Attached files

| file | filename |

|---|---|

| 8-K - URANIUM RESOURCES, INC. 8-K - WESTWATER RESOURCES, INC. | a50192470.htm |

Exhibit 99.1

Slide: 1 Uranium Resources, Inc. NASDAQ: URREU.S. Uranium Consolidation and DevelopmentMarch 5, 2012 Filed by Uranium Resources, Inc.(SEC file no. 0-17171) Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Slide: 2 Title: Safe Harbor Statement Body: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “estimates,” “projects,” “anticipates,” “believes,” “could,” and other similar words. All statements addressing operating performance, events, or developments that the Company expects or anticipates will occur in the future, including but not limited to statements relating to the Company’s mineralized uranium materials, timing of receipt of mining permits, production capacity of mining operations planned for properties in South Texas and New Mexico, planned dates for commencement of production at such properties, revenue, cash generation and profits are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties include, but are not limited to, receiving shareholder approval of the Transaction, realizing the benefits of the merger and resource development synergies, the exploration upside of the acquired properties, the Company’s ability to acquire other properties, the value gained from mine site that had been previously permitted, the benefit of permitting on private lands, the effect of additional major investors with mining investment experience, the spot price and long-term contract price of uranium, weather conditions, operating conditions at the Company’s mining projects, government regulation of the mining industry and the nuclear power industry, world-wide uranium supply and demand, availability of capital, timely receipt of mining and other permits from regulatory agents and other factors which are more fully described in the Company’s documents filed with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of the Company’s underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on the Company’s forward-looking statements. Except as required by law, the Company disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this presentation.

Slide: 3 Title: Additional Information The proposed transaction described in this presentation (the “Transaction”) will be submitted to the shareholders of each of Uranium Resources, Inc. (“URI”) and Neutron Energy, Inc. for approval. URI will file a registration statement, a joint proxy statement/prospectus and other relevant documents with the Securities and Exchange Commission (the "SEC”). Shareholders are urged to read the registration statement and joint proxy statement/prospectus when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Investors will be able to obtain a free copy of the registration statement and joint proxy statement/prospectus, as well as other filings containing information about URI and Neutron, at the SEC’s website (http://www.sec.gov). Investors will also be able to obtain these documents, free of charge, by accessing URI’s website (www.uraniumresources.com). URI and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of URI in connection with the Transaction. Information about the directors and executive officers of URI is set forth in the proxy statement for URI’s 2011 annual meeting of shareholders, as filed with the SEC on April 29, 2011. Additional information regarding the interests of those participants and other persons who may be deemed participants in the Transaction may be obtained by reading the joint proxy statement/prospectus regarding the Transaction when it becomes available. Investors may obtain free copies of these documents as described above.

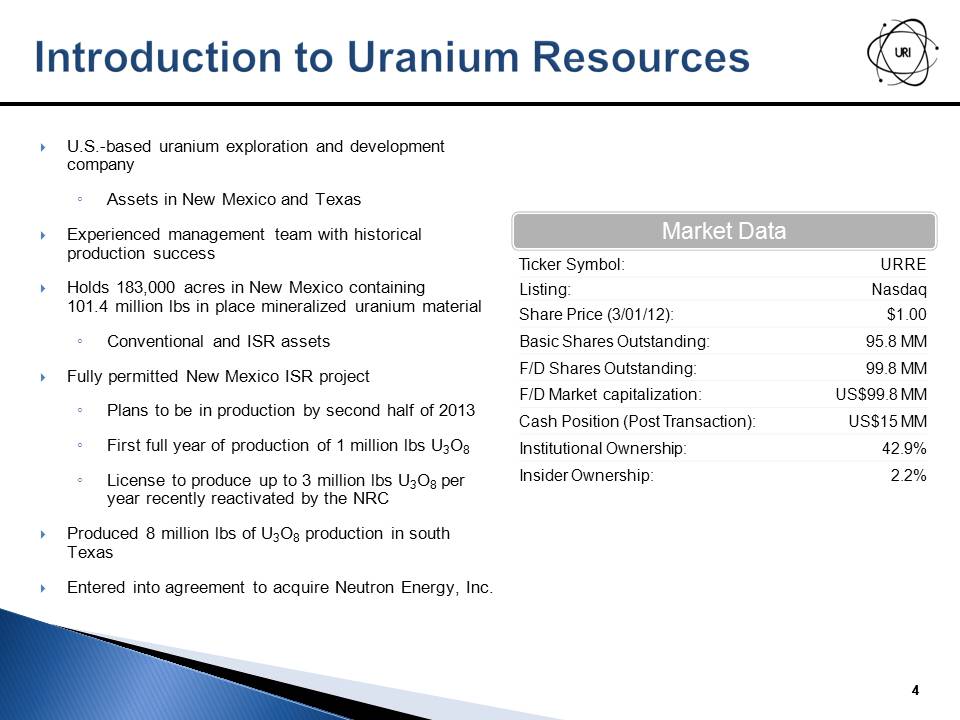

Slide: 4 Title: Introduction to Uranium Resources U.S.-based uranium exploration and development company Assets in New Mexico and TexasExperienced management team with historical production successHolds 183,000 acres in New Mexico containing 101.4 million lbs in place mineralized uranium materialConventional and ISR assetsFully permitted New Mexico ISR projectPlans to be in production by second half of 2013First full year of production of 1 million lbs U3O8License to produce up to 3 million lbs U3O8 per year recently reactivated by the NRCProduced 8 million lbs of U3O8 production in south TexasEntered into agreement to acquire Neutron Energy, Inc. Market Data

Slide: 5 URI has executed a definitive agreement to acquire 100% of Neutron Energy, Inc. (“Neutron”)URI is offering total consideration of 37 million common sharesRepresents a total transaction value of US$38.1 million based on closing price on February 24, 2012 of $1.03Resource Capital Funds (“RCF”) will provide $20 million that will be used to retire the majority of Neutron’s outstanding debt owed to RMB Australia Holdings Limited (“RMB”) in exchange for 24.6 million URI common sharesRCF will also provide an additional $10 million in funding to URI through the purchase of an additional 10.3 million URI shares to advance the development of projects held by URI and NeutronRCF will own ~24% of URI post acquisition and private placement RMB to equitize remaining outstanding debt in the form of 8.4 million URI sharesRMB will own ~6% of URI post acquisition Neutron shareholders will receive 3.8 million URI shares for 100% of Neutron equityNeutron shareholders will own ~3% of URI post acquisitionAdditional 0.2 million URI shares will be issued to Neutron to cover certain Neutron transaction costsAcquisition adds large conventional assets in New Mexico with a previously permitted strategic mill siteNeutron’s primary assets: Juan Tafoya and Cebolleta projects, with total mineralized material of 15.4 million tonsStrategic advantage east of Mt. Taylor as Juan Tafoya property includes previously permitted mill siteTransaction is accretive to URI’s total mineralized materialPositions the combined entity for further consolidation in New Mexico Title: Acquisition of Neutron Energy

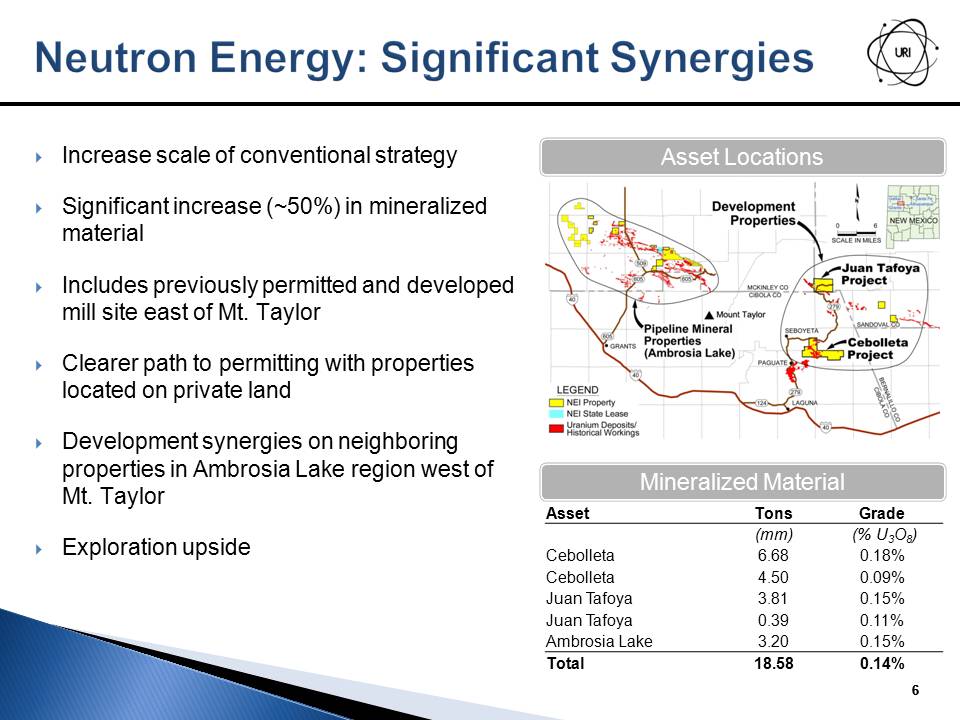

Slide: 6 Title: Neutron Energy: Significant Synergies Increase scale of conventional strategySignificant increase (~50%) in mineralized materialIncludes previously permitted and developed mill site east of Mt. TaylorClearer path to permitting with properties located on private landDevelopment synergies on neighboring properties in Ambrosia Lake region west of Mt. TaylorExploration upside Asset Locations Mineralized Material

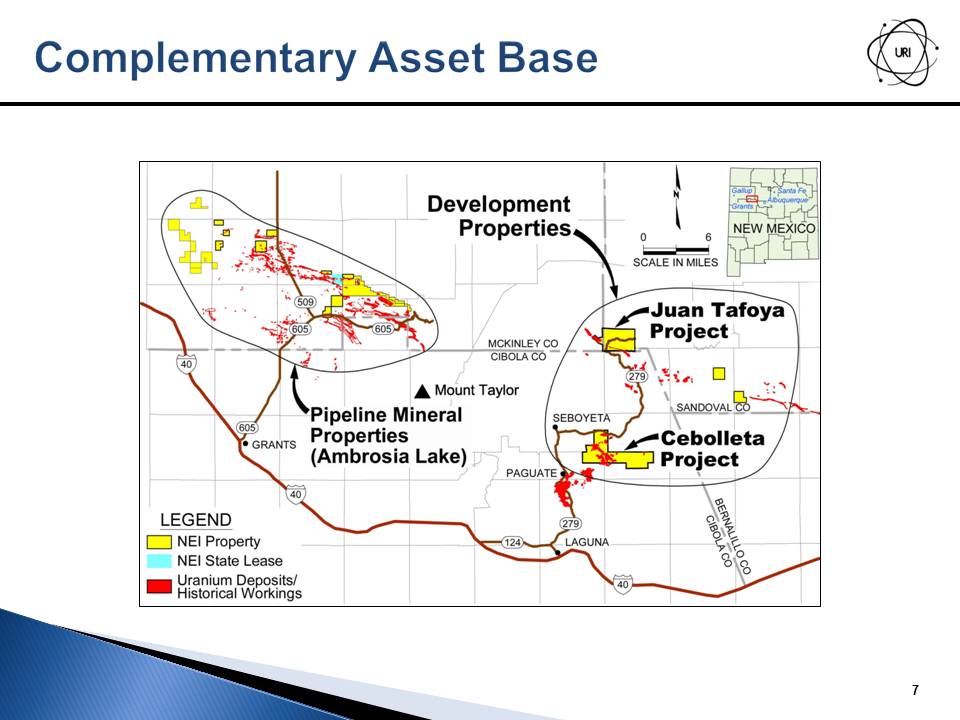

Slide: 7 Title: Complementary Asset Base

Slide: 8 Advance New Mexico ISR assets to production by the second half of 2013Act as a consolidator in New Mexico with a focus on properties that offer significant strategic advantagesAdvance development of conventional assets in New MexicoBecome a significant US-based uranium producerCapitalize on uranium processing facilities in TexasExploit experience in Texas: Exploration and development of large asset base Title: Our Strategy

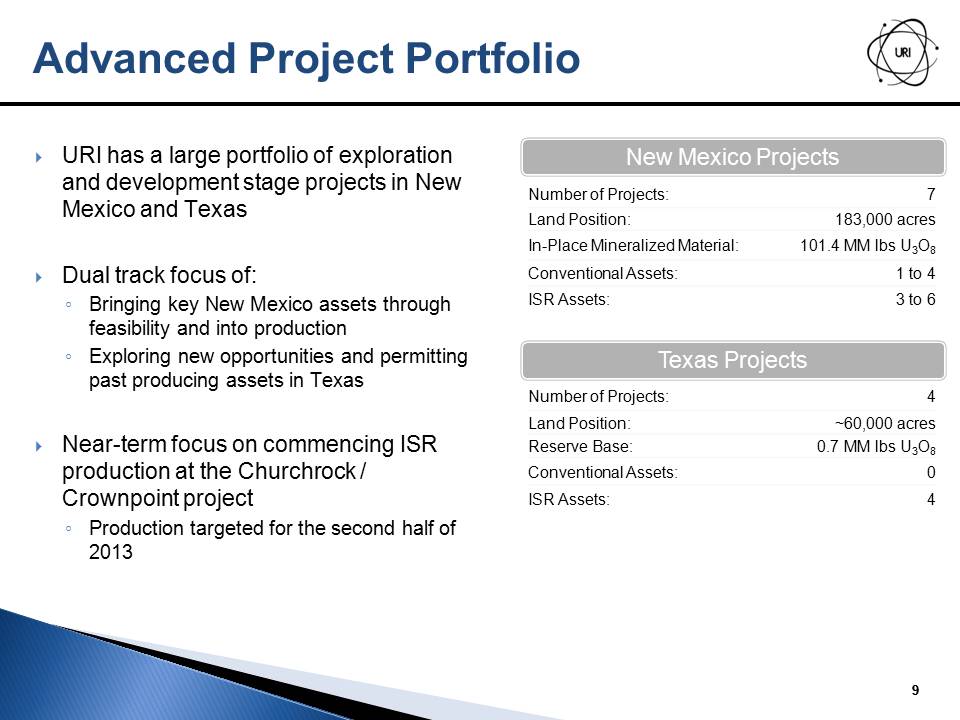

Slide: 9 URI has a large portfolio of exploration and development stage projects in New Mexico and TexasDual track focus of:Bringing key New Mexico assets through feasibility and into productionExploring new opportunities and permitting past producing assets in TexasNear-term focus on commencing ISR production at the Churchrock / Crownpoint project Production targeted for the second half of 2013 New Mexico Projects Texas Projects Advanced Project Portfolio

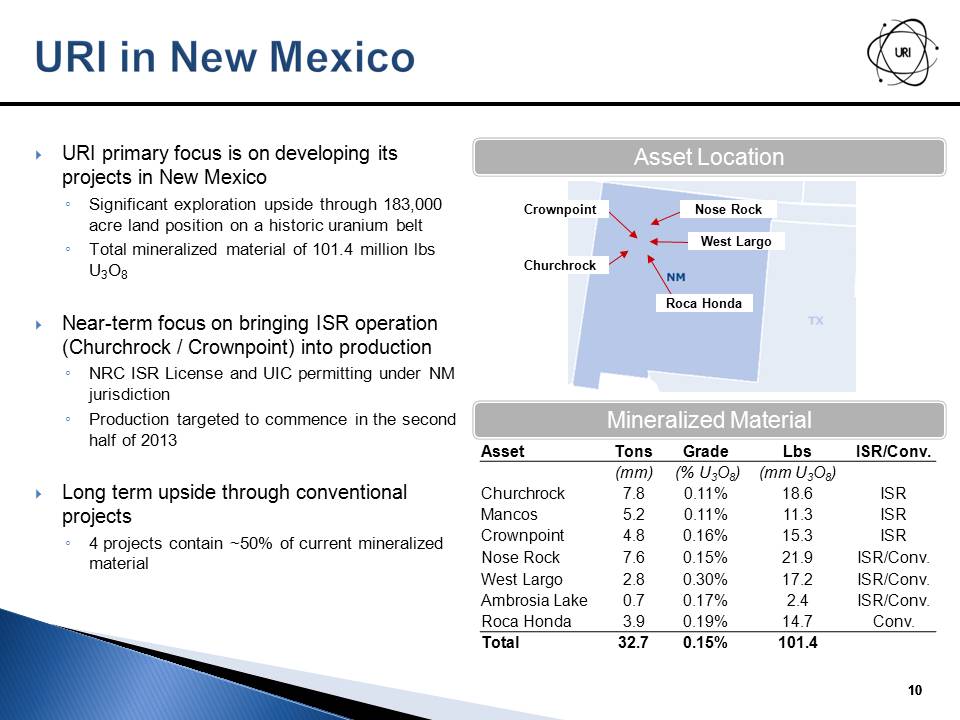

Slide: 10 URI primary focus is on developing its projects in New MexicoSignificant exploration upside through 183,000 acre land position on a historic uranium beltTotal mineralized material of 101.4 million lbs U3O8Near-term focus on bringing ISR operation (Churchrock / Crownpoint) into productionNRC ISR License and UIC permitting under NM jurisdictionProduction targeted to commence in the second half of 2013Long term upside through conventional projects4 projects contain ~50% of current mineralized material Asset Location Mineralized Material Crownpoint Churchrock Nose Rock West Largo Roca Honda Title: URI in New Mexico

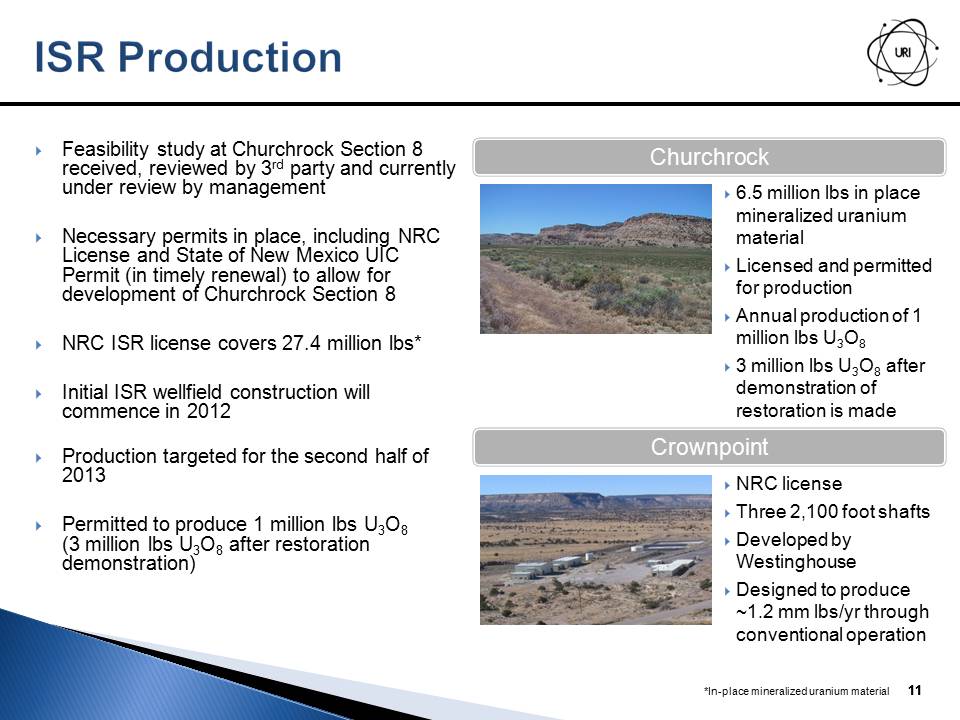

Slide: 11 Feasibility study at Churchrock Section 8 received, reviewed by 3rd party and currently under review by managementNecessary permits in place, including NRC License and State of New Mexico UIC Permit (in timely renewal) to allow for development of Churchrock Section 8NRC ISR license covers 27.4 million lbs*Initial ISR wellfield construction will commence in 2012Production targeted for the second half of 2013Permitted to produce 1 million lbs U3O8 (3 million lbs U3O8 after restoration demonstration) NRC licenseThree 2,100 foot shaftsDeveloped by Westinghouse Designed to produce ~1.2 mm lbs/yr through conventional operation Churchrock (Gp:) Crownpoint 6.5 million lbs in place mineralized uranium materialLicensed and permitted for productionAnnual production of 1 million lbs U3O8 3 million lbs U3O8 after demonstration of restoration is made Title: ISR Production *In-place mineralized uranium material

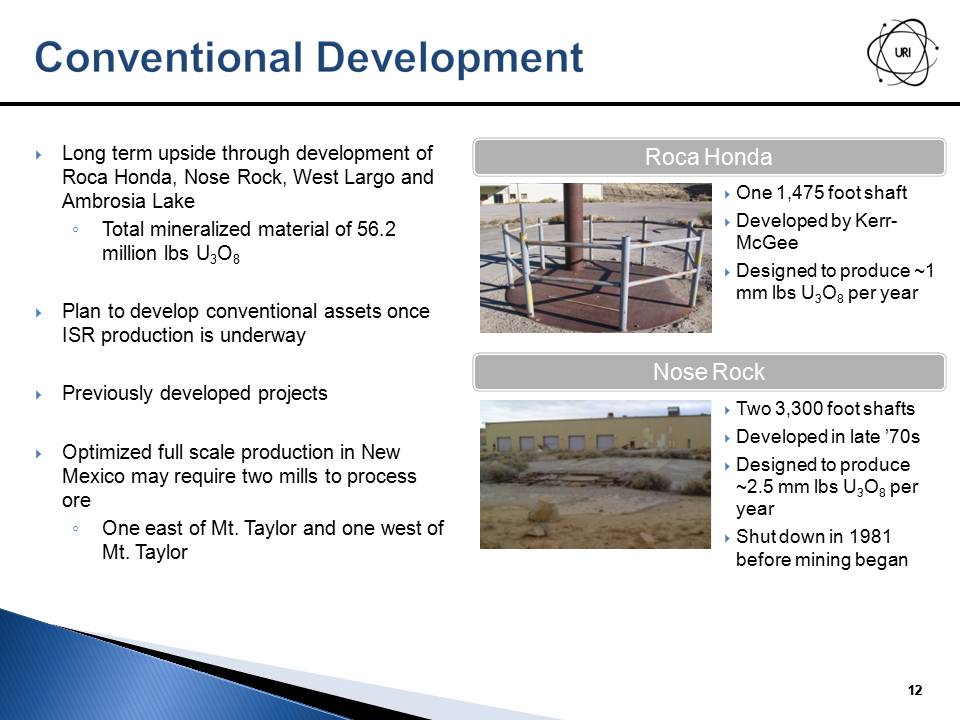

Slide: 12 Long term upside through development of Roca Honda, Nose Rock, West Largo and Ambrosia LakeTotal mineralized material of 56.2 million lbs U3O8Plan to develop conventional assets once ISR production is underwayPreviously developed projectsOptimized full scale production in New Mexico may require two mills to process oreOne east of Mt. Taylor and one west of Mt. Taylor Two 3,300 foot shaftsDeveloped in late ’70sDesigned to produce ~2.5 mm lbs U3O8 per yearShut down in 1981 before mining began Roca Honda (Gp:) Nose Rock One 1,475 foot shaftDeveloped by Kerr-McGeeDesigned to produce ~1 mm lbs U3O8 per year Title: Conventional Development

Slide: 13 Title: Grants Mineral Belt: Competitor Position

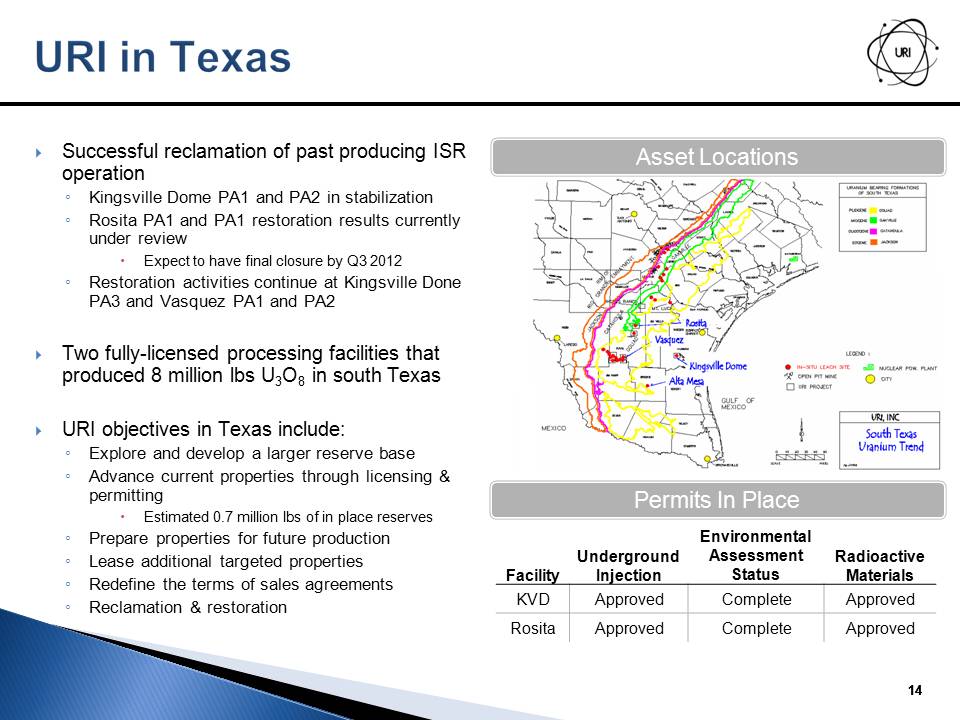

Slide: 14 Title: URI in Texas Successful reclamation of past producing ISR operationKingsville Dome PA1 and PA2 in stabilizationRosita PA1 and PA1 restoration results currently under reviewExpect to have final closure by Q3 2012Restoration activities continue at Kingsville Done PA3 and Vasquez PA1 and PA2Two fully-licensed processing facilities that produced 8 million lbs U3O8 in south TexasURI objectives in Texas include:Explore and develop a larger reserve baseAdvance current properties through licensing & permittingEstimated 0.7 million lbs of in place reservesPrepare properties for future productionLease additional targeted propertiesRedefine the terms of sales agreementsReclamation & restoration Asset Locations Permits In Place

Slide: 15 Property covers 53,524 acres in Kenedy County, TexasLocated in the prolific South Texas uranium districtOption to lease the acreage for uranium productionEntered into a joint venture agreement with Cameco’s (NYSE:CCJ) U.S. subsidiary for a three-phase, three-year exploration program in May 2011Program to be preliminary funded by Cameco who has the option to earn up to 70% of the property rights Initiated first phase on June 21, 2011 with a budget of US$1 million was completed in November 2011Phase 1 consisted of 19 holes totaling 24,560 feetPhase II program started in December 2011 with a completion target of November 2012US$1.5 million committed by URI to complete Phase II of which $1 million will be funded by CamecoUranium would be processed at URI Kingsville Dome or Rosita processing facilities under a toll processing agreementURI has the first right of refusal on other Texas development by Cameco Los Finados Exploration JV with Cameco

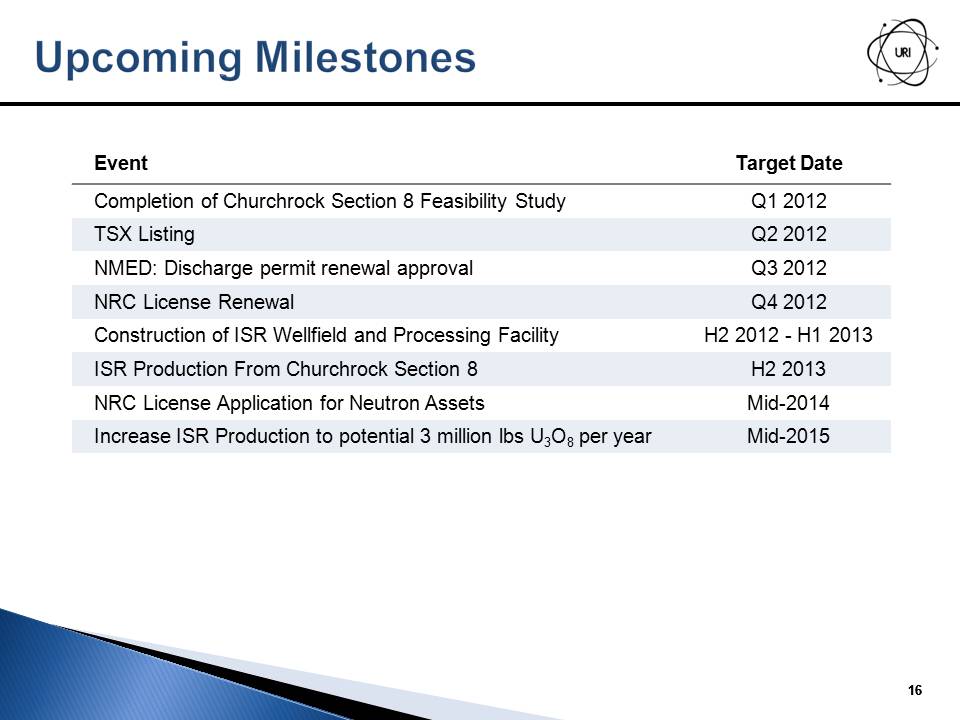

Slide: 16 Title: Upcoming Milestones

Slide: 17 Experienced Mining Management

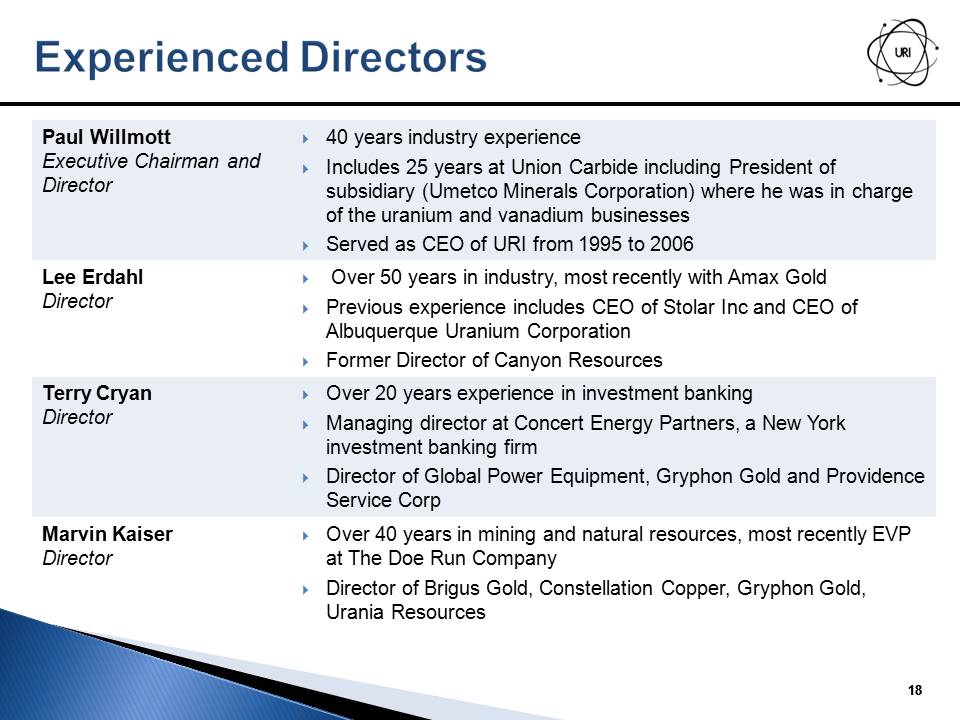

Slide: 18 Title: Experienced Directors

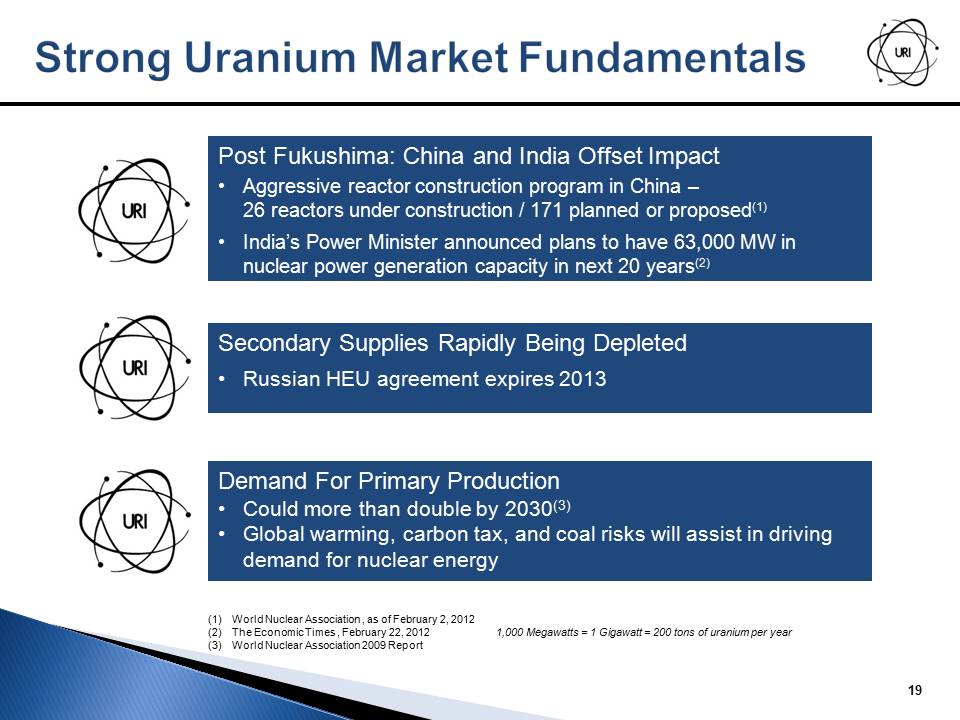

Slide: 19 Title: Strong Uranium Market Fundamentals Post Fukushima: China and India Offset ImpactAggressive reactor construction program in China – 26 reactors under construction / 171 planned or proposed(1)India’s Power Minister announced plans to have 63,000 MW in nuclear power generation capacity in next 20 years(2) Demand For Primary ProductionCould more than double by 2030(3)Global warming, carbon tax, and coal risks will assist in driving demand for nuclear energy Secondary Supplies Rapidly Being DepletedRussian HEU agreement expires 2013 World Nuclear Association , as of February 2, 2012The Economic Times , February 22, 2012 1,000 Megawatts = 1 Gigawatt = 200 tons of uranium per yearWorld Nuclear Association 2009 Report

Slide: 20 (Gp:) Significant assets in New Mexico and Texas (Gp:) Near-term ISR production in New Mexico (Gp:) Long-term synergies through previously permitted mill site (Gp:) Positions the combined entity for further consolidation in New Mexico (Gp:) New Mexico upside from conventional projects and acreage position (Gp:) Past production and exploration upside in Texas (Gp:) Acquiring large package of New Mexico projects (Gp:) Expanding URI U.S. Footprint

Title: URI Summary Highlights Slide: 21 Uranium Resources, Inc. NASDAQ: URREMarch 5, 2012