Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Unilife Corp | d297965d8k.htm |

| EX-99.3 - EXHIBIT 99.3 - Unilife Corp | d297965dex993.htm |

| EX-99.1 - EXHIBIT 99.1 - Unilife Corp | d297965dex991.htm |

Exhibit 99.2

| Second Quarter 2012 Earnings Conference Call February 9, 2012 |

| Cautionary Note Regarding Forward-Looking Statements This presentation contains forward looking statements under the safe harbor provisions of the US securities laws. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to our management. Our management believes that these forward-looking statements are reasonable as and when made. However you should not place undue reliance on any such forward looking statements as these are subject to risks and uncertainties. Please refer to our press release and our SEC filings for more information regarding the use of forward looking statements." |

| Corporate Overview Alan Shortall Chief Executive Officer |

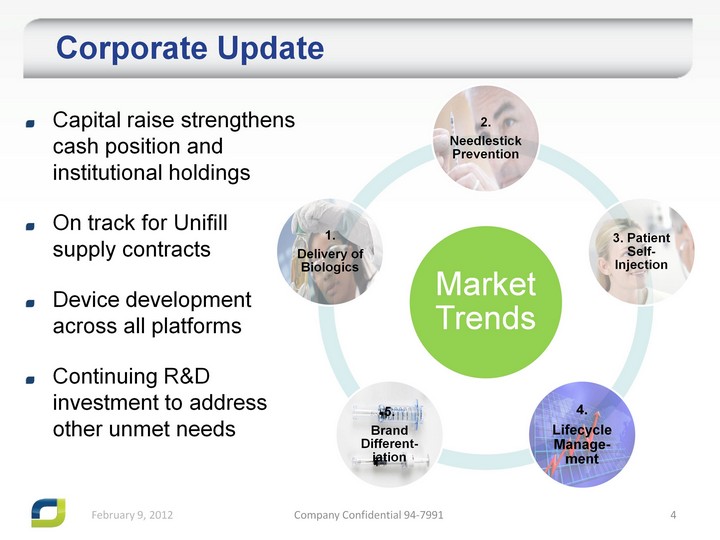

| Corporate Update Corporate Update Capital raise strengthens cash position and institutional holdings On track for Unifill supply contracts Device development across all platforms Continuing R&D investment to address other unmet needs |

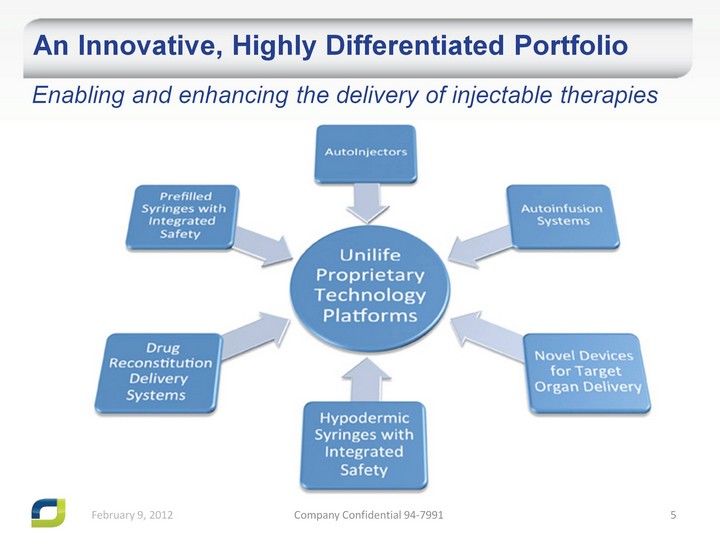

| An Innovative, Highly Differentiated Portfolio Enabling and enhancing the delivery of injectable therapies |

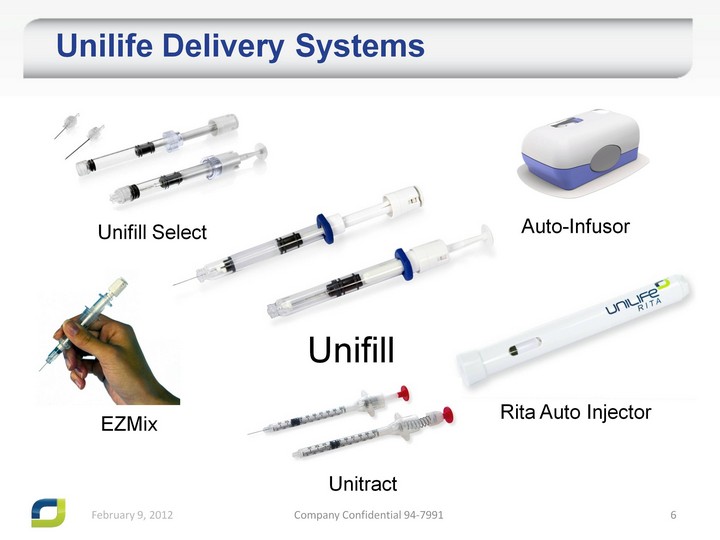

| Unilife Delivery Systems Unifill Unitract Auto-Infusor Unifill Select Rita Auto Injector EZMix |

| Prefilled Syringes with Integrated Safety The Unifill Syringe 100% user acceptance in human factor studies Commercial supply contracts on track Expected finalization of current negotiations in CY 2012 A primary drug container, a safety device and a needle containment system |

| Development completed, now in pilot production phase Expected agreements in CY 2012 Prefilled Syringes with Integrated Safety The Unifill Select All the features of the Unifill syringe, with the addition of attachable needles |

| Drug Reconstitution Delivery Systems EZMix Only dual-chamber prefilled syringe with integrated safety Generating strong commercial interest Commercialization expected in 2013 One step for reconstitution of dry drugs with the safe, intuitive injection |

| Novel Devices for Targeted Organ Delivery Confidential program with global pharmaceutical company Clinical Development Agreement signed in November 2011 $1.4 million in initial revenues To be recognized during next two quarters (up to end June 2012) Successful development of devices Supply for use in human clinical drug trials scheduled for 2012 |

| Auto-Injectors Unilife Rita Auto-Injector Designed for use with Unifill syringe Pilot production underway A highly compact auto-injector, and the only one with true end-of dose indicators |

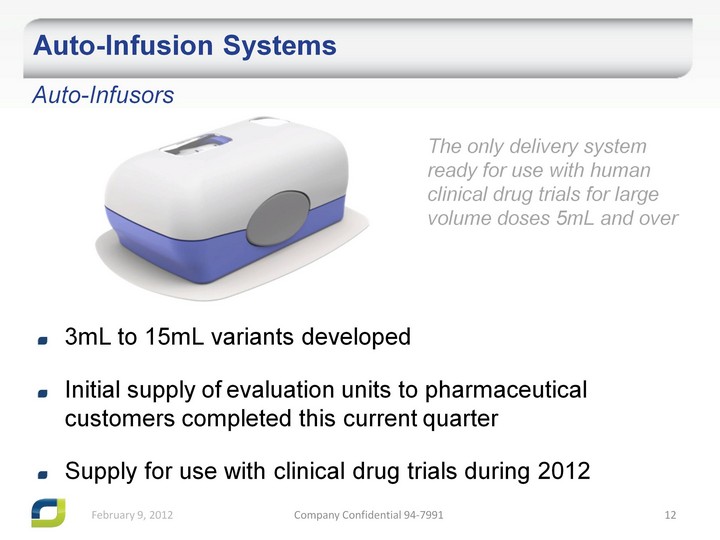

| Auto-Infusion Systems Auto-Infusors The only delivery system ready for use with human clinical drug trials for large volume doses 5mL and over 3mL to 15mL variants developed Initial supply of evaluation units to pharmaceutical customers completed this current quarter Supply for use with clinical drug trials during 2012 |

| Capital Raise Raised capital to fund development and commercial supply of advanced drug delivery systems, and expand workforce Net proceeds of $33.8 million (excluding greenshoe option) Oversubscribed, low discount to market Consisted of U.S. institutional healthcare investors Sole book running manager - Jefferies and Company Total current U.S. institutional holdings estimated to be approximately one quarter of total shares, and 64% of NASDAQ-listed shares. More than 50% increase in U.S. institutional holdings last 12 months |

| Financial Data Overview Rich Wieland Chief Financial Officer |

| Revenues for the quarter of $0.9M, compared to $1.8M for 2Q 2011 According to our business strategy, product sales reflect the discontinuing of contract manufacturing operations in December 2010 Industrialization and development fees increased $0.2M related to the clinical development and supply of a novel device for targeted organ delivery Financial Data - Fiscal 2nd Quarter 2012 |

| Net loss for the quarter was $12.9M, or $0.19 per diluted share, compared to a net loss of $10.4M, or $0.19 per diluted share for 2Q 2011 R&D expenses increased by $2.8M due to additional payroll costs and expenditures related to the development of additional advanced drug delivery devices Partially offset by a reduction of $1.3M in selling, general and administrative expenses (SG&A) Financial Data - Fiscal 2nd Quarter 2012 Continued |

| Adjusted net loss of $9.6M, or $0.14 per diluted share, compared to an adjusted net loss of $7.6M, or $0.14 per diluted share for 2Q 2011 Excludes approx. $3.3M in non-cash share-based compensation expense, depreciation and amortization and interest expense compared to $2.7M in non-cash items in 2Q 2011 Financial Data - Fiscal 2nd Quarter 2012 Continued Balance Sheet Data (As of December 31, 2011) Total cash of $41.7M Raised $33.8M, net of issuance costs, through a public offering in November 2011 |

| Looking Ahead in FY2012 Alan Shortall Chief Executive Officer |

| Stock Purchase Activities by CEO Purchased more than $1 million in shares of UNIS common stock over last month in the open market. Mr. Shortall is the largest shareholder in Unilife. Follows prior market purchases of more than $1.5 million of UNIS common stock during calendar year 2011. |

| Continued Unifill supplies to current and new customers Unifill placement onto stability studies Potential for additional access or royalty fees Commercial supply agreements Agreements for additional products within portfolio Develop or customize Unilife devices to address specific customer needs for pipeline and approved drugs and vaccines Clinical development and supply agreements Continuing to address unmet market needs in other areas Looking Forward for Calendar Year 2012 |

| Questions |