies, omadacycline does not appear to adversely affect blood cell production, nor does it appear to metabolize in the liver or anywhere else in the body, thus reducing the likelihood of causing drug-to-drug interactions. Additionally, omadacycline has resulted in low rates of diarrhea, and we have not observed confirmed cases of Clostridium difficile infection, which can frequently occur from the use of other classes of broad-spectrum antibiotics such as beta-lactams and quinolones. |

5

In addition to its broad spectrum of antibacterial activity and its availability in once-daily oral and IV formulations, omadacycline appears to penetrate tissues broadly, including lung, muscle, and kidney, thereby achieving high concentrations at the sites of infection. Since omadacycline is eliminated from the body (as unchanged parent compound) via the kidneys and intestine in an expected manner, based on the results of our Phase 1 studies, we believe it may potentially be used in patients with diminished kidney and liver function, without dose adjustment, and may potentially have benefit in patients receiving poly-pharmacy, where drug-drug interactions are of concern. We have completed pre-clinical work evaluating omadacycline for the potential treatment of sinusitis, also known as an acute sinus infection or rhinosinusitis. In addition, we have completed a proof-of-principle study in females with uncomplicated urinary tract infections, or uUTI, given the high percentage of renal elimination and urinary concentrations, omadacycline may have utility as a treatment option for patients with UTI infections.

Completed Omadacycline Clinical Studies

Assuming completion of Paratek’s on-going clinical trials on the anticipated time frame, and assuming that Paratek believes the results of the trials will support FDA approval, Paratek intends to file an NDA during the first half of 2018. We have studied omadacycline in 21 Phase 1, one Phase 2, and four Phase 3 studies. These clinical trials are summarized in Table 1. Apart from any loading dose strategies, the proposed dosing regimens for both indications in ABSSSI and CABP will be 100 milligrams, or mg, IV or 300 mg oral doses that have been shown to be bioequivalent. Duration of treatment is expected to be for 7 to 14 days.

At the time of the proposed NDA filing, we anticipate that approximately 1,900 subjects will have been exposed to omadacycline across all clinical studies. Approximately 1,200 of 1,900 subjects will have been exposed to omadacycline during participation in Phase 2 or Phase 3 studies. The number of subjects exposed in the proposed NDA exceeds those required by International Council on Harmonisation, or ICH, E1A guidance of 1,500 exposed subjects and supports the submission, evaluation, and potential approval of the NDAs for up to 14 days of treatment.

Table 1. Subject Exposure to Omadacycline in Clinical Studies

|

Clinical Study |

|

Number Exposed to Omadacycline |

|

|||||||||||||||||||||||||

|

Phase |

|

Population |

|

Study Number |

|

|

Exposure Duration (Days) a |

|

Total (Any IV or PO) |

|

|

Any IV |

|

|

IV ≥ 100 mg/dayb |

|

|

Any PO |

|

|

PO ≥ 300 mg/dayb |

|

||||||

|

Phase 1 |

|

Various – single dose |

|

|

1 |

|

|

501 |

|

|

|

211 |

|

|

|

181 |

|

|

|

361 |

|

|

|

177 |

|

|||

|

|

|

Various – multiple dose |

|

|

4-14 |

|

|

182 |

|

|

|

94 |

|

|

|

94 |

|

|

|

99 |

|

|

|

90 |

|

|||

|

Phase 1 Totals |

|

|

683 |

|

|

|

305 |

|

|

|

275 |

|

|

|

460 |

|

|

|

267 |

|

||||||||

|

Phase 2 |

|

cSSSI |

|

|

702 |

|

|

Up to 14 |

|

|

111 |

|

|

|

111 |

|

|

|

111 |

|

|

104c |

|

|

|

— |

|

|

|

Phase 3 (truncated) |

|

cSSSI |

|

|

804 |

|

|

Up to 14 |

|

|

68 |

|

|

|

68 |

|

|

|

68 |

|

|

|

63 |

|

|

|

63 |

|

|

Phase 3 (pivotal) |

|

ABSSSI |

|

|

1108 |

|

|

7-14 |

|

|

323 |

|

|

|

323 |

|

|

|

323 |

|

|

|

286 |

|

|

|

286 |

|

|

|

|

ABSSSId |

|

|

16301 |

|

|

7-14 |

|

~352 |

|

|

|

— |

|

|

|

— |

|

|

|

352 |

|

|

|

352 |

|

|

|

|

|

CABPd |

|

|

1200 |

|

|

7-14 |

|

~375 |

|

|

|

375 |

|

|

|

375 |

|

|

|

281 |

|

|

|

281 |

|

|

|

Phase 2 and 3 Totals |

|

~1,229 |

|

|

|

877 |

|

|

|

877 |

|

|

|

1,086 |

|

|

|

982 |

|

|||||||||

|

Overall Totals |

|

~1,912 |

|

|

|

1,182 |

|

|

|

1,152 |

|

|

|

1,546 |

|

|

|

1,249 |

|

|||||||||

|

a. |

Exposure duration as intended per protocol. |

|

b. |

Daily dose categorization excludes any loading dose strategy in multiple dose studies. |

|

c. |

Dosing with 200 mg. |

|

d. |

Exposure numbers for these studies are estimates based on sample size, randomization scheme and (where applicable) anticipated proportion of subjects switching from IV to PO therapy. |

Abbreviations: ABSSSI = acute bacterial skin and skin structure infection; CABP = community-acquired bacterial pneumonia; cSSSI = complicated skin and skin structure infections; IV = intravenous; PO = oral.

6

Pivotal ABSSSI Phase 3 Clinical Study with IV and Oral Omadacycline

Study Design. As part of the development program agreed with FDA, we conducted a randomized (1:1), double blind, active comparator controlled, Phase 3 study comparing omadacycline and linezolid for the treatment of adults with ABSSSI that was known or suspected to be due to a Gram-positive pathogen(s). Subject randomization was stratified across treatment groups by type of infection (wound infection, cellulitis/erysipelas, and major abscess) and geographic region. All subjects were expected to present with ABSSSI severe enough to require a minimum of at least 3 days of IV treatment. The study consisted of 3 phases: Screening, Double Blind Treatment, and Follow Up. All Screening evaluations were performed within 24 hours prior to randomization, except Screening blood cultures, which were collected within 24 hours prior to the first dose of test article. Subjects who met inclusion criteria and did not meet exclusion criteria were randomly assigned to a treatment group, and received their first dose of test article within 4 hours after randomization. The FDA primary outcome measure was Clinical Success at the Early Clinical Response, or ECR, at 48 to 72 hours after the first dose of test article in the modified intent-to-treat, or mITT, population. Clinical Success was defined as; the subject was alive, the size of the primary lesion had been reduced ≥ 20% compared to Screening measurements, without receiving any rescue antibacterial therapy, and the subject did not meet any criteria for clinical failure or indeterminate. Secondary endpoint for FDA and European Medicines Agency, or EMA, co-primary endpoints included investigator assessment of clinical response at post therapy evaluation, or PTE,visit in the mITT and clinically evaluable PTE, or CE-PTE, populations.

Study Efficacy Results. A total of 655 subjects were randomized (the intent to treat, or ITT population), 329 subjects in the omadacycline group and 326 subjects in the linezolid group (See Table 2). There were 10 randomized subjects (6 omadacycline, 4 linezolid) who did not receive test article; thus 98.5% subjects received test article (the safety population). The mITT population included 95.7% subjects because 4.3% subjects had only Gram-negative ABSSSI causative pathogens at Baseline. The micro-mITT population included 69.5% subjects (228 and 227 subjects in the omadacycline and linezolid groups, respectively), which included subjects with a Gram-positive pathogen alone or in combination with other pathogens. Overall, 80.8% subjects were included in the CE‑PTE population.

|

Population/Parameter |

|

Omadacycline n (%) |

|

|

Linezolid n (%) |

|

|

All Subjects n (%) |

|

|||

|

ITT population |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number included in population |

|

|

329 |

|

|

|

326 |

|

|

|

655 |

|

|

Safety population |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number included in population |

|

323 (98.2) |

|

|

322 (98.8) |

|

|

645 (98.5) |

|

|||

|

Number excluded from population |

|

6 (1.8) |

|

|

4 (1.2) |

|

|

10 (1.5) |

|

|||

|

mITT population |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number included in population |

|

316 (96.0) |

|

|

311 (95.4) |

|

|

627 (95.7) |

|

|||

|

Number excluded from population |

|

13 (4.0) |

|

|

15 (4.6) |

|

|

28 (4.3) |

|

|||

|

micro-mITT population |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number included in population |

|

228 (69.3) |

|

|

227 (69.6) |

|

|

455 (69.5) |

|

|||

|

Number excluded from population |

|

101 (30.7) |

|

|

99 (30.4) |

|

|

200 (30.5) |

|

|||

|

CE-PTE population |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number included in population |

|

269 (81.8) |

|

|

260 (79.8) |

|

|

529 (80.8) |

|

|||

|

Number excluded from population |

|

60 (18.2) |

|

|

66 (20.2) |

|

|

126 (19.2) |

|

|||

Percentages were based on the ITT population.

ABSSSI = acute bacterial skin and skin structure infection; CE = clinically evaluable; ITT = intent-to-treat; mITT = modified intent-to-treat; micro‑mITT = microbiological modified intent-to-treat; PTE = Post Therapy Evaluation.

Table 3 summarizes ABSSSI lesion area size and other baseline characteristics for the mITT population. In both groups the baseline lesion sizes were similar (median 299.5 cm2 for omadacycline and 315.0 cm2 for linezolid) and well above the inclusion criteria minimum of 75 cm2.

7

Table 3. Lesion Area Size (mITT Population)

|

Characteristics |

|

Omadacycline (N = 316) n (%) |

|

|

Linezolid (N = 311) n (%) |

|

|

p-value |

|

|||

|

Calculated lesion area (cm²) |

|

|

|

|

|

|

|

|

|

|

|

|

|

n |

|

|

316 |

|

|

|

311 |

|

|

|

|

|

|

Mean (SD) |

|

454.77 (442.879) |

|

|

498.34 (616.987) |

|

|

|

|

|

||

|

Median |

|

|

299.50 |

|

|

|

315.00 |

|

|

|

|

|

|

Min, max |

|

77.0, 4100.0 |

|

|

88.0, 6739.2 |

|

|

|

0.562 |

|

||

P-values for differences between treatment groups were from Fisher’s exact test (for categorical variables) or Wilcoxon Rank Sum test (for continuous variables).

max = maximum; min = minimum; mITT = modified intent-to-treat; SD = standard deviation

Table 4 summarizes the primary ABSSSI infection type in the mITT population. Randomization was stratified by type of infection and the number of subjects with major abscess was limited to no more than 30% of randomized subjects. The type of primary infections including cellulitis/erysipelas (38.9% omadacycline, 37.9% linezolid), wound infection (32.3% omadacycline, 33.4% linezolid), and major abscess (28.8% omadacycline, 28.6% linezolid) were comparable between treatment groups.

Table 4. Primary ABSSSI Infection Site at Baseline (mITT Population)

|

Characteristics |

|

Omadacycline (N = 316) n (%) |

|

|

Linezolid (N = 311) n (%) |

|

||

|

Type of primary infection |

|

|

316 |

|

|

|

311 |

|

|

Cellulitis/erysipelas |

|

123 (38.9) |

|

|

118 (37.9) |

|

||

|

Wound infection |

|

102 (32.3) |

|

|

104 (33.4) |

|

||

|

Major abscess |

|

91 (28.8) |

|

|

89 (28.6) |

|

||

Percentages were based on the number of subjects with the specific parameter assessed.

ABSSSI = acute bacterial skin and skin structure infection; mITT = modified intent-to-treat.

The primary outcome measure for FDA was ECR at 48 to 72 hours (defined as 48 hours to < 73 hours) after the first dose of test article in the mITT population. A summary is provided in Table 5. Omadacycline was found to be non-inferior to linezolid for ECR in the mITT population. Clinical success rates were high (84.8% omadacycline, 85.5% linezolid) and comparable between both treatment groups (difference [95% CI]: -0.7 [-6.3, 4.9]). Given that the lower limit of the 95% confidence interval, or CI for the treatment difference (omadacycline – linezolid) was within the 10% margin, therefore omadacycline was considered non-inferior to linezolid. The percentages of subjects assessed as either clinical failure or indeterminate were similar between treatment groups. Reasons for clinical failure at 48 to 72 hours included lack of reduction in lesion size by at least 20% (5.1% omadacycline, 4.5% linezolid), AE requiring discontinuation of test article (1.6% omadacycline, 0.6% linezolid), discontinuation of test article with need for rescue antibacterial therapy (1.3% in both groups), and receipt of potentially effective systemic antibacterial therapy for a different infection than the ABSSSI under study (0.6% omadacycline, 0% linezolid).

Table 5. ECR 48-72 Hours after the First Infusion of the Test Article (mITT Population)

|

Efficacy Outcome |

|

Omadacycline N = 316 n (%) |

|

Linezolid N = 311 n (%) |

|

Difference (95% CI) |

|

Clinical success |

|

268 (84.8) |

|

266 (85.5) |

|

-0.7 (-6.3, 4.9) |

|

Clinical failure or indeterminate |

|

48 (15.2) |

|

45 (14.5) |

|

— |

|

Clinical failure |

|

23 (7.3) |

|

19 (6.1) |

|

— |

|

Indeterminate |

|

25 (7.9) |

|

26 (8.4) |

|

— |

Difference was observed difference in early clinical success rate between the omadacycline and linezolid groups.

95% CI was constructed based on the Miettinen and Nurminen method without stratification.

Percentages were based on the number of subjects in each treatment group.

CI = confidence interval; ECR = Early Clinical Response; mITT = modified intent-to-treat.

The number and percentage of subjects classified as clinical success by the investigator’s assessment at PTE in the mITT, and CE-PTE populations calculated for each treatment group is summarized in Table 6. Clinical success rates were high and similar between the treatment groups at PTE, meeting statistical non-inferiority. In the mITT population, clinical success at PTE was 86.1% for omadacycline and 83.6% for linezolid. Reasons for clinical failure at the PTE visit for the mITT population included clinical

8

failure at the End of Treatment, or EOT, visit (4.7% omadacycline, 5.8% linezolid), discontinuation of test article with need for rescue antibacterial therapy (3.2% for both groups), and receipt of potentially effective systemic antibacterial therapy for a different infection than the ABSSSI under study (1.9% omadacycline, 1.6% linezolid). Clinical success rates were also high and similar between treatment groups in the CE population.

Table 6. Overall Clinical Response at PTE Visit Based on Investigator Assessments (mITT, and CE-PTE,)

|

Efficacy Outcome |

|

Omadacycline n (%) |

|

Linezolid n (%) |

|

Difference |

|

|

95% CI Without Stratificationa |

|

95% CI With Stratificationb |

|

|

mITT |

|

(N = 316) |

|

(N = 311) |

|

|

|

|

|

|

|

|

|

Clinical success |

|

272 (86.1) |

|

260 (83.6) |

|

|

2.5 |

|

|

(-3.2, 8.2) |

|

(-3.2, 8.1) |

|

CE-PTE |

|

(N = 269) |

|

(N = 260) |

|

|

|

|

|

|

|

|

|

Clinical success |

|

259 (96.3) |

|

243 (93.5) |

|

|

2.8 |

|

|

(-1.0, 6.9) |

|

(-0.9, 7.1) |

Difference was observed difference in overall clinical success rate at PTE between the omadacycline and linezolid groups.

Overall clinical response at PTE was based on the investigator assessment at the EOT and PTE visits.

Percentages were based on the number of subjects in each treatment group.

CE = clinically evaluable; CI = confidence interval; mITT = modified intent-to-treat; PTE = Post Therapy Evaluation.

|

a |

95% CI was constructed based on the Miettinen and Nurminen method without stratification. |

b 95% CI was adjusted for type of infection and geographic region based on the Miettinen and Nurminen method with stratification, using Cochran-Mantel-Haenszel weights as stratum weights. The 4 geographic regions were combined into 1 group. Infection type was not combined.

Study Safety Results. As seen in Table 7, overall, 48.3% of omadacycline subjects and 45.7% of linezolid subjects had at least 1 Treatment-emergent Adverse Event, or TEAE. The most commonly reported TEAEs (≥ 5%) were nausea (12.4% omadacycline, 9.9% linezolid), infusion site extravasation (8.7% omadacycline, 5.9% linezolid), subcutaneous abscess (5.3% omadacycline, 5.9% linezolid), and vomiting (5.3% omadacycline, 5.0% linezolid). A total of 19 subjects (11 omadacycline, 8 linezolid) had serious TEAEs. No subjects experienced a drug-related serious TEAE. A total of 13 subjects (6 omadacycline, 7 linezolid) had a TEAE that led to premature discontinuation of test article. The frequency of drug related TEAEs was comparable between the 2 treatment groups (18.0% omadacycline, 18.3%, linezolid). The most commonly reported drug-related TEAEs (≥ 2% for any group) were nausea (9.6% omadacycline, 6.5% linezolid), vomiting (4.0% omadacycline, 2.8% linezolid), alanine aminotransferase, or ALT, increased (2.5% omadacycline, 2.8% linezolid), diarrhea (2.2% omadacycline, 2.2% linezolid), and aspartate aminotransferase, or AST, increased (1.9% omadacycline, 2.5% linezolid).

Table 7. Number (%) of Subjects with the Most Frequent TEAEs (≥ 3% for Any Group)

|

Body System |

|

Omadacycline N = 323 n (%) |

|

Linezolid N = 322 n (%) |

|

Subjects with at least 1 TEAE |

|

156 (48.3) |

|

147 (45.7) |

|

Nausea |

|

40 (12.4) |

|

32 (9.9) |

|

Vomiting |

|

17 (5.3) |

|

16 (5.0) |

|

Diarrhea |

|

7 (2.2) |

|

10 (3.1) |

|

Subcutaneous abscess |

|

17 (5.3) |

|

19 (5.9) |

|

Cellulitis |

|

15 (4.6) |

|

15 (4.7) |

|

Infusion site extravasation |

|

28 (8.7) |

|

19 (5.9) |

|

ALT increased |

|

9 (2.8) |

|

14 (4.3) |

|

AST increased |

|

8 (2.5) |

|

12 (3.7) |

|

Headache |

|

10 (3.1) |

|

13 (4.0) |

Coding of SOCs and PTs were based on MedDRA Version 17.1.

Percentages were based on the safety population.

A TEAE was defined as an AE occurring after first dose of active test article.

A subject with multiple occurrences of an AE under 1 treatment was counted only once in the AE category for that treatment.

AE = adverse event; ALT = alanine aminotransferase; AST = aspartate aminotransferase; TEAE = treatment-emergent adverse event.

9

Overall, the TEAEs ALT increased (2.8% omadacycline, 4.3% linezolid) and AST increased (2.5% omadacycline, 3.7% linezolid) occurred at a higher percentage in the linezolid group compared to the omadacycline group. Treatment releated TEAEs of ALT increased occurred in 2.5% omadacycline subjects and 2.8% linezolid subjects. Treatment-related TEAEs of AST increased occurred in 1.9% omadacycline subjects and 2.5% linezolid subjects. All such TEAEs were considered mild or moderate in severity and no AE resulted in discontinuation of test article.

Other TEAEs of potential interest regarding liver chemistry values showed comparable incidence between treatment groups and included blood bilirubin increased (0.9% omadacycline subjects, 0.3% linezolid subjects), gamma glutamyl transferase, or GGT, increased (0.6% subjects in each treatment group), and blood alkaline phosphatase increased (0.3% subjects in each treatment group). Table 8 shows the ALT, AST and Bilirubin outliers, which appear to similar between omadacycline and linezolid. No Hy’s law cases occurred in this study on either omadacycline nor linezolid.

Table 8. ALT, AST, Bilirubin Outlying Values (Safety Population)

|

Lab Parameter (SI unit) |

|

Parameter |

|

Omadacycline N = 323 n (%) |

|

|

Linezolid N = 322 n (%) |

|

||

|

ALT (U/L) |

|

|

|

|

|

|

|

|

|

|

|

Normal at Baseline, n |

|

|

|

|

246 |

|

|

|

256 |

|

|

Worst post-baseline value, n |

|

|

|

|

240 |

|

|

|

251 |

|

|

|

|

> 3 × ULN |

|

3 (1.3) |

|

|

5 (2.0) |

|

||

|

|

|

> 5 × ULN |

|

3 (1.3) |

|

|

2 (0.8) |

|

||

|

|

|

> 10 × ULN |

|

1 (0.4) |

|

|

1 (0.4) |

|

||

|

AST (U/L) |

|

|

|

|

|

|

|

|

|

|

|

Normal at Baseline, n |

|

|

|

|

269 |

|

|

|

289 |

|

|

Worst post-baseline value, n |

|

|

|

|

263 |

|

|

|

281 |

|

|

|

|

> 3 × ULN |

|

3 (1.1) |

|

|

6 (2.1) |

|

||

|

|

|

> 5 × ULN |

|

2 (0.8) |

|

|

3 (1.1) |

|

||

|

|

|

> 10 × ULN |

|

— |

|

|

— |

|

||

|

Total Bilirubin (µmol/L) |

|

|

|

|

|

|

|

|

|

|

|

Normal at Baseline, n |

|

|

|

|

302 |

|

|

|

304 |

|

|

Worst post-baseline value, n |

|

|

|

|

296 |

|

|

|

296 |

|

|

|

|

> 1.5 × ULN |

|

2 (0.7) |

|

|

1 (0.3) |

|

||

|

|

|

> 2 × ULN |

|

1 (0.3) |

|

|

1 (0.3) |

|

||

Baseline was defined as the value closest to but prior to the initiation of test article administration.

Percentages were based on number of subjects with a normal level at Baseline and had an assessment at that visit.

Local lab results were used when central lab assessments were not available.

ALT = alanine aminotransferase; AST = aspartate aminotransferase; EOT = End of Treatment; PTE = Post Therapy Evaluation; ULN = upper limit normal.

Table 9 summarizes the protocol-specified Clinically Notable, or CN, values for HR, systolic blood pressure, or systolic BP, and diastolic blood pressure, or diastolic BP, at any post-Baseline time point. Across all of these analysis criteria, there were only minor differences between the treatment groups. Only 11 subjects (5 omadacycline, 6 linezolid) had a HR ≥ 120 bpm at any post-Baseline time point.

10

Table 9. CN Values for HR, Systolic BP, and Diastolic BP at Any Post-baseline Time Point (Safety Population)

|

CN Criteria |

|

Omadacycline (N = 323) n (%) |

|

Linezolid (N = 322) n (%) |

|

Subjects with HR value at any post-Baseline visit |

|

|

|

|

|

HR ≤ 50 bpm |

|

3 (0.9) |

|

10 (3.1) |

|

HR ≥ 120 bpm |

|

5 (1.5) |

|

6 (1.9) |

|

Subjects with HR value at Baseline and any post- Baseline visit |

|

|

|

|

|

HR ≤ 50 bpm and decrease of ≥ 15 bpm |

|

2 (0.6) |

|

5 (1.6) |

|

HR ≥ 120 bpm and increase of ≥ 15 bpm |

|

5 (1.5) |

|

6 (1.9) |

|

Subjects with systolic BP value at any post- Baseline visit |

|

|

|

|

|

Systolic BP ≤ 90 mmHg |

|

13 (4.0) |

|

9 (2.8) |

|

Systolic BP ≥ 180 mmHg |

|

5 (1.5) |

|

12 (3.7) |

|

Subjects with systolic BP value at Baseline and any post-Baseline visit |

|

|

|

|

|

Systolic BP ≥ 180 mmHg and increase of ≥ 20 mmHg |

|

4 (1.2) |

|

11 (3.4) |

|

Systolic BP ≤ 90 mmHg and decrease of ≥ 20 mmHg |

|

8 (2.5) |

|

4 (1.2) |

|

Subjects with diastolic BP value at any post- Baseline visit |

|

|

|

|

|

Diastolic BP ≤ 50 mmHg |

|

29 (9.0) |

|

24 (7.5) |

|

Diastolic BP ≥ 105 mmHg |

|

8 (2.5) |

|

12 (3.7) |

|

Subjects with diastolic BP value at Baseline and any post-Baseline visit |

|

|

|

|

|

Diastolic BP ≥ 105 mmHg and increase of ≥ 15 mmHg |

|

6 (1.9) |

|

9 (2.8) |

|

Diastolic BP ≤ 50 mmHg and decrease of ≥ 15 mmHg |

|

13 (4.0) |

|

17 (5.3) |

Baseline was defined as the value closest to but prior to the initiation of test article administration.

Percentages were based on the number of subjects with the specific parameter assessed.

BP = blood pressure; bpm = beats per minute; CN = clinically notable; HR = heart rate.

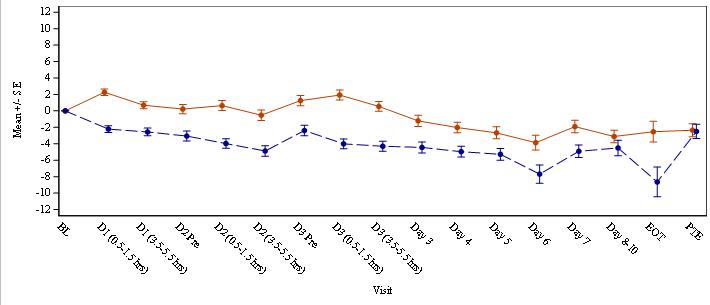

Figure F-1 presents the mean values over time for HR, shown as change from Baseline. Because the decline in HR generally was more rapid for the linezolid subjects compared to omadacycline subjects, at any given post‑Baseline time point, the mean HR in omadacycline subjects was slightly higher than linezolid subjects (difference of < 5 bpm at all time points).

Of note, during the study, sinus tachycardia was reported as a TEAE in only 1 omadacycline subject (mild severity and not related to test article) and no linezolid subjects. No subjects in either group reported palpitations.

11

Figure F-1. Change from Baseline HR (bpm) Mean Results Over Time (Safety Population)

The EOT visits were summarized with the study day of the visit up to Day 10. The EOT values on Day 2 were summarized under Day 2 Pre.

BL = Baseline; bpm = beats per minute; D = Day; LZD = linezolid; OMC = omadacycline; SE = standard error.

Study Conclusions. Overall, the efficacy of omadacycline was comparable to linezolid in the treatment of adults with ABSSSI and omadacycline was determined to be non-inferior to linezolid (based on a predefined 10% non-inferiority margin) for the FDA and EMA primary endpoints. In addition, both omadacycline and linezolid were found to be safe and well tolerated.

Early Terminated (truncated) cSSSI Phase 3 Clinical Study

Study Design. We designed our Phase 3 clinical trial pursuant to the then-current 1998 FDA guidance on developing antimicrobial drugs for the treatment of complicated skin and skin structure infections, or cSSSI. The primary objective of the clinical trial was to establish that omadacycline as a monotherapy was not inferior to linezolid, with or without moxifloxacin, as a treatment for patients with serious skin infections. Following randomization, patients initially received either IV therapy with 100 mg of omadacycline every 24 hours with the ability to switch to 300mg of oral omadacycline, or 600 mg of linezolid every 12 hours, with the ability to switch to 600mg oral linezolid. For patients with infections suspected or documented as involving gram-negative bacteria, the blinded physician had the option of providing additional antibiotic therapy to patients, with patients assigned to the linezolid arm receiving 400 mg of moxifloxacin every 24 hours and patients assigned to omadacycline receiving a placebo, since omadacycline has activity against some of the most common gram-negative bacteria that commonly cause these infections, to match the dosing regimen of linezolid-treated patients. This study had 143 subjects randomized, 140 patients received at least one dose of study drug. Of those 140 subjects, 68 were randomized to omadacycline and 72 were randomized to linezolid. Cellulitis was present in 92 of the 140 patients who received at least one dose of study drug. Although we terminated this trial before reaching its enrollment goal due to the evolving regulatory landscape, and therefore precluding any statistical conclusions with regard to non-inferiority, the overall clinical success rates were similar between omadacycline- and linezolid. The overall incidence of adverse events was similar in both treatment groups. There were no clinically significant alterations of cardiovascular, renal or hepatic safety laboratory values. One death occurred in a patient randomized to omadacycline who presented with undiagnosed metastatic lung cancer after being assessed as cured following the test of care, or TOC, visit. Study investigators did not consider any of the serious adverse events reported to be related to either omadacycline or linezolid.

cSSSI Phase 2 Clinical Study

We designed, conducted and completed a randomized Phase 2 clinical trial with the primary objective of comparing the safety and tolerability of omadacycline to linezolid in patients with cSSSI. Our key secondary objectives involved comparing the efficacy of omadacycline to linezolid and assessing the PK properties of omadacycline.

Following randomization, patients initially received IV therapy with 100 mg of omadacycline every 24 hours, or 600 mg of linezolid every 12 hours. For patients with infections suspected or documented as involving gram-negative bacteria, the blinded physician had the option of providing additional IV antibiotic therapy to patients, with patients assigned to the linezolid group also

12

receiving two grams of aztreonam every 12 hours, and patients assigned to the omadacycline group receiving a placebo to match the dosing regimen of linezolid-treated patients. Based on a blinded physician’s assessment of the appropriateness of hospital discharge and continuation of oral therapy, most patients then transitioned to oral therapy. For oral therapy, patients randomized to omadacycline received 200 mg of omadacycline (dosed as two 100 mg capsules) every 24 hours. Patients randomized to linezolid received one 600 mg tablet of linezolid every 12 hours. Patients in both groups received an average of five to six days of oral therapy following an average of 4.3 days of IV therapy. 219 patients received at least one dose of the study drug in our Phase 2 clinical trial, 111 patients were randomly selected to be treated with omadacycline and 108 were randomly selected to be treated with linezolid. Clinical response was measured in two study populations, ITT and clinically evaluable, or CE. The ITT population in this clinical trial refers to all enrolled subjects who received at least one dose of study drug, and the CE population refers to all ITT subjects who had a qualifying infection and were treated and evaluated as defined in the protocol. Although not powered to demonstrate statistical non-inferiority, results from this Phase 2 study demonstrated that the efficacy of omadacycline was comparable to linezolid for both the ITT and CE populations. The observed safety results of the study among the 111 omadacycline-treated patients, 46 (41.4%) experienced one or more TEAEs and 24 (21.6%) experienced one or more adverse events assessed as potentially treatment-related. By comparison, among the 108 linezolid-treated patients, 55 (50.9%) experienced one or more TEAEs and 33 (30.6%) experienced adverse events assessed as potentially treatment-related. In both arms of the clinical trial, the most frequently involved organ system was the gastrointestinal tract, with adverse events reported in 21 (18.9%) omadacycline-treated patients and 18 (16.7%) linezolid-treated patients. There were three serious adverse events reported in this clinical trial, one in an omadacycline-treated patient and two in linezolid-treated patients. The study investigator considered the event in the omadacycline-treated patient, which involved worsening confusion, to be unrelated to the study therapy. There were no significant alterations of cardiovascular, renal or hepatic safety laboratory values.

Phase 1 Clinical Studies

We assessed omadacycline in over 20 single-dosing and multiple-dosing Phase 1 clinical trials for both the IV and oral formulations, involving more than 600 healthy volunteer subjects.

We have also recently completed clinical Phase 1 studies with omadacycline that are needed for inclusion in the planned NDA regulatory filing with the FDA. These studies include PK, studies in special populations (ESRD subjects) and PK-lung penetration studies in healthy volunteers. In addition, we conducted a Phase 1b study in female patients with cystitis (uUTI) to evaluate the PK in plasma and urine to demonstrate the proof of principal of omadacycline at a potential treatment in UTI.

Phase 1 Clinical Study in End-Stage Renal Disease patients, and Matched Controls:

Study Design. This study was designed as an open-label, single-dose, two-period, parallel group study to compare the PK and safety of single IV doses of omadacycline in adult subjects with ESRD on a stable hemodialysis regimen and healthy adult subjects. Healthy adult subjects were matched to adult subjects with ESRD based on gender, age (± 5 years), and weight (± 10 kg). Subjects were screened for enrollment into the study within 28 days (Days -28 to -2) prior to administration of omadacycline on Day 1 of Period 1. Those who met eligibility criteria at screening were admitted to the clinical research unit on Day -1 for baseline assessments. Subjects were enrolled into the following two treatment groups: ESRD subjects on stable hemodialysis (n=8) received a single dose of omadacycline 100 mg IV infusion post-dialysis; after a washout period of 10 to 20 days they received an additional dose of omadacycline 100 mg IV infusion pre-dialysis and matched healthy subjects (n=8) received a single dose of omadacycline 100 mg IV infusion. Blood samples were collected for determination of plasma test article concentrations at specified times up to 68 hours after dose administration. Healthy subjects had PK urine samples collected at specified times up to 72 hours post dose. Dialysate samples were collected from ESRD subjects at specified times during Period Two. Approximately one week (± 3 days) after the last test article administration, subjects underwent study completion evaluations and were discharged from the study. Safety assessments included physical examinations, electrocardiograms, or ECGs, vital signs, standard clinical laboratory evaluations (hematology, chemistry, urinalysis [healthy subjects]), pregnancy assessments, and AE monitoring.

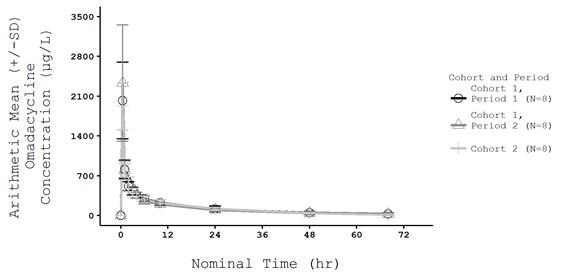

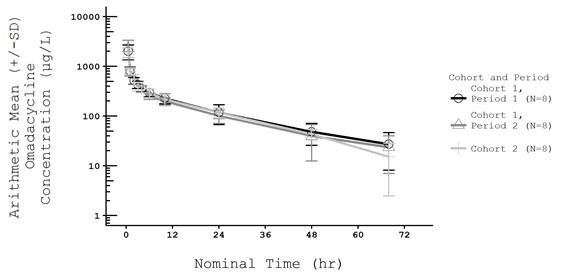

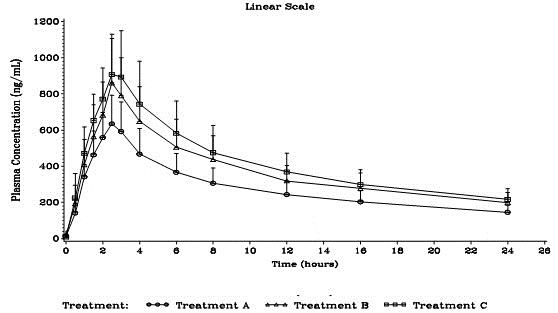

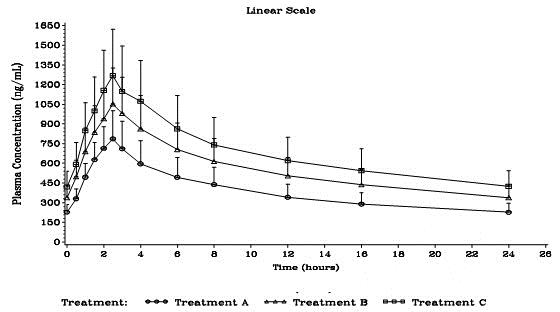

Study PK Results. A total of 16 subjects were enrolled in the study (8 assigned to each cohort) and all subjects completed the study. All subjects were included in both the Safety Population and the PK Population. Mean plasma concentration-time profiles of omadacycline following single IV doses of 100 mg are presented in Figure F‑2.

13

Figure F‑2 Arithmetic Mean (+/-SD) Plasma Omadacycline Concentration vs Time Plots Overlaid by Cohort and Treatment Period (PK Population) (Linear and Semi-log) (N = 8 per cohort)

Following a single IV dose of 100 mg in ESRD subjects and healthy subjects, plasma omadacycline concentration time profiles declined in a biphasic manner. The mean plasma omadacycline concentration time profiles were visually superimposable in the ESRD subjects (Period 1 and 2) and healthy control subjects. The profiles indicate that omadacycline exposure was similar between the subjects with ESRD (dosed after or prior to hemodialysis) and matched healthy control subjects. During dialysis in ESRD subjects, the mean percentage of the omadacycline cleared by hemodialysis compared to the total clearance of omadacycline was 47.8%. However, due to its low total systemic clearance (10.1 to 10.6 L/h) and large volume of distribution (194 to 214 L), the actual percent of the omadacycline dose in the dialysate during dialysis was only 7.89% (7.89 mg). The results indicate that renal impairment did not have an impact on the overall extent of exposure (AUC0-last and AUC0-inf) and total clearance, or CL, and a relatively small effect on the Cmax comparison.