Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ASSET ACCEPTANCE CAPITAL CORP | Financial_Report.xls |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - ASSET ACCEPTANCE CAPITAL CORP | d283895dex231.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER - ASSET ACCEPTANCE CAPITAL CORP | d283895dex321.htm |

| EX-21.1 - SUBSIDIARIES - ASSET ACCEPTANCE CAPITAL CORP | d283895dex211.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - ASSET ACCEPTANCE CAPITAL CORP | d283895dex312.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - ASSET ACCEPTANCE CAPITAL CORP | d283895dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011 Commission file number 000-50552

Asset Acceptance Capital Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 80-0076779 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

28405 Van Dyke Avenue

Warren, Michigan 48093

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(586) 939-9600

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer þ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant on June 30, 2011 (based on the June 30, 2011 closing sales price of $4.04 of the registrant’s Common Stock, as reported on The NASDAQ Global Select Market on such date) was $64,052,996.

Number of shares outstanding of the registrant’s Common Stock, $0.01 par value, at February 16, 2012:

30,684,552 shares of Common Stock, $0.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2012 Annual Meeting of Stockholders to be held on May 10, 2012 are incorporated by reference into Part III of this Report.

Table of Contents

ASSET ACCEPTANCE CAPITAL CORP.

Annual Report on Form 10-K

| Page | ||||||

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

13 | |||||

| Item 1B. |

22 | |||||

| Item 2. |

22 | |||||

| Item 3. |

22 | |||||

| Item 4. |

22 | |||||

| PART II | ||||||

| Item 5. |

23 | |||||

| Item 6. |

24 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 | ||||

| Item 7A. |

53 | |||||

| Item 8. |

53 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

53 | ||||

| Item 9A. |

54 | |||||

| Item 9B. |

54 | |||||

| PART III | ||||||

| Item 10. |

54 | |||||

| Item 11. |

56 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

56 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

57 | ||||

| Item 14. |

57 | |||||

| PART IV | ||||||

| Item 15. |

58 | |||||

| 61 | ||||||

| F-1 | ||||||

Annual Report on Form 10-K

We file reports with the Securities and Exchange Commission (“SEC”), which we make available on our website, www.assetacceptance.com, free of charge. These reports include Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to such reports, each of which is provided on our website as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC.

2

Table of Contents

| Item 1. | Business |

General

We have been purchasing and collecting defaulted or charged-off accounts receivable portfolios from consumer credit originators since 1962. Charged-off receivables are the unpaid obligations of individuals to credit originators, such as credit card issuers, consumer finance companies, retail merchants, telecommunications and other utility providers. Since these receivables are delinquent or past due, we are able to purchase them at a substantial discount. We purchase and pursue collections on charged-off consumer receivable portfolios for our own account as we believe this affords us the best opportunity to use long-term strategies to maximize collections. From January 1, 2002 through December 31, 2011, we purchased 1,234 consumer debt portfolios, with an original charged-off face value of $44.6 billion for an aggregate purchase price of $1.2 billion, or 2.76% of face value, net of buybacks.

When considering whether to purchase a portfolio, we conduct a quantitative and qualitative analysis to appropriately price the debt. This analysis includes the use of our proprietary pricing and collection probability model and draws upon our extensive experience in the industry. We have developed experience across a wide range of asset types at various stages of delinquency, having made purchases across more than 20 different asset types from over 150 different debt sellers since 2002. The delinquency stage refers to the date the debt was charged-off and the number of agencies that previously attempted to collect the debt. We selectively deploy our capital in the fresh, primary, secondary and tertiary delinquency stages, defined as:

| • | fresh accounts are typically 120 to 180 days past due, have been charged-off by the credit originator and are being sold prior to any post charged-off collection activity. These accounts typically sell for the highest purchase price; |

| • | primary accounts are typically 180 to 360 days past due, have usually been previously placed with one third party collector and typically receive a lower purchase price; and |

| • | secondary and tertiary accounts are typically more than 360 days past due, have been placed with two or more third party collectors and receive even lower purchase prices. |

We have a long-standing history in the industry, have built relationships with debt sellers and provide post-sale service. Unlike some third party collection agencies that do not own the debt and attempt collections for a period of only six to twelve months, we generally take a long-term approach to the collection effort as we are the owners of the debt. We apply an approach that encourages cooperation with the debtors to make a lump sum payment in full or to formulate a repayment plan, thereby converting debtors into paying customers. In addition, for debtors who we believe have the ability to repay their debt but do not do so voluntarily, we may proceed with legal remedies to obtain collections. Our long-term approach allows us to invest in various collection management and analysis tools that may be too costly for short-term oriented collection agencies. In many cases, we continue to receive collections on individual portfolios for more than ten years from the date of purchase.

In addition, we finance the sales of consumer product retailers through our Consumer Credit, LLC subsidiary and license our collection software through our Legal Recovery Solutions, LLC (“LRS”) subsidiary.

History

Our business originated in 1962 for the purpose of purchasing and collecting charged-off accounts receivable and became a publicly traded company in February 2004.

On April 28, 2006, the Company completed a stock purchase transaction of 100% of the outstanding shares of Premium Asset Recovery Corporation (“PARC”) to expand its existing healthcare receivable portfolio collection activities. During 2010, the Company committed to exit healthcare accounts receivable purchase and collection activities, and, on December 15, 2010, dissolved our PARC subsidiary.

3

Table of Contents

In July 2010, the Company formed LRS as a new wholly-owned subsidiary. On July 21, 2010, LRS completed an acquisition of substantially all of the assets of BSI eSolutions, LLC (“BSI”), which was a software technology company providing products and services to the debt collection industry, including the collection software we were implementing to replace our legacy system. LRS continues to provide services and license the software to other entities. The results of operations for LRS since the acquisition have not been material.

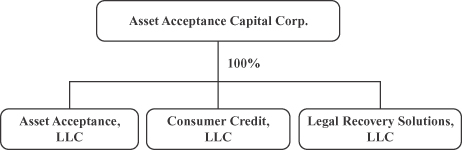

The diagram below depicts our organizational structure, including our principle operating subsidiaries:

As used in this Annual Report, all references to us mean Asset Acceptance Capital Corp. (“AACC”), a Delaware corporation, and all wholly-owned subsidiaries (referred to in our financial statements as the “Company”).

Purchasing

Typically, we purchase portfolios in response to a request to bid received from a prospective seller. Our portfolio acquisitions team cultivates relationships with known and prospective sellers. We have purchased portfolios from over 150 different debt sellers since 2002, including many of the largest consumer lenders in the United States. While we have no policy limiting purchases from a single debt seller, we purchase from a diverse set of sellers and base purchasing decisions on constantly changing economic and competitive conditions as opposed to long-term relationships with any particular seller. Depending on market conditions and opportunities presented by certain sellers, we may enter into forward flow contracts. Forward flow contracts commit a seller to sell charged-off receivables to us for a fixed percentage of the face value over a specified time period, which typically ranges between three and twelve months. Forward flow contracts may be attractive to us because the account demographics are similar from month-to-month, which provides us with operational predictability and consistency.

We purchase our portfolios through a variety of sources, including consumer credit originators, private brokers and debt resellers. Debt resellers are debt purchasers that sell accounts at some point in time after purchase. Generally, portfolios are purchased either competitively, through a mix of sealed bids or on-line auctions, or through privately-negotiated transactions between the credit originator or other holders of consumer debt and us.

Each potential acquisition begins with a quantitative and qualitative analysis of the portfolio. In the initial stages of this due diligence process, we review basic data on the portfolio’s accounts. This data typically includes the account number, the consumer’s name, address, social security number, phone numbers, outstanding balance, date of charge-off, date of last payment and date of account origination, to the extent debt sellers provide this data. We analyze this information and cross reference it with data on our existing accounts, focusing on certain key metrics, such as the state of the debtor’s last known residence, type of debt, balance ranges, time remaining on the credit bureaus, time remaining within the statute of limitations, and debtor prior payment history with us. In addition, we generally obtain certain qualitative factors relating to the portfolio from the sellers, primarily related to their origination and collection practices.

4

Table of Contents

As part of our due diligence, we evaluate each portfolio to develop a bid range utilizing our proprietary pricing model. This analytically driven model considers certain characteristics of the prospective portfolio, historical analysis of similar portfolios, estimated potential recoveries and estimated collection expenses. In addition, we also consult with our collections management to help ascertain collectability and potential collection and legal strategies.

Once we have compiled and analyzed available data, we consider market conditions and determine an appropriate bid price or bid range. The recommended bid price or bid range, along with a summary of our due diligence, is submitted to our investment committee for approval. After approval, and acceptance of our offer by the seller, a purchase agreement is negotiated. Buyback provisions are generally incorporated into the purchase agreement for bankrupt, fraudulent, paid prior or deceased accounts and, typically, the credit originator either agrees to repurchase these accounts or replace them with acceptable accounts within certain time frames, generally within 90 to 180 days. Upon execution of the purchase agreement, we receive title to the accounts and the transaction is funded.

The following table categorizes our purchased receivables portfolios acquired from January 1, 2002 through December 31, 2011 by major asset type:

| ($ and accounts in thousands) Asset Type |

Face Value of Charged-off Receivables(1) |

% | No. of Accounts |

% | ||||||||||||

| General Purpose Credit Cards |

$ | 23,473,120 | 52.7 | % | 8,868 | 26.9 | % | |||||||||

| Private Label Credit Cards |

6,565,214 | 14.7 | 7,739 | 23.4 | ||||||||||||

| Telecommunications/Utility/Gas |

3,116,527 | 7.0 | 7,907 | 24.0 | ||||||||||||

| Installment Loans |

2,709,238 | 6.1 | 437 | 1.3 | ||||||||||||

| Healthcare |

2,463,853 | 5.5 | 4,098 | 12.4 | ||||||||||||

| Health Club |

1,365,396 | 3.1 | 1,057 | 3.2 | ||||||||||||

| Auto Deficiency |

595,301 | 1.3 | 105 | 0.3 | ||||||||||||

| Other(2) |

4,262,956 | 9.6 | 2,794 | 8.5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 44,551,605 | 100.0 | % | 33,005 | 100.0 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Face value of charged-off receivables represents the cumulative amount of purchases net of buybacks. The amounts in this table are not adjusted for resales, payments received, settlements or additional accrued interest that occur after purchase. This table also excludes the purchase of a single portfolio in June 2002 with a face value of $1.2 billion at a cost of $1.2 million (or 0.1% of face value), consisting of approximately 3.8 million accounts, which would have been included in “Other”. |

| (2) | “Other” includes charged-off receivables of several debt types, including student loan, mobile home deficiency and retail mail order. |

The age of a charged-off consumer receivables portfolio, the time since an account has been charged-off by the credit originator and the number of times a portfolio has been placed with third parties for collection purposes are important factors in determining the price at which we will offer to purchase a portfolio. Generally, there is an inverse relationship between the age of a portfolio and the price at which we will purchase it, due to the fact that older receivables are typically more difficult to collect, and generally closer to the expiration of credit bureau reporting and the statute of limitations for legal actions. The consumer debt collection industry generally places receivables into the fresh, primary, secondary or tertiary categories depending on the age and number of third parties that have previously attempted to collect the receivables. We will purchase accounts at any point in the delinquency cycle. We deploy our capital within these delinquency stages based upon availability and the relative value of the available debt portfolios.

5

Table of Contents

The following table categorizes our purchased receivables portfolios acquired from January 1, 2002 through December 31, 2011 by delinquency stage:

| ($ and accounts in thousands) Delinquency Stage |

Face Value of Charged-off Receivables(1) |

% | No. of Accounts |

% | ||||||||||||

| Fresh |

$ | 2,821,501 | 6.3 | % | 1,510 | 4.6 | % | |||||||||

| Primary |

5,101,042 | 11.4 | 4,846 | 14.7 | ||||||||||||

| Secondary |

11,877,417 | 26.7 | 9,135 | 27.7 | ||||||||||||

| Tertiary |

24,751,645 | 55.6 | 17,514 | 53.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 44,551,605 | 100.0 | % | 33,005 | 100.0 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Face value of charged-off receivables represents the cumulative amount of purchases net of buybacks. The amounts in this table are not adjusted for resales, payments received, settlements or additional accrued interest that occur after purchase. This table also excludes the purchase of a single portfolio in June 2002 with a face value of $1.2 billion at a cost of $1.2 million (or 0.1% of face value), consisting of approximately 3.8 million accounts, which would have been included in “Tertiary”. |

We also review the geographic distribution of accounts within a portfolio because collection laws differ from state to state and therefore may impact cost and collectability. In addition, economic factors vary regionally and are factored into our purchasing analysis.

The following table illustrates our purchased receivables portfolios acquired from January 1, 2002 through December 31, 2011 based on geographic location of the debtor at the time of the purchase:

| ($ and accounts in thousands) Geographic Location |

Face Value of Charged-off Receivables(1) |

% | No. of Accounts |

% | ||||||||||||

| Texas |

$ | 5,952,351 | 13.4 | % | 5,231 | 15.9 | % | |||||||||

| California |

5,879,223 | 13.2 | 3,848 | 11.7 | ||||||||||||

| Florida |

4,686,495 | 10.5 | 2,424 | 7.3 | ||||||||||||

| New York |

2,738,461 | 6.1 | 1,467 | 4.5 | ||||||||||||

| Michigan |

2,165,428 | 4.9 | 2,416 | 7.3 | ||||||||||||

| Ohio |

1,791,584 | 4.0 | 2,108 | 6.4 | ||||||||||||

| Illinois |

1,727,678 | 3.9 | 1,722 | 5.2 | ||||||||||||

| Pennsylvania |

1,560,609 | 3.5 | 1,037 | 3.1 | ||||||||||||

| New Jersey |

1,480,861 | 3.3 | 1,188 | 3.6 | ||||||||||||

| North Carolina |

1,318,170 | 3.0 | 774 | 2.4 | ||||||||||||

| Georgia |

1,248,506 | 2.8 | 903 | 2.7 | ||||||||||||

| Arizona |

942,508 | 2.1 | 631 | 1.9 | ||||||||||||

| Other(2) |

13,059,731 | 29.3 | 9,256 | 28.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 44,551,605 | 100.0 | % | 33,005 | 100.0 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Face value of charged-off receivables represents the cumulative amount of purchases net of buybacks. The amounts in this table are not adjusted for resales, payments received, settlements or additional accrued interest that occur after purchase. This table also excludes the purchase of a single portfolio in June 2002 with a face value of $1.2 billion at a cost of $1.2 million (or 0.1% of face value), consisting of approximately 3.8 million accounts. |

| (2) | Each state included in “Other” represents less than 2.0% of the face value of total charged-off receivables. |

6

Table of Contents

Collection Operations

Our collection operations seek to maximize the recovery of our purchased receivables in a cost-effective manner. We have organized our collection operations into two channels; call center collections and legal collections. Within each of these channels we have specialized teams that handle certain types of collection activities and we utilize third parties to supplement internal capacity or expertise. We also utilize a network of data providers to periodically obtain updated account information to facilitate our collection activities.

Once a portfolio is purchased, we send notification letters to the debtors and analyze portfolio data to develop an effective collection strategy. This analysis includes a series of data preparation and information acquisition steps intended to ensure the accuracy of account information and help determine our collection efforts. Accounts are sorted and prioritized based on account type, status, balance size and various other demographics, as well as external collectability indicators. We segment inventory between our call center and legal collections channels, as well as our third party network, based on portfolio characteristics and analytics we use to manage capacity and overall inventory, allowing us to deploy unique collection strategies to each segment.

Call Center Collections Channel

Our call center account representatives handle substantially all collection activity related to the accounts they service. These activities include calling debtors manually and using our automated outbound dialer, inbound call management, providing required debtor notifications, skip tracing or debtor location efforts and negotiating settlements or payment plans. We utilize a standard call model that allows our account representatives to manage communications with debtors effectively. These activities are tracked and measured on an individual account representative basis and regular coaching and call monitoring occurs to improve performance and ensure compliance with regulatory requirements and internal procedures. Our performance-based model is driven by a bonus program that allows account representatives to increase their compensation based on their achievement of collection goals.

When initial telephone contact is made with a debtor, our account representatives are trained to go through a series of questions in an effort to ensure proper identification of the debtor, provide required disclosures, obtain accurate location and financial information, understand the reason the debtor may have defaulted on the account, assess the debtor’s willingness to pay and gather other relevant information that may be helpful in securing payment. If full payment is not available, the account representative will attempt to negotiate a settlement or arrange a payment plan. In an effort to maximize recoveries, we maintain settlement guidelines that account representatives, supervisors and managers must follow. Exceptions are handled by management on an account-by-account basis. If the debtor is unable to pay the balance in full or settle within allowed guidelines, monthly installment plans are encouraged in order to have the debtor resume a regular payment habit. Our experience has shown that debtors often respond favorably to this approach, which can result in settlement in full in the future.

We also utilize lettering strategies that correlate with our collector-initiated activities. Our lettering strategies are based on our analytics and often contain settlement offers to maximize collections in a cost efficient manner.

We periodically undertake skip tracing procedures to locate debtors. Skip tracing efforts are performed individually at the account representative level and in a batch process by third party information providers. The information received is either manually or systematically validated and is used in our efforts to locate debtors. Using these methods, we periodically refresh and supply updated account information to our account representatives to increase contact with the appropriate parties. The updated account information is stored within the collection platform and facilitates account segmentation and inventory modeling activities. Account segmentation and inventory modeling allow us to tailor our collection efforts based on a variety of account characteristics.

7

Table of Contents

In addition to our internal call center collections operations, we have developed an extensive network of third party collection agencies to service accounts that exceed our internal capacity or that have specific skills we believe will yield a better outcome than working the accounts internally. For example, we may consider outsourcing small balance or aged segments of accounts while our account representatives focus on other populations of accounts. These third parties include both domestic and off-shore agencies, including an agency in India which we engaged to collect on our behalf utilizing our collection platform. These varying collection channels allow us to pursue what we believe is the most effective collection strategy for each account while managing capacity.

Legal Collections Channel

We analyze purchased accounts to identify those eligible for our legal process at both the time of purchase and throughout the collection cycle. Accounts are analyzed using a proprietary suit selection model to determine whether we believe the debtor has the ability but not the willingness to pay. Our suit selection model considers various attributes including the applicable statute of limitations, credit score, employment status and the state in which the debtor resides, together with other proprietary factors we believe help us assess the debtors’ ability to satisfy their obligations. Once accounts are selected, we transfer them into our legal collections channel.

Once in the legal collections channel, we generally attempt to contact the debtors in an effort to resolve the debt through settlement or payment plans. If we are unable to resolve the accounts and we believe that the debtor has the ability to pay, we may pursue legal action through our network of third party law firms. This process generally involves pursuing a legal judgment against the debtor. Once a judgment is obtained, our legal network utilizes various collection strategies to secure payment. If we ultimately determine the accounts are not eligible for suit, or if we are unable to secure a judgment, we transfer the accounts to our call center collections channel.

Our legal forwarding department consists of account representatives, support staff and associates monitoring activities with third party law firms who perform legal activities. We have engaged a preferred, third party law firm to perform the legal recovery function in 12 key states (including nine states previously serviced with in-house collection attorneys). We also work with a network of independent law firms throughout the country who collect for us on a contingent fee basis.

Our legal collections channel also includes our bankruptcy and probate departments. The bankruptcy department files proofs of claims for receivables that are included in consumer bankruptcies filed under Chapter 7 (resulting in liquidation and discharge of a debtor’s debts) and Chapter 13 (resulting in repayment plans based on the financial wherewithal of the debtor) of the U.S. Bankruptcy Code. The probate department and our network of third party law firms submit claims against estates involving deceased debtors having assets that may become available to us through a probate claim.

We have designed our legal policies and procedures to maintain compliance with debt collection standards and applicable state and federal laws while pursuing available legal options. We monitor our associates and our third party law firms for compliance with those requirements.

Seasonality

Refer to Part II. Item 7, under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality” for the effect of seasonality on our business.

Competition

The consumer debt collection industry is highly competitive and fragmented. We compete with a wide range of other purchasers of charged-off consumer receivables, third party collection agencies, other financial service companies and credit originators that manage their own consumer receivables. Some of these companies may

8

Table of Contents

have substantially greater numbers of associates, more financial resources, more favorable operating structures and may experience lower account representative turnover rates than we do. Furthermore, some of our competitors may obtain alternative sources of financing, the proceeds from which may be used to fund expansion and to increase their number of charged-off portfolio purchases. Barriers to entry into the consumer debt collection industry are low. Companies with greater financial resources may elect at a future date to enter the consumer debt collection business. Furthermore, current debt sellers may change strategies and cease selling debt portfolios in the future.

Competitive pressures affect the availability and pricing of receivable portfolios, as well as the availability and cost of qualified account representatives. In addition, some of our competitors may have entered into forward flow contracts under which consumer credit originators have agreed to transfer a steady flow of charged-off receivables to them in the future, which may restrict those credit originators from selling receivables to other purchasers and limit the supply of receivables available to us.

We face bidding competition in our acquisition of charged-off consumer receivables. We believe successful bids are predominantly awarded based on price, but also are awarded based on service and relationships with the individual debt sellers, and the debt buyer’s ability to fund the deal. Some of our competitors may require increasing amounts of charged-off receivables to fund their operations, which could lead to increased competition for portfolios and higher prices. In addition, there has been consolidation of issuers of credit cards in recent years, which have been a principal source of our receivable purchases. This consolidation has decreased the number of sellers in the market and could eventually give the remaining sellers increasing market strength on the price and terms of the sale of charged-off accounts.

Technology Platform

We believe that information technology is critical to our success. Our key systems have been purchased from outside vendors and, with our input, have been tailored to meet our particular business needs. During 2010, we acquired the assets of BSI, the vendor that developed our collection application, including the software source code. We believe this acquisition allows us to further enhance features and functionality of our collection software and improve productivity in an efficient and cost effective manner. We maintain a full-time staff of technology professionals who monitor and maintain our information technology and communications structure. We utilize a centralized data center model, which leverages economies of scale in providing distributed computing capabilities.

The collection software in use today enables us to:

| • | automate the loading of accounts in order to expedite collecting after purchase; |

| • | segment the accounts to optimize collection strategies; |

| • | interface with third party letter production and mailing vendors, credit reporting services and information service providers to effectively communicate with debtors and obtain efficiencies in our operations; |

| • | integrate with our automated dialer to increase the number of contacts with our debtors; |

| • | integrate the scrub processes for data cleansing; |

| • | automate workflow standards to maximize system data output and user productivity; |

| • | connect to a document imaging system to allow our associates, with appropriate responsibilities, to view scanned account documents from their workstations; |

| • | automate management of third party networks; |

| • | limit an associate’s ability to work outside of Company guidelines; |

9

Table of Contents

| • | query the appropriate database for any purpose which may be used for collection, compliance, reporting or other business matters; |

| • | establish parameters to comply with federal and state laws; and |

| • | provide comprehensive data feeds to our business intelligence application. |

In order to minimize the potential impact of a disaster or other interruption of data or telephone communications that are critical to our business, we have:

| • | a diesel generator sufficient in size to power our entire Warren, Michigan headquarters, including our centralized systems; |

| • | a back-up server sufficient in size to handle our collection platform located in a separate data center; |

| • | replication of data from the primary system to the backup system; |

| • | an ability to have inbound phone calls rerouted to other offices; |

| • | fire suppression systems in our primary and back-up data centers; |

| • | redundant data paths to each of our call center offices and data centers; and |

| • | daily back-up of all of our critical applications with the tapes transported offsite to a secure data storage facility. |

In addition, we have dialer systems for incoming and outgoing calls that include call recording technology. We continuously review emerging technologies and will upgrade or replace our systems as needed to remain competitive.

Regulation and Legal Compliance—Collection Activities

We have a robust Compliance Department under the oversight of our Office of the General Counsel. Our Compliance Department assists with training our staff in relevant areas including extensive training on the Fair Debt Collection Practices Act and other relevant laws and regulations. Our Office of the General Counsel distributes guidelines and procedures for collection personnel to follow when communicating with customers, customers’ agents, attorneys and other parties during our collection efforts. They are also responsible for approving all written communications to debtors. In addition, our Office of the General Counsel regularly researches, and provides collections personnel and our training department with summaries and updates of changes in federal and state statutes and relevant case law so that they are aware of, and maintain compliance with, changing laws and judicial decisions. Our collection platform allows for integration of these guidelines and procedures which helps ensure associate compliance.

Federal, state and local statutes establish specific guidelines and procedures, which debt collection account representatives must follow when collecting on consumer accounts. It is our policy to comply with the provisions of all applicable federal, state and local laws in all of our collection activities, and, therefore, we have established comprehensive procedures for compliance. Failure to comply with these laws could lead to fines, lawsuits and disruption of our collection activities that could have a material adverse effect on us.

Our recent settlement of an FTC investigation into our debt collection practices, as discussed below under the caption “Legal Proceedings,” imposes additional disclosure and other obligations in connection with our collection of consumer debt. We have incorporated these additional obligations into our standard operating practices and procedures.

10

Table of Contents

Federal, state and local consumer protection, privacy and related laws and regulations extensively regulate the relationship between debt collectors and debtors. Significant federal laws and regulations applicable to our business as a debt collection company include the following:

| • | Fair Debt Collection Practices Act (“FDCPA”). This act imposes obligations and restrictions on the practices of consumer debt collectors, including specific restrictions regarding communications with debtors, including the time, place and manner of the communications. This act also gives consumers certain rights, including the right to dispute the validity of their obligations; |

| • | Fair Credit Reporting Act/Fair and Accurate Credit Transaction Act of 2003. The Fair Credit Reporting Act (“FCRA”) and its amendment entitled the Fair and Accurate Credit Transaction Act of 2003 (“FACT Act”) place requirements on credit information furnishers regarding verification of the accuracy of information furnished to credit reporting agencies and requires such information furnishers to investigate consumer disputes concerning the accuracy of such information. The FACT Act also requires certain conduct in the cases of identity theft or unauthorized use of a credit card and direct disputes to the creditor. We furnish information concerning our accounts to the three major credit-reporting agencies, and it is our practice to correctly report this information and to investigate credit-reporting disputes in a timely fashion; |

| • | Dodd-Frank Wall Street Reform and Consumer Protection Act. This act authorized the creation of the Consumer Financial Protection Bureau (“CFPB”). The CFPB will have authority to regulate and examine the Company. While the CFPB will have wide ranging authority over the Company it is not yet possible to know what its specific impact will be. The CFPB recently proposed a rule that would authorize it to supervise the Company’s subsidiary, Asset Acceptance, LLC, as a larger participant in the market for consumer debt collections; |

| • | The Financial Privacy Rule. Promulgated under the Gramm-Leach-Bliley Act, this rule requires that financial institutions, including collection agencies, develop policies to protect the privacy of consumers’ private financial information and provide notices to consumers advising them of their privacy policies. It also requires that if private personal information concerning a consumer is shared with another unrelated institution, the consumer must be given an opportunity to opt out of having such information shared. Since we do not share consumer information with non-related entities, except as required by law, or except as allowed by the rule in connection with our collection efforts, our consumers are not entitled to any opt out rights under this rule. Both this rule and the Safeguards Rule described below are enforced by the Federal Trade Commission, which has retained exclusive jurisdiction over enforcement of them. Consumers do not have a private cause of action for violations of the Gramm-Leach-Bliley Act; |

| • | The Safeguards Rule. Also promulgated under the Gramm-Leach-Bliley Act, this rule specifies that we must safeguard financial information of consumers and have a written security plan setting forth information technology safeguards and the ongoing monitoring of the storage and safeguarding of electronic information; |

| • | NACHA—The Electronic Payments Association. This association regulates the use of the Automated Clearing House (“ACH”) system to make electronic funds transfers. All ACH transactions must comply with Federal Reserve Regulation E and the rules of the association. This association and Regulation E give the consumer, among other things, certain privacy rights with respect to the transactions, the right to stop payments on a pre-approved fund transfer, and the right to receive certain documentation of the transaction; |

| • | Telephone Consumer Protection Act. In the process of collecting on accounts, we use automated dialers to place calls to consumers. This act and similar state laws place certain restrictions on users of automated dialing equipment who place telephone calls to consumers; and |

| • | U.S. Bankruptcy Code. In order to prevent any collection activity with bankrupt debtors by creditors and collection agencies, the U.S. Bankruptcy Code provides for an automatic stay, which prohibits certain contact with consumers after the filing of bankruptcy petitions. |

11

Table of Contents

Additionally, there are state and local statutes and regulations comparable to the above federal laws and other state and local-specific licensing requirements which affect our operations. State laws may also limit interest rates and fees, methods of collections, as well as the time frame in which judicial actions may be initiated to enforce the collection of consumer accounts. Court rulings in various jurisdictions also may impact our ability to collect.

Although we are not generally a credit originator, the following laws, which apply typically to credit originators, may occasionally affect our operations because our receivables were originated through credit transactions:

| • | Truth in Lending Act; |

| • | Fair Credit Billing Act; |

| • | Equal Credit Opportunity Act; |

| • | Retail Installment Sales Act; and |

| • | Credit Card Accountability Responsibility and Disclosure Act of 2009. |

Federal laws which regulate credit originators require, among other things, that credit card issuers disclose to consumers the interest rates, fees, grace periods and balance calculation methods associated with their credit card accounts. Consumers are entitled under current laws to have payments and credits applied to their accounts promptly, to receive prescribed notices, and to require billing errors to be resolved promptly. Some laws prohibit discriminatory practices in connection with the extension of credit. Federal statutes further provide that, in some cases, consumers cannot be held liable for, or their liability is limited with respect to, charges to the credit card account that were a result of an unauthorized use of the credit card. These laws, among others may limit our ability to recover amounts due on an account, whether or not we committed any wrongful act or omission in connection with the account. If the credit originator fails to comply with applicable statutes, rules and regulations, it could create claims and rights for consumers that could reduce or eliminate their obligations to repay the account, and have a possible material adverse effect on us. Accordingly, when we acquire charged-off consumer receivables, we typically require credit originators to represent and warrant that the receivables were originated and serviced in compliance with applicable laws, and indemnify us against certain losses that may result from their failure to comply with applicable statutes, rules and regulations relating to the receivables before they are sold to us.

There are federal and state statutes concerning identity theft or unauthorized use of a credit card. Some of these provisions place restrictions on our ability to report information concerning receivables, which may be subject to identity theft or unauthorized use of a credit card, to consumer credit reporting agencies. Additional consumer protection and privacy protection laws may be enacted that would impose additional requirements on the recovery of consumer credit card or installment accounts. Any new laws, rules or regulations that may be adopted, as well as existing consumer protection and privacy protection laws, may adversely affect our ability to collect on our charged-off consumer receivable portfolios. In addition, our failure to comply with these requirements could adversely affect our ability to recover the receivables and increase our costs.

It is possible that some of the receivables we have purchased were originated as a result of identity theft or unauthorized use. In such cases, we would not be able to recover the amount of the receivables. As a purchaser of charged-off consumer receivables, we may acquire receivables subject to legitimate defenses on the part of the consumer. Most of our account purchase contracts allow us to return to the credit originators (within an agreed upon amount of time) certain accounts that may not be collectible at the time of purchase, due to these and other circumstances. Upon return, the credit originators or debt sellers are required to replace the receivables with similar receivables or repurchase the receivables. These provisions limit, to some extent, our losses on such accounts.

12

Table of Contents

Associates

As of December 31, 2011, we employed 1,128 associates, including 1,090 associates on a full-time basis and 38 associates on a part-time basis.

Training

We have a comprehensive training program, primarily targeted at new account representatives. Our program emphasizes quality in collection activities, including compliance with laws and regulations, and contains a structured call model that is used to enhance communication skills and collection activities. We have updated our training program to include the obligations imposed on us by our recent settlement of the FTC investigation into our debt collection practices, as discussed below under the caption “Legal Proceedings.” Our training includes a blended learning approach, including classroom, interactive activities, computer-based training, e-learning and on-the-job training.

New call center collection account representatives are required to complete an eight-week training program. The program is divided into two four-week modules. The initial four-week module has weekly objectives using various learning activities, call certifications and tests. The first week includes federal, state and local collection laws (with particular emphasis on the FDCPA and the FACT Act), core Company policies and procedures and structured learning of our collection software. The second week includes training on our call model and effective call management techniques. During weeks three and four, new hires form a collection team and make supervised collection calls. Instruction and guidance is shared with new associates to improve productivity. Training includes discussion of challenges faced by associates while making collection calls. Based on those discussions, interactive activities are used to enhance collection and organization skills.

The second four-week training module starts the transition of the new hire collection team to the collection floor, where they are assigned collection and productivity goals and work under the direction of a transition supervisor. This team of new hires continues to enhance their knowledge of federal, state and local collection laws, the call model and policies and procedures. The team is closely monitored during this time and evaluated based on set criteria, which is used as part of the training process.

New legal collection account representatives are required to complete a two-week training program. The first week is the same for legal account representatives as is for non-legal collection account representatives. The second week of training focuses on our legal processes and procedures, collection software and job shadowing. After completing base level training, their training continues with their assigned leader who provides on-the-job monitoring and additional instruction on standard operating procedures for their department.

All account representatives are required to attend annual FDCPA/Compliance training and are tested on their knowledge of the FDCPA and other applicable laws. Account representatives who are not achieving our minimum standards are required to complete a FDCPA review session and are then retested. In addition, ongoing monitoring of our collection activities and changes in applicable laws and regulations helps to ensure compliance.

| Item 1A. | Risk Factors |

This Report includes forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. In addition, we may make other written and oral communications from time to time that contain forward-looking statements. All statements regarding our expected financial position, strategies and growth prospects and general economic conditions we expect to exist in the future are forward-looking statements. The words “anticipates,” “believes,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “outcome,” “continue,” “remain,” “maintain,” “trend,” “objective,” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to us or our management, are intended to identify forward-looking statements.

13

Table of Contents

We caution that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date the statement is made and we do not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance.

The risk factors contained below could cause actual results to differ materially from forward-looking statements, and future results could differ materially from historical performance.

Failure to comply with government regulation could result in the suspension or termination of our ability to conduct business and the imposition of financial penalties or cause other significant expenditures.

The collections industry is regulated under various federal and state laws and regulations. Many states and several cities require that we be licensed as a debt collection company. The Federal Trade Commission, state Attorneys General and other regulatory bodies have the ability to investigate consumer complaints against debt collection companies and to recommend enforcement actions and seek monetary penalties. Failure to comply with applicable laws and regulations could result in significant penalties or the suspension or termination of our ability to conduct collection operations, which could materially adversely affect us. Our recent settlement of the FTC investigation into our debt collection practices does not preclude other investigations or actions by various state agencies or attorneys general that could result in additional fines or sanctions which could materially adversely affect us.

Our ability to recover on our charged-off consumer receivables may be limited under federal, state and local laws.

Federal and state consumer protection, privacy and related laws and regulations extensively regulate the relationship between debt collectors and debtors. Federal and state laws may limit our ability to recover on our charged-off consumer receivables regardless of any act or omission on our part. Some laws and regulations applicable to credit card issuers may preclude us from collecting on charged-off consumer receivables we purchase if the credit card issuer previously failed to comply with applicable law in generating or servicing those receivables. Additional consumer protection and privacy protection laws may be enacted that would impose additional or more stringent requirements on the enforcement of and collection on consumer receivables.

New federal, state or local laws or regulations, such as regulations adopted by the Consumer Financial Protection Bureau under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, or changes in the ways these rules or laws are interpreted or enforced, could limit our activities in the future or significantly increase the cost of regulatory compliance. The Consumer Financial Protection Bureau recently proposed a rule that would authorize it to supervise our subsidiary, Asset Acceptance, LLC, as a larger participant in the market for consumer debt collection, which may increase our cost of regulatory compliance or require changes in the way we conduct business. Any new laws, such as the Credit CARD Act of 2009 that limits fees and interest charges on credit card holders, rules or regulations that may be adopted, as well as existing consumer protection and privacy protection laws, may adversely affect our ability to collect on our charged-off consumer receivable portfolios and may have a material adverse effect on our business and results of operations. In addition, federal and state governmental bodies are considering, and may consider in the future, other legislative proposals that would regulate the collection of consumer receivables. The FTC has proposed amendments to the Fair Debt Collection Practices Act that, if enacted, may adversely affect our business and results of operations. Although we cannot predict if or how any future legislation would impact our business, our failure to comply with any current or future laws or regulations applicable to us could limit our ability to collect on our charged-off consumer receivable portfolios, which could reduce our profitability and harm our business.

In addition to the possibility of new laws being enacted, it is possible that regulators and litigants may attempt to extend debtors’ rights beyond the current interpretations placed on existing statutes. These attempts could cause us to (i) expend significant financial and human resources in either litigating these new

14

Table of Contents

interpretations, or (ii) alter our existing methods of conducting business to comply with these interpretations, either of which could reduce our profitability and harm our business.

If we are not able to purchase charged-off consumer receivables at appropriate prices or in sufficient amounts, the resulting decrease in our inventory of purchased portfolios of receivables could adversely affect our ability to generate cash collections and income.

If we are unable to purchase charged-off consumer receivables from credit originators in sufficient face value amounts at appropriate prices, our business may be harmed. The availability of portfolios of consumer receivables at prices which generate an appropriate return on our investment depends on a number of factors, both within and outside of our control, including:

| • | our ability to borrow to fund purchases; |

| • | the absence of significant contraction in the levels of credit being extended by credit originators; |

| • | the absence of significant contraction in the levels of consumer obligations; |

| • | charge-off rates; |

| • | continued growth in the number of industries selling charged-off consumer receivable portfolios; |

| • | continued sales of charged-off consumer receivable portfolios by credit originators; |

| • | debt sellers’ willingness to sell portfolios to us; |

| • | our ability to operate at a cost that permits us to be competitive in bidding for charged-off consumer receivable portfolios; and |

| • | competitive factors affecting potential purchasers and credit originators of charged-off receivables, including the number of firms engaged in the collection business and the capitalization of those firms, as well as new entrants seeking returns, that may cause an increase in the price we are willing to pay for portfolios of charged-off consumer receivables or cause us to overpay. |

In addition, we believe that credit originators and debt sellers are utilizing more sophisticated collection methodologies that result in lower quality portfolios available for purchase, which may render the portfolios available for sale less collectible.

Because of the length of time involved in collecting charged-off consumer receivables on acquired portfolios and the volatility in the timing of our collections, we may not be able to identify trends and make changes in our purchasing or collection strategies in a timely manner.

We face intense competition that could impair our ability to achieve our goals.

The consumer debt collection industry is highly competitive and fragmented. We compete with a wide range of other purchasers of charged-off consumer receivables, third party collection agencies, other financial service companies and credit originators and other owners of debt that manage their own charged-off consumer receivables. Some of these companies may have substantially greater numbers of associates, more financial resources and may experience lower account representative turnover rates than we do. Furthermore, some of our competitors may obtain alternative sources of financing, the proceeds from which may be used to fund expansion and to increase their number of charged-off portfolio purchases. Barriers to entry into the consumer debt collection industry are low. Companies with greater financial resources than we have may elect at a future date to enter the consumer debt collection business. Competitive pressures affect the availability and pricing of receivable portfolios as well as the availability and cost of qualified debt collection account representatives. In addition, some of our competitors have signed forward flow contracts under which consumer credit originators have agreed to transfer a steady flow of charged-off receivables to them in the future, which could restrict those credit originators from selling receivables to us.

15

Table of Contents

We face bidding competition in our acquisition of charged-off consumer receivable portfolios. We believe successful bids generally are awarded based predominantly on price and to a lesser extent based on service and relationships with debt sellers. Some of our current competitors, and possible new competitors, may have more effective pricing and collection models, more efficient operating structures, greater adaptability to changing market needs and more established relationships in our industry than we have. Moreover, our competitors may elect to pay prices for portfolios that we determine are not reasonable and, in that event, our volume of portfolio purchases may be diminished. There can be no assurance that our existing or potential sources will continue to sell their charged-off consumer receivables at recent levels or at all, or that we will continue to offer competitive bids for charged-off consumer receivable portfolios. In addition, there continues to be a consolidation of issuers of credit cards, which have been a principal source of our receivable purchases. This consolidation has decreased the number of sellers in the market and, consequently, could over time, give the remaining sellers increasing market strength in the price and terms of the sale of charged-off credit card accounts and could cause us to accept lower returns on our investment in that paper than we have historically achieved.

If we are unable to develop and expand our business or adapt to changing market needs as well as our current or future competitors, we may experience reduced access to portfolios of charged-off consumer receivables in sufficient face value amounts at appropriate prices. As a result, we may experience reduced profitability which, in turn, may impair our ability to achieve our goals.

Instability in the financial markets, economic weakness or recession may affect our access to capital, our ability to purchase and collect receivables and our operating results.

Our success depends on our continued ability to purchase and collect charged-off consumer receivables. An elevated unemployment rate, increased inflation levels, depressed residential real estate values, tight availability of credit for consumers and other economic factors could negatively affect consumers’ ability to pay debts. We have experienced the impact of these economic factors on our collections in recent years. Continued depression or further declines in real estate values, high levels of unemployment and continuing credit and liquidity concerns could further reduce our ability to collect on our purchased consumer receivable portfolios and would adversely affect their value. Financial pressure on the distressed consumer may lead to regulatory restrictions on our collections and increased litigation filed against us.

In addition, instability in the financial markets may reduce our access to capital, which could lead to constraints on our ability to purchase receivables and support our operations. We may be unable to predict the likely duration or severity of any adverse economic conditions and the effects they may have on our business, financial condition, results of operations, and cash flows.

Our access to capital through our credit agreement is critical to our ability to continue to grow. If our available credit is materially reduced or the credit agreement is terminated and we are unable to replace it on favorable terms or at all, our ability to purchase charged-off receivables and our results of operations may be materially and adversely affected.

We believe that access to capital through our credit agreement has been critical to our ability to maintain our operations. Our inability to obtain financing and capital as needed or on terms acceptable to us would limit our ability to acquire additional receivable portfolios and to operate our business. In our continuing effort to maintain adequate access to funds to facilitate operations, we entered into an amended and restated credit agreement in 2011 which replaced our previous credit agreement. Under the amended and restated credit agreement, we have a $95.5 million revolving line of credit that expires November 14, 2016 and a $175.0 million term loan facility that matures on November 14, 2017. If our available credit is materially reduced or the credit agreement is terminated as a result of noncompliance with a covenant or other event of default, and if we are unable to replace it on relatively favorable terms or at all, our ability to purchase charged-off receivables to generate collections and cash flow would be limited and our results of operations may be materially and adversely affected.

16

Table of Contents

All of our receivable portfolios are pledged to secure amounts owed to our lenders under our credit agreement. In addition, our credit agreement imposes a number of restrictive covenants on how we operate our business. These include financial covenants. As of December 31, 2011, we had the ability to borrow an additional $75.9 million on our revolving line of credit under the most restrictive of these financial covenants. Our ability to meet these financial covenants is predicated on our ability to continue to generate collections, revenues and other financial results at levels sufficient to satisfy the requirements of our credit agreement. Failure to satisfy any one of these covenants could result in all or any of the following consequences, each of which could have a material adverse effect on our ability to conduct business:

| • | acceleration of outstanding indebtedness; |

| • | our inability to continue to purchase charged-off receivables needed to operate our business; or |

| • | our inability to secure alternative financing on favorable terms, if at all. |

In addition, our credit agreement contains limitations and restrictions as to our ability to seek additional credit from other lenders, and requires that a portion of proceeds from issuance of our stock, or sales of assets be used to pay down our term loan facility.

A significant portion of our collections depend on our success in individual lawsuits brought against consumers and our ability to collect on judgments in our favor.

We generate a significant portion of our revenue by collecting on judgments that are granted by courts in lawsuits filed against debtors. A decrease in the willingness of courts to grant such judgments, a change in the requirements for filing such cases or obtaining such judgments, or a decrease in our ability to collect on such judgments could have a material and adverse effect on our results of operations. The FTC has issued a report encouraging states to impose specific, greater restrictions on litigation to collect consumer debt. As we increase our use of our legal channel for collections, our short-term margins may decrease as a result of an increase in upfront court costs and costs related to counter claims. We may not be able to collect on certain aged accounts because of applicable statutes of limitations. We may be unable to obtain account documents for some of the accounts we purchase which may negatively impact our ability to collect those accounts. Courts in some jurisdictions require that a copy of the account statements or applications be attached to the pleadings in order to obtain a judgment against the account debtors. If we are unable to produce account documents, these courts will deny our claims. We may be subject to adverse effects of regulatory changes that we cannot predict.

A significant portion of our collections are obtained from third parties.

We are dependent on third parties, primarily attorneys and other contingent collection agencies, to service our receivables. Significant changes in our relationships with these third parties or significant increases in costs associated with these third parties could adversely impact our financial position, results of operations and cash flows.

We are subject to ongoing risks of litigation, including individual and class actions under consumer credit, collections, and other laws.

We operate in an extremely litigious industry and currently are, and may in the future, be named as defendants in litigation, including individual and class actions under consumer credit, collections, and other laws.

A significant portion of our portfolio purchases during any period may be concentrated with a small number of sellers.

We expect that a specific percentage of our portfolio purchases for any given fiscal year may be concentrated with a few large sellers, some of which also may involve forward flow arrangements. The consolidation of major banks in recent years has resulted in fewer sellers of charged-off consumer receivables.

17

Table of Contents

We cannot be certain that any of our significant sellers will continue to sell charged-off receivables to us on terms or in quantities acceptable to us, or that we would be able to replace such purchases with purchases from other sellers.

A significant decrease in the volume of purchases from any of our principal sellers would force us to seek alternative sources of charged-off receivables. We may be unable to find alternative sources from which to purchase charged-off receivables, and even if we could successfully replace such purchases, the search could take time, the receivables could be of lower quality, cost more, or both, any of which could materially adversely affect our financial performance.

Our operations could suffer from telecommunications or technology downtime or from not responding to changes in technology.

Our success depends in large part on sophisticated telecommunications and computer systems. The temporary or permanent loss of our computer and telecommunications equipment and software systems, through casualty or operating malfunction (including outside influences such as computer viruses), could disrupt our operations. In the normal course of our business, we must record and process significant amounts of data quickly and accurately. Any failure of our information systems or software and their backup systems would interrupt our operations and harm our business. Computer and telecommunications technologies evolve rapidly. We may not be successful in anticipating, managing or adapting technological changes on a timely basis, which could reduce our profitability or disrupt our operations and harm our business. In addition, we rely significantly on various outside vendors for the software used in our operations. Our business would be disrupted and financial performance may be harmed if they were to cease operations or significantly reduce their support to us.

We are subject to examinations and challenges by tax authorities.

Our industry is relatively new and unique and, as a result, there are not well-defined laws, regulations or case law for us to follow that match our particular facts and circumstances for some tax positions. Therefore, certain tax positions we take are based on industry practice, tax advice and drawing similarities of our facts and circumstances to those in case law relating to other industries. These tax positions may relate to tax compliance, sales and use, franchise, gross receipts, payroll, property and income tax issues, including tax base and apportionment. Challenges made by tax authorities to our application of tax rules may result in adjustments to the timing or amount of taxable income or deductions, or the allocation of income among tax jurisdictions, as well as inconsistent positions between different jurisdictions on similar matters. If any such challenges are made and are not resolved in our favor, they could have an adverse effect on our financial condition and results of operations.

We are dependent on our management team and key associates for the adoption and implementation of our strategies and the loss of their services could have a material adverse effect on our business.

Our future success depends on the continued ability to recruit, hire, retain and motivate highly skilled management and associates. The continued growth and success of our business is particularly dependent upon the continued services of our Chief Executive Officer and other executive officers. The loss of the services of one or more of our executive officers or other key associates could disrupt our operations and impair our ability to continue to acquire or collect on portfolios of charged-off consumer receivables and to manage our business. We do not maintain key person life insurance policies for our executive officers or key associates.

We generally account for purchased receivable revenues using the interest method of accounting in accordance with generally accepted accounting principles, which requires making reasonable estimates of the timing and amount of future cash collections. If the timing is delayed or the actual amount recovered by us is materially lower than our estimates, it could cause us to recognize impairments and negatively impact our earnings.

The estimates used in the interest method of revenue recognition (“Interest Method”) to calculate the projected internal rate of return (“IRR”) on our portfolios are primarily based on historical cash collections and

18

Table of Contents

payer dynamics. If actual future cash collections are materially different in amount or timing than the remaining collections estimate, earnings could be affected, either positively or negatively. Higher collection amounts or cash collections that occur sooner than projected will have a favorable impact to revenue in the form of yield increases or impairment reversals. Lower collection amounts or cash collections that occur later than projected will have an unfavorable impact and may result in an impairment of the purchased receivable balance. Impairments cause reduced earnings and volatility in earnings which could have the effect of depressing the price per share of our common stock, reducing our consolidated tangible net worth and putting pressure on the financial covenants in our credit facilities. Refer to “Critical Accounting Policies—Revenue Recognition” on page 50 for further information regarding the Interest Method and estimates.

We may not be able to collect sufficient amounts on our charged-off consumer receivables, which would adversely affect our results of operations, our ability to satisfy debt obligations, our purchase of new portfolios and our future growth.

Our business consists of acquiring and collecting receivables that consumers have failed to pay and that the credit originator has deemed uncollectible and has charged-off. The credit originators or other debt sellers generally have attempted to recover on their charged-off consumer receivables before we purchase such receivables, often using a combination of in-house recovery and third party collection efforts. Because there generally have been multiple efforts to collect on these portfolios of charged-off consumer receivables before we attempt to collect on them, our attempts to collect may not be successful. Therefore, we may not collect a sufficient amount to cover our investment associated with purchasing the charged-off consumer receivable portfolios and the costs of running our business, which would adversely affect our results of operations. In addition, if cash flows from operations are less than anticipated, our ability to satisfy our debt obligations, purchase new portfolios and maintain profitability may be materially and adversely affected.

There can be no assurance that our success in generating collections in the past will be indicative of our ability to be successful in generating collections in the future.

We are highly dependent on revenues generated from our purchased receivable collection activities. Entry into new markets or other attempts to diversify our business model may not be successful.

Substantially all our operating revenues are generated from collections on charged-off purchased receivables. Although we use multiple collection approaches, changing economic factors or collection laws, for example, may impact our ability to collect regardless of the collection approach we pursue. Although management may seek opportunities to diversify, we may not be successful.

The recognition of impairment charges on goodwill would adversely impact our financial position and results of operations.

We are required to perform an impairment test on our goodwill annually or at any time when events occur which could affect the fair value of this asset. Our determination of whether an impairment has occurred is based on a comparison of the asset’s fair value with its book value. Several factors are considered when calculating fair value, some of which involve significant management estimates. Significant and unanticipated changes in circumstances, such as adverse changes in business climate, declining expectations of cash flows or operating results, adverse actions by regulators, unanticipated competition, or changes in technology or markets, could require an impairment in a future period that could substantially affect our reported earnings and reduce our consolidated net worth and shareholders’ equity.

We experience high turnover rates for our account representatives. We may not be able to hire and retain enough sufficiently trained account representatives to support our operations.

Our ability to collect on new and existing portfolios and to acquire new portfolios is substantially dependent on our ability to hire and retain qualified associates. The consumer accounts receivables management industry is

19

Table of Contents

labor intensive and, similar to other companies in our industry, we experience a high rate of associate turnover. Based on our experience, account representatives who have been with us for more than one year are generally more productive than account representatives who have been with us for less than one year. We compete for qualified associates with companies in our industry and in other industries. Our operations require that we continually hire, train and, in particular, retain account representatives. In addition, we believe the level of training we provide to our associates makes them attractive to other collection companies, which may attempt to recruit them. A higher turnover rate among our account representatives will increase our recruiting and training costs, may require us to increase associate compensation levels and will limit the number of experienced collection associates available to service our charged-off consumer receivables. If this were to occur, we may not be able to service our charged-off consumer receivables effectively, which could reduce our ability to operate profitably.

Significant increases in interest rates could adversely impact our financial position, results of operations and cash flows.

Borrowings under our credit agreement bear interest at variable rates, with a floor of 150 basis points on London Inter Bank Offer Rate (“LIBOR”) denominated borrowings under our term loan facility. Although a portion of our outstanding borrowings have a fixed rate of interest as a result of an interest rate swap agreement, the interest rates for the majority of our borrowings are not fixed. In the future, we may amend or replace our credit agreement, which could significantly impact the rates of interest we pay. As a result, fluctuations in interest rates may adversely impact our financial position, results of operations and cash flows.