Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 03/09/2012 - KITE REALTY GROUP TRUST | form8k_030912.htm |

Investors and Analysts

PRESENTED TO:

3.2012

KITE HEADQUARTERS Indianapolis, IN

KITE REALTY GROUP

2

DISCLAIMER

This presentation contains certain statements that are not historical fact and may constitute forward-

looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks, uncertainties and other factors which

may cause the actual results of the Company to differ materially from historical results or from any

results expressed or implied by such forward-looking statements, including, without limitation: national

and local economic, business, real estate and other market conditions, particularly in light of the recent

slowing of growth in the U.S. economy; financing risks, including the availability of and costs associated

with sources of liquidity; the Company’s ability to refinance, or extend the maturity dates of, its

indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their

ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which the

Company operates; acquisition, disposition, development and joint venture risks; property ownership

and management risks; the Company’s ability to maintain its status as a real estate investment trust

(“REIT”) for federal income tax purposes; potential environmental and other liabilities; impairment in the

value of real estate property the Company owns; risks related to the geographical concentration of our

properties in Indiana, Florida and Texas; assumptions underlying our anticipated growth sources; and

other factors affecting the real estate industry generally. The Company refers you to the documents filed

by the Company from time to time with the Securities and Exchange Commission, specifically the

section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2011, which discuss these and other factors that could adversely affect the Company’s

results. The Company undertakes no obligation to publicly update or revise these forward-looking

statements (including the FFO and net income estimates), whether as a result of new information, future

events or otherwise.

looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks, uncertainties and other factors which

may cause the actual results of the Company to differ materially from historical results or from any

results expressed or implied by such forward-looking statements, including, without limitation: national

and local economic, business, real estate and other market conditions, particularly in light of the recent

slowing of growth in the U.S. economy; financing risks, including the availability of and costs associated

with sources of liquidity; the Company’s ability to refinance, or extend the maturity dates of, its

indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their

ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which the

Company operates; acquisition, disposition, development and joint venture risks; property ownership

and management risks; the Company’s ability to maintain its status as a real estate investment trust

(“REIT”) for federal income tax purposes; potential environmental and other liabilities; impairment in the

value of real estate property the Company owns; risks related to the geographical concentration of our

properties in Indiana, Florida and Texas; assumptions underlying our anticipated growth sources; and

other factors affecting the real estate industry generally. The Company refers you to the documents filed

by the Company from time to time with the Securities and Exchange Commission, specifically the

section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2011, which discuss these and other factors that could adversely affect the Company’s

results. The Company undertakes no obligation to publicly update or revise these forward-looking

statements (including the FFO and net income estimates), whether as a result of new information, future

events or otherwise.

3

COMPANY OVERVIEW

|

• Stable Operating Portfolio

|

• 54 Properties in the Retail Operating Portfolio; 93.3% leased

• Diverse tenant base: Largest tenant represents only 2.9% of annualized base rent

• 5 mile demographics: Population - 126,000; Average Household Income - $85,000

|

|

• Increased Leasing & Operating

Productivity

|

• Over 840,000 square feet of leasing production in 2011 at aggregate rent spreads of 6.3%

• 9 consecutive quarters of positive cash rent spreads

• Same property net income for the fourth quarter of 2011 increased 5.7% over the prior year

and 3.7% for the full year 2011 compared to 2010. • Average annualized retail operating portfolio rents per square foot grew 3.3% from the

previous quarter. • Revenue from property operations increased 13.8% in the fourth quarter over the same

period in the prior year. |

|

• Development & Redevelopment

Progress |

• Commenced construction at Delray Marketplace in Delray Beach, Florida.

• Transitioned Four Corner/Maple Valley in Seattle, Washington and New Hill Place Phase I

near Raleigh, North Carolina to in-process developments. Construction is expected to commence in the first half of 2012. • Scheduled to open Whole Foods at Oleander Point in Wilmington, North Carolina in May

2012. • Commenced construction of a single-tenant property in Indianapolis, Indiana that is leased

to Walgreens. |

|

• Cash NOI Growth Potential

|

• $5.9 million of annualized cash NOI (see page 21).

|

Information as of December 31, 2011

LEASING

5

PORTFOLIO SAME STORE NOI TRENDS

KITE REALTY GROUP

6

LEASED PERCENTAGES: RETAIL OPERATING PORTFOLIO

KITE REALTY GROUP

RENT SPREADS

KITE REALTY GROUP

7

|

|

2011

|

2010

|

2009

|

|

New Leases

|

8.6%

|

9.8%

|

4.4%

|

|

Renewals

|

2.9%

|

<3.5%>

|

<0.8%>

|

|

Weighted Total

|

6.4%

|

5.1%

|

2.1%

|

Cash Rent Spreads

• Nine consecutive quarters of positive aggregate rent spreads

8

• Company-wide focus on leasing the portfolio to high-credit tenants.

• Total annual production (square feet):

• 2009 - 673,000

• 2010 - 1,100,600

• 2011 - 842,200

Total Leasing Production - New and Renewal Leases

By Quarter (square feet)

LEASING - ACTIVITY

KITE REALTY GROUP

RETAIL RELATIONSHIPS

Recent Retail Relationships

• National Retailers: Nordstrom Rack / The Container Store / Arhaus Furniture / Whole Foods /

Fresh Market / Advanced Auto / Babies “R” Us and Toys “R” Us / Ulta / Urban Outfitters /

Vitamin Shoppe / buybuy Baby / Apricot Lane / Bobby Chan / Chico’s / Dollar Tree / Goodwill

/ White House | Black Market / JoS. A. Bank

Fresh Market / Advanced Auto / Babies “R” Us and Toys “R” Us / Ulta / Urban Outfitters /

Vitamin Shoppe / buybuy Baby / Apricot Lane / Bobby Chan / Chico’s / Dollar Tree / Goodwill

/ White House | Black Market / JoS. A. Bank

• Restaurants: BJ’s Brewhouse / Buffalo Wild Wings / Corner Bakery / Jason’s Deli / Pei Wei /

Max’s Grille / Shula Burger / Brother’s Bar & Grill

Max’s Grille / Shula Burger / Brother’s Bar & Grill

KITE REALTY GROUP

9

DIVERSE TENANT BASE

Quality Retail Tenants

KITE REALTY GROUP

10

(1) Annualized base rent represents the monthly contractual rent for December 2011 for each applicable tenant multiplied by 12. Excludes tenant reimbursements.

(2) S&P credit ratings for parent company as of 1/20/2012.

Information as of December 31, 2011

DEVELOPMENT/REDEVELOPMENT

KITE REALTY GROUP

12

DELRAY MARKETPLACE

Delray Beach, Florida

Delray Beach, Florida

In-Process Development

• Including anchors Publix and Frank

Theatres, we currently have 24

executed leases. The center is

approximately 72% pre-leased or

committed.

Theatres, we currently have 24

executed leases. The center is

approximately 72% pre-leased or

committed.

• Commenced construction in the 4th

quarter of 2011.

quarter of 2011.

• Closed on a $62 million construction

loan in November 2011.

loan in November 2011.

• The $93 million project is scheduled

to open in November 2012.

to open in November 2012.

KITE REALTY GROUP

13

NEW HILL PLACE

Holly Springs, North Carolina

Holly Springs, North Carolina

In-Process Development

•Closed on the sale of land to, and

entered into a site development

agreement with, Target in February

2012.

entered into a site development

agreement with, Target in February

2012.

•The $57 million development is

approximately 73% pre-leased or

committed including Dick’s Sporting

Goods, Marshall’s, Michael’s, and Petco.

approximately 73% pre-leased or

committed including Dick’s Sporting

Goods, Marshall’s, Michael’s, and Petco.

•Phase I of New Hill Place is scheduled

to commence construction in spring,

2012 after finalizing construction loan.

to commence construction in spring,

2012 after finalizing construction loan.

•Phase I of the development is

scheduled to open in spring, 2013.

scheduled to open in spring, 2013.

KITE REALTY GROUP

14

FOUR CORNER/MAPLE VALLEY

Maple Valley, Washington

Maple Valley, Washington

In-Process Development/Redevelopment

•Commenced construction at the end of

February 2012.

February 2012.

•Three anchor leases for 80,000 square feet

are fully executed with Grocery Outlet,

Johnson’s Home & Garden, and Walgreens.

are fully executed with Grocery Outlet,

Johnson’s Home & Garden, and Walgreens.

•Construction loan to be finalized prior to

construction commencement.

construction commencement.

•The $24 million project is scheduled to

partially open in late 2012.

partially open in late 2012.

KITE REALTY GROUP

15

OLEANDER POINT

Wilmington, North Carolina

Wilmington, North Carolina

In-Process Redevelopment

• KRG turned over the space to a

newly constructed Whole Foods

during the 4th quarter with an

opening scheduled for May

2012.

newly constructed Whole Foods

during the 4th quarter with an

opening scheduled for May

2012.

• The project is 86% pre-leased or

committed as of December 31,

2011.

committed as of December 31,

2011.

Before

After

After

KITE REALTY GROUP

16

HIGH QUALITY RECENTLY COMPLETED REAL ESTATE

Rivers Edge

• Successfully redeveloped and was

100% leased as of December 31,

2011.

100% leased as of December 31,

2011.

• Anchored by Nordstrom Rack, The

Container Store, buybuy Baby, Arhaus

Furniture, and BGI Fitness.

Container Store, buybuy Baby, Arhaus

Furniture, and BGI Fitness.

Eddy Street Commons

• Successfully developed and was

96.8% leased as of December 31,

2011.

96.8% leased as of December 31,

2011.

• Anchored by Urban Outfitters,

Hammes Bookstore, and University

of Notre Dame

Hammes Bookstore, and University

of Notre Dame

KITE REALTY GROUP

17

HIGH QUALITY RECENTLY COMPLETED REAL ESTATE

Cobblestone Plaza

• Successfully developed and was

92.2% leased as of December 31,

2011.

92.2% leased as of December 31,

2011.

• Anchored by Whole Foods, Party City,

and All Pets Emporium.

and All Pets Emporium.

South Elgin Commons

• Successfully developed and was

100% leased as of December 31,

2011.

100% leased as of December 31,

2011.

• Anchored by LA Fitness, Toys “R”

Us/Babies “R” Us, Ross Stores and

a non-owned Super Target.

Us/Babies “R” Us, Ross Stores and

a non-owned Super Target.

BALANCE SHEET

KITE REALTY GROUP

19

DEBT AND CAPITAL MARKETS UPDATE

Primary Debt Capital Market Initiatives

• Manage fixed to floating ratio to a goal of 80%/20% (w/construction loan debt).

• Capitalize on low long-term interest rate environment.

• De-levering in process through NOI growth and non-core asset sales.

Significant 2012 Planned Debt Transactions

• Refinance Plaza at Cedar Hill and Fox Lake Crossing

• Secure long-term financing at Cobblestone Plaza and Rivers Edge

• Finalize construction loans for development at Four Corner Square/Maple Valley

and New Hill Place - Phase I.

and New Hill Place - Phase I.

KITE REALTY GROUP

20

SCHEDULE OF DEBT MATURITIES

Extend duration of maturities while continuing to stagger debt maturities to mitigate risk.

Information as of December 31, 2011

(1) Chart excludes annual principal payments and net premiums on fixed rate debt.

(2) Assumes the Company exercises the one year extension option on unsecured line of credit.

(3) As of March 9, 2012, only $10.8 million remaining.

KITE REALTY GROUP

21

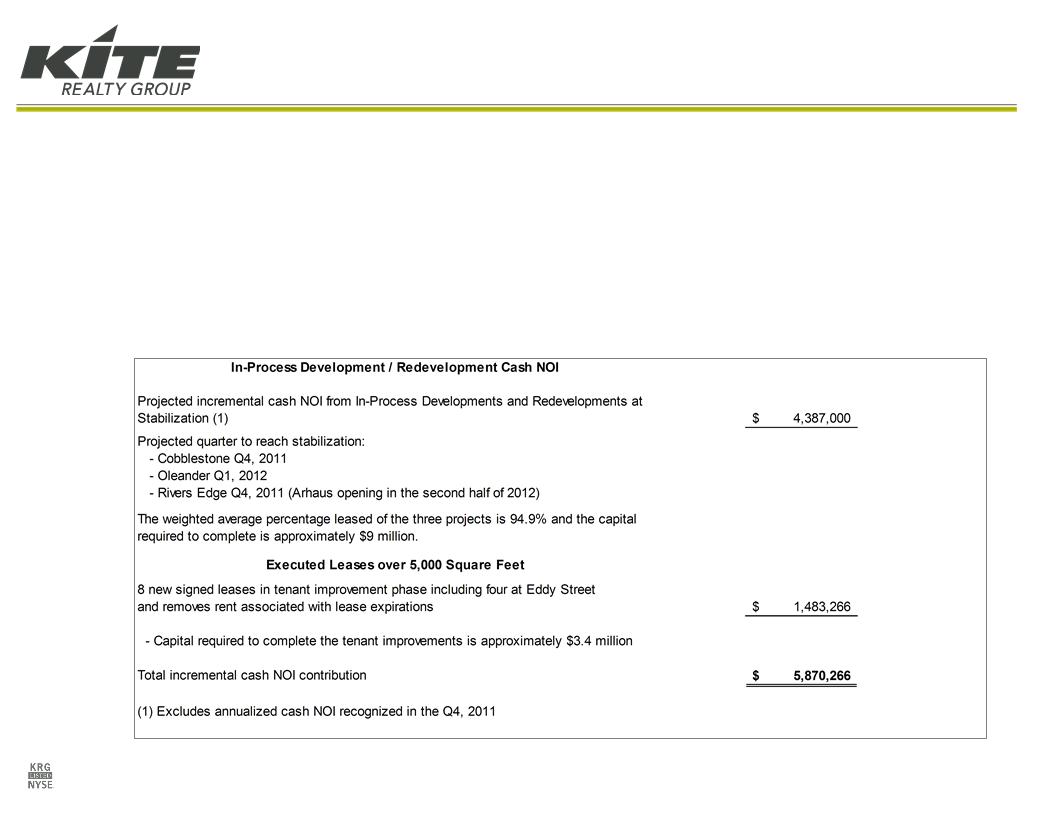

NOI GROWTH POTENTIAL THROUGH INCREMENTAL CASH NOI

• NOI growth potential through continued cash rent commencement from

executed leases at operating properties and in-process development and

redevelopment properties.

executed leases at operating properties and in-process development and

redevelopment properties.

• Continue to improve our debt-to-EBITDA level as tenants who have

executed leases take occupancy.

executed leases take occupancy.

Information as of December 31, 2011